QuickBooks is one of the most popular accounting software systems businesses use worldwide. It offers comprehensive features to streamline financial management, from bookkeeping to payroll processing.

However, despite QuickBooks’ widespread use, many businesses are exploring alternative accounting solutions that may better fit their unique needs, preferences, or budgets. The market offers a range of options that can provide similar, if not better, capabilities in different areas.

The global accounting software market is expected to expand from around $544.06 billion in 2020 to $735.94 billion by 2025, reflecting strong growth driven by the rising need for effective financial management solutions.

This article will explore 12 of the best alternatives to QuickBooks, helping you find the right accounting system for your business’s financial management needs, whether you’re looking for more flexibility, advanced features, or a more affordable solution.

Key Takeaways

|

What is QuickBooks?

QuickBooks is an accounting software that helps businesses manage their finances by automating invoicing, expense tracking, and payroll. It simplifies financial management through easy-to-use tools, making it accessible for users without an accounting background.

The software allows users to efficiently manage their financial data by automating time-consuming tasks like reconciling bank statements, creating financial reports, and tracking sales and expenses.

QuickBooks accounting also integrates with other business applications, providing a seamless experience across different business functions. With its user-friendly interface, QuickBooks is known for its accessibility, even for those without an accounting background.

This accounting system has become a tool for many businesses because of its scalability and versatility. It’s particularly favoured by small and medium-sized enterprises (SMEs) for its ease of use and affordability compared to traditional accounting services.

The system helps business owners manage their finances while saving time and reducing the likelihood of errors, making it an essential tool for financial management.

Key Features and Benefits of QuickBooks

QuickBooks provides businesses with a powerful yet easy-to-use accounting platform streamlines financial management tasks. One of its primary benefits is automation, which reduces manual effort by automating tasks such as invoicing, expense tracking, and tax calculations.

This saves time and minimizes errors, ensuring accurate financial data. QuickBooks also offers scalability, making it suitable for small startups and large enterprises.

Key Features of QuickBooks

- Invoicing and Payment Processing: Create and send professional invoices while accepting various payment methods.

- Expense Tracking: Track and categorize expenses in real-time for better financial insights.

- Integration Capabilities: Seamlessly integrate with third-party apps like PayPal, Shopify, and more.

- Real-Time Financial Reports: Access detailed reports on cash flow, profit and loss, and balance sheets instantly.

- Mobile Accessibility: Manage accounting tasks on the go with the QuickBooks mobile app.

With its comprehensive features and tangible benefits, QuickBooks continues to be a preferred choice for businesses aiming to optimize their accounting processes.

12 Best Alternatives of QuickBooks Accounting

Exploring these 12 alternatives can help you find the right fit for your business’s accounting requirements. Let’s explore the 12 best alternatives to QuickBooks that can offer the flexibility and functionality you’re seeking.

