Manual accounting processes can be time-consuming, prone to errors, and costly for businesses. That’s why adopting cloud accounting has become essential. With cloud accounting, businesses can access real-time data, automate tasks, and save time and resources.

No need to worry—HashMicro is here for you, providing a reliable, user-friendly solution to handle all your accounting needs so you can stay focused on what truly matters. HashMicro’s Accounting Software is a comprehensive cloud accounting solution simplifying financial tasks.

This article will explore how implementing HashMicro’s cloud accounting system can transform your business operations, improve efficiency, and ensure financial accuracy.

Key Takeaways

|

Table of Content:

Table of Content

What is Cloud Accounting?

Accounting is a core component of an ERP system, and cloud accounting works similarly to traditional accounting software but is hosted on remote servers. This allows businesses to manage financial records such as income, expenses, total assets, and liabilities digitally and securely.

With cloud accounting, data is encrypted and accessible only by authorized users through login credentials, ensuring high-level security like banking systems. It also eliminates the need to install software on individual desktops, as employees can access the system from any device.

Best accounting software of this type offers features like invoicing, bill management, and general ledger tracking, allowing seamless access across departments. This connectivity gives businesses a clearer view of their financial state, enabling better decision-making and collaboration.

How does Cloud Accounting Work?

Cloud accounting software utilizes cloud technology to securely store and process financial data. Businesses can access it through a web browser or mobile app, allowing them to manage their finances from any device with an internet connection, providing greater flexibility and convenience.

With cloud-based accounting software, businesses can automate essential tasks like invoicing, tracking expenses, managing bank transactions, and generating reports. All financial data is securely stored on remote servers, ensuring its safety and integrity while allowing users to access real-time information.

One of the most significant advantages of accounting systems is their accessibility. Whether in an office or working remotely, the best cloud accounting software allows users in Singapore or globally to collaborate in real-time, updating financial data simultaneously and improving overall efficiency.

Key Features of Cloud Accounting

As businesses increasingly shift to digital solutions, online accounting has become a powerful tool for managing financial operations. Its features go beyond traditional accounting methods, offering efficiency, real-time insights, and flexibility essential in today’s fast-paced environment.

Understanding the key features of cloud accounting will help you see how this technology can transform how you manage your business finances, streamlining processes and enhancing decision-making.

Let’s explore the core functionalities that make online accounting software indispensable for modern businesses:

- Reporting and visibility: Cloud accounting offers advanced reporting and analytics tools, helping businesses generate financial statements, track KPIs, and gain insights into their financial health. These features enable informed decision-making and better economic performance monitoring.

- Accessibility: Using internet-connected devices, users can access financial data from anywhere, anytime. This flexibility supports real-time collaboration, especially for businesses with remote teams or multiple locations.

- Real-time data: Cloud accounting syncs financial data in real-time, ensuring access to up-to-date information like transactions, invoices, and expenses. This feature enhances the accuracy and timeliness of financial reporting.

- Automation: The software automates repetitive tasks, including bank reconciliations, invoice creation, and expense tracking. Automation reduces errors, saves time, and lets businesses focus on strategic activities.

- Integration: Accounting software integrates with other business tools such as CRM, payment systems, and inventory management, allowing seamless data flow, minimizing manual entry, and boosting efficiency.

- Scalability: As businesses grow, cloud accounting adapts by handling increased transactions, users, and data volume without needing infrastructure upgrades, making it ideal for scaling operations.

- Security: Robust security measures, such as data encryption, regular backups, and access controls, ensure the protection of sensitive financial data. Cloud providers also maintain high-security standards to meet compliance regulations.

- Collaboration: Multiple users can access and work on financial data simultaneously, fostering teamwork between accountants, managers, and advisors while improving organizational communication.

Nowadays, cloud accounting leverages AI in accounting, enabling accountants to focus on strategy rather than routine tasks. It automates data entry, detects anomalies, and ensures compliance while reducing errors, helping businesses make informed decisions.

Cloud Accounting vs Traditional Accounting Software

Traditional or on-premises accounting software requires installation on company-owned hardware, such as individual computers or a local server maintained by the IT department. This setup limits access to the accounting system, as only employees with the software installed or those connected to the local server could use it, often leading to inefficiencies in workflow.

