As businesses in Malaysia embrace digital transformation, the demand for accounts receivable automation software continues to rise.

The accounting software Malaysia market is projected to grow at a compound annual growth rate (CAGR) of 19.6% by 2030, reflecting the increasing need for efficient financial management solutions. Choosing the right software can streamline invoicing, reduce errors, and improve cash flow.

In this article, we’ll explore the top 20 accounts receivable automation software in Malaysia, helping you find the best solution for your business. Stay with us until the end to discover which platform suits your needs best!

Table of Content

Content Lists

Key Takeaways

|

What is Accounts Receivable Software?

Accounts receivable software is a digital solution designed to help businesses manage outstanding invoices, track payments, and streamline the collection process. By automating tasks such as invoice generation, payment reminders, and reconciliation, this software reduces manual errors and improves cash flow management.

It provides real-time insights into customer payments, helping businesses maintain better financial control. Whether for small businesses or large enterprises, accounts receivable software plays a crucial role in ensuring timely payments and optimizing overall financial management.

20 Best Accounts Receivable Automation Software

Selecting the right accounts receivable automation software is essential for improving the accuracy and efficiency of your financial processes. Here are 20 recommended accounting software solutions for businesses, along with a comparison of their features, functions, and benefits.

1. HashMicro accounts receivable automation software

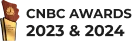

HashMicro’s accounting system is a robust solution designed to automate receivables management. It simplifies invoice processing, payment tracking, and customer communication through advanced automation features.

To help businesses better understand its capabilities, HashMicro offers a free product tour and consultation with its expert team, providing insights into how the software works and how it can be tailored to specific business needs.

With well-known clients across various industries, HashMicro has established itself as a trusted solution for businesses seeking reliable financial management tools, making it a strong choice for improving accounts receivable processes.

HashMicro’s Accounts Receivable Automation Software has features designed to optimize and simplify financial workflows. Here’s an overview of its key functionalities:

- Bank integration & automatic reconciliation: The software seamlessly connects to bank accounts, automatically matching incoming payments with outstanding invoices to ensure accurate allocation to the correct accounts receivable records.

- Budget forecasting: By analyzing historical receivables data, this tool predicts future cash inflows, providing businesses with a clearer view of expected payments and assisting in planning for upcoming expenses and investments.

- Financial ratio analysis: Calculates key financial metrics, such as the accounts receivable turnover ratio, to help businesses identify customer payment patterns and pinpoint areas that may require improved collection strategies.

- Custom invoice templates: Enables businesses to design invoices that align with branding and regulatory requirements, improving clarity and professionalism, which can encourage faster customer payments.

- Three-way matching: Ensures that invoices, received goods, and purchase orders align before processing payments, reducing the risk of overpayments, undelivered goods, and fraudulent transactions.

- Cash flow Reporting: Tracks cash inflows from receivables, helping businesses manage the timing of incoming payments and adjust credit policies or collection strategies as needed.

| Pros | Cons |

|

|

2. Sage Intacct

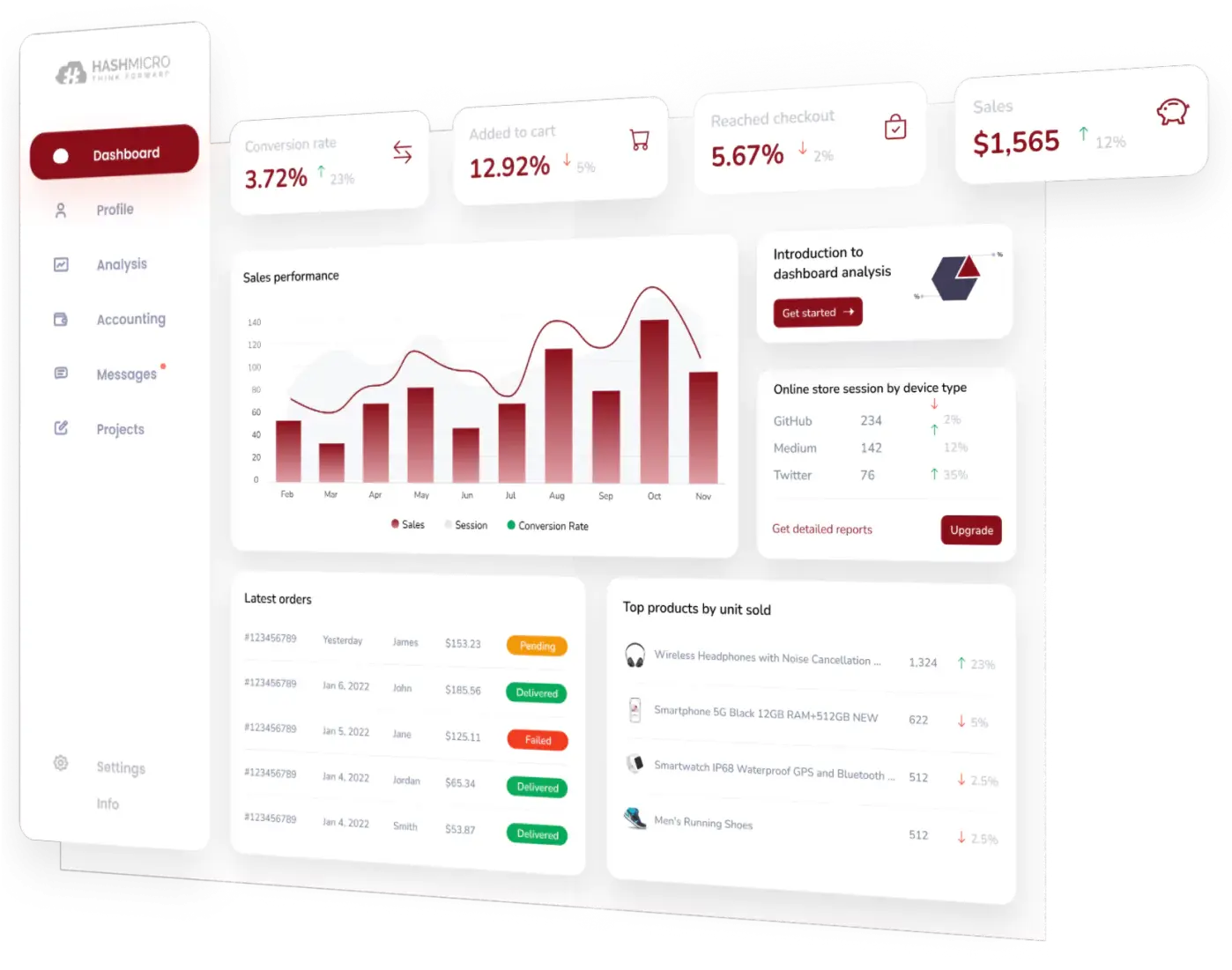

Sage Intacct provides a comprehensive solution to enhance the efficiency and accuracy of accounts receivable management. By consistently updating and synchronizing financial data, it helps businesses manage overdue payments.

