Cost and expense are known as accounting terms that most accountants acquaint themselves with, particularly those who prepare financial reports regularly. Usually, companies use accounting software to make financial statements easier to work on. A company’s financial statements include expenditures and profits. These expenditures in accounting include the cost components and expenses. Accounting software makes calculating and reporting expenses and costs easier and more precise. Both of these are critical accounting factors that we should not ignore.

However, many people still do not understand the distinction between these two critical factors. Although the two words seem synonymous at first sight, they have distinct meanings and purposes. Using best accounting software can also help you distinguish these two important things easily. following is a comprehensive explanation of the definitions, distinctions, and examples of accounting expenditures and costs.

Table of Content:

Table of Content

What is an Expense?

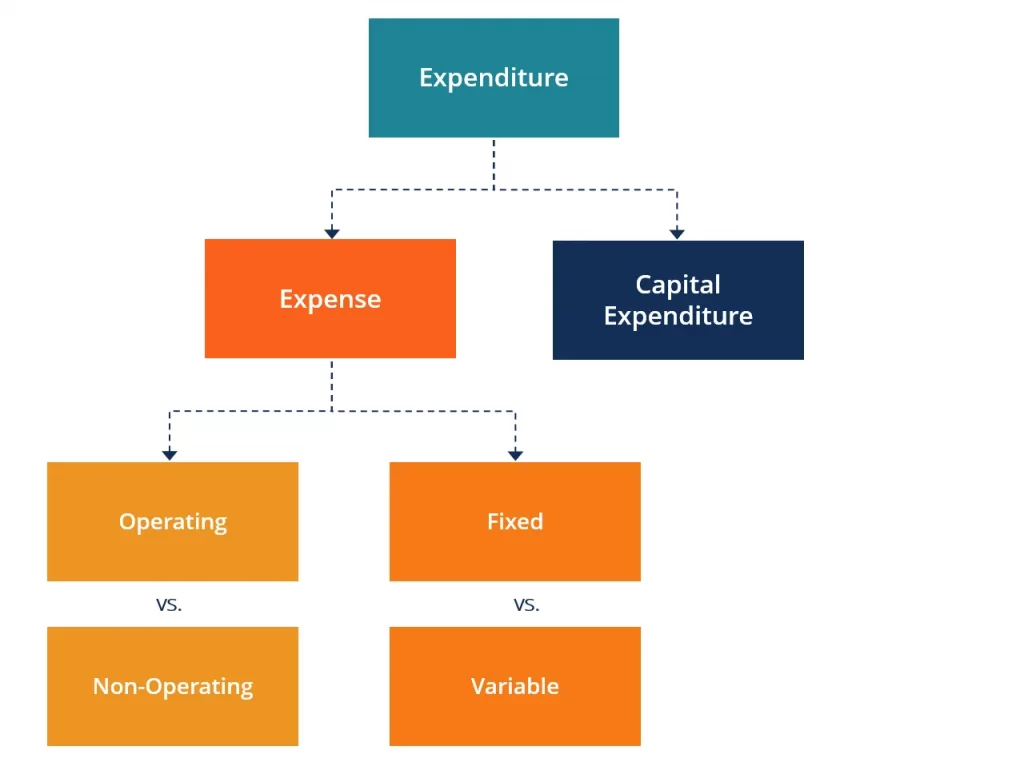

International Accounting Standards define expenses as decreases in economic benefits during the accounting period in the form of outflows or depletions of assets. In a financial accounting sense, an expense or expenditure is a cost incurred due to a business’s or organization’s operational operations within a particular accounting period. It is the amount of money that any organization is required to spend on anything.

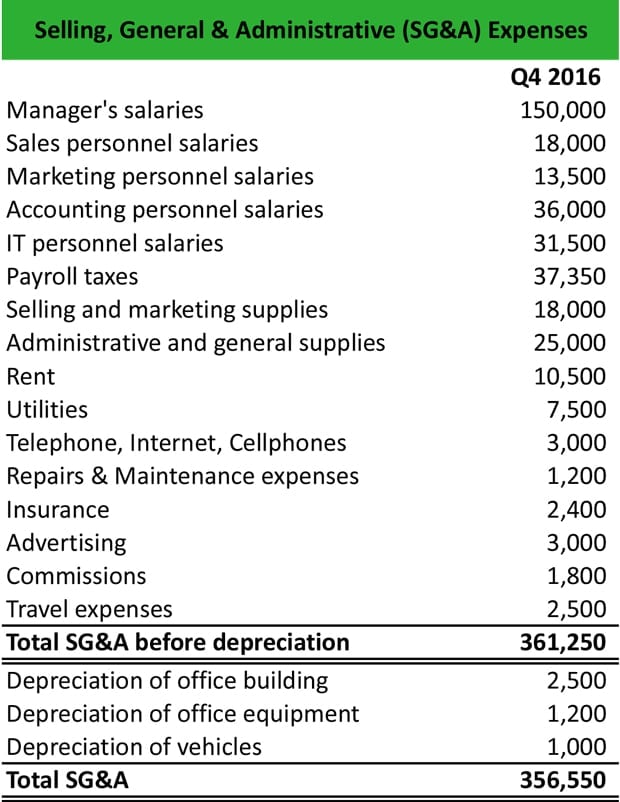

Employee wages, advertising, rent, utilities, taxes, and supplies are all examples of expenses. After each accounting period, all of these expenses are recorded on the income statement. Depending on the financial statement structure, expenses are divided into selling and general administration. Regardless of how they’re classified, the total expenditures will tallied and subtracted from the total revenues to determine the period’s net income.

