Managing expenses is a significant challenge for businesses of all sizes, especially when relying on manual processes. Without expense management software, companies face issues such as data entry errors, lost receipts, and delayed reimbursements, often resulting in financial incoherence and poor cash flow management.

According to PwC Malaysia, many Malaysian businesses still rely on manual expense tracking, slowing operations and raising error risks. These inefficiencies not only slow down operations but also increase the risk of financial mistakes. This is where automation becomes essential to streamline tracking and approval workflows.

Choosing the right expense management software is essential because the wrong system may cause integration problems, user resistance, or security concerns. In this article, we review 22 leading solutions in Malaysia to guide your decision. One of them is HashMicro, which you can try a free demo of to see how automation supports your needs.

Key Takeaways

|

What is Business Expense Management Software?

Expense management software is a tool that streamlines the tracking, approval, and reimbursement of business expenses. It enables businesses to efficiently manage their financial resources by capturing and categorizing expense data, ensuring compliance with company policies and regulations.

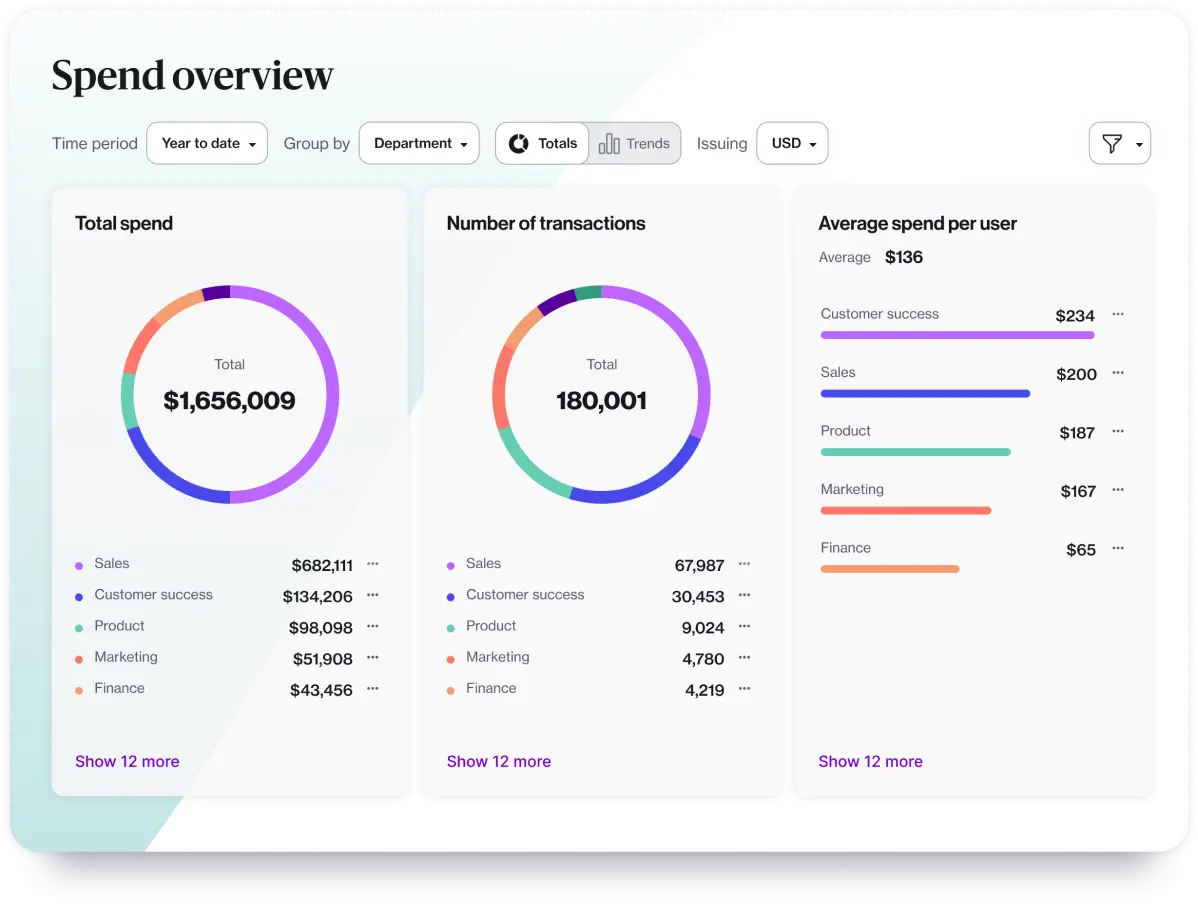

By providing real-time insights into spending patterns, expense management software enables businesses to make informed decisions, control costs, and enhance overall financial efficiency.

It typically integrates with accounting systems and offers features such as receipt scanning, automated expense reports, and mobile accessibility, making it an indispensable solution for modern businesses seeking to optimize their financial operations.

Hashy AI Fact

Need to know!

Hashy AI automates expense tracking and payment follow-ups, streamlining your financial processes and ensuring timely, accurate records without manual intervention.

Request a free demo today!

What are The Benefits of Expense Management Software?

Understanding how an expense tracker improves financial performance is crucial for every business. With accurate tracking, companies can control spending and protect their finances. Below are the key benefits you can gain:

- Clearer financial visibility: Helps you understand exactly where money is being spent, making it easier to cut unnecessary costs.

- Stronger budgeting and forecasting: Accurate records support more realistic budgets and better financial planning.

- Simpler tax filing: Complete documentation makes filing taxes easier and helps identify valid deductions.

- Improved cash flow control: Monitoring expenses ensures sufficient funds for operations and future investments.

- Smarter financial decisions: With transparent spending data, businesses can allocate resources more effectively.

- Fraud detection and cost reduction: Regular tracking helps catch suspicious spending early and uncover areas to save more.

22 Best Business Expense Management Software

To help you choose the right solution for your business, we’ve shortlisted five of the best expense management software in Malaysia. Each offers specific strengths depending on your company size, industry, and operational needs. Here’s a quick comparison to guide your decision:

Best because

The best end-to-end solution for all types of business needs

Best Because A simple, real-time expense system with reliable integrations

Best Because Fast performance with powerful integration for large organizations.

Best Because A simple expense tool that automates policies, controls costs, and supports companies of all sizes

Best Because A smart tool that simplifies travel, automates expenses, and strengthens spend control.

While these five options are among the most recommended, they represent just a portion of what’s available in the market. If you’re looking for more alternatives with different pricing models, features, or integration capabilities, explore the full list below to find other expense management software that may suit your business needs better.

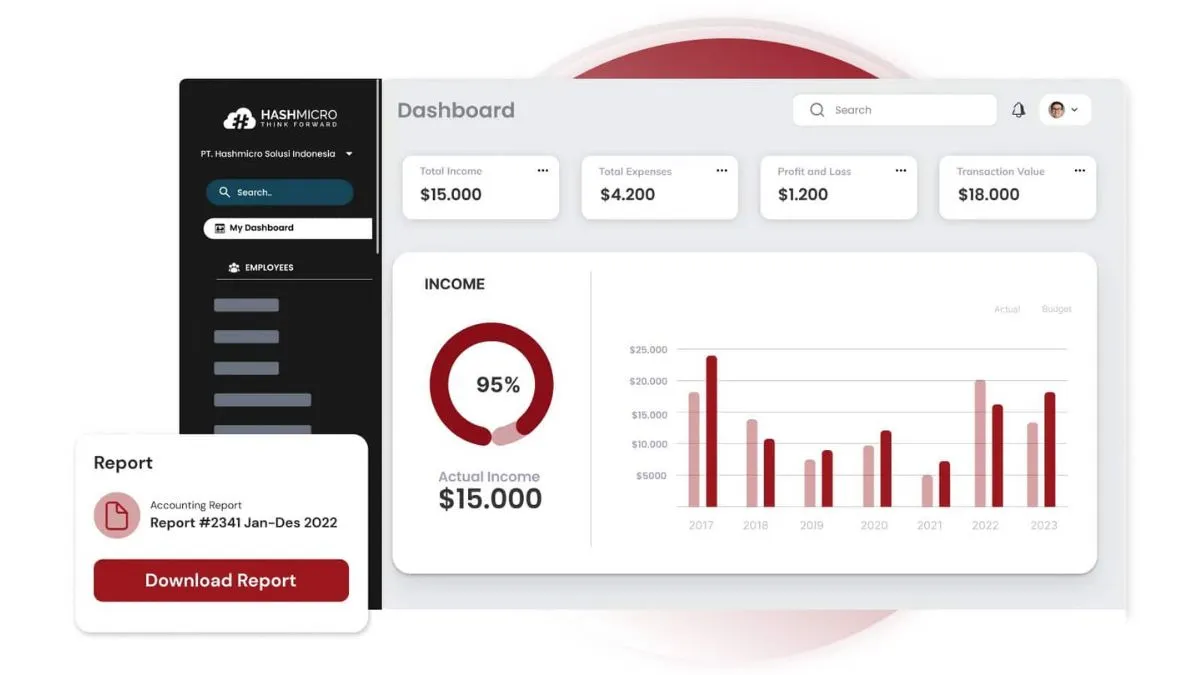

1. HashMicro Accounting Software Malaysia

HashMicro Accounting Software Malaysia is the best expense management software, streamlining and automating key accounting workflows for businesses. Its expense management module helps companies avoid delays in reimbursement and lost receipts.

