Financial reporting software automates the process of collecting, organizing, and presenting financial data to ensure accuracy and compliance with accounting standards. This software simplifies financial management, making it easier for businesses to generate reports and gain insights into their financial health.

By adopting the right financial reporting tools, companies have the potential to slash the hours spent on financial management by a staggering 50%. For that, choosing the right financial reporting software that meets a company’s specific requirements is crucial.

In this article, we will explore the detailed information about financial reporting software, and also provide the 20 best financial reporting software in Singapore. By considering the best software, you can enhance your company’s financial health.

Key Takeaways

|

20 Best Financial Reporting Software – Highlights

- HashMicro – Bank Integrations & Auto Reconciliation for seamless financial data accuracy and automated bank transaction verification.

- Datarails – Automated Data Analysis that simplifies financial performance monitoring with easy-to-use visual reports.

- Vena – Excel-Based Interface that integrates seamlessly with Microsoft Power BI and PowerPoint for familiar and flexible financial reporting.

- LicenseOne – Software Subscription Management to optimize SaaS spending and track software usage efficiently.

- Phocas – Advanced Data Analytics with interactive dashboards and deep financial data visualization.

- FreshBooks – Bank Account Synchronization for automatic financial tracking and detailed tax reporting.

- Sage Business Cloud Accounting – Full Audit Trails to ensure financial data integrity and accurate reporting.

- Tipalti – Comprehensive Financial Controls to streamline global accounts payable and procurement processes.

- Insightsoftware – ERP Integration Capabilities that allow seamless data exports and extensive financial reporting customization.

- Xledger – Real-Time Financial Insights that provide instant financial snapshots across multiple business dimensions.

- Workiva – Automated Financial Document Collaboration to ensure accuracy and efficiency in reporting processes.

- Tagetik – What-If Scenario Analysis for predictive financial planning and decision-making.

- Planful – Operational & Financial Intelligence that enhances financial planning, budgeting, and forecasting.

- Anaplan – End-to-End Business Performance Monitoring with complex financial modeling capabilities.

- Prophix – Automated Budgeting & Forecasting to eliminate manual reporting errors and improve financial planning.

- Workday Adaptive Planning – Flexible Financial Modeling that allows quick adjustments to financial strategies.

- Cube – Automated Report Compilation to streamline financial data tracking and reduce repetitive tasks.

- Jedox – Robust Data Security to ensure safe financial planning and data integrity.

- Syntellis Performance Solutions – Advanced Database Administration that enhances financial reporting accuracy.

- OneStream – Unified Financial Consolidation to integrate financial and operational data efficiently.

Table of Content:

Table of Content

What is Financial Reporting and Analysis Software?

Financial reporting software helps businesses manage and analyze their financial matters by making complex financial tasks simpler and more accurate. This tool is mainly used by teams who handle financial planning and accounts to provide detailed insights into a company’s financial condition.

It can work alone or as part of a larger system, and is crucial for following strict financial rules and making smart business decisions. The software automates the gathering and processing of financial data from various sources, which saves time and reduces mistakes from manual work. Essentially, it makes the detailed work of managing finances easier and more efficient.

For any company wanting to enhance its financial strategies, manage spend aggregation, lower costs, or grow its business, using advanced financial reporting and analysis tools is essential. These tools help share important financial information across different departments and align it with the company’s objectives. This collaboration improves management and supports a strong setup that helps the company grow and remain profitable.

Benefits of High-Quality Financial Reporting Software

Implementing high-quality financial reporting components in your business can significantly transform your financial management processes. These advanced financial reporting systems are designed not only to streamline complex data handling but also to bolster transparency and accountability.

Below are the key benefits of implementing financial reporting software:

- Risk Reduction: Financial statements software minimizes the risks of errors in your financial data. Accurate and timely reporting is crucial for maintaining compliance and stakeholder trust, as inaccuracies can lead to significant legal and financial consequences.

- Cost Savings: By automating routine tasks, financial reporting solutions enable your finance teams to avoid overtime expenses and reduce the necessity for additional personnel during financial closing periods. Moreover, the ability to create reusable reporting templates saves significant resources in the long run.

- Strategic Planning: Financial reporting systems provide vital data that aid in strategic planning. The insights gained from analyzing financial reports help in forecasting revenues, assessing liquidity, and planning effective exit strategies, crucial for scaling SaaS companies.

- Regulatory Compliance: With regulations continually evolving, having robust financial reporting software ensures that your financial statements are compliant with the latest standards. This compliance is critical for avoiding costly penalties and maintaining a company’s reputation.

- Increased Efficiency: Automation is a key feature of superior financial reporting solutions, drastically reducing the time dedicated to manual report generation. Automation in financial reporting software can cut down the time teams spend on report compilation, allowing them to focus more on strategic activities.

Key Features of Financial Reporting Software

When choosing the right financial reporting software, there must be key features to look for. In this section, we will discuss the key features of financial reporting software that may benefit your company in managing financial administration.

Automated data aggregation

Automated data aggregation effortlessly merges information from different systems. This quick gathering of data highlights the accuracy and speed that can significantly improve your company’s performance. This type of software is designed to work well with businesses of any size, from small to large, meeting the needs of each with simplicity or complexity as required.

Pre-built reporting templates and dashboards

Modern financial reporting tools are known for their quick report generation, using ready-made templates and dashboards that are both organized and adaptable to get started easily. You can create instant analyses and enable users to manage their own reports, making planning and budgeting faster and more efficient. These templates are flexible enough to meet the varied needs of a global business, working with different currencies and following international accounting standards.

BI and AI capabilities

The introduction of Business Intelligence (BI) and Artificial Intelligence (AI) in financial reporting has greatly enhanced analytical capabilities, allowing businesses to predict trends and gather important insights for strategic planning. This shift from manual to automated analysis not only improves accuracy but also, as demonstrated in a case study, increases efficiency and visibility within large organizational structures.

Automated report distribution

Automated report distribution is a standout feature of financial reporting software. Automation ensures that reports are shared quickly and consistently, reducing the risk of human errors and improving communication efficiency. In a time when security and data integrity are critical, using trusted platforms like HashMicro, can help strengthen your organization’s reputation as secure, reliable, and innovative.

