Have you ever wondered how top executives make critical decisions with confidence? The secret often lies in the numbers, and they rely on financial ratios. These powerful tools can reveal hidden insights about your business’s financial health, helping you make smarter, data-driven choices.

A financial ratio is a metric used to assess various aspects of your company’s performance, from profitability and efficiency to liquidity and solvency. By analyzing these ratios, managers and C-Suite executives can gain a clearer picture of the organization’s financial strengths and weaknesses, allowing them to make informed decisions and strategically plan for the future.

In this article, we will dive into the different types of financial ratios, their formulas, and why they are essential for the long-term success of your business. Keep reading to learn how financial ratios can be used to improve decision-making, optimize operations, and drive growth.

Key Takeaways

|

What is a Financial Ratio?

A financial ratio is a numerical measurement used to evaluate various aspects of a company’s financial performance. These ratios are derived from a company’s financial statements, such as the balance sheet and income statement, and provide valuable insights into the business’s profitability, liquidity, efficiency, and overall financial health.

By analyzing these ratios, businesses can better understand their strengths and weaknesses, helping them make more informed decisions and implement effective strategies for growth and sustainability.

Key Functions of Financial Ratios Every Business Should Understand

Financial ratios play a crucial role in assessing a company’s financial health. Integrated into financial reporting software, these ratios help quickly pinpoint potential issues, indicating growth or decline. Key functionalities include:

- Profitability: Assesses how efficiently a company generates profit (e.g., gross profit margin, return on assets).

- Liquidity: Evaluate the company’s ability to meet its short-term obligations (e.g., current ratio, quick ratio).

- Solvency: Measures long-term financial stability (e.g., debt-to-equity ratio, interest coverage ratio).

- Efficiency: Monitors how effectively resources are utilized (e.g., inventory turnover, asset turnover).

- Performance comparison: Allows for consistent comparisons over time or with industry competitors.

Types of Financial Ratios and Formulas

Now that we understand the importance and functions of financial ratios let’s explore the different types of financial ratios and the formulas used to calculate them. Each ratio provides unique insights into a company’s financial performance, and knowing how to apply these formulas is essential for effective analysis.

1. Profitability ratio

Profitability ratios assess a company’s ability to generate profit over a defined period by evaluating factors such as sales, cash flow, capital, and workforce efficiency. Below are some examples of financial ratios you can use:

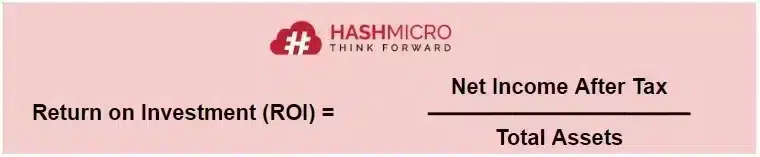

- Return on Investment (ROI): This ratio shows a company’s ability to generate profit based on its assets. ROI formula:

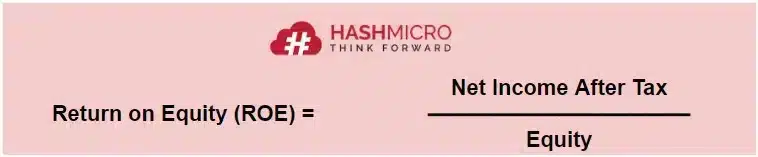

- Return on Equity (ROE): This ratio measures the net income after taxes relative to the company’s equity. The formula for ROE is:

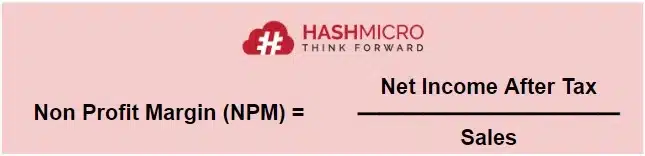

- Net Profit Margin (NPM): This ratio evaluates the company’s efficiency by comparing its net income to total sales. The formula for NPM is:

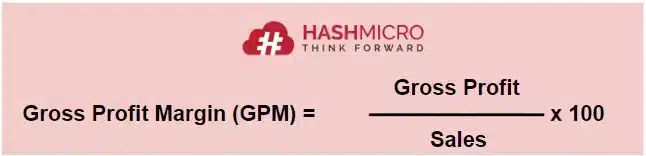

- Gross Profit Margin (GPM): This ratio determines the percentage of gross profit in relation to sales, reflecting the company’s effectiveness in controlling production costs. The formula for GPM is:

2. Liquidity ratio

Liquidity ratios assess a company’s capacity to settle short-term financial liabilities using its available assets. A company is considered “liquid” if it can meet its obligations when they are due. Here are some common examples of liquidity ratios:

- Current ratio: This ratio compares a company’s current assets to its current liabilities, indicating its ability to pay off short-term debts. The formula for the current ratio is:

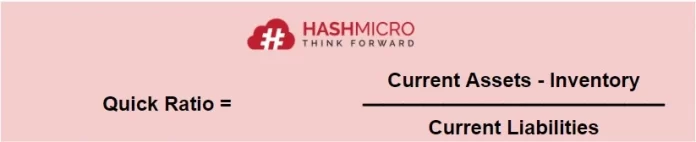

- Quick ratio: Also known as the acid-test ratio, this measures a company’s ability to meet its financial obligations without depending on inventory. The formula for the quick ratio is:

- Cash ratio: This ratio assesses a company’s cash position in relation to its current liabilities. The formula for the cash ratio is:

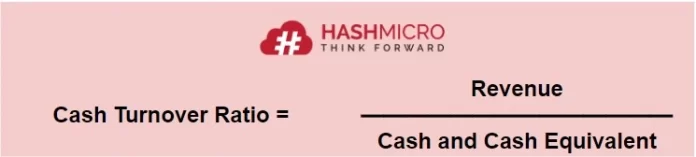

- Cash turnover ratio: This ratio indicates the relationship between net sales and net working capital. The formula for the cash turnover ratio is:

3. Solvency ratio

Solvency ratios assess a company’s ability to fulfill its long-term financial obligations, particularly in the event of liquidation. These ratios highlight the proportion of the company’s assets financed through debt. Important solvency ratios include:

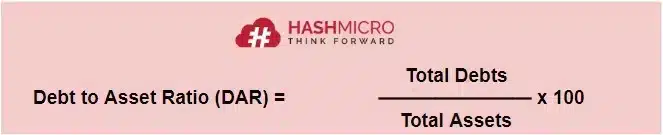

- Debt to Asset Ratio (DAR): This ratio compares a company’s total liabilities to its total assets. The formula for this financial ratio is:

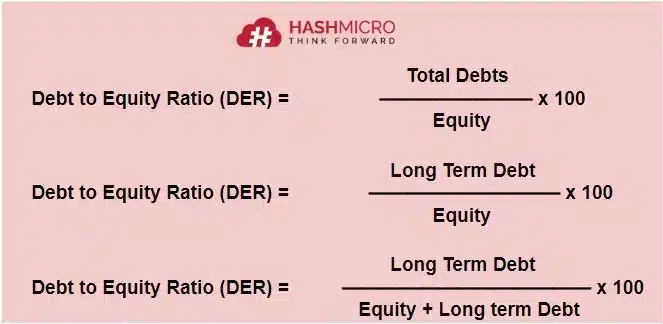

- Debt to Equity Ratio (DER): This ratio illustrates the proportion of debt versus equity that a company uses to finance its operations. The formula for DER is:

4. Activity ratio

Activity ratios evaluate how effectively a company utilizes its assets and liabilities to drive sales and maximize profits. Key activity ratios include:

- Accounts Receivable Turnover: This ratio gauges a company’s efficiency in collecting payments from its customers. The formula for accounts receivable turnover is:

- Merchandise Inventory Turnover: This ratio indicates how frequently a company sells and replenishes its inventory within a specific period. The formula for this financial ratio is:

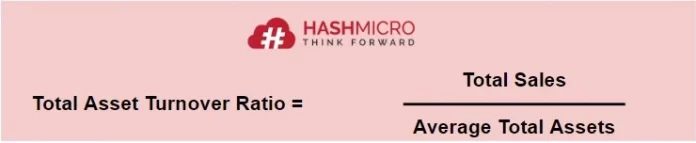

- Total Asset Turnover: This ratio evaluates how efficiently a company utilizes its assets to produce revenue. The formula for this financial ratio is:

Streamline Your Financial Ratio Analysis with Automated Accounting Software by HashMicro

HashMicro has stood as a leading accounting software provider in Southeast Asia since its establishment in 2015. The system’s advanced ERP software features simplify tasks like auditing and financial ratio calculations, making them more efficient.

HashMicro offers numerous advantages to its customers, including free demos, an intuitive and interactive UI/UX design, complimentary customization options, and no user fees. With its comprehensive features, HashMicro can seamlessly assist you in calculating financial ratios such as:

- Financial ratio: This feature provides automatic calculation for various important financial metrics such as liquidity ratios, profitability ratio, debt ratios, etc.

- Multi-level analytical: Know the trend or insight of all financial transactions in real-time and can be filtered based on various categories (project, branch, etc.)

- Cash flow reports: Track the company’s cash inflows and outflows using financial reporting tools to maintain liquidity, effectively plan finances, and address potential issues early.

- Budget S curve: Visually track and understand the distribution of expenses in a project, enabling faster decision-making.

- Custom printout system: Make it easy to print invoices for various needs and formats or displays that match the business identity.

- Forecast budget: Predict future budgets based on historical data to help plan finances, allocate resources efficiently, and make better strategic decisions.

Conclusion

Financial ratios are essential for evaluating a company’s performance and overall financial stability. Although these metrics can appear complex, using the right tools can streamline the process, ensuring both accuracy and efficiency.

HashMicro’s accounting software is designed to automate the calculation and analysis of financial ratios. With its cutting-edge features, the software simplifies these tasks, empowering you to make informed, data-driven decisions with confidence.

Request a free demo today to discover how HashMicro can elevate your business operations.

FAQ Financial Ratio

-

How to calculate gearing ratio formula?

Perhaps the most common method to calculate the gearing ratio of a business is by using the debt to equity measure. Simply put, it is the business’s debt divided by company equity.

-

How do liquidity ratios work?

Liquidity ratios measure a company’s ability to pay off its short-term debts. The Current Ratio compares current assets to current liabilities, while the Quick Ratio excludes inventory from assets to focus on more liquid assets.

-

How do efficiency ratios help in business analysis?

Efficiency ratios measure how effectively a company utilizes its assets. For instance, the Asset Turnover Ratio reveals how well a company is using its assets to generate sales, while the Inventory Turnover Ratio shows how quickly inventory is sold and replaced.