This is especially important for businesses preparing reports for LHDN or managing multiple claims in Ringgit Malaysia (RM). Discover how this software enhances your financial management with a free demo.

A key benefit is its integration with HR software for payroll, ensuring claims are processed on time and linked directly to salary disbursements. This helps reduce double entry and eases coordination between HR and finance.

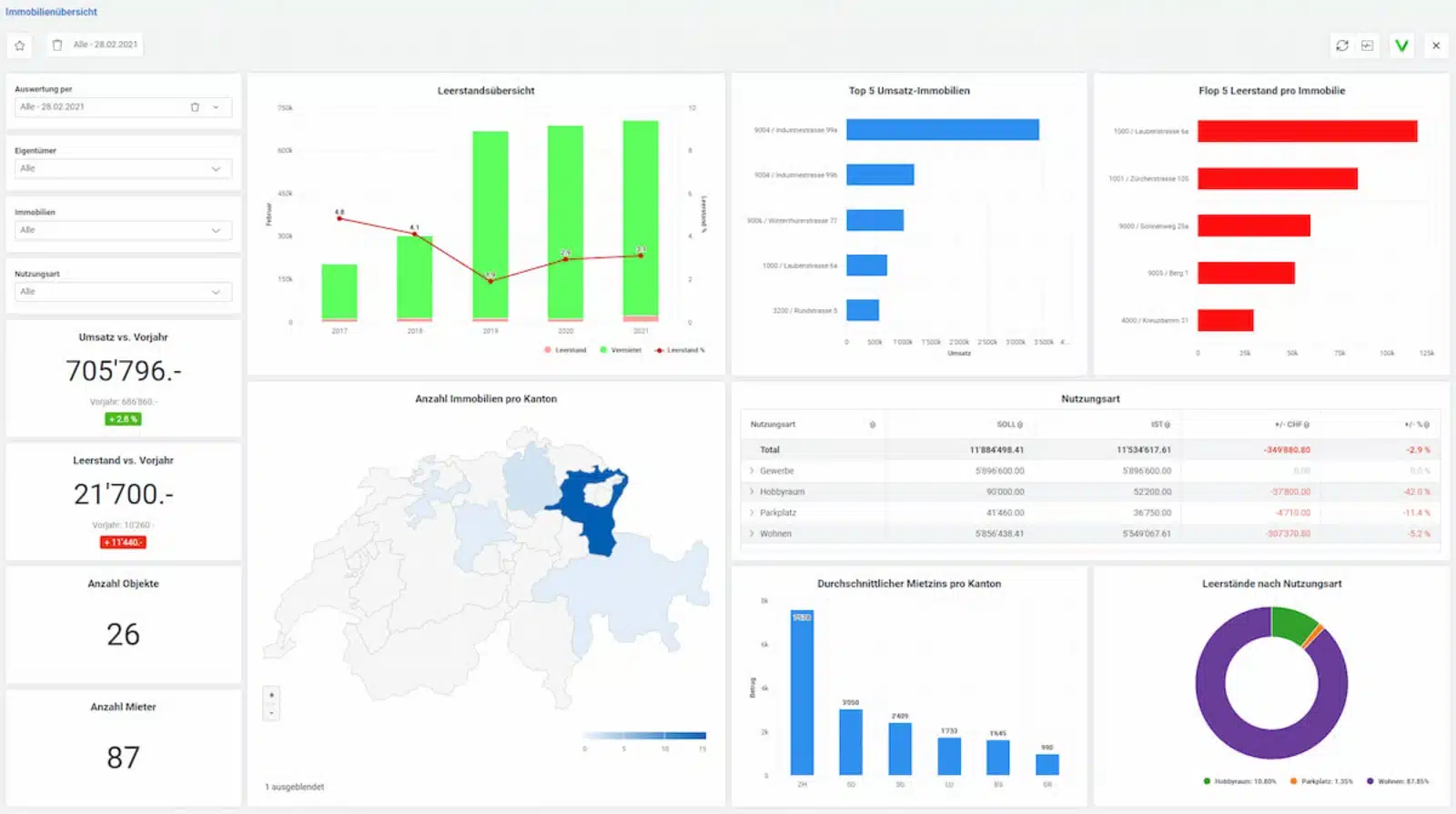

The system also supports multi-currency transactions and provides detailed reporting. For Malaysian businesses using Maybank or CIMB, the bank integration feature allows direct reconciliation, reducing manual matching errors.

Below are the comprehensive features that HashMicro Accounting Software offers:

- Automated expense reporting: Helps reduce delays and human errors when recording and submitting expenses.

- Multi-currency support: Allows claims in different currencies, ideal for companies dealing with both RM and international payments.

- Budget S-Curve: A Graphical tool that compares planned budget versus actual expenditures over time, providing insights into spending trends and efficiency throughout the project or financial cycles.

- Bank integrations – auto reconciliation: Matches transactions automatically with your Maybank or CIMB bank feeds.

- Cash flow reports: Summaries of cash inflows and outflows over a specified period, crucial for monitoring liquidity, assessing financial health, and planning cash management.

- Financial ratio: Quantitative metrics used to evaluate financial performance and efficiency, including profitability, liquidity, and efficiency ratios to measure operational health.

- Multi-level analytical: Provides comprehensive analysis across various levels of financial data, offering more profound insights into expense patterns, profitability, and overall economic performance across different business segments or departments.

| Pros | Cons |

|---|---|

|

|

Suitable for: HashMicro is ideal for medium to large enterprises across various industries, particularly those seeking a unified solution to streamline financial processes.

HashMicro’s comprehensive features and seamless integrations make it an ideal solution for businesses seeking to enhance efficiency, accuracy, and compliance in their expense management and payroll operations. Click the banner below to view the pricing scheme.

2. Rydoo

Rydoo simplifies travel and expense management with its user-friendly interface and mobile accessibility.

It automates expense reporting, receipt scanning, and expense categorization, enhancing efficiency for businesses with frequent travel requirements.

While Rydoo may lack some advanced features compared to enterprise-focused solutions, it has real-time analytics and integration capabilities with major accounting systems.

| Pros | Cons |

|---|---|

|

|

Suitable for: Navan is ideal for small to medium-sized businesses in the finance, healthcare, and education sectors. It’s ideal for organizations looking for an adaptable expense management solution