20 Best Financial Reporting Software in 2024

The right financial reporting software is more crucial than ever to ensure accuracy, efficiency, and strategic insight. In this context, we’ve curated a list of the 20 best financial reporting software options available in Singapore.

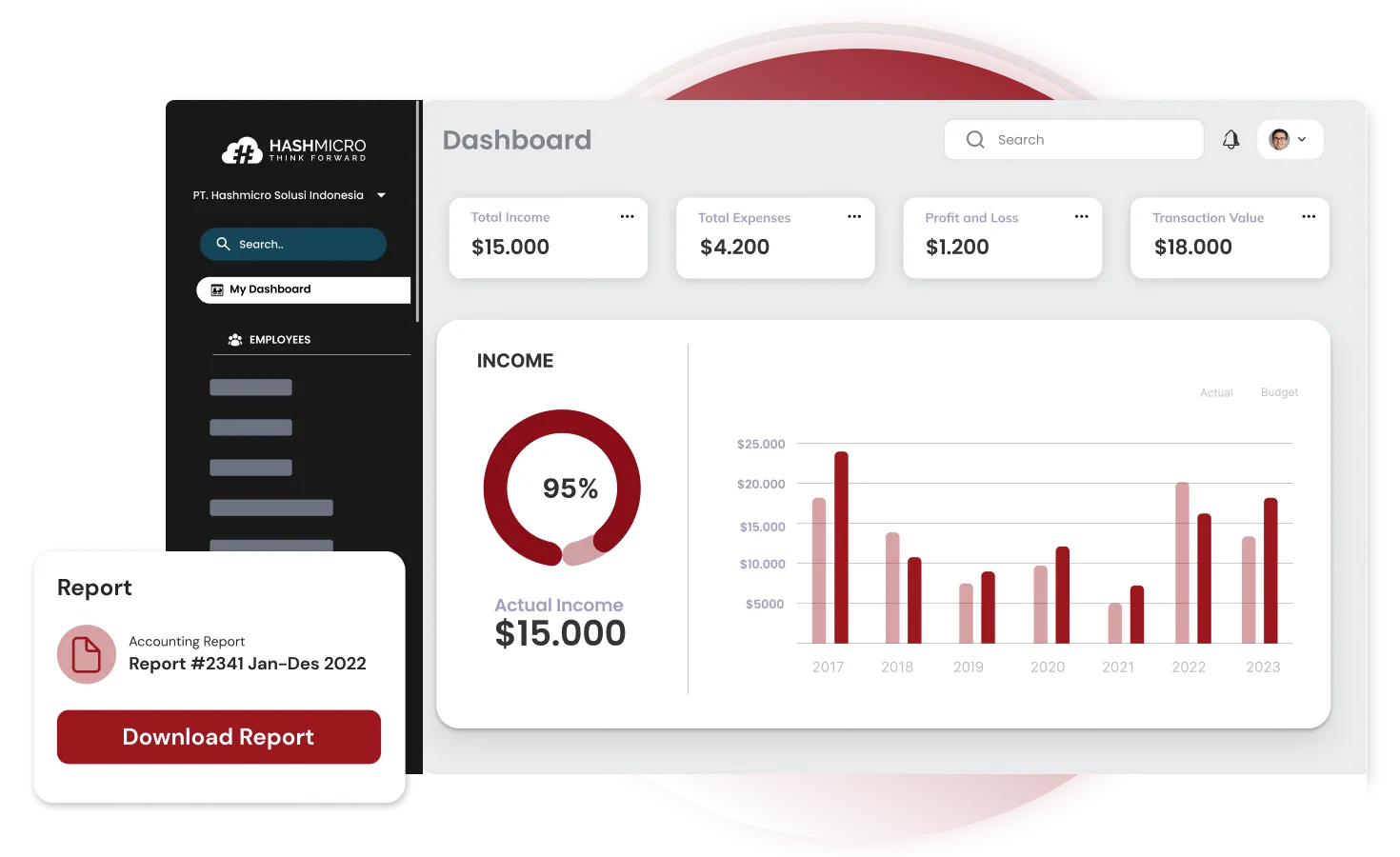

1. HashMicro Financial Reporting Software

HashMicro stands out as one of the top financial reporting software solutions in Singapore, known for its reliability and precision. With more than 1750 clients, HashMicro helps businesses streamline their financial processes effectively with its comprehensive software solution.

HashMicro offers a range of benefits such as unlimited user licenses, free demo service, comprehensive features, and the ability to integrate various modules.

Designed to meet the needs of every industry, HashMicro is especially useful for enterprises and large-scale businesses. Its scalability and robust functionality support complex financial management requirements.

As HashMicro has the key features of the financial reporting software, it also has several features that may help users achieve their goals in financial management.

- Bank Integrations – Auto Reconciliation: Within the scope of financial reporting, HashMicro’s auto reconciliation feature through bank integrations streamlines the verification process of financial entries against bank statements. This capability ensures financial data accuracy, minimizes discrepancies, and simplifies end-of-period reporting by automatically aligning bank transactions with the recorded figures, thereby enhancing the reliability of financial reports.

- Multi Level Analytical: This feature enables companies to dissect financial data at various layers of detail. This functionality is critical for producing in-depth financial reports that provide insights into different aspects of the business, from departmental performances to project-specific analytics, helping stakeholders make informed decisions based on comprehensive data breakdowns.

- Profit & Loss vs Budget & Forecast: This feature compares actual profit and loss statements with predetermined budgets and forecasts, offering a clear view of financial performance versus expectations. This comparison is integral to financial reporting as it helps identify areas where the business is over or underperforming, facilitating timely strategic adjustments and more accurate future financial planning.

- Financial Statement with Budget Comparison: HashMicro enhances financial reporting by allowing businesses to directly compare their financial statements with budgetary projections. This aids in detailed financial analysis, highlighting variances and enabling a deeper understanding of financial outcomes against fiscal targets. Such comparisons are crucial for effective financial governance and strategic management.

- Cashflow Reports: In financial reporting, cash flow reports generated by HashMicro provide a vital snapshot of the liquidity and financial health of an organization. These reports track the cash entering and leaving the business, offering insights into operational efficiency, financial stability, and the capacity to meet short-term obligations, which are essential for maintaining operational continuity.

