An invoice template plays a crucial role in managing business transactions with accuracy and efficiency. Though seemingly simple, invoice templates are essential for various business processes like accounting, sales, purchasing, and POS, each requiring tailored designs.

By choosing the right invoice format for each function, businesses streamline processes, save time, and reduce errors, ultimately enhancing overall operations.

Selecting the correct simple invoice template for each module is essential to your business’s success.

Whether you’re managing accounting, sales, or purchasing, using tailored templates minimizes mistakes, keeps workflows organized, and ensures professionalism in every transaction.

Key Takeaways

|

Table of Content:

Table of Content

What is Invoice Template?

An invoice template is a pre-designed document that offers a structured format for creating invoices quickly and accurately. It includes essential details such as company information, itemized products or services, prices, and payment terms, all of which can be customized based on the specifics of the transaction.

Different business modules require different types of invoice templates to address their unique needs. Here’s a breakdown of the most common types:

- Accounting Invoice: This type is essential for financial record-keeping. It ensures that all transactions are properly documented, which is crucial for accurate bookkeeping and compliance with regulations.

- Purchasing Invoice: Typically used in procurement, this invoice confirms the details of a purchase, such as the products, terms, and costs. It serves as both a record for the buyer and a reference for the supplier, helping to avoid misunderstandings.

- Sales Invoice: Issued by sellers to customers, this invoice details the products or services sold and requests payment. Sales invoice template plays a key role in tracking sales revenue and maintaining transparency with clients.

- POS Invoice: Generated at the point of sale in retail transactions, this invoice provides customers with immediate proof of payment. It includes all relevant details, like items purchased and the total cost, streamlining the retail experience.

By using the right invoice format or just a simple invoice template for each business module, you can ensure smoother operations, better organization, and accurate financial tracking. This is essential for maintaining efficiency and professionalism in your business.

What are the Benefits of Using Invoice Templates?

Using invoice templates, such as a simple invoice, is a powerful tool that can transform the billing process, helping Singaporean businesses work more efficiently and present a polished image. Here’s how invoice templates can bring value to businesses of all sizes and industries:

-

Invoice template can save time effortlessly

With an invoice template, businesses can instantly fill out each new invoice without starting from scratch.

By streamlining the billing process, companies can focus more on core operations while ensuring invoices are sent promptly, which can accelerate payment cycles.

-

Projects a professional image

Invoice templates help establish a clean, professional look for each transaction.

As clients receive consistent and well-organized invoices, they’ll perceive the business as reliable and detail-oriented, fostering stronger client trust and enhancing brand reputation.

-

Minimizes errors and boosts accuracy

Since invoice templates, including receipt templates, use a standard format, they reduce the risk of overlooking essential details like due dates, item descriptions, or payment terms.

This consistency ensures that invoices are clear and complete, helping businesses avoid errors that could delay payments or lead to disputes.

-

Improves record-keeping and financial tracking

By using uniform templates, such as a simple invoice or receipt template, businesses can organize their records more effectively.

This system not only simplifies tax preparation but also supports accurate financial tracking, helping companies in Singapore monitor their cash flow, generate reports, and make informed decisions with ease.

-

Offers easy invoice template customization for different needs

With invoice templates, businesses can quickly customize invoices to fit various projects, clients, or industry-specific requirements.

Adding logos, adjusting formats, or tailoring details to match branding needs gives a personalized touch that reflects the business’s identity and professionalism.

-

Invoice template encourages timely payments

Invoice templates clearly present payment terms, amounts, and deadlines, reducing client confusion and encouraging prompt payments.

With a well-structured invoice, clients know exactly what they owe and when it’s due, helping businesses maintain steady cash flow and avoid payment delays.

-

Supports compliance and accurate reporting

Properly structured invoices help businesses adhere to Singapore’s tax and regulatory standards.

Templates designed with compliance in mind can streamline auditing, minimize issues with regulatory bodies, and ensure transparent financial reporting.

Adopting invoice templates simplifies the billing process, adds a professional touch to communications, and supports financial stability, all of which are critical for building strong client relationships and ensuring smooth business operations.

If you want to know more, explore our article about the list of invoice accounting softwares that suits your needs.

How to Create an Invoice Templates?