The software supports various billing methods, including time-based and project-based invoicing, ensuring flexibility for different business needs. Additionally, it offers real-time visibility into payment statuses and customer account activity, while its automated dunning system streamlines the collection process for faster payments.

| Pros | Cons |

|

|

3. NetSuite

NetSuite offers accounts receivable automation software that streamlines the AR process for businesses. This solution automates essential tasks such as invoice generation, payment tracking, and account reconciliation, reducing manual effort and improving efficiency.

Key features of NetSuite include an automated billing system for seamless invoice creation and delivery, advanced financial analytics for deeper insights, and credit management tools to set and monitor credit limits while evaluating customer creditworthiness.

| Pros | Cons |

|

|

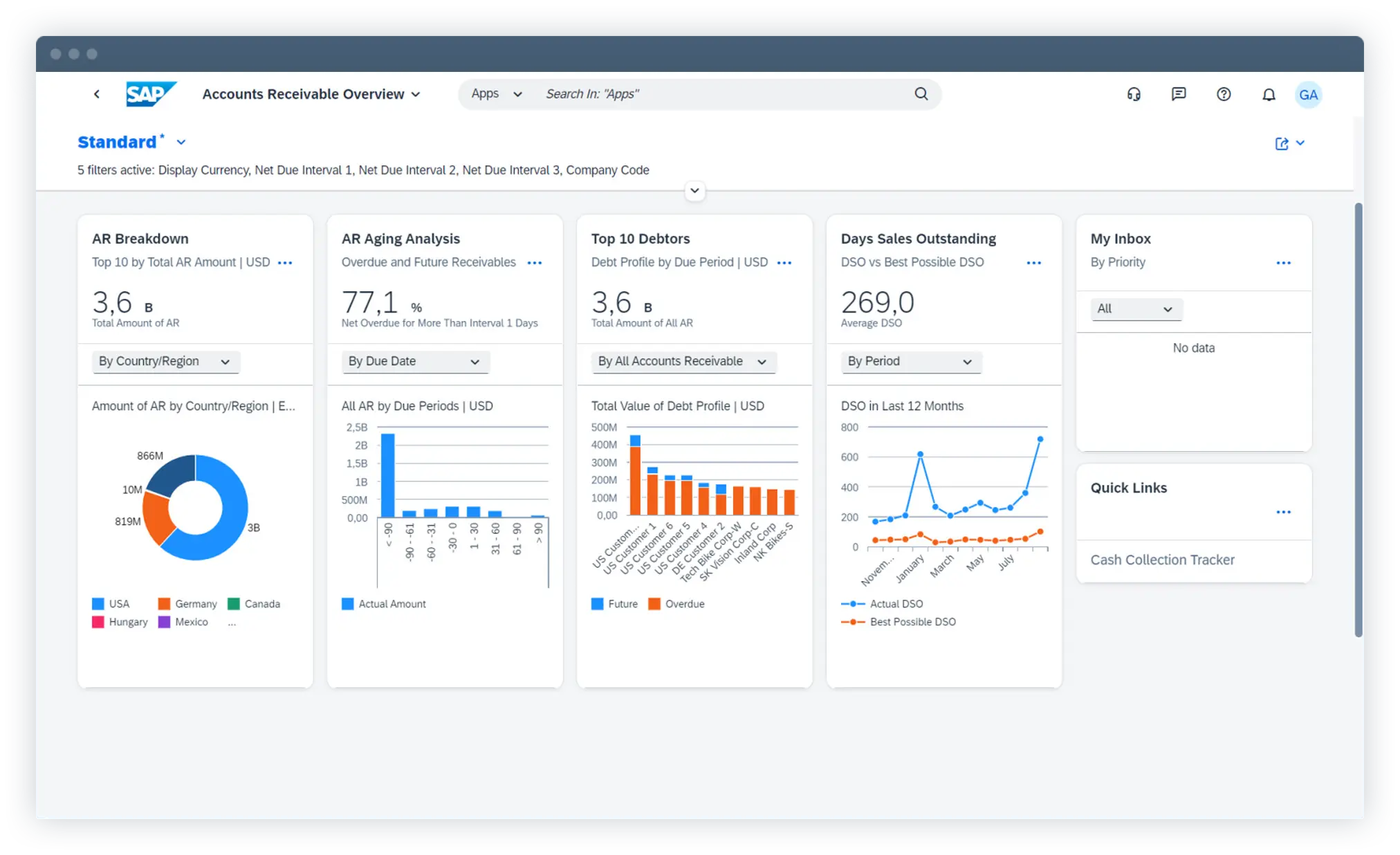

4. SAP S/4HANA accounts receivable software

SAP S/4HANA offers accounts receivable automation software that simplifies financial processes like credit management, invoice generation, and payment reconciliation, reducing the need for manual work.

Its standout features include advanced credit management tools that evaluate customer credit risk in real time and adjust credit limits based on payment history and past data.