- Custom Printout for Invoices: For financial reporting purposes, HashMicro’s feature to customize invoice printouts allows businesses to produce tailored financial documents that adhere to corporate branding and regulatory requirements. This adaptability ensures that invoices reflect detailed, pertinent financial information, contributing to transparent and professional financial communication with stakeholders and aiding in compliance and audit processes.

If you’re curious about HashMicro and willing to explore their full potential, it offers a price scheme which you can download below.

2. Datarails Financial Reporting Tools

Datarails is a cloud-based financial planning and analysis platform that specializes in automated data analysis, offering easy-to-understand charts, graphs, and data visualizations that help demystify complex financial data. This functionality enables users to quickly update data in management reports, thereby enhancing the monitoring of company and financial performance effectively.

However, it lacks significant workflow and collaboration capabilities, which are crucial for teams that require real-time interactions and data sharing across departments. Additionally, Datarails offers only a limited number of basic reporting templates, which may not meet the needs of all users.

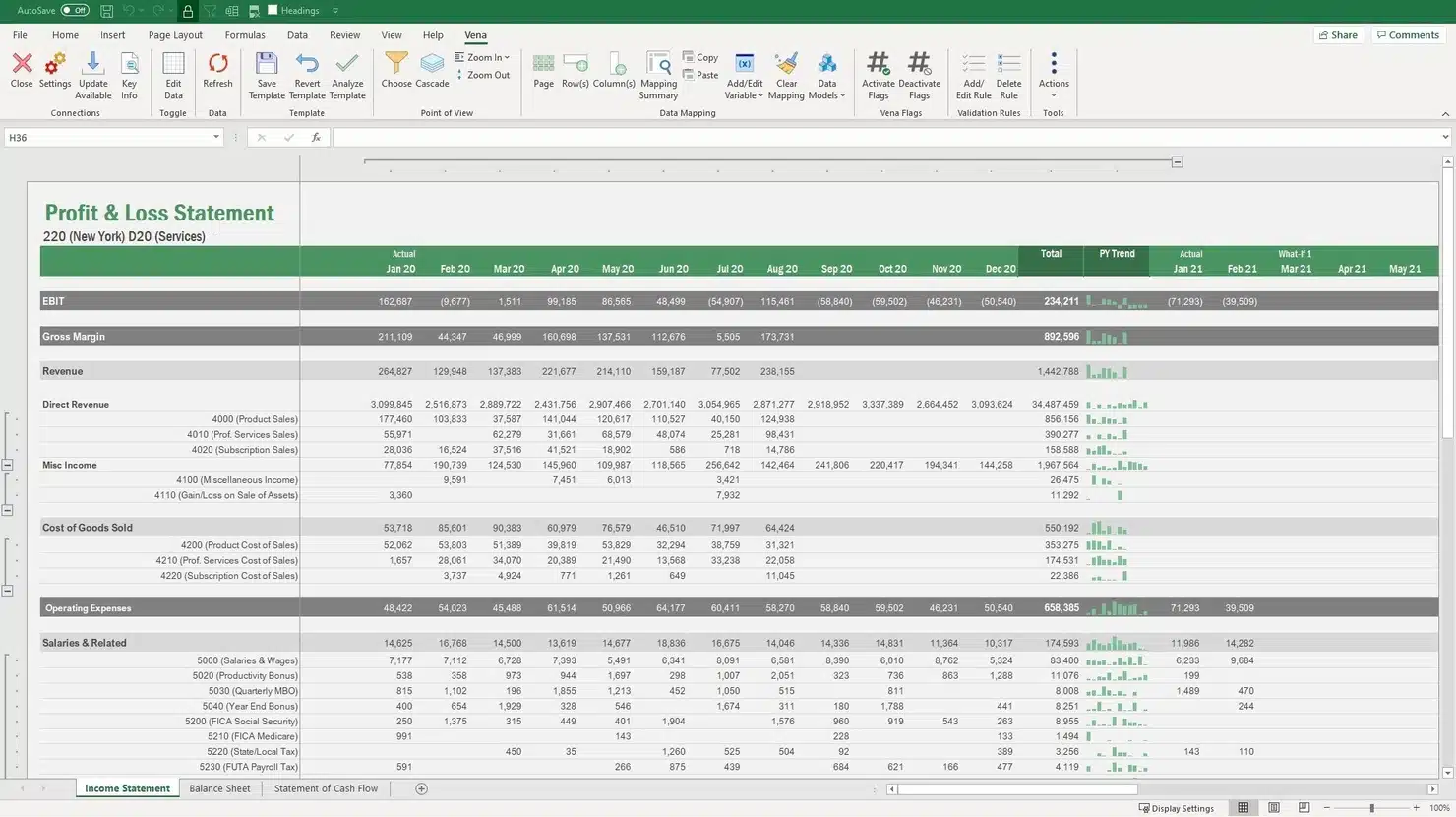

3. Vena Financial Reporting Systems

Vena combines the flexibility of Excel with the robustness of a full financial planning and analysis (FP&A) platform. It automates many essential financial consolidation and reporting processes. The familiarity of its Excel interface, enhanced by integrations with Microsoft Power BI and PowerPoint.

However, the initial setup process can be time-intensive, potentially delaying the full deployment and utilization of the software. Additionally, Mac users might encounter compatibility issues, which could limit the software’s functionality and user experience on Apple devices.

