If you’re a business owner, dealing with late payments can be a frustrating problem that’s becoming more common. In Singapore, slow payments are on the rise, with the Singapore Commercial Credit Bureau reporting an increase to 44.05%, the highest in six quarters.

Poor management of trade receivables can lead to liquidity issues and increased bad debts, affecting both supplier and customer relationships. Without effective management, businesses risk falling behind their competitors and losing revenue.

The good news is that there are proven strategies and accounting softwares which helps businesses track key metrics. customize credit policies, and speed up the collection process using an integrated payment solution.

Many businesses have already transformed their financial health by adopting these strategies. Want to know how you can do the same? Keep reading to discover the importance of trade receivables, how to calculate key metrics, and actionable tips to optimize your receivables management.

Table of Content:

Table of Content

Key Takeaways

|

What Is Trade Receivable and How Does It Work?

Trade receivables represents the money owed to a business by its customer for goods or services sold on credit. Unlike a typical sale where payment is received immediately, trade credit allows customers to pay later, usually within a specified period such as 30 or 60 days.

This arrangement can maintain strong relations with customers and increase sales by offering more flexible payment terms. This transaction creates a financial claim (accounts receivable) for the seller and a financial obligation (accounts payable) for the customer.

Once payment is received from the customer, the trade receivable in the balance sheet would then be moved from the “Accounts Receivable” line item to the “Cash” line item.

In essence, trade receivables represent the credit terms a business extends to its customers and the trust placed in them to fulfill their payment obligation. Effective management of trade receivables ensures timely collections, reduces the risk of bad debts, and supports overall financial stability.

Trade Receivables vs. Accounts Payable vs. Accounts Receivable

While trade receivables and accounts receivable are often used interchangeably, there are subtle differences between them. Similarly, accounts payable represents a different aspect of a company’s financial obligations.

| Aspect | Trade Receivable | Account Receivable | Account Payable |

|

Definition |

Money owed by customers for goods/services sold on credit. | All money owed to a business, including trade receivables. |

Money owed by a business to suppliers/vendors. |

|

Type |

Current Asset | Current Asset | Current Liability |

|

Scope |

Specific to sales of goods/services. | Broader, includes all receivables. | Specific to purchases of goods/services. |

|

Impact on Cash Flow |

Represents future cash inflows. | Represents future cash inflows. |

Represents future cash outflows. |

| Example | A customer owes $10,000 for products purchased on credit. |

Includes trade receivables, loans, and other receivables. |

A business owes $5,000 to a supplier for raw materials. |

While trade receivables and account receivable help businesses track money owed to them, accounts payable helps businesses manage their financial obligation to suppliers. Proper management of all three is crucial for accurate financial reporting, effective cash flow management, and overall business sustainability.

Importance of Trade Receivables Towards Business Performance

The addition of trade receivables to a business’s balance sheet would provide a better representation of its overall financial health and performance, particularly as a metric for evaluating the strength of a company’s cash flow and credit policies. A well managed trade receivables position would bring a significant benefit to a business in several ways:

1. Cash flow management

Trade receivables represent future cash inflows. Efficient management ensures that businesses have the liquidity needed to cover expenses, pay suppliers, and invest in growth. Delayed payments can strain cash flow, leading to operational challenges.

2. Liquidity and working capital

High levels of trade receivables can tie up working capital, making it difficult for businesses to meet short-term obligations. By optimizing receivables, companies can free up cash and improve liquidity.

3. Financial health and creditworthiness

Lenders and investors often assess a company’s trade receivables to evaluate its financial health. A high turnover ratio and low receivable days indicate efficient operations and strong creditworthiness.

4. Customer relationships

Trade receivables reflect the credit terms offered to customers. Striking the right balance between lenient credit terms and timely payments is crucial for maintaining strong customer relationships while ensuring financial stability.

5. Risk of bad debts

Uncollected receivables can turn into bad debts, impacting profitability. Effective management minimizes this risk by identifying and addressing slow-paying customers early.

Trade Receivables Formula and How to Calculate it

Calculating trade receivables is essential for understanding how efficiently your business collects payments from customers. Two key inputs will need to be determined: Net Credit Sales and Average Trade Receivables. These inputs would later be used to calculate main metrics: Trade Receivable Turnover Ratio and Trade Receivable Days.

Step 1: Calculate Net Credit Sales

Net Credit Sales represent the total sales made on credit, excluding cash sales, sales allowances, and sales returns. The formula is:

total sales – sales allowances – sales returns.

