Who doesn’t love payday? Regardless of the paycheck size, there’s something undeniably exciting about it. It boosts your balance and brings a sense of accomplishment. Whether you’re eyeing a splurge-worthy purchase, planning a well-deserved treat, or simply enjoying the reward of your hard work, payday is about more than just cash.

It’s about the possibilities it unlocks! In 2016, Singapore’s Ministry of Manpower (MOM) set rules for itemized payslips to ensure clarity in salary payments. Now, employers must provide a breakdown of earnings, reducing misunderstandings and improving transparency.

Additionally, MOM allows flexibility in delivering payslips, either digitally or in print. They must be provided within three days of payday or upon an employee’s final salary if they leave the company. Failure to comply can result in fines for each instance.

Don’t worry, though. We’ve got you covered! By reading this article, we’ll walk you through everything you need to know about itemized payslip requirements. From MOM’s new rules to format examples, we’ll help you stay compliant and avoid potential issues.

Key Takeaways

|

Table of Content:

Table of Content

What are Itemized Payslips?

An itemized payslip is a clear document given by employers that shows a detailed breakdown of an employee’s salary.

It includes basic pay, overtime, allowances, deductions, and other relevant details, helping both the employer and employee understand the full earnings for that period.

This includes both gross salary (total earnings before deductions) and net salary (the amount received after deductions), as well as specific deductions like CPF contributions and income tax.

The main purpose of an itemized payslip is to provide transparency and clarity regarding how an employee’s salary is calculated. It ensures both the employer and employee have a clear understanding of earnings and deductions, helping to prevent misunderstandings and promote trust in the payroll process.

What Must Be Included in an Itemized Payslip?

After gaining a clear understanding of the itemized payslip, it’s crucial to know the essential components that should be included in the payslip package. Much like pirates uncovering a legendary treasure chest called “Success”, let’s dig into the details below of what makes up a complete payslip. Shall we?

| Number | Itemized Payslip Components | Description |

|---|---|---|

| 1 | Employer’s Name | The name of the company providing the pay |

| 2 | Employee’s Name | The name of the employee receiving the pay |

| 3 | Period | The pay period covered by this payslip. For example: from 01/08/2023 to 31/08/2023. |

| 4 | Date of Payment | The date on which the payment is made |

| 5 | Mode of Payment | The method of payment to the employee, noted as “Cheque.” |

| 6 | Basic Pay | The standard salary amount for the employee. |

| 7 | Total Allowances | Additional payments provided on top of the basic salary which usually include transport, uniform, etc. |

| 8 | Gross Pay | The total income before any deduction. |

| 9 | Total Deductions | Amounts subtracted from the gross pay, including taxes or loans. |

| 10 | Employee’s CPF Deduction | Employee’s contribution to the Central Provident Fund (CPF) |

| 11 | Advanced Loan | Deduction for an advanced loan taken by the employee. |

| 12 | Overtime Payment Period(s) | The specific period during which overtime work was done. |

| 13 | Overtime Hours Worked | The total number of overtime hours worked by the employee. |

| 14 | Total Overtime Pay | The payment received for the overtime hours worked. |

| 15 | Other Additional Payments | Extra payments outside of regular salary and allowances. |

| 16 | Annual Bonus | A yearly bonus provided to the employee. |

| 17 | Net Pay | The final amount the employee receives after all deductions. |

| 18 | Employer’s CPF Contribution | The employer’s contribution to the employee’s Central Provident Fund. |

Benefits of Itemized Payslip for Employees

Issuing itemized payslips provides clear advantages to both employees and businesses. It builds trust, ensures transparency, and helps maintain compliance, all of which are essential for a healthy employer-employee relationship. Here’s a closer look at why itemized payslips is particularly beneficial for employees in Singapore:

-

Clarity and Transparency of Earnings

With an itemized payslip, employees gain a full breakdown of their earnings, deductions, and contributions. This means they can clearly see how their net pay is calculated, from base salary and allowances to CPF contributions and taxes.

Such transparency removes any guesswork and helps employees understand each component of their salary, reducing confusion and promoting a more trusting workplace.

Enhanced Accountability and Security

By receiving a detailed payslip, employees can verify that they’re compensated accurately for their work. In cases where they spot discrepancies, they can promptly raise them with confidence.

This system not only helps employees feel secure in their compensation but also encourages employers to be precise and accountable in payroll practices.

Legal Compliance and Peace of Mind

In Singapore, businesses are required to comply with MOM’s payslip regulations, which mandate providing a detailed breakdown of earnings and deductions.

Itemized payslips ensure that employers meet these requirements, offering employees peace of mind that their company adheres to fair and lawful employment practices. Compliace fosters a culture of responsibility and fairness, which benefits both parties.