Creating an invoice template doesn’t have to be complicated. With a clear invoice format, businesses in Singapore can design a professional and functional template that streamlines billing processes and ensures consistency. Here’s a guide to building an effective invoice template:

-

Choose the right software

Start by selecting software that suits your business needs. Many companies use programs like Microsoft Excel, Google Sheets, or Word for basic templates. However, accounting software like HashMicro or specialized invoicing platforms can provide customizable templates and integrate seamlessly with other financial processes.

-

Add your company branding

To give your invoices a professional look, add your company logo, brand colors, and font style to the template. This personal touch not only reinforces your brand identity but also gives clients a familiar and polished impression with each invoice.

-

Include essential business information

Be sure to include key company details at the top of the template. These should include your company name, address, contact information, and registration number, if applicable. Having this information clearly displayed helps clients know who they’re paying and makes your invoices look more credible.

-

Designate space for client information

Leave a dedicated section for client information, including their name, address, contact details, and any reference numbers related to the project or purchase. This clarity helps with record-keeping and provides clients with an organized format for their own accounting purposes.

-

Set up an invoice numbering system

Every invoice should have a unique invoice number for easy reference.

A consistent invoice format, with a unique numbering system (like ‘INV2023-001’), makes it easy to track each billing invoice accurately.

-

Specify product or service details

Create a section to list the items or services you provided, along with descriptions, quantities, rates, and total amounts. Each entry should be clear and detailed to ensure there’s no confusion about what the client is being billed for on the billing invoice.

-

Add the payment terms and due date

Clearly state the payment terms (e.g., “Net 30 days”) and highlight the due date. Including this information prominently ensures that clients understand the payment timeline, which can help avoid late payments and encourage on-time transactions.

-

Include taxes and additional charges

If applicable, make space for taxes (such as GST in Singapore) and any additional charges like shipping or handling fees. Try displaying these items separately to ensure transparency and help clients understand the breakdown of their total payment.

-

Summarize the total amount due

At the bottom of the template, show the total amount due in a large, easily visible font. This makes it clear how much the client needs to pay, which can help prevent misunderstandings or payment delays.

-

Provide payment instructions

To make it easy for clients to pay, add payment instructions. This could include your bank account details, preferred payment methods (e.g., bank transfer, credit card), and any other relevant payment information.

-

Add any additional notes or terms

Finally, consider including a section for additional notes, such as a thank-you message, payment reminders, or specific terms related to the project. This section can enhance client relationships and add a personal touch to the invoice.

By following these steps, you can create a customized invoice template that suits your business and meets your client’s needs.

A well-designed invoice template not only speeds up the billing process but also helps your business maintain a professional, organized, and client-friendly approach to billing.

What Kind of Situation Requires an Invoice Template?

An invoice template can streamline your billing process, adding efficiency and professionalism to your business operations. Here are some key situations when a well-structured invoice template is especially valuable:

-

For regular billing cycles

If your business follows a regular billing cycle, such as monthly or quarterly, an invoice template helps save time and ensures consistency. Instead of creating each invoice from scratch, you only need to update specific details, like the billing period and amounts, while keeping a familiar layout that clients recognize.

-

When serving multiple clients

Managing invoices for multiple clients can quickly become confusing without a standardized format. An invoice template allows you to present each client with a uniform document, making it easier for them to recognize, process, and pay promptly, which reduces payment delays.

-

For frequent sales or service transactions

Businesses involved in frequent transactions, such as retail sales, consulting, or freelance work, benefit from having an invoice template. Instead of re-entering information each time, you can quickly generate accurate invoices, even for high volumes of transactions, while maintaining a professional appearance.

-

For clients with specific billing requirements

Certain clients may require specific details on their invoices, such as itemized costs or customized fields. A flexible invoice template allows you to adjust these elements to meet client expectations and uphold a high standard of professionalism.

-

To simplify accounting and record-keeping

Using a consistent invoice template helps with tracking and analyzing financial data. Standardized invoices simplify record-keeping, making it easier to monitor revenue, identify trends, and manage cash flow. By using software like HashMicro Accounting System, you can automate the invoicing process, seamlessly integrating templates with your financial records.

-

For new businesses to establish professionalism

For startups or new businesses, an invoice template creates a professional impression from the beginning. Presenting clients with organized, branded invoices helps build trust and credibility, which is essential for developing long-term relationships.

-

For tax compliance

In Singapore, tax regulations, including GST, require invoices to include specific information. An invoice template helps ensure that tax details, such as registration numbers and tax breakdowns, are consistently and accurately displayed, keeping your business compliant with local laws.

