Accounting fraud means making financial records look different on purpose to trick people. It costs businesses around the world a huge $5 trillion each year. This is according to the Association of Certified Fraud Examiners. It shows how big of a problem financial deception is. It can be things like making profits seem higher than they are or hiding what a company owes.

As someone who owns a business or invests in the Philippines, knowing about accounting fraud is key. It helps keep your money safe and makes sure your financial reports are honest. Using a reliable accounting system can significantly reduce the risk of financial fraud in your business.

Table of Contents

Key Takeaways

|

What is Accounting Fraud?

Accounting fraud means making financial records look different on purpose to mislead others, typically investors, creditors, or regulatory authorities. This can include things like making profits seem too high, hiding what a company owes, or making fake transactions, leading to financial risk.

Accounting fraud is illegal and can lead to serious penalties, including fines and imprisonment for those involved. It also damages the trust of investors and can severely harm the company’s reputation.

Some big examples of accounting fraud are the Enron scandal, the WorldCom scandal, and the Madoff Ponzi scheme. These cases show how bad fraud can be. They remind us of the need for strong financial checks and watching over things closely.

Types Accounting Fraud

Accounting fraud is a complex issue. It includes many types of deception in financial reports. From aggressive accounting to corporate fraud by top executives, it’s a wide range of problems. These issues can have big effects on businesses.

Aggressive Accounting

Aggressive accounting makes a company’s finances look better than they are. It might involve recognizing money too early or not counting all costs. This isn’t always illegal but can trick investors into thinking a company is healthier than it is.

Corporate Fraud

Corporate fraud is when top people lie about a company’s money. They might make the numbers look better to get more money or support. This includes things like making too much money look real or hiding costs.

Occupational Fraud

Occupational fraud is done by employees trying to get something for themselves. This can be stealing from the company or lying about its money. It’s often about personal gain, like taking money that doesn’t belong to them.

There are many kinds of accounting fraud. Knowing them helps stop these tricks. Companies can protect themselves by being careful and having strong rules.

How Accounting Fraud Happens

Accounting fraud is when someone manipulates financial records to look better. This can include overstating revenue, failing to record expenses, and misrepresenting assets and liabilities. It also includes making changes to inventory and balance sheets to hide financial issues. These actions, like revenue recognition fraud, asset misappropriation, and financial statement manipulation, can harm businesses and investors a lot.

Overstating Revenue

One way fraud happens is by overstating revenue. This can be done by recording sales that haven’t happened yet, or by making goods and services seem more valuable. This revenue recognition fraud makes a company seem more profitable than it really is.

Unrecorded Expenses

Another fraud method is failing to record expenses. Companies might not report all costs, delay reporting liabilities, or leave out some expenses. This asset misappropriation makes it seem like the company is making more money than it is.

Misstating Assets and Liabilities

Fraudsters might also misrepresent the value of assets and liabilities. They could overvalue assets, undervalue liabilities, or even make up assets. This financial statement manipulation changes how a company looks financially.

Manipulating Inventory and Balance Sheets

Finally, companies might manipulate their inventory and balance sheets to hide problems. This could mean inflating inventory levels, lowering the cost of goods sold, or adjusting the balance sheet to hide the company’s true condition. These methods of accounting fraud can trick investors and auditors.

How to Identify Accounting Fraud in Financial Statements

Spotting signs of accounting fraud in financial statements needs a sharp eye and knowledge of common financial statement red flags. By noticing oddities and patterns, you can find fraud and protect your business from accounting fraud harm.

Red Flags to Look Out For

Some key signs of accounting fraud include:

- Sudden, unexplained changes in revenue or profit margins

- Unusual or suspicious transactions, especially with related parties

- Inconsistencies between financial statements and supporting documents

- Significant increases in inventory levels or accounts receivable

- Unexplained changes in cash flow or liquidity

Patterns in Financial Reports

Looking closely at financial report patterns can also reveal fraud. Watch for:

- Recurring adjustments or write-offs

- Unusual journal entries or accounting entries

- Discrepancies between reported financial data and industry benchmarks

- Unexplained changes in accounting policies or estimates

The Role of Audits

Regular, independent audits are key to finding red flags in financial statements and detecting fraud. Auditors with experience can spot issues that internal teams might miss. This is crucial for ensuring the accuracy and integrity of your financial reports.