In contrast, cloud accounting software stores all data on the cloud, providing flexibility for remote access through any device with internet connectivity. This shift not only enhances accessibility but also reduces the risks associated with data loss or damage commonly seen in traditional systems that rely on local storage.

Traditional on-premise accounting software requires higher upfront costs, including hardware, installation, and manual upgrades. In contrast, cloud accounting software uses an as-a-service model, with the provider handling maintenance, updates, and bug fixes. This reduces long-term costs and eliminates the need for internal management.

Maintenance also differs significantly between the two. Traditional systems require the company to troubleshoot and fix bugs within the limitations of the software provider’s support, sometimes forcing businesses to handle complex issues internally.

With cloud-based solutions, all updates and technical issues are managed by the provider, ensuring a smoother, more efficient process without burdening the company’s internal IT resources.

Related article: Why is Cloud Accounting Software Important to Business?

Challenges of Traditional Accounting Software

Traditional accounting software, while effective in the past, presents several challenges in today’s dynamic business environment. These limitations can hinder growth, flexibility, and efficiency.

Below are some of the critical challenges associated with traditional accounting systems:

- Limited accessibility: Traditional accounting software is often installed on a single computer or network, restricting access to on-site locations. This can create challenges for businesses with remote teams or multiple offices, as employees cannot access financial data from different places.

- Time-consuming manual processes: Many traditional systems require extensive manual data entry and reconciliation, which increases the risk of errors and consumes valuable time. This inefficiency can slow down financial reporting and lead to inaccuracies in financial statements.

- Costly upgrades and maintenance: Traditional accounting software typically requires expensive upgrades and ongoing maintenance to stay functional and secure. These costs can be burdensome, particularly for small and medium-sized businesses.

- Lack of real-time data: Unlike cloud accounting, traditional software does not offer real-time data synchronization. This can delay access to crucial financial information and hinder timely decision-making.

- Limited integration: Traditional systems often struggle to integrate with other business applications such as CRM, inventory, or payroll, leading to siloed data and inefficient workflows. This lack of integration can result in duplicate data entry and operational bottlenecks.

- Security risks: Traditional accounting software stores data locally, making it more vulnerable to security breaches, hardware failure, and data loss. Regular backups and security updates are essential but often overlooked, leaving financial data at risk.

These challenges highlight the need for more agile and scalable solutions, such as cloud accounting, to better meet the demands of modern businesses.

Benefits of Cloud Accounting Software

The cloud-based accounting software encloses many solutions to serve several accounting or bookkeeping functions. The main benefits of cloud accounting explain why it has become the choice for many finance business staff as a tool to do their daily jobs.

How exactly does this benefit your business? Generally, some of the benefits include the following:

1. Access your accounts anywhere

Accounting software on the cloud enables you to access your financial data anytime, anywhere. You can access your key business numbers from any location as long as there is the internet.

In other words, employees don’t need to work from the central office-based computer. Some cloud software even provides you with the mobile app version, making it easier to access your numbers while you’re on the go.

2. Access real-time information

You may achieve real-time reporting by keeping your bookkeeping and bank reconciliation up to current when your data lives in the cloud. Instead of scrolling through pages of information on traditional accounting methods only to get out-of-date reports, you can get a quick snapshot of the company’s current financial situation.

This real-time picture is critical when you are making important decisions about your business’s financial future.

3. Save time with automation

Automation in cloud accounting software reduces manual tasks like data entry, invoicing, and bank reconciliation. This not only saves time but also improves overall efficiency, allowing businesses to focus on more strategic tasks.

4. Access to the app ecosystem

You can add a range of third-party apps and tools to expand your core business system. These apps include cash flow forecasting, project management tools, online invoicing, and other practical solutions.

The tools will help you save time while reducing resourcing costs at the same time. In addition, you can also identify problems in advance and minimize unnecessary admin that’s slowing your business processes down.

5. Live bank feeds

Many cloud accounting software offer live feeds to your bank accounts, linking your banking directly to accounting. Instead of manually entering data or uploading bank statements, the live feed updates your accounts instantly. This speeds up reconciliation and gives a more accurate view of your bank balance.

