Inventory valuation methods – Inventory represents one of the most valuable assets of a retail business, and it is an essential component of the company’s balance sheet. This is why retailers must know the value of their inventory.

There are four methods that retailers can implement to find out the value of their inventory, namely LIFO, FIFO, FEFO, and Weighted-Average Cost methods.

The LIFO, FIFO, FEFO, and Average Cost methods are common methods in the accounting cycle. However, this method is complex and time-consuming. This makes an accountant need an accounting software that can simplify their work. How do these methods work, and what distinguishes them? The following provides a more in explanation.

Key Takeaways

|

Table of Content:

Table of Content

What is Inventory Valuation Method?

Inventory valuation methods are the techniques businesses use to assign value to their inventory and calculate the cost of goods sold (COGS). These methods impact financial statements, taxes, and overall profitability, so choosing the right one is crucial.

An effective inventory valuation method ensures accurate financial reporting and efficient inventory management. It helps businesses determine the true cost of inventory, manage stock levels, and make informed pricing decisions.

What are Types of Inventory Valuation Methods?

Inventory valuation methods are used to determine the cost of goods sold (COGS) and the value of ending inventory. Different methods can impact financial statements and tax obligations. Here are the main types:

Inventory Valuation: FIFO

According to the FIFO (First In, First Out) method, items that are first added to inventory have to be removed or sold first, while items that last entered the warehouse will be sold later. This is the most common method that companies use for inventory valuation.

The FIFO method assumes that older inventory is the cost of sales and newer inventory is ending inventory. The actual flow of inventory may not exactly match the first-in, first-out pattern.

For example,

A bakery produces 200 loaves of bread on Monday at a cost of $1.5 each, and 200 more on Tuesday at $2 each. FIFO states that if the bakery sold 200 loaves on Wednesday, the COGS (on the income statement) is $1.5 per loaf because that was the cost of each of the first loaves. The $2 loaves would go to the ending inventory (on the balance sheet).

Also read: 5 Effective Ways for Optimizing Inventory Turnover

Inventory Valuation: LIFO

LIFO (Last In, First Out) is the opposite of the FIFO method. According to the LIFO method, the last items we purchase or produce we should sell it first, while the first items that arrive in the inventory we will sell it later on.

Under this method, the cost of the most recent products purchased (or produced) is the first to be expensed as the cost of goods sold (COGS)—which means the lower price of older products will be reported as inventory.

The LIFO method helps companies save on taxes when inflation occurs, due to small profits. However, this method is somewhat more complex than other inventory valuation methods. The bookkeeping costs are more expensive while the profit or loss is lower.

Now International Financial Reporting Standards (IFRS) forbid the LIFO method. This method is ineffective for valuing inventory for three reasons. The LIFO method generates a higher operating profit than other inventory valuation systems.

Secondly, the LIFO method also does not represent the current level of inventory costs. When using this method, you’re unable to figure out the relevant value or the actual state of your inventory. In the end, this reduces the quality of the financial statements themselves. Lastly, some companies often use this method to manipulate taxes.

Also read: What is PPIC (Production Planning & Inventory Control)?

Inventory Valuation: FEFO

The inventory employee usually arranges the product near the front racks or easily accessible spots so customers can take it promptly. The company will usually store products with longer shelf life in the warehouse first.

Also read: Why Business Should Switch to Cloud Inventory Management

Weighted-Average Cost

The Weighted-Average Cost method is the midpoint or a combination of the FIFO and LIFO methods. According to this method, the cost of goods available for sale is divided by the number of units available for sale.

It is commonly used when inventory items are so melded or identical to each other that it is impossible to assign specific costs to single units.

A significant advantage of using the weighted average cost method is that it is the simplest way to track inventory expenses. You can just mark up the average price of the stock units instead of tracking the initial cost.

An issue with the weighted average cost method is when your inventory prices vary widely, where you may not recover the costs of the more expensive units and may even suffer a loss with your sales price.

