Are you struggling with manual financial management? Therefore, accounting software emerged as a modern tool that offers real-time financial insights, which aids in better decision-making and resource allocation.

However, choosing the right software can be challenging due to the many options available. A wrong choice can lead to inefficiencies and financial losses. Hence, it’s crucial to select the software that aligns with your business’s needs.

But, you don’t need to worry because HashMicro accounting software comes as the best solution. HashMicro streamlines financial processes by providing features such as forecast budget, financial statement, landed cost management, bank integration, and many more.

Besides, this article will provide other insights on selecting the best 20 accounting software in Singapore for 2025 that ensures accuracy, financial integrity, and compliance with SFRS.

Key Takeaways

|

Table of Content:

Table of Content

What is Accounting Software?

With features that automate routine operations, businesses can save valuable time and reduce the likelihood of errors associated with manual data entry.

Moreover, accounting software provides a comprehensive view of an organization’s financial landscape, enabling users to monitor income, expenses, assets, and liabilities with ease. By generating detailed financial reports, it aids in informed decision-making and strategic planning.

This software is essential for businesses of all sizes, helping them maintain compliance with accounting standards and tax regulations while ensuring they remain financially organized and efficient.

What Are The Key Benefits of Accounting Software?

As accounting software supports a wide range of accounting system software, it provides significant benefits for businesses across various sectors. These advantages include, but are not limited to:

- Accurate financial recording and tracking: Accounting system software ensures the integrity of financial data, which is crucial for compliance with ACRA regulations, and supports the preparation of financial statements.

- Comprehensive financial management features: Singapore accounting software includes general ledger management, accounts payable and receivable, bank reconciliation, expense tracking, and financial reporting, all tailored to meet Singapore’s financial standards.

- Advanced functionalities: Automated invoicing streamlines GST-compliant billing in Singapore while budgeting tools aid financial planning. Cash flow management ensures liquidity and stability, tax calculations simplify IRAS compliance, and system integration enhances operational efficiency.

- Catering to diverse business needs: Accounting software in Singapore caters to various business sizes and industries, with features and pricing plans tailored to meet specific local requirements, including those required by Singapore’s diverse economic landscape.

- Timely and accurate financial reporting: Systems generate income statements, balance sheets, and cash flow statements, which are essential for decision-making, tax compliance, and financial analysis and ensure adherence to Singapore’s financial reporting standards.

What Are the Top 20 Accounting Software Choices in Singapore for 2025?

Choosing the right Singapore accounting software is crucial for efficient financial management. Here are 20 best accounting software options in Singapore to help you find the best solution for your business needs.

1. HashMicro Best Accounting Software Singapore

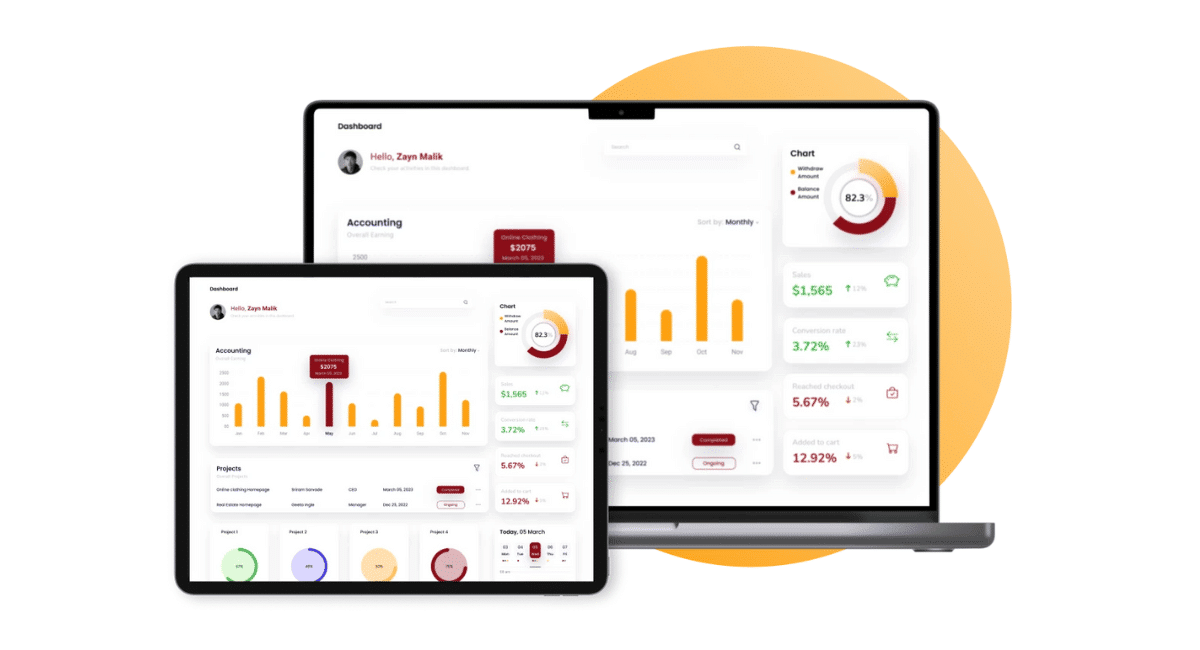

HashMicro Accounting Software is a comprehensive tool for automating financial management tasks. It seamlessly integrates digital financial management, inventory management, CRM, and purchasing into a single platform.

To fully understand how the best accounting system software can optimize financial management, HashMicro offers a free product tour and consultation. This hands-on experience allows potential users to see the software’s features firsthand.

Why we chose this software:

We chose HashMicro software for its end-to-end ERP solutions that streamline business operations and enhance efficiency across various industries.

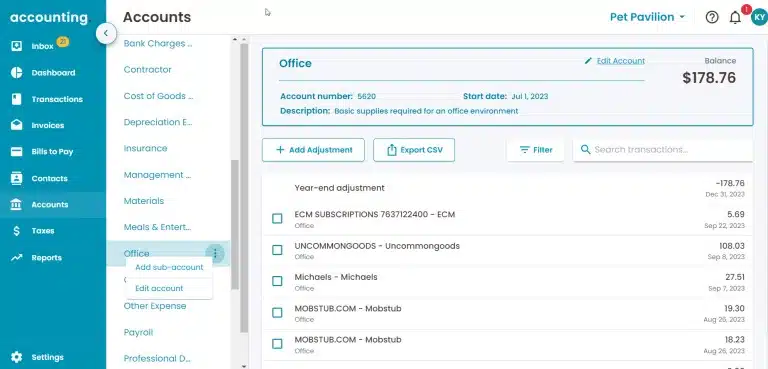

2. Accounting System Software QuickBooks

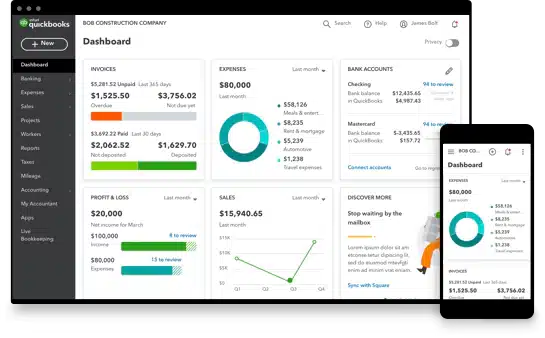

QuickBooks is one of the best cloud accounting software in Singapore developed by Intuit. It provides a system that is either desktop-based or cloud-based online. The features offered include managing inventory, managing cash, and so on.