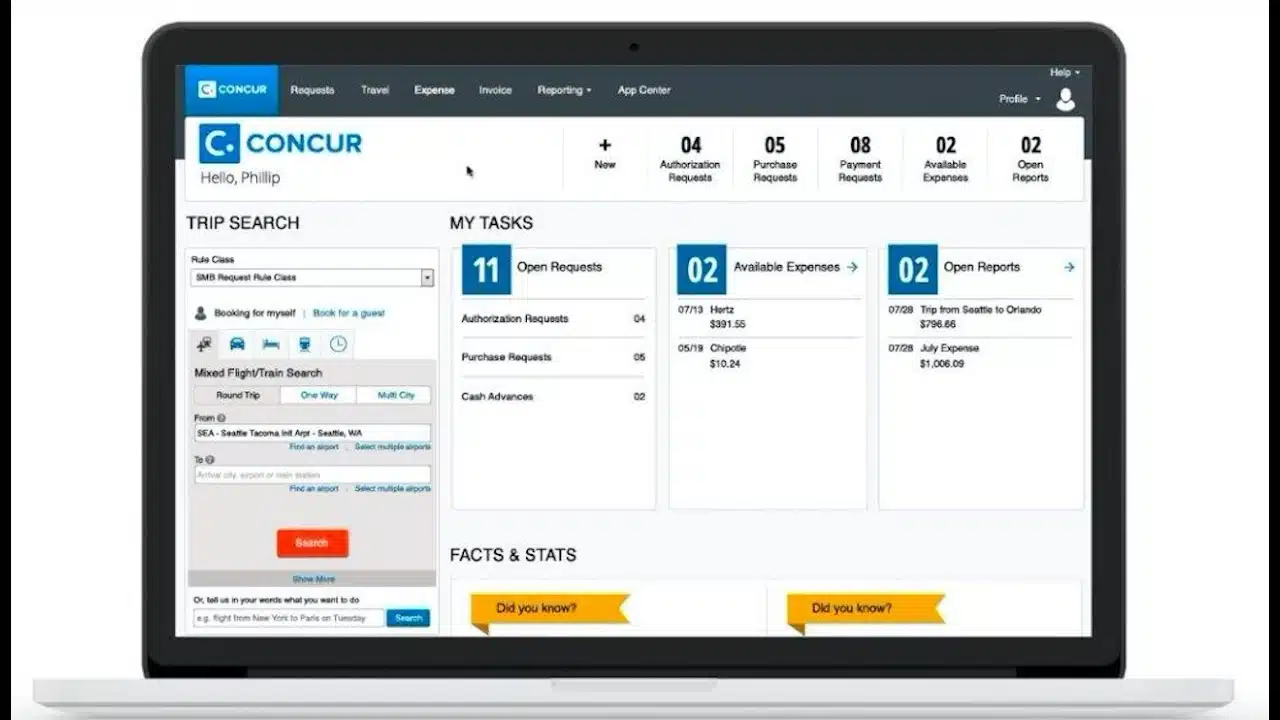

3. SAP Concur Expense

SAP Concur Expense is a widely used expense management software known for its comprehensive features and global reach.

It automates the expense reporting and travel expense management process, ensuring that expenses are accurately recorded and compliant with company policies.

SAP Concur integrates with major accounting systems and ERP software, providing a seamless experience for businesses. The system offers features such as automatic receipt recording, range tracking, and policy compliance checks.

| Pros | Cons |

|---|---|

|

|

Suitable for: SAP Concur Expense is ideal for large enterprises and multinational corporations across industries such as technology, pharmaceuticals, and finance.

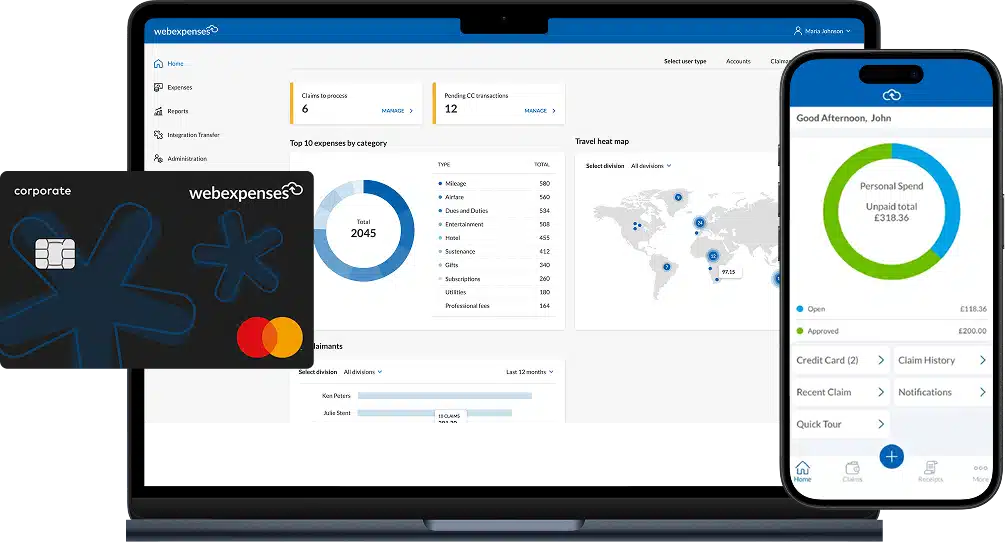

4. Webexpenses

Webexpenses is a user-friendly expense management software designed to simplify expense reporting and approval processes.

It offers mobile apps that enable employees to submit expenses on the go, along with features such as receipt scanning and automated expense categorization.

The software provides a straightforward and cost-effective solution for businesses looking to streamline their expense management processes without investing in a complex system.

| Pros | Cons |

|---|---|

|

|

Suitable for: Webexpenses are ideal for small to medium-sized businesses across various industries, including retail, education, and non-profit. It caters to companies looking for an affordable and user-friendly expense management solution

5. Zoho Expense

Zoho business expense management software is part of the Zoho suite of business applications, providing a comprehensive expense management solution that integrates seamlessly with other Zoho apps.

This app is designed to simplify the expense reporting process and ensure compliance with company policies.

Its integration with the broader Zoho ecosystem makes it particularly beneficial for businesses already using Zoho’s suite of applications.

| Pros | Cons |

|---|---|

|

|

Suitable for: Zoho Expense is ideal for small to medium-sized businesses and startups across various industries, including IT, consulting, and marketing.

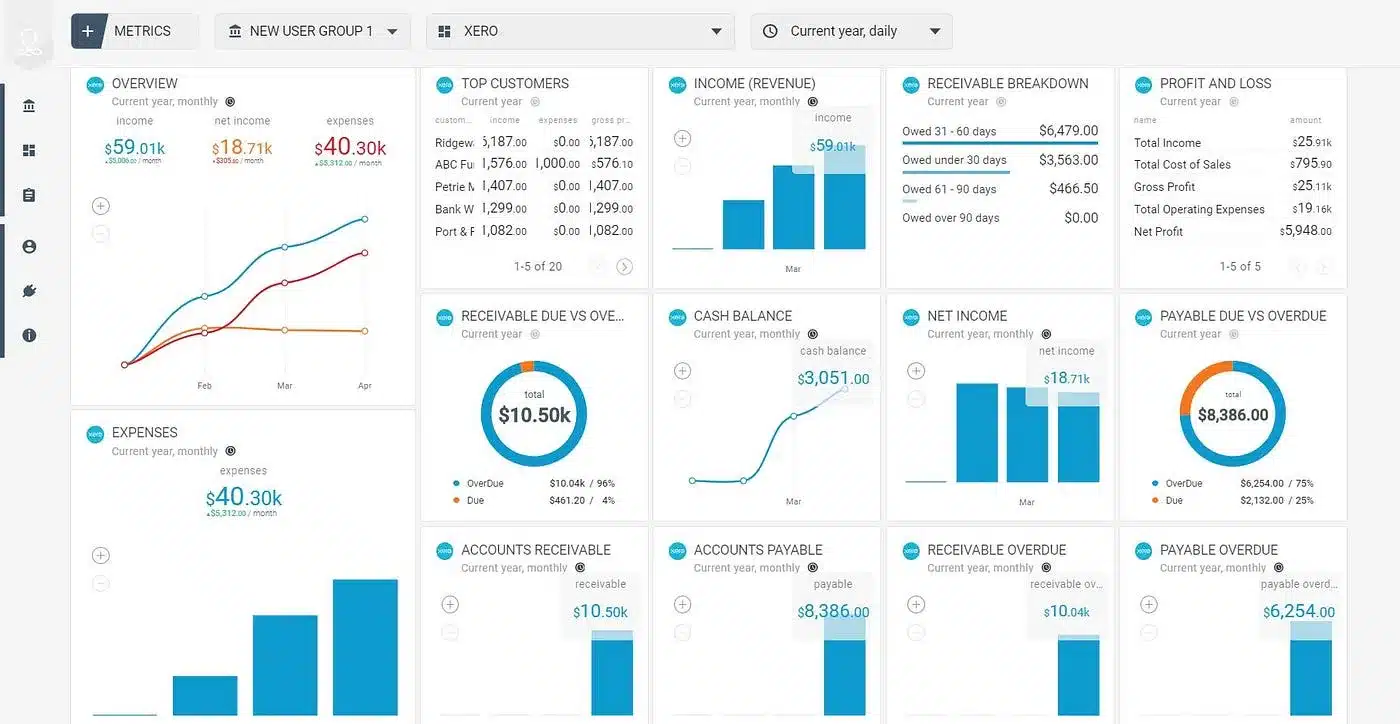

6. Xero

Xero is a cloud-based accounting software known for its robust expense management capabilities. It allows users to track expenses, create expense claims, and manage receipts efficiently.

