Struggling to keep track of your business’s cash flow? Many businesses face challenges in managing inflows and outflows, leading to financial uncertainty. A cash flow statement template simplifies tracking, ensuring better clarity and efficiency.

Approximately 60% of businesses do not have a formal cash flow forecasting process, indicating a gap in proactive financial planning that can lead to unexpected cash shortfalls and hinder effective financial management and growth preparation.

An accounting system with a cash flow statement template helps businesses monitor financial health with automated tracking, real-time updates, and precise categorization. This article provides templates and explores how HashMicro’s Accounting Software simplifies financial management for a more efficient cash flow process.

Table of Content:

Table of Content

Key Takeaways

|

What is a Cash Flow Statement Template

Types of Cash Flow

1. Operating cash flow

Operating cash flow (OCF) refers to the cash generated or consumed by a company’s core business activities, such as sales and expenses. This type of cash flow reflects whether a company can generate sufficient revenue to cover its daily operational costs.

Positive operating cash flow generally indicates a healthy business that can support its operations from revenue alone, while negative OCF may signal financial challenges or operational inefficiencies.

2. Investing cash flow

Investing cash flow covers transactions related to acquiring and disposing of long-term assets, like property, equipment, and investments. It includes cash spent on purchasing fixed assets or received from selling them.

Negative cash flow from investing is common in growth phases, while positive cash flow from investing may indicate asset sales or divestments.

3. Financing cash flow

Financing cash flow relates to the cash activities that fund the company’s operations and growth, such as issuing or repurchasing stocks, obtaining loans, and repaying debt. This category captures how a business manages its capital structure.

Positive financing cash flow may result from raising funds via equity or debt issuance, while negative financing cash flow often reflects the repayment of loans or dividend payments to shareholders.

By analyzing each category, they can better assess whether the company is generating sufficient cash to support its operations, investing strategically for future growth, and managing its capital effectively.

Benefit of Cash Flow Statement Template

Before diving into the specifics, it’s essential to understand why a cash flow statement template is a valuable tool for any business. Let’s explore the key benefits in more detail:

1. Improved financial organization

A cash flow statement template provides a structured layout for categorizing cash inflows and outflows, which minimizes the chance of missing entries or misclassifying transactions. By ensuring all financial activities are recorded in an organized way, the template simplifies cash tracking and supports more accurate financial management.

2. Enhanced financial clarity

A template offers a clear, consolidated view of cash movements, allowing businesses to understand how operational, investing, and financing activities impact their cash position. This visibility aids in identifying trends, spotting cash shortages before they become critical, and helping businesses make well-informed strategic spending decisions.

3. Streamlined reporting and forecasting

Many digital or software-integrated templates come with automated calculations, built-in summaries, or visualizations that save time and reduce manual errors. These features improve the accuracy of current reporting and provide valuable insights for forecasting, helping businesses plan for future investments and funding needs.

With these benefits in mind, a sample cash flow statement can be a strategic asset for business financial management. In the next section, we’ll explore how to select the right template and customize it to fit your unique business needs.

How to Create a Cash Flow Statement Template

Creating a custom cash flow statement example tailored to your business needs doesn’t have to be complicated. Here’s a step-by-step guide to help you get started:

1. Define key cash flow categories

Start by organizing your template into the three main cash flow categories: Operating, Investing, and Financing. Each section should have fields for everyday cash activities. For example, in the Operating section, include cash received from sales, payments for inventory, and operational expenses like salaries and rent.

For Investing, include asset purchases or sales, and in Financing, document loan proceeds or repayments and equity activities.

2. Set up input fields and automate calculations

Use spreadsheet software (like Excel or Google Sheets) or a digital accounting tool that supports basic automation for simplicity and accuracy. Set up input fields for cash inflows and outflows under each category and automate subtotals for each section.

Adding a formula to calculate the net cash flow (total inflows minus total outflows) for each period will allow you to see the overall cash position at a glance.