Having a record of itemized payslips is especially valuable for employees when they need documentation for financial planning. Whether applying for loans, mortgages, or credit, itemized payslips provide reliable proof of income, making these processes smoother.

This access to organized financial records enables employees to manage their finances with confidence and clarity.

-

Reduced Conflicts and Strengthened Trust

Since itemized payslips document every payment and deduction clearly, they help reduce potential conflicts overcompensation. Both employees and employers can refer to these payslips to resolve any payroll disputes quickly, saving time and resources.

This level of transparency helps establish trust between both parties, promoting a more harmonious workplace.

An itemised payslip offers more than just a breakdown of earnings; it reassures employees that their compensation is managed fairly and transparently. With this clarity, employees no longer have to worry about how their annual salary is allocated or why their take-home pay may vary.

This transparency helps rebuild trust between employers and employees, ultimately fostering a more harmonious, positive workplace environment.

MOM’s Regulation on Itemized Payslip that Your Business Needs to Comply

Now that we’ve uncovered what makes up a complete itemised payslip, much like the pirates need a treasure map to find and unlock the “Success” treasure chest, understanding and following the Ministry of Manpower (MOM) regulations is crucial for any business operating in Singapore.

MOM payslips regulation requires employers to issue detailed payslips to all employees covered under the Employment Act, and these payslips need to break down earnings, deductions, and any other relevant financial details.

These payslips offer transparency and clarity, which can prevent misunderstandings and foster trust between employers and employees.

Then, employers must issue payslips at the time of salary payment. If you can’t provide the payslip at that moment, MOM allows up to 3 working days to issue it. Additionally, in cases of termination or dismissal, you must give the payslip along with the final salary payment.

By adhering to these requirements, you ensure your business stays compliant and builds a reputation for fair and transparent practices. Failure to provide itemised payslips can lead to significant consequences. MOM may issue an order compelling you to comply or impose financial penalties of $100 to $200 for each occurrence.

Legal Consequences of Non-Compliance

Did you know that from 2021 to 2023, MOM received an average of 670 complaints per year against employers regarding the non-issuance or late issuance of itemised payslips? Since the issue became something important, non-compliance with these regulations is not just about missed deadlines; it is considered an offence under the Employment Act, which could result in further penalties.

MOM may issue an order requiring you to comply or impose financial penalties ranging from $100 to $200 for each occurrence. It is considered an offence under the Employment Act, which can result in further penalties.

Additionally, every day that an inaccurate or missing payslip remains uncorrected could lead to a fine of up to $500. This makes it essential for employers to promptly address these issues. In more severe cases, if payslips are found to be inaccurate or incomplete, employers could face fines of up to $5,000 or even jail terms of up to 6 months for each offence.

Keeping Records of Itemized Payslips Issued

To stay fully compliant, you must keep records of itemised payslips for current employees for at least the past 2 years. For ex-employees, retain the last 2 years’ payslip records for one year after their departure.

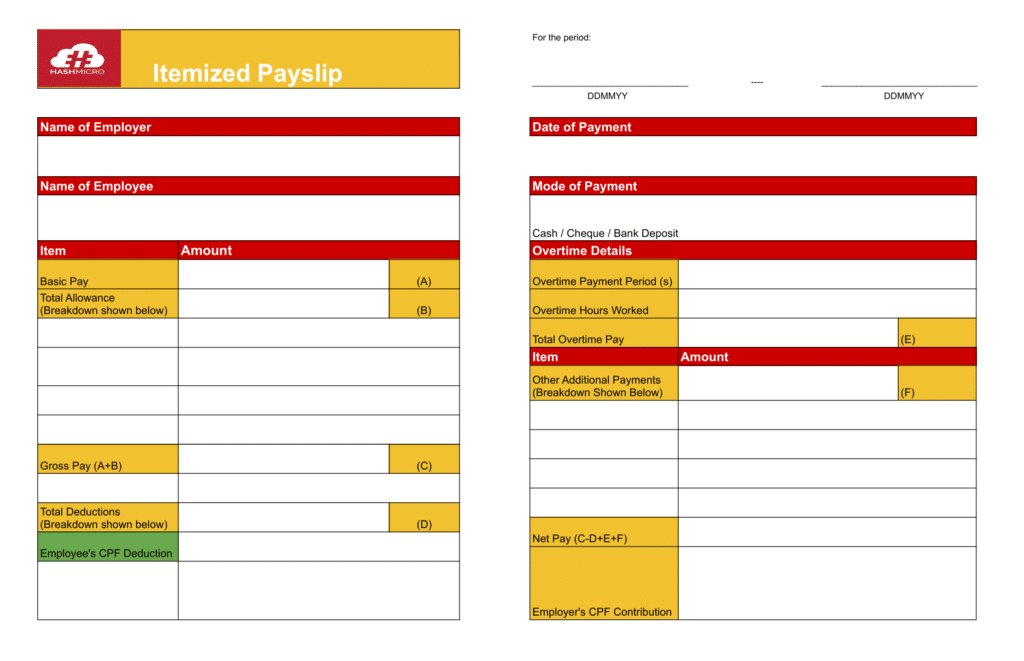

Example Format of an Itemized Payslip

If you’re curious to understand how a fully compliant itemized payslip should be structured, this section will walk you through the essentials that make it complete in the eyes of MOM.