Additionally, its powerful analytics capabilities provide in-depth insights into accounts receivable activities, helping businesses make informed financial decisions.

| Pros | Cons |

|

|

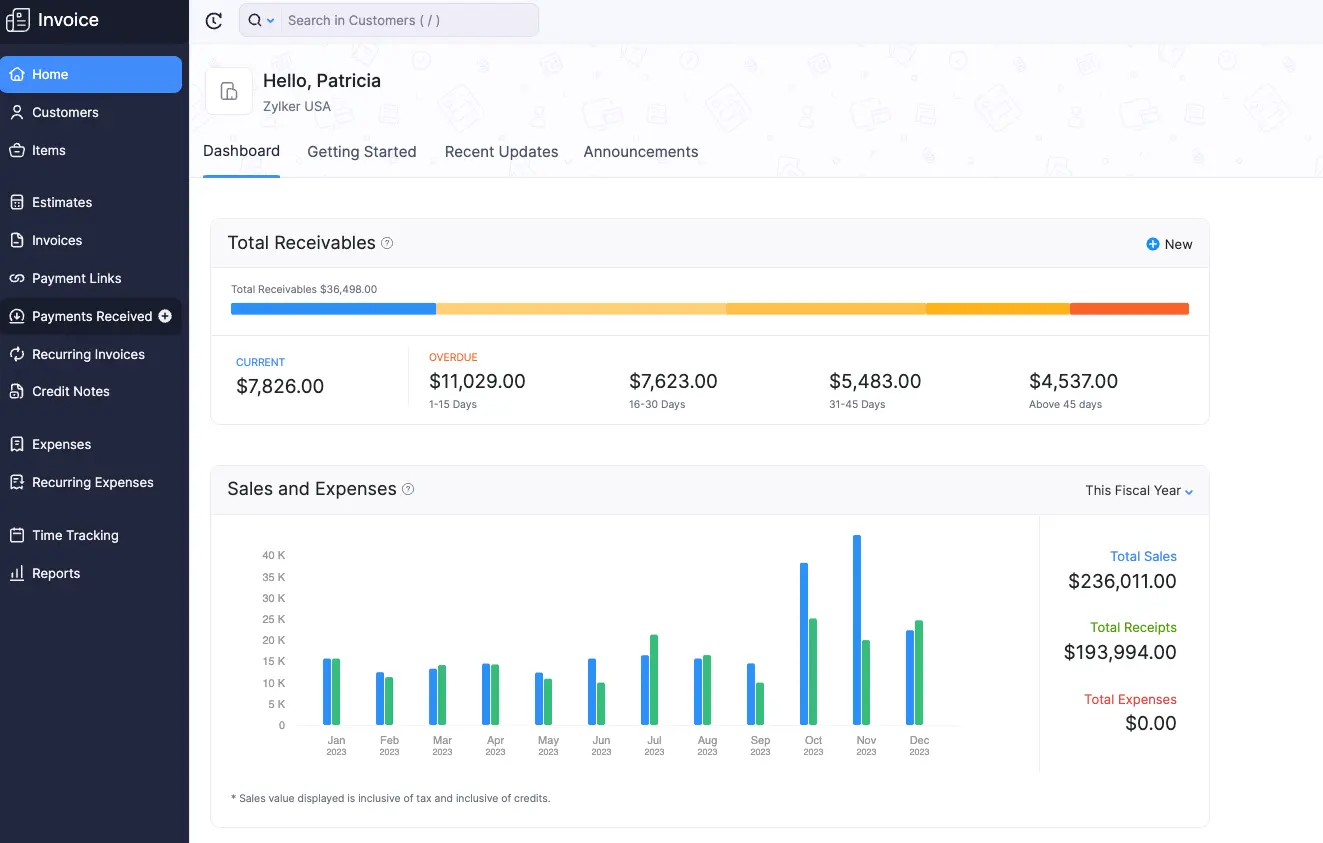

5. Zoho Books accounting system

Zoho Books is an integral component of Zoho’s financial suite, designed to simplify and automate receivables management. This accounts receivable software helps businesses track invoices, process payments, and manage customer accounts more efficiently.

Key features include advanced analytics that provides real-time insights into accounts receivable, enabling businesses to monitor aging summaries and assess customer payment behaviors effectively.

| Pros | Cons |

|

|

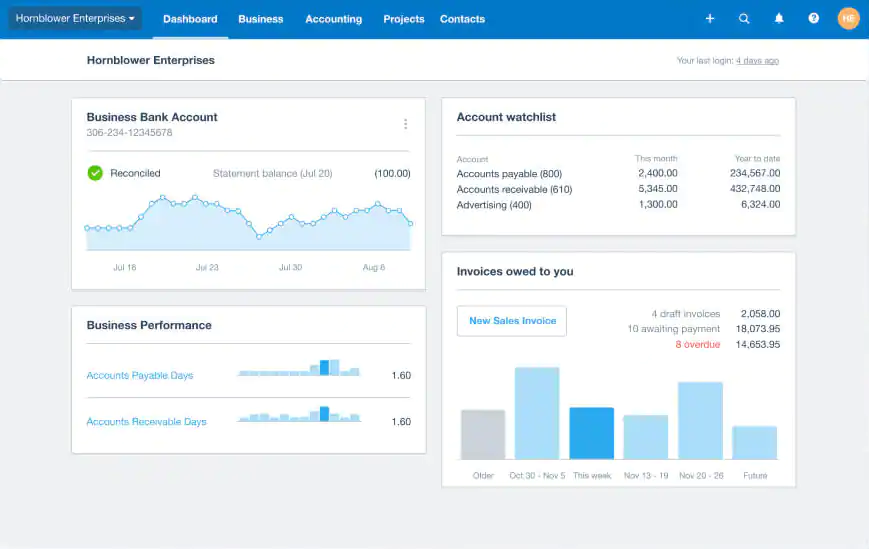

6. Xero accounts receivable automation software

Xero’s Accounts Receivable Automation Software helps simplify invoice management and incoming payments. It seamlessly integrates with Xero’s accounting system, ensuring efficient data flow between invoicing and financial reporting.

Key features include real-time invoice tracking, automated payment reminders, and support for multiple payment gateways, making transactions faster and more convenient for customers.

Integrating account payable software alongside accounts receivable automation can further improve cash flow management and operational efficiency for businesses looking to enhance their financial processes.

| Pros | Cons |

|

|

7. Square Invoices

Square Invoices offers an accounts receivable automation solution that simplifies the management of businesses’ outstanding payments. This software allows users to easily create, send, and track invoices from their devices or through the Square app.

Key features include customizable invoice templates, automated payment reminders, real-time status tracking, seamless mobile integration for invoicing on the go, secure payment processing, and comprehensive reporting and analytics to help businesses stay on top of their finances.

| Pros | Cons |

|

|

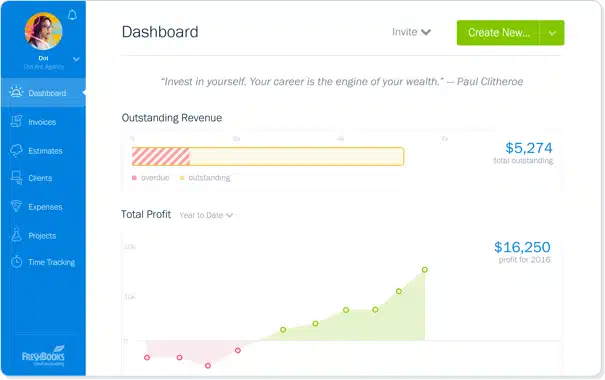

8. FreshBooks accounting system

FreshBooks is recognized as one of the top accounting software solutions, offering seamless automation to keep financial records accurate and up to date. It automatically updates account balances as payments are received, ensuring better tracking and follow-ups.