With seamless integration with other accounting features, such as invoicing and bank reconciliation, Xero offers real-time visibility into financial data.

With intuitive features such as invoicing, bank reconciliation, and robust reporting tools, Xero empowers businesses to manage their finances with ease and accuracy.

| Pros | Cons |

|---|---|

|

|

Suitable for: Xero is ideal for small to medium-sized businesses across various industries, including retail, hospitality, and professional services.

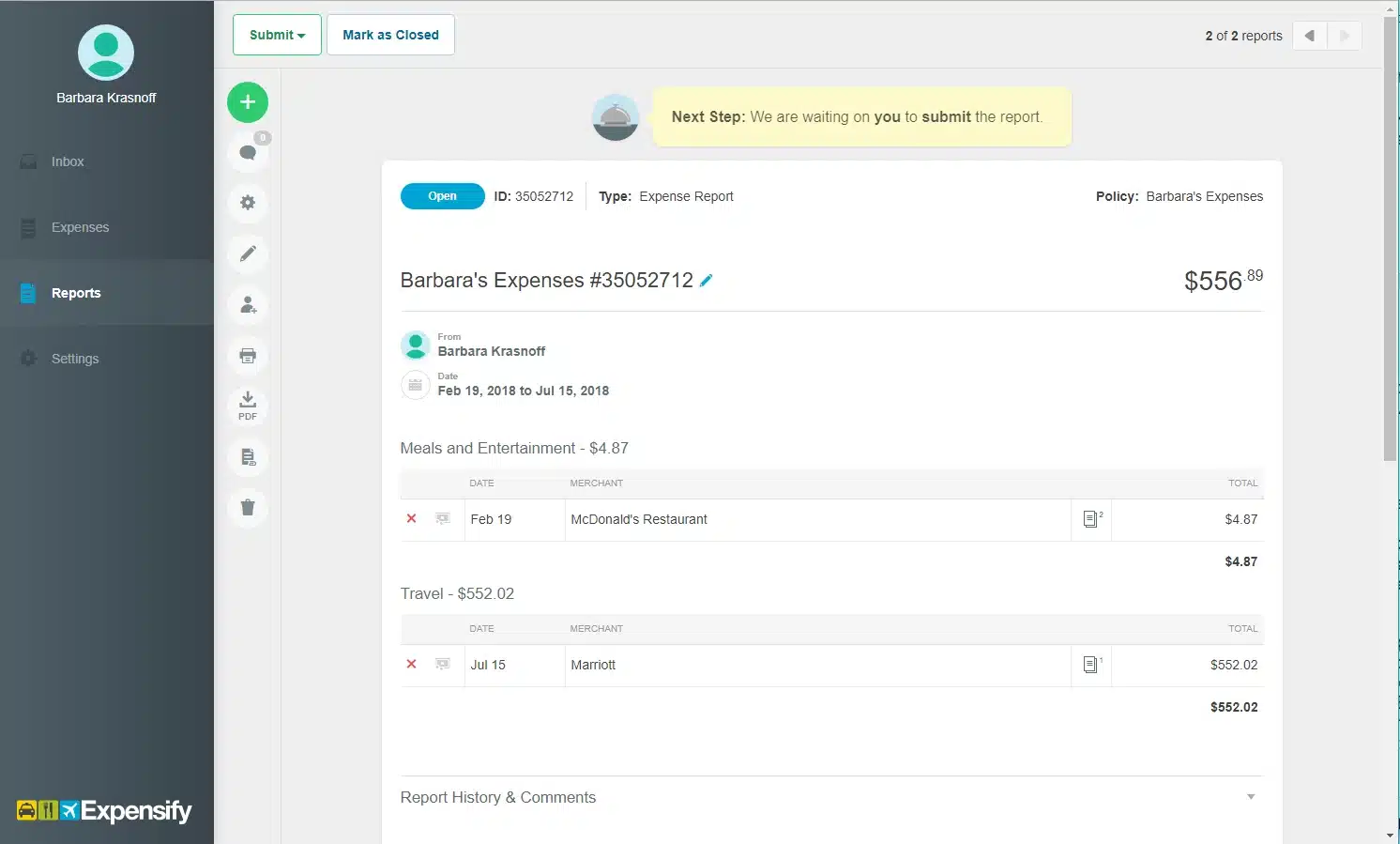

7. Expensify

Expensify is a leading expense management solution designed to simplify the entire expense reporting process. It leverages innovative technology such as SmartScan for receipt scanning, ensuring accurate data capture and categorization.

Expensify is ideal for businesses looking to streamline expense management workflows, enforce policy compliance, and gain real-time visibility into spending trends.

| Pros | Cons |

|---|---|

|

|

Suitable for: Expensify is best suited for small to medium-sized businesses and enterprises in the technology, finance, and consulting sectors. It’s designed for organizations seeking an efficient, scalable expense management solution that enhances compliance and financial control.

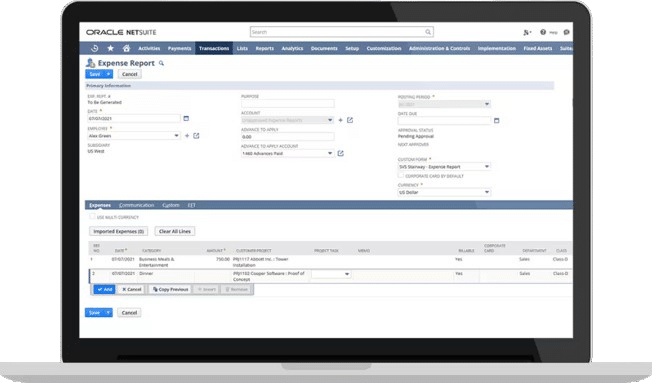

8. NetSuite Expense Management

This platform is part of the comprehensive NetSuite ERP suite, providing robust capabilities for managing employee expenses and travel.

This software supports mobile receipt capture and submission, ensuring timely and accurate expense tracking from anywhere.

With advanced analytics and reporting tools, businesses can gain deep insights into spending patterns and compliance metrics.

| Pros | Cons |

|---|---|

|

|

Suitable for: Enterprises across various industries, including technology, finance, and consulting. It caters to companies looking for an efficient and scalable expense management solution that enhances compliance and financial control.