The idea behind the method is that you will make up any loss when you sell the less expensive items. If that doesn’t happen, you may end up discontinuing the item and never recouping your losses.

How to Choose the Right Inventory Valuation Method for Your Business

Inventory valuation is a crucial part of financial management, directly impacting your cost of goods sold (COGS), net income, and tax obligations. With several methods available, selecting the right one requires a careful look at your business model, financial goals, and industry standards, consider the following:

- Pricing Trends: FIFO shows higher profits when costs rise, while LIFO reduces taxable income.

- Financial Reporting Standards: IFRS prohibits LIFO, so businesses following international guidelines must choose FIFO, WAC, or Specific Identification.

- Industry Practices: Different industries often have standard approaches to inventory valuation.

- Operational Simplicity: FIFO and WAC are easier to manage and align well with high-volume businesses.

Ultimately, the right inventory valuation method balances accuracy, compliance, and financial strategy. By understanding how each method impacts your financial statements and tax obligations, you can make a more informed decision that supports your business’s long-term success.

Optimize Inventory Valuation Process with HashMicro Warehouse Management Software

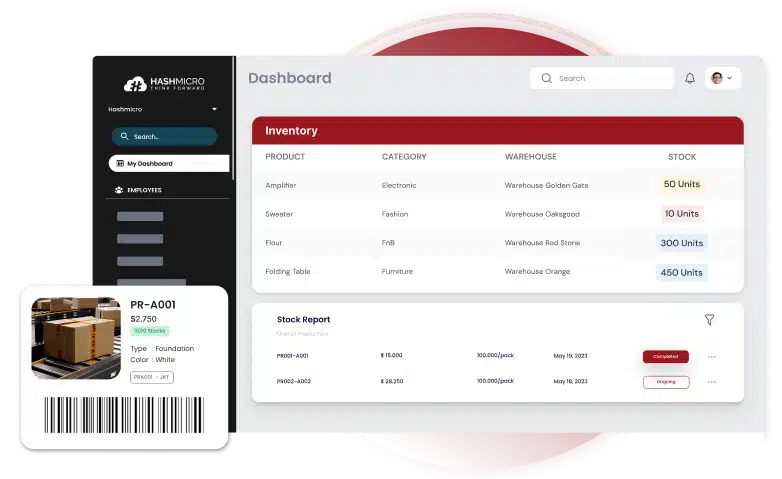

Calculating stock values requires precision. Because miscalculations can cause harm to your business, using the inventory management system that allows you to perform the valuation automatically. This fully integrated software accurately values inventory in a periodic inventory system using FIFO, FEFO, and Average Cost methods.

Enhance your inventory valuation process with HashMicro Inventory Management Software, seamlessly integrated with advanced warehouse drone technology. This integration ensures accurate inventory tracking and real-time data updates directly to HashMicro’s system, minimizing discrepancies and improving stock valuation.

Moreover, HashMicro WMS paired with warehouse drones enhances decision-making and financial planning. By leveraging cloud-based inventory management, the system seamlessly integrates drone data to provide precise inventory valuation, helping businesses choose the most suitable valuation methods like FIFO, LIFO, or Weighted Average Cost (WAC). This leads to more accurate financial reporting, optimized forecasting, and reduced operational costs, keeping your business competitive in a fast-evolving industry.

If you want to explore how our system can streamline your inventory valuation, you can register for a free demo now!

Conclusion

The LIFO, FIFO, FEFO, and Average Cost methods are common for an accountant. Accountants often use this method to determine and manage the sales system in the company. However, this method is complex and takes a lot of time to work on. This is what makes an accountant need integrated accounting software from HashMicro.

Moreover, companies can adopt an ERP system that allows them to integrate their business functions, automate financial reports, and create comprehensive business and inventory reports in real time. If you want to get a free demo of our tour product, click here!