When it comes to accounts receivable automation software, FreshBooks stands out for its reliability and efficiency. Its key features include automated invoicing, payment reminders, online payment integration, expense and time tracking, detailed financial reporting, multi-currency support, and client management tools.

Designed to simplify financial tasks, FreshBooks helps businesses of all sizes manage their finances more effectively.

| Pros | Cons |

|

|

9. Centime accounts receivable automation software

Centime’s accounts receivable automation software is designed to help businesses streamline their invoice management and improve cash flow. It offers automated invoicing, real-time payment tracking, and intelligent reminders to reduce late payments.

With seamless integrations and detailed financial insights, Centime helps businesses manage receivables efficiently and maintain healthy financial operations.

| Pros | Cons |

|

|

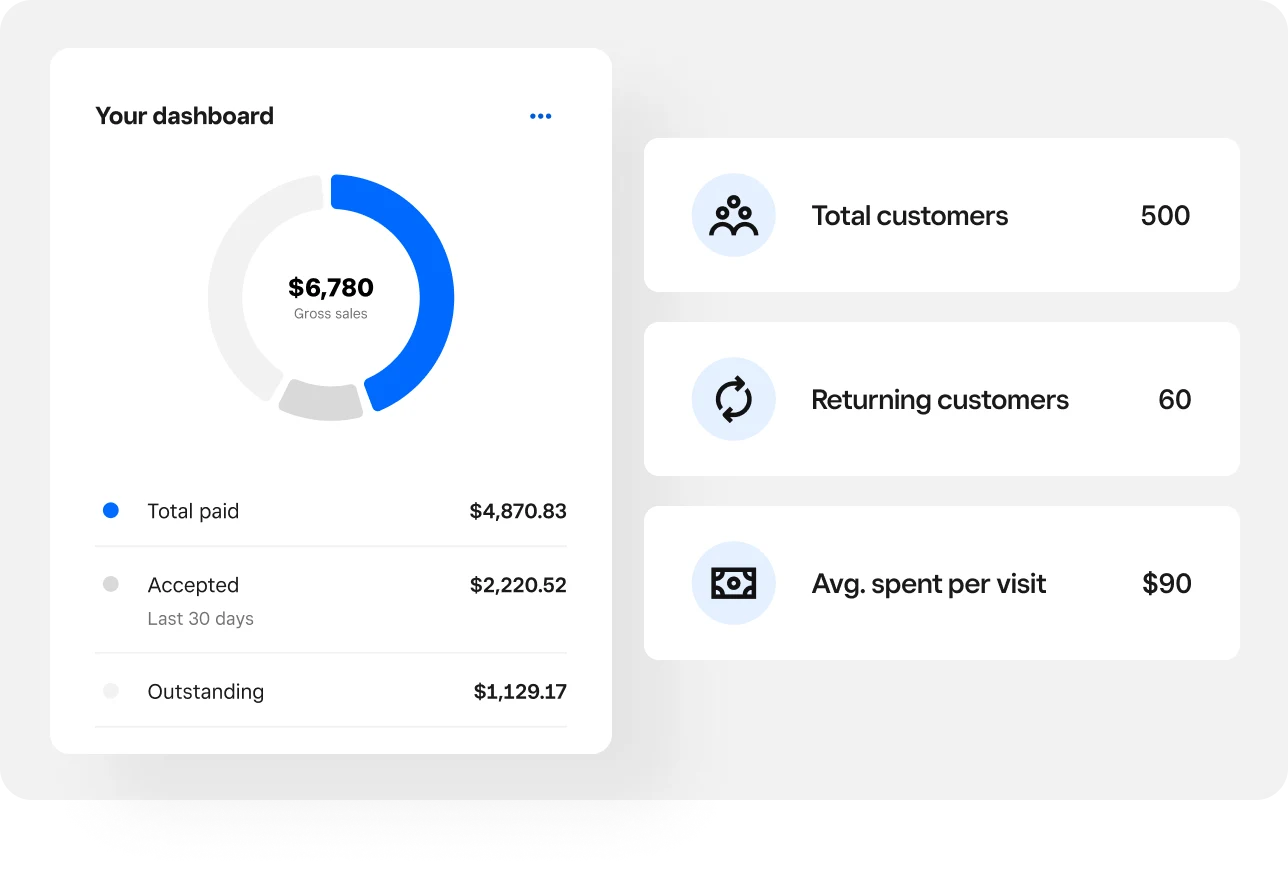

10. Invoice2go accounts receivable automation software

Invoice2go’s accounts receivable automation software stands out by helping businesses manage their receivables more efficiently. It streamlines invoicing, tracks payments in real time, and sends automated reminders to reduce late payments.

The software also updates accounts receivable records automatically, ensuring accuracy and improving overall financial management.

| Pros | Cons |

|

|

11. HighRadius

HighRadius offers accounts receivable automation software designed to simplify and improve how businesses manage their receivables. By reducing manual tasks and minimizing errors, the software helps increase efficiency in financial operations.

Its key features include automated invoice processing, payment reconciliation, credit and collections management, cash application, and dispute resolution. Additionally, it provides advanced reporting and analytics to give businesses better insights into their receivables and overall financial performance.

| Pros | Cons |

|

|

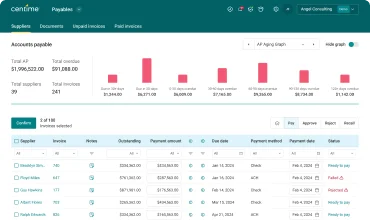

12. Billtrust

Billtrust’s accounts receivable automation software is designed to streamline the receivables process, reducing manual work and improving efficiency. It automates key tasks such as invoicing, payment processing, and cash application, helping businesses manage their finances more effectively.

