Have you ever wondered why your companies get revenue or losses for unknown reasons? Or curious why profits seem to slip away despite your business experiencing high revenues? You may consider it as a mystery puzzle that needs to be solved.

And here’s the clue, the key to complete the puzzle lies on how well you understand and manage your business. This is how a profit and loss statement come into handy, it breaks down where your revenue comes from and what kind of expenses that impact your bottom line.

By examining this statement regularly, you gain insight into which areas of your business are thriving, and which ones need improvement. Throughout this guide, we’ll explore the essentials of the Profit and Loss Statement and show you how to use it as a powerful tool for boosting profitability.

Plus, as a bonus, we’re providing a free Profit & Loss Statement template to help you get started. With this blueprint, you’ll be equipped to make informed decisions, optimize expenses, and steer your business toward financial mastery.

Key Takeaways

|

Table of Content:

Table of Content

What is a Profit and Loss Statement?

A Profit and Loss (P&L) Statement, also known as an income statement, is a financial report that summarizes a company’s revenues and expenses over a specific period of time. Usually P&L Statement being created monthly, quarterly, or annually. This statement is crucial for understanding a company’s financial performance and its ability to generate profit through effective management of income and expenses.

The P&L Statement provides insights into three core areas:

- Revenue Generation: It records all sources of income, showing how effectively the company is reaching its sales targets.

- Expense Management: By listing costs and expenses, the P&L Statement helps companies track their spending and assess operational efficiency.

- Profitability Assessment: The final figure reveals whether the company is making a profit or incurring a loss during the period.

Unlike the Cash Flow Statement, which tracks cash transactions, the P&L Statement emphasizes accrued revenues and expenses, following established accounting principles like revenue recognition and accruals.

Along with the Balance Sheet and Cash Flow Statement, the P&L is part of the trio of essential financial reports for assessing a company’s overall health.Creating a P&L Statement is also important for demonstrating your business profitability to investors, stakeholders, and financial institutions.

This report not only supports internal decision-making but also helps optimize operational efficiency and drive strategic improvements. For a comprehensive understanding, refer to this profit and loss guide that delves into its importance and functionality.

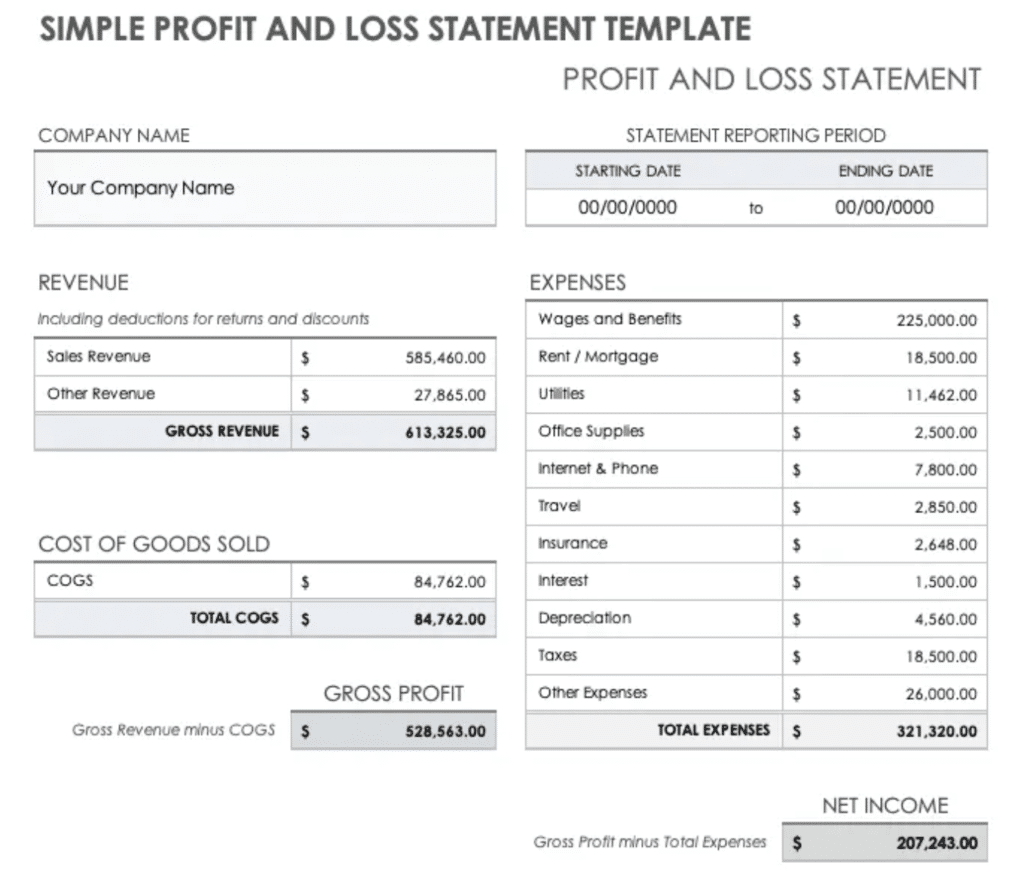

Profit and Loss Statement Template Format

A Profit and Loss (P&L) statement template typically follows a structured format to organize and present financial data in a clear, concise manner. Here’s a breakdown of the essential sections found in most P&L templates:

- Header:

- Company Name: The name of the business

- Report Title: “Profit and Loss Statement” or “Income Statement”

- Time Period: Specifies the period covered, such as “For the Month Ending [Date]” or “For the Year Ending [Date]”

- Revenue Section:

- Sales Revenue: Gross revenue or sales income

- Other Income: Additional income sources like interest or investment income

- Total Revenue: Sum of all income sources

- Cost of Goods Sold (COGS):

- Direct Costs: Costs directly associated with producing goods or delivering services

- Gross Profit: Total Revenue minus COGS, reflecting the initial profit before expenses

- Operating Expenses:

- Selling Expenses: Costs related to sales activities, such as marketing and advertising

- Administrative Expenses: Overhead costs, including rent, utilities, and office supplies

- Research and Development (if applicable): Costs for innovation or product development

- Total Operating Expenses: The sum of all operational costs

- Operating Profit (EBIT):

- Earnings Before Interest and Taxes (EBIT): Gross Profit minus Operating Expenses, showing profit from core business operations

- Non-Operating Items:

- Interest Expenses: Costs of debt financing

- Other Income/Expenses: Any additional income or expenses not directly related to operations

- Net Profit (or Net Income):

- Net Profit Before Tax: Earnings Before Interest and Taxes minus Non-Operating Items

- Taxes: Income tax on profits

- Net Profit After Tax: Final profit after accounting for all expenses and taxes

Profit and Loss Statement Template Formula

The Profit and Loss (P&L) Statements Formula is a straightforward calculation that summarizes a company’s ability to generate profit by deducting its expenses from its revenues. Here’s the basic formula:

- Total Revenue: Average Sales Price * The numbers of unit sold

- Cost of Goods Sold (COGS): Beginning Inventory + Purchases in the Current Period – Ending Inventory

- Gross Profits: Total Revenue−Cost of Goods Sold (COGS)

- Total Operating Expenses:

-

-

- Revenue – Operating Income – COGS

- Selling Expenses + Administrative Expenses + Research and Development Expenses

-

- Operating profit (EBIT): Gross Profit – Operating Expenses

- Non-Operating Items:

-

- Interest Expenses: Total Interest Payments for the Period

- Other Income/ Expenses: Total Other Income – Total Other Expenses

-

- Net profit or Net Income:

-

- Net Profit Before Tax: EBIT – Interest Expenses – Net Other Income/ Expenses

- Taxes: it is being determined according to the applicable tax rate

- Net Profit after tax: Net Profit Before Tax – Taxes

-

How to Create Profit and Loss Statement Template

Creating a template statement of Profit and Loss (P&L) is essential for any business, as it provides a clear picture of financial performance over a specified period. This structured approach allows businesses to analyze income and expenses effectively. Below is a refined guide on how to create an effective P&L statement template:

-

Define the reporting period

To begin, decide the time frame for your Profit and Loss (P&L) statement. This is important for tracking the performance of your business. You can choose:

- Monthly: Ideal for monitoring short-term performance.

- Quarterly: Gives a broader view while still being manageable.

- Annually: Provides a comprehensive look at your business’s financial health over the year.

-

Choose the right format

Next, choose how you’ll create your P&L statement. You can either:

-

- Spreadsheet Software: Tools like Microsoft Excel or Google Sheets make it easy to adjust calculations on the fly.

- Accounting Software: Many accounting software solutions offer built-in templates, providing extra functionality to streamline the process.

-

Create the header

The header of your P&L statement sets the stage for the entire document. Make sure to include:

-

- Business Name: Ensure your business name is clearly displayed.

- Statement Title: Label it as “Profit and Loss Statement” or “Income Statement.”

- Time Period: Indicate the period covered, e.g., “For the Year Ending [Date].”

-

Input revenue information

Accurate revenue data is key to assessing your financial health. Start with:

-

- Sales Revenue: Calculate this by multiplying your average sales price by the number of units sold.

- Formula: Total Revenue = Average Sales Price x Number of Units Sold

- Other Income: Include any additional income, such as interest or returns from investments.

- Calculate Total Revenue: Add together all your sources of revenue.

- Formula: Total Revenue = Sales Revenue + Other Income

-

Calculate Cost of Goods Sold (COGS)

Next, calculate your Cost of Goods Sold (COGS), which reflects the direct costs of producing the goods or services you sell. Here’s how:

-

- Beginning Inventory: Note the value of your inventory at the start of the period.

- Purchases: Include any inventory purchased during the period.

- Ending Inventory: Subtract the value of remaining inventory at the end of the period.

- Formula: COGS = Beginning Inventory + Purchases – Ending Inventory

Once you have this, calculate your Gross Profit by subtracting COGS from Total Revenue by using the formula below:

-

- Formula: Gross Profit = Total Revenue – COGS

- Formula: Gross Profit = Total Revenue – COGS

-

List operating expenses

Operating expenses are costs tied to the everyday functions of your business. Make sure to include:

-

- Selling Expenses: Marketing, sales commissions, and advertising costs.

- Administrative Expenses: Rent, utilities, salaries, and office supplies.

- Research and Development: If applicable, include any R&D expenses.

- Calculate Total Operating Expenses: Add up all operating expenses to get the total.

- Formula: Total Operating Expenses = Selling Expenses + Administrative Expenses + R&D Expenses

-

Determine operating profit (EBIT)

Operating Profit, or EBIT (Earnings Before Interest and Taxes), shows your business’s profitability before accounting for interest and taxes. To calculate EBIT, please look at the formula below:

-

- Formula: Operating Profit (EBIT) = Gross Profit – Total Operating Expenses

-

Account for non-operating items

Include income and expenses not directly tied to your main business activities:

-

- Interest Expenses: Record any interest paid on loans or debt.

- Formula: Interest Expenses = Total Interest Payments

- Other Income/Expenses: Add any other income or losses not related to core operations.

