Is your business’s financial performance stuck in neutral, or worse, slipping into reverse? Have you tried to improve it but are still getting nowhere?

Imagine this: your cash flow is tighter than a packed MRT at rush hour, debts are piling up like unread emails, and profits feel as elusive as a parking spot in Orchard Road on a Saturday. If this sounds all too familiar, you’re not alone.

Poor financial management and analysis can drag even the most promising companies down. But don’t worry—help is at hand!

In this article, we’ll walk you through 20 practical strategies to get your business’s financial performance back on track. From tightening up your expense management to boosting revenue, these tips are designed to help you steer your company toward financial success.

Ready to shift gears and accelerate your business growth? Let’s dive in and start turning those numbers around!

Key Takeaways

|

Why Should Businesses Improve Their Financial Performance?

Financial performance improvement plan (PIP) is crucial for businesses for several compelling reasons. There are five main reasons why you should start improving your business’s financial performance.

Firstly, a robust financial standing ensures sustainability and growth. Companies with vital financial health can weather economic downturns, invest in innovation, and expand their market presence.

Optimized financial performance management can improve a business’s cash flow, reduce waste, and help you make more informed decisions that lead to increased profitability.

Secondly, attracting investors becomes significantly easier when a business demonstrates consistent financial success. Investors are more likely to fund ventures that show promise of profitability and stability.

But that’s not all—better financial performance monitoring also boosts employee morale. According to PwC’s 2023 Employee Financial Wellness Survey, 73% of financially stressed employees would consider another employer that cares more about their financial well-being.

So, when a company is financially sound and employees are well-paid, they will feel more secure. After all, no one wants to do business with a company that might not be there tomorrow!

Another important thing to remember is that customer trust and loyalty are often tied to a company’s financial reputation. Customers prefer to engage with businesses that are perceived as stable and reliable.

RepTrak says a business’s financial performance drives 12.9% of its reputation. The number can increase depending on the stakeholders, companies, markets, or industries. Even in China, financial performance placed third as one of the most important concerns for business.

Lastly, improving financial performance allows businesses to give back to the community through corporate social responsibility initiatives, creating a positive impact beyond profits.

The next section will provide step-by-step strategies for improving your business’s financial performance and maintaining its financial health.

20 Practical Strategies to Improve Your Business Financial Performance

Now that we’ve established why improving your financial performance is crucial, it’s time to roll up our sleeves and get to work.

Here are the 20 practical strategies to help you turn those financial challenges into opportunities. Ready to improve your business’s financial performance? Let’s dive in!

Stage 1: Foundation and planning

The foundation and planning stage involves setting up your business for financial success. As the person in charge, you should clearly define your business objectives, understand your costs, and establish systems to monitor financial performance effectively.

Follow these five steps in this stage to ensure you have a solid base to build upon as your business grows and evolves.

1. Clarify and stay aligned with your business plan

First, ensure your business plan is crystal clear and aligned with your financial goals. This plan should outline your mission, vision, and specific economic targets.

For example, if your goal is to expand into a new market within the next year, your financial strategy should include budgeting for marketing, new hires, and product development.

By staying aligned with your business plan, you prevent your business from drifting off course and ensure that every financial decision supports your long-term objectives.

2. Know your day-to-day costs

Understanding your daily operational costs is crucial. This includes everything from employee wages to utility bills.

Let’s say you run a small café; knowing that your daily operating cost is $500 allows you to set daily sales targets. If you’re only bringing in $450 a day, it’s time to re-evaluate your expenses or find ways to increase revenue.

The key is to keep these costs as low as possible without sacrificing quality or service, which results in greater profitability.

3. Monitor cash flow

Cash flow is the lifeblood of your business, so keeping an eye on it is essential. Regularly track the money coming in and going out. For instance, a retail store should monitor cash flow to ensure sales revenue covers inventory purchases and other expenses.

A practical approach might be using a cash flow statement outlining cash inflows (like sales revenue) and outflows (like rent, utilities, and salaries).