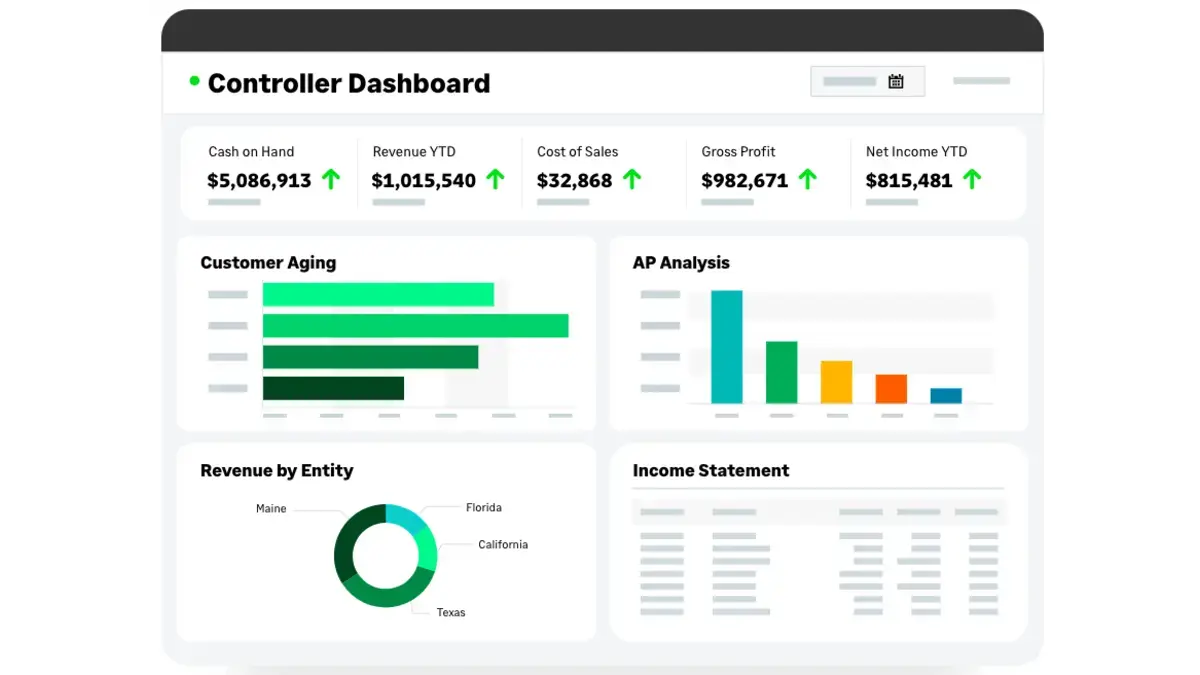

1. HashMicro Accounting

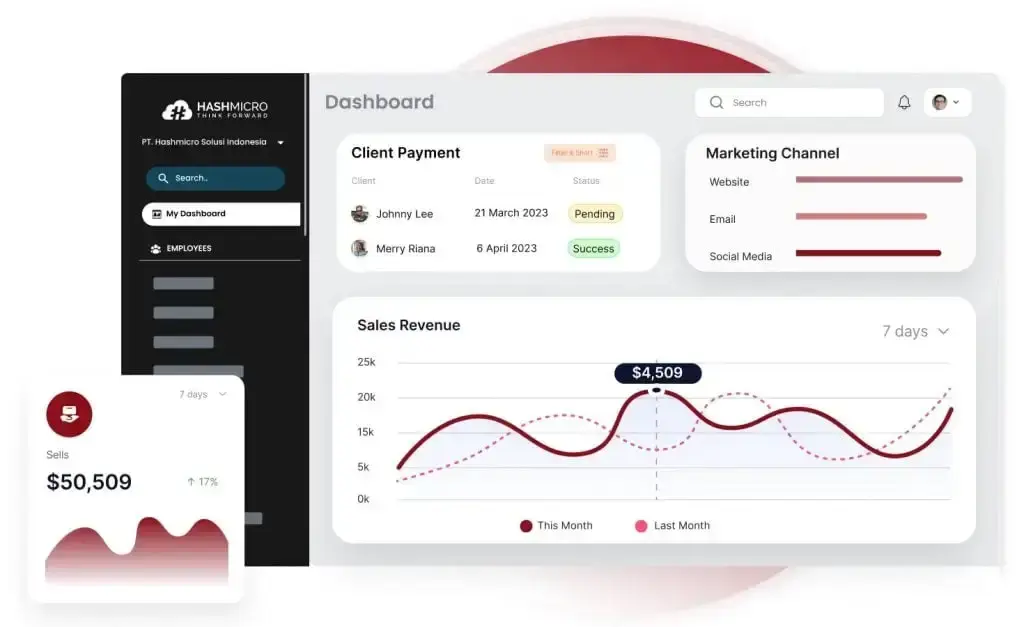

HashMicro Accounting System is an accounting software solution designed to streamline financial management with a comprehensive set of features and an intuitive interface. This system offers capabilities such as automated transaction recording and real-time financial reporting.

This accounting system fully suits local regulations, including tax laws and other accounting requirements. It also provides unlimited user access, allowing flexible usage for the entire team within the organization.

Key features:

- Bank Integration – Auto Reconciliation: This feature automatically integrates with your bank accounts to fetch transaction data, simplifying the reconciliation process.

- Multi-Level Analytical: This feature enables businesses to analyze financial data at multiple levels, such as by department or cost center. It helps gain detailed insights and makes financial decision-making more informed.