One of their main features is a feature that categorizes each accounting activity so that users can easily search for transactions.

Why we chose this software:

We chose QuickBooks Intuit for its intuitive interface and powerful accounting tools that make financial management and bookkeeping easy for businesses of all sizes.

Features:

- Invoicing

- Expense tracking

- Payroll management

- Reporting

| Pros | Cons |

|

|

3. Finance Software Xero

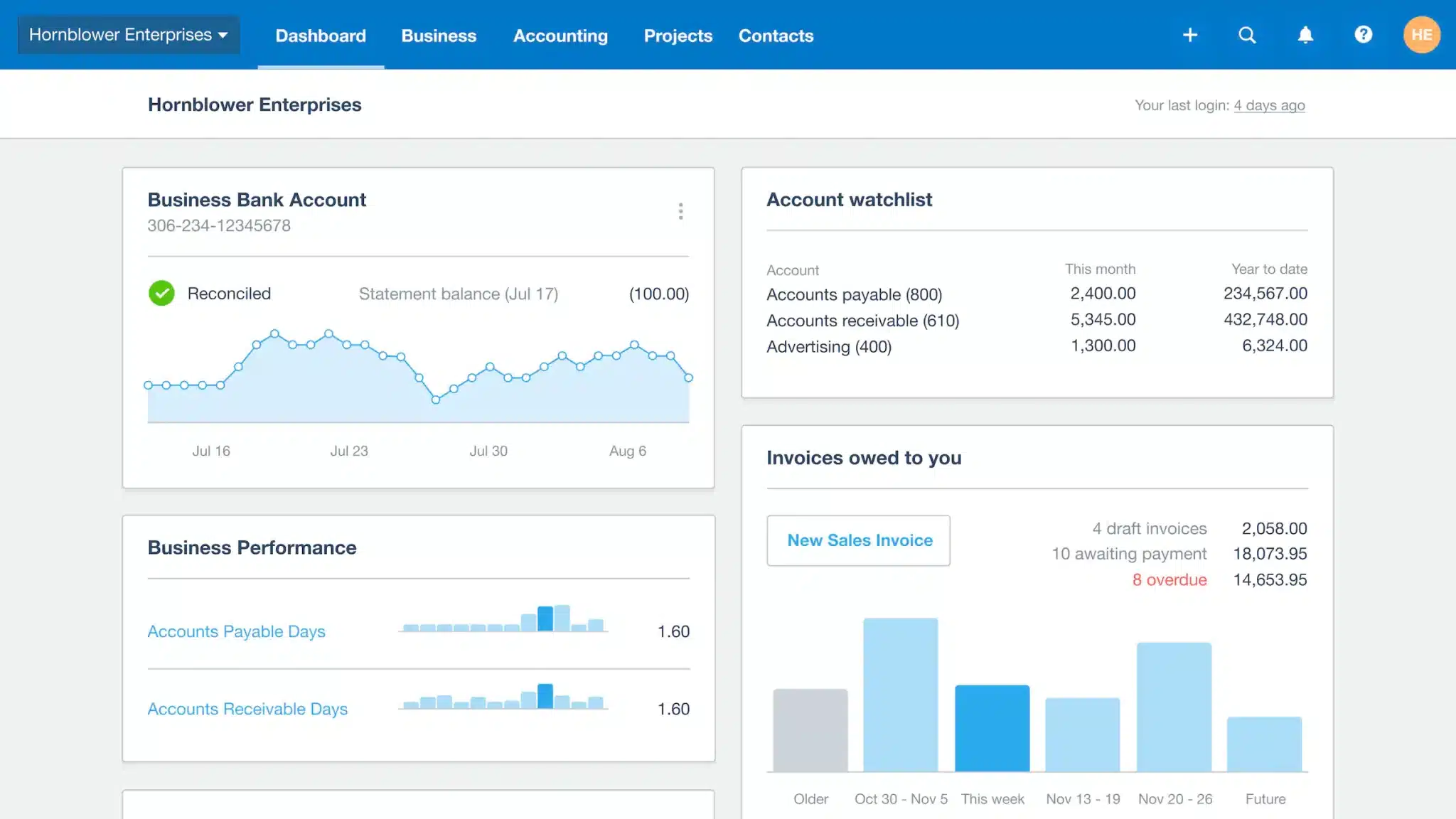

Xero software is one of the popular accounting apps in Singapore that can automate accounting processes within your company. This accounting system software can connect business owners with their numbers, banks, and advisors anytime.

Features owned by Xero range from paying bills, claiming expenses, bank connections, managing contacts, and tracking projects. Xero has various features that third parties can use.

Why we chose this software:

We chose Xero Accounting Software for its user-friendly features that simplify financial management and streamline bookkeeping processes for businesses of all sizes.

Features:

- Bank reconciliation

- Online invoicing

- Expense claims

- Payroll

| Pros | Cons |

|

|

Find more accounting software in Singapore that is as good as Xero by checking out our other articles about Xero alternatives.

4. Accounting Software Sage Cloud

The journey of establishing Sage software began in 1981. To date, more than 20 countries have become customers. Sage provides an accounting system software for business in Singapore.

Unlike other online accounting software Singapore providers, Sage provides two different features between the accounting process and employee payroll to be more focused. In addition, the Sage interface is also user-friendly, so it is suitable for businesses.

Why we chose this software:

We chose Sage Cloud for its robust features and cloud-based accessibility, enabling seamless financial management and real-time business collaboration.