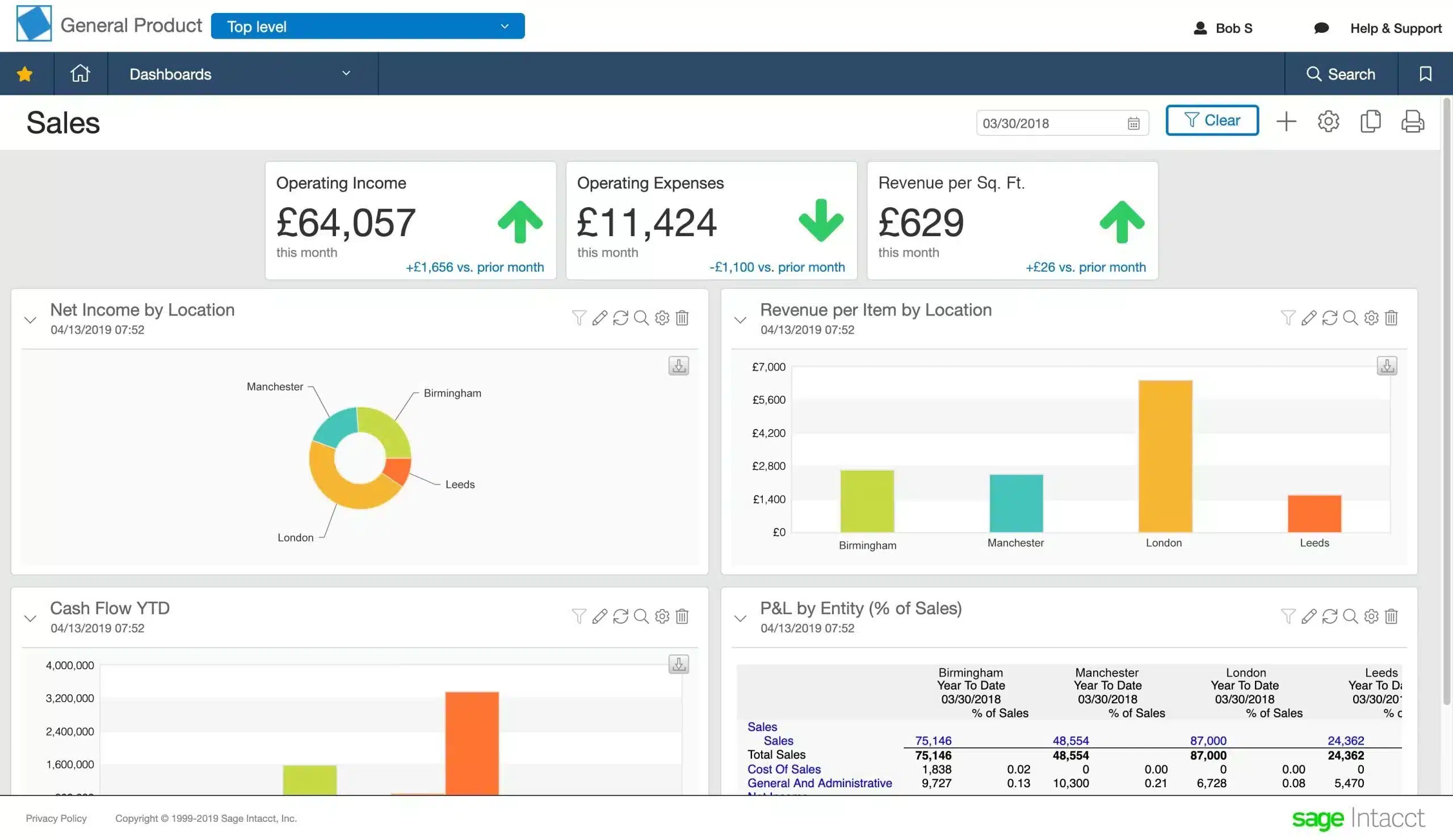

9. Sage Intacct

Sage Expense Management is a cloud-based financial management solution that includes a robust expense management module.

This expense management system helps businesses reduce errors and save time by automating the capture, reporting, and approval of expenses.

The software’s advanced reporting capabilities enable businesses to gain detailed insights into spending patterns and financial health, which can inform better decision-making.

| Pros | Cons |

|---|---|

|

|

Suitable for: Sage Intacct is ideal for medium to large businesses that require a comprehensive financial management solution. Its scalability and advanced features make it suitable for companies with complex financial needs.

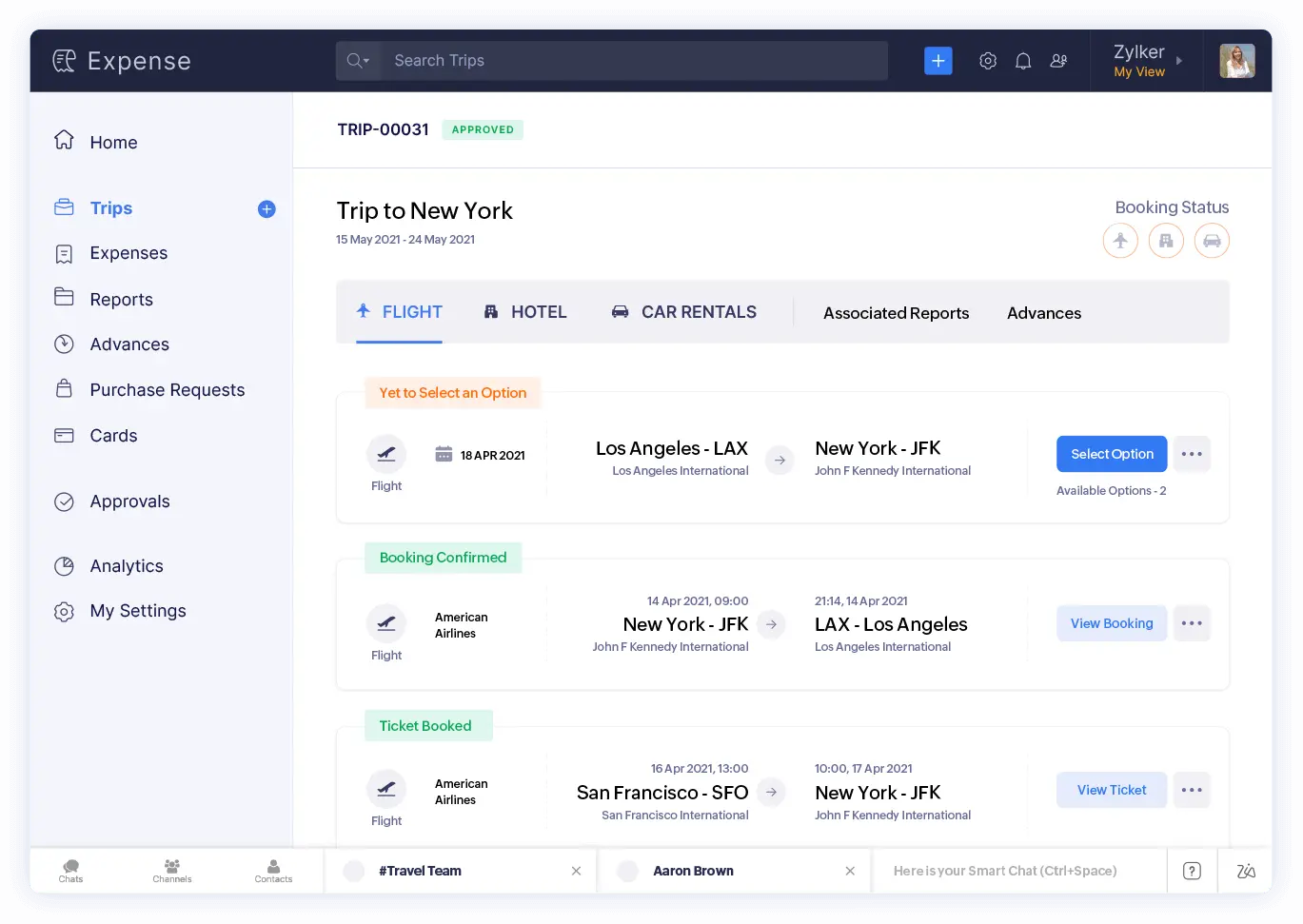

10. Navan

Navan, formerly known as TripActions, is an expense and travel management platform designed to streamline business travel and expense processes.

It offers features such as automated expense reporting, travel booking, policy enforcement, and seamless integration with accounting systems.

Navan provides businesses with a comprehensive solution to manage travel expenses, track employee spending, and ensure compliance with company policies.

| Pros | Cons |

|---|---|

|

|

Suitable for: Navan is ideal for small to medium-sized companies in various industries, including healthcare, education, and non-profit sectors.

11. Abacus

Abacus is an intuitive expense management software designed to streamline the expense reporting and reimbursement process.

Its real-time reporting capabilities provide businesses with actionable insights into spending patterns and budget allocation, making it a valuable tool for financial control and decision-making.

This expense management app offers features such as automated expense categorization, receipt scanning, and policy enforcement, all accessible through a user-friendly interface.

| Pros | Cons |

|---|---|

|

|

Suitable for: Abacus is well-suited for medium to large enterprises in the technology, consulting, and professional services sectors. It’s ideal for businesses seeking a scalable expense management solution that enhances efficiency

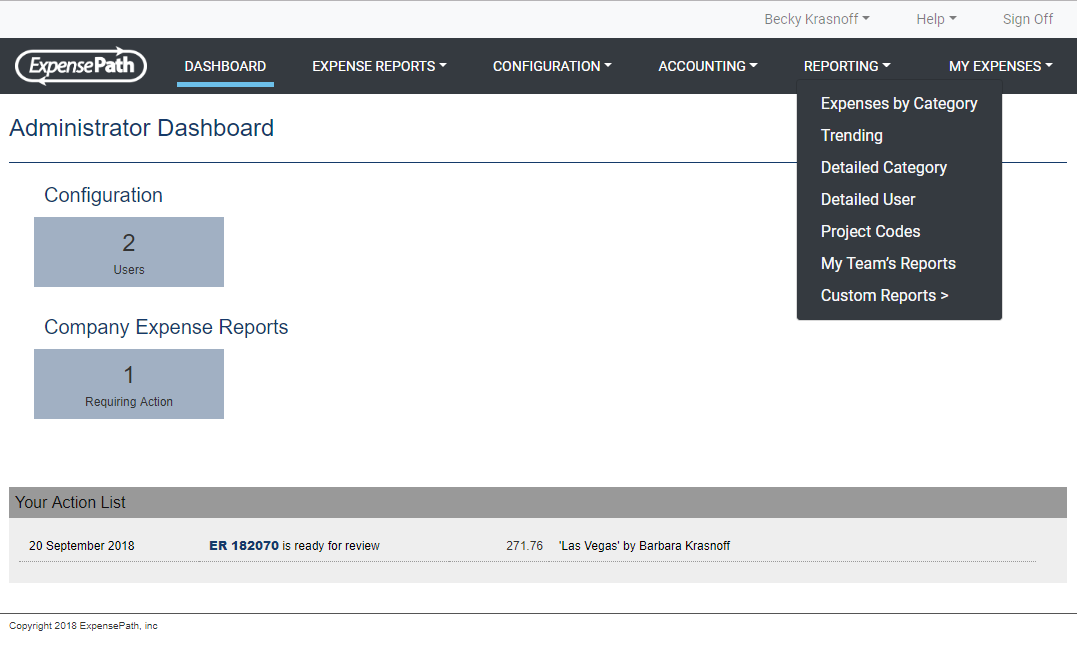

12. ExpensePath

ExpensePath is a comprehensive expense management app designed to simplify expense reporting and approval workflows.