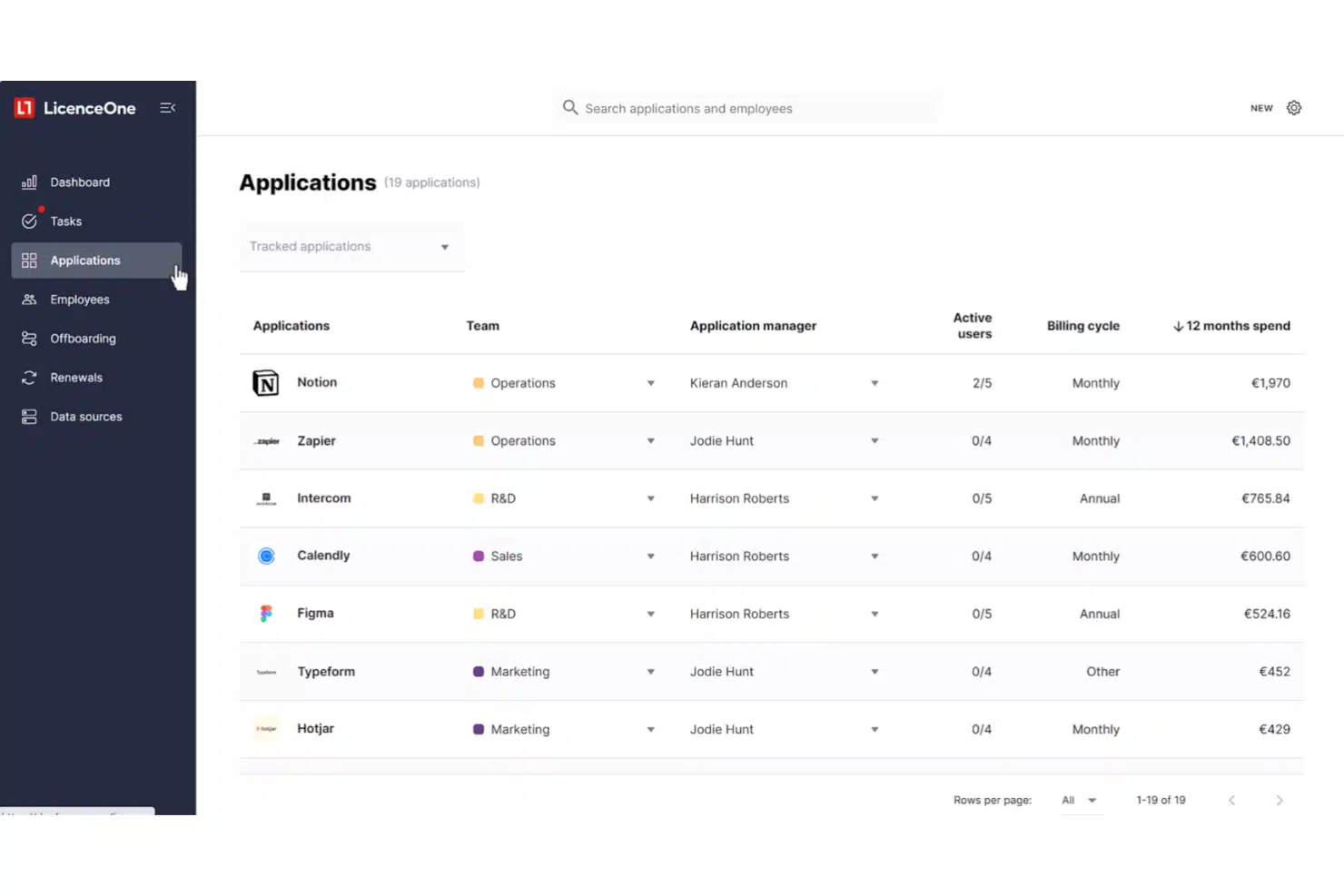

4. LicenseOne Financial Performance Software

LicenceOne is primarily designed as a software management platform that aids businesses in managing their software subscriptions efficiently. By focusing on cost optimization, spend management, and app usage tracking, LicenceOne helps companies avoid overspending on SaaS subscriptions.

However, LicenceOne has certain limitations that may affect its utility for some businesses. While it excels in license management and the automated tracking of SaaS usage, its integrations with third-party systems, especially accounting software, are limited. This could restrict its effectiveness for companies looking for a seamless integration across all financial management systems.

