HR Payroll software is critical to any company. In other words, it simplifies the payroll process in an organization, ensuring accurate salary calculation as well as a timely salary payment. If you are looking for the most suitable payroll system for your business, you are on the right page!

Key Takeaways

|

Table of Content:

Table of Content

What is a Payroll App?

A payroll app is a sophisticated software or cloud-based system designed to streamline and optimize the payroll distribution process within a company. By automating various payroll management tasks, the app significantly enhances the accuracy of the entire financial records.

The payroll app consolidates all relevant payroll information into one integrated platform, enabling companies to easily access employee wage data, generate payslips, and calculate tax deductions.

Furthermore, the payroll app provides valuable assistance to human resource managers by offering features that facilitate attendance tracking, leave management, and other payroll-related aspects.

This automation simplifies HR operations, eliminating the need for labor-intensive manual record-keeping methods. Additionally, the payroll app offers employees transparent and precise visibility into their performance and compensation, enhancing accountability and accuracy.

Why is Payroll App Management Important?

Payroll app management is important for several reasons. Firstly, it eliminates the need for manual calculations and paperwork, reducing the risk of errors and saving valuable time for HR staff.

By automating tasks such as wage calculations, tax deductions, and generating payslips, the payroll app provides accurate and timely results, ensuring employees are paid correctly and on time.

Additionally, payroll apps simplify tax management by keeping up with ever-changing tax regulations. These apps automatically calculate tax deductions and generate reports, ensuring compliance with legal requirements and reducing the risk of penalties or audits. This not only saves businesses time but also helps avoid costly mistakes.

Moreover, payroll app management offers advanced features such as time and attendance tracking, leave management, and employee self-service portals. These functionalities streamline HR processes, enabling efficient tracking of employee attendance, leaves, and overtime hours.

The employee self-service portals empower employees by providing access to their pay stubs, tax documents, and other important information, reducing the administrative burden on HR staff.

What are Some Methods of Payroll App Management?

In this section, we will explore some of the key methods of payroll app management that businesses can utilize to optimize their payroll processes. Understanding these methods will help businesses make informed decisions about the most suitable approach for their specific payroll needs.

Let’s delve into the details of these payroll app management methods and explore the benefits and considerations associated with each approach.

Manual payroll management using spreadsheets

Manual payroll management using spreadsheets has long been a common method for businesses to handle their payroll processes. This method involves creating and maintaining intricate spreadsheets to calculate employee wages, deductions, and tax obligations.

While it is a cost-effective approach initially, manual payroll management through spreadsheets is labor-intensive and prone to errors, making it inefficient and time-consuming.

Payroll management software

Payroll management software offers a more advanced and automated approach to payroll management. These software solutions provide comprehensive features and functionalities to streamline the entire payroll process. They automate tasks such as wage calculations, tax deductions, and generating payslips, saving time and reducing errors.

Payroll management software also often includes additional features like time and attendance tracking, leave management, and employee self-service portals, enhancing overall HR efficiency. With regular updates to tax regulations and compliance, these software solutions help businesses stay up-to-date and ensure legal compliance.

Outsourcing

Another option for payroll app management is outsourcing the entire payroll process to a third-party service provider. Outsourcing allows businesses to delegate payroll management to experts, freeing up internal resources and reducing the administrative burden.

These payroll service providers have specialized knowledge and dedicated teams to handle payroll tasks efficiently and accurately. By outsourcing, businesses can ensure compliance and timeliness in payroll processing.

Key Features of a Payroll App

We will delve into the key features of payroll app management that empower businesses to effectively handle their payroll responsibilities. These features go beyond basic payroll processing and offer a range of functionalities that simplify tasks, improve accuracy, and provide valuable insights.

By understanding the key features of payroll app management, businesses can identify the most suitable software solution for their needs.

Attendance and leaves tracking

One of the crucial features offered by a comprehensive payroll app is the ability to track employee attendance and leaves efficiently. This feature simplifies and automates the process of monitoring and managing employee attendance records, ensuring accurate payroll calculations, and facilitating leave management.

