Did you know that companies lose an estimated 5% of their annual revenue to fraud?

Effective financial audit processes are essential for businesses to detect and prevent fraudulent activities, ensure regulatory compliance, and maintain accurate and reliable financial records.

In this article, we will explore the key steps and strategies to manage the financial audit process effectively, from planning to reporting. Also, adopting financial software can simplify the process. Whether you are an auditor or a business owner, implementing these best practices will help you navigate the complexities of financial auditing and safeguard your business’s financial integrity.

Key Takeaways

|

What is a Financial Audit?

A financial audit is a comprehensive examination and assessment of an organization’s financial records, transactions, and processes. It involves a systematic and independent review conducted by qualified professionals to ensure the accuracy, reliability, and compliance of financial information.

Planning

Planning is a crucial phase in the financial audit process. It involves defining the objectives and scope of the audit, identifying key risk areas, and developing an audit plan. Proper planning ensures that the audit is conducted efficiently and that all relevant areas are thoroughly evaluated.

Internal Controls

Internal controls are measures, policies, and procedures implemented by an organization to safeguard its assets, promote adherence to financial regulations, and prevent fraudulent activities. Evaluating and testing internal controls is an essential component of a financial audit to assess the effectiveness of the organization’s control environment.

Testing

Testing is conducted to gather evidence and assess the accuracy and reliability of financial information and transactions. This involves a review of supporting documentation, interviews with key personnel, and various analytical procedures. Testing helps auditors identify any material misstatements or irregularities in the financial statements.

Reporting

Reporting is the final step in a financial audit, where the auditors communicate their findings, conclusions, and recommendations. The audit report provides an opinion on the fairness and reliability of the financial statements, highlights any significant issues or risks identified, and offers suggestions for improvement and compliance.

By following a structured approach that includes planning, evaluating internal controls, conducting testing, and producing accurate reports, financial audits help organizations ensure transparency, maintain regulatory compliance, and enhance stakeholder confidence in their financial statements.

What’s The Difference Between Accounting and Auditing?

Understanding the distinction between accounting and auditing is essential for anyone involved in financial processes. While these terms are often used interchangeably, they represent distinct disciplines with different objectives and functions.

Accounting refers to the process of recording, classifying, and summarizing financial transactions. Accountants are responsible for maintaining an organization’s financial records, preparing financial statements, and providing insights into the financial health of the business. They ensure compliance with accounting principles and regulations, giving stakeholders an accurate representation of the company’s financial position.

Auditing, on the other hand, is an independent examination of an organization’s financial statements and records. It involves assessing the accuracy, completeness, and fairness of the financial information presented. Auditors play a crucial role in providing reasonable assurance to stakeholders that the financial statements are reliable and transparent. They evaluate the effectiveness of internal controls and ensure compliance with regulatory requirements.

While accounting focuses on creating financial records and reporting, auditing focuses on verifying and validating those records. Accounting is an ongoing process that provides detailed financial information for decision-making, while auditing is a periodic examination that provides an independent and objective evaluation of the financial statements.

Accounting is typically performed internally within an organization, whereas auditing is conducted by external, independent auditors. Furthermore, while accounting is governed by generally accepted accounting principles (GAAP), auditing is guided by generally accepted auditing standards (GAAS).

In summary, accounting and auditing are complementary yet distinct financial processes. Accountants are responsible for recording and reporting financial transactions, while auditors provide an independent assessment of the accuracy and reliability of those financial records. Understanding these differences is crucial for effectively managing financial operations and ensuring compliance and transparency in organizations.

What is Reviewed During a Financial Audit?

In a financial audit, several areas and aspects are thoroughly reviewed to ensure the accuracy and integrity of the financial statements, as well as compliance with applicable regulations and internal controls. Here’s an overview of the key components that undergo examination during a financial audit:

- Financial Statements: The financial statements, including the balance sheet, income statement, and cash flow statement, are closely reviewed to verify their accuracy and completeness. This involves analyzing the underlying transactions, recording methods, and presentation of financial information.