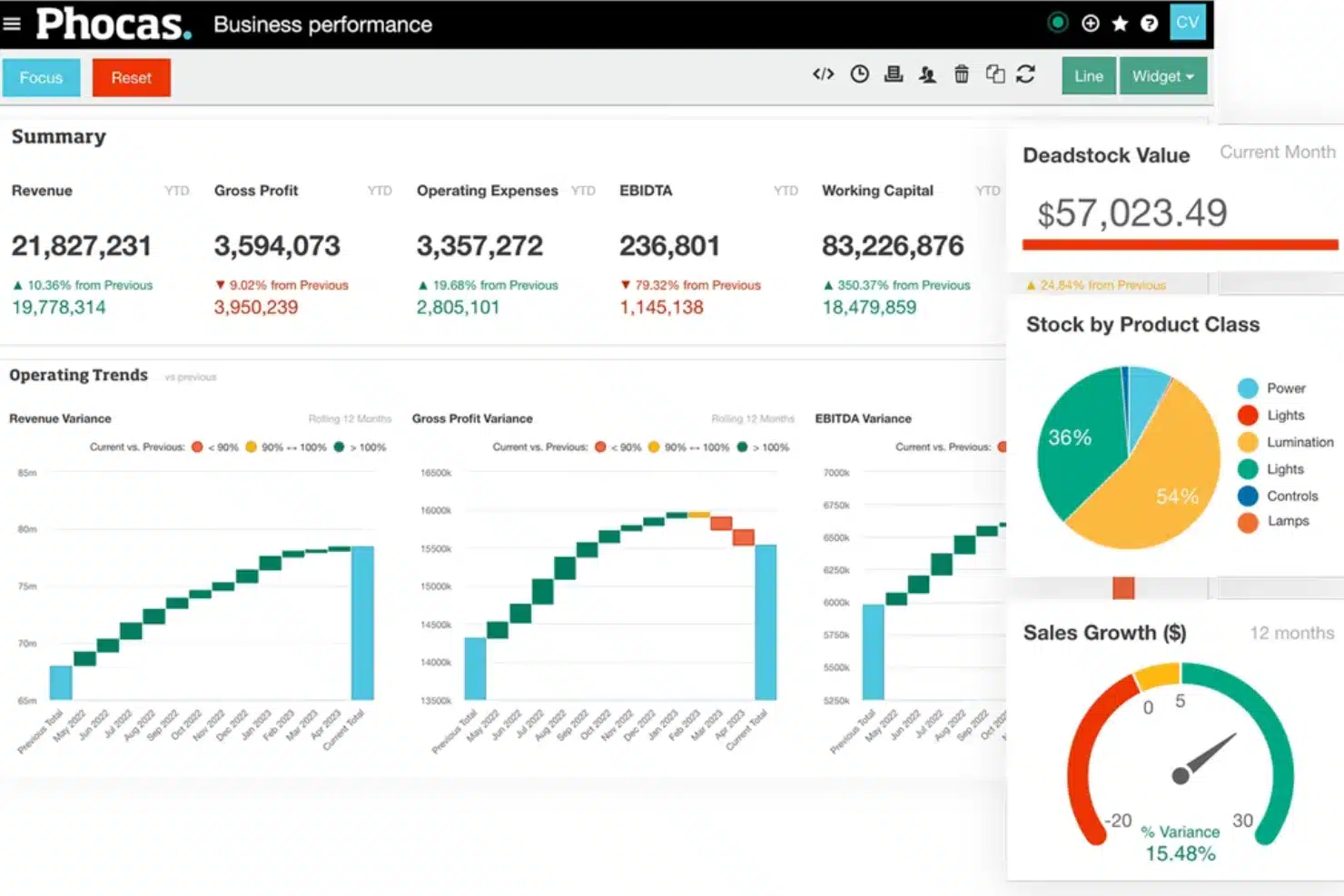

5. Phocas Financial Reporting Solutions

Phocas is an automated financial reporting software designed to empower organizations with advanced data analytics, visualization, and reporting capabilities. It supports businesses in enhancing their data-driven decision-making by integrating with a wide range of data sources, such as ERP and CRM systems.

Meanwhile, Phocas needs a steep learning curve for new users, particularly those keen to leverage its full potential. Additionally, the initial setup and configuration of the software can be time-consuming, which might delay its integration into daily operations.

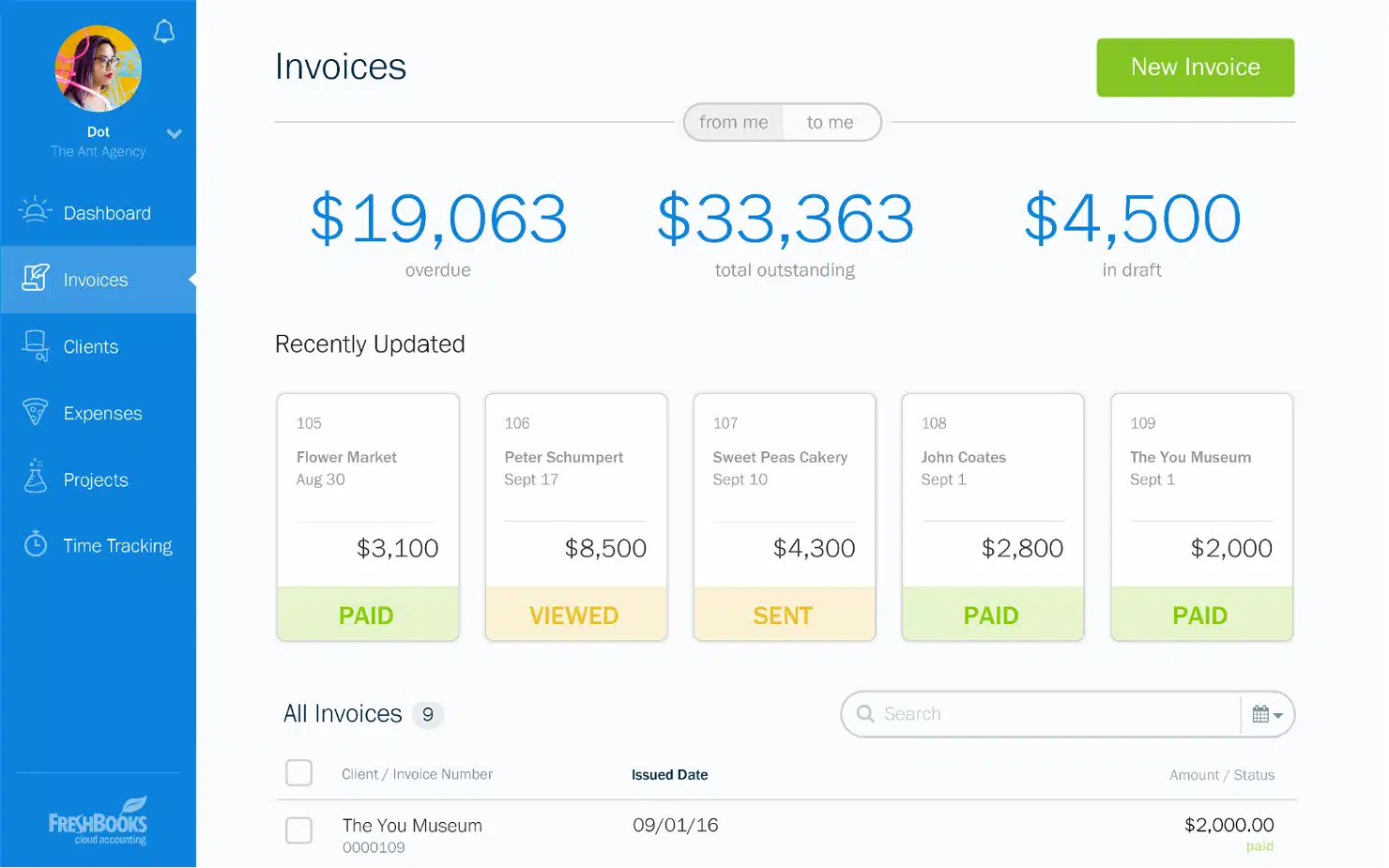

6. FreshBooks Financial Statement Software

FreshBooks is an accounting software that caters primarily to the needs of small businesses, freelancers, and solopreneurs. It offers key features like annual and interim financial statements, bank account synchronization, and detailed tax reporting, which streamline various financial tasks.

However, it has certain limitations that might not suit every business. It lacks a full audit trail, which is crucial for businesses that need detailed records for financial scrutiny or regulatory compliance. Additionally, FreshBooks imposes limits on the number of billable clients, which might hinder scalability for growing businesses or those with a large client base.