You can use this formula to calculate your cash flow:

![]()

This formula helps you see if your business generates enough cash to sustain and grow.

4. Upgrade record-keeping with real-time data

Relying on outdated information can be costly and might cause losses for your business. Implementing real-time data solutions, like cloud-based accounting software, can help you keep track of your financial records.

For example, with real-time data, an e-commerce business can instantly track sales, update inventory, and monitor expenses. This proactive approach helps you make informed decisions quickly, ensuring you’re always ahead.

Upgrading your record-keeping with real-time data is essential for accurate financial performance, but doing it manually can be a headache. Fortunately, finance ERP software like HashMicro automates this process and easily provides real-time updates.

Does it fit your budget? Check out the price scheme—you might be surprised how affordable intelligent financial management can be!

5. Choose the right metrics

Not all metrics are created equal. Focus on financial metrics that truly reflect your business’s health. For a subscription-based business, key metrics include customer acquisition cost (CAC) and lifetime value (LTV).

For example, if your CAC is higher than your LTV, it’s a red flag that you spend more to acquire customers than you earn from them.

By choosing the right metrics, you ensure that you’re measuring what matters most, allowing you to adjust your strategy to achieve sustainable growth.

Stage 2: Expense management and cost efficiency

This stage focuses on streamlining business operations by identifying and cutting unnecessary expenses. The goal is to increase profitability by reducing costs without compromising the quality of your products or services.

Effective expense management ensures your business can maintain a healthy cash flow and allocate resources to growth areas. Here are four steps you need to do in this stage:

6. Reduce expenses

To improve your business’s financial health, examine where your money is going. Categorize your expenses into essential and non-essential.

Essential expenses include rent, utilities, and employee salaries. Non-essential costs could consist of subscriptions you rarely use or excessive travel expenses.

For example, virtual meetings or economy flights should be considered instead of first-class flights to meetings. Cutting these unnecessary costs can add up significantly over time, improving your bottom line.

7. Control overhead costs

Overhead costs are the ongoing expenses that keep your business running, such as utilities, office supplies, and administrative costs. Start by negotiating better rates with your suppliers or switching to energy-efficient equipment to reduce utility bills.

For instance, implementing energy-saving lighting or using cloud-based software instead of maintaining expensive servers can help cut down costs. Regularly reviewing and adjusting these costs in your statement of financial performance is critical to maintaining a lean operation.

Managing these expenses becomes a breeze with HashMicro’s cloud-based finance ERP software. This powerful tool helps you track and reduce costs efficiently in Singapore.

Curious about other top financial software? Check out our article on Singapore’s best financial reporting software—it’s the perfect next step!

8. Sell unused/unwanted business assets

Over time, businesses accumulate assets that are no longer in use—think old office furniture, outdated tech, or excess inventory. Instead of letting these items gather dust, sell them to generate quick cash.

For example, if you’ve upgraded your office computers, sell the old ones on platforms like Shopee or Carousell. This frees up space and provides additional funds to be reinvested into the business.

9. Consolidate and reduce business debt

Debt can be a heavy burden on your business, especially if it comes with high interest rates. We must be careful and remember what Henry Wheeler Saw (aka Josh Billings) said: “Debt is like any other trap, easy enough to get into, but hard enough to get out of.”

To manage this, consider consolidating multiple debts into a single loan with a lower interest rate. This makes repayment easier and less expensive.

For instance, if your business has several credit card debts, you might consolidate them into a single business loan. This will reduce the overall interest paid and improve your cash flow.

Stage 3: Revenue optimization

This stage aims to maximize revenue by fine-tuning pricing strategies, increasing sales conversion rates, and expanding your customer base.

Businesses can achieve sustainable growth, improve profitability, and strengthen their market position by strategically managing these areas. There are five steps in this stage, which are:

10. Improve account receivable collection

Efficiently managing your accounts receivable is crucial to maintaining healthy cash flow. Start by setting clear payment terms and communicating them upfront to your customers. Implement automated reminders for upcoming due dates and promptly follow up on overdue invoices.