3. Create visual summaries for clarity

Add charts or graphs if your template software supports visual data presentation. Visual summaries, such as monthly or quarterly cash flow trends, make it easier to identify patterns and communicate financial health to stakeholders

4. Customize for recurring needs and update regularly

Tailor the template with sections unique to your business, such as fields for seasonal sales fluctuations, recurring loan repayments, or planned asset acquisitions. Regular updates to your template are crucial; consider setting a monthly or quarterly review schedule to ensure the data remains current and accurate.

5. Save and test for accuracy

Before finalizing, test the template with sample data to ensure all calculations work as expected. Verify that the template accurately reflects cash flows and that all links and formulas update automatically when new data is added.

Once complete, save the template as a master file and use it as a standard for regular cash flow management and forecasting.

Following these steps, you can create a cash flow statement format tailored to your business and adaptable as financial needs evolve.

When Do We Need a Cash Flow Statement Template?

Cash Flow Statement Method

In understanding cash flow management, choosing the correct method to prepare cash flow statements can significantly impact the clarity and usefulness of financial reporting. Let’s explore the two main methods and their different purposes in tracking business finances.

1. Direct method

The direct method records cash transactions straightforwardly, focusing on cash received and paid out in specific activities. This includes customer cash receipts and supplier payments, showing actual cash movements.

Although this method offers transparency, it requires meticulous tracking, making it time-consuming for companies with numerous transactions.

2. Indirect method

The indirect method starts with net income and adjusts for non-cash expenses, like depreciation and changes in working capital.

This approach is often easier to prepare and aligns with accrual accounting. It reflects cash flows by reconciling net income with changes in assets and liabilities. This method is widely favored for its simplicity and efficiency in regular financial reporting.

The direct method may benefit smaller companies seeking transaction-level detail, while the indirect method provides a broader overview, making it ideal for businesses that follow accrual accounting principles.

Components of Cash Flow Statement

A cash flow statement is divided into three main sections, each representing different sources and uses of cash: cash flows from operating activities, investing activities, and financing activities.

These sections provide a comprehensive overview of a company’s cash position, revealing how money is generated and used within the organization over a while.

1. Operating Activities

This section focuses on cash flow from the business’s core operations. It includes cash generated from the sale of goods or services and cash paid for operating expenses such as salaries, rent, utilities, and taxes.

2. Investing activities

Cash flows from investing activities include purchasing and selling long-term assets, such as equipment, property, and investments in other businesses. This section shows how a company is investing in its future operations.

3. Financing activities

The financing activities section reflects the cash flow associated with external funding. This includes cash inflows from issuing stocks or taking on loans and outflows from repaying debts or distributing dividends to shareholders.

Analyzing each section of the cash flow statement helps stakeholders gauge operational efficiency, investment activities, and the company’s approach to financing, making it an essential tool for informed business decision-making.