The attendance tracking functionality within a payroll app eliminates the need for manual timekeeping methods, such as timecards or logbooks. Instead, it leverages advanced technology, such as biometric systems, RFID cards, or digital time clocks, to record and track employee clock-in and clock-out times.

By automating this process, businesses can eliminate time theft, reduce errors, and save significant administrative effort.

Payroll reports

Payroll reports generated by a payroll app offer a comprehensive overview of employee compensation, including wages, overtime, bonuses, and deductions. These reports break down the payroll data by individual employee or department, enabling businesses to analyze payroll expenses and identify areas for cost optimization.

In addition to providing financial data, payroll apps generate reports that comply with legal requirements and tax regulations. These reports include tax summaries, payroll tax liabilities, and deductions, ensuring businesses remain in full compliance with applicable labor laws.

By automating the generation of these reports, payroll apps reduce the risk of errors and simplify the tax reporting process.

Tax filing

Tax filing features in a Payroll App keep businesses up-to-date with the latest tax laws, ensuring compliance with legal requirements. These apps automatically calculate payroll tax deductions based on the current tax rates and thresholds.

By automating tax calculations, Payroll Apps reduce the risk of errors and penalties, providing businesses with confidence in their tax filing accuracy.

Benefits of Using a Payroll App

Understanding the benefits of payroll app management is essential for organizations looking to optimize their payroll processes and stay ahead in today’s competitive business landscape.

So, let’s dive into the details and explore how adopting a payroll app can transform your payroll management, streamline operations, and contribute to the overall success of your business.

Simplified onboarding

With a Payroll App, the onboarding process becomes streamlined and user-friendly. The app typically offers features that allow HR staff to easily input and manage new employee information. This includes essential details such as personal information, tax forms, banking details for direct deposit, and other pertinent data required for payroll processing.

The payroll app simplifies the collection of necessary documents by providing electronic forms that can be completed digitally. This eliminates the need for manual paperwork and reduces the administrative burden on HR staff.

New employees can conveniently fill out the required information directly within the app, ensuring accuracy and efficiency in the onboarding process.

Timekeeping tools

Timekeeping tools provided by a payroll app replace traditional manual methods, such as punch cards or time clocks, with automated and sophisticated alternatives. These tools leverage various technologies, such as biometric systems, digital time clocks, or mobile applications, to record employee clock-in and clock-out times with precision.

By automating the timekeeping process, businesses eliminate the need for manual data entry and reduce the risk of errors or discrepancies. Employees can conveniently clock in and out using the designated timekeeping tool, and the recorded data is automatically transferred to the payroll app.

This integration ensures that accurate attendance information is captured and used for payroll calculations, minimizing the potential for mistakes.

Employee welfare

One key aspect of employee welfare addressed by a Payroll App is the accurate and timely processing of employee compensation. The app automates the calculation and distribution of salaries, wages, bonuses, and other forms of employee remuneration.

By ensuring accurate and prompt payment, the app fosters financial stability and security among employees, which is essential for their overall welfare.

Moreover, Payroll Apps often provide employees with self-service portals, allowing them to access their pay stubs, tax documents, and other important financial information conveniently.

This self-service capability empowers employees to stay informed about their earnings, deductions, and tax-related details. It enhances transparency and enables employees to proactively manage their financial affairs, further contributing to their welfare

Automated reporting

Traditionally, creating payroll reports involved manual compilation of data, which was time-consuming and prone to errors. However, with a payroll app, businesses can automate the generation of various reports, eliminating the need for manual data entry and calculations.

The app retrieves relevant payroll data, such as employee wages, taxes, deductions, and benefits, and generates comprehensive reports at the click of a button.

Best Payroll App in Singapore & Indonesia

Rapid technological developments have made various payroll software Singapore and Indonesia providers appear. Payslips Singapore is one of the biggest obstacles for companies to increase their business. This is because the number of employees at the company makes it difficult for companies to manage their payslips.