By using an invoice template in these scenarios, your business saves time, reduces errors, and fosters a more reliable and efficient billing process. Solutions like HashMicro Accounting System can further enhance this process by offering customizable templates that integrate seamlessly into your workflow.

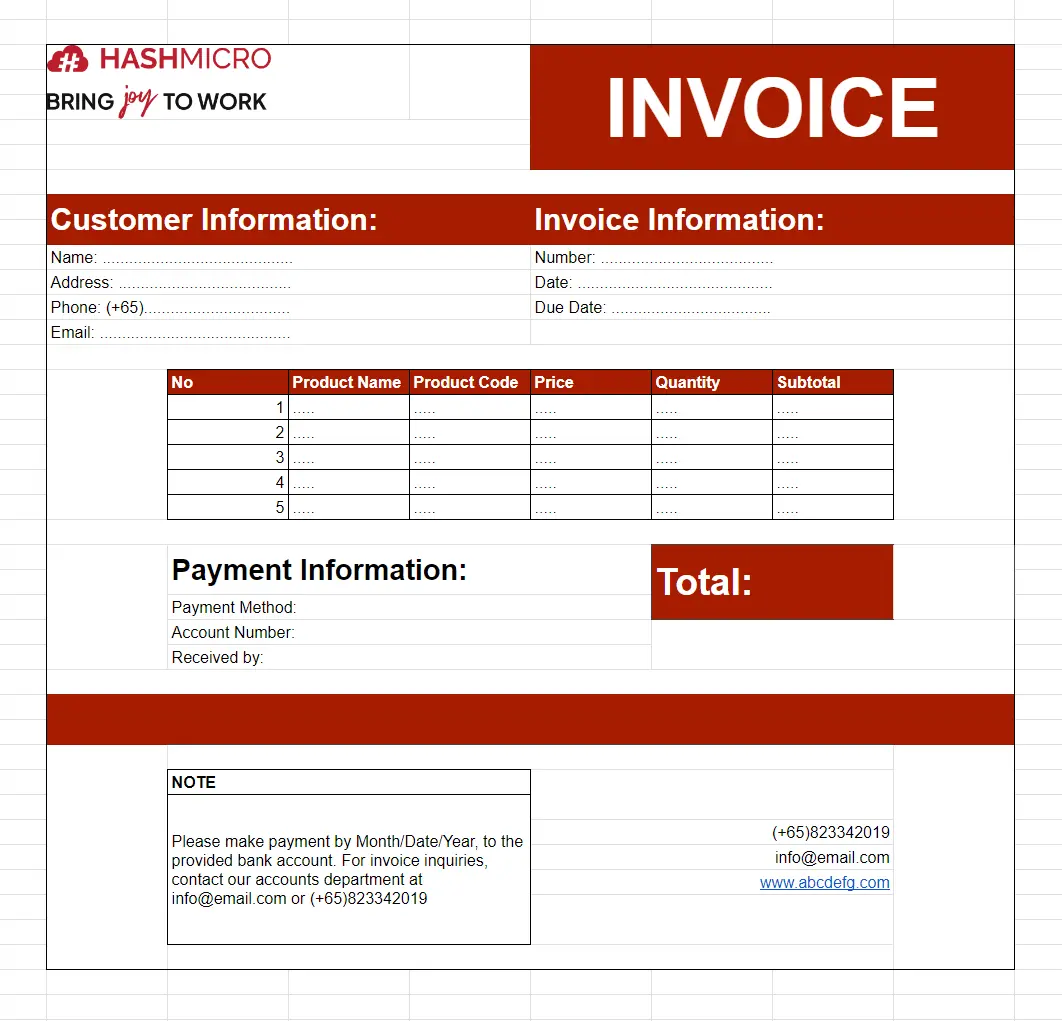

How Many Essential Elements of an Invoice Template?

To create a professional and clear invoice, businesses in Singapore can refer to an invoice sample or invoice example as a guide for essential elements, making the payment process straightforward and efficient.

Here’s a breakdown of the nine essential components every effective invoice should contain:

-

Header with Business Information

Start by adding your company’s logo, which reinforces brand identity and adds a professional touch. Include your business name, address, contact number, email, and website. Additionally, listing companies with registered business numbers or tax IDs here can provide transparency and build client trust.

-

Invoice template details

Ensure each invoice has a unique invoice number for tracking. Include both the invoice date (when the invoice was issued) and the due date, which states when payment is expected. Popular terms like “Net 30” or “On Receipt” can clarify your payment timeline and avoid misunderstandings.

