Accounting principles are the fundamental rules that guide how financial information is recorded and reported. Did you know that about 60% of small business owners don’t know enough about these principles, according to BusinessDasher?

This lack of understanding often leads to inaccurate records and poor financial decisions. By learning accounting principles early, you can keep your financial reports organized and make better business judgments.

To simplify financial management, HashMicro Accounting Software automates your accounting processes and ensures compliance with the latest standards. Schedule a free demo today to see how it helps you work faster, more accurately, and with greater confidence.

Key Takeaways

|

Table of Contents

What Are Accounting Principles?

Accounting principles are the rules that guide how we handle financial transactions. They provide a standardized system for tracking income, expenses, assets, and liabilities, enabling businesses to maintain financial control and manage their money wisely.

These principles are like the rules of the game for money matters. They make sure everyone records and reports money the same way. Under GAAP guidance, following these rules helps accountants be very accurate and honest.

These rules are important for comparing financial statements over time. They build trust with people who look at these statements. They also help accountants deeply understand financial transactions, translating to more comprehensive and accurate financial records, such as special journals and general ledgers.

Importance of Accounting Principles

In the Philippines, accounting principles are essential for addressing accounting problems by improving the quality of financial information reported by businesses.

They provide a structured framework for preparing consistent and reliable financial statements, helping to prevent accounting problems and facilitating a better understanding among stakeholders.

- Enhancing Financial Information Quality: Accounting principles ensure clarity and dependability in financial data, enabling stakeholders to make informed decisions.

- Facilitating Understanding: By standardizing financial statements, these principles make it easier for users to comprehend the information presented.

- Simplifying Comparisons: Uniform accounting standards allow for straightforward comparisons of financial statements across different periods and companies.

- Foundation for Tax Calculations: These principles serve as the basis for determining taxable income, ensuring compliance with tax regulations.

According to the Securities Regulation Code (SRC) Rule 68, companies in the Philippines are required to prepare financial statements in accordance with the Philippine Financial Reporting Standards (PFRS), which are aligned with international accounting standards.

This alignment provides valuable insights to investors, lenders, creditors, and other stakeholders, supporting informed decision-making regarding resource allocation for both public and private companies.

12 Types of Accounting Principles

The basic accounting principles or concepts are fundamental ideas that guide the preparation of financial reports.

In the Philippines, these concepts are derived from the Philippine Financial Reporting Standards (PFRS), the Conceptual Framework for Financial Reporting, or from long-established practices widely accepted within the accounting profession.

Below are the most commonly recognized accounting principles:

1. Separate Entity Concept

This concept views a business as an independent entity, separate from its owner(s). Only the transactions directly related to the business are recorded in the books of accounts, while personal transactions of the owner(s) are excluded.

2. Historical Cost Principle

Under this accounting principle, assets are initially recorded at their acquisition cost, reflecting their value at the time of purchase. This provides an objective and verifiable basis for asset valuation, minimizing subjective interpretations.

3. Going Concern Assumption

The business is assumed to continue operating for an indefinite period of time, unless there is evidence to suggest otherwise. This assumption is essential for meaningful accounting measurements. For example, assets are recorded at historical cost only if the business is expected to operate as a going concern.

In contrast, a liquidating concern applies when the business plans to cease operations or has no other choice due to bankruptcy. In such cases, assets are measured at their net selling price instead of historical cost.

4. Matching Principle

According to the matching principle, certain costs are initially recorded as assets and are only recognized as expenses when the related revenue is earned, to accurately reflect profitability in a given period.

5. Accrual Basis of Accounting

This concept requires economic events to be recorded in the period they occur, regardless of when cash is received or paid. Income is recognized when earned, while expenses are recognized when incurred.

6. Prudence (Conservatism)

Prudence requires accountants to exercise caution when making estimates in situations of uncertainty. For example, when choosing between a potentially unfavorable or favorable outcome, the unfavorable outcome is chosen to avoid overstating assets or income and underestimating liabilities or expenses.