6. Improve the accuracy of your accounting

Automation and real-time data in online accounting software help reduce human errors. This ensures more precise bookkeeping and reporting, giving you confidence in your financial numbers.

7. Connected online payment

You can connect your cloud accounting software and invoicing software to payment apps. This allows customers to pay you automatically, resulting in speeding up payment times and reducing the burden of admin work that you or your staff have to carry.

8. No installation required

Cloud-based accounting requires no software installation, so you can access it instantly through a web browser. This simplifies setup and eliminates the need for IT maintenance or hardware upgrades.

9. Secure sharing of data

You can easily grant access to your accounts when you’re working with all the staff involved, such as accountants, banks, or other advisers. Say goodbye to passing down USB sticks or sending emails back and forth as your consultants have secure access to all your financial information in real-time.

This method is quicker, and safer, and gives your consultants the data to support and advise you going forward.

10. Access to tech support

Cloud accounting provides immediate access to expert tech support from your software provider, ensuring issues are resolved swiftly. With 24/7 assistance, businesses experience minimal downtime, which helps maintain productivity and business continuity.

Additionally, this level of support ensures that users can easily navigate any software updates or new features.

Reasons to Use Cloud Accounting Software

1. Cheaper to operate and own

Generally, cloud accounting software is a cheaper option than the on-premises alternative. There’s no need to buy hardware, nor to worry about bills adding up from upgrades and maintenance, as your vendor will take care of all that.

To add up, the company does not have to purchase VPN software or any other app that allows employees to work away from the office as the cloud software has allowed that.

2. More predictable costs

Using accounting software on the cloud, much easier to know how much the company will likely spend on the accounting solution annually since it doesn’t have to worry about upgrades and maintenance costs.

With the SaaS delivery, everything is already set into a single price with clear additional users or functionality costs. This leads to your company being able to keep your IT budget from cutting into other business areas.

3. Best-in-class infrastructure

Leading cloud vendors support large numbers of businesses and organizations, which requires them to have the best-in-class infrastructure. They engineer their data centers in a way that delivers incomparable performance, security, and scale.

Accordingly, most businesses cannot match the vendor’s capabilities in any of these areas on their own due to the limitation of capital and expertise. However, these businesses can obtain the rewards of this infrastructure by buying and adopting accounting software on the cloud from such a top provider.

4. Take advantage of the latest technology

Users of cloud-based accounting software can benefit from cutting-edge technologies that deliver significant business advantages, especially when system upgrades are performed regularly. For instance, a small or medium-sized business might not have the resources to independently invest in advanced technologies like machine learning or robotic process automation (RPA) to enhance their financial processes.

However, an upgrade to their cloud-based accounting software could include these features, allowing the company to reap the benefits without incurring extra costs. Therefore, it is crucial to choose the most trusted accounting software for businesses in Singapore for accurate reporting and optimal performance.

5. Enhanced business continuity

Your accounting system’s data is both extensive and vital, and losing it might be disastrous. Because your data is stored on a remote server and backed up to data centers in different places, cloud software provides a security blanket.

So, even if one of your data centers is destroyed by a flood or tornado, your firm may continue to run normally. On-premises systems hosted on an in-house server don’t share this benefit; it’s there from the start with the cloud.

6. Unify your business

Accounting software on the cloud can serve as the foundation for conducting your company on the cloud. There are cloud solutions accessible for each and every part of operations. Connecting these solutions, for example, allows you to track clients as they advance from offer to paying client and then post the transaction to the general ledger automatically.

Employees may access information and make necessary modifications from anywhere once all systems are in the cloud.

7. Access to the latest technology

Cloud-based accounting software provides access to cutting-edge technology. Regular updates from the vendor introduce advanced features like machine learning and robotic process automation (RPA) without additional investment. Small and midsize businesses can enjoy these benefits without the high upfront costs typically associated with these technologies.

Related article: Why Singaporean Businesses Need Online Accounting

By adopting the best cloud accounting software, companies can streamline operations, cut costs, and stay ahead of the competition—especially in tech-forward markets like cloud accounting in Singapore.

Future of Cloud Accounting

As businesses increasingly rely on cloud accounting software, exciting advancements are on the horizon. Emerging technologies will enhance efficiency, reduce costs, and transform how companies manage their financial operations.

