In the bustling retail landscape of the Malaysia, many businesses grapple with the complexities of managing their finances effectively. From fluctuating inventory costs to the intricacies of sales tracking, these challenges can significantly impact a company’s financial health.

Retail accounting emerges as a pivotal solution, offering tools and methodologies specifically tailored to address the unique financial dynamics of retail businesses. By implementing robust retail accounting practices, Malaysia companies can enhance accuracy in financial reporting and improve overall business efficiency.

This article delves deeper into retail accounting, exploring its fundamental principles and highlighting its advantages. Business owners and CEOs will find valuable insights into how retail accounting can streamline operations and bolster the financial foundation of their enterprises.

Key Takeaways

|

What is Retail in Accounting?

Retail accounting is a specialized method of accounting that caters specifically to the needs of retail businesses. This approach focuses on accurately reporting income and expenses in the fast-paced retail environment, where inventory management and sales tracking are critical.

The cornerstone of retail accounting lies in the periodic monitoring of inventory and cost of goods sold (COGS). Retailers often update their financial records based on the inventory they purchase and sell, making use of techniques such as the Retail Inventory Method (RIM) to estimate ending inventory and COGS effectively.

A crucial aspect of retail accounting is inventory valuation, which can significantly affect the financial statements. By assigning a cost to the inventory sold and adjusting the value of the remaining inventory, retail accounting provides a clear picture of a business’s gross profit during a specific period.

Accurate retail accounting ensures that businesses can track their profitability and manage financial records with greater precision. It helps in making informed purchasing decisions, setting sales targets, and strategizing promotions based on well-documented financial data.

To achieve an accurate retail accounting, businesses can use an accounting software. This system is suitable for retail business, mainly in managing financial health.

What is the Retail Method?

The Retail Method is a practical accounting approach that estimates inventory value based on the cost-to-retail price ratio. Here’s a step-by-step guide on how it operates:

- Maintain Accurate Records: Keep detailed records of all purchases and existing inventory, noting both the cost price and the retail price.

- Calculate the Cost-to-Retail Ratio: Use the formula: Cost price ÷ Retail price × 100. This ratio is essential for determining the value of the ending inventory.

- Estimate Ending Inventory at Retail Prices: Subtract the retail price of goods sold from the total retail price of goods available for sale to estimate the ending inventory at retail prices.

- Convert Retail to Cost Price: Apply the calculated cost-to-retail percentage to convert the estimated retail inventory back to cost price.

Example:

Suppose your store purchases goods worth $50,000 at a cost and plans to sell them for $80,000. The cost-to-retail ratio would be 62.5%.

If your beginning inventory is $20,000 and additional purchases during the period amount to $30,000, your total goods available for sale are $50,000.

Let’s say your sales during the period total $60,000 at retail prices:

- Calculate the cost of goods sold using the cost-to-retail ratio: $60,000 × 62.5% = $37,500.

- Determine the ending inventory by subtracting the cost of goods sold from the goods available for sale: $50,000 – $37,500 = $12,500.

This calculated ending inventory helps maintain an accurate account of stock levels and financial standing without needing a detailed physical inventory count.

Advantages of Retail Accounting

The retail method provides a quick and efficient way to estimate the ending inventory balance, which is invaluable for businesses with multiple locations. This efficiency stems from eliminating the need for a physical inventory count, saving significant time and reducing operational costs.

Additionally, the method facilitates centralized inventory reporting, simplifying the preparation of financial statements and aiding in budgetary processes. It also allows for quick adjustments to inventory values, reflecting sales activities and price changes promptly, which is crucial for maintaining up-to-date financial records.

Disadvantages of Retail Accounting

However, the retail method is not without its drawbacks. It primarily relies on estimates, requiring consistent pricing across all products and uniform pricing changes, conditions that are rarely met in dynamic retail environments. Variations in pricing due to factors like promotions, markdowns, or external influences such as theft and product damage can significantly distort inventory valuations.