That’s why companies need Singapore payroll software to make it easier for them to manage payslips. HR Payroll app will also provide Singapore payslip templates that are widely used by the public and other companies.

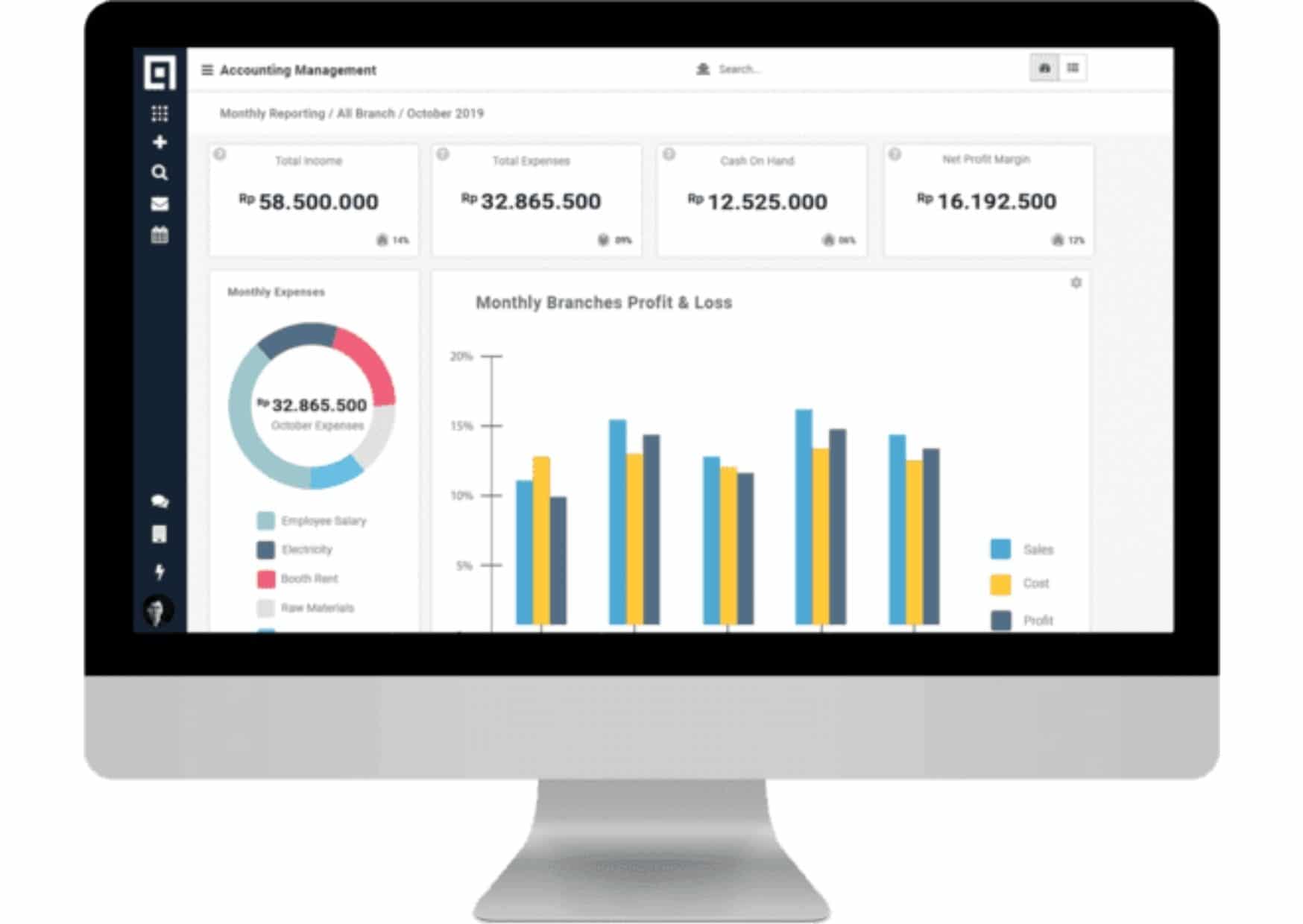

HashMicro Payroll Software

Firstly, HashMicro’s HR Payroll Software is most suitable for enterprise-level companies with many employees. Some of its users include Danone, Hermès, Trans Corp, Yokohama, UOB, Bank of China, and The Face Shop.