Features:

- Stock and inventory management

- Project tracking

- Bank integration

- Online invoicing

| Pros | Cons |

|

|

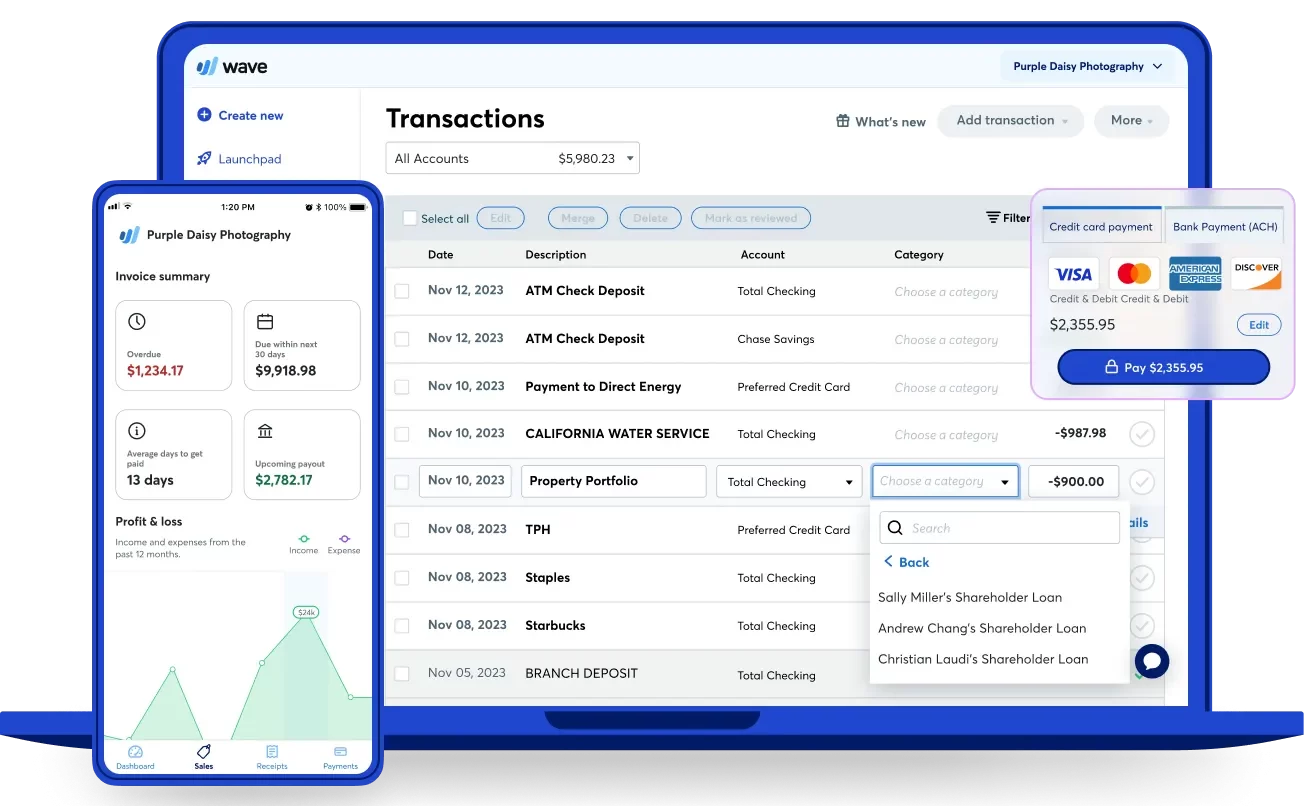

5. Wave Accounting System Software

Wave is an accounting software Singapore that provides financial management solutions. It offers a range of features, including invoicing, accounting, payroll, and receipt scanning, all accessible from a user-friendly dashboard.

Why we chose this software:

We chose Wave for its user-friendly platform that offers comprehensive financial management tools, perfect for businesses with simpler needs.

Features:

- Personal Finance

- Expense tracking

- Receipt scanning

| Pros | Cons |

|

|

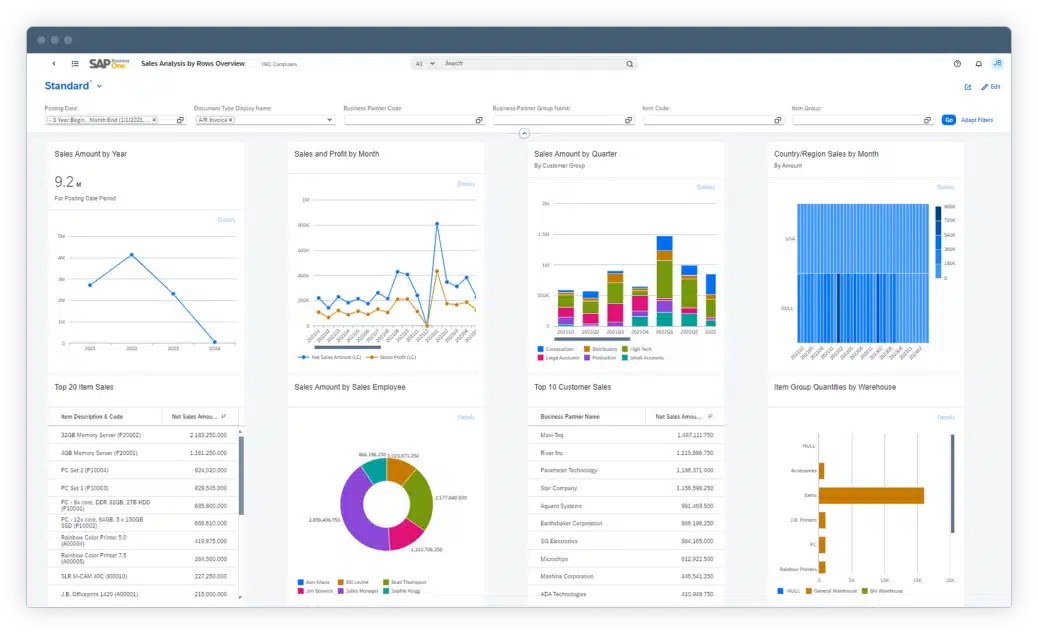

6. Financial Software SAP Business One

SAP Business One is a Singapore accounting software company designed for enterprise business. It offers comprehensive features to help businesses manage their financial operations, including invoicing, accounting, expense management, and payroll processing.

SAP also offers a range of integrations with other software applications, such as payment and e-commerce platforms, making it easy for businesses to connect with other tools.

Why we chose this software:

We chose SAP Business One for its integrated, scalable ERP solutions that provide comprehensive business management capabilities, which are ideal for growing enterprises.