By being alert and using the importance of audits, you can protect your business from accounting problems.

| Red Flags of Accounting | Fraud Potential Impact |

| Sudden changes in revenue or profit margins | Indicates manipulation of financial data |

| Unusual or suspicious transactions | May conceal fraudulent activities |

| Inconsistencies in financial statements | Points to inaccurate or misleading reporting |

| Significant inventory or receivables fluctuations | Could mask misappropriation of assets |

| Unexplained changes in cash flow or liquidity | Suggests potential financial irregularities |

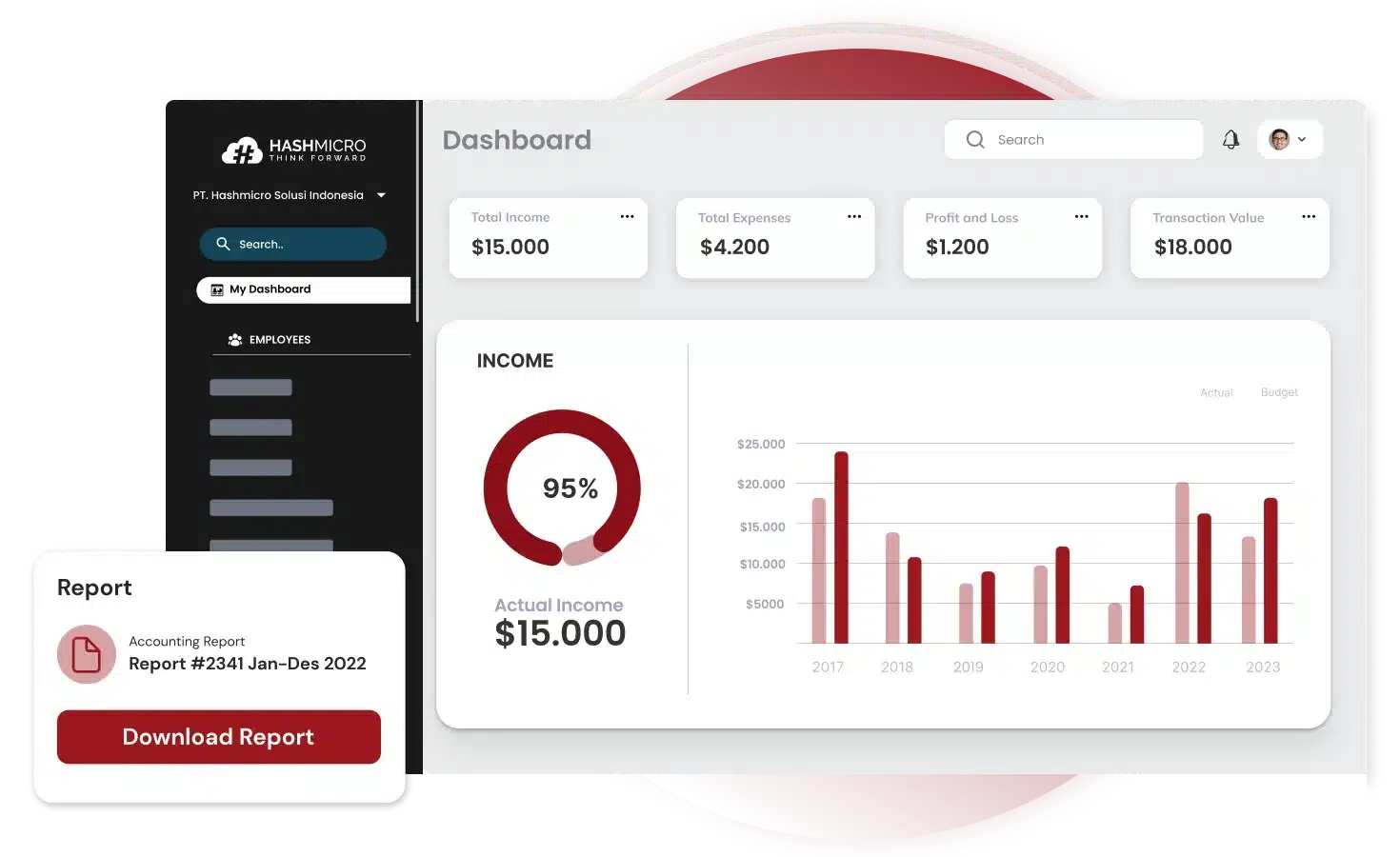

If you’d like an extra layer of protection for your finances, HashMicro’s Accounting Software offers powerful tools to help detect fraud and maintain transparency. For more details, feel free to explore our free demo by clicking the pricing scheme banner below.

Who Monitors and Regulates Accounting Fraud?

In the Philippines, the Securities and Exchange Commission (SEC) is in charge. They watch over and enforce accounting principles and laws against accounting fraud. The SEC works hard to find and check on fake financial reports. They can fine people and companies a lot and even charge them with crimes.

