To get insurance, make sure you fall into a reasonable category regarding existing insurance issues. Insurance companies that don’t match the weight of your company’s activity will refuse to insure your business if the problem is severe and frequent, as this reflects negatively on the insurance company’s assessment of your company.

After analyzing your business’s risk profile, you can determine whether the insurance you wish to purchase is better appropriate for the company’s needs.

Make Sure That the Policy Covers All Your Business Activity

After acknowledging your business risk, you need to ensure that your insurance company provides a policy that supports all of your business activity. Read the policy carefully. Pay attention to covered or not covered things.

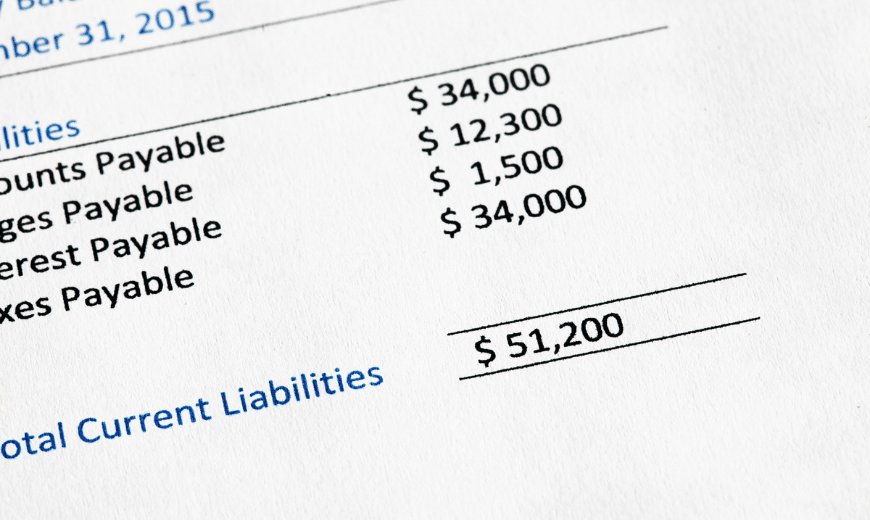

Ensuring the things that insurance is responsible for is important. Do not let the insurance party reject your business insurance claim because the clause does not cover the policy. Choosing insurance needs good analysis and deepening so that every problem has entered the calculation of business financial expenditures. To facilitate the recording of the company’s finances, use Accounting Software from HashMicro.

You may ask questions like this:

Does this policy protect all of the activities related to my business? Does this policy only cover public liability or also include product liability? What is included and not included in the public liability policy? And lastly, who is covered by the policy?

Check the Requirements of Your Industry Association, Professional Membership, and Contract Agreement

Be Careful with the laws where your company is regarding public liability insurance. You have to be attentive to the minimum coverage cost based on your industry association and professional membership.

Some contract agreements also oblige their working partners to have public liability insurance. So, prepare all the requirements that you need to fulfill before having your policy issued.

Ask for More Than One Quotation

It’s very normal if a company wants to suppress their expense. However, if you choose the cheapest public liability insurance might not be the right option. Think carefully about the risk and the soon-to-be-issued policy.

The effective way to get the right policy at an affordable cost is by requesting many quotations. After that, you can compare the price and the offer provided.

Minimize Your Business Risk

After you choose the suitable policy for your company, the risk will still be there. However, e regular evaluation of your business will reduse your business risk. This is a good strategy to decrease your insurance cost from time to time.

Do everything you are capable of to protect your business to ensure that all your business activity run according to the plan with minimize mistake. For example, by training your employee right. To facilitate human resource training, use HashMicro’s Competency Management Software.

Conclusion

Public liability insurance is essential, as every business activity carries some level of risk. Before issuing an insurance policy for your business, there are several important factors to consider. By integrating the best ERP software, businesses can better manage risk-related data, maintain accurate records, and streamline compliance—making the insurance application and claims process more efficient and reliable.

You can also apply accounting software and ERP system to help your company to run its daily operation effectively and accurately. Every function in business can you identified easily with a real-time cloud-based system. With that way, you can think of solutions immediately when an obstacle come in your way. If you are interested to tryout this cloud-based system, try the free demo here.