Effortlessly Manage Cash Flow Statements with HashMicro Accounting Software

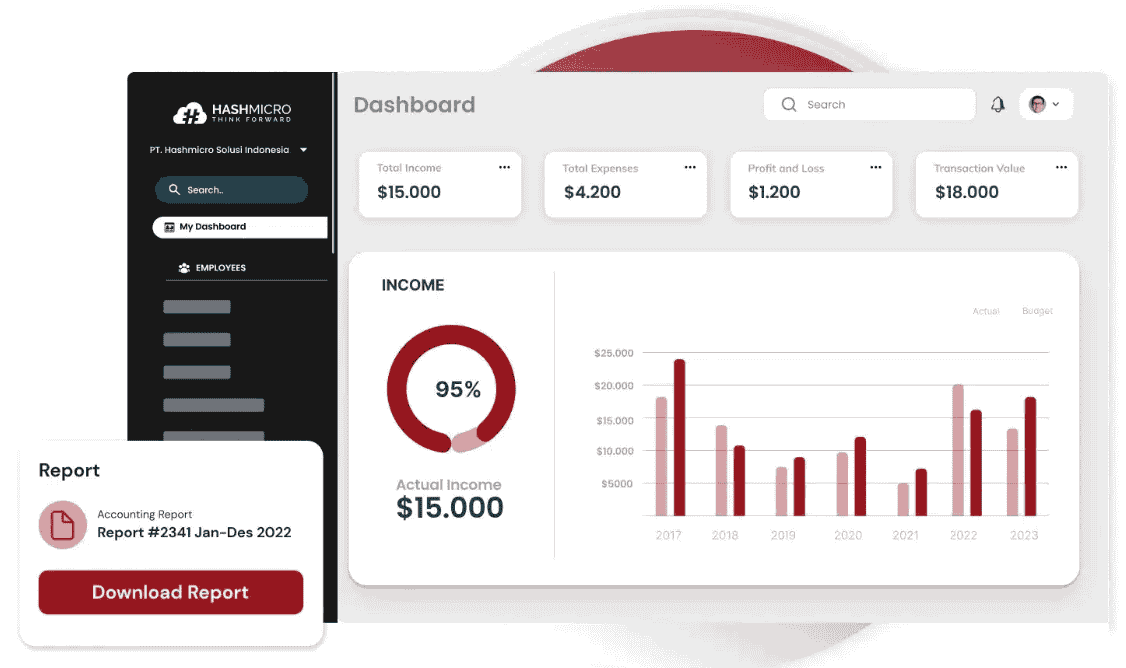

HashMicro Accounting Software provides a powerful solution for businesses to handle cash flow statements with ease and accuracy. By utilizing HashMicro’s customizable cash flow statement templates, companies can automate the tracking of cash inflows and outflows.

Integrated within HashMicro’s Accounting System, the cash flow management tools go beyond templates to support in-depth financial planning. With automated data entry and reporting, businesses can minimize errors and focus on actionable insights.

- Cash Flow Reports: Provides real-time insights into cash inflows and outflows, helping businesses monitor liquidity and make informed financial decisions to maintain stability and support growth.

- Forecast Budget: Enables accurate financial forecasting by estimating future income and expenses, helping businesses set realistic budget expectations and adjust plans proactively.

- Financial Statement with Budget Comparison: Compares actual financial results with budgeted amounts, offering a clear view of performance versus projections to identify areas for improvement or adjustment.

- Profit & Loss vs. Budget & Forecast: Displays profit and loss alongside budget and forecast data, allowing businesses to evaluate their financial standing relative to planned goals and make informed adjustments.

- Budget S Curve: Visualizes cumulative budget spending over time, providing insights into budget consumption patterns and helping maintain expenditure within planned limits.

- Bank Integration – Auto Payment: Connects directly to banks for seamless payment processing, enabling automated payments and reducing manual entry errors for streamlined financial operations.

Conclusions

A cash flow statement template is essential for tracking cash inflows and outflows. It provides a clear snapshot of a company’s financial health and helps businesses maintain proper cash management.

The importance of a cash flow statement cannot be overstated; it enables organizations to assess liquidity, predict cash shortages, and make informed financial decisions that can influence both short-term stability and long-term growth.

HashMicro’s Accounting System offers a comprehensive solution to cash flow management. It combines customizable templates, automated reports, and powerful analytics to simplify the process.

Experience the benefits firsthand by scheduling a free demo with HashMicro, where you’ll discover how easy it can be to enhance your cash flow management and make data-driven financial decisions that drive success.

FAQ About Cashflow Statement Template

-

What is a cash flow statement in Excel?

An actionable cash flow statement in Excel provides a detailed view of cash inflows and outflows across operating, investing, and financing activities. It clearly displays the cash and cash equivalents a company holds at the beginning and end of the period, offering valuable insight into financial movement over time.

-

Which are the 3 main activities of a cash flow statement?

The cash flow statement is divided into three sections: operating activities, investing activities, and financing activities.

-

What should not be included in cash flow statement?

This contrasts with the income statement, which reflects income and expenses on an accrual basis according to GAAP accounting. Additionally, the cash flow statement excludes non-cash items such as depreciation.