7. Time Period Concept

The life of a business is divided into shorter, equal periods known as reporting periods. Most reporting periods last for 12 months, but they can also be shorter or longer:

- A calendar year starts on January 1 and ends on December 31.

- A fiscal year covers 12 months but starts on a date other than January 1 (e.g., July 1, 2020, to June 30, 2021).

- An interim period refers to a reporting period shorter than 12 months, such as a month, a quarter (3 months), or six months (semiannual period).

8. Stable Monetary Unit Principle

This accounting principle assumes that assets, liabilities, equity, income, and expenses are measured using a common unit, such as the peso in the Philippines. However, it’s important to acknowledge that this principle can be challenged in periods of high inflation, as the purchasing power of the monetary unit may fluctuate significantly.

9. Materiality Principle

This concept applies only to items that are significant enough to influence economic decisions. An item is considered material if its omission or misstatement could impact decision-making. Determining materiality requires professional judgment and depends on the size and nature of the item.

10. Cost-Benefit Principle

The cost of processing and communicating financial information should not exceed the benefits derived from its use. This principle ensures that resources aren’t wasted on overly complex or detailed reporting when the value of the insights gained is minimal.

11. Full Disclosure Principle

This principle ensures that users of financial statements receive all relevant information while balancing detail and clarity. It requires:

- Sufficient detail to disclose matters that affect decision-making.

- Conciseness to keep the information understandable while considering the costs of preparing and using it.

12. Consistency Concept

The consistency concept requires businesses to apply the same accounting policies and methods across periods. For example, the accounting policies used this year should match those used in the previous year, unless a change is required by a standard.

Generally Accepted Accounting Principles (GAAP)

GAAP, established in the United States, includes standards set by bodies like the Governmental Accounting Standards Board (GASB) for state and local governments. While GAAP is primarily used in the U.S., it may serve as a reference for multinational companies operating in the Philippines.

As a set of rules for making financial statements, it’s very important for private companies and non-profits in the U.S. These rules ensure that financial information is clear and fair, building trust in the financial world.

The core concepts of GAAP (Generally Accepted Accounting Principles) include essential principles like revenue recognition, the matching principle, and full disclosure. GAAP ensures that income is recognized when earned and expenses are matched to corresponding revenues, providing a clear view of financial performance.

While GAAP is not the primary standard in the Philippines, businesses interacting with U.S. entities must understand it for cross-border transactions.

Rather than GAAP, the Philippine Financial Reporting Standards (PFRS) and Philippine Accounting Standards (PAS) are the updated rules that replaced the previously used Generally Accepted Accounting Principles (GAAP) in the Philippines.

These standards, created by the Accounting Standards Council (ASC), are based on international rules from IFRS and IAS to ensure global consistency.

To help you understand the distinctions more clearly, the table below outlines the key differences between GAAP and Philippine standards.

| Topic | GAAP (U.S.) | Philippines (PFRS & PAS) |

| Definition | A set of Generally Accepted Accounting Principles used mainly in the United States for preparing financial statements. | A set of updated standards that replaced Philippine GAAP, aligned with IFRS and IAS for global consistency. |

| Governing Bodies | Established by U.S. standard-setting bodies, including the GASB, for state and local governments. | Developed by the Accounting Standards Council (ASC). |

| Primary Use | Used by private companies, non-profits, and governmental entities across the United States. | Used by all businesses and entities required to comply with the Philippine financial reporting standards. |

| Key Principles | Includes revenue recognition, matching principle, cost principle, and full disclosure. | Mirrors IFRS and IAS principles, ensuring compatibility with global reporting practices. |

| Geographical Scope | Primarily used in the U.S., with some relevance for multinational companies operating across borders. | Required for companies operating in the Philippines. |

| Relevance to Cross-Border Business | Important for Philippine businesses dealing with U.S. companies or investors to understand GAAP requirements. | Provides consistency with global standards, easing international reporting. |

| Purpose | Ensures clarity, fairness, and consistency in U.S. financial reporting. | Aligns Philippine reporting with international standards for transparency and comparability. |

Read more: Manufacturing Accounting Software

International Financial Reporting Standards (IFRS)

IFRS stands for International Financial Reporting Standards. These standards ensure that company accounts are clear and can be compared worldwide. IFRS is key for companies working in many countries. It makes accounting easier for them by using one set of rules.