Example: If a company has total sales of $1 million, cash sales of $200,000, and sales returns of $50,000, the Net Credit Sales would be calculated as:

$1,000,000 – $200,000 – $50,000 = $750,000.

Step 2: Calculate Average Trade Receivables

Average Trade Receivables represent the average amount of receivables over a specific period. Using an average provides a more balanced view of receivables rather than focusing on a single point in time. The formula is:

(Opening Receivables + Closing Receivables) / 2

Example: If the company had trade receivables of 250,000 at the start of the year and $150,000 at the end of the year, the Average Trade Receivables would be:

($250,000 + $150,000) / 2 = $200,000.

Step 3: Calculate the Trade Receivable Turnover Ratio

The Trade Receivable Turnover Ratio measures how often your business collects its receivables within a specific period. It indicates the efficiency of your credit and collection processes. The formula is:

(Net Credit Sales / Average Trade Receivables)

Using the example above:

1,000,000 / 200,000 = 5

This means the company collects its receivables 5 times a year.

Step 4: Calculate Trade Receivable Days

The Trade Receivable Days formula calculates the average number of days it takes to collect payments from customers. It provides a clearer picture of your cash flow cycle. The formula is:

(Average Trade Receivables / Net Credit Sales) × 365

Using the same example:

(200,000 / 1,000,000) × 365 = 73 days

This means it takes the company an average of 73 days to collect payments from customers.

Why These Metrics Matter

- A high turnover ratio and low receivable days indicate efficient collection processes and healthy cash flow.

- A low turnover ratio and high receivable days may signal issues like slow-paying customers or ineffective credit policies.

By regularly calculating these metrics, businesses can identify areas for improvement and take proactive steps to optimize their receivables management.

How To Improve Trade Receivables Turnover Ratio and Boost Cash Flow

As been stated before, while having the addition of trade receivables to a business’s balance sheet is important for its overall financial health, it would also be critical to make sure that payments are being collected in a timely manner to avoid issues regarding cash flow and liquidity. Therefore, some strategies that businesses can implement to reduce trade receivables and improve cash flow include:

1. Offer early payment discounts

Incentivize customers to pay sooner by offering discounts for early payments. For example, a 2% discount for payments within 10 days can encourage faster settlements.

2. Negotiate partial payments

Oftentimes, the biggest reason for delayed payments would be financial difficulties. In such cases, consider negotiating partial payments. This would ensure that cash inflow is still secure while maintaining positive customer relations.

3. Set clear payment terms

Clearly define payment terms in contracts and invoices. Specify due dates, late payment penalties, and acceptable payment methods to avoid misunderstandings.

4. Conduct Credit Checks

Before extending credit, assess the creditworthiness of customers. This reduces the risk of non-payment and ensures that credit terms are offered only to reliable clients.

5. Use robust accounting software

Investing in the best accounting software can significantly improve how you manage trade receivables. It helps track payments and generate real-time reports, essential for maintaining healthy cash flow and avoiding payment delays.

