Benefits of cloud accounting are changing how businesses manage financial documents like invoices and balance sheets. By using cloud-based solutions, companies can make handling these important tasks easier, leading to smoother operations and fewer mistakes.

Table of Content:

Table of Content

What is Cloud Accounting?

Cloud accounting offers a range of advantages, and understanding the benefits of cloud-based accounting software can enhance the efficiency and effectiveness of your financial management. Here are ten key benefits of cloud accounting that can help your business thrive:

-

Access your accounts anywhere

With cloud accounting, you can manage your finances from anywhere, whether at the office, home, or while traveling. This flexibility ensures you’re always connected to your financial data.

-

Access real-time information

-

Save time with automation

-

Access to the app ecosystem

Many cloud accounting solutions integrate with various applications tailored to your business needs. This benefit of the cloud accounting ecosystem allows seamless connections with tools like CRM systems and inventory management, enhancing overall efficiency.

-

Live bank feeds

-

Improve the accuracy of your accounting

Cloud accounting reduces the risk of human error through automated processes. This increased accuracy ensures your financial data is reliable and helps maintain compliance.

-

Connected online payment

Streamline your payment processes by connecting your accounting software with online payment platforms. This integration simplifies transactions, making it easier for customers to pay and for you to receive funds.

-

No installation required

Cloud accounting solutions eliminate the need for complicated installations. Simply log in via a web browser to access your accounting software, saving time and resources.

-

Secure sharing of data

With cloud accounting, sharing sensitive financial data becomes secure and straightforward. You can collaborate with your team or external advisors while maintaining control over access rights.

-

Access to tech support

Enjoy dedicated tech support from your cloud provider. This support ensures any issues are addressed quickly, minimizing downtime and keeping your accounting operations running smoothly.

How to Choose Cloud Accounting Software?

Selecting the right cloud accounting software is crucial for your business’s financial health and operational efficiency. Here are key factors to consider when making your choice:

-

Assess your business needs

Begin by evaluating your business requirements. Consider the size of your company, the complexity of your financial transactions, and specific features you need, such as invoicing, expense tracking, or inventory management.

-

User-friendly interface

Look for software with an intuitive and user-friendly interface. A simple design can make a significant difference in how easily your team adapts to the system and minimizes the learning curve.

-

Scalability

Choose software that can grow with your business. As your company expands, your accounting needs may evolve, so select a solution that offers scalability in features and user capacity.

-

Integration capabilities

Ensure the software can seamlessly integrate with other tools you already use, such as CRM systems, payment processors, or e-commerce platforms. This connectivity can enhance your overall workflow and data consistency.

-

Real-time reporting and analytics

Choose cloud accounting software that offers real-time reporting and analytics. Having immediate access to financial data can empower you to make informed decisions and identify trends quickly.

Given the sensitive nature of financial information, prioritize software with robust security features. Look for encryption, two-factor authentication, and regular backups to protect your data.

-

Cost-effectiveness

Consider the pricing structure of the software. Look for solutions that offer a good balance between features and cost, including subscription models that align with your budget. Be wary of hidden fees.

-

Customer support

Evaluate the level of customer support offered by the provider. Reliable tech support is essential for troubleshooting issues and ensuring minimal disruption to your accounting processes.

-

User reviews and reputation

Research user reviews and the overall reputation of the software. This feedback can provide insights into the software’s performance and the experiences of other businesses similar to yours.

-

Trial period or demo

Take advantage of trial periods or demos to test the software before committing. This hands-on experience allows you to evaluate its functionality, ease of use, and suitability for your business.

By considering these factors, you can make an informed decision and choose cloud accounting software that best fits your business needs. The right solution can enhance efficiency, improve accuracy, and ultimately contribute to your company’s success.