Here are the key trends shaping the future of cloud-based accounting software:

- AI & machine learning: Advancements in AI and machine learning are set to elevate online accounting systems by automating data processes and improving accuracy. These technologies empower businesses to make informed decisions and accurately forecast financial outcomes.

- Blockchain: Integrating blockchain will redefine security and transparency, offering a tamper-proof ledger for financial transactions. This innovation minimizes fraud risks and enables real-time auditing, ensuring smoother, more reliable financial operations.

- App integration: The future of cloud accounting will see greater synergy with other business tools, simplifying integration with CRM, payroll, and inventory management. This seamless connection boosts efficiency, eliminating the hassle of switching between platforms.

These innovations will push accounting software to new heights, allowing businesses to reduce costs, improve accuracy, and gain competitive advantages. By adopting the best cloud-based accounting software, companies can stay ahead of the curve and navigate an increasingly digital financial landscape.

Best Cloud Accounting Software of 2024

1. HashMicro

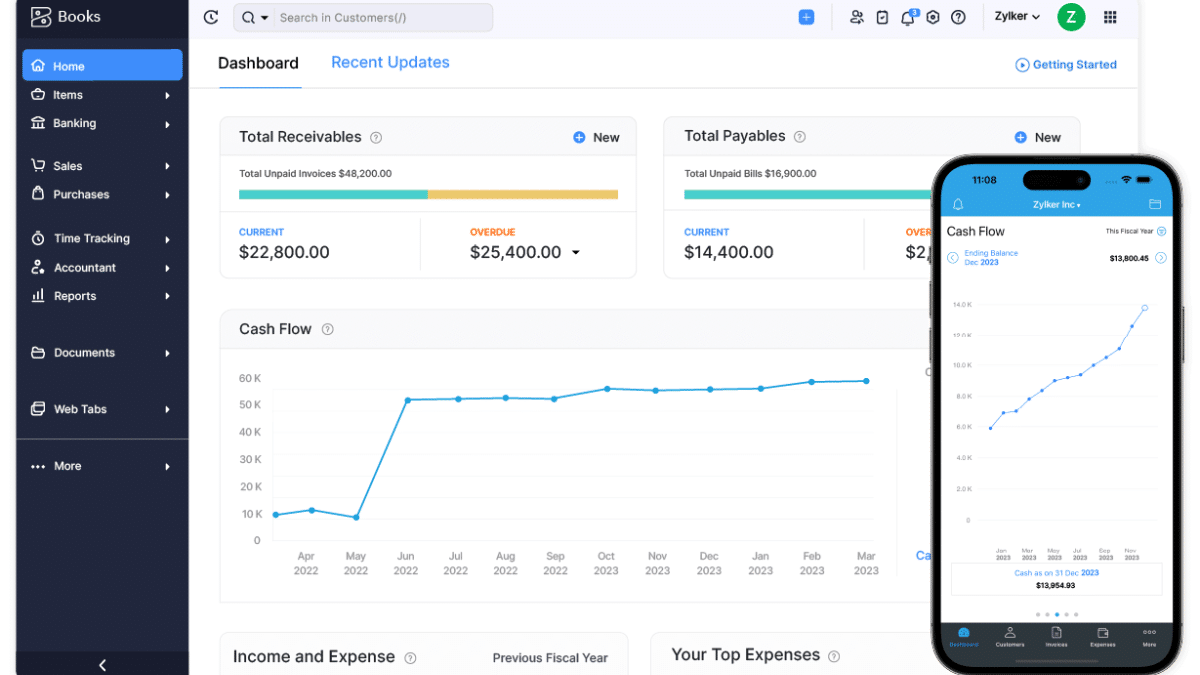

Founded in 2015, HashMicro was established as a leading provider of best cloud accounting software in Singapore and beyond. HashMicro’s cloud-based software automates a range of accounting tasks such as creating financial reports, cash flows, and adjusting journals and invoices.

HashMicro’s cloud accounting software is renowned for its comprehensive features and user-friendly interface, making it the preferred choice for thousands of business owners. Moreover, HashMicro offers a free demo to allow potential users to experience the software’s capabilities firsthand.

