Cash flow statements, together with revenue and balance sheets, provide critical financial data that affects organizational decision-making. While all three are useful in assessing a company’s finances, some business leaders believe cash flow statements are the most significant. Because of this, many companies use reliable accounting software to manage their company cash flow statement.

Cash flow statement are used by business owners, managers, and stakeholders to better understand the value and general health of their firms and to assist in financial decision-making. All things can be optimized by using integrated accounting software Learning how to prepare and read financial statements, regardless of your position, can help you comprehend your company’s inner workings and contribute to its future success.

Key Takeaways

|

Table of Content:

Table of Content

Cash Flow Statement Definition

A cash flow statement is an important tool for managing finances since it tracks an organization’s cash flow. This statement is one of three major reports that assist in determining a company’s performance (together with the income statement and the balance sheet). It is usually useful for developing a cash prediction in order to plan for the short future. An accurate prediction may be calculated by utilizing.

The cash flow statement identifies the source of income and assists you in tracking incoming and departing funds. Operating operations, investing activities, and financial activities generate cash for a business. The statement also provides information on cash withdrawals, business expenses, and investments at a certain point in time. The information obtained from the cash flow statement is useful for management in making educated decisions to regulate corporate operations.

Importance of Cash Flow Statement to Business Finances

A company must always have enough revenue to be successful. This enables it to repay bank loans, purchase commodities, or invest for attractive returns. If a company does not have enough funds to fulfill its debts, it is declared bankrupt. Here are some of the advantages of using a cash flow statement:

1. Details about spending

A cash flow statement is used to show the principal payments a company makes to its creditors. It also displays transactions recorded in cash and not represented in other financial statements. These include purchasing inventory, granting loans to clients, and buying capital equipment.

2. It helps maintain the optimal level of cash on hand

The corporation must decide if too much of its cash is idle or if there is a shortage or excess of funds. If the business has extra cash, it can invest in shares or acquire inventory. If there is a scarcity of capital, the corporation can borrow money to keep operating.

3. Profits help companies grow by earning cash

There are other money-making options. When a corporation buys less equipment, it generates cash. It gains cash whenever it collects client receivables faster than usual.

4. Cash flow statements are useful for short-term planning

A successful corporation must have enough cash to cover upcoming bills. A financial manager can make important judgments by analyzing past cash flows. Foreseeing a cash deficit to pay off debts or setting a base to request bank credit are cash flow-based decisions.

Also read: Cash Flow Management – The Following Four Common Mistakes Problem

How to Handle Negative and Positive Cash Flow Statements?

Positive cash flow is when more money comes in than goes out, this can be managed by using integrated accounting software. This means your cash spending is less than the cash you earned from consumers, loans, or asset sales.

Negative cash flow means spending more than you earn. When your organization has negative cash flow, you’ll have less cash over time. Positive and negative cash flow are two aspects of cash flow, but they’re undoubtedly the most crucial for cash flow management. Cash is the lifeblood of a business, therefore you need a good plan and tools to manage your cash condition and predict its future.

How Can Digital Payments Improve Your Business?

Digital payments enable faster money flow, greater tracking, enhanced security, more embedded data, and less processing time. They can improve your financial operations by doing the following:

- Increasing financial processing efficiency while lowering expenses

Payment mix variations are driven by the internal costs of invoice processing and payment production using the best CRM software. Best-in-class performers processed an invoice in 3.1 days for $2.56 versus $10.89 on average.

- Better reconciliation information should be included in transactions

Digital transactions may have embedded data containing information about the underlying client and the goods or services provided. By automating financial procedures, you can boost the benefits of automation and get a higher return on investment.

- Meeting the payment recipient’s preferences

While it used to be payers who wanted to go digital, it is now recipients who see the savings and benefits of electronic payments and are investing in the systems required to go digital.

- Supporting the overall need for speed and providing real-time payments

The desire for speed is a constant in corporate improvement and technical progress, and B2B payment transactions are no exception. Digital payments have the potential to speed up transaction times by using complete finance software.

- Taking advantage of your employees’ growing familiarity with all things digital

Today’s workforce has grown up in a world where information is as freely accessible on mobile devices as it is on desktop computers. As new finance managers take over critical company positions, you’ll often discover that they have little patience for fraud-prone and costly checks and will seek to replace them with digital payments.

- Reducing fraud opportunities

The fight against fraud in the digital era looks different. There are unique vulnerabilities and established fraud methods, but you may limit their danger with the correct safeguards. The best accounting software can prevent fraud from occurring by implementing tight security.

Creating a Cash Flow Statement

Once you’ve determined your starting balance, you must compute cash flow from operating operations. This stage is critical because it shows how much money a company makes from its operations. The direct or indirect technique used to calculate cash flow from operations.

Direct method

The direct method of estimating cash flow from operating activities is a simple process that requires adding all cash collections from operations to all cash outflows from operations. This method records all transactions that resulted in cash payments or receipts throughout the reporting period.

Indirect method

The indirect method of calculating cash flow from operational activities requires you to start with net income from the income statement (see step one above) and apply adjustments to “reverse” the impact of accruals made during the reporting period. Depreciation and amortization are two of the most commonly used and regular adjustments.