Furthermore, unlike other inventory valuation methods such as First In First Out (FIFO), Last In First Out (LIFO), or Weighted Average Cost, the retail method may not accurately reflect the current market conditions or cost trends, potentially leading to discrepancies in financial reporting and tax calculations.

Those disadvantages can be avoided by implementing accounting software. This software automates complex accounting principles in retail, helping businesses monitor their financial condition. If you’re interested in exploring more about retail accounting software, you can download the price scheme below.

Example of Retail Accounting

Consider a clothing retailer in Malaysia that needs to manage a large and frequently changing inventory due to seasonal trends and varying consumer preferences. Here’s how they might apply the retail method to simplify their accounting process:

1. Starting Inventory and Purchases

At the beginning of the quarter, the retailer’s inventory consists of various clothing items valued at a retail price of MYR 1,000,000.

During the quarter, additional purchases are made, amounting to a retail price of MYR 500,000.

2. Sales During the Period

Over the quarter, the retailer records total sales of MYR 800,000 at retail prices.

3. Calculating the Cost-to-Retail Ratio

Assume the total cost price of the beginning inventory and purchases is MYR 900,000.

The cost-to-retail ratio is calculated by dividing the total cost by the total retail price of goods available for sale:

MYR 900,000 / MYR 1,500,000 = 0.60 or 60%.

4. Estimating Ending Inventory

To estimate the ending inventory at cost, the retailer first determines the retail value of unsold goods:

Retail price of goods available for sale (MYR 1,500,000) minus retail price of goods sold (MYR 800,000) equals MYR 700,000.

The ending inventory at cost is then estimated by applying the cost-to-retail ratio:

MYR 700,000 x 60% = MYR 420,000.

This example shows how the retailer can estimate their ending inventory without a physical count. However, for big retail stores that need more than just accounting, but also tracking sales and customer preferences, it is recommended to use retail CRM software to make workflows easier.

Alternative to Retail Accounting: HashMicro Accounting Software

While retail accounting methods like the Retail Method offer certain efficiencies, they also come with significant limitations, such as potential inaccuracies due to pricing variability and the inability to track individual item details effectively. HashMicro Accounting Software provides a superior alternative, addressing these disadvantages with precision and comprehensive functionality.