- Internal Controls: Internal controls are evaluated to assess the effectiveness of an organization’s systems and processes for financial reporting and safeguarding assets. This includes reviewing the design and implementation of controls, testing their operating effectiveness, and identifying any weaknesses or deficiencies.

- Compliance: Compliance with financial regulations and accounting standards is a critical aspect of a financial audit. The auditors ensure that the organization’s financial practices and disclosures adhere to the relevant legal and regulatory requirements, industry guidelines, and generally accepted accounting principles (GAAP).

By thoroughly reviewing these areas, auditors can provide assurance to stakeholders, such as investors, creditors, and regulators, regarding the reliability and transparency of the organization’s financial information.

Why is a Financial Audit Performed?

A financial audit serves a crucial purpose in the world of business and finance. It is conducted to ensure the accuracy, reliability, and transparency of financial statements. Regulatory compliance, accurate financial reporting, and investor confidence are among the key reasons why organizations undertake financial audits.

Financial audits play a vital role in maintaining regulatory compliance. In today’s complex business landscape, organizations must adhere to various financial regulations and reporting requirements. By conducting a financial audit, companies demonstrate their commitment to upholding these regulations, mitigating the risk of penalties, fines, and legal consequences.

Accurate financial reporting is another fundamental purpose of a financial audit. Audit procedures and reviews help verify the reliability of financial statements and ensure that they present a true and fair view of the organization’s financial position. This accuracy is essential for making informed decisions, both internally and externally.

Building investor confidence is yet another significant objective of a financial audit. Investors rely on financial statements to assess the financial health and performance of a company. By subjecting their financial statements to an audit, organizations provide investors with an objective evaluation of the company’s financial status. This transparency enhances investor confidence and potentially attracts more investment opportunities.

Overall, the importance of financial audits cannot be overstated. They ensure regulatory compliance, enhance the accuracy of financial reporting, and strengthen investor confidence. By undergoing a thorough and transparent financial audit process, organizations demonstrate their commitment to sound financial practices, fostering trust and credibility with stakeholders.

Benefits of a Financial Audit

A financial audit offers numerous benefits to organizations, helping them enhance their overall financial management and decision-making processes. Let’s explore how conducting a financial audit can contribute to risk management, fraud detection, and operational improvement.

Risk Management: One of the key benefits of a financial audit is its ability to identify and assess potential risks within an organization’s financial operations. By examining financial records, processes, and controls, auditors can help identify vulnerabilities and provide recommendations to mitigate these risks. This proactive approach to risk management allows organizations to safeguard their assets, protect against fraud, and maintain regulatory compliance.

Fraud Detection: Financial audits play a crucial role in detecting and preventing fraudulent activities. Through rigorous testing and examination of financial transactions and controls, auditors can identify irregularities, suspicious patterns, and potential instances of fraud. Prompt detection of fraud helps organizations take appropriate action, minimize financial losses, and ensure the integrity of their financial reporting.

Operational Improvement: A financial audit can uncover inefficiencies and weaknesses in an organization’s financial processes, providing valuable insights for operational improvement. Auditors assess the effectiveness of internal controls, identify bottlenecks, and recommend solutions to streamline operations and enhance efficiency. By implementing audit recommendations, organizations can optimize their financial processes, reduce costs, and improve overall performance.

Moreover, the findings and recommendations resulting from a financial audit can contribute to informed decision-making processes. Accurate and reliable financial information assists management in making strategic decisions, planning budgets, and allocating resources effectively.

In summary, a financial audit brings multiple benefits to organizations. It helps manage risks, detect and prevent fraud, improve operational efficiency, and supports decision-making processes. By prioritizing regular financial audits, organizations can ensure financial integrity, compliance, and sustainability.

Preparing for a Financial Audit

When it comes to a financial audit, preparation is key. By taking the necessary steps to prepare for the audit in advance, you can help ensure a smooth and successful process. In this section, we will provide practical tips on how to prepare effectively for a financial audit.