For instance, if a customer consistently pays late, consider offering a small discount for early payments or charging a late fee to encourage timely payments.

This helps reduce the time between the sale and the receipt of payment, keeping your business financially stable.

11. Revise your offer and pricing

Regularly reviewing and adjusting your pricing strategy is critical to staying competitive. Begin by analyzing your cost structure, market demand, and competitor pricing. If your sales have plateaued, consider whether your prices reflect the value you provide.

For example, if you sell premium products but price them too low, customers might question the quality. Conversely, if prices are too high, consider offering tiered pricing or discounts to attract different customer segments.

The aim is to strike a balance where your prices are competitive yet profitable.

12. Boost the conversion rate

Focus on improving the customer journey to increase the percentage of leads that become paying customers. This can include refining your sales pitch, enhancing the user experience on your website, or personalizing marketing efforts.

For instance, if your website has a high bounce rate, consider simplifying the navigation or offering a live chat feature to assist visitors in real-time.

The formula for the conversion rate is:

For example, if you had 100 conversions out of 1,000 visitors, your conversion rate would be 10%. Improving this rate means more revenue with the same amount of traffic.

13. Offer multiple payment options

Providing various payment methods can significantly enhance the customer experience and reduce barriers to purchase. For example, if you only accept credit cards, you might miss out on customers who prefer digital wallets or bank transfers.

By integrating options like PayPal, Apple Pay, PayNow, PayLah, NETS, and many more, you cater to a broader audience and make it easier for them to complete transactions. This not only boosts sales but also builds customer trust and satisfaction.

14. Expand your customer base

Diversifying your market and reaching new customer segments is essential for sustained growth. Identify untapped markets or demographics that could benefit your product or service.

For example, if your business primarily targets urban areas, consider marketing to suburban or rural regions with less competition.

Additionally, leverage social media and online advertising to target specific groups based on interests, behaviors, and location. Expanding your customer base increases sales and reduces the risk of relying on a limited market.

Stage 4: Financial strategy and investment

This stage, consisting of three steps, is about securing and managing the financial resources needed to fuel your business’s growth. Like Suze Orman said, “the key to making money is to stay invested.”

Whether through business financing, external investments, or flexible financing structures, the goal is to ensure that your business has the financial muscle to seize opportunities and weather challenges while maintaining a stable cash flow.

15. Apply for business financing

Business financing is essential for fueling growth, whether launching a new product or expanding operations. Start by assessing your needs: do you need a short-term loan to manage cash flow or a long-term loan for capital investment?

Research various financing options, from traditional bank loans to crowdfunding platforms. For instance, a small manufacturing company might seek a loan to purchase new machinery to increase production capacity.

Prepare a solid business plan and financial projections to convince lenders of your ability to repay the loan.

16. Consider external investment

External investment can bring money, expertise, and connections to your business. Think of it like bringing in a co-pilot to help navigate through turbulence.

Whether through venture capital, angel investors, or equity partners, the key is finding the right fit for your business.

For example, a tech startup might seek out a venture capital firm specializing in their industry, providing funds and strategic guidance. Investors want a return, so be prepared to share the rewards and risks.

17. Transition to flexible financing structures

Flexible financing structures allow your business to adapt to changing circumstances without feeling stuck in financial quicksand.

This might involve a mix of equity and debt financing or revolving credit facilities that provide more breathing room during low-revenue periods.

For example, a retail company might use a revolving credit line to manage seasonal fluctuations in inventory purchases. This approach ensures that you’re not over-leveraged while still having access to the funds needed for growth.

One helpful formula when considering financing is the Debt-to-Equity Ratio:

![]()

This ratio helps you assess your business’s financial leverage. A lower ratio indicates less risk, showing the company is less dependent on borrowed money. However, different industries have different benchmarks, so compare your ratio with industry standards.