- Formula: Net Other Income/Expenses = Total Other Income – Total Other Expenses

- Formula: Net Other Income/Expenses = Total Other Income – Total Other Expenses

- Interest Expenses: Record any interest paid on loans or debt.

-

Calculate Net Profit or Net Income

Now, calculate your final profit with their formula:

-

- Net Profit Before Tax: Subtract interest and non-operating items from EBIT.

- Formula: Net Profit Before Tax = EBIT – Interest Expenses – Net Other Income/Expenses

- Taxes: Apply the relevant tax rate to calculate tax liabilities.

- Net Profit After Tax: Subtract taxes from Net Profit Before Tax to get the final net profit.

- Formula: Net Profit After Tax = Net Profit Before Tax – Taxes

- Formula: Net Profit After Tax = Net Profit Before Tax – Taxes

- Net Profit Before Tax: Subtract interest and non-operating items from EBIT.

-

Review and customize

Finally, don’t forget to review and fine-tune your P&L statement:

-

- Double Check Formulas: Ensure all formulas are accurate and that the figures align with your financial data.

- Customize Line Items: Feel free to adjust the line items to suit your specific business model. For instance, you may have unique revenue streams or expense categories.

10 Types of Profit and Loss Statement Template

After knowing how to create a profit and loss statement, here’s an easy-to-use Profit and Loss (P&L) Statement template incorporating HashMicro’s capabilities. This list of templates below can serve as a guide for creating an organized, comprehensive income statement that supports effective financial tracking and analysis.

You can set it up in a spreadsheet program like Excel or Google Sheets or even import it into accounting software that integrates well with other modules like HashMicro.

-

Basic profit and loss template

Effortlessly track and analyze your business’s financial performance with this user-friendly spreadsheet template. Designed for businesses of all sizes, it enables quick insights into monthly revenue and expenses, empowering you to make informed adjustments.

Simply download, customize it in Google Spreadsheets, and begin monitoring month-to-month trends to guide your business toward stronger financial health.

-

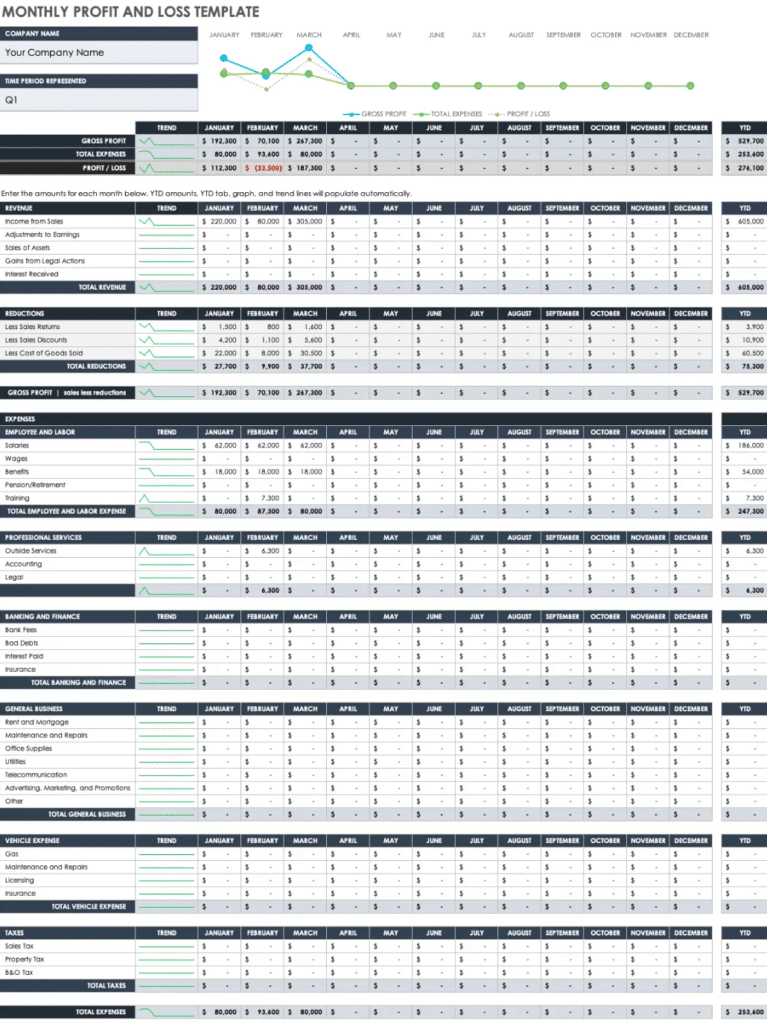

Monthly profit and loss statement

Take charge of your business’s financial performance with this easy-to-use spreadsheet template. It’s designed to help you capture key revenue and expense categories, allowing you to track your progress month by month.

By comparing your results, you can quickly identify trends, make informed decisions, and adjust strategies accordingly. Available for download in Google Spreadsheets, this template is ready for you to personalize and start using right away.