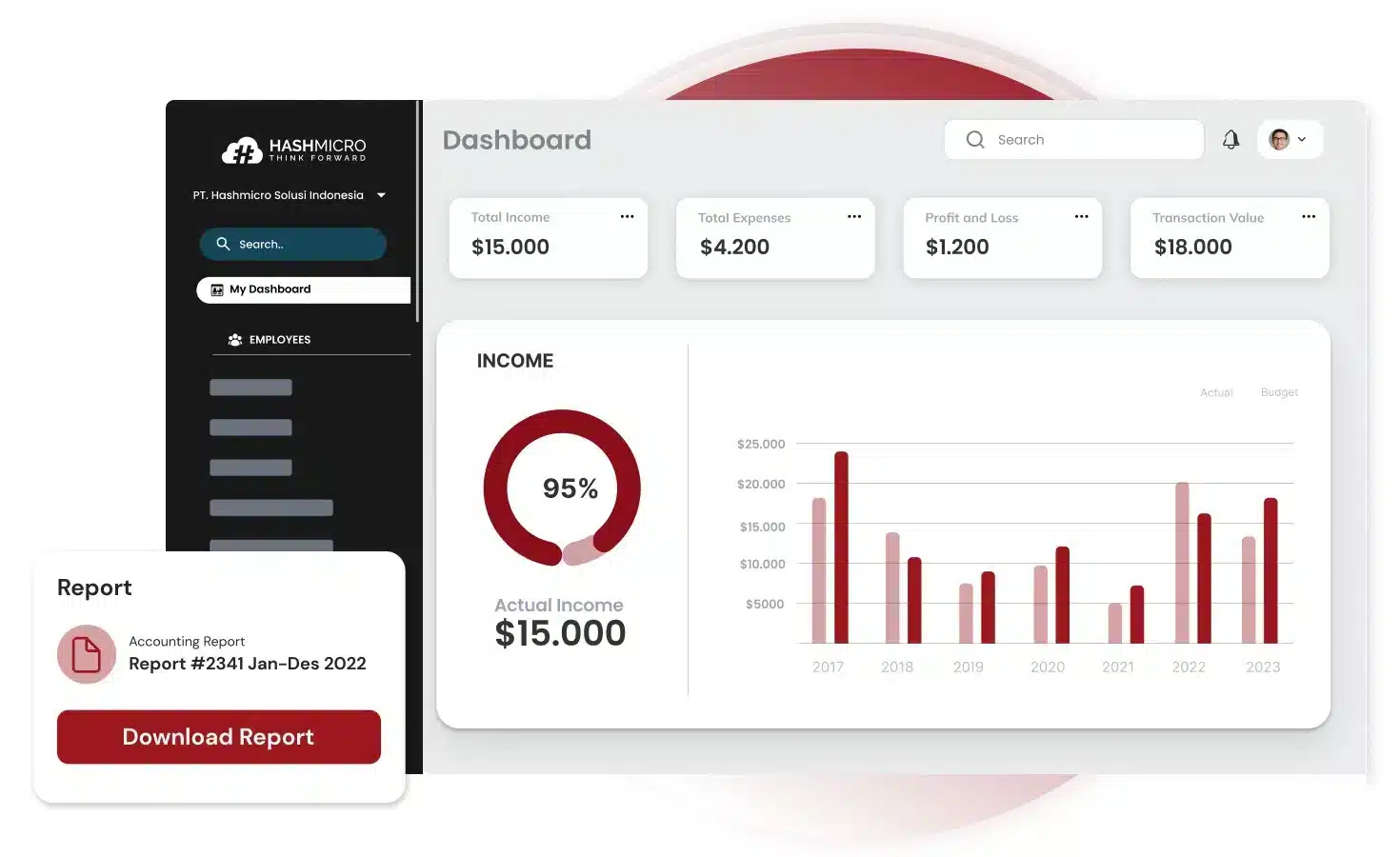

Accounting software streamlines and automates the financial management processes within retail businesses. This software works by integrating all financial transactions into a single system that automatically updates and provides real-time visibility into financial health.

HashMicro’s accounting software stands out as the premier accounting solution in the Malaysia, providing a comprehensive suite of features designed to meet the intricate needs of modern retail businesses. You can read the complete information about the features below, and try the free demo to unlock the full potential.

Feature Highlights of HashMicro Accounting Software:

- Multi-Level Analytical: This feature, commonly found in advanced ERP software, enables in-depth financial analysis across various business dimensions, helping companies make well-informed decisions.

- Cashflow Reports: Essential for monitoring the inflows and outflows of cash, these reports ensure that businesses can manage their liquidity effectively, planning expenditures and investments wisely.

- Budget S Curve: By comparing actual spending against projected budgets over time, this feature provides a visual representation of financial progress, facilitating effective budget management and control.

- Profit & Loss vs Budget & Forecast: This comparison allows businesses to measure their actual financial performance against their forecasts and budgets, identifying variances and enabling proactive adjustments.

- Landed Costs Management: This feature includes all costs associated with getting products to customers, such as shipping, duties, and taxes, ensuring accurate cost assessment and pricing strategies.

Accounting software not only automates and simplifies retail accounting but also provides a comprehensive suite of tools that improve accuracy and decision-making in retail business management. Its user-friendly interface and powerful capabilities make it a top choice for retailers looking to upgrade their financial systems.

Conclusion

As we’ve explored the complexities of retail accounting and its essential role in managing the financial intricacies of businesses in the Malaysia, it’s clear that while traditional methods like the retail method offer certain efficiencies, they also have limitations.

HashMicro Accounting Software emerges as the best solution, transcending these limitations with its advanced features and automation capabilities. With HashMicro, retailers gain access to real-time financial insights and enhanced accuracy in inventory and sales tracking—capabilities that traditional retail accounting methods can’t match.

If you’re looking to elevate your retail management system and ensure a robust financial foundation, explore HashMicro Accounting Software and consider a free demo to see how it can transform your business operations.