-

Client Information

Label this section as Bill To, where you’ll list the client’s full name, company name, and billing address. If the shipping address differs, add a Ship To section to ensure the client’s records are accurate and complete. Including their contact details, such as phone and email, facilitates quick communication for any follow-ups.

-

Itemized Description of Goods or Services

Present a detailed itemized list of the goods or services provided. Under each line item, add a description of the product or service to ensure clarity.

Referencing an invoice example can help ensure that essential details like quantity, rate, and the calculated amount (quantity times rate) are included. This clear breakdown of costs makes the invoice easy for clients to understand and process.

-

Subtotal, Tax, and Total

In this section, calculate and display the subtotal for all line items before tax. Add the tax amount if applicable (e.g., GST). Finally, the total amount due must be displayed clearly, showing the exact sum the client needs to pay. This transparency in pricing ensures there are no surprises.

-

Payment Information

Specify the payment methods you accept, such as bank transfer, credit card, or PayNow. If applicable, include bank account details (name, account number, and routing number) to make the transfer process smooth. Mention any payment terms; for instance, late fees or early payment discounts, so clients are aware of all conditions upfront.

-

Additional Notes and Terms

Use this area to include any relevant details, such as delivery instructions or special arrangements. Additionally, adding terms and conditions here can cover important policies, such as late payment penalties or restrictions on services, ensuring both parties are aligned on expectations.

-

Signature or Authorization Section (Optional)

In cases where large contracts or recurring invoices are involved, you may want to add a signature section. This space allows both you and the client to confirm acceptance, ensuring payment terms are mutually understood.

-

Thank You Message

Including a brief thank-you note at the end of your invoice adds a personal touch, reinforcing a positive relationship with your client. Expressing gratitude for their business can leave a lasting, favorable impression.

By following these steps and using a simple invoice template or reviewing an invoice sample, businesses can create professional invoices that are easy for clients to process and pay promptly.

What are the Common Problems with Invoice Template Formats?

To ensure that invoices facilitate prompt payments and maintain professionalism, it is essential to avoid common formatting issues. A well-organized invoice not only communicates costs but also reinforces trust and clarity in your business relationships. Below are some frequent pitfalls to watch out for:

-

Missing contact information

Without clear contact details, clients may struggle to reach your business with questions. This lack of information often results in delays, as clients will need to request further details to clarify the invoice.

-

No unique invoice number

An invoice without a unique identification number complicates tracking and record-keeping. When managing multiple clients, missing invoice numbers can create confusion and hinder proper payment reconciliation.

-

Vague item descriptions

When descriptions are unclear or lack sufficient detail, clients may become confused about what they’re being charged for. This ambiguity can lead to disputes or payment delays, especially if clients need to request additional explanations.

-

No due date or payment terms

Without a due date or specific payment terms, clients may delay payments or misunderstand your expectations. Stating clear terms helps clients plan their payments and reduces the chances of overdue invoices.

-

Calculation Errors

Invoices with miscalculated taxes, totals, or discounts can undermine confidence in the accuracy of your billing. Calculation mistakes often lead to additional follow-ups and can harm the professionalism of your business.

-

No Payment Instructions

Omitting specific payment instructions can leave clients uncertain about how to proceed with their payment. This is particularly problematic for clients who prefer specific payment methods or who are unfamiliar with local banking details.

-

Unprofessional Layout

A cluttered or poorly structured invoice not only looks unprofessional but can also make information difficult to locate. Clients may find it frustrating if essential details like totals or due dates are hard to identify at a glance.

-

Missing Additional Notes or Terms

Invoices that lack space for additional notes or terms can omit crucial details, such as return policies or late fees. These terms help clarify expectations and provide transparency for clients.

-

No Thank-You Note

An invoice without a brief thank-you note can feel overly transactional. Including a message of appreciation is a small gesture that helps reinforce positive relationships and enhances client loyalty.

Addressing these common issues is key to creating clear, professional invoices that support efficient payment processes and contribute to strong client relationships.

