The finance module in ERP is a modern tool that revolutionizes how you manage finances. The module is designed to integrate financial operations, automate tasks, and provide real-time insights, all within a single platform.

Are you still relying on spreadsheets and manual processes to manage your finances? These outdated methods can lead to inefficiencies, errors, and missed opportunities that not only slow down business operations but also lead to financial loss.

Furthermore, the ERP software market in Malaysia is expected to grow to $194.50 million by 2024. This significant growth indicates a strong demand for ERP solutions as more companies see the benefits of using integrated management systems.

In this article, we will discuss what is ERP finance module by exploring its key benefits and features. We aim to provide you with an understanding of how this module can transform your financial management practices and make your business more efficient.

Key Takeaways

|

Table of Content

Content Lists

What is an ERP Finance Module?

The finance module in ERP is an ERP system component that streamlines financial functions. It serves as the central hub for recording, analyzing, and reporting transactions, including everything from accounting and budgeting to asset management and procurement.

Furthermore, the finance module centralizes financial data from various departments, ensuring continuous real-time updates. This integration provides an accurate and comprehensive view of the company’s financial status, enhancing decision-making and maintaining compliance.

Benefits of Finance Module in ERP

Implementing a finance module in ERP software offers numerous benefits that can increase efficiency and enhance the overall financial management of a company. Here are some of the key advantages:

- Cost control: The finance module helps companies monitor and control costs more effectively by providing detailed insights into financial operations. Managers can identify areas where costs can be reduced and optimize budget allocations to improve performance.

- Improved financial accuracy:The finance module automates financial transactions and reduces manual data entry. This leads to more accurate financial statements and reports, providing a reliable basis for decision-making, including critical metrics such as the debt to equity ratio.

- Consolidated financial data:It integrates data from various departments, providing a unified view of financial health. This integration is crucial for comprehensive financial analysis and for preparing consolidated financial statements. The finance module also ensures consistency across the accounting cycle, making it easier to track, process, and report financial data across multiple entities.

- Real-time financial reporting: The ERP finance module enables instant access to financial data. This timely information helps managers and executives make informed decisions quickly without waiting for end-of-month reports.

- Better regulatory compliance: You can configure an ERP finance module to adhere to local and international financial regulations, ensuring the company remains compliant with necessary financial reporting standards and tax requirements.

- Scalability: As your business grows, the finance module can scale to accommodate increased transaction volumes and more complex financial management needs without compromising performance or efficiency.

Features of Finance Module in ERP

The accounting and finance module in ERP software has several features designed to manage and optimize financial operations comprehensively. Therefore, below are the features to look for in an ideal ERP finance module:

1. General ledger management

Central to the finance module, this feature consolidates all financial transactions from different departments into a single ledger. This integration ensures consistent and accurate financial data by setting a cut off date for entries, making audits easier and enabling smooth financial tracking across the organization.

2. Accounts payable and receivable

This component manages the dynamics of incoming and outgoing funds. It tracks what the company owes to its suppliers and what is owed to the company by its clients. This feature improves cash flow management and maintains robust financial health.

3. Budgeting and forecasting

These tools allow teams to create detailed budgets that monitor spending in alignment with strategic goals. Additionally, forecasting capabilities enable companies to predict future financial conditions based on current data, helping to guide strategic decisions and resource allocation.

4. Financial reporting and analysis

The finance and accounting module of ERP creates financial reports such as balance sheets, income statements, and cash flow statements. It also facilitates detailed financial analysis, providing insights into financial performance.

5. Asset management

Effective asset management in the ERP finance module features covers the entire lifecycle of a company’s assets. It ensures that all assets are accounted for, properly valued, and managed according to internal policies and applicable accounting standards.

6. Tax management

This component handles tax calculations and generates accurate tax reports, simplifying compliance with local and international tax regulations. It automates tax processes, reducing the risk of human error and ensuring timely and correct tax filings.

7. Cash management

This feature allows for the management of cash flows, ensuring that the company maintains adequate liquidity for its operations while optimizing the allocation of excess cash. It supports effective treasury operations, helping businesses maximize interest income.

