In today’s competitive business landscape, the efficiency and accuracy of financial reporting are paramount. Yet, many companies still rely on manual processes for their financial reports, which is time-consuming, prone to errors, and can result in compliance issues.

According to one AccountingOnline article, companies (US only) were estimated to lose $7.8 billion annually due to dysfunctional and labor-intensive financial reporting processes. This loss is attributed to the inefficiencies in the conventional role of Financial Planning and Analysis (FP&A) teams, which involve creating reports like P&L statements, balance sheets, and cash flows through manual methods. Now, you can see how important it is to use an automated system to create financial reports.

The urgency of adopting financial reporting software is also rising in Malaysia. With rapid economic growth and increasing regulatory demands, businesses need a reliable solution to manage their financial data effectively.

Financial reporting software automates the complex processes involved in financial reporting, ensuring that businesses can maintain accuracy, comply with regulations, and make informed decisions based on real-time data.

This article delves into the definition and benefits of using financial business reporting software and recommends some of the best financial reporting software available in Malaysia.

By exploring these solutions, you can find the right software to enhance your financial reporting processes, reduce manual workloads, and ensure your business remains competitive in the modern market.

Table of Content

Content Lists

Key Takeaways

|

What is Financial Reporting Software and Its Benefits for Businesses?

Financial reporting software is a digital tool that automates and streamlines the creation of financial reports. It helps businesses collect, process, and analyze data for accurate, timely statements. Financial reporting software integrates with other systems to ensure consistency and reliability.

Consequences of using and not using the software

Using financial reporting software can lead to significant improvements in accuracy, efficiency, and compliance. According to a report by Business Wire, companies that implemented financial business reporting software saw a 25% reduction in the time spent on financial closing activities.

In contrast, not using such software can result in various challenges. Manual reporting processes are prone to errors, time-consuming, and inefficient. This can lead to delayed decision-making and compliance issues.

For instance, a study by the American Productivity & Quality Center (APQC) found that organizations without automated financial reporting spend 30% more time on these tasks than those with computerized systems.

Critical benefits of financial reporting software

Here are several key benefits you may gain when you implement financial reporting software:

- Improved accuracy: Automation reduces the risk of human errors, ensuring that financial reports are precise and reliable.

- Time efficiency: Automated processes significantly reduce the time required to compile and generate reports, freeing up resources for strategic activities.

- Regulatory compliance: The software helps businesses comply with local and international financial regulations, reducing the risk of penalties.

- Enhanced data analysis: With real-time data processing and advanced analytics, companies can gain deeper insights into their financial performance.

- Cost savings: By streamlining financial processes, businesses can reduce operational costs and improve overall profitability.

Investing in financial reporting software is a strategic move that can significantly improve a company’s financial management and decision-making processes.

Different Types of Financial Reporting Software

Financial reporting software comes in various types, each designed to meet specific business needs and reporting requirements. Understanding these accounting automation types can help you choose the right solution for your organization.

- Standard reporting software: These systems offer basic functionalities for generating standard financial reports, such as balance sheets and income statements. They are suitable for smaller businesses or those with straightforward reporting needs.

- Advanced analytical software: This type provides sophisticated analytical tools, including multi-level data analysis, financial forecasting, and performance metrics. It’s ideal for larger businesses that require in-depth insights and detailed reporting and handling multiple valuations like goodwill.

- Integrated financial software: These solutions combine financial reporting with other business functions such as ERP or CRM systems. Integration ensures seamless data flow between different departments, enhancing accuracy and efficiency in financial reporting while leveraging ERP benefits to streamline overall business operations.

- Cloud-based reporting solutions: This financial business reporting software offers remote access and real-time updates, making it ideal for businesses with multiple locations or remote teams. It also provides scalability and flexibility to adapt to changing needs.

- Regulatory compliance software: Designed to ensure adherence to financial regulations, this software helps businesses avoid penalties and maintain accurate, compliant records.

Choosing the right type of financial reporting software depends on your specific needs. This ensures you get the most effective solution for accurate and efficient financial management.

20 Best Financial Reporting Software in Malaysia for Businesses

Now that we understand financial business reporting software and its numerous benefits for businesses, it is crucial to choose the right solution to meet your specific needs.

This section will explore the 20 best financial reporting software options available in Malaysia, helping you make an informed decision.

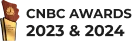

1. HashMicro Financial Reporting Software

HashMicro financial reporting software is the most recommended in Malaysia due to its comprehensive features and proven reliability. Businesses choose HashMicro for its real-time financial insights, seamless integration capabilities, and robust compliance with local regulations.

If you’re having trouble creating a financial report, a free demo offer lets you try HashMicro’s software and experience its benefits firsthand. This offer allows you to assess the software’s impact on efficiency and accuracy without any initial investment, making it a risk-free decision.

HashMicro financial reporting software is the best option due to its advanced features and seamless integration capabilities. Its user-friendly interface and real-time analytics provide businesses with accurate, up-to-date financial insights that drive strategic decision-making.

By automating complex financial processes, HashMicro ensures compliance with local regulations and reduces the risk of errors. The software integrates effortlessly with existing systems, streamlining operations and enhancing overall efficiency.

Key features:

- Automatic bank reconciliation: This feature automatically reconciles bank transactions with financial records, ensuring accuracy and saving time.

- Multi-level analytical: Enables detailed financial analysis by comparing statements across projects or branches for better insight.

- Profit and loss vs. budget and forecast: This tool compares actual profit and loss against budget and forecast, helping track performance and adjust strategies through the software.

- Cash flow reports: Provides real-time cash flow statements for improved liquidity management and financial planning.

- Financial ratio: Calculates key financial ratios, providing insights into the business’s financial health and performance.

- Financial statement with budget comparison: This option shows financial statements with budget comparisons within the software, highlighting variances and aiding financial control.

- Forecast budget: Generates budget forecasts to help businesses plan financial activities and allocate resources efficiently.

Strengths:

- Fully automated: HashMicro’s fully automated system streamlines financial processes, reducing manual effort and errors for accurate reporting.

- Integrated features: The software seamlessly connects financial modules, providing a comprehensive view of data and enhancing decision-making.

- Easy to customize: HashMicro allows businesses to tailor the software to their specific financial reporting needs.

- Industry-ready: HashMicro meets specialized financial reporting requirements for compliance and relevance across various sectors.

- Easy to use: The user-friendly interface boosts efficiency, productivity, and accuracy in financial reporting.

Weaknesses:

- Implementation duration: Implementation time varies based on the complexity of the desired features.

- Variety of features: The extensive features may not suit businesses needing only simple solutions.

Having explored HashMicro financial reporting software’s essential features, strengths, and weaknesses, it stands out as a top choice.

Download their price scheme to fully appreciate its value and see how it fits within your budget. This is an excellent business opportunity to enhance financial management with a cost-effective, high-quality solution.

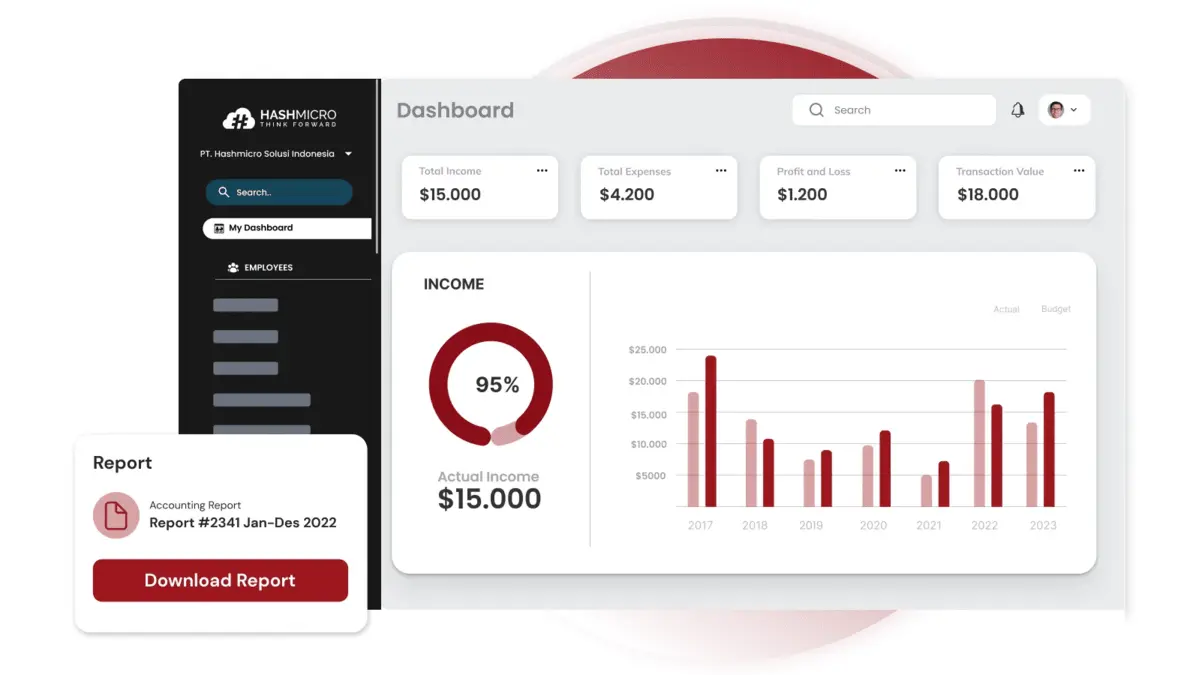

2. Xero Accounting Software Malaysia

Xero Accounting is a comprehensive cloud accounting software designed to streamline and simplify accounting processes for businesses of all sizes. By utilizing Xero, companies can efficiently manage their finances, ensure compliance, and gain valuable insights.

With its cloud-based platform, Xero offers real-time access to financial data, enabling business owners and accountants to make informed decisions and stay ahead in a competitive market.

Key features:

- Real-time financial reporting

- Automatic bank reconciliation

- Invoice management

- Expense management

- Multi-currency support

Strengths:

- User-friendly interface: The intuitive design simplifies the accounting process, making it accessible for users with limited accounting knowledge.

- Scalable solutions: Ideal for small to medium-sized businesses with scalable features.

- Integration capabilities: Integrates with hundreds of third-party apps to enhance functionality and streamline operations.

- Mobile accessibility: Offers a mobile app for managing finances on the go, providing flexibility and convenience.

- Robust security: Ensures data protection with multi-layered security, including two-step authentication.

Weaknesses:

- Limited customization: The software offers limited customization options, which may not meet the needs of businesses with unique requirements.

