Managing payroll involves more than just disbursing salaries – it requires compliance with various regulations and meticulous calculations. For human resource management staff and company officials, having a clear understanding of Singapore payroll is essential for a smooth and efficient payroll process.

Apart from payroll, tax calculation is also crucial. Calculating salary and tax may be challenging sometimes, but with the help of a payroll system, the company can gain an easier strategy to automate these complex progress.

So, let’s dive in and explore the important things to know about Singapore payroll!

Key Takeaways

|

Singapore Payroll Regulations

When it comes to payroll in Singapore, businesses must adhere to various regulations to ensure compliance and avoid legal issues. The primary governing law is the Employment Act, which sets out the working conditions and basic employment terms. According to the Employment Act, salaries must be paid at least once a month, and overtime wages should be paid within 14 days of the salary period. While Singapore does not have a minimum wage policy, it follows the Progressive Wage Model (PWM) in certain sectors to ensure fair compensation for workers.

In addition to the Employment Act, employers are also required to make Central Provident Fund (CPF) contributions for their employees. The CPF is a mandatory social security savings plan that provides benefits such as healthcare, retirement, and social welfare. Employers must calculate and contribute CPF based on their employees’ wages and age group. There are different CPF contribution rates for different age groups, and employers must ensure accurate calculations to fulfill their CPF obligations.

Further to CPF contributions, employers may also need to pay levies such as the Skills Development Levy (SDL) and Foreign Worker Levy (FWL). SDL is used to fund workforce training and development programs, while FWL is a levy that applies to foreign workers to regulate the number of foreign employees in Singapore. Employers must fulfill these levies and comply with the associated requirements to meet their statutory obligations and avoid penalties.

Implementing a payroll system for large businesses with numerous employees can greatly optimizes the payroll process. Such a system minimizes the risk of human error, which is particularly crucial in a complex environment where even small mistakes can lead to significant issues. By automating calculations and ensuring adherence to Singapore’s specific payroll regulations, the payroll system ensures that every employee is paid accurately and on time.

Key Points:

- The Employment Act governs working conditions and basic employment terms in Singapore.

- Salaries must be paid at least once a month, and overtime wages should be paid within 14 days.

- The Progressive Wage Model (PWM) ensures fair compensation in certain sectors.

- Employers must make CPF contributions for their employees based on their wages and age group.

- Skills Development Levy (SDL) and Foreign Worker Levy (FWL) may need to be paid by employers.

Payroll Variable Components for a Business

When it comes to payroll in Singapore, there are various variable components that need to be considered in the salary calculation process. These components can have a significant impact on an employee’s overall compensation. It is crucial for employers to accurately track and calculate these components to ensure fair and compliant payroll management.

Singapore payroll variable components include:

- Bonuses: Employers may offer performance-based bonuses or incentives to reward employees for their hard work and achievements.

- Overtime Pay: Some employees may be eligible for overtime pay if they work additional hours beyond their regular working hours.

- Cash Allowances: Companies may provide cash allowances for specific purposes such as transportation or meal expenses.

- Commissions: Sales or commission-based employees may receive a percentage of sales or revenue they generate.

Additionally, some employers offer year-end bonuses or additional benefits like medical leave and statutory claims. These variable components play a crucial role in determining an employee’s total remuneration. Employers must ensure accurate calculation and timely payment of salaries to maintain a smooth payroll process and keep employees satisfied, while also complying with regulations set by the commissioner or relevant labor authorities.

Accurate Calculation for Fair Payroll Management

“Accurately tracking and calculating variable components in payroll is essential for fair and compliant payroll management. It ensures that employees are compensated correctly and in accordance with their contributions to the organization. Employers must keep detailed records of these components and regularly review their payroll processes to ensure accuracy. By doing so, businesses can maintain employee trust and satisfaction while upholding their legal obligations.”

Proper payroll management also involves staying up to date with changes in employment laws, tax regulations, and other statutory requirements. This will help businesses avoid penalties or legal issues related to payroll management. Regularly reviewing and improving payroll processes can contribute to a streamlined and efficient payroll management workflow, benefiting both employers and employees.