One crucial aspect of preparation is proper documentation. Documenting your financial transactions, processes, and policies is essential for demonstrating compliance and providing auditors with the necessary evidence to support their findings. Ensure that all documentation is organized, up-to-date, and easily accessible for review.

In addition to documentation, conducting a review of your internal controls is essential. Internal controls serve as safeguards against fraud, errors, and irregularities in financial reporting. Reviewing your controls prior to the audit allows you to identify any weaknesses or gaps that need to be addressed, thereby improving the overall effectiveness and accuracy of your financial processes.

Furthermore, effective communication with auditors is crucial in preparing for a financial audit. Establish clear channels of communication to ensure that auditors have the necessary information and access to key personnel within your organization. This open line of communication facilitates a collaborative and transparent audit process.

By following these tips and focusing on proper documentation, internal controls review, and effective communication with auditors, you can ensure that your organization is well-prepared for a financial audit. Being proactive and prepared will not only streamline the audit process but also enhance the accuracy and reliability of your financial reporting.

Use Software to Improve The Financial Audit Process

Software and technology have transformed various industries, and financial audit is no exception. Leveraging software tools can significantly improve the efficiency and accuracy of the financial audit process. By embracing automation and data analytics, auditors can gain valuable insights and streamline their operations.

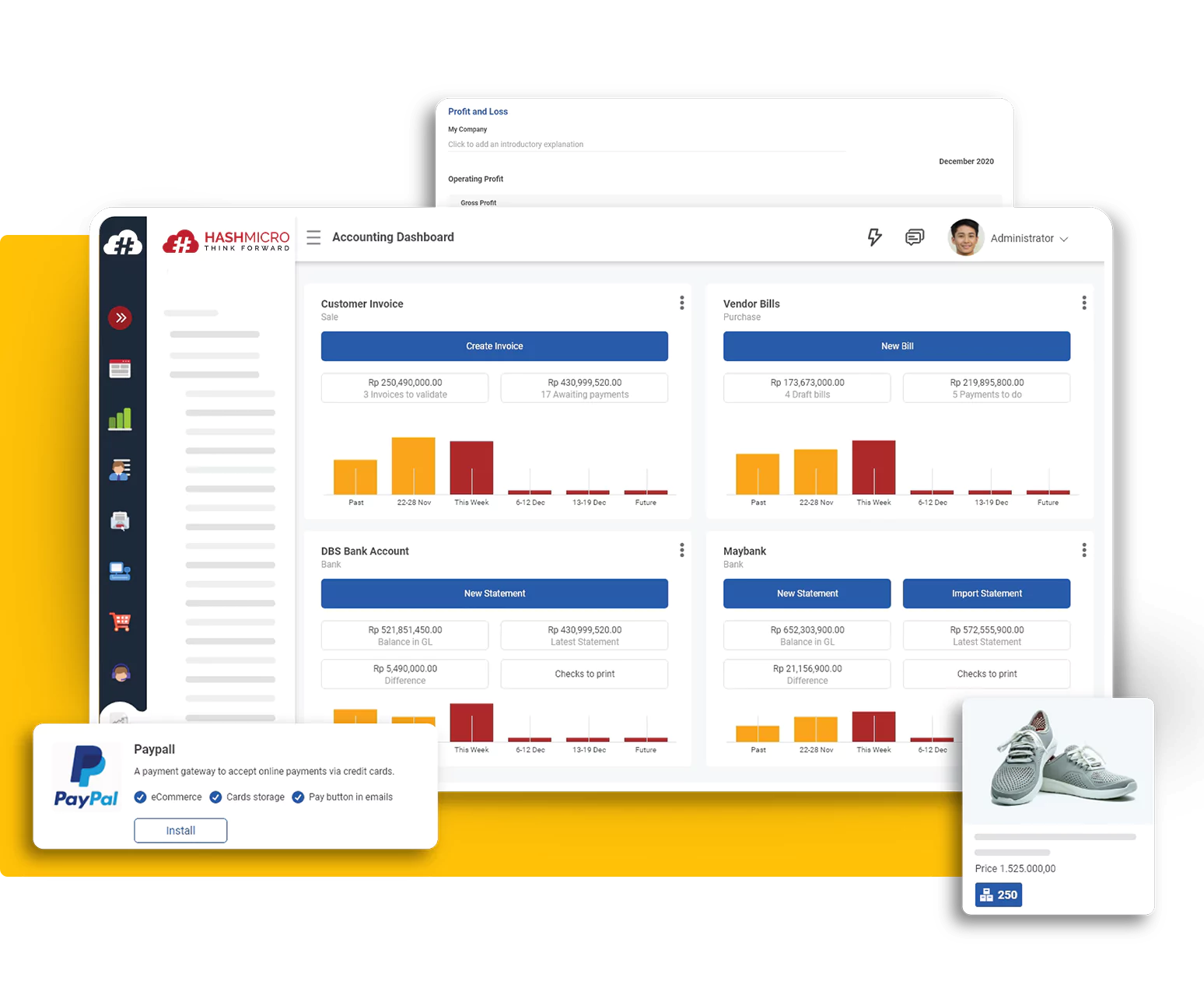

One of the best financial software in Singapore is HashMicro financial software. Trusted by 2.250+ clients worldwide, HashMicro provides excellent ERP software products and services. It offers automation with complete features to streamline financial audit processes in a company.

Here are some features of HashMicro financial software that may benefit your company:

1. Bank Integration

Imagine all your bank accounts speaking the same language and being accessible in one place. HashMicro’s bank integration does just that, allowing for real-time synchronization of transactions. This feature streamlines your financial operations, making it easier to manage cash flows and reconcile accounts, ensuring that your financial data is always up to date and accurate.

