Church accounting software is a specialized type specifically tailored to meet the unique financial needs of religious organizations. It includes features and functionalities specifically designed to handle the financial aspects of managing a religious institution. By utilizing church accounting software, religious institutions can streamline their financial management processes, ensure compliance with tax regulations, and maintain accurate financial transaction records.

In addition to the core functionalities, integrating the best accounting software with payroll management systems can bring even more benefits of Accounting Software Integration with Payroll Managementenefits to churches. The integration allows for seamless data transfer, such as eliminating the need for manual entry and reducing the risk of errors. This integration automatically synchronizes employee salary information, tax deductions, and other payroll-related data with the accounting software.

What is Payroll Management?

Payroll management in accounting software refers to the comprehensive process of efficiently and accurately managing employee compensation within an organization. It involves utilizing specialized software tools and features to streamline payroll tasks, such as calculating wages, deducting taxes, generating pay stubs, and ensuring compliance with labor laws and regulations.

How is Church Accounting Software Integrated with Payroll Management?

When integrated with accounting software for the church, payroll management allows for seamless coordination and efficiency in handling payroll processes within the church organization. The integration works by synchronizing employee data and payroll calculations in a single software platform. This integration enables churches to automate various payroll tasks, such as calculating wages and managing tax withholdings, all within their broader accounting system.

Key Features of Church Accounting Software with Payroll Management

Church accounting software with payroll management offers several key features that cater to churches’ and religious organizations’ unique needs. These features ensure efficient and accurate control of payroll processes while adhering to relevant tax regulations and compliance standards.

The first key feature is payroll calculation and processing. The software provides automated tools to calculate employee wages, taxes, and deductions based on predefined rules and regulations. It handles various pay structures, such as hourly rates, salaries, and stipends. It can also handle complex scenarios like overtime, bonuses, and benefits.

The following key feature is tax compliance and reporting. Church accounting software with integrated payroll management assists in maintaining tax compliance by automatically keeping track of tax rates. It generates tax reports and forms, reducing the administrative burden of tax filing. The software helps churches navigate the intricacies of tax laws specific to religious organizations, such as clergy housing allowances or tax exemptions.

Benefits of Accounting Software Integration with Payroll Management

One of the main benefits of accounting software for churches is increased efficiency and time savings. By integrating payroll management with accounting software, businesses can streamline their processes and eliminate the need for manual data entry and duplicate record-keeping. This integration allows for seamless information sharing between the two systems, reducing the risk of errors and saving valuable time for HR and accounting teams.

Another benefit is improved accuracy and compliance. Accounting software integration with payroll management ensures that businesses stay updated with tax regulations and reporting requirements. The software automatically calculates tax withholdings, handles complex payroll scenarios, and generates necessary tax forms and reports. This significantly reduces the risk of errors or non-compliance, minimizing the potential for financial penalties or legal issues.

Recommended Church Accounting Software with Payroll Management

When managing the unique financial needs of churches and religious organizations, finding the right accounting software with integrated payroll management is essential. This combination of features can significantly streamline financial processes, ensure accurate compensation for staff members, and help churches maintain compliance with tax regulations. There are many software that will help you to choose the best accounting software for payroll management.

