Have you heard of the phrase “exit strategy”? This term is well known among large enterprises, but small and medium-sized businesses may have never heard of it and may be unaware of its meaning.

In some instances, people mistakenly believe that the exit strategy for a business is the same strategy for trading on the stock market when in fact, it is different.

The primary goal of using an exit strategy is evaluating the business. Any potential exit will affect the decisions the business makes regarding its structure. Overall, the business’s exit strategy is to ensure that you gain a substantial profit; however, this is just one of many strategies that a business owner can use to increase profits for your financial business.

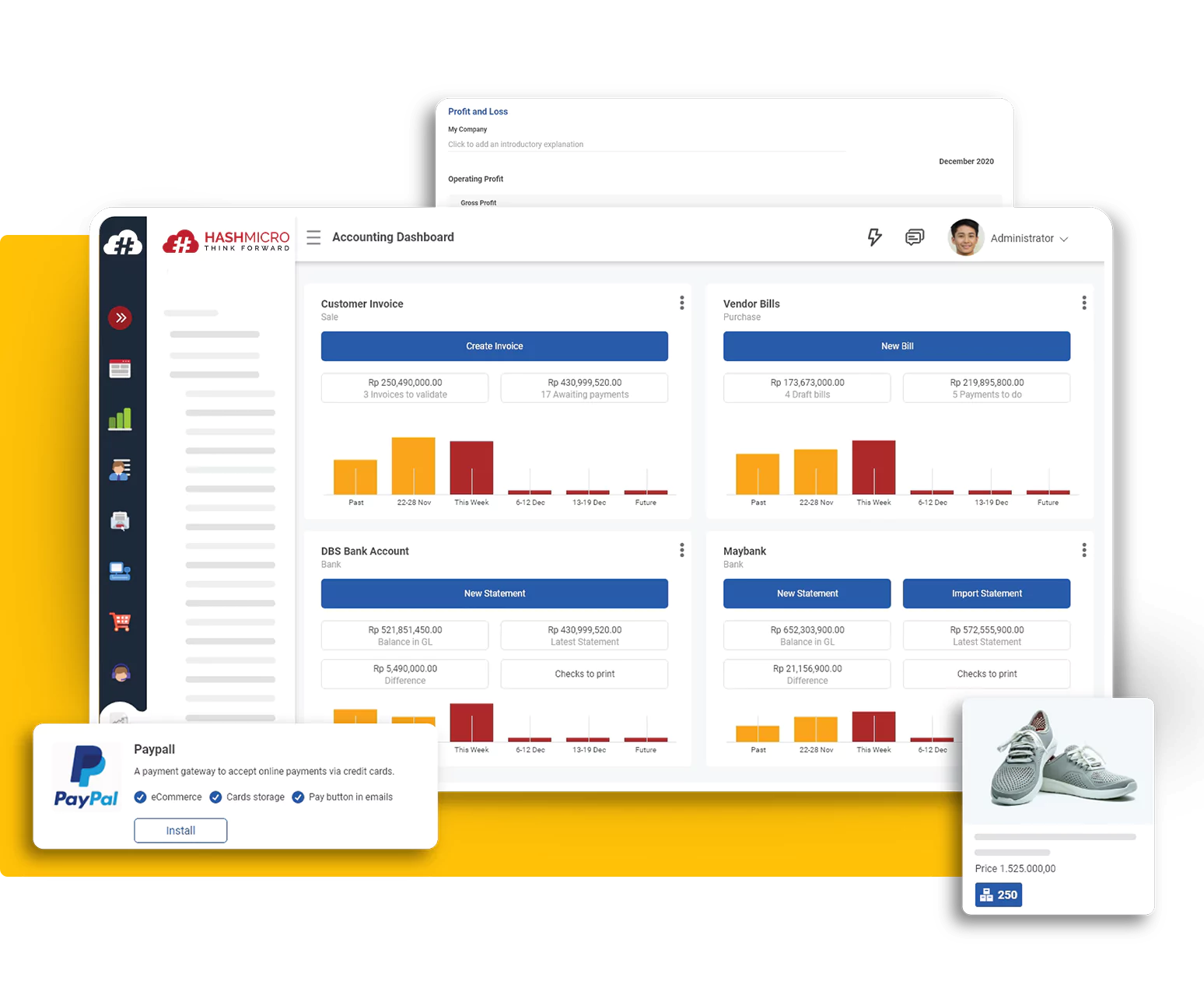

Another strategy you could choose is using Financial Software to better manage your company’s finances to ensure that it is always profitable and continues to thrive. You may download the pricing scheme here to know the estimated price of the software.

Also read: Get to know the term gross profit in the business world

What is an Exit Strategy?

Simply put, an exit strategy is a plan for getting out of an investment. The best way to do an existing strategy is to sell the investment for more money than you originally paid for it or after making a profit.

Individual investors, venture capitalists, stock traders, and business owners are utilizing exit strategies to determine whether or not it is the appropriate time for them to withdraw from an investment. In terms of timing, when and under what circumstances an exit may occur, each exit strategy plan is specific to its situation.

Following the brief description of ‘exit strategy,’ you may wonder, “So, what is an exit strategy in business?” A business’s exit strategy is a plan developed by an entrepreneur to sell the ownership stake in a company by selling it to investors or another business.

An exit strategy provides a mechanism for a company owner to decrease or liquidate their ownership in a company. If the business is successful, it will earn a significant profit from the stock sale.