-

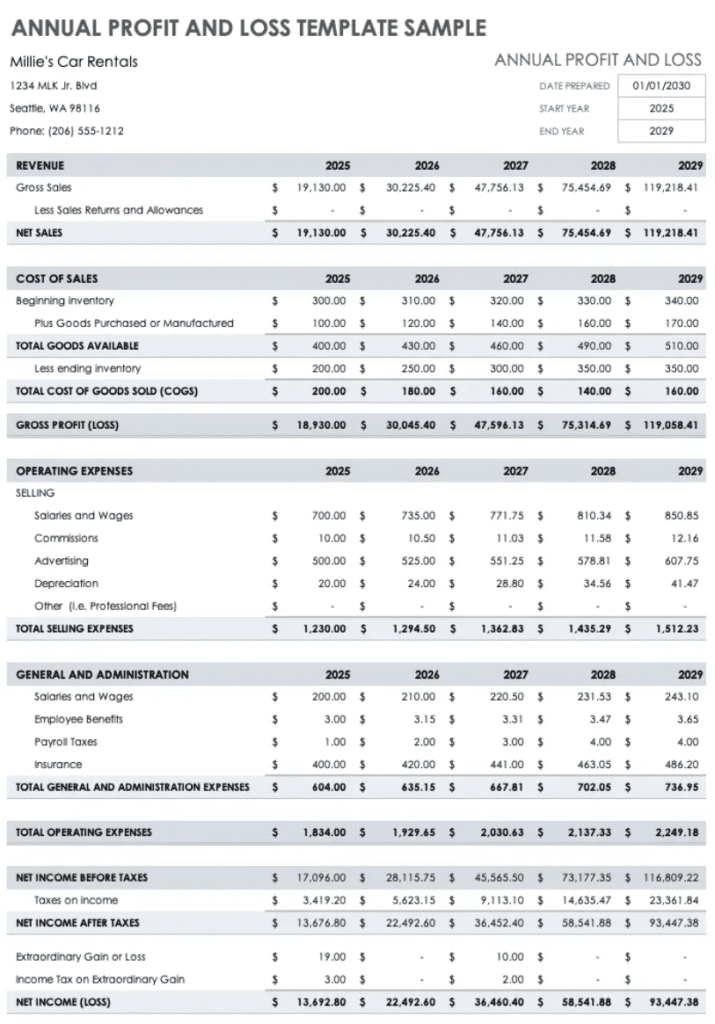

Annual profit and loss statement

Gain a complete picture of your business’s financial health with this comprehensive annual overview template. By consolidating monthly data into one clear, easy-to-understand document, it allows you to assess the year’s performance quickly and effectively.

Perfect for year-end evaluations, this template is ready for easy distribution and customization in a spreadsheet format, making it simple for you to share insights with your team or stakeholders.

-

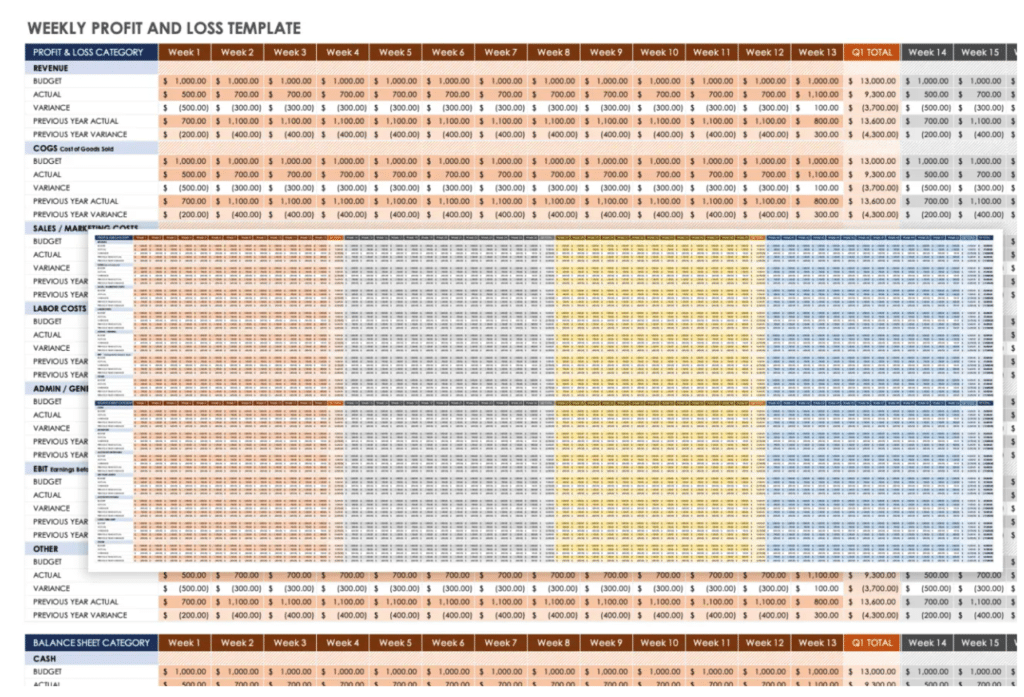

Weekly profit and loss statement

A Weekly Profit and Loss (P&L) Statement tracks weekly revenue, expenses, and profit, giving a quick view of business performance. This format suits fast-paced businesses needing timely insights for adjustments. Download our Weekly P&L Spreadsheet Template example to streamline your weekly financial tracking.