- Learning curve for advanced features: Basic features are user-friendly, but advanced functionalities may need extra training and time to master.

- Cost: Pricing for premium features and larger organizations may concern budget-conscious businesses.

- Offline functionality: Cloud-based software needs an internet connection to access most features, which can be a drawback in areas with unreliable internet.

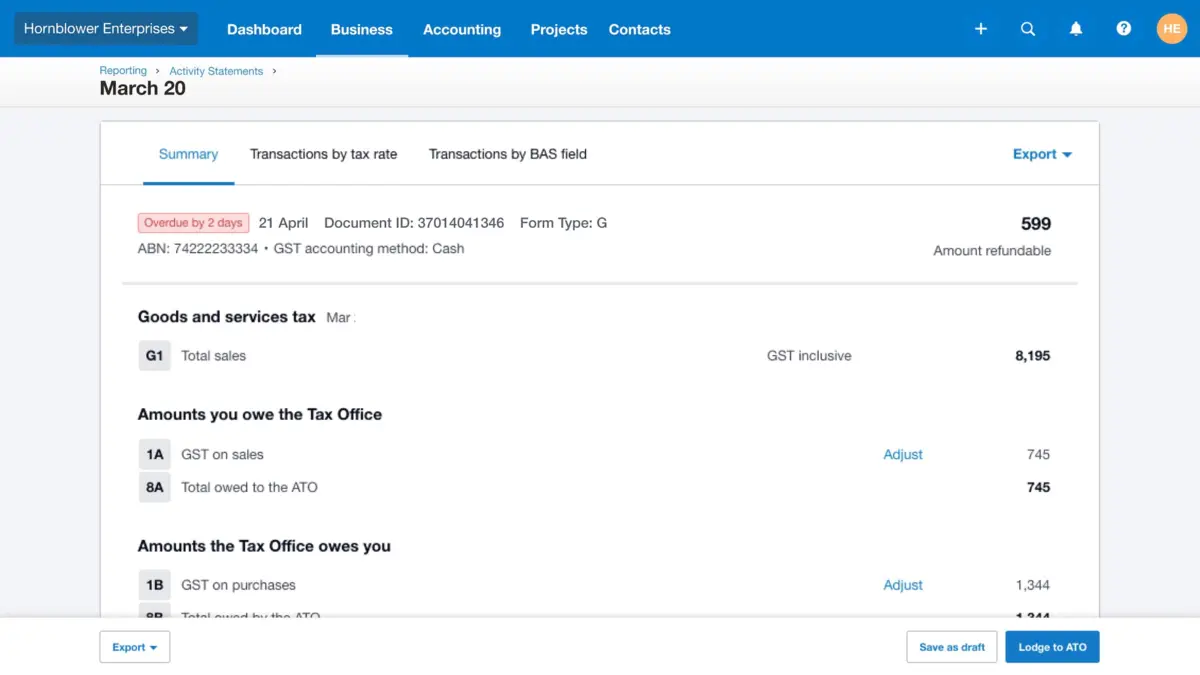

3. Zoho Books Bookkeeping Software

Zoho Books is intuitive bookkeeping software designed to streamline your business’s accounting processes. As one of the top financial reporting software companies, it offers comprehensive invoicing, expense tracking, inventory management, and financial reporting tools.

Its user-friendly interface and integration capabilities make it ideal for businesses seeking to improve financial transparency and decision-making.

Key features:

- Real-time financial reporting and analytics

- Automated bank feeds and reconciliation

- Customizable invoicing and payment reminders

- Inventory management and control

- Multi-currency transactions and compliance

Strengths:

- User-friendly interface: This accounting software features a clean and intuitive interface, making it easy for users to navigate and utilize its extensive functionalities.

- Comprehensive financial management: This service offers a wide range of tools for managing invoices, expenses, inventory, and taxes, providing a holistic approach to financial management.

- Automation: This technology automates repetitive tasks such as bank reconciliation and payment reminders, saving time and reducing the risk of human error.

- Integration capabilities: Seamlessly integrates with other Zoho products and third-party applications, allowing for a more streamlined workflow.

- Scalability: Suitable for small to medium-sized businesses, with features that support growth and evolving financial needs.

Weaknesses:

- Learning curve: While user-friendly, new users may initially face challenges with the advanced features and settings.

- Limited customization: Some users may find the report and template customization options limited compared to other financial software.

- Mobile app limitations: The mobile app is functional but needs some of the advanced functionalities of the desktop version.

- Cost: The pricing structure may be high for tiny businesses or startups, especially with additional users or advanced features.

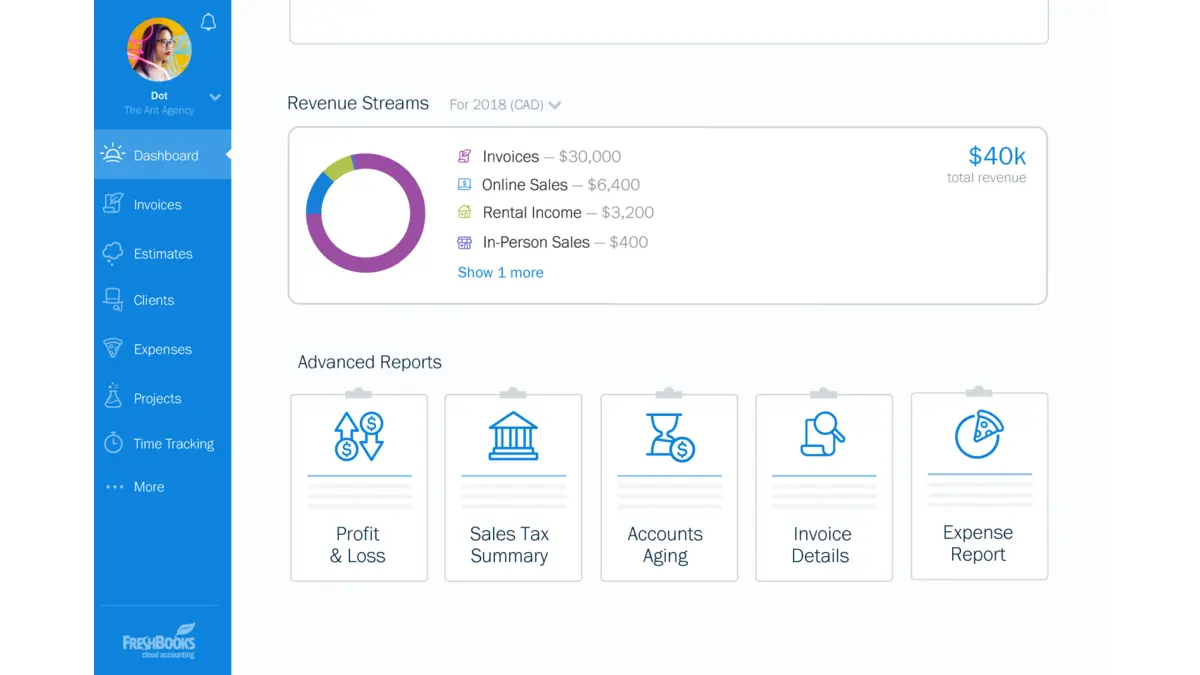

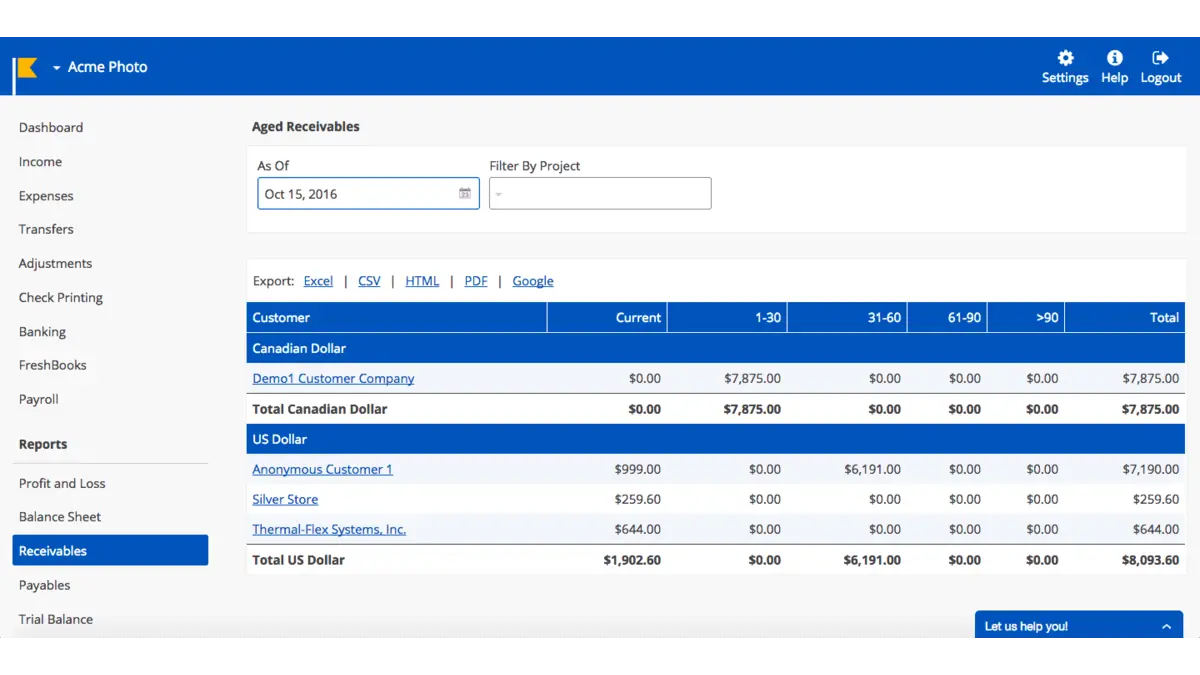

4. FreshBooks Financial Reporting Software Malaysia

FreshBooks is intuitive financial reporting software designed for small—to medium-sized businesses, freelancers, and service-based professionals. Its user-friendly interface and comprehensive features make it easy to manage finances and generate detailed financial reports.

By using FreshBooks, businesses can streamline their accounting processes, save time on administrative tasks, and focus on growth and client satisfaction.

Key features:

- Automated invoicing

- Expense tracking

- Time tracking

- Financial reports

- Multi-currency billing

Strengths:

- User-friendly interface: FreshBooks offers an easy-to-navigate platform, making it accessible for users with varying levels of accounting knowledge.

- Comprehensive invoicing tools: The automated invoicing feature saves time and ensures consistent cash flow by sending timely reminders and tracking payments.