Features:

- Financial Accounting

- Inventory management

- CRM integration

- Multi-location support

| Pros | Cons |

|

|

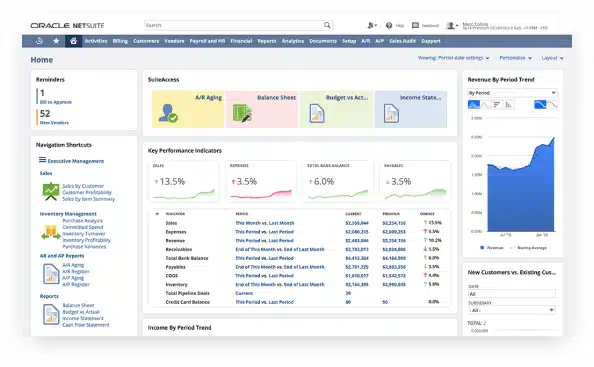

7. Cloud Accounting Software Oracle NetSuite

Oracle NetSuite is an accounting system software that offers a range of features to help businesses manage their finances. These include bank feeds automatically importing transactions from bank accounts, credit cards, and PayPal accounts.

This Singapore accounting software also provides tools for managing sales, purchasing, and inventory and allows businesses to generate professional-looking invoices and quotes.

Why we chose this software:

We chose Oracle NetSuite for its robust cloud-based ERP solutions that offer extensive financial management and operational efficiency for businesses of all sizes.

Features:

- E-commerce integration

- Scalability

- CRM integration

- Financial management

| Pros | Cons |

|

|

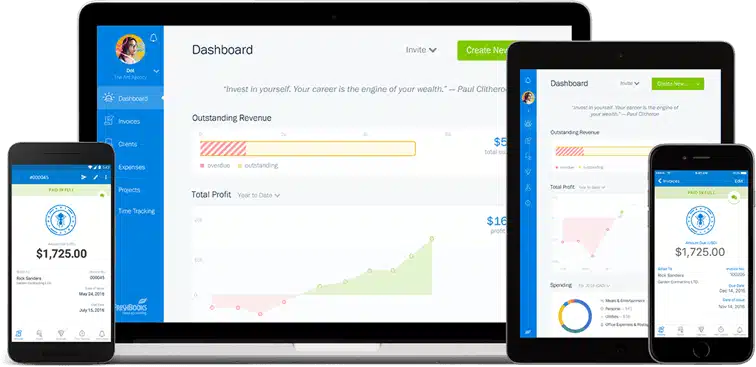

8. FreshBooks Accounting Software Singapore

FreshBooks is a business accounting software in Singapore that provides invoicing, accounting, expense management, and time-tracking features. With its user-friendly interface and comprehensive features, businesses can easily manage their financial operations, generate professional-looking invoices and estimates, track expenses and time, and reconcile bank accounts.

Why we chose this software:

We chose FreshBooks for its easy-to-use invoicing and accounting features, which streamline financial management and enhance productivity.

Features:

- Time tracking

- Client Portal

- Project management

- Invoicing

| Pros | Cons |

|

|

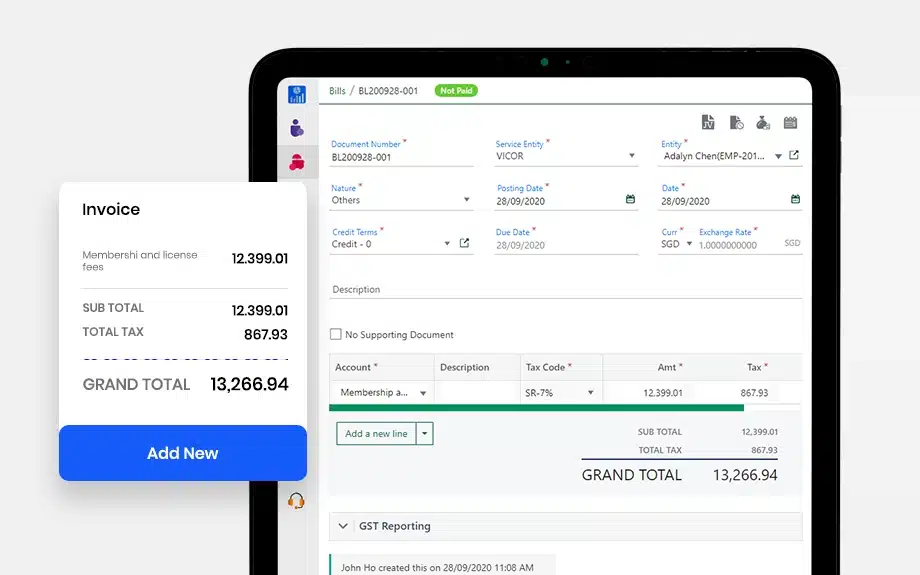

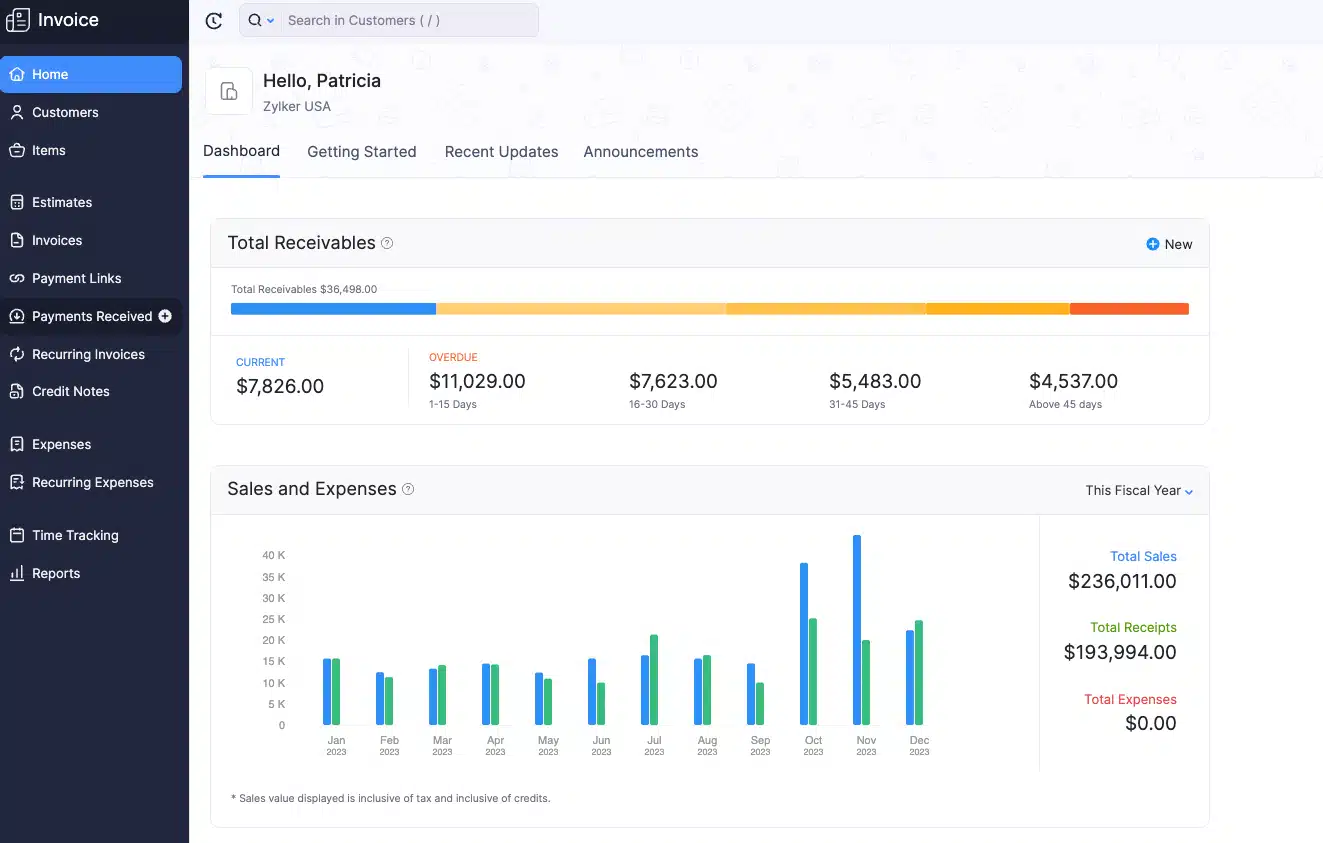

9. Zoho Books

Zoho Books is one of the best accounting software in Singapore designed for businesses. The software provides capabilities for tracking billable hours, generating professional-looking invoices, reconciling bank accounts, managing inventory, and generating financial reports.

Why we chose this software:

We chose Zoho Books for its accounting features and seamless integration capabilities. These provide businesses with efficient financial management and enhanced workflow automation.

Features:

- Inventory management

- Bank reconciliation

- Collaboration

- Expense tracking

| Pros | Cons |

|

|

10. Trulysmall Singapore Accounting System Software

Trulysmall is an open-source accounting system software solution designed for businesses. Its features include accounting, invoicing, inventory management, and point-of-sale capabilities.

With Trulysmall, businesses can easily manage their financial operations, generate professional-looking invoices, keep track of inventory levels, manage customer and supplier accounts, and reconcile bank accounts.

Why we chose this software:

We chose TrulySmall for its simple and efficient accounting tools, making financial management straightforward and hassle-free.

Features:

- Digital payments

- Automatic posting

- Multi-currency

- Invoicing

| Pros | Cons |

|

|

11. Acccounting Software KashFlow

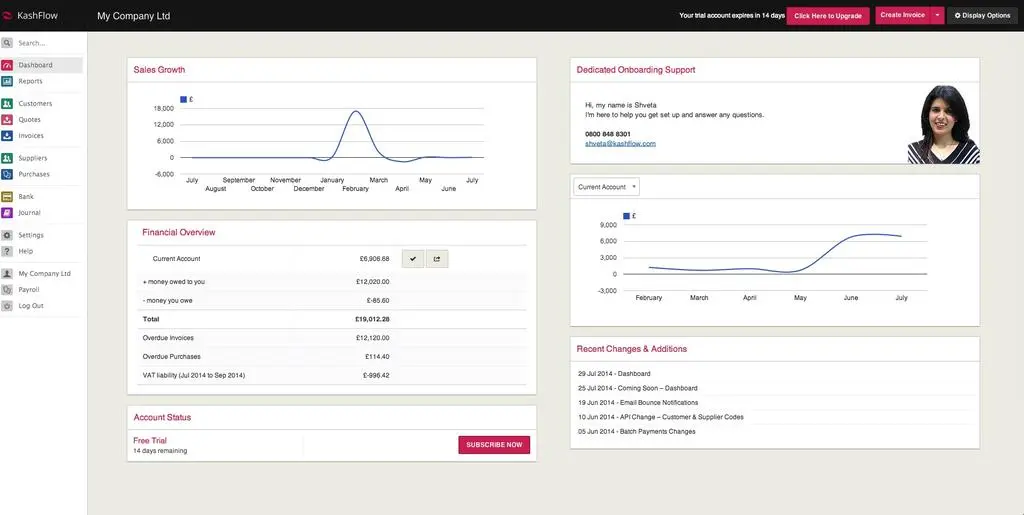

KashFlow is a cloud-based accounting software in Singapore designed specifically for UK businesses. It is tailored to comply with UK tax laws and integrates seamlessly with HMRC, making it ideal for handling VAT, payroll, and other tax-related matters.

Why we chose this software:

We chose KashFlow for its intuitive, cloud-based accounting software that simplifies financial management and streamlines business bookkeeping.

Features:

- Online invoicing

- Reporting

- Payroll

- All-in-one account

| Pros | Cons |

|

|

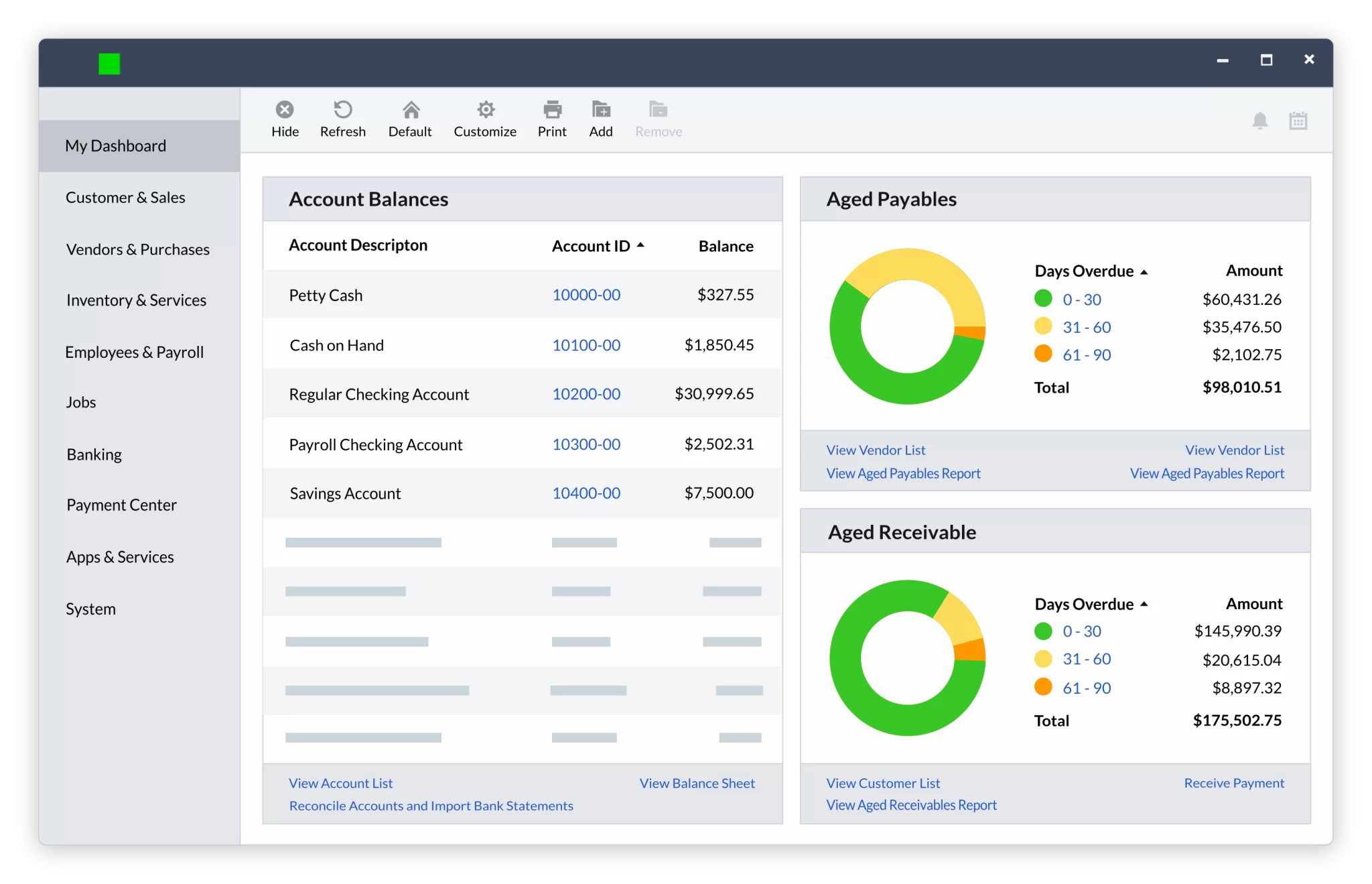

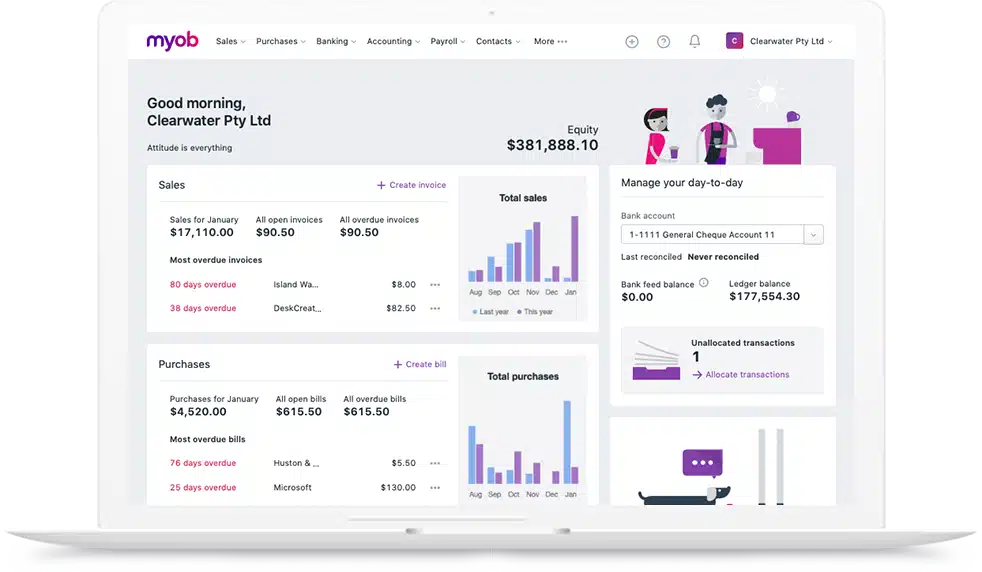

12. MYOB Accounting Software

MYOB Accounting is a comprehensive Singapore accounting software with various features and functionalities. This software is known for its ease of use and efficient handling of accounting tasks.

Why we chose this software:

We chose MYOB Accounting for its powerful, user-friendly features that simplify financial management and support compliance.

Features:

- Cashflow management

- Bank integration

- Track income and expense

| Pros | Cons |

|

|

13. Accounting System Software Lightspeed

Lightspeed is one of the best accounting software in Singapore designed for retail and restaurant businesses. Its features include point-of-sale (POS) capabilities, inventory management, customer relationship management, and e-commerce integration.

Why we chose this software:

We chose Lightspeed for its integrated POS and accounting solutions, which enhance business operations and streamline financial management for the retail and hospitality industries.

Features:

- Billing management

- Cash management

- Online payments

| Pros | Cons |

|

|

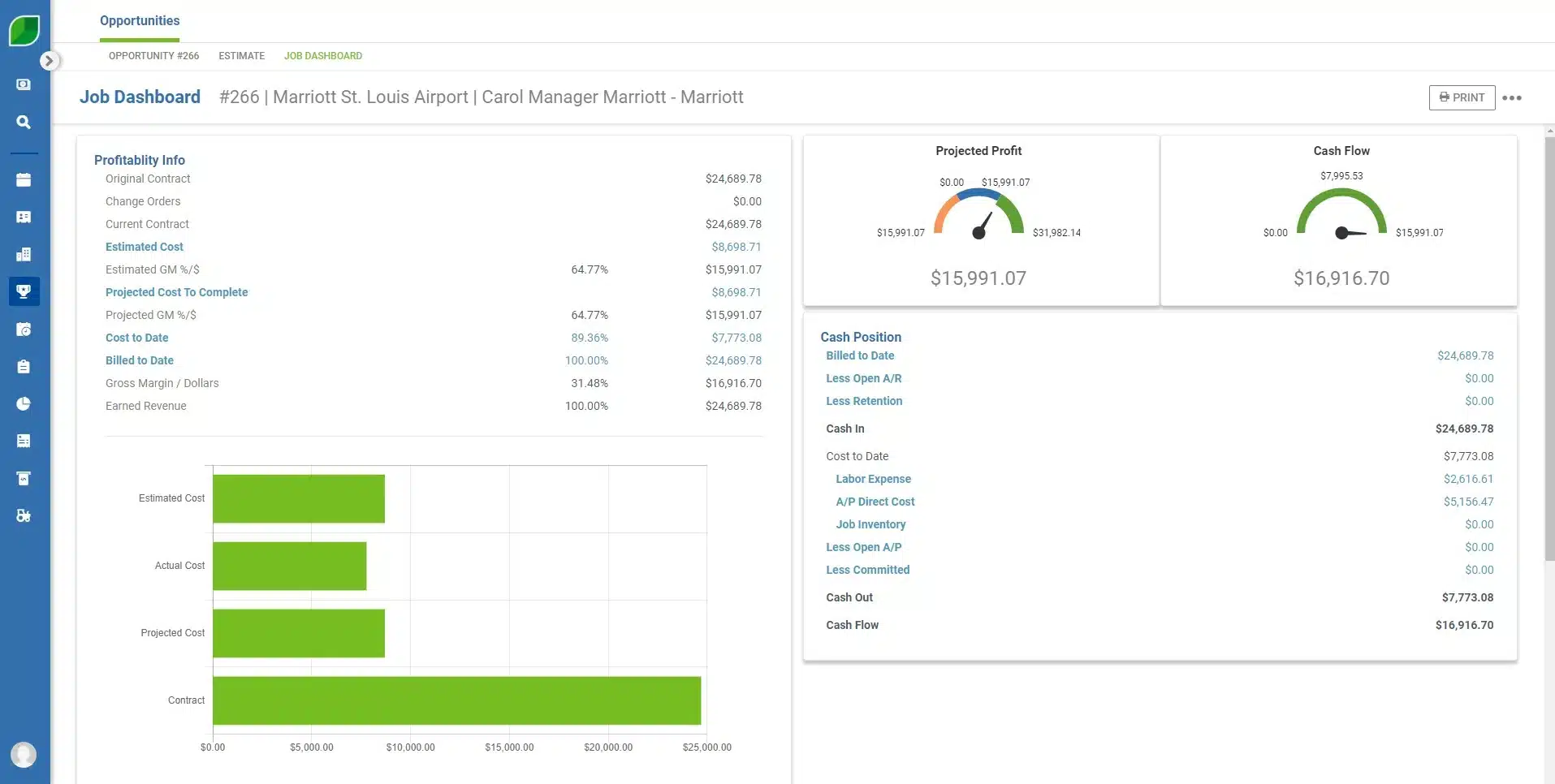

14. Aspire Accounting Software

Aspire offers an all-in-one financial platform tailored for growing businesses. It features integrated solutions for expense management, global payments, and financial reporting. Its user-friendly interface provides seamless integration with major Singapore accounting software.

Why we chose this software:

We chose Aspire for its innovative digital banking solutions, which simplify financial management and provide seamless integration with business accounting software in Singapore.

Features:

- Multiple currencies

- Remote access

- Online transaction

| Pros | Cons |

|

|

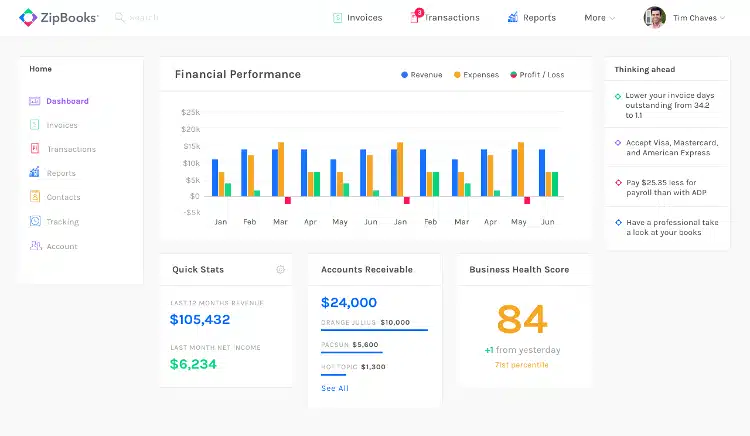

15. Accounting System Software ZipBooks

ZipBooks is an accounting software in Singapore that simplifies financial management for businesses. It offers features such as simple bookkeeping, automated expense tracking, and intelligent reporting. However, some users may find its features too basic for complex accounting needs.

Why we chose this software:

We chose ZipBooks for its smart, user-friendly Singapore accounting software that offers automated bookkeeping and detailed financial insights.

Features:

- Invoicing and billing

- Time tracking

- Mobile accounting

| Pros | Cons |

|

|

16. Financio Accounting System Software

Financio is a comprehensive cloud accounting system software for Singapore businesses. It simplifies accounting tasks with features like automated bookkeeping, e-invoicing, and multi-user collaboration. It is designed for ease of use and offers a multilingual interface and responsive support.

Why we chose this software:

We chose Financio for its straightforward, cloud-based accounting software that simplifies financial management.

Features:

- Billing and invoicing

- Reporting and analytics

- Multi-branch connectivity

| Pros | Cons |

|

|

17. SmartCursors

SmartCursors offers cloud accounting software in Singapore designed to provide businesses with comprehensive financial management. The platform includes automated bookkeeping, real-time financial reporting, and budget management, which help streamline accounting processes.

Why we chose this software:

We chose SmartCursors for its innovative accounting solutions, which offer seamless integration, real-time financial tracking, and automation, making them ideal for modern businesses.

Features:

- Multiple entities

- Customer and vendor management

- Cash flow management

| Pros | Cons |

|

|

18. Highnix Accounting System Software

Highnix offers a robust ERP system with integrated accounting software Singapore features. It supports multi-currency transactions and complies with stringent regulatory standards, including Singapore’s IRAS e-tax guidelines.

Why we chose this software:

We chose Highnix for its advanced, user-friendly accounting software in Singapore. This software provides comprehensive financial management and robust reporting tools tailored to businesses of all sizes.

Features:

- Integration with third-party applications

- Billing and invoicing

- Authentication and data backup

| Pros | Cons |

|

|

19. Kashoo

Kashoo is a cloud-based accounting software that aims to simplify financial management for small businesses. Its user-friendly interface and essential features allow business owners to access their financial data from any location, which can be beneficial for those who prioritize mobility.

Why We Choose This Software: Kashoo may be a suitable option for small businesses seeking a straightforward, cloud-based accounting solution, particularly for those who value simplicity and mobility.

Features:

- Invoicing: Enables users to create, send, and manage invoices with minimal effort.

- Expense Tracking: Provides real-time tracking of business expenses.

- Bank Reconciliation: Automates transaction syncing for accurate reconciliation.

| Pros | Cons |

|

|

20. AccountEdge Pro

This particular software being designed for small to medium-sized businesses, which caters to Mac users. It offers a range of features, including invoicing, payroll, and reporting, making it an option for those who prefer an offline accounting solution.

Why We Choose This Software: Kashoo may be a suitable option for small businesses seeking a straightforward, cloud-based accounting solution, particularly for those who value simplicity and mobility.

Features:

- Multi-User Access: Allows multiple users to work on a single company file simultaneously.

- Invoicing and Billing: Streamlines billing processes with efficient management of invoices and sales orders.

- Integrated Payroll Management: Includes features to simplify employee payment processes.

| Pros | Cons |

|

|

How Many Types of Accounting Software Are Available in Singapore?

