Easily calculate your business COGS with HashMicro’s Online Accounting Software. You will get the best features such as financial statements that will be created automatically, have high accuracy, save time, and have information presented in real time. Get the free demo now!

COGS is one of the important components in determining the success of a business. Maybe you have often heard this term in the world of finance, especially in the field of accounting. COGS calculation is very important you do so that your business can achieve maximum profits and know the right moment to increase the price of the product you provide. With Manufacturing Software you can optimize material management and production cost budgets. The system will also ensure that you can adjust production activities based on demand, supply chain fluctuations, and production capacity. This number of is a very important thing to know as a COGS accounting data.

Table of Content:

Table of Content

To find out the understanding of COGS in more depth, here we present an article that will discuss the main things about COGS.

What is COGS?

COGS is the cost of expenditure during the production process of goods or services, both direct and indirect expenses. This calculation is useful so that the products sold to generate profits for the company. COGS or Cost of Goods Sold is also a basic cost that is mandatory for companies to take into account when producing goods and services.

Some of the components included in the cost of goods sold are overhead costs, raw materials, etc. In addition, calculating the value of this base price is fairly easy, but still must be thorough so that there are no uncounted costs that result in losses.

Companies that are able to determine and calculate the price of this staple will be able to get the appropriate target market and the product is easier for the public to accept. In addition, the company will avoid losses due to price selection errors on each product that will be sold.

Components in COGS

Before you do the calculation of the cost of goods sold, you need to know what components are in the cost of goods sold. There are three important components to calculating COGS, including:

1. Inventory at the beginning

This component is a supply of trade goods available at the beginning of the accounting bookkeeping period that will run. Therefore, the company should always pay attention to the amount of availability of existing goods, such as the availability of stock and materials that you will use in the production process. The use of inventory software can optimize inventory levels, including raw materials. This software can also prevent stockpiling of goods in warehouses by ensuring old products are sold first.

The calculation of stock inventory is very important so that your company can avoid the unavailability of the stock of goods. Of course, if there is a vacancy in the stock of goods, it can cause scarcity of production and can cause losses.

2. Net purchase

This component is the total purchase of trade goods that the company makes by debit or credit. This net purchase aims to maintain the availability of stock so that it is in a safe condition. In addition, in the calculation of net purchases, you have to calculate the number of transportation costs during the production process of goods.

After that, you also have to record the price in accordance with discounts and discounts and record the return of the product you have purchased. Of course, this will reduce the total of your net purchase calculation. With Procurement software, you can get the best price from all vendors. So that this can increase the efficiency of the procurement of goods.

3. Inventory at the end

The value of this component can be known after calculating the adjustment data at the end of the accounting period. This final inventory usually contains the amount of stock of trade goods that are still left at the end of the period.

In general, not all trade goods that exist at the beginning of the period do not enter the production process. This is done so that the rest of the production can be used by the company in the next process. The rest of the merchandise is commonly known as the final supply of trade goods.

You already know the components that are in the calculation of the cost of goods sold. Next, you need to know how to calculate COGS in order to get maximum profit and avoid losses. Here are some steps you need to pay attention to in calculating the cost of goods sold in your company:

1. Calculation of net income

You need to know some elements of a net sale before doing the calculations. These elements, namely:

- Purchase return

- Gross profit

- Discounts

In this case, transportation costs are not included in the net sale as they are common expenses. The calculation is using the following formula:

Net income = sales – (return of goods + discount)

2. Calculation of net purchase

There are several elements included in the net purchase, such as:

- Gross profits

- Discount

- Purchase return

- Purchase cut

The calculations are as follows:

Net purchases = purchases – returns – allowances – discounts

3. Calculation of COGS

After calculating the net value of sales and purchases, you’ll start calculating the cost of goods sold. In calculating the cost of goods sold, you need to do it in a very long way that requires thoroughness.