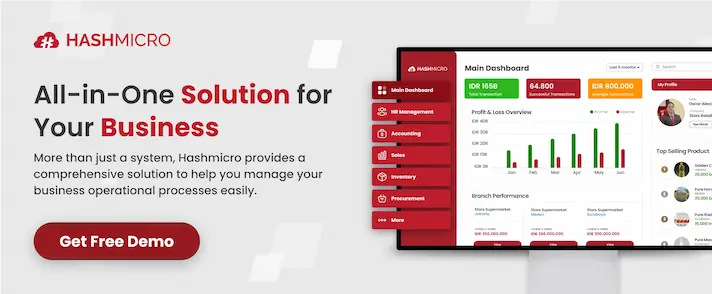

HashMicro

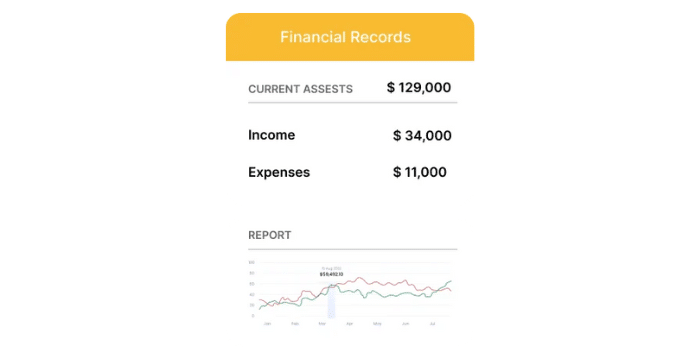

HashMicro offers comprehensive accounting software with integrated payroll management features. Their accounting software is designed to streamline financial processes and provide accurate and efficient payroll management for businesses of all sizes. HashMicro’s accounting software allows businesses to easily track their financial transactions, manage expenses, generate invoices, and handle tax obligations.

One of the standout features of HashMicro’s accounting software is its payroll management functionality. It enables businesses to automate payroll processes, including calculating employee salaries, deducting taxes and benefits, and generating payslips. The software allows for easy integration with attendance systems, making it simple to track employee attendance and calculate accurate working hours for payroll purposes.

Flockbase

Flockbase’s accounting software with payroll management provides churches and nonprofit organizations with a reliable and efficient solution to handle their financial operations. The user-friendly interface and the software’s powerful features allow organizations to streamline their payroll processes, minimize errors, and ensure compliance with payroll regulations.

QuickBooks

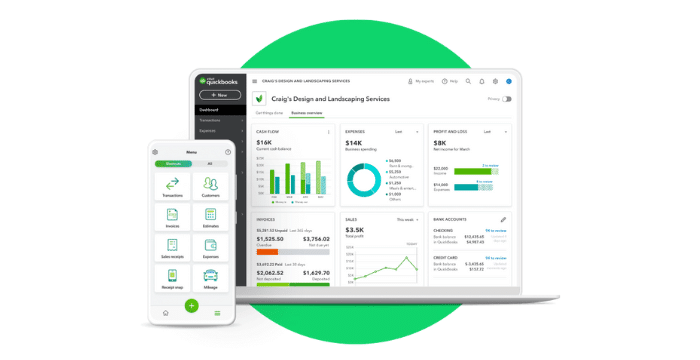

QuickBooks is a renowned accounting software that offers a comprehensive solution for businesses and includes robust payroll management features. One of the key benefits of using QuickBooks for payroll management is its ability to automate and simplify the payroll process. With QuickBooks, businesses can easily calculate employee salaries, handle deductions and withholdings, generate pay stubs, and even facilitate direct deposits, all within a centralized platform.

Aplos Church Accounting Software

One of the significant advantages of using Aplos for payroll management is its user-friendly interface, which simplifies the payroll management tasks for church administrators and staff. The software provides intuitive tools for calculating salaries, handling deductions, and generating pay stubs or direct deposits. It also ensures compliance with tax regulations and generates necessary reports and forms for tax filing.

Sage Intacct

Sage Intacct is a powerful accounting software that offers comprehensive features, including integrated payroll management capabilities. The benefit of using Sage Intacct for payroll management lies in its ability to automate and streamline the payroll process, enhancing business efficiency and accuracy. With Sage Intacct, businesses can easily calculate employee salaries, manage deductions and benefits, and generate payroll reports with just a few clicks.

Xero

Xero accounting software offers a range of features, including integrated payroll management capabilities. The benefit of using Xero for payroll management lies in its seamless integration with the core accounting functions, providing businesses with a comprehensive and unified platform. With Xero, businesses can efficiently handle their payroll processes, saving time and ensuring accuracy.

Conclusion

In conclusion, as technology advances, accounting software with payroll management has become indispensable for churches and religious organizations. These software options offer many benefits, including automation, accuracy, compliance, and integration. By utilizing the best church accounting software with payroll management, churches can optimize their financial operations, minimize errors, and save time and effort in payroll processing.

This year has brought outstanding church accounting software options with integrated payroll management features. Among the top contenders is HashMicro Accounting Software. This software provides a comprehensive solution catering to churches’ and nonprofit organizations’ unique needs, offering robust payroll management features alongside efficient financial operations. You can try out the free demo first before using our product and getting a grant of up to 50%!