And if it’s unsuccessful, an “exit plan” gives the entrepreneur the ability to cut their losses. An investor, such as a venture capitalist, may also utilize an exit strategy to arrange for the sale of an investment’s holdings to generate cash flow. Business exit strategies are not the same as trading exit strategies used in financial markets.

How Business Exit Strategies Work

A business exit strategy is a plan an entrepreneur should pay attention to. It’s one of the important aspect need to be created in the business plan. Before starting a business, entrepreneurs should include an exit strategy in their first business plan because choosing an exit strategy can affect how a business grows. There are a few business exit strategies you may choose, such as;

- Initial public offerings (IPOs)

- Strategic acquisitions

- Management buyouts are all common types of exit strategies (MBOs).

Entrepreneurs choose the business exit strategy depending on many things, like how much control or involvement (if any) they want to keep in the business, whether entrepreneurs want the company to be run the same way after they leave or if they are willing to see it change as long as they’re paid well to sign off.

With a strategic acquisition, for example, the founder will no longer be responsible for the ownership, but they will also lose control. IPOs are often seen as the holy grail of ways to get out of a business because they often bring the most prestige and the most money. On the other hand, most people think going bankrupt is the worst way to leave a business.

Also read: Top Digital Payment Trend in 2022

Exit Strategy Example

1. Exit strategies for a business

It depends on the business type; there are various ways for the business owner to plan for a smooth exit strategy. In the case of a family-run business, for instance, an exit strategy could center on the owner’s retirement. The exit strategy of this type of business has two ways; selling the company or passing it on to the next generation (if you intend to retire at a certain point in the future).

Or in the worst case, if a company is losing money and showing no signs of turning a profit, the owner may think about taking such drastic action, which is to liquidate all of the company’s assets and shut down operations. It allows a business owner to settle debts and dissolve an insolvent company.

2. Exit strategy for trader/investors

Speaking of an exit strategy for investors, there are various metrics investors can use to determine when to leave an investment. Let’s say, as an investor, you invest in 100 shares of XYZ stock. You could base the planning of your exit strategy on the following:

- The investment’s expected rate of return,

- The maximum loss that the investment can incur

- The investment’s intended holding period.

Let’s assume you invested $1,000 and want a 10% return on your money by buying 100 shares. Once you reach 10%, you can cash out while the market rises and make a profit. An alternative way is to limit your maximum loss to 5%.

So when the stock price drops by 5%, you may consider selling to prevent further losses. Time can also be the guide as a strategy to leave the investment. If you’re 30 and prefer buy-and-hold, you may plan to sell years from now.

If you’re interested in day trading and short-term gains, you might find day trading groups helpful for insights, as you might have a shorter exit window. You may also consider options trading services as an option to maximize returns before you plan your exit strategy as an investor.

3. Exit strategy for startups

Startups or larger enterprises might have more complicated exit strategies. The following are some examples of possible departure strategy plans:

- Initial an Initial Public Offering (IPO) to exit.

- Merger or acquisition that enables a change in ownership.

- Selling or the liquidation of assets and the closing of the company.

IPO strategy can also benefit investors because IPO investing allows investors to purchase shares of a company when it goes public. Purchasing IPO stock could be advantageous if a new public business succeeds.

Exit Strategies: Why They Matter

A business must have a well-defined plan. A lack of a plan will lead to business failure. It is important to consider all of one’s business exit options before making a final decision. You should proceed only after careful evaluation; otherwise, you risk losing money.

In some cases, business owners must stop operating their companies to meet immediate financial needs. Having exit strategies help business owners figure out what to do next and get the most out of their exit.

Due to the inherent risk associated with investing, many venture capitalists eventually have to consider cashing out. For better financial management, Financial Software provides tools to help your business operate its finance easier and generate a comprehensive report to let you know the future business decision.

Meanwhile, instead of following the crowd, falling to emotions, or attempting to time the market, exit strategies for investors might assist in maintaining focus on the final aim. For example, if you go into an investment knowing that your exit strategy will restrict your losses to 5%, you’ll know when to sell ahead. Using an investment strategy might help you avoid tripling your losses and keep you from remaining too long in a profitable investment.

Also read: Improve Your Business Accounting Using Financial Software

How to Create a Business Exit Strategy Plan

There are a few things to be considered before starting a business exit strategy, which those are;

- Create intentions and goals for the business

The first thing that should do is to know the business owner’s personal goals and intentions. When the owner tries to do an exit strategy, whether the intention and goal are to earn profit? Or leaving a legacy?

The precise goals and tasks that need to be prioritized can be found more easily when the exit strategy’s purpose and goal have been established. The answers to the questions will help to determine whether the business will eventually be sold, merged with another, liquidated, or set up for transition through succession planning.

2. Choose a timeframe

The timeframe is another important factor. When will the owner sell? A business owner should be flexible with this timeline. When determining the parameters of this time frame, the owner of a business should leave room for flexibility.

3. Watch market conditions

Several factors should be considered, including the current supply and demand for the company’s goods or services and the market demand for businesses.

Conclusion

An exit strategy is a plan to leave an investment. Selling an investment for more than you paid or after making a profit is the best existing strategy. Investors, startups, and small or even large enterprises can use such a strategy. As for the business owner, such a strategy evaluates the company. A few things need to be considered to make an excellent exit strategy, or it will fail business structure decisions.

The business exit strategy is to ensure a substantial profit, but it’s just one of many ways to increase profits for your financial business. Using Financial Software to manage your company’s finances can help it remain profitable and successful.

Financial software provides tools to help your business operate its finances easier and generate a comprehensive report to inform future business decisions. Download the pricing scheme to know the estimated price, or try the demo version for free in your enterprise.