Calculating Salary Payroll in Singapore

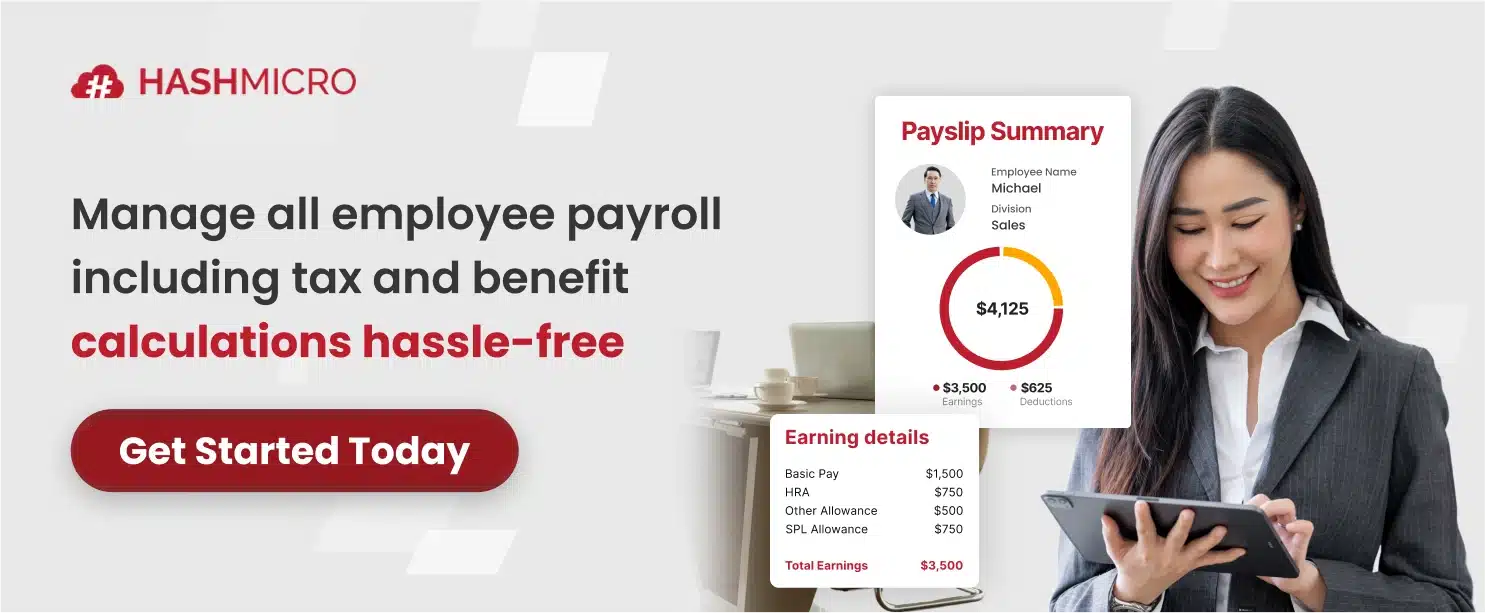

Calculating salary payroll in Singapore involves taking into account various factors to determine an employee’s total wages. It includes considerations such as the employee’s basic salary or wages, overtime pay, allowances, and bonuses. To accurately calculate the salaries, employers must also factor in mandatory contributions such as the Central Provident Fund (CPF) and other levies.

The CPF contributions are calculated based on an employee’s total wages and age group. Different age groups have different CPF contribution rates, and employers need to ensure compliance with these rates. Additionally, employers must also take into account levies like the Foreign Worker Levy (FWL) and Skills Development Levy (SDL) when calculating payroll. These levies are important for regulating the employment of foreign workers and supporting workforce training and development programs.

Accurate calculation and timely payment of salaries are essential to maintain a smooth payroll process.

Compliance with income tax regulations is also a crucial aspect of payroll management in Singapore. While employers are not required to withhold taxes from employee salaries on a monthly basis, they must provide employee remuneration returns for tax purposes. It is the responsibility of employees to file their annual income tax returns and pay the applicable taxes.

By accurately calculating and disbursing salaries, employers can ensure a fair and compliant payroll management process in Singapore. It is important for businesses to stay updated with the latest regulations and guidelines to avoid penalties or legal issues. Implementing robust payroll systems and partnering with payroll service providers can help streamline the calculation and administration of payroll, ensuring a smooth and efficient process.

Singapore Payroll Management Workflow

In order to ensure smooth and compliant payroll processing in Singapore, it is crucial to establish an efficient payroll management workflow. This workflow encompasses a series of steps to accurately calculate and disburse employee salaries while maintaining compliance with legal and regulatory requirements.