When exploring accounting software in Singapore, businesses can choose from cloud-based, desktop, and hybrid options, each offering distinct deployment and features tailored to various needs. Below are the explanations of each type of accounting system software:

- Cloud accounting system software in Singapore are increasingly popular for their flexibility and accessibility. They allow financial management from anywhere via the Internet and boast features like scalability, robust data security, and seamless integration with other cloud applications.

- Desktop accounting system software, installed locally, provide robust functionality and secure data storage, with the added benefit of offline access. However, they require regular updates and may lack the collaborative ease of cloud solutions.

- Hybrid accounting system software combines the advantages of both, offering offline access with the flexibility of cloud features. This type is ideal for businesses needing stringent data control and remote accessibility.

Each type aims to be the best accounting software in Singapore by addressing specific business requirements, ensuring companies find the perfect fit to streamline their financial processes.

How to Choose the Right Accounting Software?

Selecting the ideal Singapore accounting software for your business can significantly impact your financial management and operational efficiency. To make the right choice, follow these key steps:

1. Identify your business needs

Consider factors like your business size, the complexity of your financial transactions, and any industry-specific needs. Understanding these aspects will help you narrow down the software options that align with your business goals.

2. Evaluate features and capabilities

Look for software that offers essential accounting features such as invoicing, expense tracking, payroll processing, and financial reporting. Advanced features like automation, tax compliance, and integration with other business tools can also be crucial for streamlining your accounting processes.

3. Consider ease of use

User-friendly software can save time and reduce errors. Choose a platform with an intuitive interface and clear navigation. This ensures that your team can quickly adapt to the software without extensive training.

4. Check for scalability

As your business grows, your accounting needs may evolve. Opt for software that can scale with your business, offering additional features and capabilities as required. This will prevent the need for frequent software changes and disruptions.

5. Assess customer support and training

Reliable customer support and training resources are vital. Ensure the software provider offers comprehensive support, including tutorials, documentation, and live assistance. This helps resolve issues promptly and maximize the software’s benefits.

6. Read reviews and compare pricing

Research user reviews to gauge the software’s performance and reliability. Compare the pricing models of different options to find a solution that offers the best value for your budget. Consider both upfront costs and any ongoing subscription fees.

Conclusion

Bookkeeping or accounting software in Singapore has become essential for companies because this crucial function cannot be performed poorly. Therefore, when choosing the software for your accounting activities, you must select one that suits your company’s needs.

HashMicro Accounting Software is the best accounting system software that offers features that seamlessly integrate accounting activities with other activities, like purchasing and CRM in sales.

So, what are you waiting for? Learn more by clicking the image below or schedule a free demo now to experience the transformational power it brings to your operations.

Frequently Asked Questions About Accounting Software

-

What is ERP accounting software?

ERP (Enterprise Resource Planning) accounting software is a business management solution that integrates various functions into a unified system. Unlike standalone accounting software, ERP accounting software provides a holistic approach by combining financial management with other essential business processes.

-

Which accounting software is the simplest to operate?

HashMicro Accounting Software is one of the easiest to use with feature-rich systems. It can be customized to customer needs and integrated with inventory management, CRM, and purchasing systems to provide accurate data.

-

What is the difference between accounting software and ERP?

While accounting software and ERP systems are designed to improve business operations, they serve different purposes and offer distinct features. Understanding these differences can help businesses choose the right solution for their needs.

-

What are the types of accounting software in Singapore?

In Singapore, businesses have access to a range of accounting software solutions designed to meet various needs, from small startups to large enterprises. The types of accounting software available can be broadly categorized into the following:

Enterprise Resource Planning (ERP) Software with Accounting Modules: Integrates accounting with other business functions such as human resources, inventory management, and customer relationship management (CRM). It’s ideal for large enterprises or businesses with complex, cross-functional needs. Example: HashMicro, SAP Business One, Oracle NetSuite.

Cloud-Based Accounting Software: Hosted on remote servers, accessible via the internet, and often based on a subscription model. Offers real-time access to financial data, automatic updates, and integration with other cloud applications. Cloud-based accounting software suitable for businesses of all sizes looking for flexible, scalable, and cost-effective accounting solutions. Example: Xero, Zoho.

Payroll and HR Integrated Accounting Software: Combines accounting functions with payroll processing, employee management, and other HR functionalities. This type of accounting software is suitable for businesses that want to streamline their accounting and HR processes into a single system. Example: KashFlow, Payboy.

-

Should a small business get accounting software?

Yes, small businesses should consider investing in accounting software. Managing finances manually or with basic spreadsheets can be time-consuming and error-prone. Accounting software automates tasks like recording transactions, managing invoices, and tracking expenses, saving time and minimizing mistakes.

Moreover, it helps maintain accurate financial records, which are crucial for budgeting, forecasting, and informed decision-making. The software can generate financial reports, offering insights into the business’s financial health and aiding tax preparation and compliance. Overall, adopting accounting software enhances efficiency, improves financial control, and supports growth, making it an invaluable tool for small businesses.

-

Understanding Pricing Plans and Tiers for Accounting Software in Singapore

When choosing accounting software for your Singapore business, understanding the pricing plans is essential. Basic plans usually include invoicing and expense tracking, ideal for small businesses, while higher-tier plans offer advanced features like multi-currency support and automated tax calculations.

Pricing often depends on the number of users, transaction volume, and support level. Basic plans may limit users, whereas premium tiers provide unlimited access and advanced reporting. Many providers also offer flexible payment options, including monthly or annual subscriptions and free trials. Assessing your business’s needs will help you select a plan that delivers value and effectively supports your operations.

-

Why Are Security Features Important for Accounting Software in Singapore?

Security features are vital for Singapore businesses using accounting software, as they protect sensitive financial data from threats. Essential features include data encryption, two-factor authentication, and secure access controls.

Compliance with regulations like the Personal Data Protection Act (PDPA) is crucial. Robust security measures in accounting software help ensure compliance while safeguarding financial and client data. Some software also offers real-time monitoring for suspicious activity and regular backups, ensuring that financial information remains secure and recoverable.

-

How Do Industry-Specific Accounting Software Solutions Benefit Singapore Businesses?

Industry-specific accounting software offers tailored features that meet the unique needs of various sectors. For Singapore businesses, these solutions provide functionalities like inventory management for retail or project tracking for construction, ensuring alignment with industry requirements.

By adopting software designed for their sector, businesses can streamline operations and enhance efficiency. For example, hospitality companies may benefit from automated billing, while manufacturing firms require tools to manage production costs. Additionally, this software helps ensure compliance with local regulations, allowing businesses to focus on their core operations with confidence in their financial management.