-

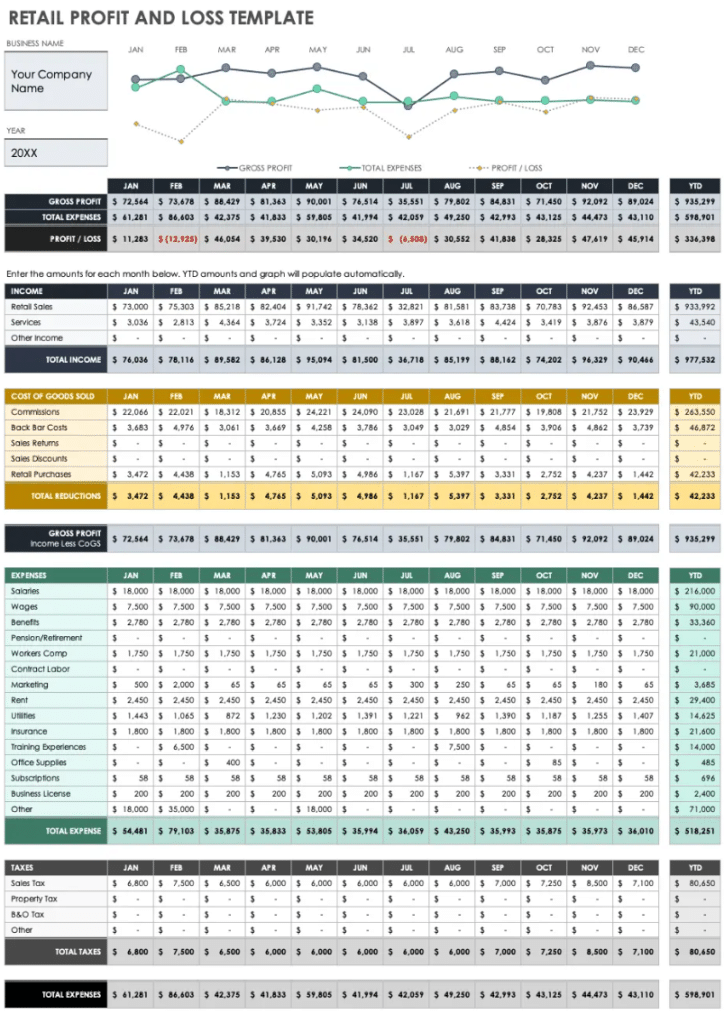

Retail profit and loss template

Retail Profit and Loss (P&L) Templates offer a straightforward way for retail businesses to track income, cost of goods sold, operating expenses, and net profit.

With a focus on profit margins and inventory costs, this template helps retailers make informed financial adjustments to enhance profitability. Available in sheets just to help calculate your business.

-

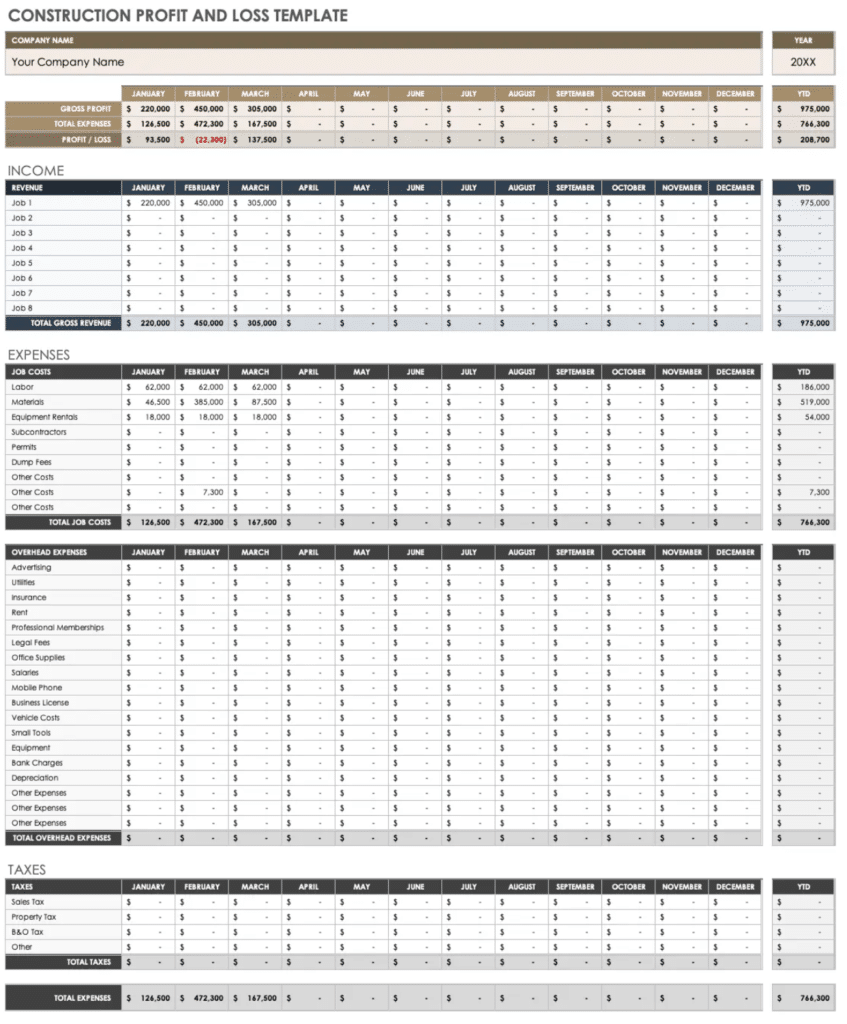

Construction profit and loss template

The Construction Profit and Loss Template is designed to help contractors and builders effectively monitor their financial performance. It provides a structured way to track revenues, costs, and expenses associated with construction projects, enabling better decision-making and budgeting.

By analyzing profit margins, businesses can identify areas for improvement and ensure project profitability. Available in Spreadsheets format, making it easy to share with stakeholders.