Stage 5: Advanced financial management

This stage is about fine-tuning your financial strategies using sophisticated tools and methods. The goal is to enhance decision-making, minimize risks, and maximize profitability through technology, detailed analysis, and strategic alignment.

This stage ensures your business survives and thrives in a competitive environment. Here are the final three steps you need to do in this last stage:

18. Use FP&A software

Implementing Financial Planning & Analysis (FP&A) software allows you to accurately forecast, budget, and plan your finances.

For example, a retail company could use FP&A software to predict seasonal sales trends based on historical data, helping them allocate resources efficiently.

This software can generate detailed reports and dashboards, enabling you to make data-driven decisions, spot trends proactively, and respond to financial challenges.

Using FP&A software is a game-changer for improving financial performance, and when it comes to top choices in Singapore, HashMicro leads the pack. Their finance ERP software’s powerful features are tailored to local business needs, making it a must-have tool.

Want to explore more options? Check out our other article on the best accounting software in Singapore for financial reporting, planning, and analysis—you won’t want to miss it!

19. Critically examine your supply chain

Analyzing your supply chain is crucial for reducing costs and improving efficiency. Consider a manufacturer who sources materials from various suppliers.

By examining the supply chain, they might discover that consolidating orders with a single supplier reduces shipping costs and improves delivery times.

Additionally, implementing just-in-time inventory can minimize storage costs and reduce waste. The formula here is simple: better supply chain management = lower costs + higher efficiency.

20. Align risk management and compliance

Risk management and compliance are like the safety nets of your financial strategy. Ensuring your business complies with regulations while managing financial risks can prevent costly penalties and disruptions.

For instance, a financial institution must adhere to anti-money laundering laws. By aligning their risk management with compliance, they can avoid hefty fines and protect their reputation.

Improve Your Business’ Financial Performance with HashMicro’s Accounting Software

HashMicro’s finance ERP software is Singapore’s most recommended solution for improving financial performance. Its advanced features tailored to local business needs ensure real-time insights, streamlined processes, and compliance, making financial management more efficient and effective.

You can experience HashMicro’s software firsthand through a free demo, which is a smart move to see its benefits without commitment. Discover how it can streamline your financial planning and analysis, making your business run smoother than ever.