Role of the SEC and Other Regulators

The SEC is key in SEC oversight of money reports and company rules. They keep an eye on public companies, look at financial statements, and check for odd things. They also work with other groups like the Bangko Sentral ng Pilipinas (BSP) and the Insurance Commission to fight accounting fraud.

Penalties for Accounting Fraud

Those caught in accounting fraud in the Philippines face big penalties for accounting fraud. They might get fined a lot, face criminal charges, or even go to jail. The SEC can take away licenses or send cases to the Department of Justice for criminal action.

“Accounting fraud has far-reaching consequences, not only for the companies involved but also for the wider economy. That’s why the SEC takes such a firm stance in enforcing accounting fraud regulations and holding perpetrators accountable.”

The SEC and other Philippine groups are working hard. They aim to protect investors, make things clear, and keep the financial markets honest.

Read more: 15 Types of Accountants: Exploring Financial Professionals

Preventing Accounting Fraud

To protect your business from accounting fraud, you need a strong plan. Use internal controls, regular audits, ethical leadership, and automated accounting tools. These steps help keep your finances safe and prevent fraud.

Strong Internal Controls

Setting up a solid system of internal controls is key. This means clear policies, duties divided among employees, and watching financial actions closely. Also, teach your team to spot and report any odd behavior to keep your finances safe.

Regular Financial Audits

Doing regular audits, both inside and outside, is vital. They help find any issues in your money handling. These audits also give you chances to improve your financial reports and follow the law better.

Ethical Leadership

Creating a culture of honesty and ethics is crucial. Leaders should show the way by being open and responsible. They must not tolerate any financial wrongdoings. Training and talking about ethics often helps keep everyone on the right path.

Automated Accounting Software

Using top-notch accounting software is a big help. It is supposed to have tools for spotting problems, watching finances live, and keeping things in order. This makes it easier to keep track of your money and avoid fraud.

If you’re looking for a solution that offers all this and more, best accounting tools could be a great option to consider. It’s designed to help businesses manage their finances smoothly and securely.

How HashMicro’s Accounting Software Can Help Prevent Accounting Fraud

Managing company finances manually can lead to serious risks, such as accounting fraud, inaccuracies, and inefficient resource management. This is where HashMicro’s Accounting Software steps in, offering a reliable solution to safeguard your company from financial misconduct and streamline your accounting processes:

- Automated Financial Tracking: Stop fraud before it starts! HashMicro automatically records every transaction in real-time, eliminating manual errors and ensuring airtight financial accuracy.

- Audit Trails and Compliance: Ensure full transparency with detailed audit trails for every transaction. HashMicro makes it easy to track who did what and when, safeguarding your company from fraudulent activity.

- Access Control and Permissions: Limit unauthorized access! HashMicro allows you to control who can view or edit financial data, reducing the risk of tampering and ensuring only authorized personnel make changes.

- Real-Time Data Integration: Catch fraud in its tracks! With real-time updates, HashMicro helps you detect irregularities immediately, enabling quick actions before any damage is done.

- Custom Reports and Analytics: Spot fraud fast with in-depth financial reports. HashMicro gives you the power to analyze data for discrepancies, helping you stay ahead of fraudulent activity with ease.

Ready to Protect Your Business from Accounting Fraud? Try HashMicro’s Accounting Software today and discover how it can help you safeguard your financial data, ensure compliance, and enhance transparency across your organization!

Conclusion

Accounting fraud poses a serious threat to businesses, with global losses amounting to trillions annually. From overstating revenue to hiding liabilities, fraudulent practices damage trust, undermine company integrity and invite severe legal consequences.

Recognizing red flags like sudden changes in profit margins, unusual transactions, and discrepancies in financial reports is essential for protecting your business. Regular audits, strong internal controls, and ethical leadership are critical in preventing fraud.

Moreover, leveraging technology such as HashMicro’s Accounting Software provides an added layer of security. With features like automated tracking, real-time data integration, and audit trails, businesses can streamline their financial processes and reduce the risk of fraud. For a closer look at how HashMicro can protect your finances, try the free demo now!

Frequently Asked Questions

-

What is the most famous accounting fraud?

The most famous accounting fraud is the Enron scandal, where executives manipulated financial statements to conceal debt and inflate profits, leading to the company’s bankruptcy in 2001.

-

What is the fraud flag rule?

The fraud flag rule refers to specific indicators or “red flags” that suggest potential fraudulent activity in financial statements. These can include sudden changes in revenue, inconsistencies in reports, or unusual transactions.

-

What do you mean by false accounting fraud?

False accounting fraud involves intentionally misrepresenting financial information to mislead stakeholders. This includes practices like overstating revenues, hiding expenses, or falsifying records, ultimately distorting a company’s true financial condition.