Notable features include automated invoicing, secure electronic payment processing, customer portals for easy access, detailed analytics and reporting, an automated cash application, and credit management tools, all of which aim to optimize financial workflows.

| Pros | Cons |

|

|

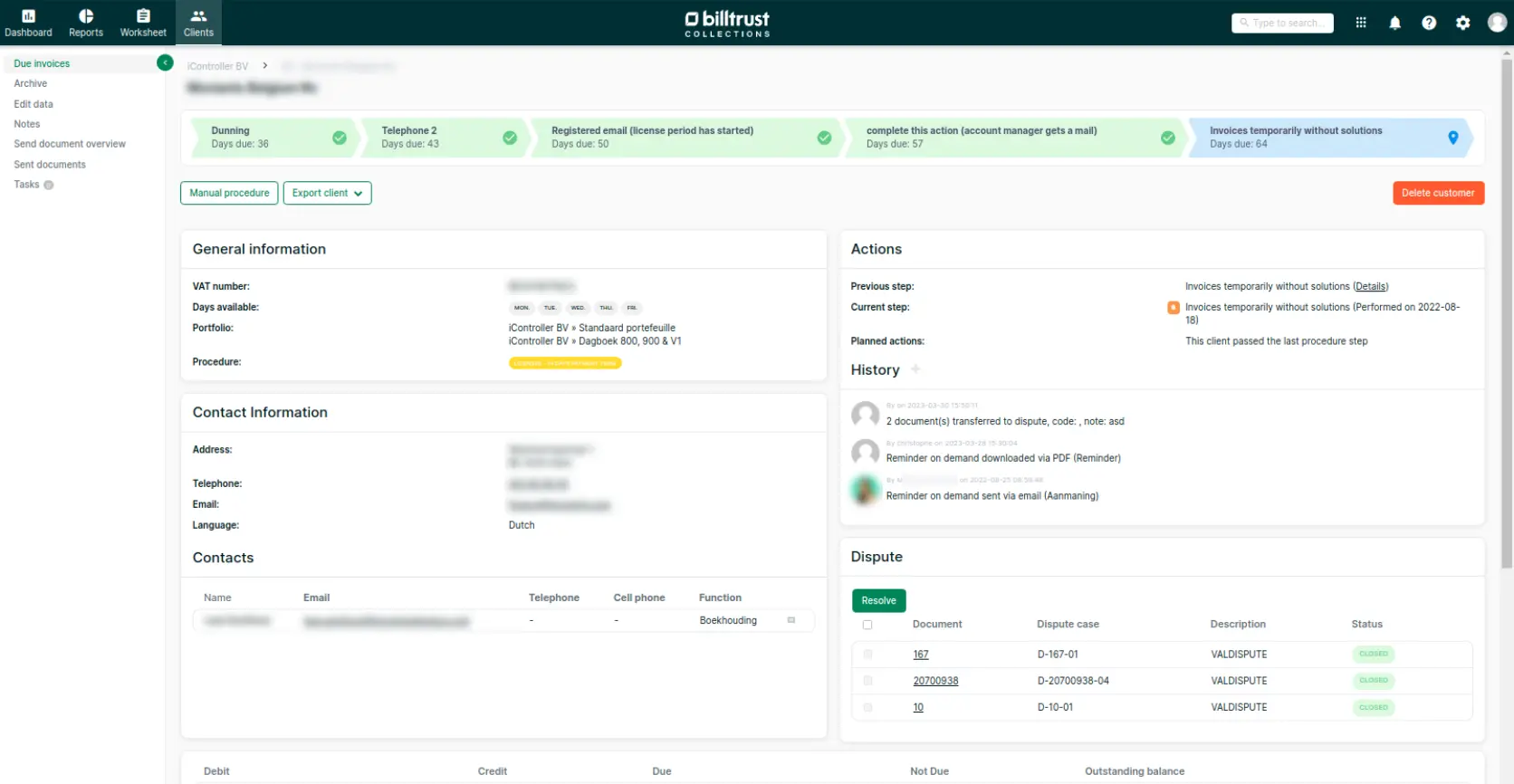

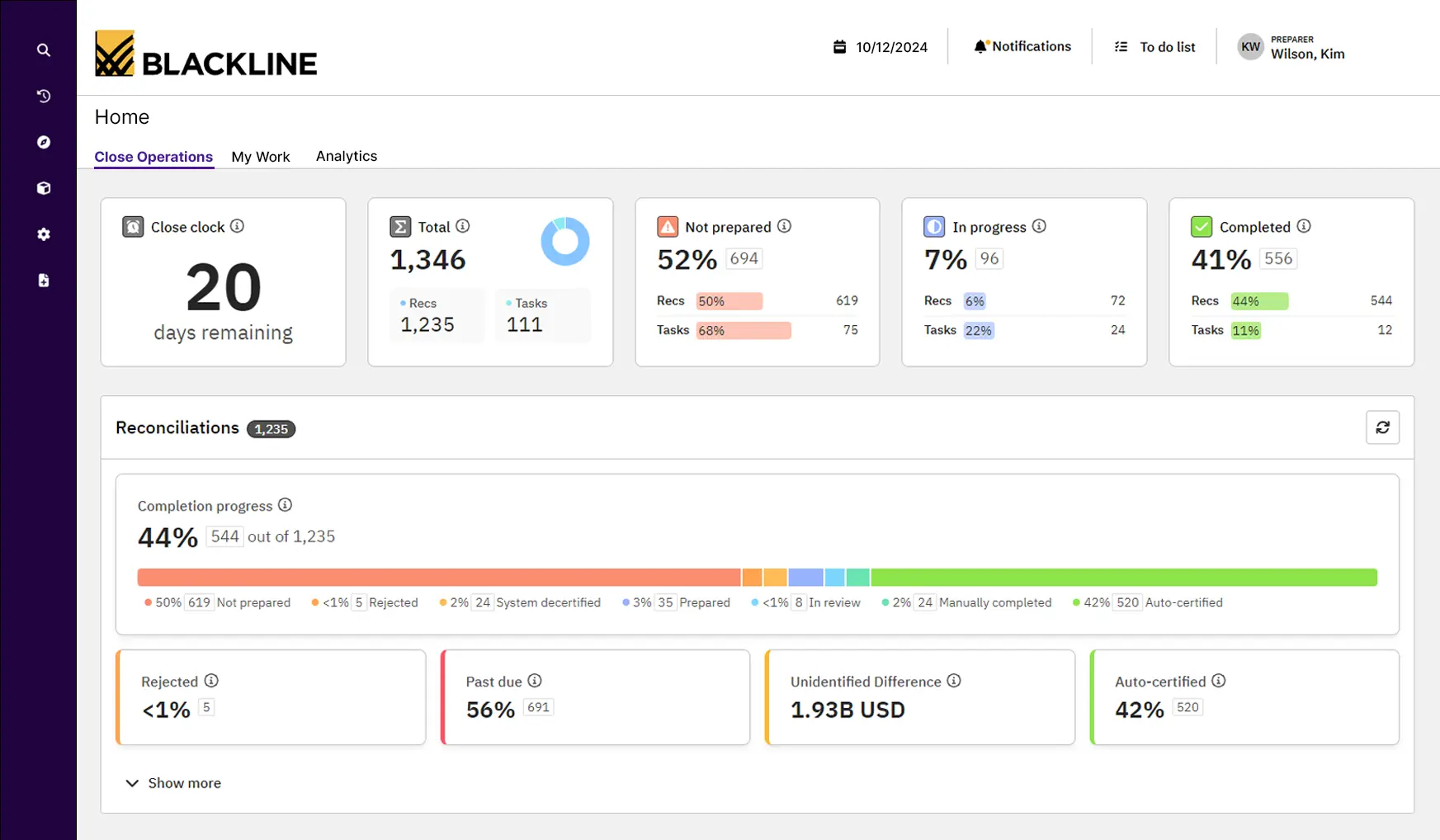

13. BlackLine accounting system

BlackLine’s accounts receivable automation software simplifies receivables management by seamlessly integrating with existing financial systems. It automates invoicing, payment tracking, and collections to improve efficiency and reduce manual workload.

Key features include automated invoice processing, real-time payment tracking, dispute resolution, credit risk assessment, and comprehensive reporting and analytics. These tools help businesses maintain accuracy, improve cash flow, and keep financial records up to date.

| Pros | Cons |

|

|

14. BILL AP/AR accounting software

BILL AP/AR is designed to simplify and optimize accounts receivable management for businesses. It automatically generates invoices from sales data, delivers them to customers, and tracks their status until payment is received.