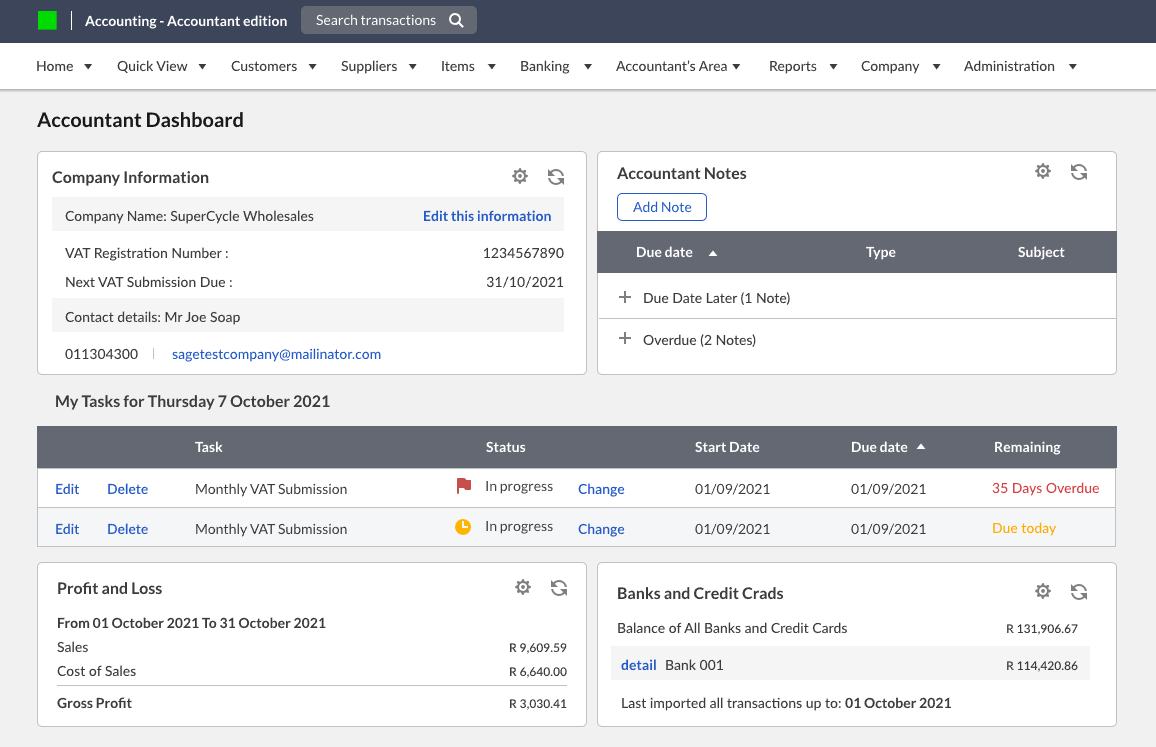

7. Sage Business Cloud Accounting

Sage Business Cloud Accounting is a cloud-based financial reporting tool that offers affordability and simplicity, particularly appealing for small teams and startups. It covers all basic financial reporting needs including full audit trails, cash flow management and forecasting, automated tax reporting tools, and inventory tracking.

However, it has some limitations. The API integration capabilities are not particularly user-friendly, which might complicate the process for businesses looking to integrate Sage with other systems. Additionally, the basic plan comes with limited features, which might necessitate upgrades as business needs grow and evolve.

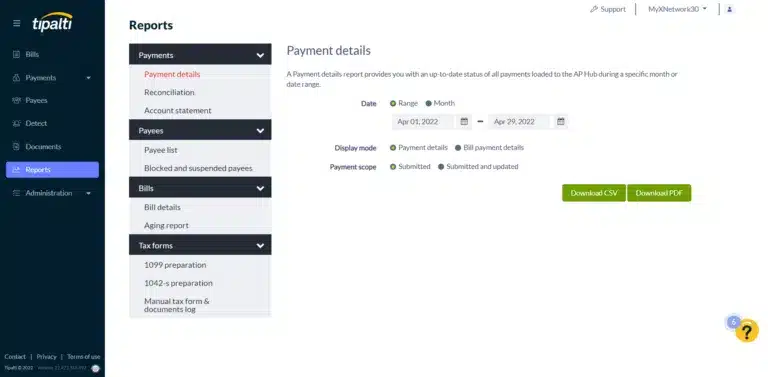

8. Tipalti Financial Performance Software

Tipalti is an automated financial reporting software that incorporates extensive financial reporting capabilities. It is particularly valued for its comprehensive suite of tools that support internal controls over financial reporting (ICFR), procurement, and international accounts payable.

Despite its robust functionalities, Tipalti presents a learning curve that may require a significant time investment from users to fully leverage its features. Additionally, the absence of batch downloads can limit efficiency in handling large volumes of transactions, potentially affecting the workflow of businesses with high transaction volumes.

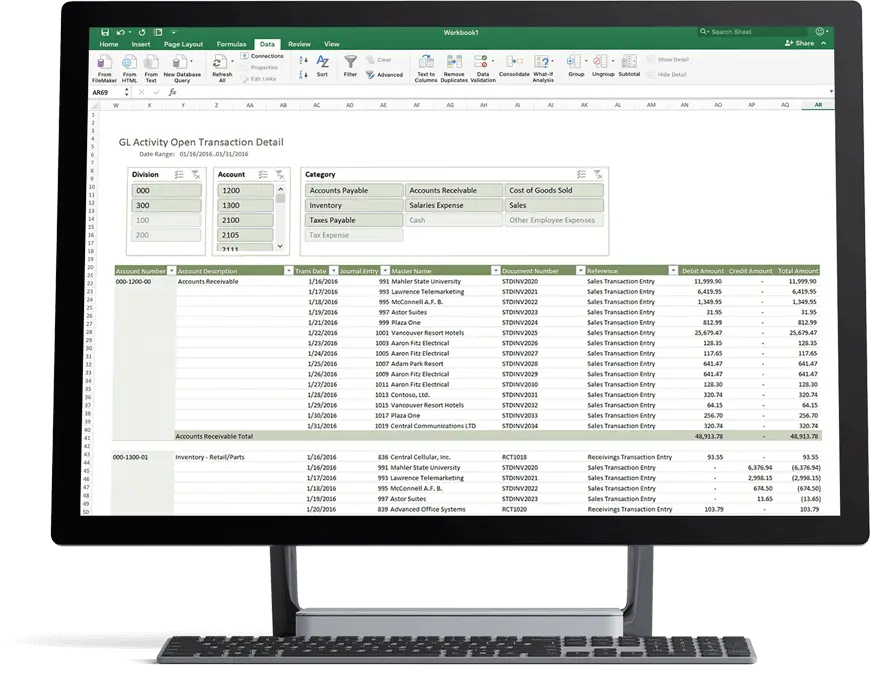

9. Insightsoftware Financial Reporting Solutions

Insightsoftware is tailored for organizations that require robust integration capabilities and extensive customization in their financial reporting. It excels in facilitating seamless data exports from ERP or enterprise performance management (EPM) systems to Excel, where users can create highly customized dashboards.