Designed for small to medium-sized businesses, ExpensePath simplifies expense reporting and approval workflows through seamless integration with accounting systems.

It offers features such as receipt capture, range tracking, and real-time expense tracking through its intuitive mobile app and web interface.

| Pros | Cons |

|---|---|

|

|

Suitable for: ExpensePath is perfect for small to medium-sized businesses in healthcare, retail, and non-profit organizations. It’s especially beneficial for companies seeking an affordable yet robust expense management solution that enhances productivity and financial control.

13. Receipt Bank

Receipt Bank revolutionizes expense tracking with its advanced optical character recognition (OCR) technology, automating the extraction of receipt and invoice data for seamless integration with major accounting platforms.

Its ability to automatically categorize expenses and streamline reconciliation makes Receipt Bank a preferred choice for businesses looking to reduce administrative overhead and enhance financial transparency.

| Pros | Cons |

|---|---|

|

|

Suitable for: Receipt Bank is an expense tracking software, particularly useful for small to medium-sized businesses in retail, hospitality, and professional services. It’s designed for companies looking to streamline receipt management and eliminate manual data entry

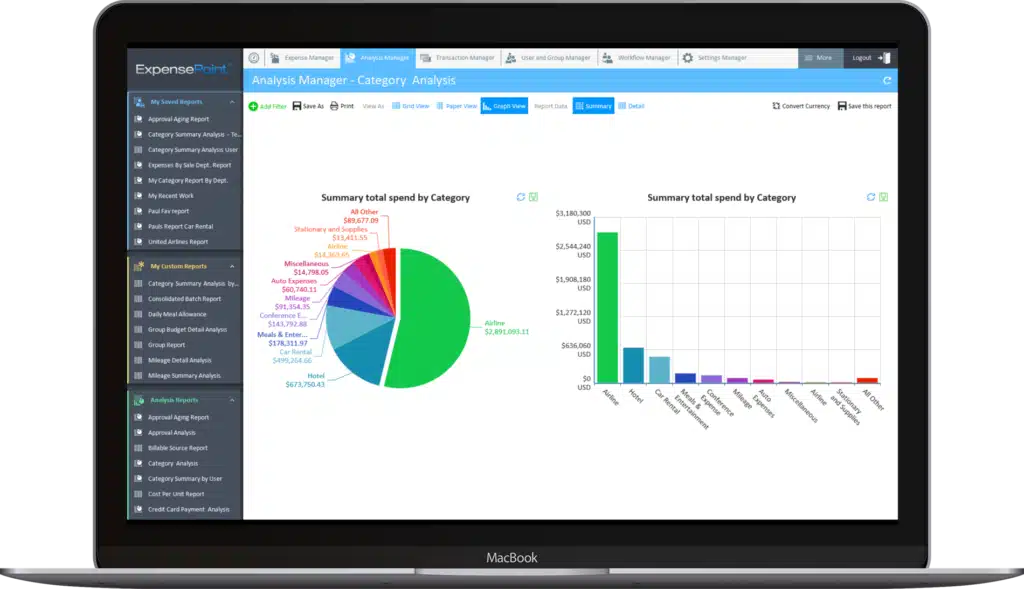

14. ExpensePoint

ExpensePoint is a flexible expense management software designed to streamline the entire expense reporting process.

This expense management automation offers features such as receipt scanning, mileage tracking, and automated approval workflows to simplify expense management tasks.

With customizable reporting and analytics tools, businesses can gain valuable insights into spending trends and compliance metrics, thereby enhancing financial control and informed decision-making.

| Pros | Cons |

|---|---|

|

|

Suitable for: ExpensePoint is an expense management automation ideal for small to medium-sized enterprises in manufacturing, technology, and education. It caters to businesses seeking a flexible and scalable expense management solution that enhances operational efficiency and financial transparency.

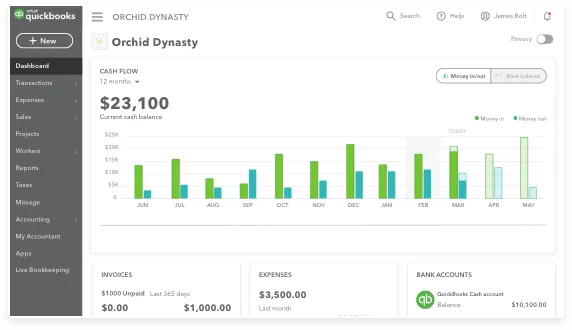

15. QuickBooks Online

QuickBooks Online is a widely used cloud-based accounting software that includes robust expense management capabilities.

This corporate expense management solution enables businesses to track expenses, create accurate expense reports, and efficiently manage receipts.

With its comprehensive reporting tools and mobile app accessibility, businesses can monitor cash flow and manage expenses on the go, making it a valuable tool for financial management.

| Pros | Cons |

|---|---|

|

|

Suitable for: QuickBooks Online is perfect for small to medium-sized businesses in the retail, construction, and hospitality industries. It’s ideal for organizations seeking an all-in-one accounting and expense management solution to boost efficiency.

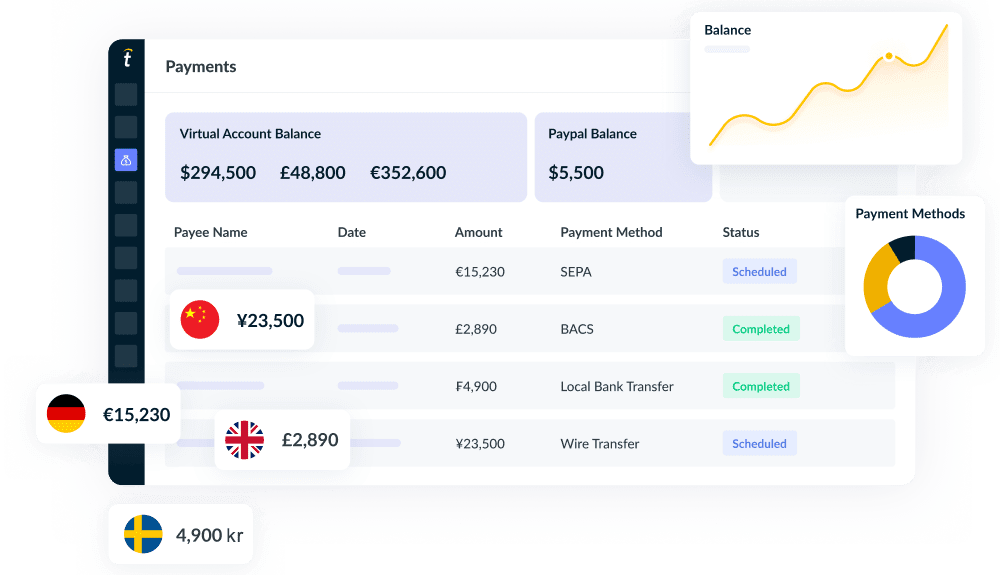

16. Tipalti

Tipalti offers comprehensive expense management solutions tailored for businesses handling global transactions and complex payment processes.

It streamlines expense reporting, reimbursement, and payment workflows with robust automation features. Tipalti’s platform integrates seamlessly with ERP systems, providing real-time visibility and control over expenses and cash flow.

