For some people who have been in the investment, the world must be quite familiar with the equity terms. Equity is the value of ownership of a thing. It will then be taken into account for investment by one person, body, or organization. Moreover, equity is also an important factor in keeping companies in order to last a long time.

Equity is also used to determine the size of a company’s assets and the number of obligations that must be met. That later will also affect the balance sheet of the company. Use an asset management app that can manage all assets in real-time, including the number of assets owned by the company. In this article, we will discuss what equity is, its purpose, its elements, how to calculate it, and an example of changing equity reports in a company.

Table of Content:

Table of Content

What is Equity?

Equity is in general a representation of the value of ownership of a matter. It could be an enterprise, an inventory, or a stock of a company. The accounting equation refers to a left-hand column that contains assets or properties and a right-hand column containing debts and equity.

Equity is the net wealth of a corporation. Based on the default Statement of Financial Accounting (SFAC), equity is a residual right to corporate activity after reducing all liability. In short, the meaning of equity is the right of a company owner to an asset after being reduced with a liability. Included in these liabilities are the reductions of money to shareholders, the value of debt, and others.

Value equity is calculated as the difference between an asset and a liability on a company’s balance sheet. It is determined by subtracting total liabilities from total assets. Factors that can reduce equity include a corporation’s losses or profits withdrawn by the owner. Equity becomes negative, or a deficit, when liabilities exceed assets.

Reporting its own amount of equity in a company’s balance describes the company’s health condition or lack thereof. A company is unhealthy when its equity is constantly negative. However, equity is not the sale value of the company.

The Importance of Equity in Business

In addition to seeing how assets are available, the importance of equity reporting in business is to provide information about the history and investment prospects of other owners and equity holders. The presentation of shareholders’ equity has the purpose of providing information about the company’s juridical obligations to shareholders and other parties. The company must monitor the management of the building as one of the company’s fixed assets. The use of a facility management system is one of the right things that companies should choose because it can help manage and maintain your company’s building facilities.

To fulfill its purpose, the information you need to present about the equity stakeholder must include at least the following:

- Source equity shareholders with every record

- The juridical regulations governing the limitation of the dividends and return of capital deposits to the shareholders

- The priority of some other shareholders or other equity holders.

It should also appear in accordance with current regulations of the law and according to the proper registration of the establishment.

Elements in Equity

Equity is what a holding company needs. Any company is able to properly and precisely determine its equity value. The trick is to record every asset a company has and any liability. This value should be greater than a liability value in order to avoid running a deficit.

There are several elements responsible for creating equity, some of which are as follows:

Paid-up capital

Paid-up capital is a number of investments invested by business owners and investors in a certain amount. The goal is to expand the business. In other words, the equity or property rights of the shareholders, are equal to already deposited capital.

Two parts of this capital include share capital and agio or disagio stock. Share capital is the amount of stock value that passes through a business. Meanwhile, agio or disagio represents the difference between the shareholder deposits and the nominal amount. Agio is the amount above the nominal value, whereas disagio is the amount below the nominal value.

Donation or grant capital

It is not uncommon for a company to receive additional capital when it comes to donations or grants. Based on the understanding equity is total wealth deducted from a liability. That’s why increased assets from grants or donations would increase corporate equity. The capital derived from donations or grants is when companies record additional assets without going through capital expenditures.

Capital from reassessment

The company sometimes does reviews of its assets. When then in the assessment there is an adjustment, there is a change in the company’s balance sheet. For example, the asset of a property may increase in value, and the value of equity will increase as well. This type of capital comes from the rest of previous periods in accounting for later periods. This was intended so that the remaining capital of the previous period could be maximum for additional business needs in the future.

Unshared profit

Unshared profits are the remainder or amount of the company’s profits derived from previous years and not divided. This type of capital can be taken by those who are entitled to dividends next time. In order to finance the distribution of the dividends, the company must own several other reserves. The GMS, for example, will determine the dividends held back on the open company.

How to Calculate Equity

To determine the financial position of the business, figuring out your owner’s equity is a good way. Furthermore, if you seek financial assistance from lenders or investors, you will undoubtedly need to calculate it. Therefore it is important to know it will not reflect the market value of your real assets.

To calculate the owner’s percentage that is by reducing the liabilities of the asset’s worth. Here are the equations:

Equity owner = asset-liabilities

For example, if you own a house worth 800,000,000 but have 500,000,000 in debt for loans on the home purchase, it represents 300,000,000 from the equity. If the asset increases, then your equity will also increase.