Key features include automated payment reminders, integrated payment processing, real-time tracking and reporting, and customizable invoice templates. These tools help businesses improve accuracy, streamline operations, and enhance efficiency in managing receivables.

| Pros | Cons |

|

|

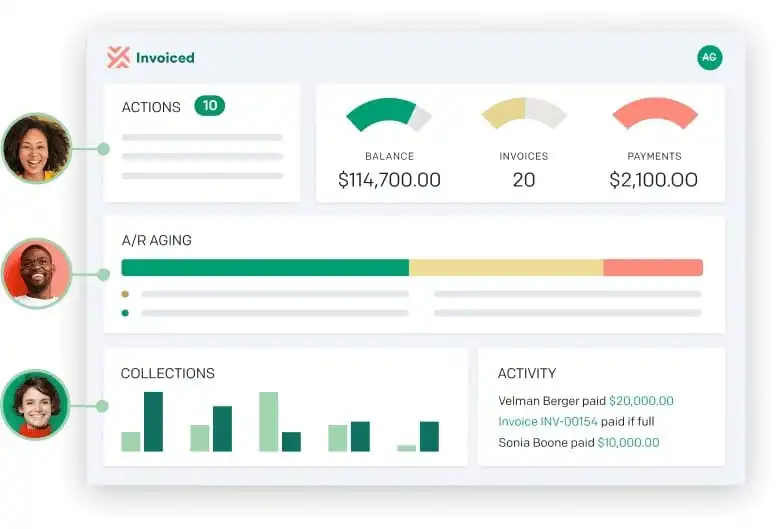

15. Invoiced accounts receivable automation software

Invoiced is a robust accounts receivable system that automates key tasks such as invoice creation, payment tracking, and customer communication. By synchronizing all financial data, it helps reduce errors and improve overall efficiency.

Key features include automated invoice generation, payment reminders, online payment processing, customer portals for easy access, and comprehensive reporting and analytics. These tools enable businesses to streamline financial processes and manage receivables more effectively.

| Pros | Cons |

|

|

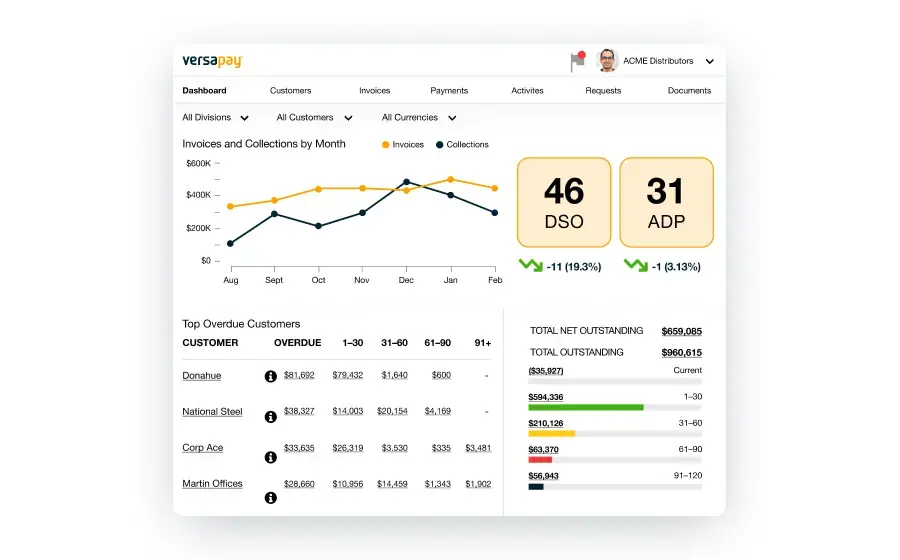

16. Versapay accounting system

Versapay’s accounts receivable automation software streamlines various aspects of receivables management, including invoicing, payment processing, and reconciliation. It facilitates real-time collaboration, helping businesses receive timely payments and resolve disputes quickly.