- Robust expense management: Expense tracking and categorization capabilities help businesses maintain accurate financial records and optimize budgets.

- Detailed financial reporting: FreshBooks provides a wide range of economic reports that offer valuable insights into business performance and aid decision-making.

- Excellent customer support: FreshBooks is known for its responsive and helpful customer service, providing users with the support they need to resolve issues quickly.

Weaknesses:

- Limited customization: Compared to other financial reporting software, some users may find the invoice and report customization options limited.

- Pricing: FreshBooks can be relatively expensive for tiny businesses or freelancers with limited budgets.

- Mobile app limitations: While the mobile app is convenient, it may need more advanced features available on the desktop version.

- Complexity for more prominent businesses: FreshBooks is ideal for small to medium-sized businesses; larger companies may find it needs features for complex accounting needs.

- Third-party integration: Although FreshBooks integrates with many third-party applications, users may need help with specific integrations or find the selection limited.

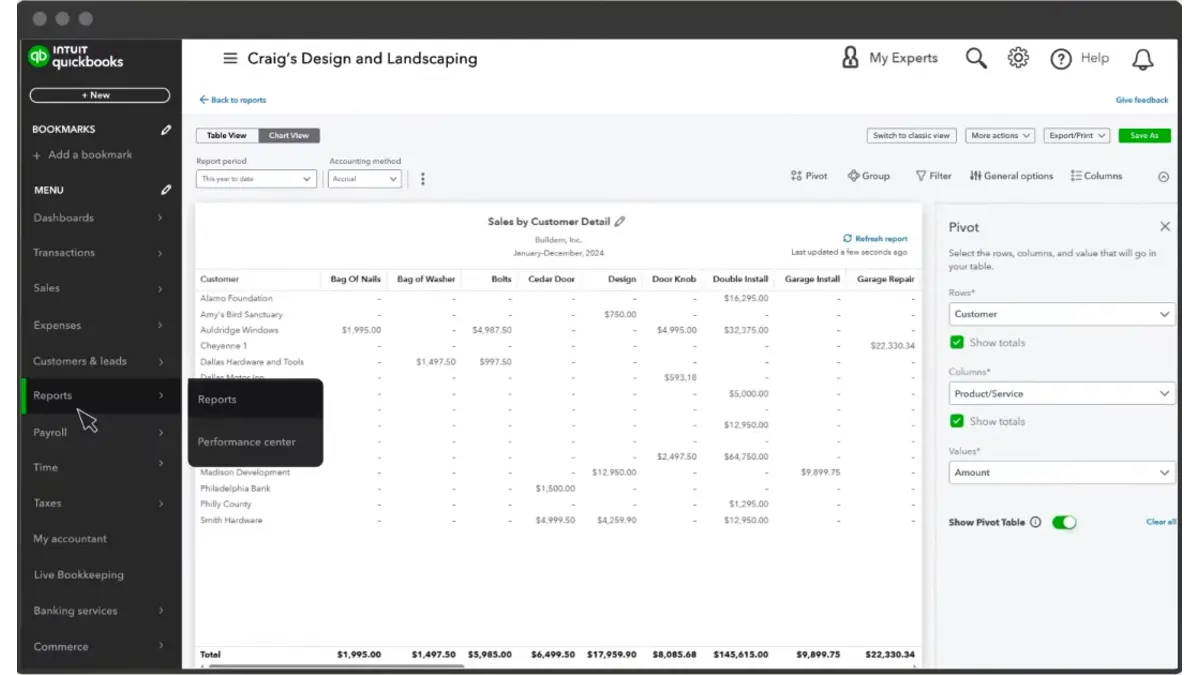

5. Intuit Quickbooks Accounting Software Malaysia

Intuit QuickBooks is a comprehensive financial reporting software designed to streamline accounting processes for small—to medium-sized businesses. With its user-friendly interface and powerful features, QuickBooks helps companies manage their finances efficiently.

Using QuickBooks, businesses can save time on administrative tasks, maintain financial accuracy, and gain valuable insights to make informed decisions.

Key features:

- Automated invoicing

- Expense tracking

- Real-time financial reporting

- Integration with bank accounts

- Payroll management

Strengths:

- User-friendly interface: QuickBooks features an intuitive interface, making it easy for users of all accounting knowledge levels to navigate.

- Comprehensive features: The software includes invoicing, expense tracking, payroll management, and financial reporting, covering all accounting needs.

- Real-time data: Real-time financial reporting allows businesses to access up-to-date financial information quickly, facilitating timely decision-making.

- Bank integration: QuickBooks integrates with bank accounts to automate transaction imports and reconciliations, reducing manual entry errors.

- Scalability: The software is scalable, suitable for small businesses, and can grow as business needs evolve.

Weaknesses:

- High cost: QuickBooks can be costly for small businesses, particularly when selecting advanced features or adding extra users.

- Complexity for advanced features: Basic features are user-friendly, but advanced ones can be complex and may require extra training.

- Limited customization: Compared to other financial tools, report and invoice customization options are limited.

- Internet dependence: QuickBooks, being cloud-based, requires a stable internet connection, which can be a limitation in areas with poor connectivity.

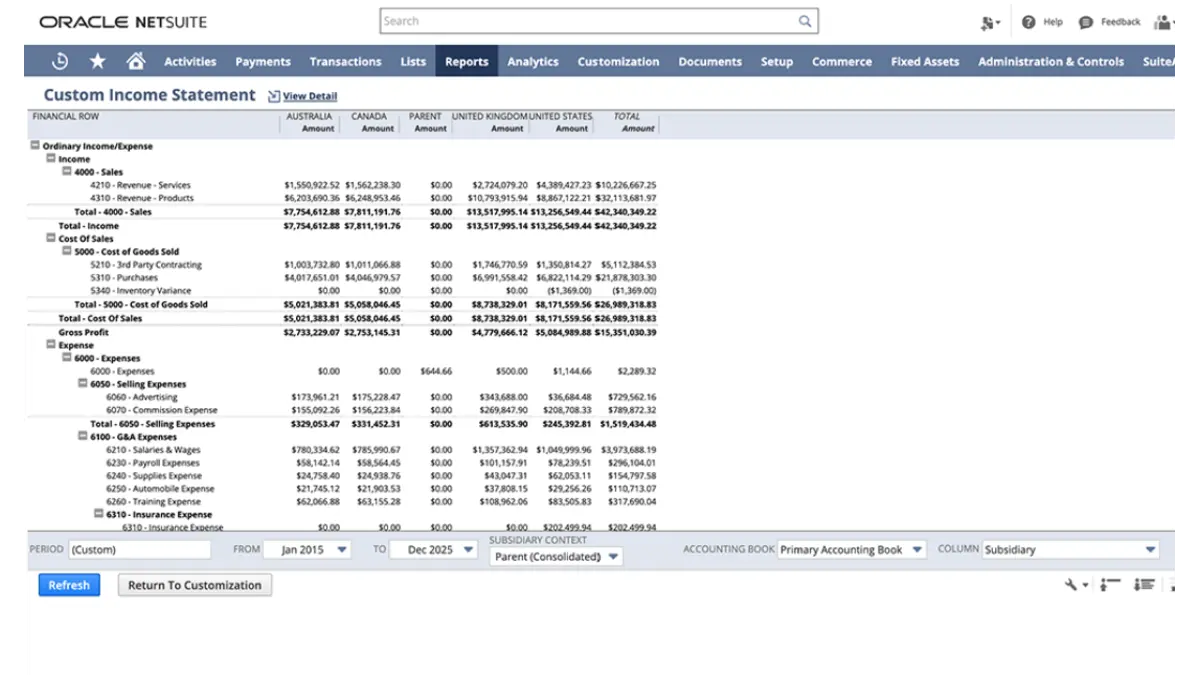

6. Oracle NetSuite Financial Reporting Software

Oracle NetSuite is comprehensive financial reporting software designed to streamline business processes and enhance financial transparency. Businesses should use it for its robust capabilities in automating financial operations.

With its cloud-based architecture, Oracle NetSuite ensures scalability and flexibility, making it an ideal solution for growing enterprises looking to optimize their financial management.

Key features:

- Automated financial processes

- Real-time financial insights

- Multi-currency support

- Compliance management

- Integration capabilities

Strengths:

- Comprehensive financial management: Provides comprehensive financial tools, including accounts receivable, accounts payable, and general ledger management.

- Real-time reporting: Provides accurate, real-time financial reports for quicker, more informed decision-making.

- Scalability: Flexible for businesses of all sizes, allowing growth and adaptation as the company expands.

- User-friendly interface: An intuitive and easy-to-navigate interface reduces the learning curve for new users.

- Strong security measures: Ensures data protection with advanced security protocols and regular updates.

Weaknesses:

- High cost: This can be expensive for small businesses or startups, with significant upfront and ongoing expenses.

- Complex implementation: Initial setup and customization can be time-consuming and may require expert assistance.

- Learning curve: Though user-friendly, the software’s extensive features may require significant training to utilize fully.

7. Workiva Financial Reporting Software Malaysia

Workiva is a leading financial reporting software that streamlines complex financial processes and ensures compliance with regulatory requirements. This software integrates data from various sources to provide a unified and reliable financial reporting system.

Businesses should use Workiva to reduce manual errors, improve collaboration, and comply with evolving regulatory standards.

Key features:

- Automated data integration

- Real-time collaboration

- Compliance management

- Audit trail

- Dynamic reporting

Strengths:

- Enhanced accuracy: Automated data integration reduces manual errors, ensuring high accuracy in financial reports.

- Improved collaboration: Real-time collaboration features allow teams to work together efficiently, regardless of location.

- Regulatory compliance: Comprehensive compliance tools help businesses stay up-to-date with regulatory requirements.

- Transparency and accountability: Detailed audit trails clearly record all changes, enhancing transparency and accountability.

- Customizable reporting: Dynamic reporting capabilities allow for tailored financial reports that meet specific business needs.

Weaknesses:

- Cost: Workiva’s advanced features and capabilities come at a higher price, which may concern smaller businesses.

- Learning curve: New users may face a steep learning curve due to the software’s extensive functionalities.

- Integration complexity: Integrating Workiva with existing systems can be complex and require additional IT resources.

- Limited customization: Despite its dynamic reporting, some users may find it difficult to customize certain aspects to meet unique business needs.