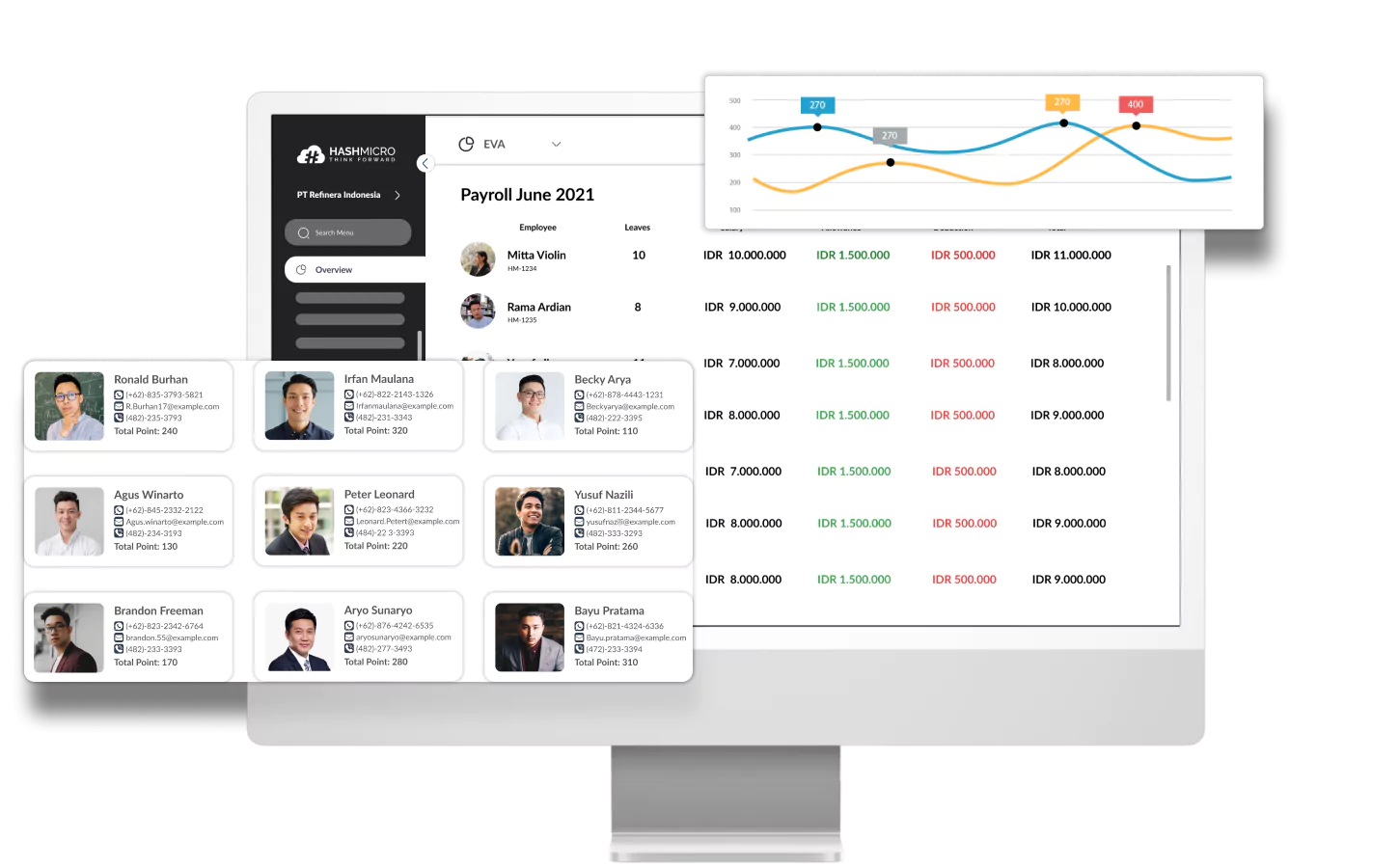

The typical payroll management workflow begins with setting up payroll systems and collecting employee data. This includes gathering important details such as employee names, identification numbers, and salary information. It is important to ensure the accuracy and cleanliness of this data to avoid errors in payroll processing.