- Profit & Loss vs Budget & Forecast: This feature compares actual profit and loss against budgeted figures and forecasts, helping businesses assess their financial performance.

- Cash Flow Reports: Cash flow reports provide a detailed view of cash inflows and outflows over a period of time. This helps businesses monitor liquidity, manage working capital, and plan for future financial needs.

- Forecast Budget: This feature allows businesses to project future budgets based on historical data and expected financial trends. Forecasting income and expenses helps in financial planning and ensures better resource allocation.

To learn more about the pricing schemes offered by HashMicro Accounting System, explore packages tailored to your business needs. Click the banner below for more pricing information!

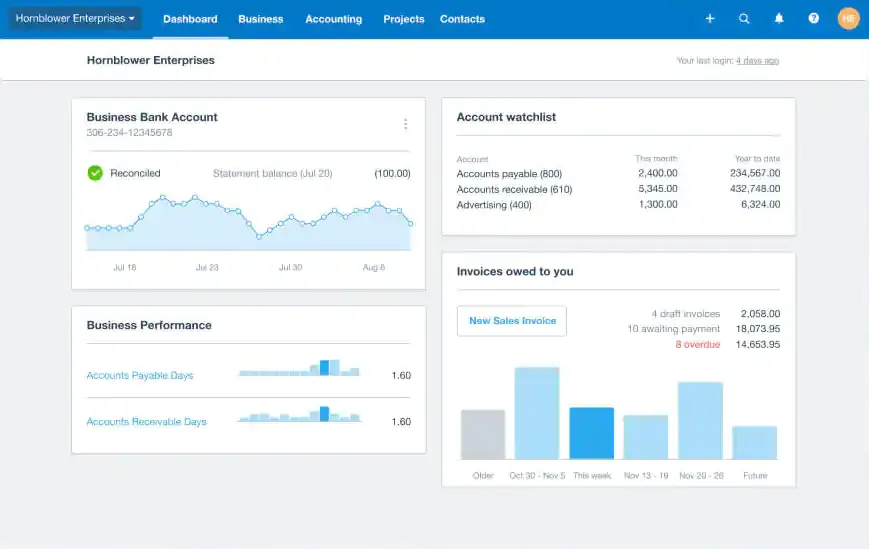

2. Xero

Xero is a cloud-based accounting software known for its simplicity and robust features. It is particularly popular among small and medium-sized businesses that need an easy-to-use system with strong collaboration features.

Xero offers strong integration with third-party applications and supports multi-currency transactions, making it ideal for international businesses. Its plans allow unlimited users, offering flexibility for growing businesses.

Key Features:

- Multi-currency support for global businesses

- Automated bank feeds and reconciliation

- Expense management

- Inventory tracking

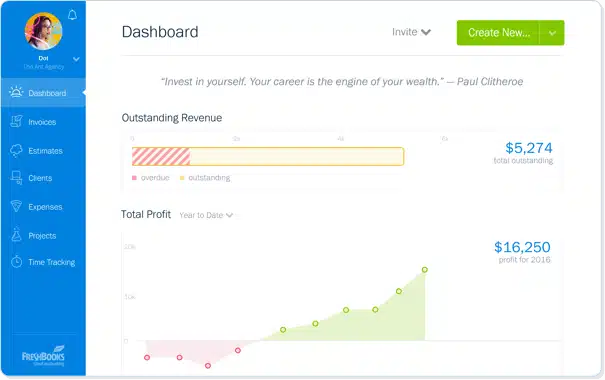

3. Freshbooks

FreshBooks is a user-friendly accounting software designed for small businesses and freelancers. It emphasizes ease of use, with a clean interface and features that simplify invoicing, time tracking, and expense management.

FreshBooks is ideal for businesses looking for a simple yet comprehensive billing and project management solution. It offers automatic invoice reminders and integrations with payment processors like PayPal and Stripe.

Key Features:

- Customizable invoicing

- Expense tracking

- Client portal

- Mobile app

4. Wave Accounting System

Wave Accounting is a free cloud-based accounting software that provides many of the features found in paid solutions. It is a great choice for small businesses and startups on a budget.