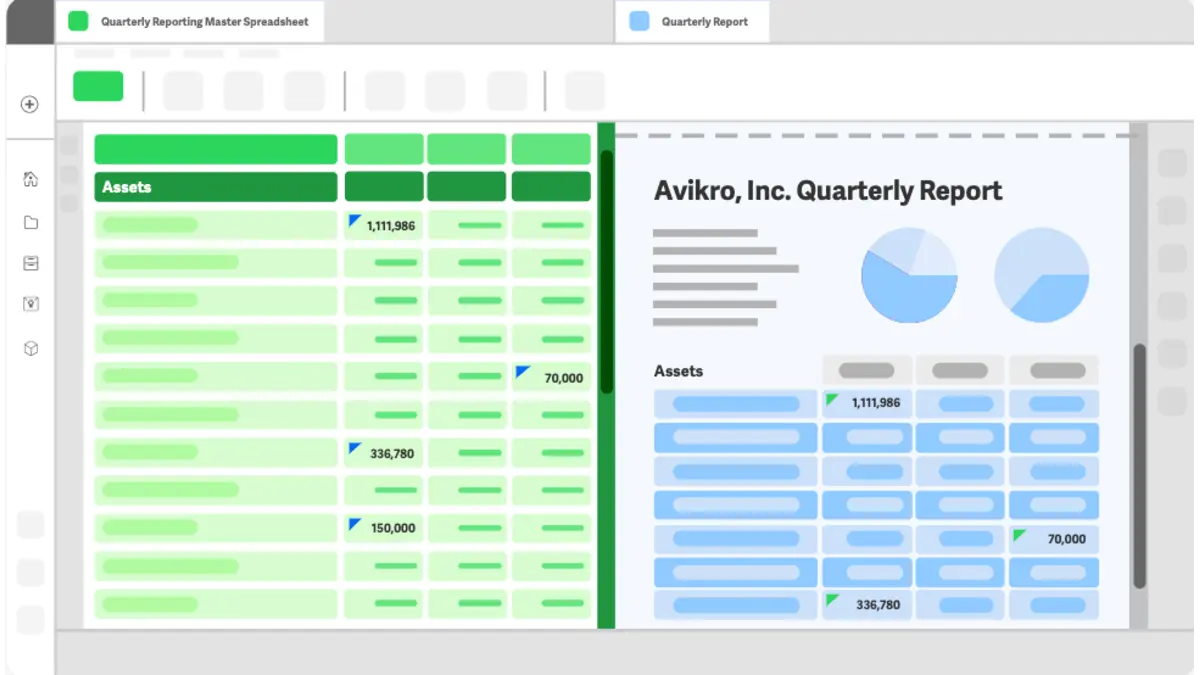

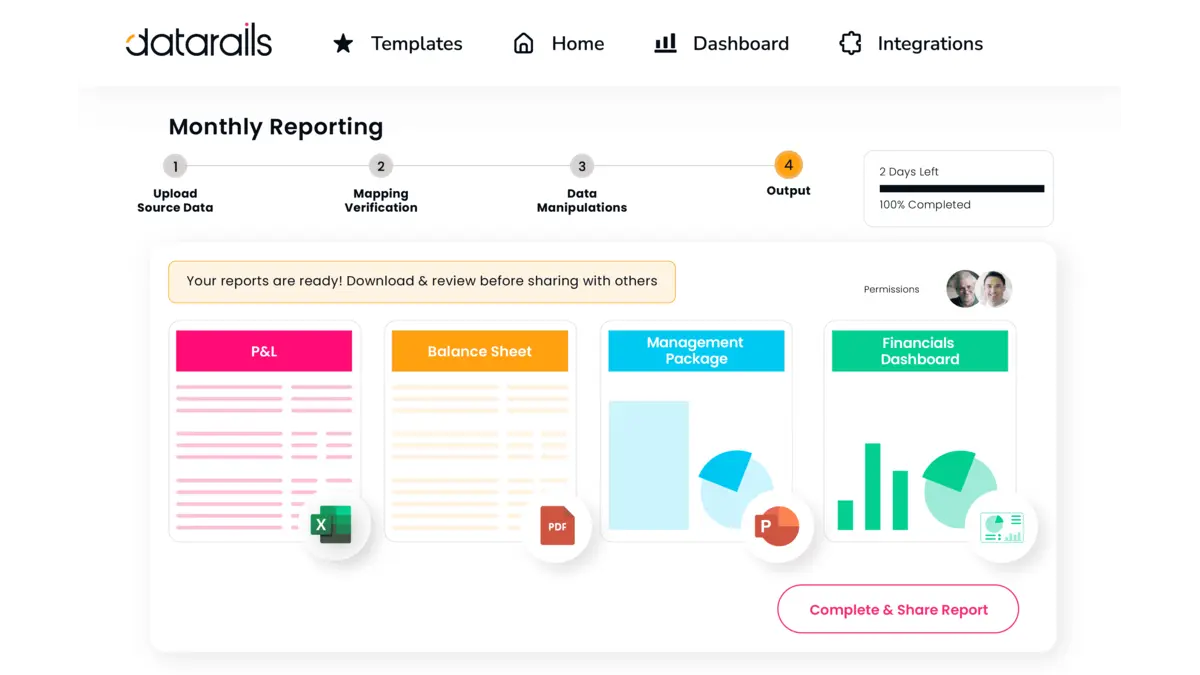

8. Datarails Bookkeeping Software Malaysia

Datarails is an advanced financial reporting software designed to streamline the financial reporting process for businesses of all sizes. By leveraging its powerful data integration capabilities, Datarails allows organizations to consolidate financial data from multiple sources.

This software is ideal for companies looking to enhance their financial decision-making and reporting efficiency by ensuring accuracy and real-time insights.

Key features:

- Data integration

- Automated consolidation

- Customizable dashboards

- Collaboration tools

- Scenario analysis

Strengths:

- Ease of use: User-friendly interface that simplifies financial reporting processes, making it accessible even for non-technical users.

- Real-time data: Provides real-time financial data and insights, enabling timely and informed decision-making.

- Automation: Reduces manual effort through automated data consolidation and report generation, improving efficiency and accuracy.

- Integration capabilities: Strong integration with various financial systems and data sources, ensuring comprehensive and accurate reports.

- Scalability: Scalable solutions are suitable for businesses of all sizes, from small enterprises to large corporations.

Weaknesses:

- Cost: Priced higher than some competitors, which may deter smaller businesses with limited budgets.

- Learning curve: Initial setup and configuration can take time and training, especially for new users.

- Customization limits: Dashboards are customizable, but report customization may be more limited than other flexible solutions.

- Feature overlap: This may have redundant features with existing financial systems, leading to underutilizing some capabilities.

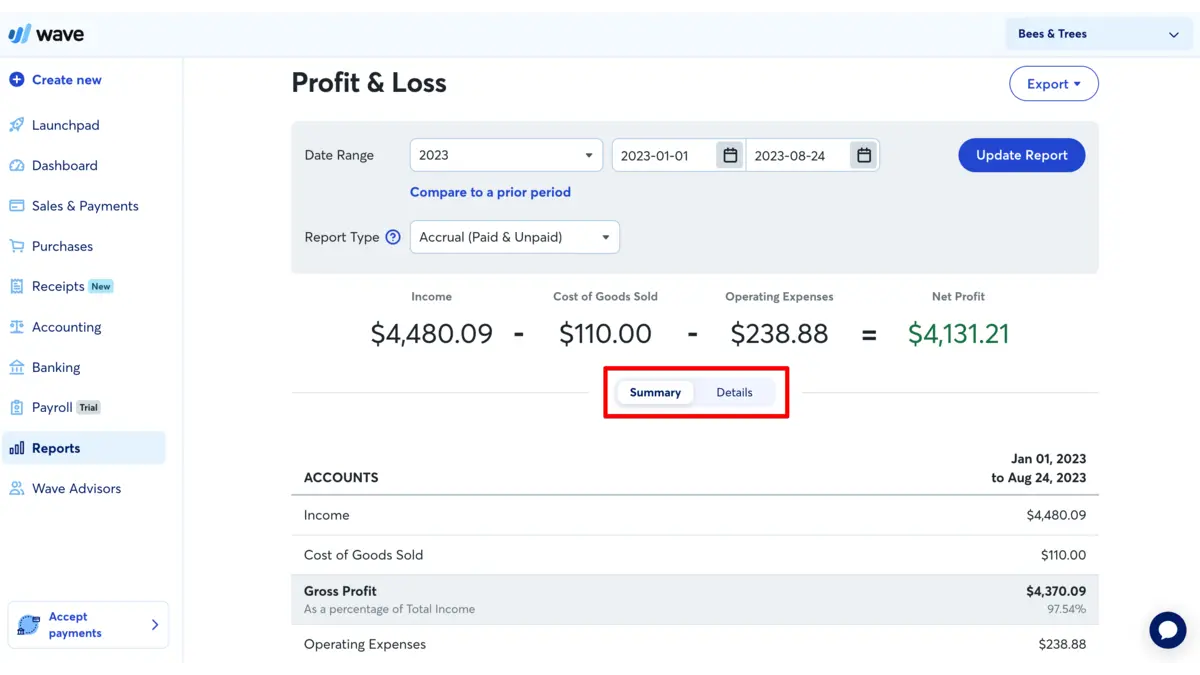

9. Wave Financial Reporting Software Malaysia

Wave Accounting is a robust financial reporting software designed specifically for small businesses, freelancers, and entrepreneurs. It provides a comprehensive suite of accounting tools that streamline financial management, ensuring accuracy and efficiency.

Businesses should use Wave Accounting to simplify their financial tasks, gain real-time insights, and make informed decisions without incurring high costs.

Key features:

- Customizable invoicing

- Receipts management

- Double-entry accounting

- Automatic bank transaction connections

- Detailed financial reports

Strengths:

- User-friendly interface: The software’s intuitive design ensures easy navigation and a smooth user experience.

- Comprehensive features: Provides comprehensive accounting tools, from invoicing to financial reporting, meeting diverse business needs.

- Integration capabilities: It integrates seamlessly with other Wave products, such as payments and payroll, creating a unified financial management system.

- Cloud-based access: Cloud-based access ensures flexibility and convenience by allowing access from anywhere.

Weaknesses:

- Limited customer support: Customer support is limited, with no phone support for free users.

- Advanced features: Lacks advanced accounting features that more extensive or complex businesses need.

- International functionality: Limited currency options and international support can hinder global companies.

- Mobile app limitations: The mobile app’s limited features compared to the desktop version can restrict accounting tasks on the go.

- Scalability: This may not scale well for rapidly growing businesses needing advanced features and higher transaction volumes.