It ensures compliance with global tax and regulatory requirements, making it a preferred choice for enterprises looking to streamline financial operations across borders.

| Pros | Cons |

|---|---|

|

|

Suitable for: Tipalti is particularly beneficial for medium to large enterprises in the technology, e-commerce, and manufacturing sectors. It’s designed for companies managing international operations and seeking a robust expense management solution

17. ExpenseOnDemand

ExpenseOnDemand is a user-friendly expense management solution designed to simplify the process of expense reporting and approval. It offers features such as receipt scanning, mileage tracking, and customizable approval workflows.

ExpenseOnDemand integrates seamlessly with accounting systems, ensuring accurate expense tracking and compliance with company policies. Its mobile app enhances accessibility, allowing employees to submit expenses on the go.

| Pros | Cons |

|---|---|

|

|

Suitable for: ExpenseOnDemand is ideal for small to medium-sized businesses across various industries, including healthcare, retail, and professional services.

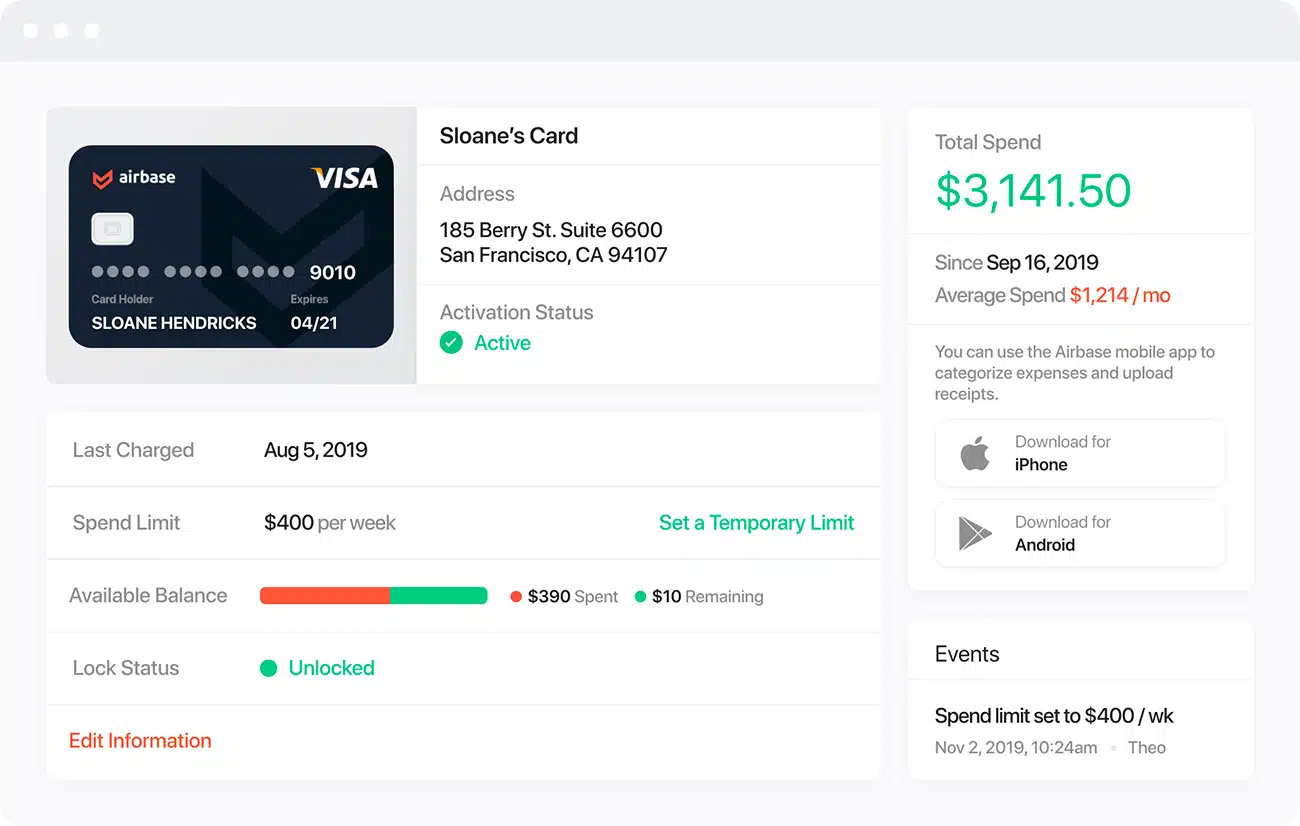

18. Airbase

Airbase is a modern corporate expense management software that combines expense tracking, bill payments, and budgeting on a single platform. It offers features such as virtual cards for online purchases, automated approval workflows, and real-time reporting.

Its robust controls and audit trails ensure compliance with financial policies and regulations, making it suitable for businesses prioritizing financial transparency and operational efficiency.

| Pros | Cons |

|---|---|

|

|

Suitable for: Airbase is ideal for medium to large enterprises across various industries, including technology, finance, and professional services.

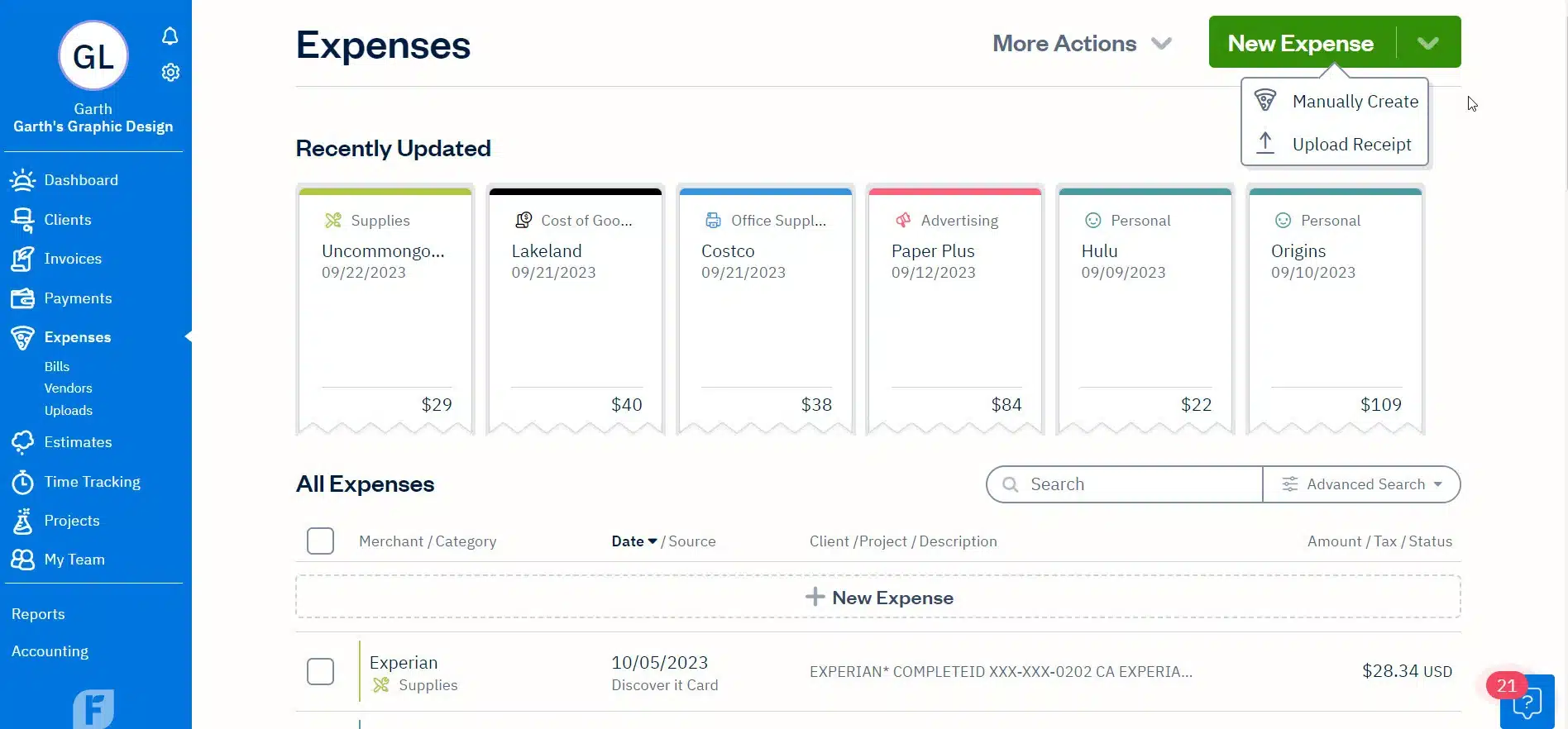

19. FreshBooks

FreshBooks is a cloud-based accounting software known for its intuitive interface and comprehensive expense management capabilities. It simplifies expense tracking, invoicing, and financial reporting for small businesses and freelancers.