Complete with a modern and user-friendly interface, Payroll systems by HashMicro are very easy to understand and accessible for both HR managers and employees.

HashMicro payroll app has localized features such as tax calculation, insurance management, and bonus management. Developed in-house, HashMicro makes it easy for HR managers to calculate employee salaries based on their performance and working hours.

In conclusion, HashMicro’s payroll app also has other features that cover all HR operations such as timesheet management, including:

- Approval Management

- Access Right Management

- Petty Cash Management

- Claim & Reimbursement Management

- Employee Database Management

- Attendance & Timesheet Management

- Leave Management

- Payslip Management

- Polling & Survey Management

- Performance Management

- Appraisal Management

- Recruitment Management

- Tax Calculation

- Analytical Reporting

In addition, HashMicro HR payroll software can be used by as many users as possible without additional fees. Moreover, another advantage that you can get from implementing this system is a dedicated support team that can come directly to your place.

For more optimal results, this payroll system can also be integrated with accounting software and competency management software.

Soltius

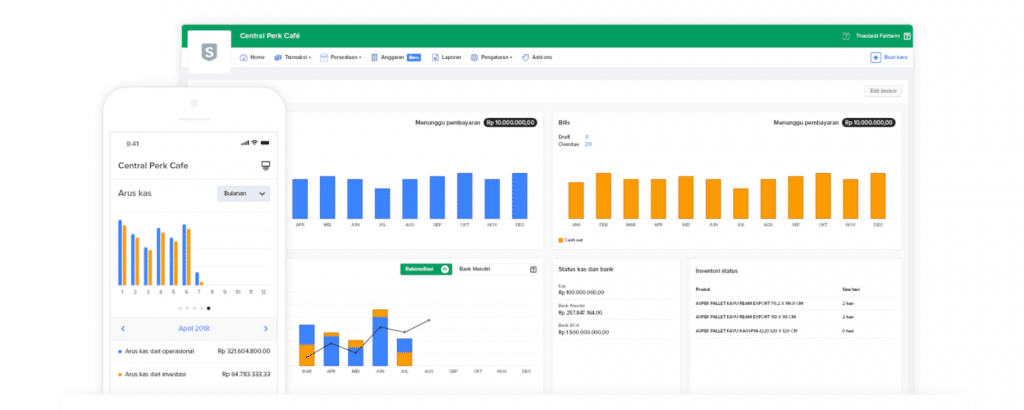

Sleekr is well-known among startups and SMEs. Some companies that have used it are Stock Sale, IDN Media, Miniso, and Mercure Hotels. Certainly, Sleekr offers complete, localized features like insurance and tax calculation.

In terms of price, Sleekr is affordable for small and medium-sized companies. The cost depends on the number of employees in a company. After that, by paying recurring monthly subscription fees, companies can enjoy various solutions that cover HR databases, business processes, office administration, and payroll.

However, Sleekr cannot serve Singapore payslip operations. This is because Sleekr has not served the payroll system for Singapore employees. That is why many Singaporean companies have switched to using the Hashmicro payroll software. Hashmicro serves Singapore payslip management as HR payroll software.

Hashmicro is the best HR payroll program provider in Indonesia and Singapore. This Company is able to manage various employee salaries and manage corporate and employee tax calculations. Hashmicro provides complete and integrated software with each other. That’s why HashMicro’s payroll system is trusted by many companies.