-

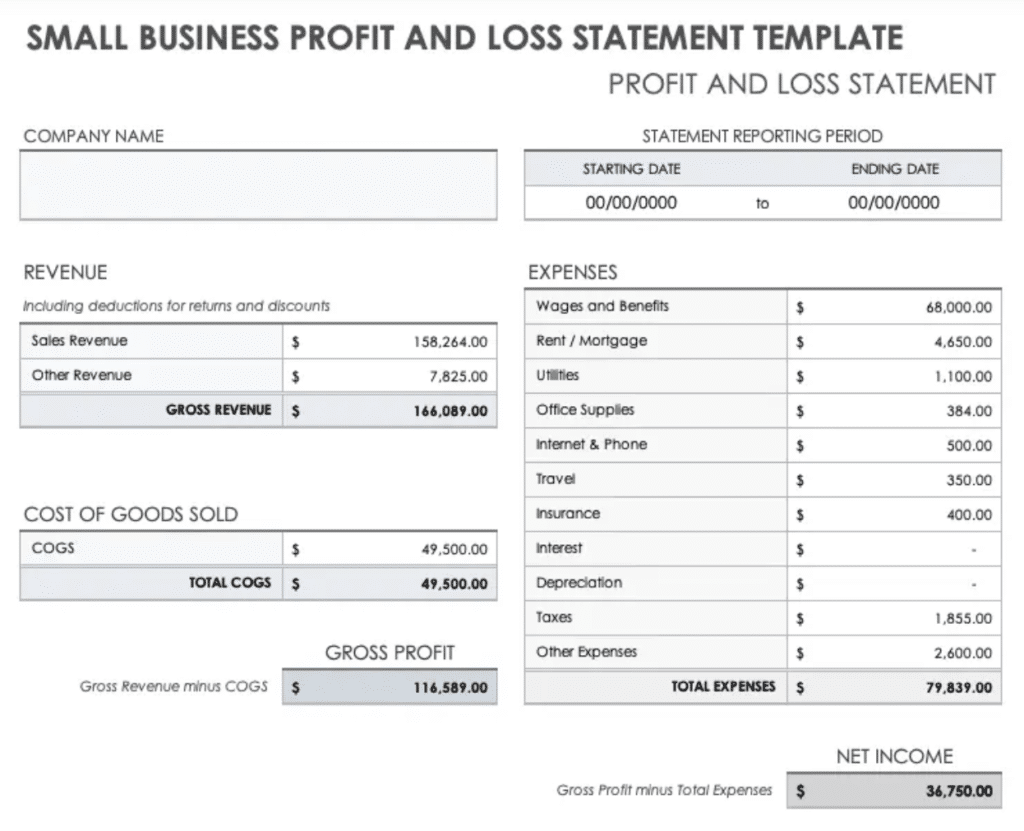

Small business profit and loss template

The Small Business Profit and Loss Template plays an essential role in tracking financial performance over a specified period. It helps business owners assess income, expenses, and profits, enabling more informed decision-making.

By organizing financial data, this template simplifies the identification of trends and areas for improvement. Try to download it in Google Sheets for real-time collaboration.

-

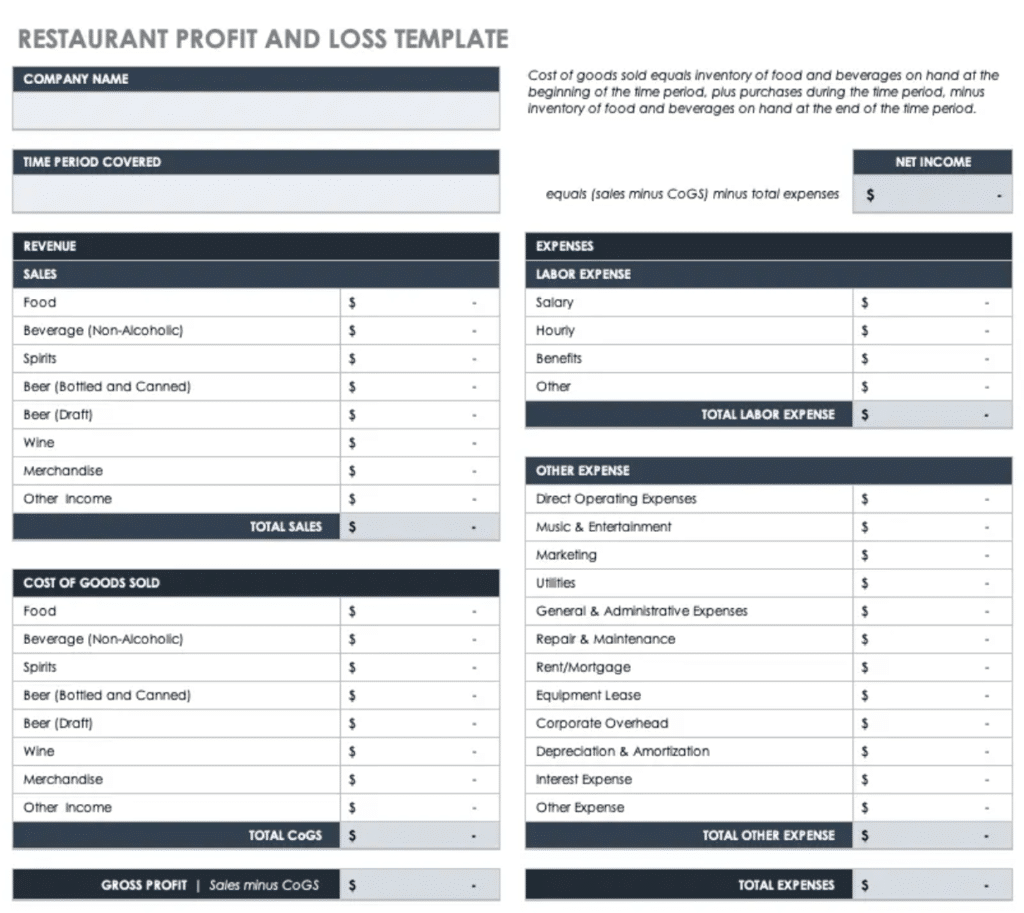

Restaurant profit and loss templates

Restaurant Profit and Loss Templates provide an effective way to manage the finances of dining establishments. These tools enable restaurant owners to monitor income, track expenses, and assess profitability over specific periods.

