In 2024, 76% of Singapore’s top 100 companies now recognize climate change as a financial risk, up from just 49% in 2022. This sharp increase shows how fast businesses in Singapore are embracing Environmental, Social, and Governance (ESG) principles.

However, despite this growing awareness, many businesses still struggle implementing an ESG framework. Problems like fragmented data, inconsistent reporting, and complex compliance requirements make ESG adoption seem overwhelming.

Without the right tools and strategy, companies risk falling behind in sustainability efforts and losing investor confidence. Manually managing ESG responsibilities often leads to errors, inefficiency, and missed opportunities for business growth.

So, how can businesses overcome these challenges and turn ESG awareness into real, measurable benefits? By reading this article, you can better understand the ESG framework and leverage technology like ERP software.

Table of Content:

Table of Content

Key Takeaways

|

What is an ESG Framework and Why It Matters

An ESG framework is a set of standards that helps businesses measure and manage their impact on environmental, social, and governance factors. It provides clear guidelines for tracking sustainability efforts and ensuring responsible business practices.

But why should businesses care about ESG? Beyond regulatory compliance, a strong ESG framework offers several concrete benefits.

Enhanced investor confidence

Companies with well-structured ESG practices attract more investors who prioritize ethical and sustainable businesses. ESG transparency reassures stakeholders that the company manages risks responsibly and operates with long-term sustainability in mind.

When businesses adopt a recognized ESG framework, they enhance their credibility and open the door to more funding opportunities from ESG-focused investors. This is crucial in markets like Singapore, where investor expectations around sustainability are rising.

Operational efficiency and cost savings

ESG frameworks help businesses optimize their operations by identifying energy-saving opportunities, reducing waste, and improving supply chain efficiency. By tracking environmental impact and social responsibilities, companies gain better control over their resources.

For example, companies that adopt Supply Chain Management Software can minimize excess inventory and reduce logistical costs while improving ESG compliance. This leads to cost savings and more sustainable business practices.

Stronger brand reputation

Consumers and business partners prefer companies that prioritize environmental and social responsibility. By adopting an ESG framework, businesses show their commitment to sustainable and ethical practices.

This commitment builds customer loyalty and enhances the company’s public image. It also positions businesses as industry leaders in corporate responsibility, giving them a competitive edge.

Risk mitigation and business continuity

ESG frameworks help businesses identify and manage risks related to environmental impact, social issues, and governance practices. By addressing these risks early, companies can avoid regulatory penalties, reduce operational disruptions, and ensure long-term stability.

For example, businesses with strong governance practices are less likely to face compliance issues or legal disputes, making them more resilient in a changing regulatory landscape.

Regulatory compliance

ESG reporting standards in Singapore have become more stringent. Since last year, all companies are required to report on climate change, including their greenhouse gas emissions.

Starting in 2027, this requirement will also extend to all large non-listed companies. This means that companies that adopt a robust ESG framework stay ahead of evolving regulations and avoid non-compliance risks.

List of ESG Frameworks

ESG frameworks are designed to cater to three distinct audiences, each with specific objectives and reporting needs.

1. Investors: evaluating sustainable and ethical investments

For investors, ESG frameworks are crucial for evaluating potential investments’ sustainability and ethical impact. These frameworks assist investors:

- Identify companies with strong ESG performance that align with responsible investment strategies.

- Evaluate risks related to climate change, social responsibility, and governance issues that may affect financial returns.

- Compare ESG metrics across industries to make data-driven investment decisions.

2. Government: establishing ESG policies and regulatory compliance

Governments and regulatory bodies use ESG frameworks to shape policies, monitor corporate sustainability efforts, and ensure environmental and social regulations compliance. ESG reporting frameworks enable governments to:

- Standardize sustainability disclosures to enhance transparency across industries.

- Identify areas where policy intervention is needed, such as carbon emissions reduction or social equity programs.

- Encourage corporate accountability through incentives or penalties related to ESG performance.

3. Corporate management: integrating ESG into business strategy

For corporate executives and management teams, ESG frameworks act as a roadmap for embedding sustainability into business operations. These frameworks help organizations:

- Align ESG goals with business objectives to create long-term value.

- Identify areas for improvement in environmental sustainability, social impact, and governance practices.

- Improve stakeholder trust and brand reputation by demonstrating a commitment to responsible business practices.

ESG frameworks serve different audiences, so there is no single standard for all. Organizations should choose one that aligns with their goals, whether for compliance, investment appeal, or sustainability initiatives. These frameworks fall into three categories: benchmark, regulatory, and voluntary.

Benchmark Frameworks

Benchmark ESG frameworks evaluate corporate sustainability using industry standards and peer comparisons. They offer specific benchmarks for businesses to track progress and help investors make informed decisions

Third-party organizations usually create and oversee them to assist investors and stakeholders in evaluating ESG risks and performance. Scores are based on data submissions and publicly available information.

