As businesses in Singapore face rising compliance demands and complex financial operations, relying on manual processes is no longer effective. Without efficient accounting software, companies risk costly mistakes and delays.

Automated accounting software simplifies invoicing, payroll, tax compliance, and reporting in one solution, reducing errors and saving time. This allows businesses to focus on growth and efficiency.

Looking for the best accounting tools? We’ve researched for you. Explore our list of the top 22 accounting software options, including HashMicro, and find the perfect fit for your business. Ready to see it in action? Try our free demo now!

Key Takeaways

|

What is Cloud Accounting Software?

Cloud accounting software is a digital solution that helps businesses manage financial records through an internet-based system. It securely stores data on remote servers, enabling access from anywhere with a secure login. It also tracks debit and credit transactions, ensuring an accurate financial analysis report and balance management.

Cloud-based platforms eliminate the need for installations and updates, offering real-time access to financial reports like income statements, cash flow, and tax filings. Cloud-based accounting works by using secure web-based software to help streamline business processes. They help businesses stay organised and compliant, while supporting managerial accounting with insights into operational costs and performance.

Large businesses in Singapore increasingly favor cloud accounting software. This software offers remote management and ensures compliance with IRAS and ACRA filings. It also facilitates seamless collaboration with accountants, catering to the complex needs of businesses of all sizes.

Key Features of Cloud Accounting Software

Cloud-based accounting platforms typically have features that automate financial tasks and improve economic performance. These features may vary across providers, but core functions include:

- Transaction Recording: Tracks and logs income, expense & cost, and payments automatically.

- Invoicing & Billing: Generates, sends, and follows up on customer invoices.

- Tax Compliance: Calculates GST and generates tax reports aligned with Singapore’s IRAS accounting software standards.

- Financial Reporting: Provides statements like balance sheets, P&L reports, and cash flow analysis.

- Bank Reconciliation: Matches bank feeds with recorded transactions for greater accuracy.

- Multi-Currency Support: Converts and records transactions in multiple currencies for global operations.

- User Access Controls: Assigns role-based permissions to maintain financial data security.

- Integration Capabilities: Syncs with systems like CRM, HR, payroll, and inventory for seamless operations.

These functions enable businesses to reduce human error, reduce repetitive work, and stay tax-compliant with up-to-date financial insights.

Advantages of Using Cloud Accounting Software

Investing in cloud accounting software brings multiple benefits for businesses in Singapore. Here’s how it adds value to financial operations:

1. Improves financial accuracy: Cloud accounting systems help reduce manual errors by automating data entry, reconciliation, and reporting. This accuracy ensures that your financial statements reflect the true health of your business and meet compliance standards.

2. Enables real-time access: Cloud systems update automatically and are accessible from any internet-connected device. Business owners and finance teams can log in to check balances, generate reports, or approve payments anytime, even on the go.

3. Streamlines tax and regulatory compliance: Singapore-based software often includes features that align with local tax regulations, including IRAS-compliant e-invoicing and GST computation. This simplifies financial audits and reporting.

4. Saves time and resources: Automated bank feeds, invoice generation, and recurring transactions free up time for finance teams to focus on strategy rather than manual entry.

5. Scales with your business: Cloud accounting platforms are built to grow with your company. Whether you add new users, open new branches, or integrate with other software, these systems offer flexibility and scalability without overhauling your workflows.

6. Enhances collaboration: Multiple users can access the system simultaneously, allowing internal teams and external advisors, such as auditors or accountants, to collaborate in real time. This flexibility is also valuable for businesses using the best accounting software for transport company, streamlining financial tasks like inventory tracking, sales, and service revenue management.

22 Best Cloud Accounting Software in Singapore for 2026

Singapore offers a competitive accounting software landscape, with tools catering to different industries and business sizes. Here’s a list of 22 top-performing accounting software solutions worth considering:

1. HashMicro Accounting Software

Is your current accounting system unable to keep up with the increasing complexity of your growing business in Singapore? As companies expand, financial operations become more intricate, often leading to inefficiencies, costly errors, and missed opportunities for optimization.