Key features include automated invoice distribution, real-time payment tracking, an integrated customer portal, automated reconciliation, and advanced analytics and reporting. These tools enhance efficiency, optimize cash flow, and reduce manual workload.

| Pros | Cons |

|

|

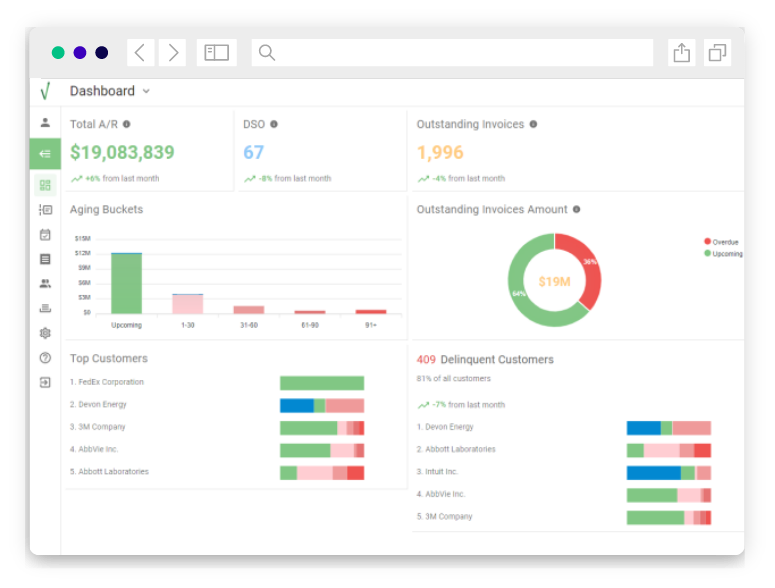

17. Tesorio accounting system

Tesorio is a leading accounts receivable automation software designed to simplify and enhance receivables management. It automates tracking, collections, and reporting, reducing reliance on manual processes.

Key features include automated invoice reminders, real-time payment tracking, cash flow forecasting, advanced analytics, seamless integration with existing financial systems, and customizable reporting options. These tools help businesses improve efficiency and maintain better control over their receivables.

| Pros | Cons |

|

|

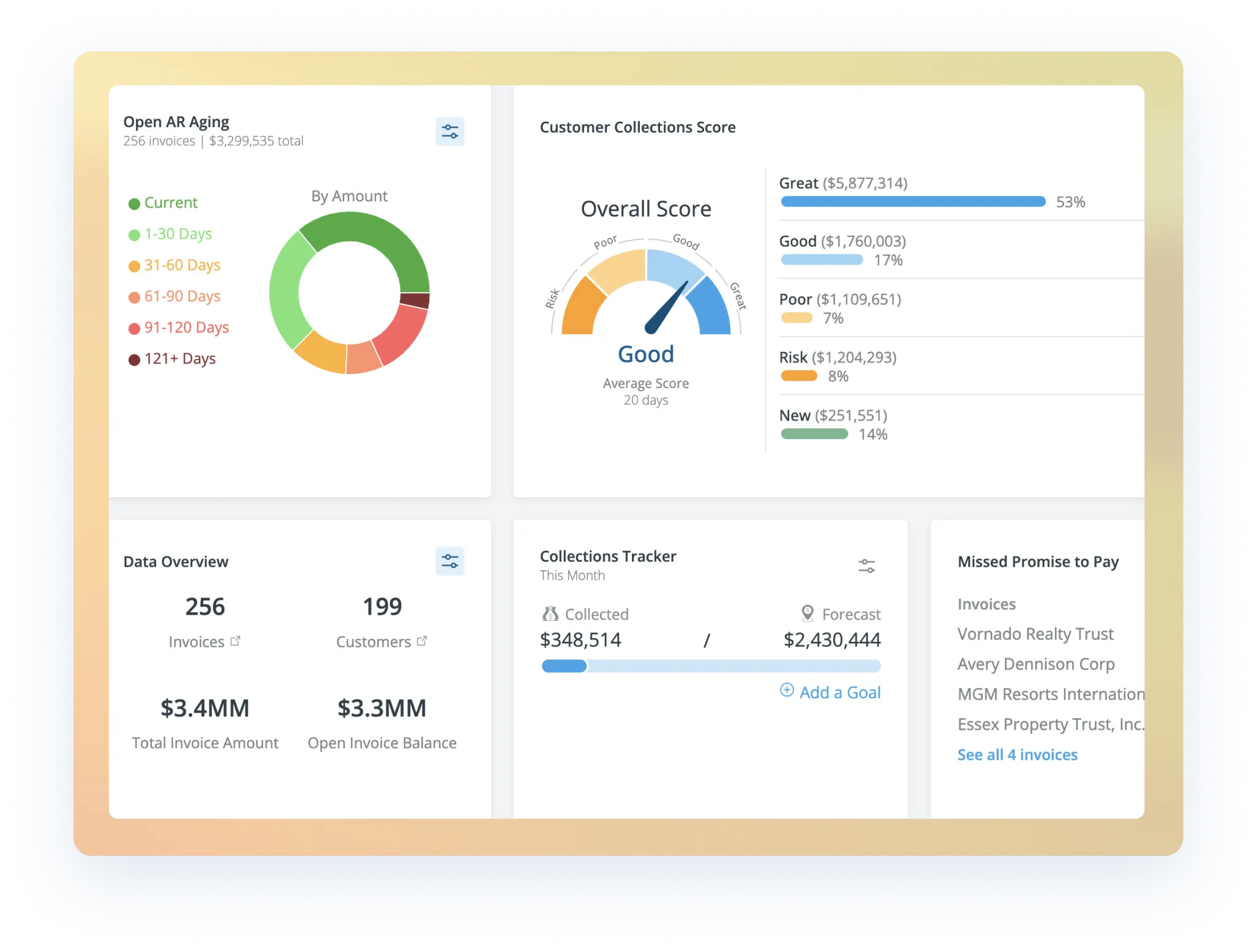

18. Gaviti accounting system

Gaviti provides a comprehensive platform to improve collection processes and strengthen financial performance for businesses struggling with overdue accounts receivable. It seamlessly integrates with existing ERP and accounting systems, ensuring real-time updates and data synchronization.