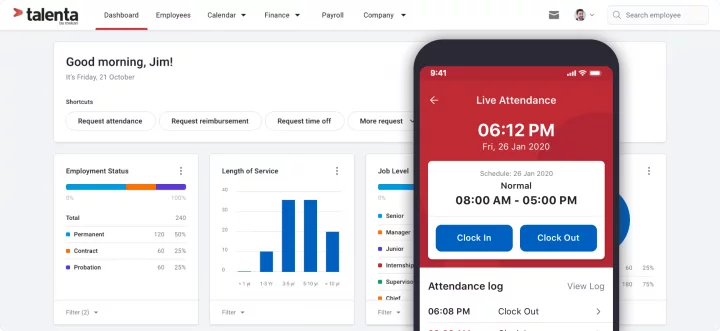

Talenta

Just like Sleekr, Talenta is an alternative that should be considered an Indonesian startup. Some of his clients are Go-Jek, Sushi Tei, H&M Indonesia, and Matahari Mall. In addition, to offering local features, Talenta also offers integrated features that include loans, investments, insurance, job market, and health protection.

In addition, Talenta also provides recruitment management and training & learning management features. Talenta is a subsidiary of Mekari which is a payroll app vendor in Indonesia.

However, the completeness of the features available in Talenta is not as complete as HashMicro. Hashmicro is one of the best payroll system providers in Indonesia and Singapore.

This is because of HashMicro’s very complete and integrated features. Hashmicro has a payroll feature that is automatically linked to company finances. It will also make it easier for accountants to calculate and distribute company finances for employee salaries.

In addition, Hashmicro also provides payroll software that HR can schedule salary distribution. That’s what makes Hashmicro trusted by various world companies as the best payroll HR software provider in Indonesia and Singapore.

Singroll

Singroll is one of the most popular HR payroll software in Singapore. This software is a payroll software that many companies use. This is because of various features that can improve HR performance, especially in the payroll system.

Payroll systems Singroll has features for quick scheduling, distribution, and payroll calculations. This allows the company to not miss the salary of each employee. As a payroll software provider, this software also provides an employee data collection feature that is quick and easy for you to do.

Employees only need to fill out a form and it will automatically input to the company. That’s what causes the vendor to be one of the Payroll software Singapore. However, HashMicro provides payroll software that is more complete and more effective to facilitate the calculation of employee salaries.

Hashmicro payroll software also has features to make it easier for companies to calculate employee salaries, taxes, and attendance. That’s why Hashmicro has been trusted by many companies in Indonesia and Singapore.

Zelt

In the evolving corporate landscape of Singapore, Zelt emerges as an innovator in the HR and payroll management vendor landscape, setting a new standard for efficiency and compliance in payroll processes.

With its latest global payroll offering, Zelt is transforming the way businesses handle their most critical financial operations across multiple regions including India, Sri Lanka, and Indonesia.

Its intuitive design and robust features tackle the core challenges of payroll management, ensuring accuracy, operational efficiency, and strict adherence to local regulations.

With unparalleled flexibility to cater to diverse business needs, integration capabilities for managing global talent, and employee-centric features that enhance workplace efficiency and satisfaction, Zelt stands out as the ultimate solution for Singaporean companies aiming to streamline their HR and payroll functions.

As businesses in Singapore navigate through globalization and technological advancements, Zelt serves as a reliable partner, offering a comprehensive and user-friendly platform that not just meets, but exceeds the modern workplace’s practical needs.

Ramco

Ramco is a multinational company that has served around 35 countries in the world as a payroll software provider. The features of its payroll program are different from other payroll systems in Singapore.

That’s what makes Ramco expand to various countries around the world such as Oracle. One of the interesting features of Ramco is the payroll system that is up to date, making it easier for HR to track the payroll.

The Payroll system Singapore from Ramco is also integrated with the company’s accounting system which makes payroll reports always transparent. HR and Accountants can work together and see how much money they spend on employee salaries and know about payslips in Singapore.