Once the employee data has been collected and verified, the payroll processing phase begins. This involves calculating salaries based on factors such as basic wages or salary, overtime pay, allowances, and bonuses. It is crucial to accurately track and calculate these components to ensure fair and compliant payroll management.

After the salaries have been calculated, payslips are generated and issued to employees. These payslips provide a transparent breakdown of an employee’s salary, including the various components and deductions. Payslips should be clear and easily understandable to ensure transparency and avoid any confusion.

Aside from processing salaries and issuing payslips, payroll management also involves submitting statutory requirements and preparing yearly income tax reports. These tasks may include making CPF contributions, paying levies such as the Skills Development Levy (SDL) and Foreign Worker Levy (FWL), and ensuring compliance with income tax regulations. It is important to stay up to date with the latest changes in regulations to avoid any penalties or legal issues.

Key points:

- Establishing an efficient payroll management workflow is crucial for smooth and compliant payroll processing in Singapore.

- The workflow includes setting up payroll systems, collecting and cleaning employee data, processing payroll, issuing payslips, and fulfilling statutory requirements.

- Accurate calculation and timely payment of salaries, as well as compliance with regulations, are essential for maintaining employee satisfaction and legal compliance.

- Partnering with payroll service providers can help businesses streamline their payroll processes and ensure compliance with payroll regulations.

Singapore Social Security System

In Singapore, the social security system plays a crucial role in ensuring the well-being of employees. The cornerstone of this system is the Central Provident Fund (CPF), which serves as a mandatory social security savings plan for both employers and employees. The CPF provides a comprehensive range of benefits, including healthcare, retirement, and social welfare.

As an employer, it is your responsibility to remit the mandatory CPF contributions to the CPF Board for eligible employees, which includes Singapore Citizens and Singapore Permanent Residents. These contributions are calculated based on different age groups and employee wages, ensuring that individuals have access to financial security throughout their lives.

Providing comprehensive social security benefits, the CPF system aims to support employees in various aspects of their lives, including healthcare, housing, and retirement. By contributing to the CPF, employers demonstrate their commitment to the well-being of their employees and the overall development of Singapore’s workforce.

Compliance with CPF contributions is an essential aspect of Singapore payroll management. It is important to accurately calculate and remit these contributions on time to avoid penalties and legal issues. By fulfilling your obligations towards the social security system, you contribute to the overall stability and prosperity of both your employees and the nation.

Key Points:

- The Central Provident Fund (CPF) is Singapore’s mandatory social security savings plan.

- Employers must remit CPF contributions for eligible employees.

- The CPF provides benefits for healthcare, retirement, and social welfare.

- Compliance with CPF contributions is essential for Singapore payroll management.

Mandatory Levies and Statutory Requirements for Employers

As employers in Singapore, it is crucial to understand the mandatory levies and statutory requirements related to payroll compliance. By ensuring compliance with these regulations, businesses can avoid penalties and legal issues that may arise. Let’s take a closer look at some of the key levies and requirements that employers need to fulfill.

Social Security Contributions: CPF

The Central Provident Fund (CPF) is a mandatory social security savings plan that both employers and employees contribute to. Employers are responsible for remitting the CPF contributions to the CPF Board for eligible employees. CPF contributions cover benefits such as healthcare, retirement, and social welfare. It is essential for employers to calculate and remit the CPF contributions accurately based on the employee’s wages and age group. Compliance with CPF contributions is crucial in ensuring proper social security coverage for employees.

Skills Development Levy (SDL)

Employers in Singapore must pay the Skills Development Levy (SDL). The SDL is used to support workforce training and development programs. The levy amount is calculated based on the employee’s monthly remuneration, and it is payable for all employees (including foreign employees) who are under a contract of service with the employer. Employers need to ensure timely payment of the SDL to fulfill their statutory obligations.

Foreign Worker Levy (FWL)

The Foreign Worker Levy (FWL) is a levy that applies to employers who employ foreign workers in Singapore. The FWL is aimed at regulating the number of foreign employees in the country. The levy amount varies depending on factors such as the sector and skill level of the foreign worker. Employers need to fulfill their FWL obligations by making the required levy payments within the stipulated timeframes.

Compliance with these mandatory levies and statutory requirements is essential for employers in Singapore. By fulfilling these obligations, businesses can maintain legal compliance, provide social security coverage, and contribute to the skills development of the workforce. It is important to stay updated with any changes in legislation and ensure accurate calculation and timely payment of these levies to avoid any potential penalties or legal issues.