8. Bank reconciliation

This feature automatically compares the company’s recorded amounts with bank statements, quickly identifying and resolving discrepancies. This ensures that the financial records accurately reflect the company’s financial position.

ERP Finance Module Use Cases

A business use case is a task or workflow carried out with the help of software. Here are some practical examples of how the accounting and finance module in ERP can be utilized in various financial processes:

- Payables: This involves managing the cycle of invoice processing, cash management, and bank reconciliation. The module automates invoice entry, approval workflows, and payment processing, ensuring that all payables are managed efficiently.

- Receivables: The module handles billing, extending credit, and matching invoices with cash received. Through automation, businesses can ensure timely billing and improve cash flow management, reducing the time spent on manual entry and tasks.

- Revenue recognition: The finance module in ERP ensures compliance with strict regulations by properly recognizing revenue in the general ledger and income statement. This is particularly important for industries with complex revenue streams.

- Reconciliation: It automatically reconciles account discrepancies to avoid delays in the monthly close. Businesses can ensure all accounts are balanced and discrepancies are addressed promptly, improving financial accuracy and closing efficiency.

- Collections: ERP modules analyze receivables and customer accounts to identify payment risks and encourage timely collection. This approach helps manage receivables more effectively, reducing the risk of bad debt and improving cash flow.