Each component of the payslip template, from the employee’s full name to the payroll period, basic salary, allowances, and deductions, plays a crucial role in ensuring transparency and clarity.

Based on the sample itemized payslip provided, you’ll see how each detail is presented in a clear, itemized format, helping businesses align with MOM regulations and build trust with employees.

Use this example as a reference to ensure your payslips meet the necessary standards before distribution, and you can download this standard MOM itemized payslip template as well.

How HashMicro Can Help Your Business’s Itemized Payslip?

You’ve finally uncovered the legendary “Success” treasure chest, yet it remains sealed, held back by a lock that won’t budge. Why? Because there is only one key that can open it and that key is HashMicro’s HRM software.

Just imagine the thrill as the lock finally clicks open, like winning the lottery, revealing a powerful solution to your payroll and HR challenges, meticulously crafted to meet Singapore’s strict MOM compliance. With HashMicro in your hands, you don’t simply automate payroll.

You transform it, ensuring unparalleled accuracy, transparency, and the peace of mind you need to focus on what truly drives your business forward. This isn’t just a tool. It’s the game changer that propels your business to new heights, unlocking endless possibilities for growth and success.

Here’s how it becomes the best choice for businesses looking to streamline this process:

-

Compliance with Local Regulations

One of the biggest challenges companies face when creating payslips is ensuring compliance with Singapore’s labor laws, such as the Ministry of Manpower (MOM) requirements.

HashMicro HRM automatically calculates and ensures that payroll is in full compliance with these regulations, including CPF contributions, tax deductions, and other statutory requirements.

By doing this, businesses can avoid costly penalties and maintain peace of mind knowing by using our payroll software their itemized payslip are accurate and up to date.

-

Customizable Itemized Payslip Formats

HashMicro’s software allows businesses to generate fully customizable itemized payslips. Whether you’re dealing with full-time employees, part-timers, or contractors, the system enables you to tailor the format to include all the necessary breakdowns of earnings, deductions, and statutory contributions.

This flexibility ensures that all employees receive clear, concise, and accurate payslips that comply with legal standards, while also meeting the specific needs of the business.

-

Automation for Accuracy and Efficiency

HashMicro HRM automates crucial payroll tasks such as salary calculations, tax deductions, leave management, and overtime payments. This automation minimizes human errors and ensures that the final payslips are 100% accurate every time.

Additionally, it saves your HR team significant time by eliminating the need for manual calculations. The software automatically processes all data from attendance and leave management, so businesses don’t have to worry about incorrect entries.

-

Multi-Language Support for Diverse Workforces

Singapore is a multilingual country, and businesses often employ workers who speak various languages. HashMicro HRM recognizes this diversity by offering multi-language support for payslips, including English, Mandarin, and Malay.

This feature ensures that every employee can receive their payslip in the language they are most comfortable with, which not only increases clarity but also enhances employee satisfaction and engagement.

-

Advanced Reporting Capabilities

HashMicro HRM comes with powerful reporting tools that allow businesses to gain insights into payroll costs, tax liabilities, and other key metrics. This data helps management make informed decisions regarding budgeting, forecasting, and financial planning.

Reports can be generated easily, providing companies with a clear view of their payroll and expenses at any time, thus facilitating more strategic decision-making.

For your information, HashMicro HRM software is designed to meet the diverse needs of businesses in Singapore, offering a seamless, fully automated, and compliant solution for generating itemized payslips.

By leveraging advanced technology, businesses can ensure accuracy, save time, and maintain compliance, making HashMicro the ideal choice for companies seeking to streamline payroll management.

Conclusion

Itemized payslips are essential not only for legal compliance but also for fostering trust and transparency in the workplace. By providing clear breakdowns of salary components, businesses ensure that employees understand their pay and feel confident in its accuracy, reducing the likelihood of disputes and misunderstandings.

This transparency boosts employee morale and shows a commitment to fairness. To simplify payroll management, HashMicro’s HRM software offers automatic payroll calculations, customizable payslips, and full compliance with Singapore’s regulations.

It’s the ideal solution for businesses seeking to streamline operations while ensuring accurate and transparent payroll practices. Try a free demo today and see how it can support your company’s success.