Some of its features are:

- Automated Financial Reporting: Generate accurate financial reports instantly, reducing manual effort and errors.

- Real-Time Data Access: Access up-to-date financial information anytime, anywhere, ensuring you always have the latest insights.

- Multi-Currency Support: Easily manage transactions in multiple currencies, ideal for businesses with international operations.

- Comprehensive Tax Management: Simplify tax calculations and ensure compliance with local regulations.

- Integration with Other Systems: Seamlessly integrate with existing ERP systems, enhancing overall business efficiency.

- User-Friendly Interface: Intuitive design ensures ease of use, minimizing the learning curve for new users.

- Secure Data Storage: State-of-the-art security measures protect your financial data from unauthorized access.

Ready to transform your financial management with HashMicro’s cloud accounting software? Their team of experts is ready to help you get started schedule a free demo and see how our software can revolutionize your business operations.

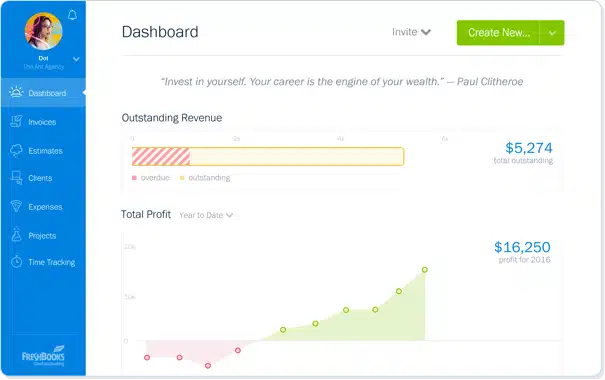

2. FreshBooks

3. Zoho Books

Zoho Books accounting software on the cloud provides a strong set of capabilities for monitoring billable hours, generating professional invoices, reconciling bank accounts, inventory management, also generating financial reports. Additionally, Zoho offers more than 40 integrative platforms that can manage every aspect of your business, in addition to the features provided by Zoho Books.