FreshBooks allows users to capture receipts, track expenses, and categorize transactions effortlessly.

| Pros | Cons |

|---|---|

|

|

Suitable for: FreshBooks is ideal for freelancers, small businesses, and service-based industries, including consulting, design, and marketing. It is particularly beneficial for companies looking for a straightforward and affordable expense management solution

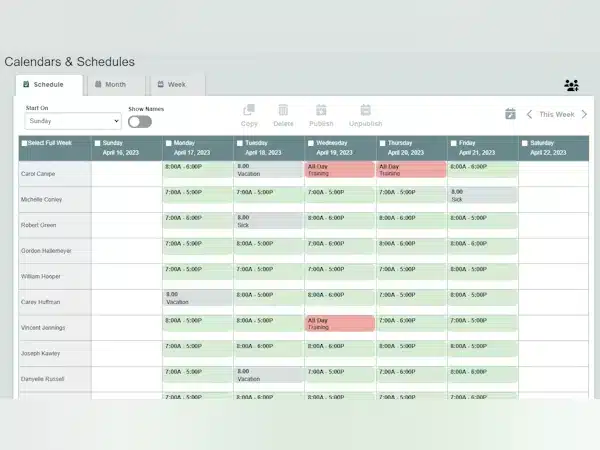

20. Timesheet.com

Timesheet.com offers a comprehensive expense management solution integrated with time tracking and project management features. It enables businesses to track employee time, manage expenses, and allocate costs to projects with ease.

Timesheet.com provides real-time visibility into project budgets and expenses, enabling businesses to effectively monitor profitability and resource allocation.

| Pros | Cons |

|---|---|

|

|

Suitable for: Timesheet.com is ideal for project-based businesses, professional services firms, and consulting companies seeking an integrated solution for time tracking, expense management, and project costing.

21. Wave

Wave is an accounting platform equipped with expense management software that makes expense monitoring simple. The system is quick to set up and beginner-friendly, making it a practical choice for companies just starting to manage the costs digitally.

| Pros | Cons |

|---|---|

|

|

Suitable for: Wave is best suited for freelancers, solo entrepreneurs, and small businesses in Malaysia that need simple, budget-friendly expense tracking and accounting tools. It’s ideal for companies with straightforward financial operations.

22. GnuCash

GnuCash is expense management software Malaysia that supports double-entry bookkeeping, making it ideal for small businesses. It tracks income and expenses, reconciles bank statements, and generates over 30 customizable reports like balance sheets and profit & loss.

| Pros | Cons |

|---|---|

|

|

Suitable for: GnuCash is best suited for micro-businesses and small companies that need essential features such as expense tracking, invoicing, and financial reporting. It’s also ideal for users who prefer an open-source platform.

Overall Comparison of Accounting Systems in Malaysia

| Provider | Connection Quality | Bank Coverage | Ease of Integration | Data Enrichment |

|---|---|---|---|---|

| HashMicro | ||||

| Rydoo | ||||

| SAP | ||||

| Zoho | ||||

| Xero | ||||

| Expensify | ||||

| NetSuite | ||||

| Navan |

Why You Should Use Expense Management Software

Here are compelling reasons why integrating this technology into your operations can streamline processes and drive financial accountability:

- Streamlined Expense Tracking:Automates expense tracking and data collection, reducing manual errors and ensuring accuracy across teams.

- Improved Compliance and Policy Adherence: Built-in policies and approval flows help enforce spending rules and reduce fraud or compliance risks.

- Real-time Visibility and Reporting: Gives instant insight into spending trends to support faster, more informed budgeting decisions, essential for businesses balancing operational expenses and debt financing.

- Enhanced Employee Productivity: Simplifies claim processes, letting employees focus on key tasks. Mobile apps allow easy submissions.

- Integration with Accounting Systems: Connects directly with financial systems (e.g., Maybank/CIMB), easing reconciliation and improving accuracy.

In conclusion, leveraging expense management software is not just about managing expenses; it’s about empowering your organization with tools to drive financial discipline, operational efficiency, and strategic decision-making.

By automating tedious tasks and providing actionable insights, these solutions play a crucial role in modernizing financial management practices and achieving sustainable business growth.

You can also explore articles on the best accounting software for comprehensive financial management.

How to Choose the Right Expense Management Software

Selecting the right expense management software for your organization is crucial for maximizing efficiency and ensuring financial accuracy. Here are key considerations to guide your decision-making process:

- Assess Your Business Needs: Identify your team’s expense volume, approval complexity, and integration needs before choosing a solution.

- User-Friendly Interface: Select tools that are easy to use and quick to adopt, reducing training time and user resistance.

- Customization and Flexibility: Choose software that adapts to your company’s unique policies and workflows, not the other way around.

- Mobile Accessibility: Ensure the system supports mobile claims and approvals, especially for teams frequently on the go.

- Integration Capabilities: The software should connect with existing accounting tools to maintain data accuracy and simplifies financial reporting.

- Automation Features: Look for automated workflows for claims, approvals, and compliance checks to reduce manual effort.

- Data Security: Ensure the software offers encryption, multi-factor authentication, and meets financial data protection standards.

By carefully considering these factors, you can choose a solution that enhances financial control, improves operational efficiency, and supports your organization’s growth.

Conclusions

Choosing the wrong expense management software can lead to significant risks. It may result in poor user adoption and inefficiency, ultimately costing your business time and money. Therefore, selecting the right solution is essential to achieving optimal results.

Among the top contenders, HasMicro Accounting Software stands out as a reliable and comprehensive expense management solution. It offers advanced reporting capabilities and customizable workflows tailored to your unique business needs.

Experience the benefits of HasMicro Accounting firsthand. Sign up for a free demo today through the banner below and discover how it can transform your expense management processes and drive your business forward.

FAQ about Expense Management Software

-

How to budget expenses?

“Step 1: Determine Your Net Income – Calculate your take-home pay after taxes and deductions as the foundation of your budget.

Step 2: Monitor Your Expenses – Track all fixed and variable expenses to understand where your money is going.

Step 3: Establish Achievable Goals – Set specific, measurable financial targets for both the short term and the long term.

Step 4: Create a Plan – Develop a budget that allocates funds to necessities, wants, and savings or debt repayment.

Step 5: Adjust Your Spending to Adhere to Your Budget – Modify your spending habits to stay within your budgetary constraints.

Step 6: Regularly Assess Your Budget – Review and update your budget regularly to adapt to any changes in your financial situation.”

-

What is the best budget formula?

The 50/20/30 budget suggests allocating 50% of your net income to necessities, 20% to savings, and 30% to discretionary spending. If you’ve studied the Basics of Budgeting, you’re already acquainted with the concepts of wants and needs. This budgeting method advocates for a specific distribution of your expenses between wants and needs.

-

What are the 3 P’s of budgeting?

Consider it a way to devise a plan for spending your money on what matters to you. Begin with three simple steps: paycheck, prioritize, and plan.

-

Is expense management software in Malaysia a requirement for every business?

Expense tracking software isn’t required for every business, but it can improve accuracy, save time, and reduce manual errors. While small companies may rely on spreadsheets, growing businesses with frequent expense claims or multiple employees will benefit from automation, clearer financial visibility, and easier reporting.

-

How often should one monitor income and expenses?

Monitoring income and expenses is crucial for any business. At a minimum, finances should be reviewed weekly to stay aligned with targets and adjust quickly when needed. The ideal frequency depends on the business size, budget structure, and complexity; for larger companies, it may require more frequent checks. By regularly tracking and setting reminders, businesses can better manage budgets and stay on course with financial goals.

-

What are the 4 categories of business expense?

“In Malaysia, business expenses generally fall into four categories:

Operating Expenses – Daily costs required to run the business, such as rent, utilities, and wages.

Capital Expenses – Long-term investments like equipment, vehicles, or property.

Tax-Deductible Expenses – Costs eligible for tax relief under LHDN rules, including travel, training, and office supplies.

Non-Deductible Expenses – Personal or non-business-related costs, such as fines or private entertainment, which are not claimable under tax laws.”