Here is a formula that you can use in calculating the cost of goods sold:

COGS = Beginning inventory + P − Ending inventory

P = Purchase during the period

Examples of Calculating COGS in the Food Business

A businessman who opens a business in the field of Food and Beverages will usually conduct many experiments in his business. They will conduct several experiments on purchasing raw materials in order to get the cheapest price from the supplier.

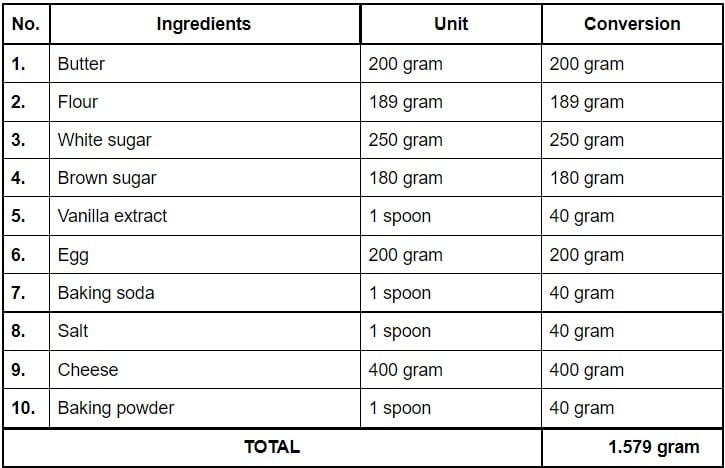

Assumption of calculation:

Now let’s try to calculate the COGS of a food business. Assuming there is a Cake &Bakery business that must produce cakes as many as 30 pieces. You need to note the ingredients you need in the cake production process.

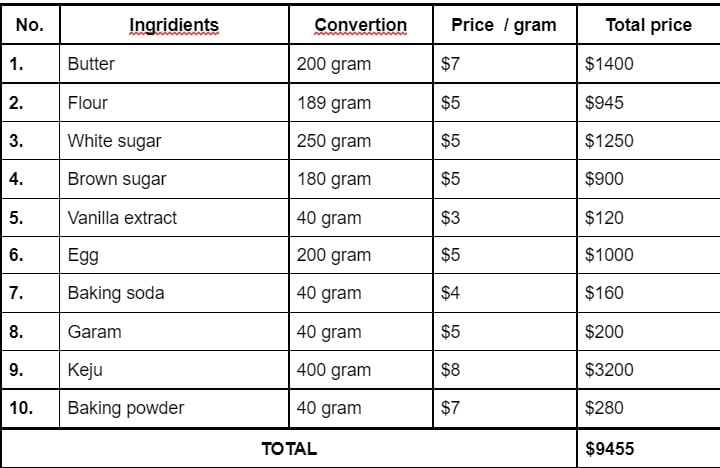

That measure is just an example. After doing the calculation of the dose you need, it’s time for you to record the price of the material. For example:

The price of $9455 is the basic price of raw materials that you need in making cakes as many as 30 pieces. Of course, there will be a possibility that this amount will be reduced or increased by following other expenses, such as courier services, discounts, etc. Components that you can include in the COGS calculation are employee salaries, and the cost of electricity, water, packaging, etc.

Let’s establish that the COGS in the Cake&Bakery food business is $9455 per 30 cakes in one production period. So, it can be known that the net price of the cake is $ 315.1/cake.

Read: Increase Business Profits with the Cross-Selling Method

Conclusion

By knowing the cost of goods sold or COGS, then you can easily set a margin that provides the maximum profit possible and can also know the right time for you to raise the selling price of the product.

In addition, there are several methods of costing inventory that will affect your COGS. The methods of costing the inventory are FIFO (First In, First Out), LIFO (Last In, First Out), dan Average.

Easily calculate your business COGS with HashMicro’s Online Accounting Software. You will get the best features such as financial statements that will be created automatically, have high accuracy, save time, and have information presented in real time. Get the free demo now!