Carbon Disclosure Project (CDP)

CDP is a global system that collects and analyzes data on environmental impacts, particularly climate change, water security, and deforestation. Organizations submit data, which CDP scores based on transparency, awareness, management, and leadership sustainability.

CDP assigns companies scores (A to D-) based on their environmental disclosures. Investors, businesses, and governments use CDP ratings to evaluate environmental risks and track corporate progress in sustainability.

Global Real Estate Sustainability Benchmark (GRESB)

GRESB is a leading ESG benchmark for real estate and infrastructure investments. It assesses environmental, social, and governance factors to help institutional investors understand the sustainability performance of property portfolios.

GRESB collects data from real estate companies and funds and evaluates them based on ESG indicators such as energy efficiency, carbon footprint, and tenant engagement. Investors use scores to compare real estate investments and guide sustainable decision-making.

Voluntary Frameworks

Voluntary ESG frameworks provide guidelines and best practices for sustainability reporting but are not legally required. Companies voluntarily adopt these frameworks to enhance their ESG reporting and credibility to meet investor expectations and industry standards.

These frameworks offer flexibility in ESG disclosures, allowing businesses to align with global sustainability standards while using the provided guidelines to disclose sustainability performance in annual reports, sustainability reports, or investor communications.

Global Reporting Initiative (GRI)

GRI is one of the most widely used ESG frameworks. It provides a comprehensive set of reporting standards that help businesses disclose their environmental, social, and governance performance.

GRI offers modular reporting standards, including sector-specific guidelines, that companies can adapt to their needs. Businesses report on economic, environmental, and social impacts using GRI metrics, ensuring transparency for stakeholders.

Sustainability Accounting Standards Board (SASB)

SASB provides industry-specific sustainability reporting standards that help companies disclose ESG information relevant to financial performance. These standards are particularly useful for investors looking for financially material ESG data.

SASB works by defining ESG factors that impact financial performance in 77 different industries. Companies use SASB standards to disclose sustainability risks and opportunities directly affecting their business value.

Task Force on Climate-related Financial Disclosures (TCFD)

TCFD is a framework developed to help companies report climate-related financial risks and opportunities. Investors and regulators widely use it to assess the impact of climate change on businesses.

TCFD outlines recommendations for governance, strategy, risk management, and metrics related to climate risks. Organizations use these recommendations to disclose climate-related financial information in annual reports and investor communications.

UN Principles for Responsible Investment (UN PRI)

UN PRI is a voluntary ESG framework designed for investors who want to integrate sustainability considerations into their investment strategies. It promotes responsible investment practices globally.

UN PRI works by encouraging investors to adopt six principles for responsible investing, including incorporating ESG factors into investment decisions and promoting transparency. Signatories report annually on their ESG integration progress.

EU Taxonomy

The EU Taxonomy is a classification system that defines which economic activities are environmentally sustainable. It helps investors, businesses, and policymakers navigate sustainable finance regulations.

EU Taxonomy sets clear criteria for activities contributing to climate change mitigation, adaptation, and other environmental objectives. Companies operating in the EU must disclose whether their activities align with the taxonomy’s sustainability criteria.

Regulatory Frameworks

Regulatory ESG frameworks are legally mandated reporting requirements that governments or regulatory bodies impose. They ensure that companies disclose ESG-related information in a standardized and transparent manner to comply with environmental, social, and governance laws.

Governments and regulators require companies to report ESG data based on predefined criteria. These reports are submitted to regulatory bodies and made available to the public. Companies that fail to comply may face fines, legal penalties, or reputational damage.

Corporate Sustainability Reporting Directive (CSRD) (EU)

CSRD is a mandatory ESG reporting regulation in the European Union that expands on previous reporting requirements under the Non-Financial Reporting Directive (NFRD).

CSRD requires large and listed EU companies to disclose ESG information, including sustainability risks, environmental impacts, and social factors. It also introduces detailed reporting standards and external assurance requirements.

National Greenhouse and Energy Reporting (NGER) (AUS)

NGER is Australia’s national reporting framework for greenhouse gas emissions and energy use. It ensures transparency in emissions reporting and helps the government track climate action progress.

NGER requires large corporations to report their emissions, energy consumption, and production annually. The data is used for regulatory compliance, carbon pricing mechanisms, and national climate policies.

Streamlined Energy and Carbon Reporting (SECR) (UK)

SECR is a UK mandatory sustainability reporting framework requiring businesses to disclose energy use and carbon emissions in annual reports. SECR works by applying to large companies and LLPs that meet certain size criteria. It ensures organizations track and report their energy efficiency measures, helping the UK meet carbon reduction targets.