Types of Expenses in Accounting

An expense has an impact on financial accounting accounts, especially income statements. The report is divided into five sections, which are as follows:

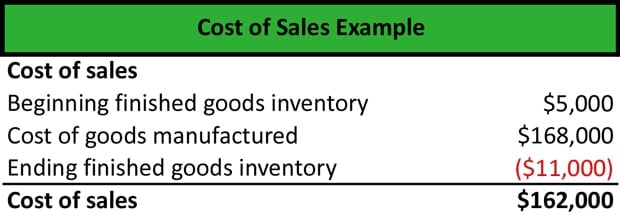

1. Cost of goods sold

COGS measures the “direct cost” of producing products or services. It comprises direct material, labor, and manufacturing overhead costs and is proportionate to sales. Increasing income needs additional resources. COGS is often the second line item on the income statement, following sales revenue. After deducting COGS, you will find the gross profit.

2. Operating expense

These are the expenses incurred by an organization or company due to regular commercial activities, such as marketing, payroll, R&D, inventory costs, equipment, insurance, and rent.

3. Financial expense

Financial expenses cost spent by the organization due to interest, fees, and commissions on liabilities (including client deposit accounts, borrowings, and subordinated debt) during the reporting period.

4. Extraordinary item

An exceptional item is a gain or loss that is not produced by a company’s regular business activities, is rare, and is unlikely to occur shortly. Extraordinary things should separated in the company’s financial accounts.

5. Non-operating expense

Expenses that are not directly linked to the main activities of the company. Interest charges and other expenses connected with borrowing money are common examples.

6. Non-cash charge

A non-cash charge is a write-down or accounting cost that does not require payment in cash. They may reflect significant changes in a company’s financial position, impacting profits but having little effect on short-term capital.

Differences between Expense and Cost

Technically, cost and expenditure are synonyms. But in business, cost and expenditure have distinct connotations. Expenses include rent, utilities, and other fixed monthly costs.

A cost is an estimated amount that individuals pay or spend while shopping for anything. It may be precise, such as when someone asks the dealership owner how much an Audi costs in America. In business, understanding costs is crucial, particularly addressable spend, which can be optimized through strategic procurement to save expenses.

1. Location in the financial statements

The significant distinction between the two variables is the site of financial statement preparation. Expenses that have been spent and do not offer future benefits are reflected in the income statement. Meanwhile, unused expenses will be reflected in the balance sheet. Because wasted expenses are considered assets, they are deemed future benefits. That’s why you need to track the usage of the assets correctly. You can use asset management software to track and manage all of the assets you have.

2. Differences in the accounting period

The accounting period shows the second difference. Because they are subtracted from revenue, expenses have a shorter accounting period. At the same time, expenses have a more extended accounting period since they are capital expenditures.

3. Amount issued who make coast expense

Expenses have a lower expenditure since they are removed from income expenditures. Costs have higher spending since they come from capital expenditures. Conversely, higher costs mean more capital expenditures, whereas higher expenses mean lower profit or income.

4. Cost value difference

Expenses have a somewhat higher nominal, while costs have a comparatively lower nominal. For example, rental charges or depreciation costs are not considered expenses since they will incurred in the next accounting period. Expenses have a higher nominal amount since they are not associated with minor items in the business. In contrast, the burden may become an option for low-value expenditures.

5. Advantages that the business receives

Because the accounting and terms of these two variables are different, the advantages that the business will get will, of course, be distinct as well. Similarly, the use of costs will affect the quantity of capital available after the fact. At the same time, the utilization of expenditures will impact the amount of public financing immediately after the fact.

Examples of Expenses and Costs

Expenses:

Cost:

Conclusion

Entrepreneurs are acquainted with the words expenses and costs. The distinction between costs and expenditures is critical to understand to avoid making financial reporting errors. Understanding the difference between cost and expenditure will make it much simpler to differentiate between the function of use and placement. Additionally, your financial statements will prevent future recording mistakes.

However, manually creating financial reports becomes very challenging since it requires more effort and is prone to human mistakes. As a result, you may utilize Hashmicro’s Accounting Software to simplify your job. With the finest and most comprehensive accounting system for businesses, you can manage your finances, such as cash flow management, journal entries, and reconciliation. The system is also People network-ready for seamless invoicing management. Try out its free demo here!

Related article:

- What is a General Ledger? Get to Know the Benefits for Companies!

- CoA (Chart of Account): Definition, Benefits, and Types