Free Invoice Template Download

Download Free Invoicing Template

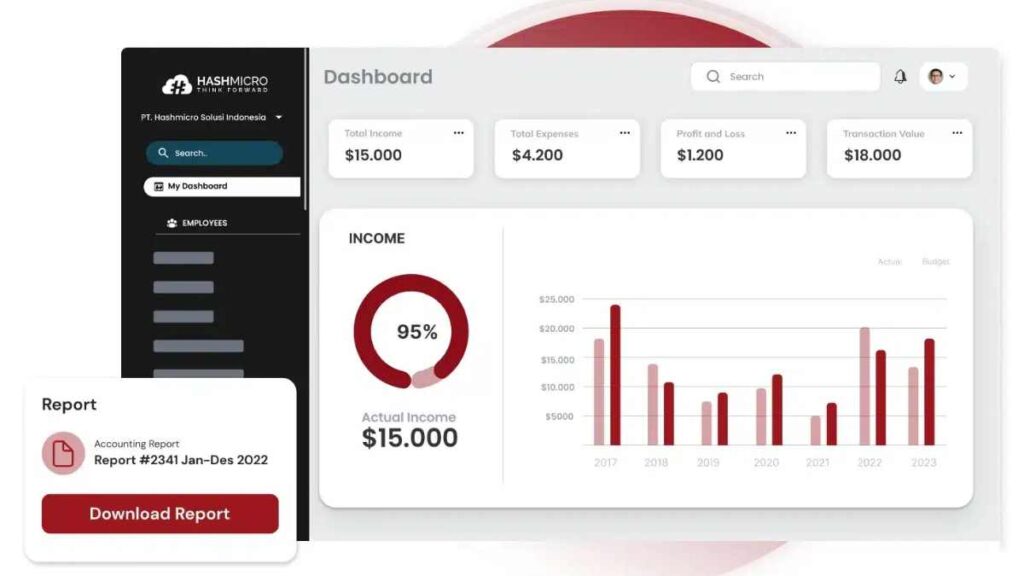

How Does HashMicro Accounting Software Enhance Invoice Template Management?

Efficient financial management is essential for businesses aiming to maintain smooth operations and ensure profitability. Managing invoices manually often leads to time-consuming tasks and increased risk of errors, which can negatively impact cash flow and delay payments.

HashMicro’s accounting software streamlines and automates invoice management, providing businesses with better control and enhanced efficiency. With its intuitive design and powerful features, HashMicro helps businesses reduce manual workload, minimize mistakes, and improve operational accuracy.

Below are some key features of the software that make it the ideal solution for invoice management:

-

Hashy AI

An AI system that assists AR Collectors in managing bills. One of its advantages is the automatic follow-up with customers. So, if there is an unpaid invoice, Hashy can promptly remind them via notification. This helps businesses reduce payment delays without the need for manual chasing.

-

Automated invoice template creation

It automates the creation of invoices, which saves valuable time and eliminates the risk of human error. This feature ensures that all invoices are generated consistently and professionally, allowing your team to focus on more strategic tasks.

-

Customizable invoice formats

With HashMicro, you can tailor invoice templates to meet your specific business needs. Whether you require particular fields, layouts, or branding, this flexibility ensures that your invoices align with your company’s identity and customer expectations.

-

Tax compliance and integration

The software integrates directly with tax authorities, simplifying the process of creating invoices that comply with regulatory requirements. By automating this process, HashMicro eliminates the need for manual updates and adjustments, ensuring your business remains compliant with local tax laws.

-

Automated payment tracking and reminders

HashMicro’s automated payment tracking and reminder system helps businesses stay on top of overdue invoices. You will receive alerts, allowing you to address payment delays promptly and maintain a healthy cash flow.

This reduces the time spent chasing overdue payments and ensures that your financial operations stay on track.

-

Comprehensive financial tracking

This software provides a comprehensive view of your financial data by tracking invoices across various projects, departments, or branches. This feature enables you to make informed, data-driven decisions and gain deeper insights into your company’s financial health.

With its ability to automate tasks, ensure compliance, and deliver real-time financial insights, HashMicro provides businesses with a comprehensive solution for invoice management. This makes it the ideal tool for companies looking to streamline operations and make more strategic financial decisions.

Conclusion

Selecting the right invoice templates, such as a tailored sales invoice template, consistent receipt format, or structured billing invoice, is crucial for streamlining business operations, ensuring accuracy, and presenting a professional image.

Using these templates saves time, reduces errors, improves financial tracking, minimizes mistakes, and fosters trust with clients, which is key to building strong relationships and ensuring timely payments.

For a seamless invoicing process, HashMicro Accounting Software offers automated invoicing, customizable templates, and tax regulation integration, helping businesses stay organized and compliant.

Don’t forget to try HashMicro’s free demo today to optimize your financial management.