Sustainability Financial Disclosure Regulation (SFDR) (EU)

SFDR is an EU regulation that enhances transparency in sustainable investments and ESG risks for financial market participants. It aims to prevent greenwashing by standardizing ESG disclosures.

SFDR works by classifying financial products based on sustainability integration. Firms must disclose ESG risks, sustainability impact, and how their investments align with environmental objectives.

Here’s a summary that compares all the frameworks mentioned above to help you better understand each and decide which is the best fit for your organization.

| Feature | Benchmark Frameworks | Voluntary Frameworks | Regulatory Frameworks |

| Purpose | Measure and compare ESG performance | Provide structured ESG reporting guidelines | Enforce ESG disclosure through legal mandates |

| Mandatory? | No | No | Yes |

| Developed by | Third-party organizations | NGOs, industry groups | Governments, regulators |

| Assessment Method | Scores, rankings, ratings | Self-reported disclosures | Standardized reports submitted to authorities |

| Who Uses It? | Investors, stakeholders | Businesses, investors | Governments, regulators |

| Impact | Enhances reputation, attracts investors | Increases transparency, aligns with global standards | Ensures compliance, avoids penalties |

Companies often adopt a mix of these frameworks based on their industry, market expectations, and legal obligations. For example, a corporation may use GRI (voluntary) for sustainability reporting, CSRD (regulatory) for compliance in the EU, and CDP (benchmark) for climate impact assessment.

By leveraging the right ESG framework, companies can enhance sustainability efforts, improve transparency, and build trust with stakeholders, ultimately driving long-term business success.

ESG Framework vs. ESG Reporting

While ESG frameworks and reporting standards are interconnected, they serve distinct purposes in sustainability management.

ESG frameworks provide guidelines, principles, and best practices for organizations to structure their sustainability initiatives. They help businesses define what ESG factors to measure and how to incorporate them into decision-making. Examples include GRI, SASB, and TCFD, which set broad ESG assessment and strategy frameworks.

ESG reporting standards, on the other hand, define specific disclosure requirements and metrics that companies must follow when reporting their ESG performance. These standards ensure consistent, comparable, and transparent sustainability reporting across industries. For example, IFRS Sustainability Standards and the SEC’s ESG disclosure rules mandate how companies must report ESG-related risks and opportunities.

For example, a company might adopt the GRI framework to shape its ESG strategy and then use Sustainability Reports to communicate its ESG performance to stakeholders. Proper alignment between frameworks and reporting ensures regulatory compliance and stakeholder trust.