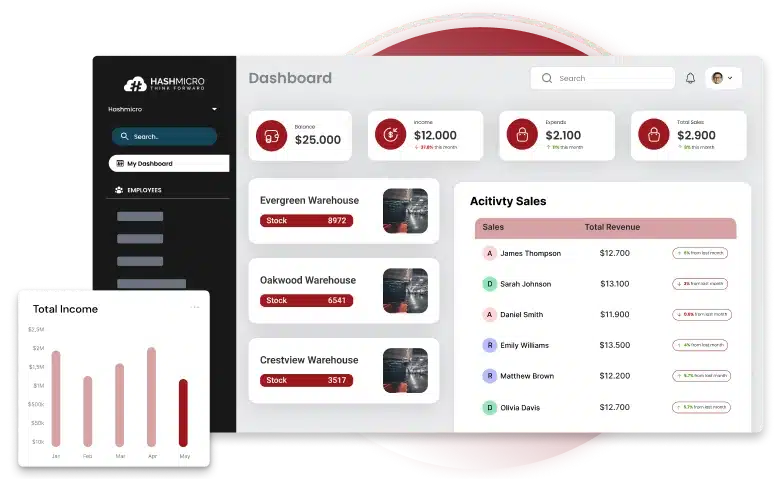

HashMicro Accounting Software is specifically designed for businesses with high operational complexity, providing real-time visibility into every aspect of your financial operations. From tracking expenses to ensuring tax compliance, this comprehensive platform streamlines your processes, keeps your financial data accurate and up-to-date, and empowers you to make more informed decisions.

Here are some of the key features of HashMicro Accounting Software that can help streamline your financial operations and drive greater efficiency for your business:

- Bank Integrations – Auto Reconciliation & Payment: By automatically reconciling and processing payments through integrated bank connections, you reduce manual errors and save time, allowing for faster, more accurate financial operations.

- Multi-Level Financial Analysis: Comparing financial statements across different levels (projects, branches, etc.) can help you gain a deeper understanding of your financial health, enabling better strategic decision-making.

- Profit & Loss vs. Budget & Forecast: By directly comparing actual profit and loss with your budget and forecasts, you can easily identify discrepancies and adjust your financial strategy to stay on track.

- Cash Flow & Budget Forecasting: Generating cash flow reports and forecasting budgets gives you a clear view of your future financial situation, helping you plan for potential cash shortages or surpluses.

- Financial Statements with Budget Comparison: Financial statements that include budget comparisons allow you to quickly assess financial performance and make necessary adjustments to ensure profitability.

- Customizable Invoices: By customizing invoices to suit different business needs, you can enhance professionalism and accuracy in client transactions, improve customer satisfaction, and speed up payments.

- Multi-Company & Inter-Company Transactions: Managing multiple companies and inter-company transactions from one platform simplifies financial consolidation, providing a unified view of your financial performance across all entities.

Don’t let inefficiencies slow down your business growth. Click the banner below to learn more about how HashMicro Accounting Software can streamline your financial processes. Get details on pricing and find the perfect solution for your business today!

2. QuickBooks Online

Known for its simple UI and powerful features like expense tracking and customized reports, QuickBooks is an online accounting software that is ideal for contractors. It helps manage project costs, invoicing, and compliance, making it perfect for SMEs needing automation and insights to streamline operations.

3. SAP Business One

An enterprise-grade financial management system like SAP Accounting System integrates accounting with operations and supply chain processes. It is best for mid- to large-sized companies.

4. Oracle NetSuite

A full-scale ERP system with strong accounting capabilities, perfect for businesses seeking scalability and deep financial analysis.

5. Xero

Xero Accounting Software is popular among startups and small businesses for its clean design, online invoicing, and real-time financial dashboards.

6. Sage Business Cloud Accounting

Supports local compliance and provides clear tools for invoicing, expense management, and project costing.

7. Zoho Books

Great for businesses already using the Zoho suite. Includes automated banking, GST reports, and multi-user collaboration tools.

8. MYOB Accounting

A trusted brand such as MYOB Accounting Software offers desktop and cloud accounting versions. Known for tax compliance features and cash flow management.

9. Wave

Wave Accounting offers free accounting tools with paid payroll and payment add-ons. Suitable for freelancers or micro-businesses.

10. Financio

Aimed at small businesses in Singapore, with local tax support, multilingual UI, and integration with IRAS for e-invoicing.

11. FreshBooks

Designed for service-based businesses, offering features like time tracking, invoicing, and project-based reporting.

12. SmartCursors

Combines accounting and operations tools with strong data protection and analytics—ideal for growing businesses needing real-time visibility.

13. Highnix

Enterprise-grade ERP with built-in accounting and compliance tools tailored for Singapore’s regulatory landscape.

14. Aspire

All-in-one financial platform with expense management, payments, and real-time reporting. Suitable for tech-savvy SMEs.

15. Trulysmall Accounting

Lightweight cloud solution for freelancers or small businesses looking for a simple, no-frills bookkeeping tool.

16. ZipBooks

User-friendly cloud accounting with brilliant insights and financial health indicators. Best suited for startups and small service businesses.

17. AccountEdge Pro

Offline accounting software for Mac users offers invoicing, payroll, and multi-user access for desktop environments. It’s beneficial for construction accounting, helping manage job costing, project budgets, and equipment expenses, ensuring accurate financial tracking for each project.