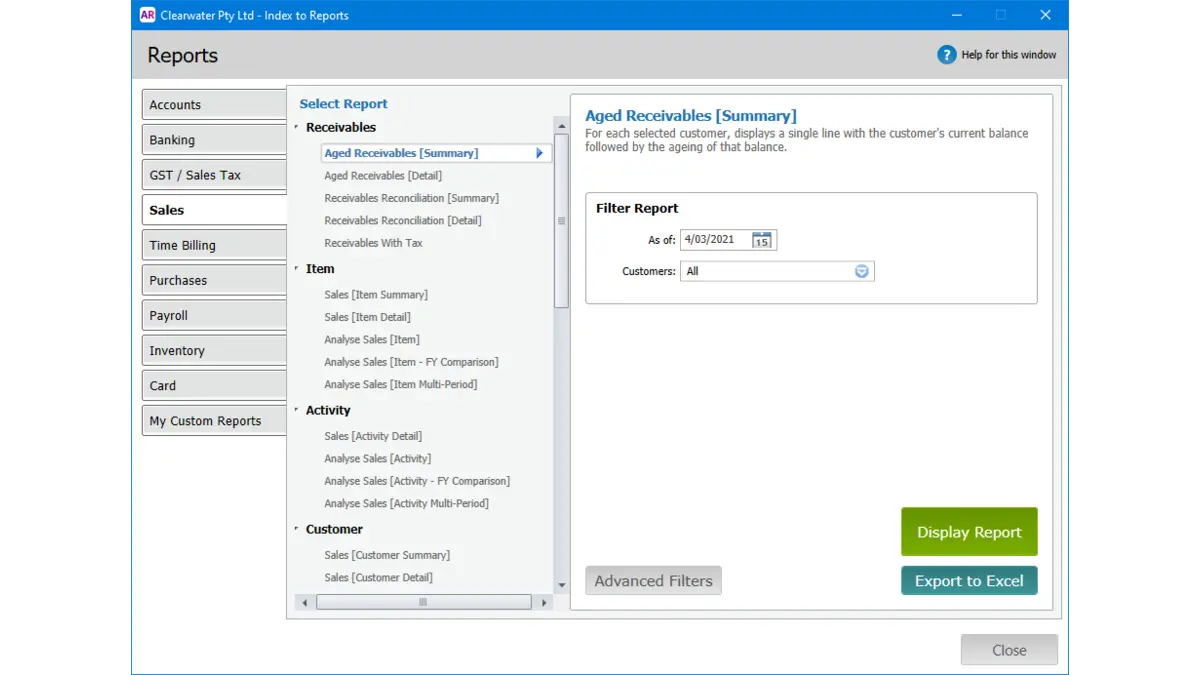

10. MYOB Automated Financial Reporting Software

MYOB Financial Reporting Software is a comprehensive business solution streamlining financial management processes. It offers an intuitive platform that ensures accurate and efficient reporting.

By using MYOB, businesses can save time on manual bookkeeping, reduce errors, and focus on strategic growth. It also helps companies to stay compliant and make informed financial decisions.

Key features:

- Automated financial reports

- Tax compliance tools

- Real-time data access

- Customizable dashboards

- Multi-currency support

Strengths:

- User-friendly interface: Easy-to-navigate interface that reduces the learning curve for new users.

- Comprehensive features: Provides a comprehensive suite of accounting, payroll, and financial reporting tools.

- Scalability: Suitable for businesses of all sizes, from small enterprises to large corporations.

- Excellent customer support: MYOB is known for its responsive and helpful customer support team.

- Integration capabilities: Easily integrates with other business applications, enhancing overall productivity.

Weaknesses:

- Cost: The pricing structure can be expensive for smaller businesses or startups.

- Learning curve for advanced features: Basic features are user-friendly, but advanced ones may require extra training.

- Limited international support: MYOB primarily serves the Australian and New Zealand markets, limiting its appeal to global businesses.

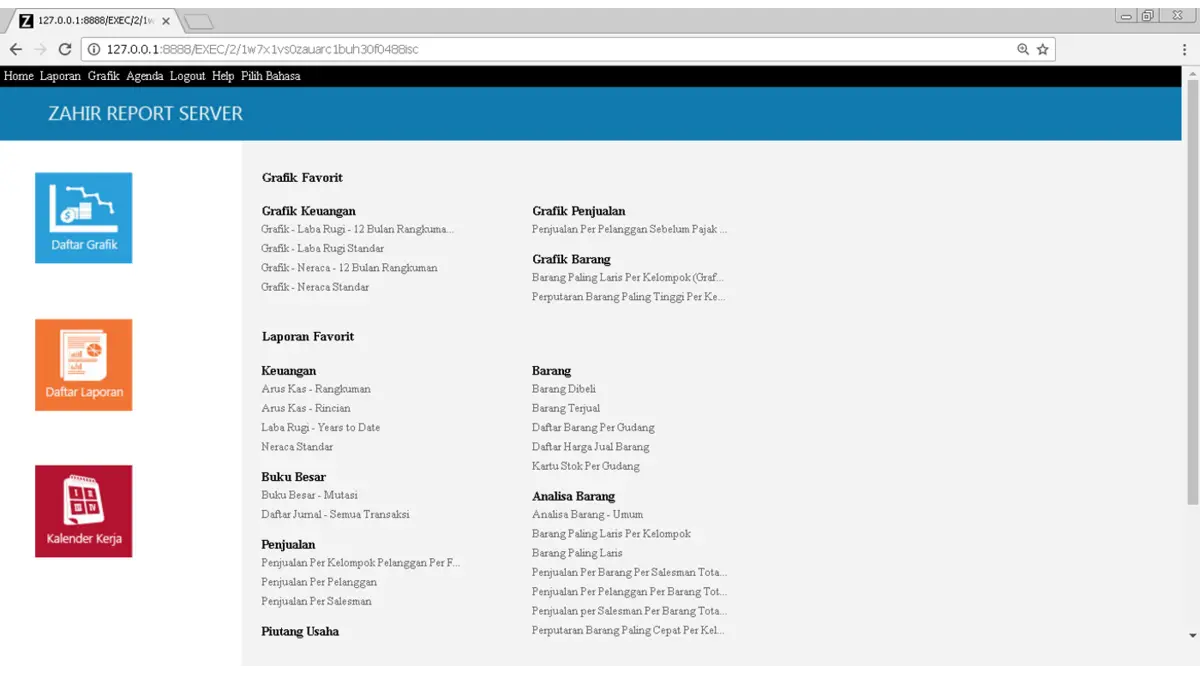

11. Zahir Automated Financial Reporting Software

Zahir Accounting is comprehensive financial reporting software designed to streamline and simplify your business’s economic management. It enables companies to automate complex accounting tasks, improve accuracy, and gain valuable insights.

Ideal for SMEs, this software ensures efficient financial reporting, helping you make informed business decisions and maintain compliance with regulatory standards.

Key features:

- Real-time financial reporting and analysis

- Automated invoice generation and management

- Integrated tax calculation and reporting

- Comprehensive budgeting and forecasting tools

- Multi-currency support and conversion

Strengths:

- User-friendly interface: The software’s intuitive design allows users of all skill levels to manage their finances efficiently.

- Comprehensive functionality: Zahir Accounting addresses various accounting needs, including invoicing, tax management, and financial reporting.

- Customization options: Users can customize the software to meet their business needs, increasing flexibility and usability.

- Real-time data access: Provides up-to-date financial information, enabling timely and informed decision-making.

- Strong support and training: Provides excellent customer support and extensive training resources to help users maximize the software’s potential.

Weaknesses:

- Limited integration: This may need to integrate smoothly with some third-party applications, complicating workflows for businesses using multiple software solutions.

- Steep learning curve: While the basic features are user-friendly, mastering advanced tools may need extra training.

- Pricing: This can be relatively expensive for small businesses or startups with limited budgets.

- Customization complexity: Although customization is a strength, it can be complex and time-consuming without proper guidance.

- Periodic updates: Frequent software updates can cause temporary disruptions and require user adjustments.

12. Kashoo Financial Reporting Software

Kashoo is a user-friendly financial reporting software designed to simplify accounting tasks for small businesses and freelancers. It offers an intuitive interface that streamlines invoicing, expense tracking, and financial reporting.

By using Kashoo, businesses can save time on bookkeeping, ensure compliance with tax regulations, and gain valuable insights into their financial health.

Key features:

- Real-time financial reporting

- Automated invoicing

- Expense tracking

- Automatic bank reconciliation

- Multi-currency support

Strengths:

- User-friendly interface: Kashoo’s intuitive design allows users to manage their finances easily without a steep learning curve.

- Comprehensive reporting: Provides customizable financial reports that help businesses monitor their economic performance.

- Excellent customer support: Provides responsive and knowledgeable customer support for any issues or questions.

Weaknesses:

- Limited advanced features: These may require advanced accounting features for larger businesses or complex financial needs.

- Mobile app limitations: While convenient, the mobile app may lack the full functionality of the desktop version.

- Customization constraints: Limited customization options may only meet some users’ needs.

- Integration limitations: Fewer integrations with third-party apps compared to some competitors may be a drawback for businesses needing extensive connectivity.