By organizing financial data clearly, owners can identify trends, optimize costs, and make informed decisions to enhance their business operations. Download our Restaurant P&L Spreadsheet Template to simplify your financial management and gain valuable insights into your restaurant’s performance.

-

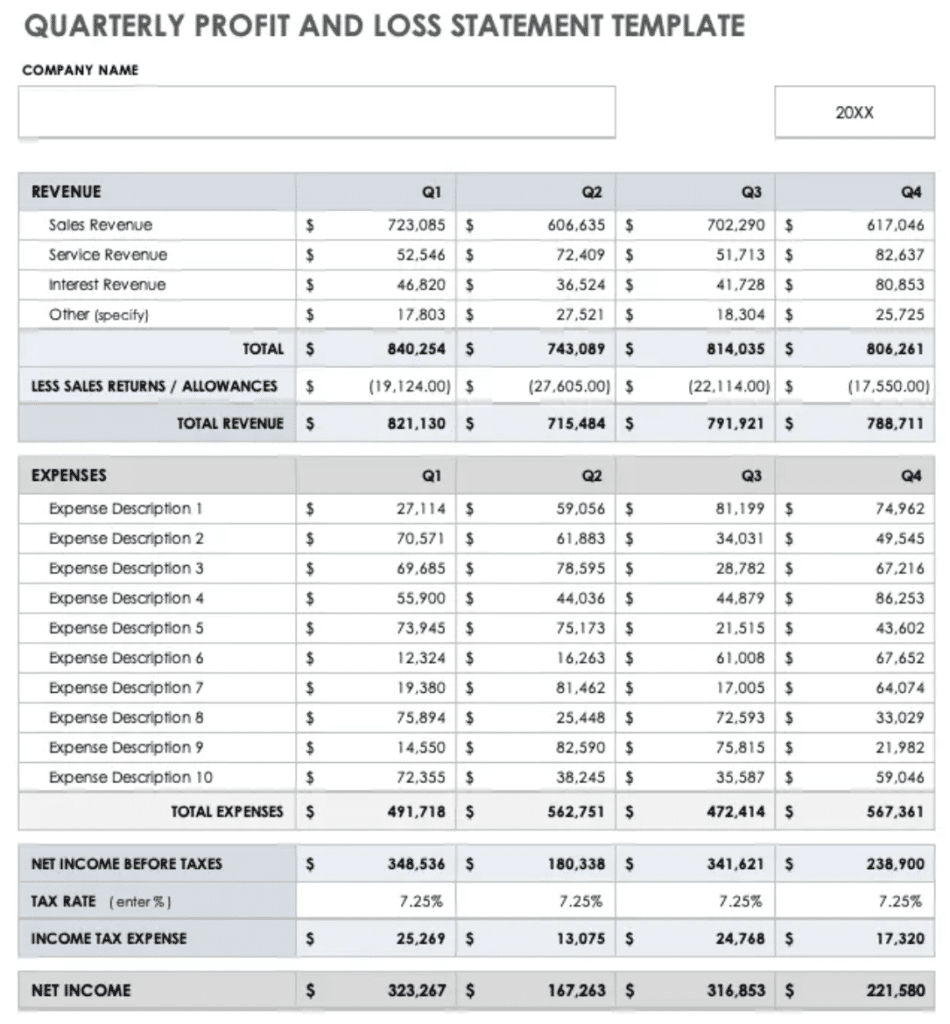

Quarterly profit and loss dashboard

A Quarterly Profit and Loss Statement offers a comprehensive view of a business’s financial performance over three months. This statement helps business owners track revenue, expenses, and profits, allowing them to identify trends and make strategic decisions.

By analyzing quarterly data, companies can better understand their financial health and adjust their operations accordingly.

You may download the Quarterly P&L Spreadsheet Template example to make your financial analysis at ease and maintain clear insights into your business’s quarterly performance.