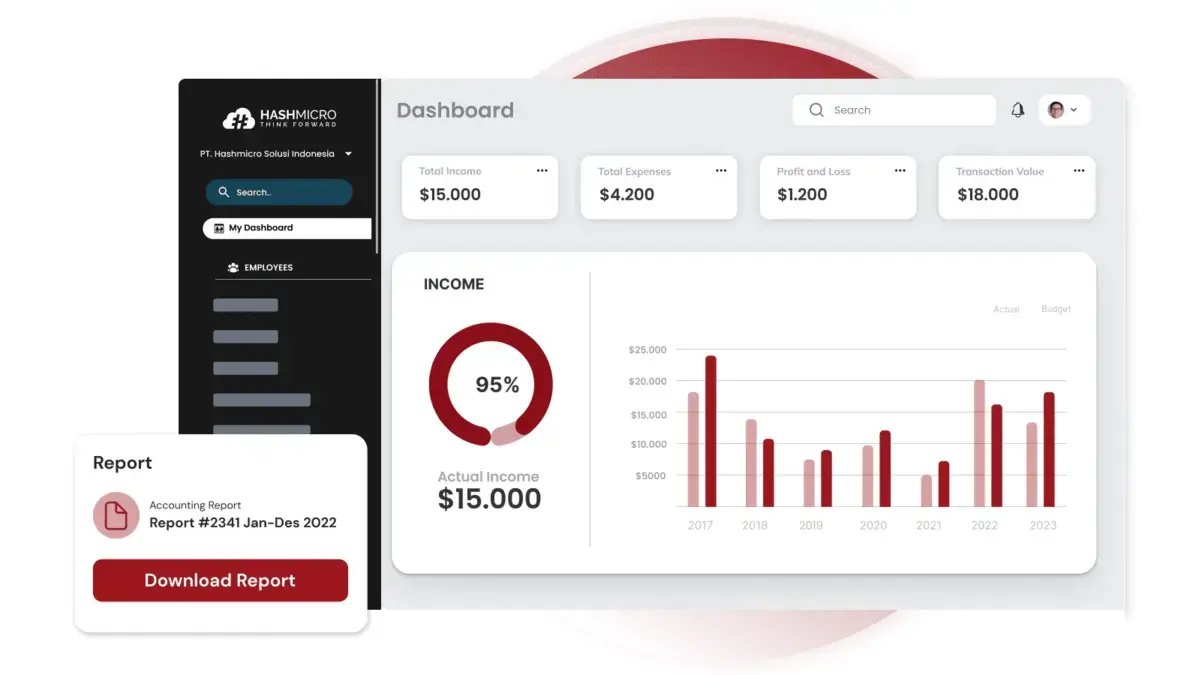

HashMicro’s finance ERP software offers a user-friendly financial dashboard that simplifies profit tracking per contract, effortlessly manages asset depreciation, and streamlines budgeting.

With tools for accrual and amortization calculation, cash flow prediction, financial consolidation, and accurate financial reporting, it’s like having a financial genius at your fingertips; minus the hefty salary!

Here are key features HashMicro’s accounting software has that can improve your business’s financial performance:

- Financial dashboard: It gives you a real-time overview of your finances, allowing quick monitoring of key metrics and enabling faster, informed decisions.

- Cash flow forecasting: Accurately predicts cash flows, helping you plan for shortfalls or surpluses, ensuring better resource allocation and financial stability.

- Fast bank reconciliation: Automates bank transaction reconciliation, saving time and reducing errors while keeping accounts accurate and up-to-date for enhanced financial trustworthiness.

- Accrual and amortization: Ensures accurate recognition of expenses and revenue, aligning with accounting standards and reflecting your business’s proper financial health.

- Peppol e-invoicing: Facilitates secure electronic invoicing, speeding up payment cycles and boosting cash flow by reducing manual processes and accounts receivable days.

- Analytical reporting: Generates detailed financial reports, offering insights into performance trends and areas for improvement, driving more intelligent decisions and better profitability.

Conclusion

Improving your business’s financial performance is no longer a luxury—it’s a necessity. Relying on outdated methods could leave you behind. Implementing modern, high-tech accounting software is crucial for accurate FP&A.

HashMicro’s finance ERP software offers powerful tools that provide real-time insights, streamline processes, and help you make smarter financial decisions. Don’t wait until financial challenges become overwhelming; take control now with the right technology.

Curious to see how HashMicro can revolutionize your financial management? Access the free demo today and experience how our software can elevate your business.

With HashMicro, you’ll be equipped to navigate the complexities of financial planning easily and confidently. Don’t miss out—start your journey toward better financial performance today!

FAQ about Financial Performance

-

How is financial performance defined?

Financial performance refers to the overall effectiveness of a company in generating revenue, managing its expenses, and achieving profitability. It encompasses a range of economic metrics that assess the company’s financial health, stability, and ability to meet its financial obligations.

-

What characterizes strong financial performance?

Strong financial performance is characterized by consistent revenue growth, high profitability, effective cost management, and a solid return on investment. It also includes maintaining a healthy balance sheet with low debt levels, strong cash flow, and meeting short-term and long-term financial obligations.

-

What are the three key aspects of financial performance?

The three key aspects of financial performance are profitability, liquidity, and efficiency. Profitability measures a company’s ability to generate income relative to its revenue, assets, or equity. Liquidity assesses the company’s ability to meet its short-term obligations.

-

How can one assess a company’s financial performance?

Evaluating financial performance involves analyzing various financial statements, including income, balance, and cash flow statements. Key metrics such as profit margins, return on assets, return on equity, and debt-to-equity ratio are used to gauge the company’s profitability, efficiency, and financial stability.