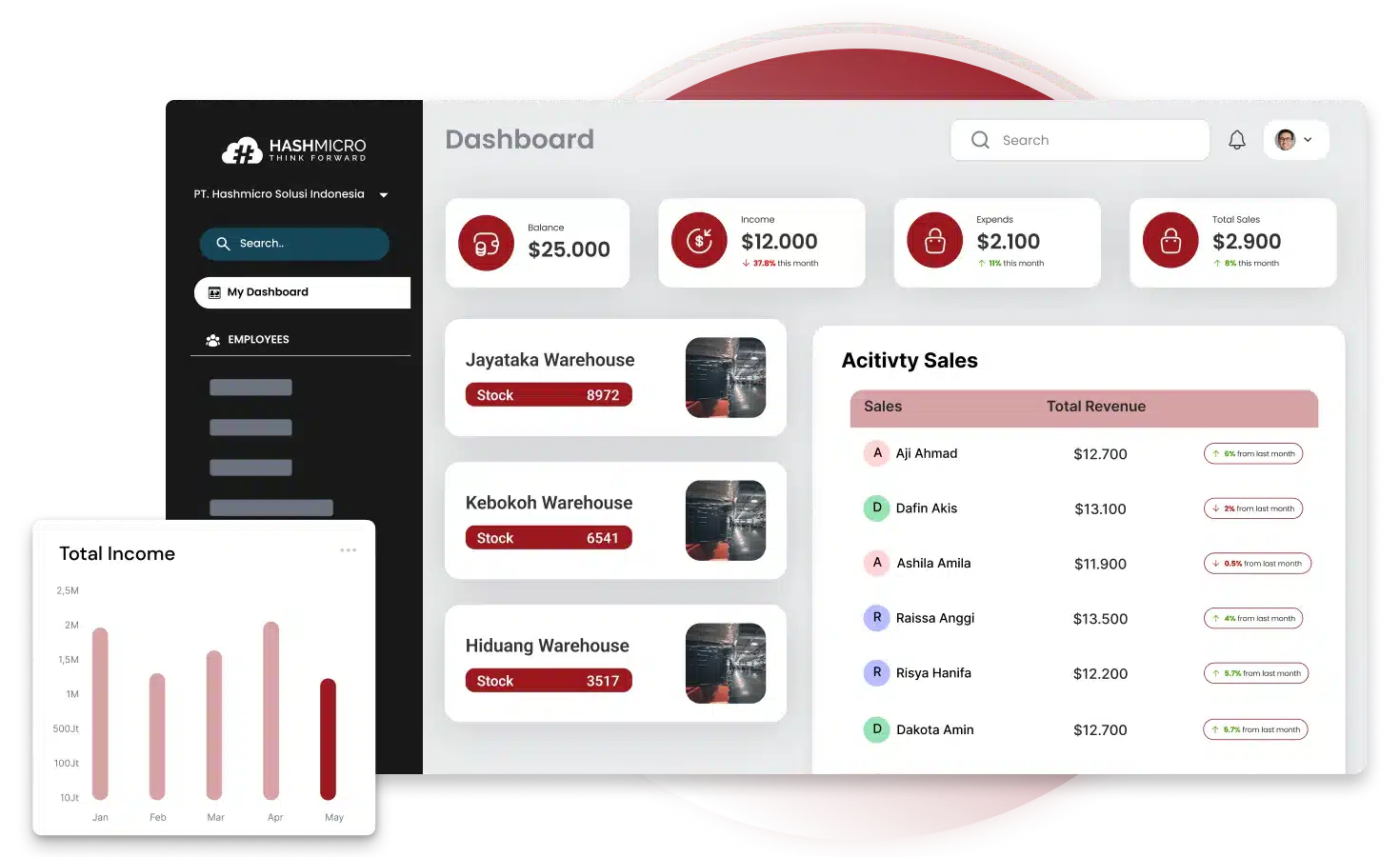

The role of ERP in ESG data management

Managing ESG data manually is inefficient and error-prone. ERP Software automates data collection, reporting, and compliance tracking by integrating with energy meters, HR systems, and supply chain databases. Built-in analytics generate accurate ESG reports aligned with regulations, reducing errors and ensuring timely compliance.

ERP solutions track carbon emissions, energy use, and waste management while ensuring compliance with sustainability laws. Real-time dashboards help set goals, track progress, and provide insights. By using ERP technology, companies simplify ESG reporting, improve compliance, and boost sustainability efforts.

HashMicro provides a comprehensive ESG software solution to help businesses streamline ESG processes. Explore HashMicro’s pricing scheme and see how you can invest in a system that simplifies ESG sustainability management and boosts operational efficiency.

How HashMicro’s ERP Software Strengthens ESG Implementation

HashMicro provides a comprehensive ERP software solution designed to help businesses streamline ESG processes and achieve sustainability goals with greater accuracy and efficiency.

Key features of HashMicro’s ERP include:

- Automated ESG Data Tracking

HashMicro’s ERP automatically tracks key environmental, social, and governance metrics like greenhouse gas emissions, energy use, and workforce diversity, reducing errors and saving time. - Integrated Sustainability Reporting

The ERP’s built-in tools generate reports aligned with global ESG standards, making it easier to showcase sustainability efforts and meet Singapore’s evolving requirements. - Smart Financial and Resource Management

HashMicro’s ERP system optimizes budgets for sustainability projects, tracks ESG-related costs, and monitors the ROI of green initiatives. - Business Intelligence and Analytics

With advanced analytics and real-time dashboards, the ERP helps businesses track ESG performance, identify trends, and measure progress. - Compliance Monitoring

HashMicro’s ERP includes automated tools that alert businesses to potential risks and ensure adherence to ESG regulations, reducing non-compliance penalties.

Conclusion

Smart businesses would implement an ESG framework not only for regulatory compliance, but also as a strategic move toward long-term sustainability and business growth. By aligning operations with environmental, social, and governance principles, businesses can strengthen stakeholder trust, mitigate risks, and enhance operational efficiency.

To manage ESG processes effectively, businesses need the right tools. HashMicro’s ERP software simplifies ESG data tracking, automates sustainability reporting, and ensures real-time compliance monitoring. With these capabilities, businesses can make informed decisions and achieve their ESG goals more efficiently.

Ready to take your ESG strategy to the next level? Book a free demo of HashMicro’s ERP software today and discover how automation can drive your business toward a more sustainable and profitable future.

FAQ Surrounding ESG Frameworks

-

How can businesses measure ESG performance?

Businesses measure ESG performance by tracking key indicators like carbon emissions, employee satisfaction, diversity metrics, and governance practices. Automated systems like ERP software help businesses gather and report ESG data accurately and in real time.

-

What are the regulatory requirements for ESG reporting in Singapore?

In Singapore, companies listed on the Singapore Exchange (SGX) must comply with mandatory ESG reporting requirements. These include disclosures on environmental impact, social practices, and corporate governance standards.

-

How does ESG impact investor decision-making?

Investors increasingly prioritize companies with strong ESG practices, viewing them as lower-risk and more sustainable long-term investments. Transparent ESG reporting enhances investor confidence and opens opportunities for ESG-focused funding.