Also read: How to Create a Cash Flow Projection and Its Benefit for Your Business

Cash Flow Statement Example

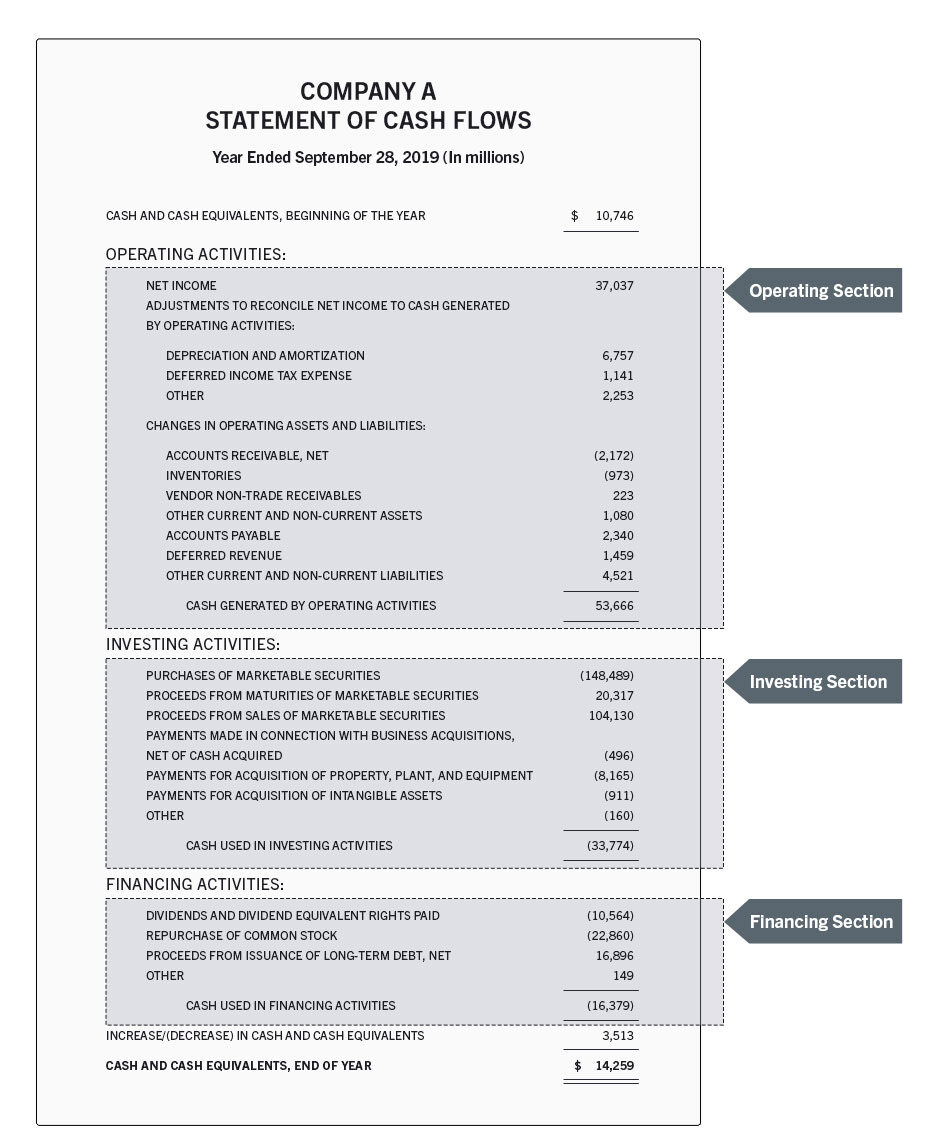

To help understand each element of the cash flow statement, here’s an example of a fictional corporation prepared using the indirect method.

This cash flow statement template is for a reporting period that ended on Sept. 28, 2019. As you’ll discover at the top of the sheet, the initial amount of cash and cash equivalents was around $10.7 billion.

During the reporting period, operating activities generated a total of $53.7 billion. The investing activities section shows the business used a total of $33.8 billion in transactions linked to investments. The financing activities section shows a total of $16.3 billion was spent on activities connected to debt and equity financing.

At the bottom of the cash flow statement, the three components are totaled to total a $3.5 billion rise in cash and cash equivalents throughout the reporting period. Therefore, the ultimate amount of cash and cash equivalents at the end of the year equals $14.3 billion.

Integrating Digital Payment Gateway with Accounting Software

The process of creating a cash flow statement may be time-consuming, and the nature of Excel sheets makes them prone to errors. As a result, an increasing number of businesses are turning to online accounting software in order to handle their transactions and generate cash flow statements. Many businesses incorporate digital payments with integrated accounting software. This is because it makes transactions easier and more accurate, lowering the risk of inaccurate digital payment transactions.

Conclusion

A cash flow statement is an important document for a corporation since it reveals whether the company has enough liquid cash to pay its bills and invest in assets. When it comes to the management of their cash flow statements, businesses should seriously consider implementing the best accounting software.

The cash flow statement alone cannot be used to interpret a company’s performance. For your overview, you can download software pricing scheme calculations before implementing software in your company. To experience the benefits of the software yourself, you can request a free demo here.