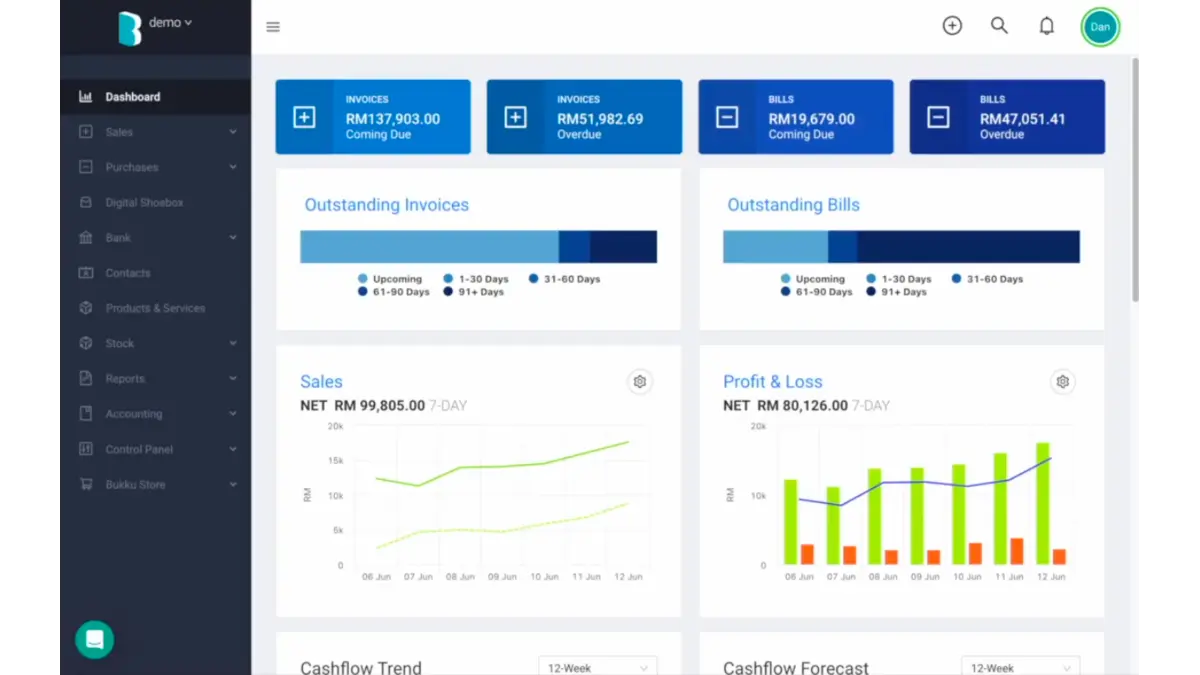

13. Bukku Accounting Software Malaysia

Bukku Accounting is an innovative financial reporting software designed to streamline and simplify the accounting process for businesses of all sizes. With its user-friendly interface and comprehensive features, it empowers companies to manage their finances efficiently.

Whether a small startup or an established enterprise, Bukku Accounting offers the tools to maintain apparent financial oversight, make informed decisions, and optimize your financial operations.

Key features:

- Automated financial reporting

- Expense tracking

- Invoice management

- Tax management

- Multi-currency support

Strengths:

- User-friendly interface: Intuitive design that makes navigating and operating the software easy for users.

- Comprehensive reporting: Offers a wide range of detailed and customizable financial reports.

- Scalability: Suitable for small and more significant enterprises, with features that grow with your business.

- Automation: Reduces manual data entry and minimizes errors with automated processes.

- Customer support: Provides robust support and resources to help users resolve issues quickly.

Weaknesses:

- Learning curve: Some users may find the initial setup and learning process challenging.

- Cost: Higher subscription fees compared to some competitors, which might be a concern for small businesses.

- Customization limits: Limited customization options are available for advanced users seeking highly tailored solutions.

- Integration: Integration with other third-party software can be limited or complex.

- Mobile app: The mobile app may lack some features on the desktop version, affecting on-the-go accessibility.

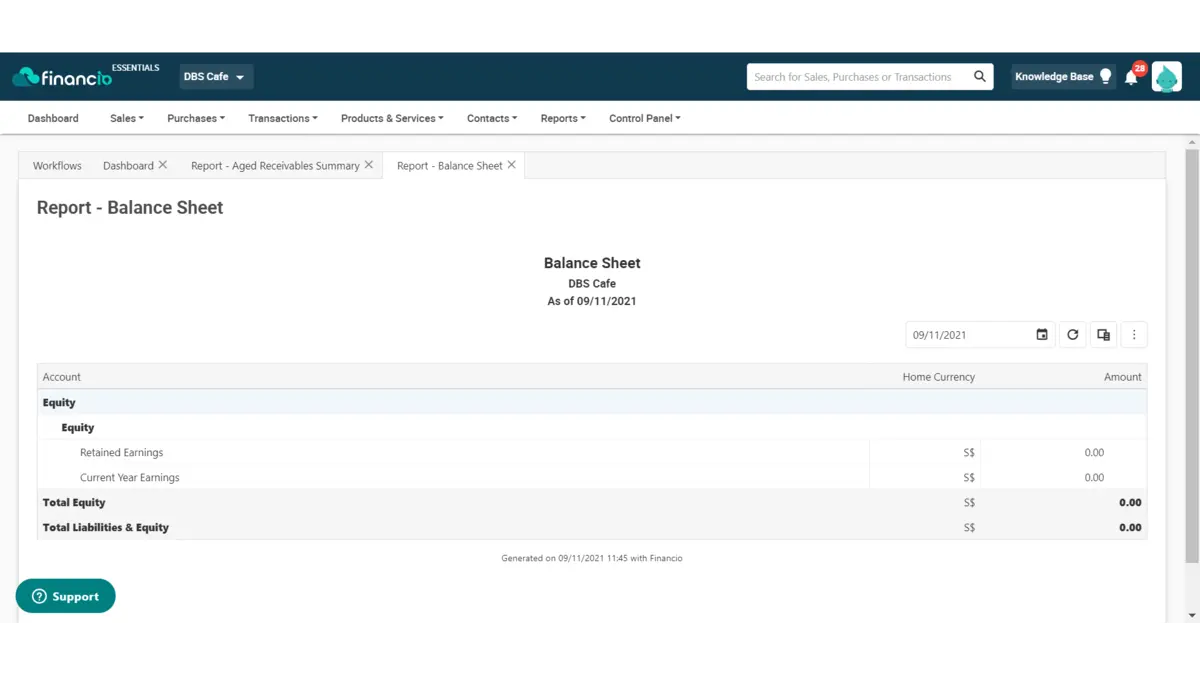

14. Financio Bookkeeping Software

Financio is an innovative financial reporting software designed to streamline and simplify the financial management process for small and medium-sized businesses. With its user-friendly interface and powerful features, Financio helps business owners stay on top of their finances.

By using Financio, businesses can enhance their financial visibility, make informed decisions, and seamlessly comply with regulatory requirements.

Key features:

- Automated financial reporting

- Multi-currency support

- Integrated invoicing

- Secure data backup

- Customizable dashboards

Strengths:

- User-friendly interface: Intuitive design makes the software easy for users of all technical levels to navigate and use effectively.

- Comprehensive reporting: Provides a wide range of detailed financial reports that cater to various business needs.

- Real-time data: Offers real-time financial data, enabling businesses to make timely and informed decisions.

- Scalability: Scales with the business, accommodating growth and increased complexity without compromising performance.

- Excellent customer support: Renowned for its prompt and helpful customer support.

Weaknesses:

- Limited customization: Some users may need help finding the customization options for reports and dashboards.

- Integration challenges: You may face integration challenges with specific third-party applications.

- Learning curve: Despite its user-friendly interface, users unfamiliar with financial software may experience a learning curve.

- Pricing: This can be considered expensive for tiny businesses or startups with tight budgets.

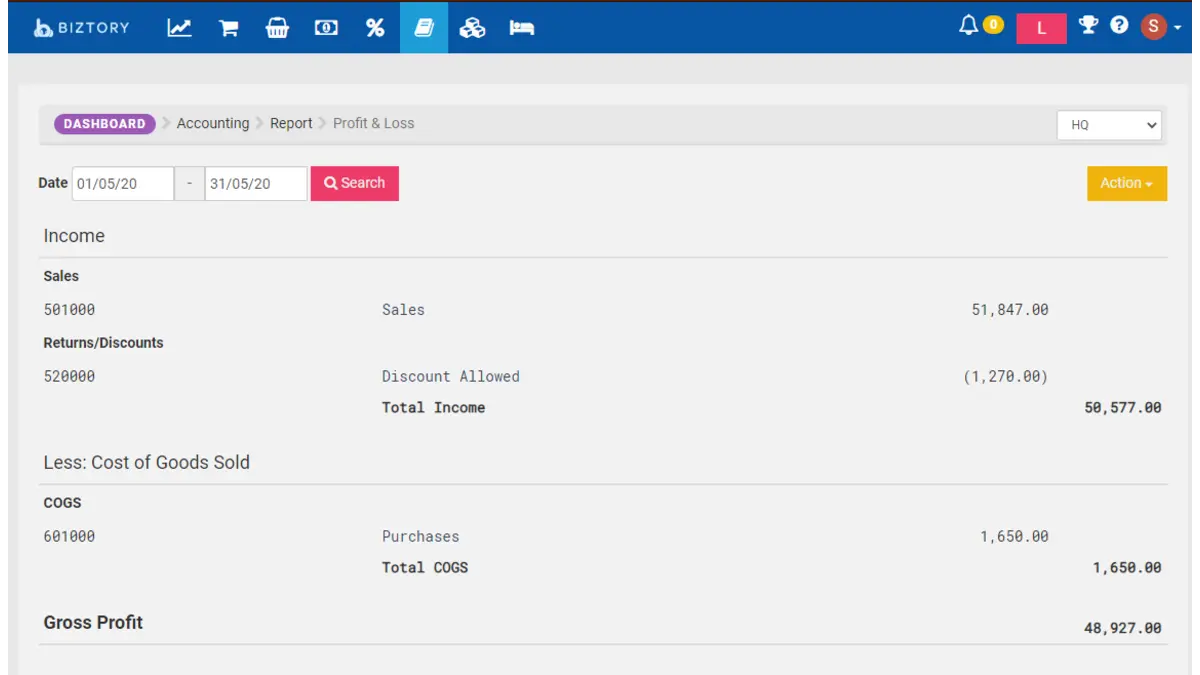

15. Biztory Financial Reporting Software

Biztory is a comprehensive financial reporting software designed to simplify and enhance your business’s financial management. By offering real-time insights and easy-to-understand reports, Biztory enables companies to make informed decisions and maintain accurate financial records.

This software is essential for any business looking to streamline their accounting processes, ensure compliance, and achieve financial clarity.

Key features:

- Automated financial reports

- Customizable dashboards

- Integrated tax calculations

- Multi-currency support

- Secure data storage

Strengths:

- User-friendly interface: Biztory offers an intuitive, user-friendly interface accessible to users of all accounting knowledge levels.

- Real-time data: Provides real-time financial insights for timely decision-making and proactive management.

- Customization options: Customizable dashboards and reports enable businesses to focus on critical financial information.

- Comprehensive tax support: Integrated tax calculations and compliance features ensure businesses meet their tax obligations easily.

- Robust security: Advanced features protect financial data from unauthorized access and breaches.

Weaknesses:

- Limited integrations: Biztory’s limited integration options with other business software could be a drawback for companies using multiple tools.

- Scalability concerns: Biztory suits small to medium-sized businesses but may only partially meet the needs of rapidly growing enterprises with complex financial requirements.

- Feature depth: While Biztory offers essential features, it may need some advanced functionalities in specialized financial software.

- Learning curve: New users may face a slight curve, especially if unfamiliar with financial reporting tools.