However, Insightsoftware may present budgetary constraints for smaller teams due to its potentially high cost. Furthermore, while it offers strong reporting and data management features, its analytical tools are somewhat limited, which might not suffice for organizations that require deep analytical capabilities.

10. Xledger Financial Statement Software

Xledger is a cloud-based financial management system known for its advanced automation capabilities and real-time financial insights. It offers instant access to financial data across multiple dimensions such as projects, departments, and entire companies, supported by extensive drill-down capabilities.

Despite its extensive features, Xledger might present challenges for smaller businesses, primarily due to its cost, which may be steep for smaller budgets. Additionally, there is a slight learning curve associated with its use, as new users must familiarize themselves with its comprehensive suite of features and integrations.

11. Workiva Financial Reporting Software

Workiva is a financial reporting software with robust document collaboration capabilities. Its extensive automations facilitate streamlined data collection and enhance financial reporting processes, ensuring accuracy and timeliness across various reports such as budget-to-actual variances and management reporting.

But, the absence of phone or live support may pose challenges for users requiring immediate assistance or real-time problem resolution. Additionally, while Workiva offers a mobile application for Android devices, it lacks a corresponding app for iOS, which could limit accessibility for users within Apple’s ecosystem.

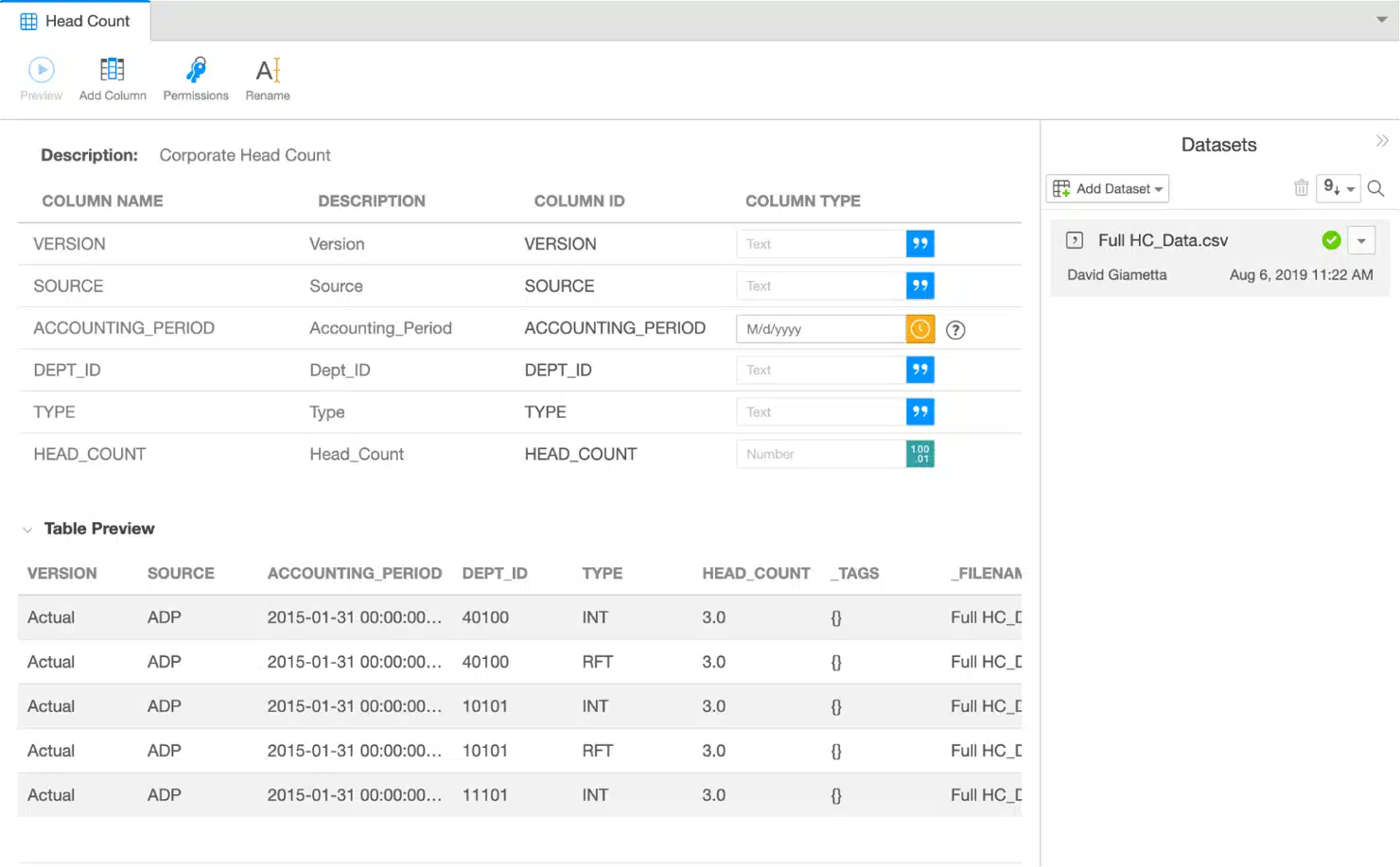

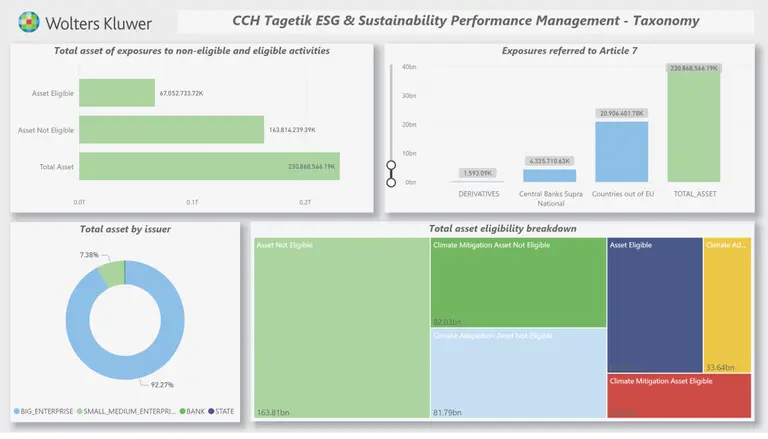

12. Tagetik Financial Reporting Systems

CCH Tagetik is a robust financial reporting and analysis software that leverages historical financial data to create more accurate budgets, financial plans, and forecasts. The platform is known for its advanced analytics and sophisticated reporting features, which include what-if scenario analysis and activity-based and driver-based costing models.