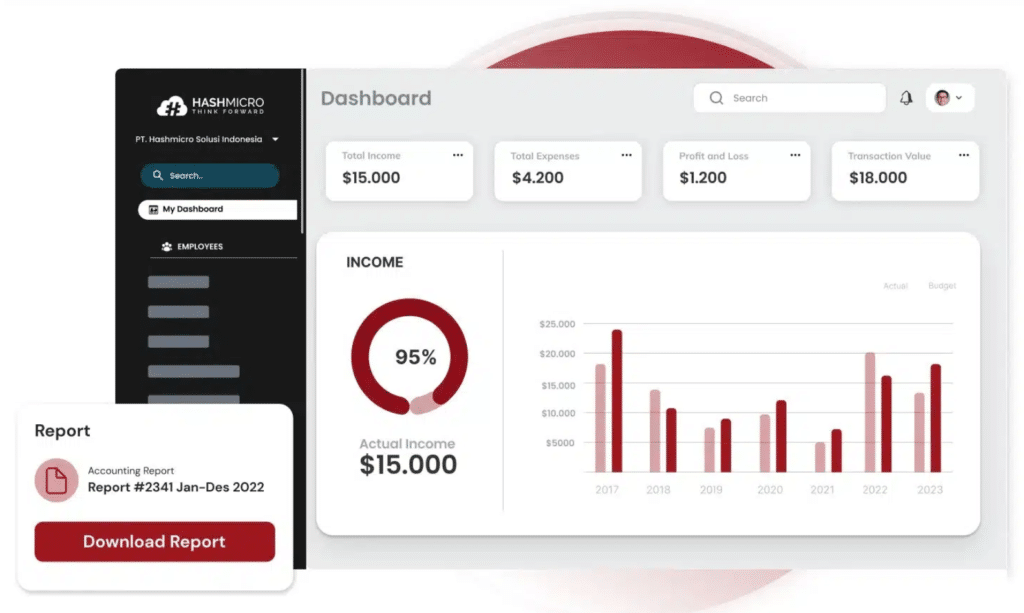

Best Cloud Accounting Software in Singapore: HashMicro

-

Banking integration and automation

-

Enhanced multi-level financial analysis

-

Budgeting and forecasting tools

-

Cash flow and equity management

-

Automated currency updates and multi-company transactions

Businesses with international operations benefit from HashMicro’s automated currency updates, which reduce the risk of errors in exchange rate calculations. The platform also supports multi-company setups with intercompany transactions, facilitating consolidated financial reporting.

Conclusion

Cloud accounting has become an essential ally for companies eager to enhance their financial management. With features like real-time data access and automated processes, businesses can operate more efficiently and accurately.

By switching from traditional methods to cloud-based solutions, you not only reduce the risk of errors but also speed up operations, allowing your team to focus on what truly matters: growth and innovation.

Additionally, cloud accounting offers impressive security for your sensitive financial data. With bank-grade encryption, automatic backups, and real-time threat detection, you can feel confident knowing your information is well protected against the vulnerabilities of traditional accounting systems.

The ability to access your financial information from anywhere and seamlessly integrate with other tools makes cloud accounting a practical and effective choice for businesses across Singapore.

If you’re considering a cloud accounting solution with the best benefits, look no further than HashMicro’s software. Its user-friendly interface and powerful automation features make it an excellent option for businesses of all sizes.

We invite you to try HashMicro’s free demo and discover how this innovative software can streamline your accounting processes and support your success. Let’s elevate your financial management together!

FAQ on Benefit of Cloud Accounting

What are the advantages and issues using cloud accounting as a SaaS for an organization?

Why is cloud accounting safe?

Cloud-based accounting software secures your financial data using encryption, transforming information into an unbreakable code. This technology is similar to that used in online banking, offering a high level of protection. Top cloud accounting solutions also incorporate additional security measures, such as regular audits, automatic backups, and multi-factor authentication. With these protective features in place, businesses can confidently rely on the safety of their financial data stored in the cloud.What is the future of cloud accounting?

The future of cloud accounting software is bright, with key trends driving efficiency and cost reduction:

- AI & Machine Learning will automate data processes, improve accuracy, and enhance decision-making.

- Blockchain will provide secure, transparent transactions and enable real-time auditing.

- App Integration will streamline operations by connecting accounting software with other business tools.

These innovations will help businesses reduce costs, improve accuracy, and stay competitive in a digital financial world.