18. KashFlow

Tailored for UK businesses but available globally, KashFlow accounting software easily handles VAT, payroll, and bank integration. It’s also an excellent choice for accounting software for transport companies, offering features to manage fleet expenses, fuel costs, and route profitability.

19. Akaunting

An open-source cloud platform with invoicing, expense tracking, and basic financial reporting, ideal for developers or businesses needing more control. It’s also useful for carbon accounting, helping companies to track their carbon footprint and manage sustainability goals alongside financial data.

20. Kashoo

Straightforward, mobile-first software built for small business owners who need basic accounting with minimal setup.

21. Lightspeed Accounting

Part of an all-in-one retail and restaurant POS system with accounting integrations, inventory, and customer tracking.

22. ABSS (formerly MYOB Singapore)

Popular among SMEs for its intuitive layout, inventory accounting management, and localized payroll support.

Also Read: How to Use Rebates in Retail Business

How to Choose the Best Accounting Software for Your Business

Selecting the best accounting software in Singapore requires more than comparing features. It means evaluating your current needs, potential future growth, and the regulatory landscape you operate in.

Here’s a step-by-step guide:

1. Assess your business size and complexity: Start with understanding your daily transaction volume, number of employees, and the complexity of your financial operations. A retail shop may need POS integration, while a consultancy firm may prioritise project-based billing.

2. Identify must-have features: List core features you need, such as GST tracking, multi-currency support, or e-invoicing. Determine whether you need mobile access, reporting tools, or integrations with existing HR, inventory, or CRM systems.

3. Choose cloud vs on-premise: Cloud solutions are ideal for businesses that value remote access, easy updates, and lower IT maintenance. On-premise software may suit those needing more control over data storage.

4. Evaluate pricing and support: Compare pricing tiers based on user limits, feature sets, and support availability. Don’t forget to factor in hidden costs like setup fees, training, or additional modules.

5. Consider scalability: Think long term. Choose software that can support growth, whether by adding more users, managing more transactions, or integrating with more business tools.

6. Prioritise local compliance: Look for solutions that support IRAS e-invoicing, ACRA reporting standards, and local tax codes. This ensures smoother operations and fewer headaches during audits.

7. Test before you buy: Take advantage of free demos, trials, or consultation sessions. Seeing the interface and workflow in action will help you make an informed decision.

Conclusion

Accounting software is a critical tool for large businesses that aim to stay financially healthy, compliant, and adaptable in today’s fast-evolving environment. In Singapore, where tax regulations and digital transformation are rapidly changing, the right cloud-based solution can make a significant difference in maintaining operational efficiency and compliance.

For large enterprises, it’s essential to choose software that can scale with your complex needs and provide the flexibility to manage multiple departments, projects, or locations. Start by identifying the core features that will best support your operations.

If you’re ready to streamline your financial processes, minimize errors, and gain real-time insights into your cash flow, HashMicro’s Accounting Software is the ideal choice. Get started with a free trial system today!

Warning: Undefined array key "med" in /home/hashmicr/public_html/blog/wp-content/plugins/insert-headers-and-footers/includes/class-wpcode-snippet-execute.php(419) : eval()'d code on line 281

FAQ About Accounting Software

-

What core features should accounting software include?

Accounting managers typically look for software that covers all essential financial functions—such as general ledger, accounts payable and receivable, journal entries, tax calculation, and financial reporting. Advanced capabilities like cash flow forecasting, asset depreciation tracking, and financial ratio analysis are also valuable for strategic planning.

HashMicro’s Accounting Software offers a full suite of core features, including automated journal entries, financial budgeting and realization, real-time reporting, and multi-level analysis—making it a complete solution for managing both day-to-day transactions and long-term financial health.

-

Does the software support local tax regulations and financial reporting standards?

Compliance with local laws is a non-negotiable factor when choosing accounting software in Singapore. Managers need tools that handle GST reporting, IRAS e-invoicing, and ACRA-compliant financial statements with minimal manual effort.

HashMicro’s Accounting Software is fully equipped for Singapore’s regulatory landscape, with built-in IRAS e-invoicing integration, GST automation, and reporting features that meet local tax standards, ensuring stress-free audits and accurate submissions.

-

Can the software integrate with other business systems (ERP, CRM, HR, inventory)?

Accounting doesn’t work in isolation. Managers often require software that connects seamlessly with other systems to avoid data silos and manual duplication—especially with CRM, procurement, HR, inventory, and sales.

HashMicro’s Accounting Software is part of a larger modular ecosystem that integrates directly with its ERP, CRM, procurement, and inventory systems. This allows businesses to unify financial and operational data in one platform, making tracking profitability, managing costs, and streamlining workflows across departments easier.