4. Xero

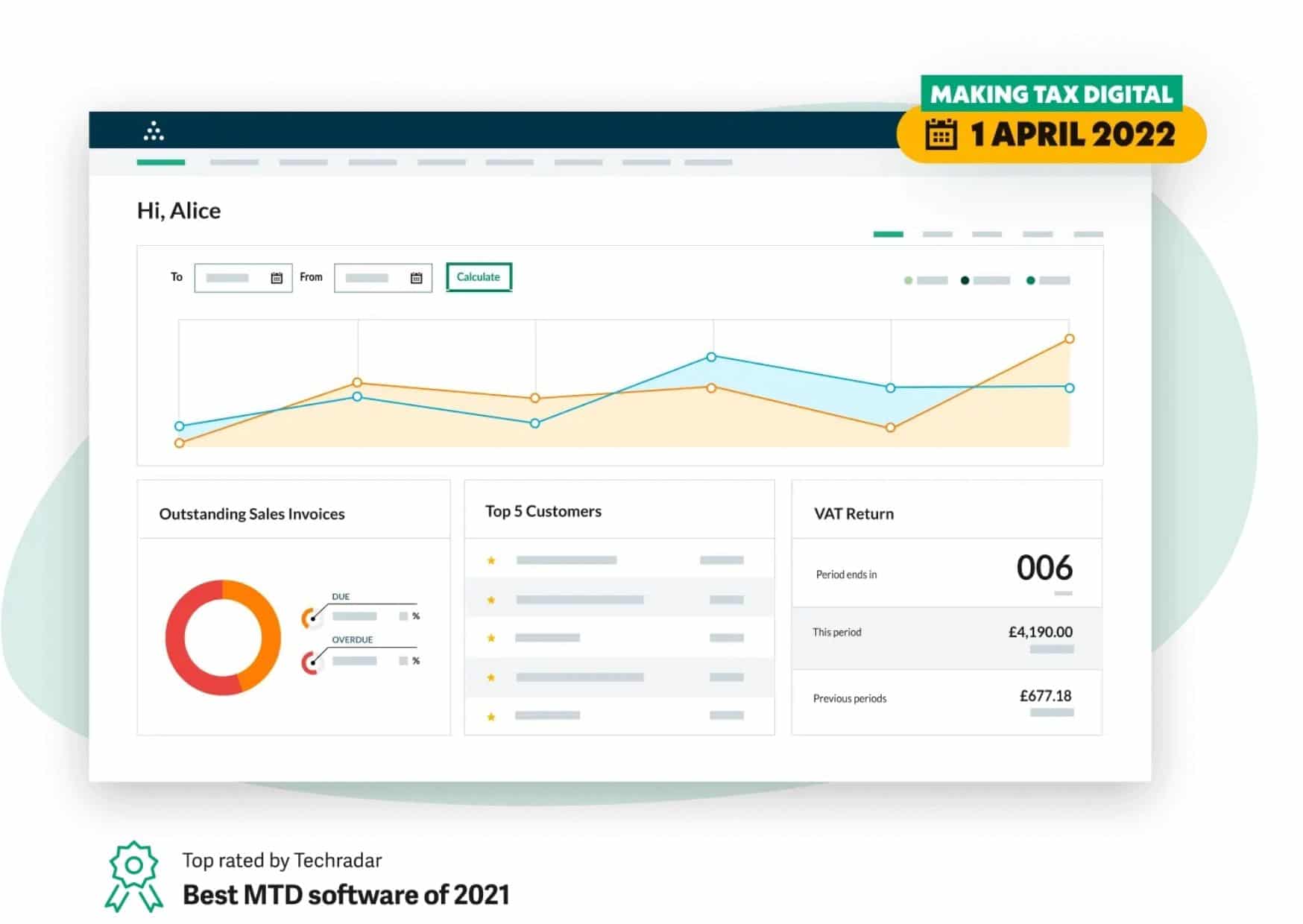

Xero is a type of cloud-based accounting software in Singapore that has the ability to automate various accounting tasks for your company. Among the notable features offered by Xero is the ability to pay bills, process expense claims, establish bank connections, manage contacts, and also track projects.