Examples of Company Equity Change Reports

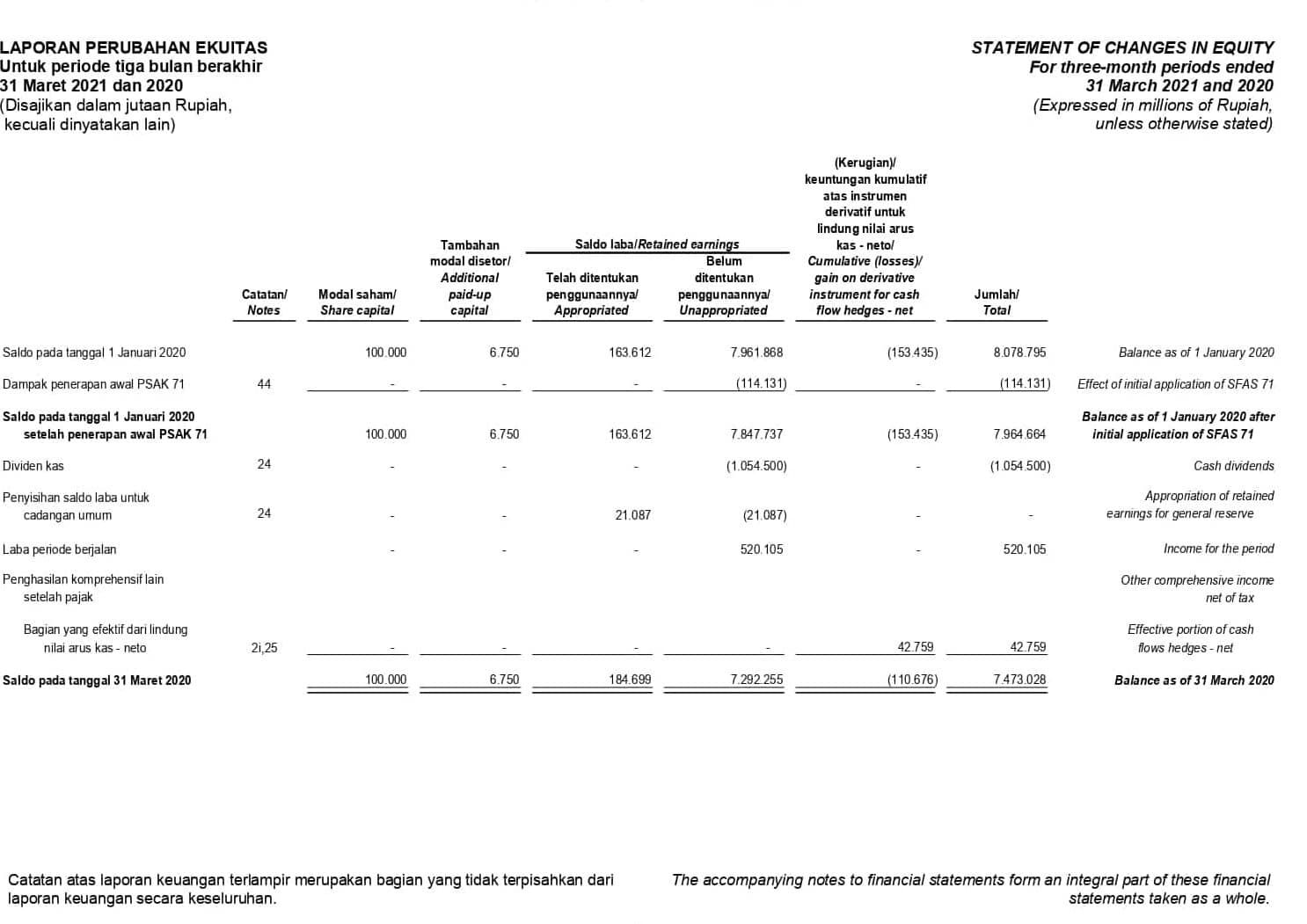

To make it easier to understand, here we give an example of the company change in equity report. The sample we took came from PT ADIRA DINAMIKA MULTI FINANCE Tbk.

Conclusion

That is an explanation of its equity, purpose, element, how to calculate it, and example reports in a company. Thus, many companies are trading their company’s stock in public to increase its ownership value. It has been proven effective in raising capital in developing a business.

Moreover, it is also useful to cover the obligations or debts that a corporation has. A good equity corporation is of positive value when activity exceeds total debt. But if its value is more often negative, it means the company is running a deficit. The conclusion is that equity represents ownership of money, assets, or inventory within a company.

To find out the nominal amount can calculate the difference in assets with the company’s expenses or liabilities. Find out what the condition of your company’s financial statements is in full and real-time with the Accounting Software from HashMicro. So decision making will be easier and we will be able to select the best decisions. Immediately join us to make your business financial decisions wisely!