This software supports core accounting tasks such as invoicing, bookkeeping, and expense tracking while offering integrations with payment systems like PayPal and credit card processors. While free, Wave also offers paid services for payroll and payments.

Key Features:

- Free invoicing

- Automated income and expense tracking

- Bank account and credit card syncing

- Customizable invoices

- Simple financial reports

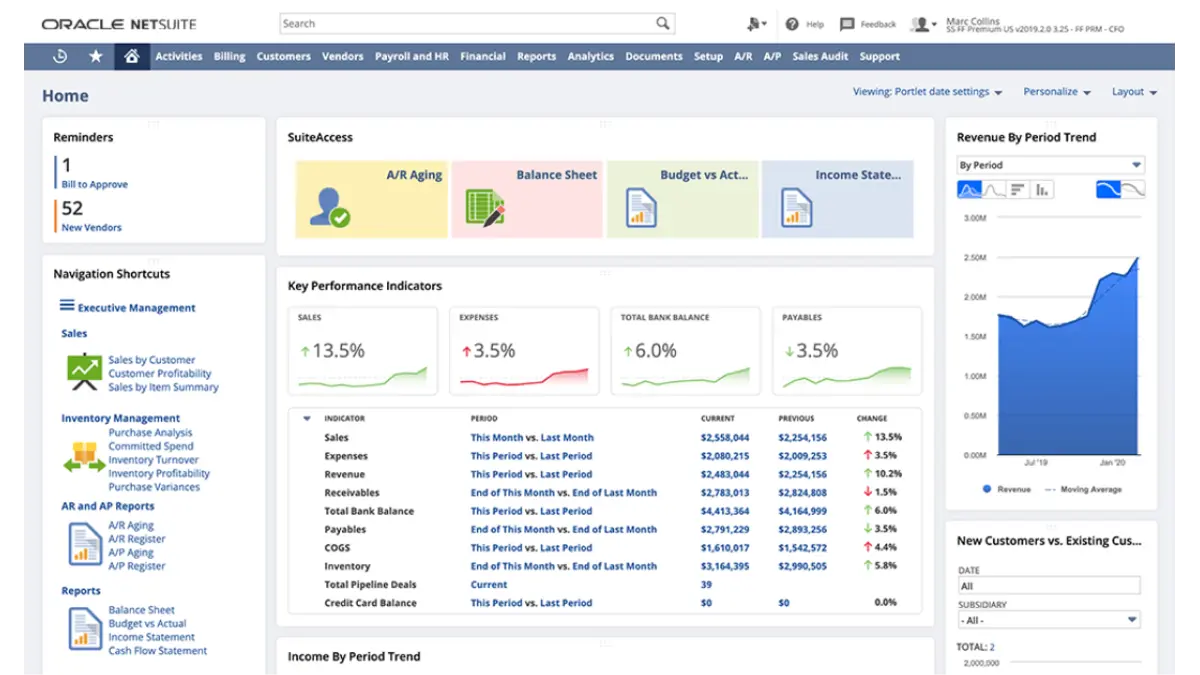

5. Netsuite

NetSuite is an enterprise-level cloud ERP solution that includes comprehensive accounting features. It is particularly beneficial for growing businesses or large organizations that need advanced accounting and financial management tools, such as real-time reporting, multi-currency handling, and complex invoicing.

This system integrates financial management with other business functions like CRM, inventory management, and order processing.

Key Features:

- Advanced financial management

- Multi-currency

- Inventory and supply chain management

- Built-in CRM and sales features

6. Sage Intacct

Sage Intacct is an advanced accounting solution designed for businesses seeking robust financial management features. It is particularly suitable for mid-market businesses and offers powerful reporting capabilities and multi-entity management.

Accounting system Sage stands out for its strong compliance tools and deep integration with other enterprise systems, allowing seamless management of finances and operations across departments.