Simplify Your Financial Workflow with HashMicro Accounting Software

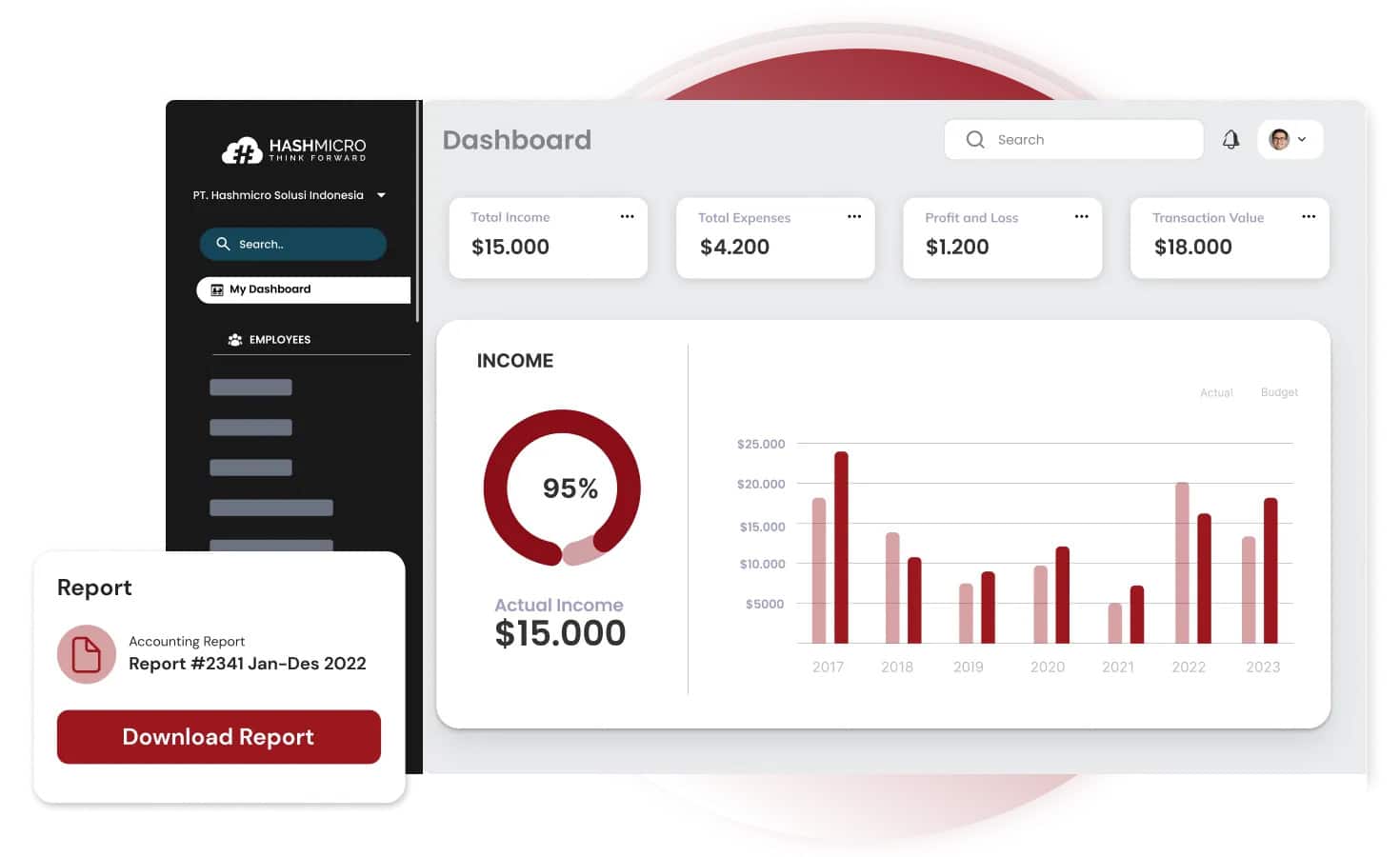

HashMicro Accounting Software is a robust ERP finance module that streamlines and automates financial management. The software manages core accounting tasks and integrates various financial processes into a unified platform.

To help businesses fully understand the capabilities and benefits of their accounting software, HashMicro offers a free product tour and consultation. This allows potential users to explore the features and understand how they can be tailored to meet their specific management needs.

Moreover, HashMicro is trusted by prominent companies such as Forbes, Bank of China, and Changi Airport Group. This endorsement highlights the software’s reliability and capability to meet the demanding financial management needs of top-tier institutions.

Features:

- Financial Dashboard: HashMicro provides a real-time overview of key financial metrics like revenue, expenses, and profits. This customizable dashboard visually presents essential data, enabling quick and informed decision-making.

- Cash Flow Forecasting: This feature forecasts future cash inflows and outflows to help businesses anticipate and plan for potential cash shortages or surpluses, thus maintaining optimal cash flow levels.

- Fast Bank Reconciliation: This feature automates matching financial records with bank statements, reducing time, effort, and errors. It quickly identifies discrepancies, ensuring accurate financial records.

- Accrual & Amortization: This feature automates the recognition of expenses and revenues incurred but still need to be paid or received, ensuring accurate and timely financial information in compliance with accounting standards.

- IRBM E-Invoicing: HashMicro allows businesses to send and receive invoices electronically through the IRBM (Inland Revenue Board of Malaysia) network, ensuring compliance with Malaysia’s tax regulations.

- Analytical Reporting: HashMicro generates detailed reports on financial performance, helping businesses identify trends and make data-driven decisions. Custom reports can be tailored to specific needs for strategic planning.

If you want to optimize your financial operations, exploring HashMicro’s pricing schemes can provide valuable insights into the cost-effectiveness of ERP solutions. Click the banner below to see the pricing plans and find the perfect fit for your business needs.

Conclusion

In conclusion, the finance and accounting module of ERP is indispensable for modern businesses aiming to streamline their financial operations. Integrating various financial processes into a single system provides real-time insights, improves accuracy, and ensures regulatory compliance.

HashMicro Accounting Software stands out as a robust ERP finance module, offering a reliable solution trusted by leading companies. Its end-to-end capabilities and comprehensive features make it an ideal choice for businesses looking to enhance their financial management.

Discover how HashMicro can revolutionize your financial operations and propel your business toward success. Sign up for a free demo today and get the chance to consult your needs with our professional team.

Frequently Asked Questions About Finance Module in ERP

-

What is financial management in ERP?

Financial management software is often part of a company’s ERP system, which integrates financial and operational data and gives teams a complete view of the business.

-

How does ERP help with financial reporting?

ERP systems automate the creation of financial reports like income statements, balance sheets, and cash flow statements. These automated reports comply with accounting standards and regulations, minimizing the risk of errors and ensuring adherence to legal requirements.

-

What are the modules of ERP?

Below are some of the modules of the ERP system:

– Financial management

– Procurement

– Risk management

– Supply chain management

– Manufacturing

– Customer relationship management

– Human resource management