The core concepts of IFRS significantly impact businesses in the Philippines, where the Philippine Financial Reporting Standards (PFRS) closely align with IFRS. For Philippine companies, adopting IFRS-based standards enhances transparency and comparability, making it easier for businesses to attract foreign investments and engage in international trade.

By using IFRS principles, such as fair presentation and the accrual basis of accounting, businesses in the Philippines can present financial statements consistent with international practices.

Differences Between GAAP and IFRS

IFRS vs. GAAP differ significantly in their approach. Mainly used in the U.S., GAAP, is rules-based with strict guidelines, while IFRS is principle-based, offering more flexibility. GAAP is overseen by the Financial Accounting Standards Board (FASB) in the U.S., while IFRS is regulated globally by the International Accounting Standards Board (IASB).

The transition from a U.S.-influenced GAAP to IFRS began in the Philippines in 2005. leading to adopting the Philippine Financial Reporting Standards (PFRS), which closely align with IFRS. Larger enterprises must adhere to PFRS, while smaller businesses can opt for the simplified version, PFRS for SMEs.

Understanding IFRS vs GAAP is crucial for Philippine businesses, especially when dealing with international investors. While the country fully adopts IFRS, familiarity with GAAP remains essential for engaging with U.S. entities. Adopting IFRS gives local businesses a competitive edge, attracting global investments and facilitating seamless financial communication.

Accounting Standards and Relevant Regulatory Bodies in the Philippines

Accounting standards and regulatory bodies ensure consistency and compliance in the Philippines’ financial reporting system. This section outlines the key accounting standards and the regulatory bodies enforcing them.

1. Accounting Standards

Accounting concepts and principles can be classified as either explicit or implicit:

- Explicit concepts and principles: These are specifically outlined in the Conceptual Framework for Financial Reporting and the Philippine Financial Reporting Standards (PFRS).

- Implicit concepts and principles: These are not explicitly stated but are widely applied due to general and long-term acceptance within the profession.

The PFRS are the standards and interpretations adopted by the Financial Reporting Standards Council (FRSC). They consist of:

- Philippine Financial Reporting Standards (PFRS)

- Philippine Accounting Standards (PAS)

- Interpretations

These standards act as guides for the recording and communication of accounting information, offering a more detailed application of accounting concepts.

The FRSC, as the official accounting standard-setting body in the Philippines, is responsible for issuing the PFRS. These standards are based on the International Financial Reporting Standards (IFRS), which are developed by the International Accounting Standards Board (IASB).

2. Regulatory Bodies

In the Philippines, several regulatory bodies oversee financial reporting to ensure transparency and compliance:

- Securities and Exchange Commission (SEC): The SEC has the authority to prescribe the financial reporting framework used by corporations in the Philippines, as set out in Rule 68 of the Securities Regulation Code.

- Bureau of Internal Revenue (BIR): The BIR is responsible for overseeing tax and financial matters, ensuring that businesses comply with tax laws and regulations.

- Bangko Sentral ng Pilipinas (BSP): The BSP is the primary regulator of banking institutions, issuing rules and guidelines that include financial reporting matters to maintain financial stability.

- Cooperative Development Authority (CDA): The CDA is the primary regulator for cooperatives, having the authority to require submission of audited financial statements.

Characteristics and Features of Accounting Principles

Comparability is a big deal in accounting principles. It lets people easily compare finances over time and between companies, allowing businesses to keep their accounting the same. It helps investors, regulators, and managers make smart choices with the same financial info.

Reliability means the financial info is trustworthy. Keeping accurate records with standard accounting rules builds trust in consolidated financial statements. This trust is key for handling business changes and being open with finances.

Relevance means the financial information is useful for making decisions. Accounting principles ensure that all financial data shows the company’s true state. This helps companies make quick, smart choices and keeps them ready for market changes and new rules.