Key Features:

- Advanced financial reporting

- Multi-currency support

- Customizable automation for workflows

- Strong integration with other business systems

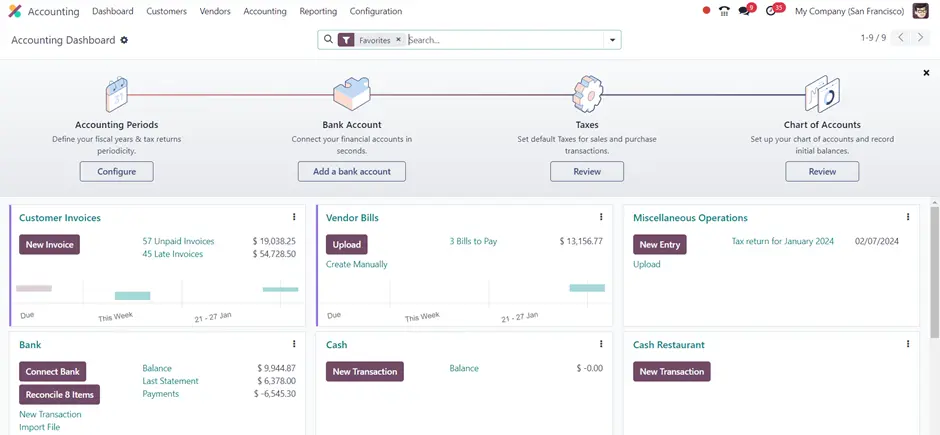

7. Odoo

Odoo is an open-source ERP solution offering various modules, including accounting, CRM, inventory management, and project management. It is highly customizable and ideal for businesses that need an all-in-one solution.

This accounting software features support invoicing, payments, and financial reporting, and it integrates seamlessly with other business functions, making it ideal for businesses looking for flexibility and scalability.

Key Features:

- Modular design with multiple business functions

- Invoicing, payments, and tax management

- Real-time financial reporting

- Multi-currency

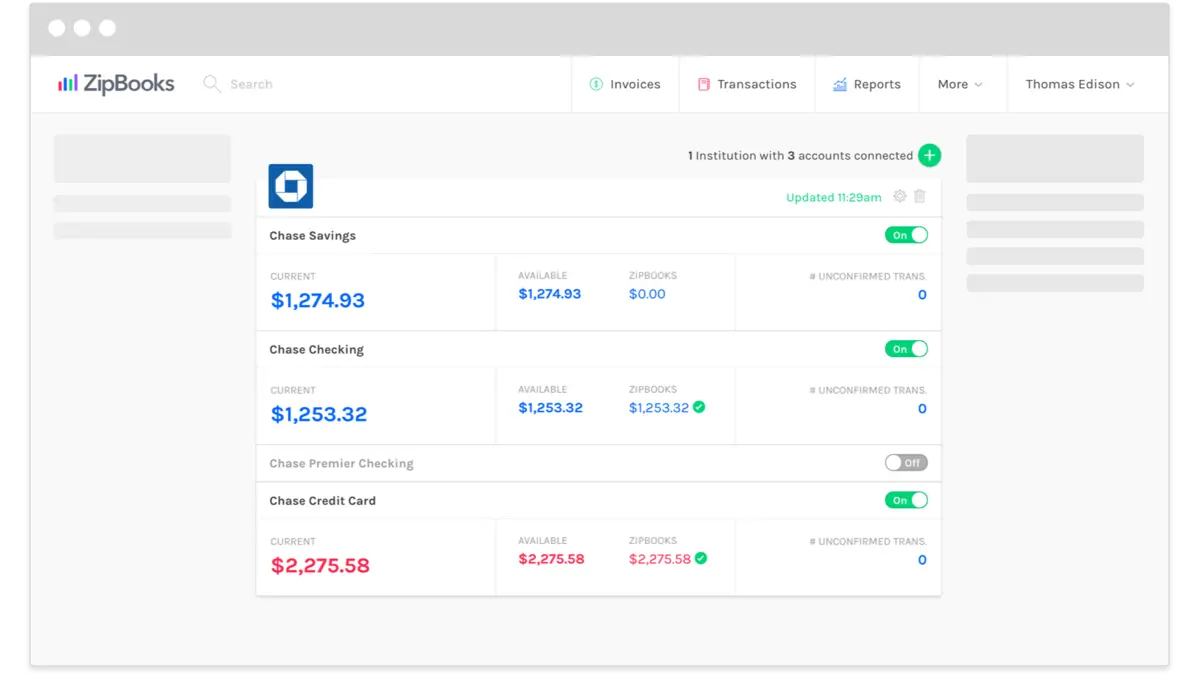

8. Zipbooks

ZipBooks is a modern accounting software designed for small businesses looking for simplicity and efficiency. It offers a sleek and intuitive interface with features such as invoicing, expense tracking, and financial reporting.