Key features include automated invoice distribution, payment reminders, customizable dunning letters, real-time analytics, integration with major ERP systems, and a user-friendly dashboard that offers a clear overview of receivables performance.

| Pros | Cons |

|

|

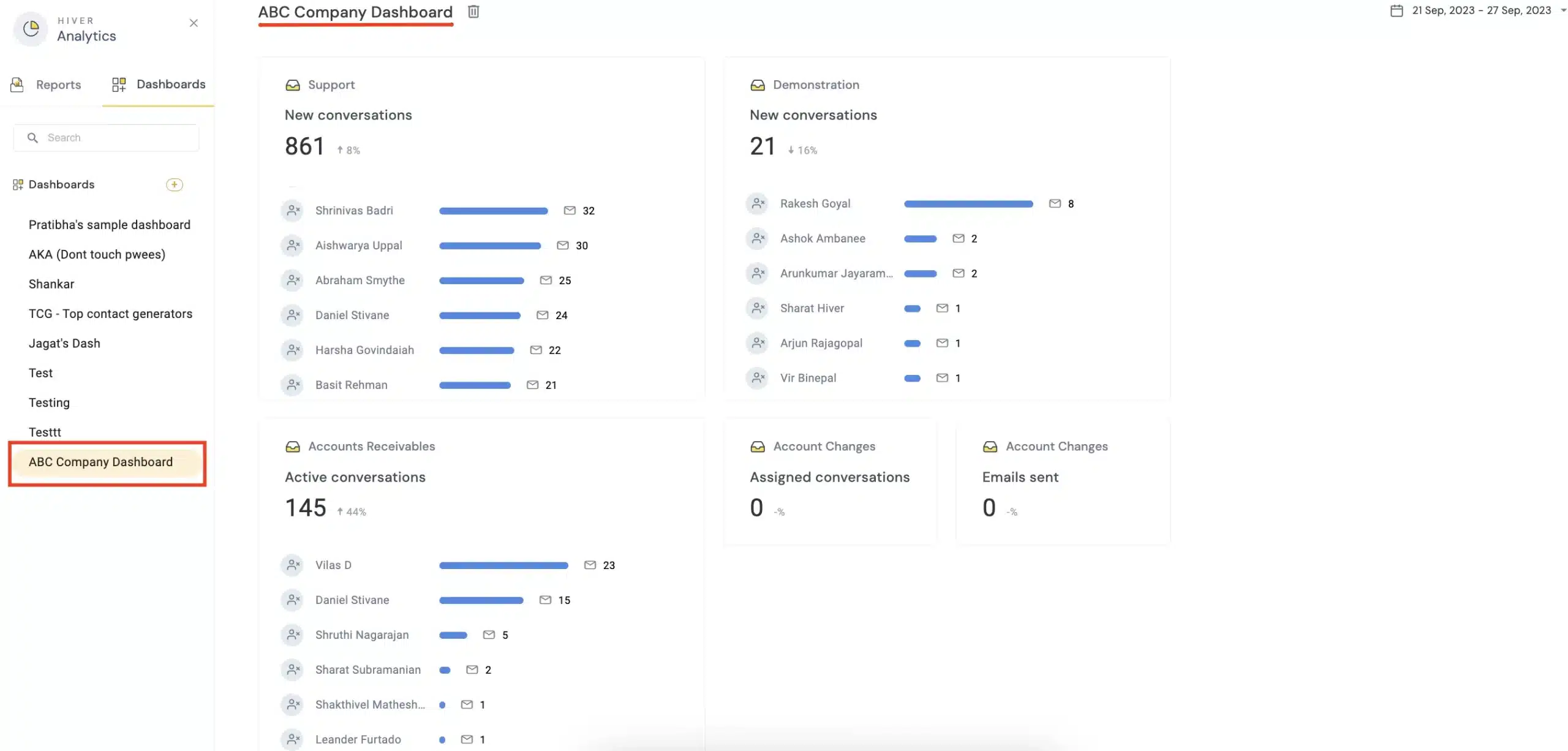

19. Hiver

Hiver’s AR Automation Software is designed to streamline and improve receivables management. By integrating with existing financial systems, it provides real-time data updates, reducing manual work and minimizing errors.

Key features include seamless integration with financial platforms, automated invoice tracking, payment reminders, real-time data synchronization, and detailed reporting and analytics. These tools help businesses manage receivables more efficiently and make well-informed financial decisions.

| Pros | Cons |

|

|

20. BlueSnap accounts receivable automation software

BlueSnap’s Accounts Receivable Automation Software simplifies essential receivables tasks, including invoicing, payment tracking, and reconciliation. It ensures real-time transaction recording with high accuracy, reducing errors and improving financial efficiency.

Key features include global payment processing, advanced invoicing capabilities, real-time payment tracking, multi-currency support, detailed reporting tools, fraud prevention measures, and robust security protocols.

These features help businesses manage receivables more effectively while maintaining secure and seamless transactions.

| Pros | Cons |

|

|

5 Major Pain Points in Accounts Receivable Operations

Effectively managing accounts receivable (AR) is essential for maintaining a steady cash flow, but businesses often face several challenges that can disrupt operations. Here are five common issues companies encounter in AR management:

- Delayed payment cycles: Slow payments, often due to manual invoicing and late customer payments, can negatively impact cash flow and hinder business growth.

- Payment tracking and reconciliation: Manually matching payments to invoices is time-consuming and prone to errors, leading to discrepancies and delayed collections.

- High Days Sales Outstanding (DSO): A high DSO indicates longer collection times, which can strain cash flow and affect financial stability.

- Invoice errors: Mistakes such as incorrect amounts or missing details can result in disputes and payment delays.

- Ineffective communication: Poor communication regarding payment terms and due dates can create confusion, increasing the risk of late payments.

Conclusion

Selecting the right accounts receivable automation software is crucial for any business. The right solution can simplify workflows, enhance accuracy, minimize manual tasks, and ensure consistent cash flow.

HashMicro Accounting Software stands out with its comprehensive features and smooth integration capabilities. Trusted by businesses in various industries, HashMicro provides reliable solutions and outstanding customer support, making receivables management easier for your business.

Discover how HashMicro’s accounting software can streamline your accounts receivable processes and boost your business’s financial success. Sign up for a free demo today and consult with our expert team to address your specific business needs.

FAQ Accounts Receivable Software

-

What do you mean by accounts receivable?

Accounts receivable are the funds that customers owe your company for products or services that have been invoiced. The total value of all accounts receivable is listed on the balance sheet as current assets and include invoices that clients owe for items or work performed for them on credit.

-

What is an example of an account receivable?

Accounts receivable examples include outstanding payments for goods sold to customers on credit, professional services rendered with payment pending, and outstanding invoices for products delivered but not yet paid for.

-

What is the main goal of accounts receivable?

The primary goal of managing accounts receivable is to accelerate cash flow by ensuring timely payments. And to achieve that, you need to set effective accounts receivable goals and objectives. But setting AR collections goals is only half the battle.