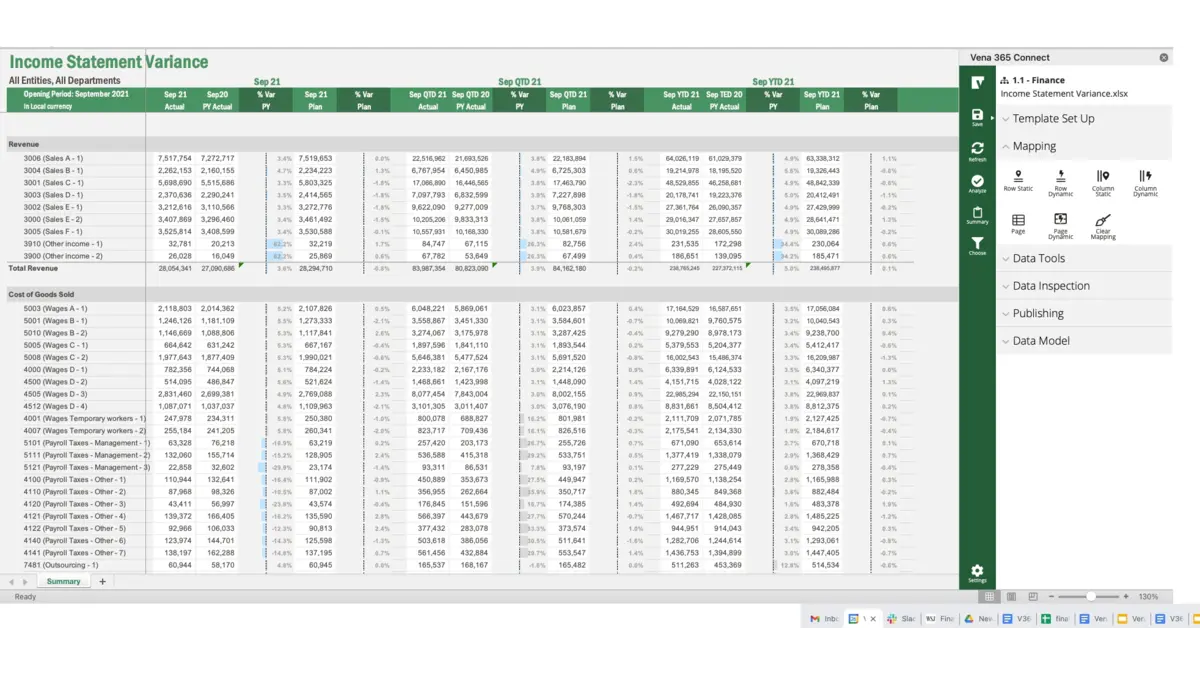

16. Vena Financial Reporting Solutions

Vena Solutions is a comprehensive financial reporting software that streamlines and automates your financial processes, enabling more accurate and efficient reporting. This software offers a robust platform that integrates with your existing systems.

By using Vena Solutions, businesses can significantly reduce manual tasks, improve data accuracy, and foster collaboration across departments, ensuring a more agile and responsive financial management process.

Key features:

- Excel interface integration

- Automated reporting

- Scenario planning

- Real-time data access

- Collaborative workflow

Strengths:

- User-friendly interface: Vena’s Excel integration allows easy adoption and navigation without a steep learning curve.

- Scalability: The software is highly scalable, adapting to businesses of all sizes and growing with your company’s needs.

- Comprehensive reporting: Provides diverse reporting options and customization to meet various business needs.

- Integration capabilities: Easily integrates with ERP, CRM, and other business systems for seamless data flow.

- Strong customer support: Vena offers excellent customer support and training to help users maximize the software’s potential.

Weaknesses:

- High cost: Vena Solutions’ pricing can be high, making it less accessible for smaller businesses with limited budgets.

- Complex implementation: The initial setup and implementation process can be complex and time-consuming.

- Limited mobile access: Vena’s limited mobile capabilities may hinder on-the-go access compared to some competitors.

- Dependency on Excel: Excel integration is a strength, but users must be proficient in Excel to utilize the software entirely.

- Customization challenges: While Vena offers extensive customization, it often requires significant effort and expertise to configure.

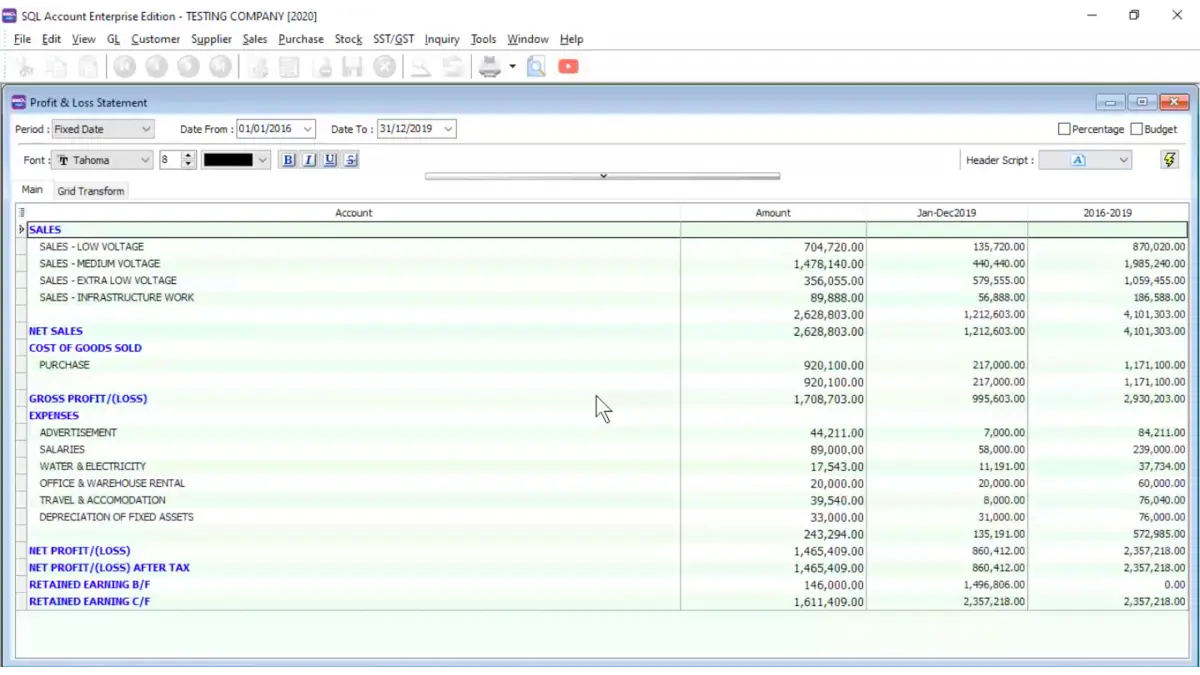

17. SQL Account Software Malaysia

SQL Account is comprehensive financial reporting software designed for businesses seeking efficient and accurate financial management. It simplifies complex accounting tasks, allowing companies to streamline their financial processes.

The software is ideal for businesses of all sizes, offering robust features that enhance productivity and decision-making. Using SQL Account, companies can achieve greater financial transparency, improve resource management, and make informed strategic decisions.

Key features:

- Advanced double-entry accounting system

- Real-time financial reporting

- Comprehensive tax compliance tools

- Customizable financial dashboards

- Seamless integration with other business systems

Strengths:

- User-friendly interface: SQL Account’s intuitive interface makes it accessible for users of all accounting knowledge levels.

- Real-time reporting: The software provides real-time updates, ensuring businesses have the most current financial information.

- Customizable dashboards: Businesses can tailor financial dashboards to display the most relevant data, enhancing decision-making.

- Comprehensive tax compliance: SQL Account offers extensive tax compliance features to help businesses stay aligned with local regulations.

- Seamless integration: The software integrates smoothly with other systems, enhancing efficiency and reducing data entry errors.

Weaknesses:

- Learning curve for advanced features: Some users may find the advanced features complex and need additional training to utilize them fully.

- Limited customization options: The software offers some customization, but businesses with specific needs might need more flexibility.

- Support response time: Reports of slower customer support response times can be challenging during urgent situations.

- Initial setup complexity: Setting up an SQL Account can be complex and time-consuming for businesses with less technical expertise.

- Price cost: For smaller businesses or startups, the software’s cost may be higher than that of simpler alternatives.

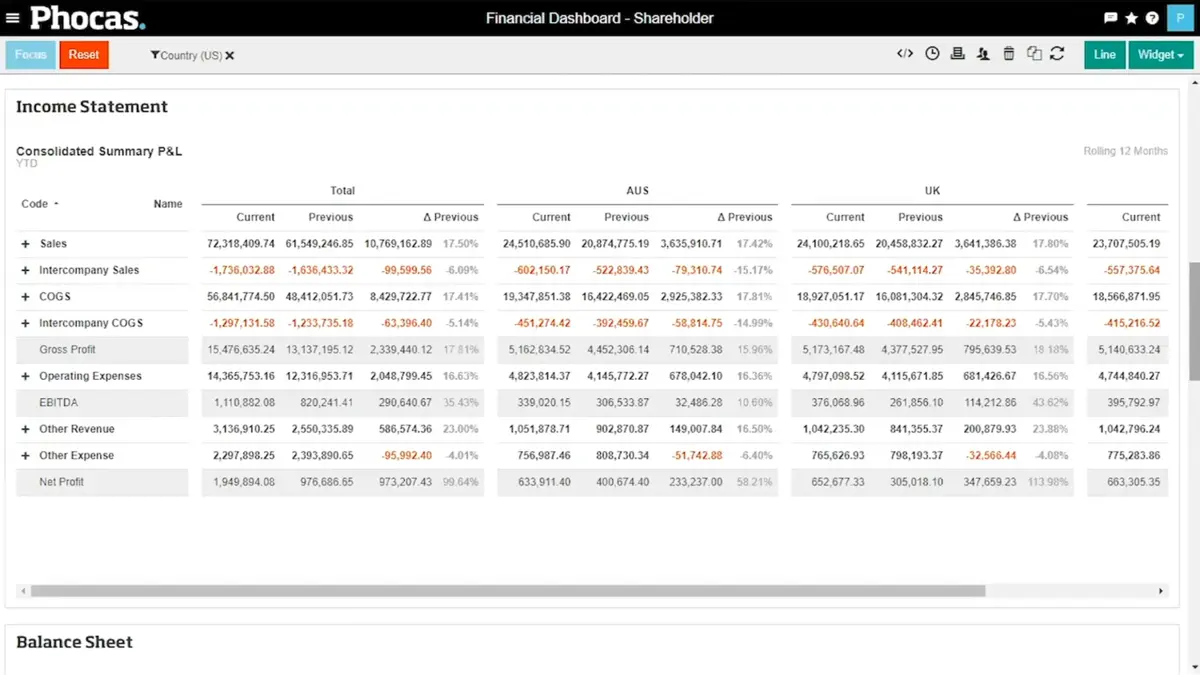

18. Phocas Financial Reporting Software

Phocas is a comprehensive financial reporting software designed to help businesses gain deep insights into their financial data, streamline reporting processes, and make informed decisions. It enables users to visualize financial performance, track key metrics, and identify trends.