With its smart insights and automated tools, ZipBooks helps businesses streamline their bookkeeping processes and gain actionable insights to improve financial performance.

Key Features:

- Smart insights with business health scores

- Automated billing and invoicing

- Expense tracking

- Financial reporting

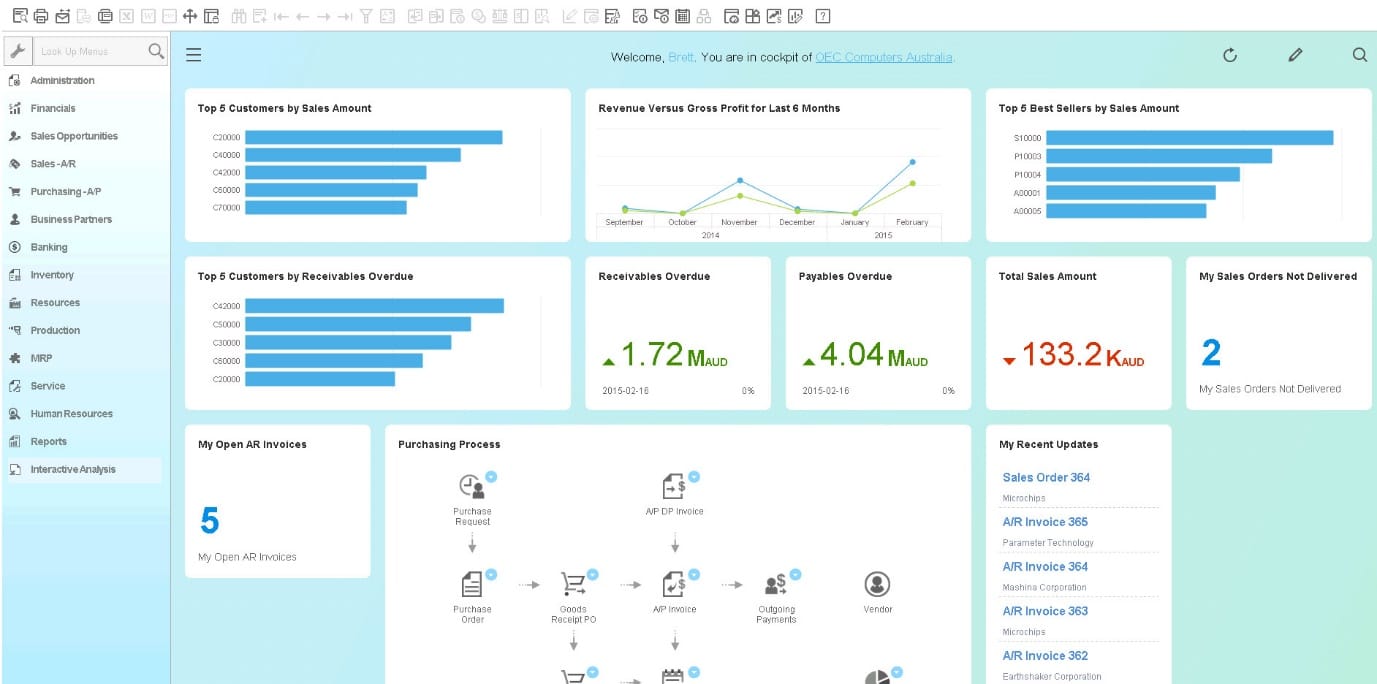

9. SAP

SAP’s financial management tools are part of its comprehensive ERP solutions, making it ideal for large businesses and enterprises. Known for its robust functionality and customization, SAP offers advanced tools for managing complex accounting tasks, financial planning, and compliance requirements.