Individual Tax System in Singapore

When it comes to managing payroll in Singapore, it’s important to have a clear understanding of the individual tax system. Unlike some countries where employers withhold taxes from employee salaries, Singapore follows a progressive income tax system, where individuals are responsible for paying their own taxes directly to the tax authorities.

Employers in Singapore are required to provide employee remuneration returns for tax purposes, but they do not have the responsibility of withholding taxes on a monthly basis. This means that employees must file their own annual income tax returns and pay the applicable taxes based on their income level. It’s important for employers to provide accurate information to employees to facilitate their tax filing process.

Singapore follows a progressive income tax system, where individuals are responsible for paying their own taxes.

The personal income tax rates in Singapore vary from 0% to 22%, depending on the income level. Employees should familiarize themselves with the tax brackets and applicable rates to ensure compliance. To support individuals in meeting their tax obligations, the Inland Revenue Authority of Singapore provides various resources and guidelines to help taxpayers understand their tax obligations and complete their tax returns accurately.

By understanding the individual tax system in Singapore, employers can ensure that they provide the necessary information and support to their employees for tax compliance. This contributes to a smooth payroll process and helps employees fulfill their tax obligations in a timely manner.

Streamlining Payroll Management in Singapore with Payroll Software

In any organization, payroll management is a crucial function. It involves ensuring that employees are paid correctly and on time, while complying with all statutory regulations. With the ever-changing landscape of employment legislation, payroll management has become increasingly complex.

One way to streamline payroll management is to use payroll software. Payroll software is a specialized application that automates many of the tasks involved in payroll management. By using payroll software, businesses can save time and resources on payroll management.

There are many payroll software solutions available in the market. When choosing a payroll software solution, businesses should consider their specific needs and requirements. Some of the factors to consider include the size of the business, the number of employees, the frequency of payroll, and the complexity of the organization’s payroll processes.

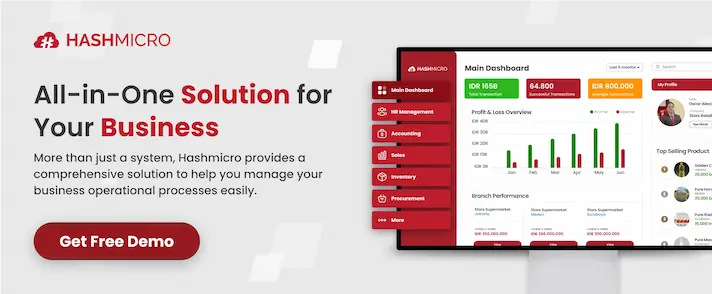

HashMicro stands out as the premier payroll software solution in Singapore, offering a comprehensive and professional service that caters to businesses of all sizes. Its robust system handles the intricate needs of modern payroll management, accommodating unlimited users and providing a suite of complete features. This makes it an ideal choice for organizations seeking a reliable and efficient way to manage their payroll.

With HashMicro, companies can navigate the complexities of payroll processes with ease, ensuring compliance with statutory regulations while streamlining operations. Its user-friendly interface and versatile functionalities make it a top choice for businesses aiming to optimize their payroll management in a dynamic legislative environment. Also, tax calculation is no longer a problem since its system can automate tax calculations.

Conclusion

In conclusion, understanding Singapore payroll is vital for businesses operating in the country. By adhering to payroll regulations and accurately calculating salaries, businesses can ensure compliance, maintain employee satisfaction, and avoid legal issues. It is essential to follow laws such as the Employment Act, CPF contributions, levies, and income tax regulations.

Establishing an efficient payroll management workflow is key. This includes setting up payroll systems, collecting and processing employee data, and submitting statutory requirements. Partnering with payroll service providers can also help streamline the payroll process and ensure accuracy and timeliness.

Warning: Undefined array key "med" in /home/hashmicr/public_html/blog/wp-content/plugins/insert-headers-and-footers/includes/class-wpcode-snippet-execute.php(419) : eval()'d code on line 281

By prioritizing compliance and efficiency in payroll management, businesses can maintain smooth operations and avoid penalties or legal consequences. By integrating advanced payroll software, a company can significantly streamline its payroll processes, ensuring more efficient and accurate financial management. Contact HashMicro today and claim the free demo!