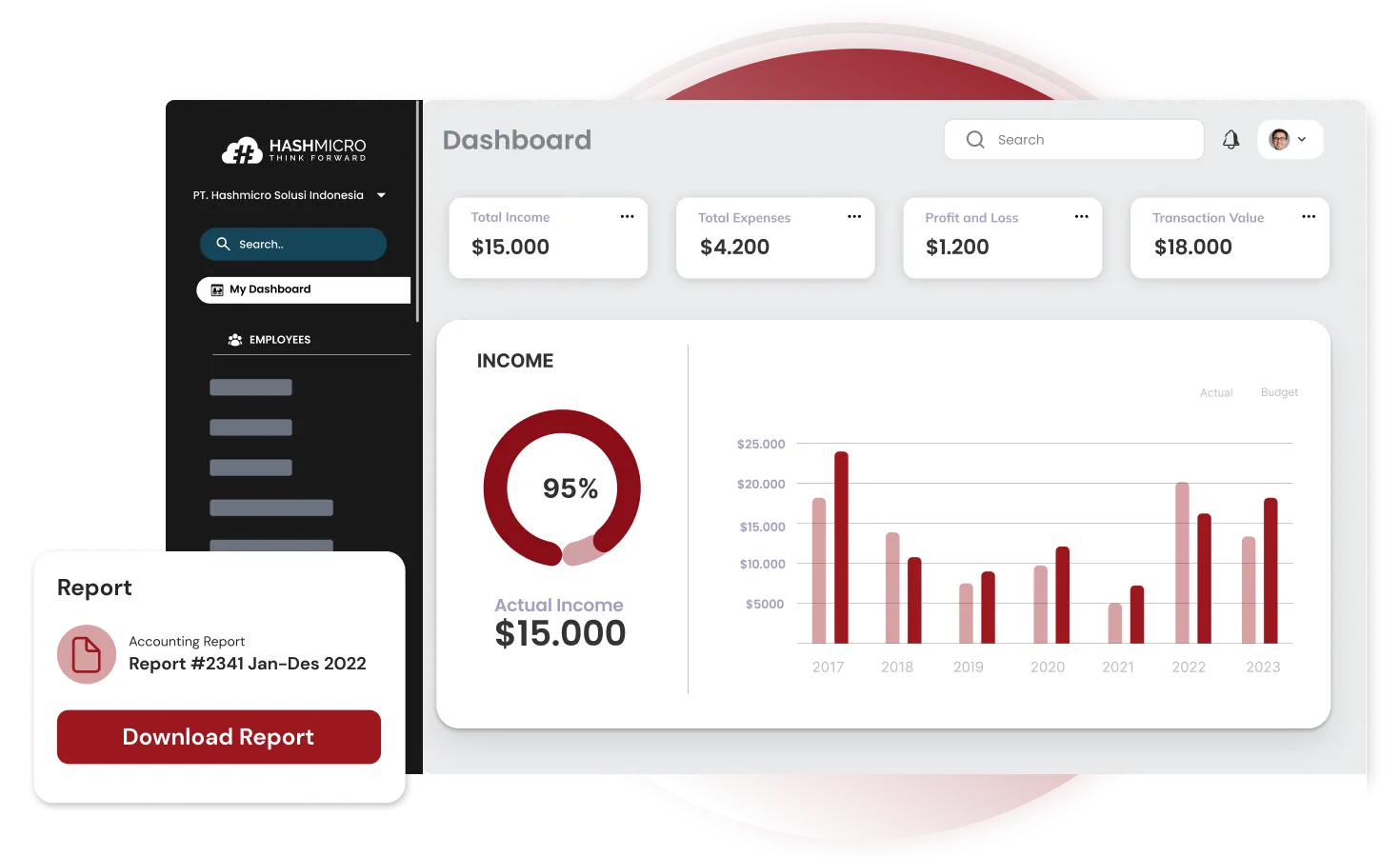

Different types of accounting software offer unique features tailored to specific business needs. Understanding these differences ensures you find the perfect fit to enhance your operations. HashMicro’s Accounting Software provides advanced functionalities to optimize your financial management strategy.

Optimize Trade Receivables With HashMicro Accounting Software

A manual process for managing trade receivables is prone to errors and can lead to delayed payments. Even a software with limited functionality may not provide the transparency and insights needed to optimize receivables. HashMicro’s Accounting Software offers comprehensive features to help businesses manage their trade receivables with great efficiency. Some key benefits include:

- Automated invoice tracking

HashMicro’s software automates the entire invoicing process, from generating invoices to sending payment reminders. This ensures timely follow-ups and reduces the risk of delayed payments. - Real-time reporting

With real-time reporting features, you can monitor your trade receivables at a glance. Track key metrics like the trade receivable turnover ratio and trade receivable days to make informed decisions. - Integrated payment solutions:

The software integrates with payment gateways, allowing customers to pay invoices online. This speeds up the collection process and improves cash flow. - Customizable credit policies:

Set and enforce credit terms tailored to your business needs. HashMicro’s software helps you manage credit limits, payment terms, and customer creditworthiness effectively. - Comprehensive aging reports:

Generate detailed aging reports to identify overdue accounts and take timely action. This feature helps you prioritize collections and reduce bad debts.

Conclusion

Trade receivables are a critical component of financial management, especially for businesses facing cash flow challenges. By understanding their importance, calculating key metrics, and implementing effective strategies, companies can improve liquidity and sustain growth.

Investing in the best accounting software can make a significant difference in managing receivables efficiently. HashMicro’s Accounting Software offers advanced features to streamline receivables management, from automated reminders to real-time tracking. Optimize your trade receivables management today.

Feel free to contact us and book a free demo to discover how HashMicro can help your business thrive.

Frequently Asked Questions Surrounding Trade Receivable

-

Is receivables a creditor or debtor?

Receivables are considered debtors because they represent money owed to your business by customers.

-

Are trade receivables good or bad?

Trade receivables are neither inherently good nor bad. They are a normal part of business, but poor management can lead to cash flow issues.

-

What is the ideal trade receivable turnover ratio?

The ideal ratio varies by industry, but a higher ratio generally indicates efficient collection of receivables.