Just like Ramco, HashMicro also provides integrated payroll software that can improve HR performance and manage employee payslips in Singapore. HashMicro payroll software can be integrated with company accounting. This makes employee payroll more transparent and timely.

HashMicro also provides a payroll system that is easy for companies to use. The HashMicro payroll application has been trusted by companies in Indonesia and Singapore as an integrated payroll system to manage and control employee Singapore payslips.

Choosing the Best Payroll Software for Your Business

Before choosing a payroll system, you need to first understand your business needs. In short, write them down and then find out if some of the payroll systems that you are considering provide features that suit your business needs.

Secondly, if you own a large company, then you should narrow your choices by choosing several vendors who have experience in providing services for large-scale companies. Therefore, meet those that are in line with your company’s budget.

Most importantly, you need to know your system developers well. In conclusion, we recommend that you choose an in-house developed software to facilitate the installation, customization, training, and maintenance processes.

Importantly, make sure that the payroll software you are going to choose does not have additional costs. Lastly, be sure to check the best HR software options to make sure you get what you need.

HashMicro provides free consultations for those who are looking for payroll solutions for their businesses. Moreover, find out more about HashMicro HR payroll software or contact HashMicro directly and try out the free demo by clicking here.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: { “@type”: “Question”, “name”: “What is one of the best payroll software?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “You can use HashMicro payroll software as payroll software that is trusted and used by many large companies in the world.” } } }

SAP HCM is an HR payroll program offered by Soltius to various companies in Indonesia. Just like HashMicro, Soltius is suitable for companies with lots of employees.

One of the main advantages that you can get by using SAP HCM is the ease of distributing salaries since it is connected with most banks in Indonesia. As a result, various reports relating to salaries, taxes, and attendance can be generated very easily.

Furthermore, just like HashMicro, SAP HCM also offers customer self-service which enables employees to request leaves and reimbursements or access data through their PCs. Above all, employee performance and achievements can also be monitored easily through the system.

Deskera

Deskera HRMS is another option that you should consider especially if you own a large-scale company. For instance, some of its clients are Pertamina, Telkomsel, Mitsubishi Electric, and Starbucks.

Furthermore, this software payroll program makes it easy for HR professionals to manage various insurance benefits, including work-related accidents, health, and pension insurance. Most importantly, other features offered by Deskera are tax management including Tax Withholding & Fiscal Residency.

Sleekr

Sleekr is well-known among startups and SMEs. Some companies that have used it are Stock Sale, IDN Media, Miniso, and Mercure Hotels. Certainly, Sleekr offers complete, localized features like insurance and tax calculation.

In terms of price, Sleekr is affordable for small and medium-sized companies. The cost depends on the number of employees in a company. After that, by paying recurring monthly subscription fees, companies can enjoy various solutions that cover HR databases, business processes, office administration, and payroll.

However, Sleekr cannot serve Singapore payslip operations. This is because Sleekr has not served the payroll system for Singapore employees. That is why many Singaporean companies have switched to using the Hashmicro payroll software. Hashmicro serves Singapore payslip management as HR payroll software.

Hashmicro is the best HR payroll program provider in Indonesia and Singapore. This Company is able to manage various employee salaries and manage corporate and employee tax calculations. Hashmicro provides complete and integrated software with each other. That’s why HashMicro’s payroll system is trusted by many companies.

Talenta

Just like Sleekr, Talenta is an alternative that should be considered an Indonesian startup. Some of his clients are Go-Jek, Sushi Tei, H&M Indonesia, and Matahari Mall. In addition, to offering local features, Talenta also offers integrated features that include loans, investments, insurance, job market, and health protection.

In addition, Talenta also provides recruitment management and training & learning management features. Talenta is a subsidiary of Mekari which is a payroll app vendor in Indonesia.

However, the completeness of the features available in Talenta is not as complete as HashMicro. Hashmicro is one of the best payroll system providers in Indonesia and Singapore.