-

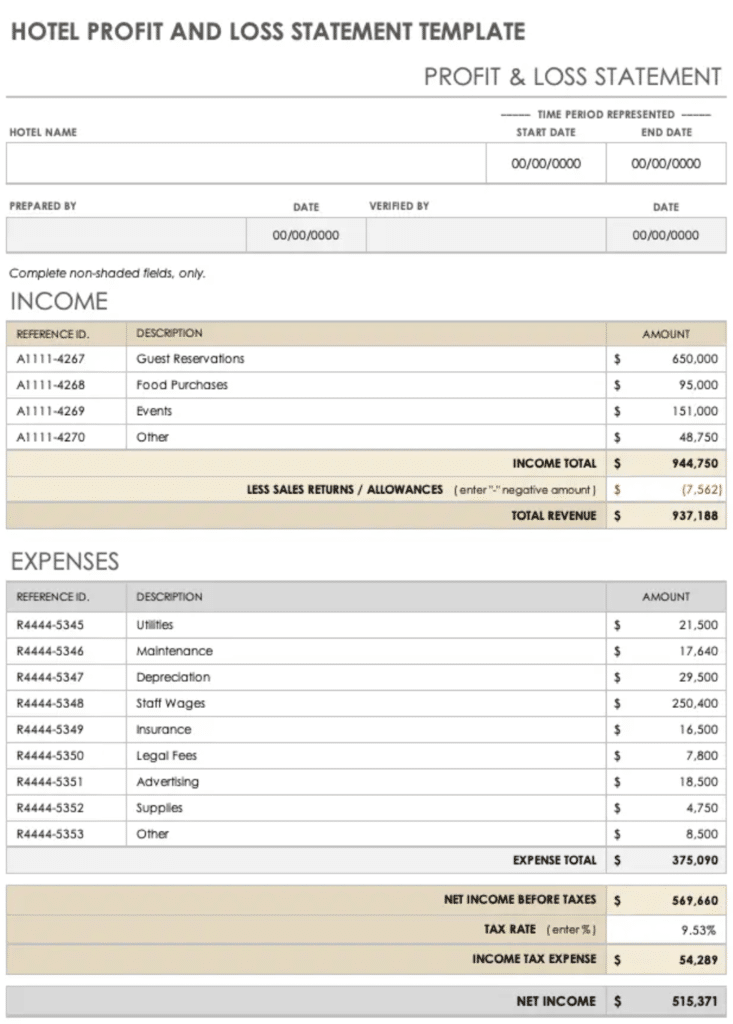

Hotel profit and loss template

An organized overview of a hotel’s financial performance is essential for effective management, highlighting revenues and expenses specific to the hospitality sector.

This template helps hotel managers track room sales, food and beverage income, and other revenue streams while monitoring operational costs like payroll, maintenance, and marketing.

Utilizing this resource allows hotel operators to make informed decisions to enhance profitability and improve efficiency. Available in Spreadsheets, don’t forget to download it for your business calculation.

Create Profit and Loss Statement Template Efficiently with HashMicro Accounting System

Conclusion

A profit and loss statement are a key financial document that provides valuable insights into a company’s operational performance by detailing revenues, expenses, and profits or losses.

This report helps business owners and stakeholders assess the company’s financial health, make informed decisions, and allocate resources efficiently.

It also serves as a critical tool for strategic planning, forecasting, and setting future financial goals.

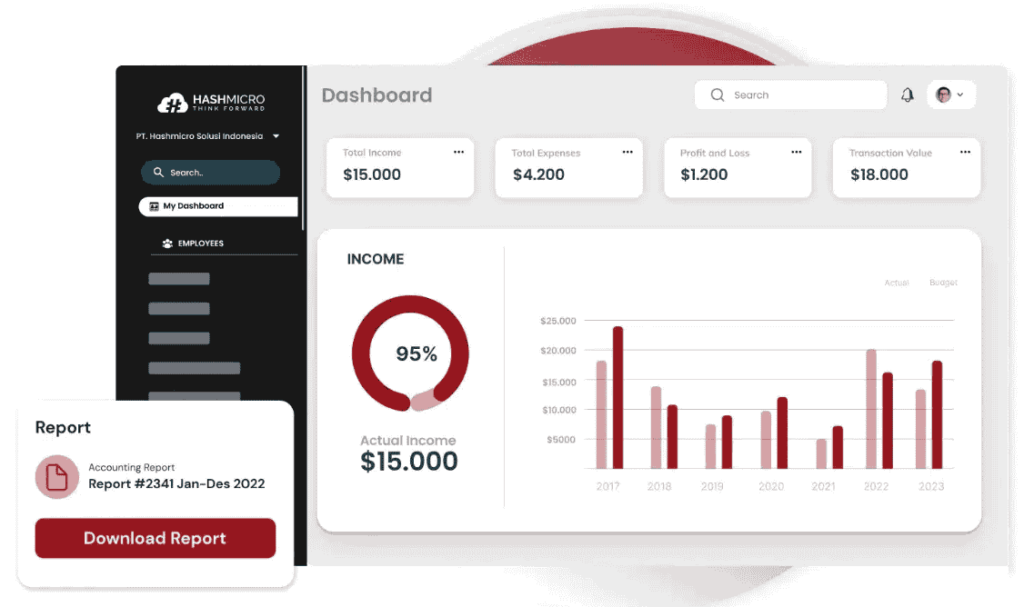

To simplify the management of profit and loss statement, consider using HashMicro’s accounting software. With its user-friendly interface and powerful features, it makes tracking income and expenses easy, ensuring accurate reporting and valuable insights.

Try our free demo today and see how it can help drive your business’s growth and success.

FAQ on Profit and Loss Statement

How do I make a simple profit and loss statement?

Creating a simple profit and loss (P&L) statement involves listing your income and expenses to determine whether your business is profitable. Here’s a basic step-by-step guide:

1. Gather Income Sources: Start by listing all income sources, including sales, services, or any other revenue streams. Calculate the total income.

2. List Your Expenses: Next, record all expenses incurred by your business, such as rent, utilities, salaries, and cost of goods sold (COGS). Be thorough in listing both fixed and variable costs.

3. Calculate Gross Profit: Subtract the COGS from total income. This gives you the gross profit, a measure of profitability before other expenses.

4. Deduct Operating Expenses: Subtract operating expenses (like rent, utilities, and administrative costs) from the gross profit to find the net profit or loss.

5. Review and Finalize: Review each entry to ensure accuracy. Your final figure will reveal whether you’re operating at a profit (positive balance) or loss (negative balance).Is there a profit and loss template in Excel?

Yes, Excel offers a P&L template that automatically calculates totals, making it easy to track income and expenses efficiently for any business size.

What is a P&L statement template?

A Profit and Loss Statement template is a pre-designed document or report that explains a company’s financial condition over a specific period of time. By using templates, the process is simplified by providing a structured format for inputting financial data.Does Word have a profit and loss template?

Yes, Microsoft Word offers customizable Profit and Loss statement templates. While Word is suitable for basic reports, Excel is recommended for more complex calculations due to its automatic features.