However, CCH Tagetik does come with its challenges. While it offers extensive analytics capabilities, it lacks group cash flow functionality, which can be a limitation for organizations that need to manage complex, consolidated cash flow statements.

13. Planful Financial Reporting Tools

Planful is a cloud-based financial planning and analysis (FP&A) platform that provides businesses with robust operational and financial intelligence tools. Designed to enhance financial data management, decision-making, and reporting, Planful supports businesses in streamlining their planning and budgeting cycles.

However, the software lacks dynamic dashboard functionality, which can be a drawback for companies that require real-time data visualization to make quick, informed decisions. Additionally, users may find it challenging to create custom formulas, reports, and dashboards based on their specific needs.

14. Anaplan Financial Performance Software

Anaplan is a cloud-based planning and performance management platform that assists organizations in connecting their data rapidly and automating various financial, operational, and reporting processes. The platform excels in creating complex models that calculate and monitor end-to-end business performance, aiding organizations in reporting and analyzing critical KPIs to top-level management.

But, the platform allows for only three dimensions in the rows/columns area, which can be restrictive for businesses needing more complex data segmentation. Additionally, Anaplan struggles with creating flexible dependent filtering criteria, which can complicate user experiences when trying to display interdependent data clearly.

15. Prophix Financial Reporting Solutions

Prophix excels at eliminating tedious manual reporting tasks, providing tools for streamlined budgeting, planning, forecasting, reporting, and analysis. Notably, Prophix includes currency conversion capabilities, which simplify financial reporting across multiple currencies, an essential feature for global businesses.

However, Prophix often faces challenges with data importing and data management during deployment, which can complicate the initial setup and integration. The platform’s template creation process can also be cumbersome, particularly when needing to incorporate multiple data views or when formulas require pointing to specific intersections in the database.

16. Workday Adaptive Planning

Workday Adaptive Planning is a cloud-based corporate financial reporting software renowned for its flexibility and user-friendly design, making it a popular choice among organizations aiming to automate and enhance their reporting processes. It makes Workday Adaptive Planning particularly effective for companies needing to quickly adapt to changing conditions, prioritize tasks, and foster efficient collaboration across departments.

However, despite its strengths, Workday Adaptive Planning presents certain challenges that may limit its appeal for some users. The platform can be difficult to modify once set up; updating models, adding new departments or accounts, or creating new reporting hierarchies can be cumbersome.

17. Cube Financial Statement Software

Cube is a financial planning and analysis (FP&A) platform designed to enhance strategic decision-making within finance teams by automating and streamlining repetitive reporting tasks. It allows users to create custom models to map and store complex datasets efficiently, featuring an easy-to-use interface that simplifies the building, configuring, and monitoring of these models.

However, Cube offers a limited audit trail, which can complicate collaboration as users might need to wait for others to finish their entries before proceeding. Additionally, when new general ledger accounts are created, users are required to manually map these to their parent accounts, which can be a cumbersome process.

Another notable drawback is its limited visual user interface and reporting modules, which might not meet the needs of users who rely heavily on visual data presentations and comprehensive reporting functionalities.

18. Jedox Automated Financial Reporting Software

Jedox serves as a unified business planning and analytics platform that helps organizations efficiently analyze and report on essential financial, operational, and customer data. It provides robust security features ensuring that data remains safe, secure, and up-to-date.

Some users may find it challenging to perform ad hoc data analysis and visualization, as the platform primarily supports structured data environments. Furthermore, user permissions in Jedox are restricted to database and cube levels, which might limit finer control over data access and manipulation.

19. Syntellis Financial Performance Software

Syntellis Performance Solutions is a software and analytics provider that caters predominantly to financial and healthcare organizations in the upper mid-market and enterprise space. The platform is recognized for its strong expertise in database administration and data engineering, supported by a team of knowledgeable consultants who assist organizations in streamlining processes and simplifying reporting.

However, the reporting features are somewhat inflexible without custom scripting, making it difficult to create and add tailored reports. This could pose a barrier for organizations that require highly customized reporting capabilities. Additionally, performance issues may arise when querying larger tables and datasets, potentially slowing down the retrieval of information.

20. OneStream Financial Reporting Software

OneStream provides a unified corporate financial reporting software that integrates financial and operational data, enhancing visibility and control. OneStream is particularly adept at creating flexible and powerful reports and dashboards, coupled with strong financial consolidation and close capabilities, ensuring accuracy and efficiency throughout the entire financial cycle.

However, OneStream requires significant onboarding and training, as it is not very intuitive unless users have a foundational understanding of its functionalities. Additionally, transitioning from an on-premise setup to cloud-based SaaS can be complex and time-consuming, particularly due to the unique needs and structures of different businesses.

Conclusion

Choosing the right financial reporting software is crucial to manage and deep-analyze company’s financial health. In the article above, several choices of financial reporting software is available in the market. But, considering the best software that suits your company’s criteria and needs is a priority.

One of the best accounting software available is HashMicro, with complete features and benefits for a better financial management. Equipped with user-friendly interface and professional assistance, you don’t need to worry because the software is easy to access.

Adopting the best financial reporting software can lead your business into a better financial management and avoid human-errors. Grab the chance to enhance your business by trying the free demo of HashMicro financial reporting software now!

Questions about Financial Reporting Software

-

How to choose the best financial reporting software?

Financial accounting software automates the process of tracking and managing financial transactions. It records income and expenses, generates financial reports, and ensures accurate financial data by integrating with other business systems.

-

How to choose the best financial reporting software?

To choose the best financial reporting software, consider factors like user-friendliness, features that match your business needs, integration capabilities with other systems, security, scalability, and customer support.

-

What’s the best financial reporting software?

The best financial reporting software is the HashMicro Accounting System. It offers comprehensive features, user-friendly interfaces, and robust integration options, making financial management efficient and accurate.