Its integration with other SAP modules, such as inventory and supply chain management, ensures streamlined operations across business functions.

Key Features:

- Advanced financial planning

- Real-time financial reporting

- Multi-currency

- Integration with SAP ERP

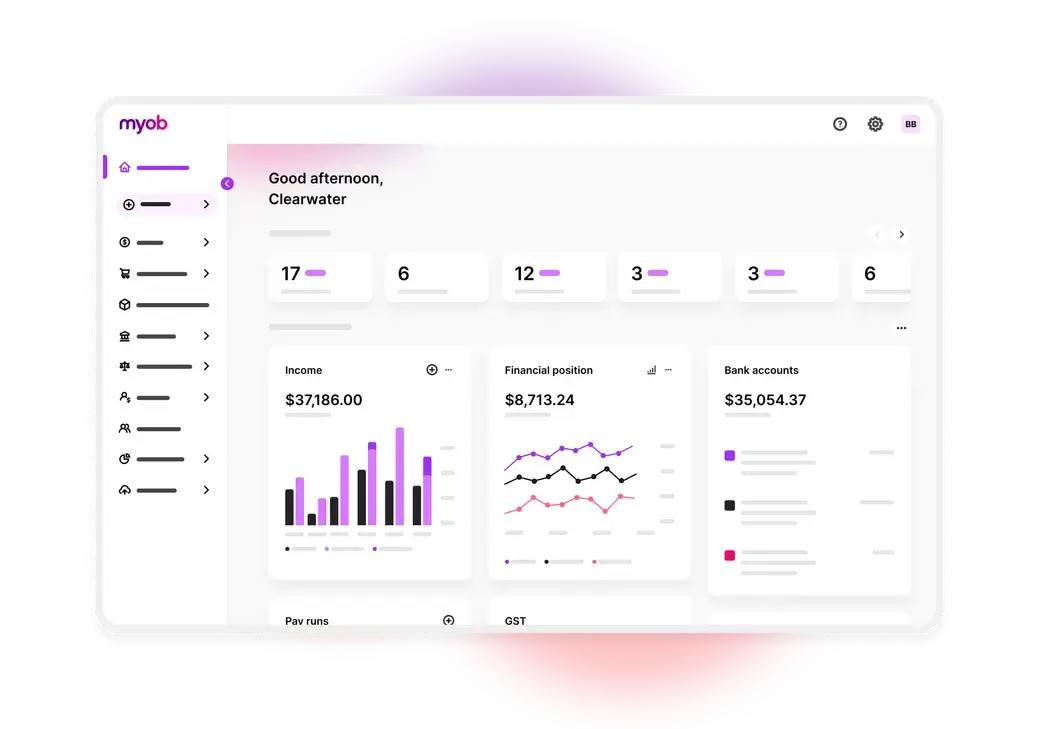

10. MYOB

MYOB (Mind Your Own Business) is a versatile accounting software popular in Australia and New Zealand, designed for small to medium-sized businesses. It offers easy-to-use features for invoicing, expense management, and payroll processing.

This system supports both cloud-based and desktop solutions, giving businesses flexibility in choosing how they manage their finances.

Key Features:

- Flexible cloud and desktop options

- Tax compliance tools

- Payroll processing

- Bank reconciliation

11. Acumatica

Acumatica is a cloud-based ERP solution with a strong focus on accounting and financial management. It is designed for growing businesses that require scalability and advanced financial features.

Acumatica’s open platform allows for customization and integration with other tools, making it suitable for industries like retail, manufacturing, and distribution.

Key Features:

- Scalable ERP with robust accounting tools

- Multi-currency

- Customizable dashboards

- Integration with CRM and SCM

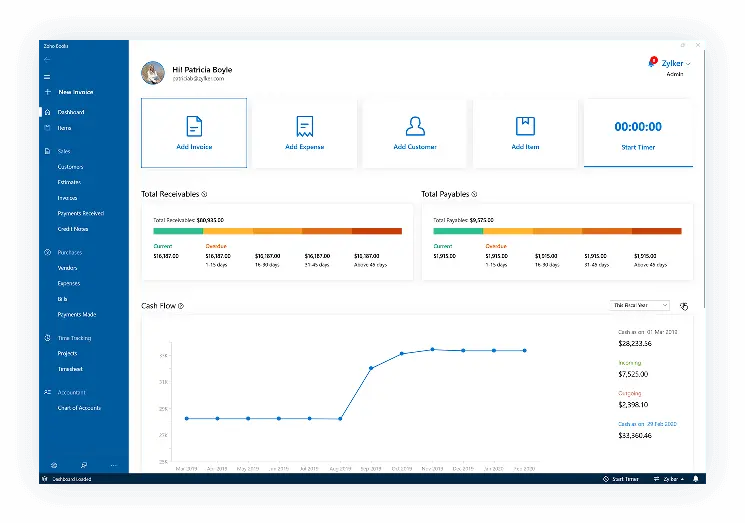

12. Zoho

Zoho Books is part of the Zoho suite of business tools, offering a simple yet powerful accounting solution for small to medium-sized businesses.

It stands out for its seamless integration with other Zoho products, making it ideal for businesses already using the ecosystem. Zoho Books simplifies tasks like invoicing, expense tracking, and tax preparation while offering automation features to save time.

Key Features:

- Seamless integration with the Zoho ecosystem

- Automated workflows

- Tax compliance

- Multi-currency

You can also check out other articles related to Zoho Invoice reviews for more detailed insights and comparisons to help you make the best choice for your business.

How to Choose The Right QuickBooks Alternatives

Selecting the right QuickBooks alternative involves careful consideration of several factors to ensure the software can meet your business goals effectively. Below are the essential steps to guide your decision-making process.

1. Identify your business needs

Before exploring available options, evaluate your business requirements. Consider factors like your business size, the complexity of your accounting tasks, and the integrations you need. For instance, scalability might be your top priority if you’re a growing company.

2. Set a budget

Accounting software comes with varying price points, from free solutions to premium software with advanced features. Determine a realistic budget for your accounting needs. Remember to account for hidden costs such as setup fees, training, or add-ons.

3. Consider ease of use

Ease of use is critical when choosing any software. A steep learning curve can lead to errors and inefficiencies. Look for software with a user-friendly interface and comprehensive support, such as tutorials, documentation, or customer service.

4. Evaluate features and integrations

Ensure the software offers the features your business relies on, such as expense tracking, invoicing, payroll management, and tax compliance. Check for integrations with your existing tools, such as CRM systems, e-commerce platforms, or payment gateways.

8. Consider long-term scalability

Your chosen solution should grow with your business. Opt for scalability software, allowing you to add users or upgrade features as your needs evolve. Scalability prevents the hassle of switching platforms as your business expands.

By clearly defining your needs and carefully evaluating your options, you can find a solution that not only meets your current requirements but also supports your business growth in the long run.

Conclusions

QuickBooks is one of the most popular accounting software solutions, widely known for its ability to handle essential financial tasks such as invoicing, payroll management, and tax compliance.

Aside from QuickBooks, several other accounting software options offer comparable or even enhanced functionality tailored to different business requirements, from free solutions suitable for small businesses to more complex systems designed for larger enterprises.

One of the standout alternatives is HashMicro Accounting. This solution provides an integrated approach to accounting, offering features such as automated invoicing, real-time financial reporting, and seamless integrations with other business systems.

We recommend trying out HashMicro through a free demo if you’re considering making the switch. This will give you an in-depth understanding of how its features can help optimize your financial processes.

FAQ About QuickBooks Alternatives

-

Who needs to use QuickBooks?

Whether you’re a sole proprietor, a small business owner, a bookkeeper, or an accountant, QuickBooks is dedicated to supporting your business growth. Easily manage your finances in real-time with our intelligent and secure platform.

-

How do QuickBooks work?

QuickBooks, developed by Intuit, is accounting software designed for small businesses to manage income, expenses, and monitor their financial status. It allows users to create invoices, pay bills, prepare taxes, and generate financial reports.

-

What is QuickBooks most useful for?

QuickBooks provides key features such as invoicing and sales management, expense tracking, payroll handling, financial reporting, and inventory management. These capabilities assist businesses in managing their financial operations effectively and accurately.