This is because of HashMicro’s very complete and integrated features. Hashmicro has a payroll feature that is automatically linked to company finances. It will also make it easier for accountants to calculate and distribute company finances for employee salaries.

In addition, Hashmicro also provides payroll software that HR can schedule salary distribution. That’s what makes Hashmicro trusted by various world companies as the best payroll HR software provider in Indonesia and Singapore.

Singroll

Singroll is one of the most popular HR payroll software in Singapore. This software is a payroll software that many companies use. This is because of various features that can improve HR performance, especially in the payroll system.

Payroll systems Singroll has features for quick scheduling, distribution, and payroll calculations. This allows the company to not miss the salary of each employee. As a payroll software provider, this software also provides an employee data collection feature that is quick and easy for you to do.

Employees only need to fill out a form and it will automatically input to the company. That’s what causes the vendor to be one of the Payroll software Singapore. However, HashMicro provides payroll software that is more complete and more effective to facilitate the calculation of employee salaries.

Hashmicro payroll software also has features to make it easier for companies to calculate employee salaries, taxes, and attendance. That’s why Hashmicro has been trusted by many companies in Indonesia and Singapore.

Zelt

In the evolving corporate landscape of Singapore, Zelt emerges as an innovator in the HR and payroll management vendor landscape, setting a new standard for efficiency and compliance in payroll processes.

With its latest global payroll offering, Zelt is transforming the way businesses handle their most critical financial operations across multiple regions including India, Sri Lanka, and Indonesia.

Its intuitive design and robust features tackle the core challenges of payroll management, ensuring accuracy, operational efficiency, and strict adherence to local regulations.

With unparalleled flexibility to cater to diverse business needs, integration capabilities for managing global talent, and employee-centric features that enhance workplace efficiency and satisfaction, Zelt stands out as the ultimate solution for Singaporean companies aiming to streamline their HR and payroll functions.

As businesses in Singapore navigate through globalization and technological advancements, Zelt serves as a reliable partner, offering a comprehensive and user-friendly platform that not just meets, but exceeds the modern workplace’s practical needs.

Ramco

Ramco is a multinational company that has served around 35 countries in the world as a payroll software provider. The features of its payroll program are different from other payroll systems in Singapore.

That’s what makes Ramco expand to various countries around the world such as Oracle. One of the interesting features of Ramco is the payroll system that is up to date, making it easier for HR to track the payroll.

The Payroll system Singapore from Ramco is also integrated with the company’s accounting system which makes payroll reports always transparent. HR and Accountants can work together and see how much money they spend on employee salaries and know about payslips in Singapore.

Just like Ramco, HashMicro also provides integrated payroll software that can improve HR performance and manage employee payslips in Singapore. HashMicro payroll software can be integrated with company accounting. This makes employee payroll more transparent and timely.

HashMicro also provides a payroll system that is easy for companies to use. The HashMicro payroll application has been trusted by companies in Indonesia and Singapore as an integrated payroll system to manage and control employee Singapore payslips.

Choosing the Best Payroll Software for Your Business

Before choosing a payroll system, you need to first understand your business needs. In short, write them down and then find out if some of the payroll systems that you are considering provide features that suit your business needs.

Secondly, if you own a large company, then you should narrow your choices by choosing several vendors who have experience in providing services for large-scale companies. Therefore, meet those that are in line with your company’s budget.

Most importantly, you need to know your system developers well. In conclusion, we recommend that you choose an in-house developed software to facilitate the installation, customization, training, and maintenance processes.

Importantly, make sure that the payroll software you are going to choose does not have additional costs. Lastly, be sure to check the list of the best HR software options to make sure you get what you need.

HashMicro provides free consultations for those who are looking for payroll solutions for their businesses. Moreover, find out more about HashMicro HR payroll software or contact HashMicro directly and try out the free demo by clicking here.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: { “@type”: “Question”, “name”: “What is one of the best payroll software?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “You can use HashMicro payroll software as payroll software that is trusted and used by many large companies in the world.” } } }