5. Sage

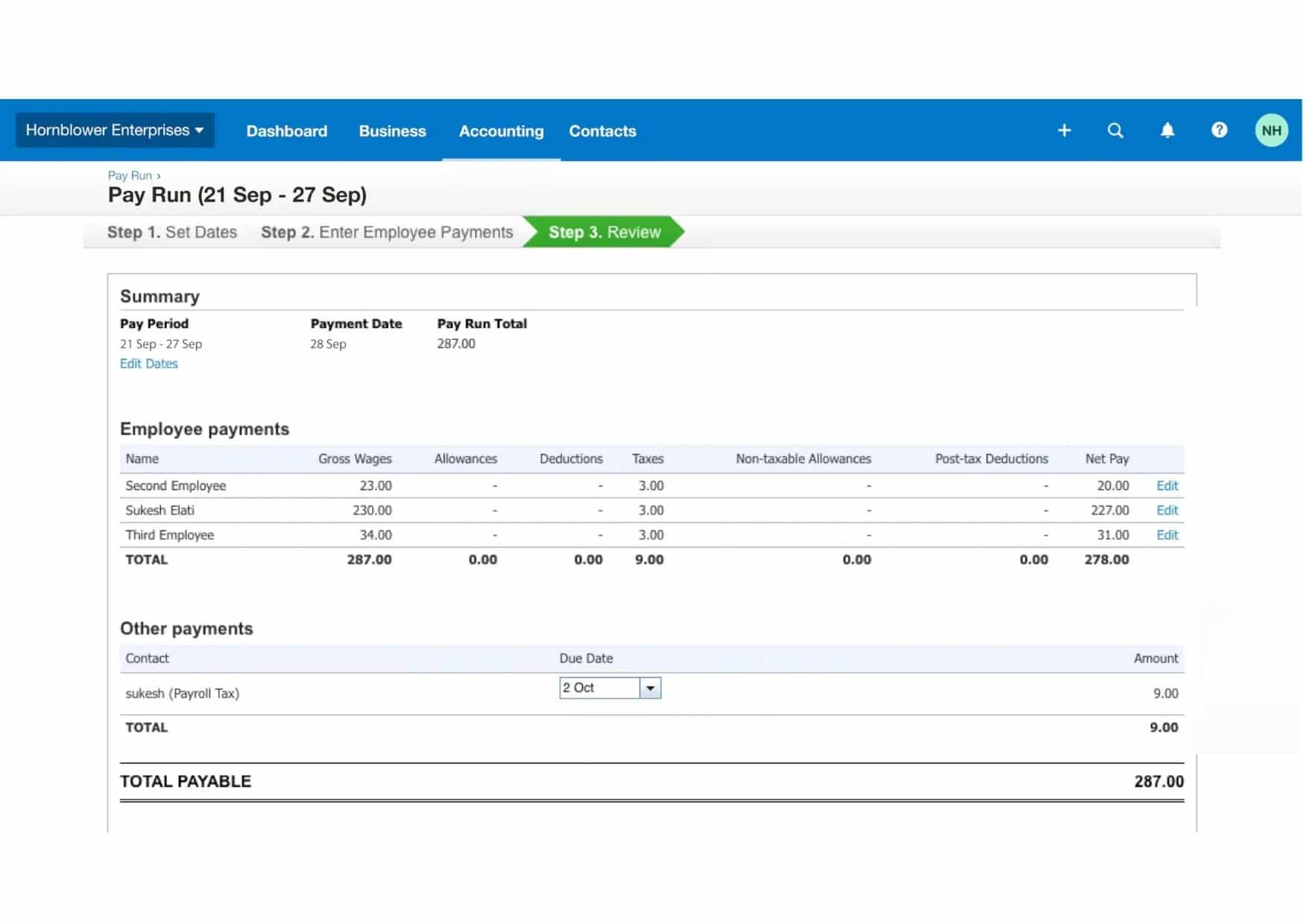

Sage offers an accounting solution that caters to the needs of small and medium-sized businesses in Singapore. New business owners who are just starting out may find the simplicity and fundamental features to be a straightforward beginning point for their financial activities. Sage provides two separate features for accounting and employee payroll, allowing for a more targeted approach.

Conclusion

Cloud accounting software helps businesses streamline their financial processes by integrating and automating core accounting tasks. It offers enhanced security and accessibility, making it easier for companies to manage their finances efficiently and allowing for growth and scalability in today’s competitive landscape.

HashMicro accounting software is one of the best solutions available, offering comprehensive cloud-based features. With real-time data updates, seamless integration across business functions, and automation, HashMicro helps businesses make smarter financial decisions and boosts overall efficiency.

Ready to experience the benefits firsthand? Try HashMicro’s online accounting software with a free demo today, and see how it can transform your financial operations. Click the button below to get started!

FAQ About Cloud Accounting

-

What is cloud accounting software?

Cloud accounting software is a type of accounting software that is hosted on remote servers and accessed through the Internet. As long as there is an internet connection users can access their accounting data

-

Is cloud accounting software secure?

Yes. The software uses encryption that rewrites your information into a secured and unbreakable code to store your data. Data stored in the cloud is usually less prone to hardware failures compared to data stored on a hard drive, meaning that it is less likely to be lost due to these issues.

-

How much does cloud accounting software cost?

The cost of accounting software on the cloud is determined by the features provided and the intricacies of your business. Additionally, if you only require basic features, there may be free options available to you.

-

What companies should use cloud accounting software?

Accounting software is utilized by companies of various sizes, industries, and locations, with many opting to use it from the beginning. Considering that finances play a crucial role in all aspects of an organization, it offers advantages to everyone involved.

-

Is Cloud Accounting Safe?

Cloud-based accounting software ensures the security of your financial data through encryption, which protects information by converting it into an unbreakable code. This is the same technology used in online banking, providing a high level of safety.

The best cloud accounting software also includes security features such as regular audits, automatic backups, and multi-factor authentication. With these safeguards, businesses can trust that their financial data remains secure in the cloud.

-

Cost of Cloud Accounting

Cloud accounting software is often less expensive than on-premises solutions because it offloads costs like hardware and IT staff to the provider. SaaS solutions charge an annual license fee, which can be customized based on the number of users and products.

This flexible pricing model allows businesses to pay for their needs and easily add users or modules as they grow. Hybrid cloud systems may involve higher one-time licensing and hosting fees, with additional costs for implementation based on system complexity.