2. Budget S Curve

Visualizing your budget over time is now simpler with the Budget S Curve feature. This tool helps you understand how your spending progresses against your budget, offering a clear, graphical representation of your financial status over the project’s lifecycle. It’s an invaluable aid for tracking budget performance and making informed decisions.

3. Cashflow Reports

Cashflow is the lifeblood of your business. HashMicro’s cashflow reports provide a detailed and dynamic view of cash inflows and outflows, enabling you to forecast and plan effectively. These reports help you anticipate future cash positions, ensuring you’re never caught off guard by financial needs.

4. Profit & Loss vs Budget & Forecast

Understanding your business’s financial health has never been easier. The best accounting software can compare actual profits and losses against your initial budget and forecasts, offering insightful analysis for performance evaluation. It aids in identifying deviations and making strategic adjustments, fostering a culture of continuous improvement.

5. Financial Statement with Budget Comparison

HashMicro elevates traditional financial statements by integrating budget comparisons directly into them. This feature allows for a comprehensive view of your financial performance against planned figures, providing a deeper understanding of where your business stands financially and where it’s headed.

6. Equity Movement Report

The Equity Movement Report offers a detailed overview of changes in equity, capturing everything from capital injections to dividends. This feature is crucial for stakeholders to understand how their equity is affected by business operations, enhancing transparency and trust.

7. Treasury & Forecast Cash Management

Effective cash management is essential for any business. This tool not only helps you manage current cash positions but also forecasts future cash requirements. By leveraging predictive analysis, you can ensure optimal liquidity, plan for future investments, and avoid potential cash shortages.

8. Landed Costs Management

Navigating the complexities of importing goods is made simpler with HashMicro’s landed costs management feature. This tool accurately allocates costs associated with the acquisition of goods, such as freight, duties, and taxes, ensuring precise cost analysis and inventory valuation.

HashMicro also offers several benefits such as unlimited users, customizable software integration, professional consultation, and free demo service. Do not miss the chance try the most comprehensive financial software in Singapore!