Businesses should use Phocas for its user-friendly interface, robust analytics capabilities, and ability to integrate seamlessly with various data sources, ensuring accurate and up-to-date financial reporting.

Key features:

- Customizable dashboards

- Data integration

- Real-time analytics

- Advanced visualization tools

- User-friendly interface

Strengths:

- Intuitive and user-friendly: Phocas offers an interface that is easy to navigate, reducing the learning curve for new users.

- Comprehensive data integration: The software integrates multiple data sources to capture and analyze all relevant financial data.

- Real-time data access: Provides up-to-date financial information, allowing businesses to make timely and informed decisions.

- Customizable reporting: Users can create tailored reports and dashboards to meet their business needs.

- Advanced analytics: Offers powerful analytics tools that help identify trends, patterns, and anomalies in financial data.

Weaknesses:

- High initial setup cost: The initial implementation and setup can be costly for some businesses.

- Limited mobile access: The mobile version of Phocas needs to have the same level of functionality as the desktop version.

- Complex customization: Customizing dashboards and reports to suit specific needs can be complex and time-consuming.

- Dependency on data quality: Phocas’s effectiveness heavily depends on the quality and accuracy of integrated data sources.

- Learning curve for advanced features: Basic features are user-friendly, but advanced analytics and customization may require additional training.

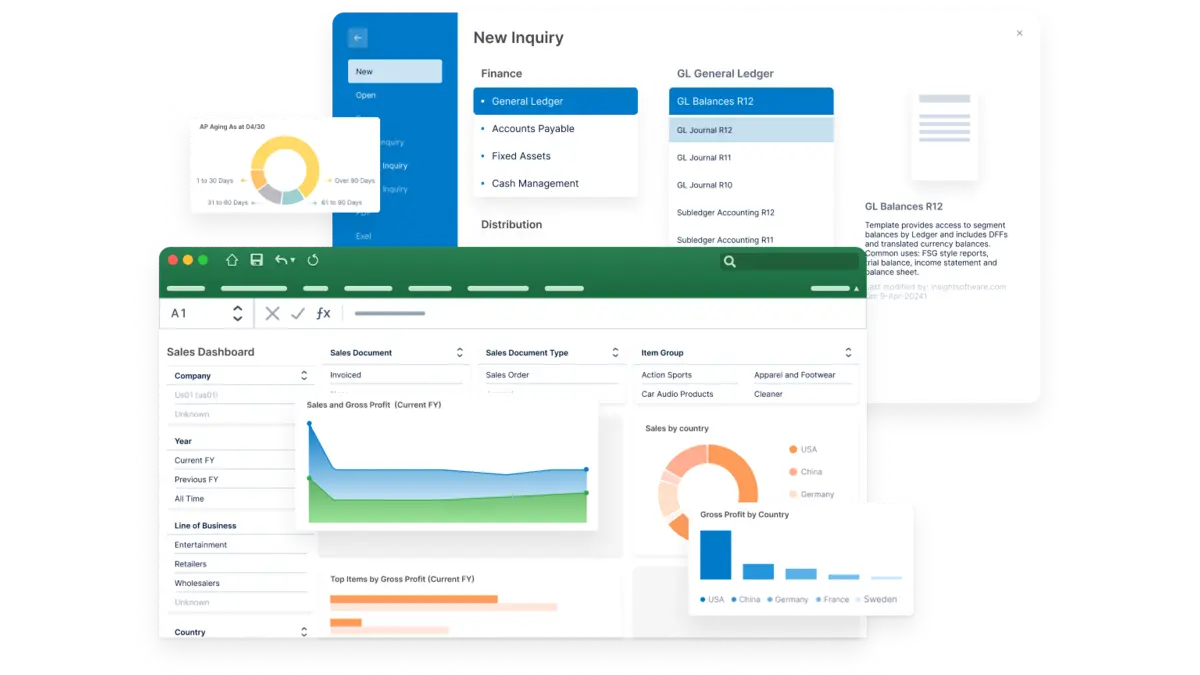

19. InsightSoftware

InsightSoftware is a comprehensive financial reporting solution designed to streamline and enhance your business’s financial operations. It provides powerful tools for accurate reporting, data visualization, and real-time insights.

With InsightSoftware, you can eliminate manual processes, reduce errors, and ensure compliance, making it an essential tool for any organization aiming for financial clarity and operational excellence.

Key features:

- Automated financial reporting

- Real-time data integration

- Customizable dashboards

- Advanced data visualization

- Regulatory compliance

Strengths:

- Ease of use: Intuitive interface that simplifies complex financial reporting tasks.

- Scalability: Suitable for businesses of all sizes, with features that grow with your company.

- Comprehensive reporting: Offers a wide range of reporting capabilities, from basic financial statements to complex analytics.

- Real-time insights: Provides real-time data integration, ensuring up-to-date information for decision-making.

- Customization: Highly customizable to meet the unique needs of different business sectors.

Weaknesses:

- Implementation time: Implementing fully can require significant time and resources, especially for larger enterprises.

- Initial cost: Higher initial investment than other tools can be a barrier for small businesses.

- Learning curve: Despite its intuitive interface, some users may initially find the range of features overwhelming.

- Integration complexity: Integrating with existing systems can be complex and may need dedicated IT support.

20. Xledger Financial Reporting System

Xledger is comprehensive financial reporting software designed to streamline and enhance financial management for businesses of all sizes. Its automatic financial processes enable businesses to make informed decisions, improve financial efficiency, and achieve compliance.

Its user-friendly interface and advanced reporting capabilities make it an essential tool for businesses looking to optimize their financial operations and gain a competitive edge.

Key features:

- Real-time financial reporting

- Automated processes

- Scalable cloud platform

- Advanced analytics

- Multi-currency support

Strengths:

- Automation efficiency: Reduces manual tasks, boosting productivity and accuracy in financial management.

- Real-time data access: Enables businesses to access real-time financial data for better and faster decision-making.

- Scalability: The cloud-based platform scales easily with business growth, accommodating more data and users.

- Comprehensive reporting: Provides customizable reports, offering businesses deeper insights into their financial health.

- User-friendly interface: Designed with an intuitive interface, it is easy for users to navigate and utilize effectively.

Weaknesses:

- Cost: This can be relatively expensive for small businesses or startups with limited budgets.

- Implementation time: The initial setup and implementation can be time-consuming and resource-intensive.

- Learning curve: Users may face a steep learning curve due to the software’s extensive features.

- Customization limitations: Despite its many features, some users may need help customizing the software to their specific needs.

- Customer support: Reports of slow customer support response times can be a drawback for urgent issues.

How to Choose The Right Financial Reporting Software

Choosing the right financial reporting software is crucial for ensuring the accuracy and efficiency of your financial operations. Here are some key factors to consider to make an informed decision:

- Identify your business needs: Assess your business’s financial reporting needs to determine if you require basic capabilities or advanced features like real-time analytics, multi-currency support, and automated compliance reporting.

- Ease of use: Opt for software with a user-friendly interface to reduce the learning curve, enhance productivity, and minimize errors.

- Scalability: Choose scalable software that grows with your business, accommodating increased data volumes and users without compromising performance.

- Integration capabilities: Ensure the software seamlessly integrates with your existing ERP system, CRM, and financial tools to maintain data consistency and a comprehensive view of your financial health.

- Security and compliance: To avoid legal complications, prioritize software with robust security features like encryption and access controls and ensure it complies with financial regulations.

- Customer support: Choose a provider known for reliable customer support to ensure prompt issue resolution and minimize operational disruptions.

- Cost: Consider the total cost of ownership, as investing in a high-quality solution can save money long-term by improving efficiency and accuracy.

By carefully evaluating these factors, you can select the financial reporting software that best meets your business needs and supports your long-term growth.

Conclusion

In today’s fast-paced business environment, leveraging modern, high-tech financial reporting software is not just beneficial—it’s essential. Financial reporting software like HashMicro transforms how businesses manage their finances, ensuring accuracy, efficiency, and compliance.

With advanced features and seamless integration, HashMicro stands out as a leading solution that can drive significant improvements in your financial management.

Don’t let outdated processes hinder your business growth. The urgency of adopting a cutting-edge financial reporting system like HashMicro cannot be overstated. Doing so will allow you to gain real-time insights, reduce errors, and stay ahead of regulatory requirements.

Take the first step towards financial excellence. Access HashMicro’s free demo and experience firsthand how this powerful software can revolutionize your financial operations. Visit HashMicro’s website to get started today!

FAQ about Financial Reporting Software

-

How does financial reporting software ensure compliance with Malaysian regulations?

Financial reporting software ensures compliance with Malaysian regulations by automating the generation of financial statements in formats required by local authorities. The software integrates updates to tax laws and financial regulations, ensuring that reports are always compliant. A robust solution like HashMicro’s software can help businesses stay up-to-date with the latest legal requirements, reducing the risk of non-compliance.

-

What are the key challenges in implementing financial reporting software in Malaysia?

Key challenges include ensuring data accuracy during migration, integrating with existing systems, and training employees to use the new software. Overcoming these challenges involves choosing a user-friendly platform, like HashMicro’s accounting software, which offers comprehensive training and seamless integration capabilities. This approach minimizes disruption and ensures a smooth transition.

-

How does financial reporting software improve data accuracy and reliability?

Financial reporting software improves data accuracy and reliability by automating data entry and calculations, reducing the risk of human error. It consolidates data from various sources into a single platform, ensuring consistency and accuracy. HashMicro’s solution also includes validation checks and real-time updates, enhancing the reliability of financial reports.

-

What types of financial reports can be generated using financial reporting software?

Financial reporting software can generate various reports, including profit and loss statements, balance sheets, cash flow statements, and custom reports tailored to specific business needs. HashMicro’s software provides comprehensive reporting capabilities that allow businesses to track financial performance, analyze trends, and make informed decisions based on accurate data.