Limitations and Critiques of Accounting Principles

Before exploring further, it’s important to distinguish accounting from bookkeeping. Bookkeeping records transactions like sales and expenses, focusing on straightforward data entry. Accounting, however, interprets and analyzes this data, applying principles to provide a comprehensive view of a business’s financial health.

Accounting principles are essential for financial reporting, but they come with certain limitations:

- Only monetary items are recorded, which means that significant non-monetary events are excluded, even if they affect the business.

- Assets are recorded based on their historical cost, so they ignore changes in value caused by inflation or market trends.

- Accounting focuses exclusively on past transactions with no room to account for future events that may impact finances.

- The legal form of transactions is often prioritized over their economic substance, potentially misrepresenting the financial reality.

These limitations show that while accounting principles provide structure, additional analysis is often needed for a complete financial picture.

How HashMicro Accounting Software Can Address Accounting Principle Challenges

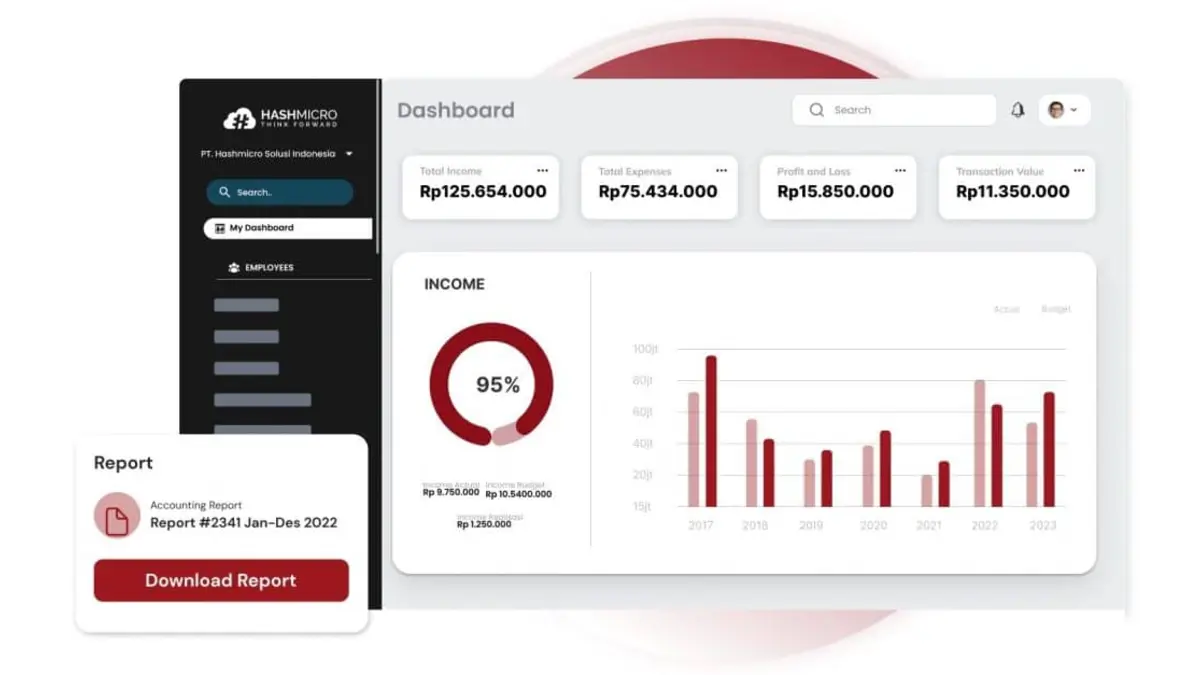

HashMicro’s Accounting Software is designed to streamline financial reporting and ensure compliance with key accounting principles. Automating processes like revenue recognition and expense matching, helps businesses maintain accurate financial records in line with GAAP and IFRS standards.

The software’s consistent application of accounting rules, like accruals and cost principles, minimizes the risk of errors and enhances transparency in financial reporting.

For businesses facing challenges with traditional accounting principles, HashMicro’s solution simplifies complex financial tasks while ensuring adherence to global standards. This ultimately results in better financial management, improved stakeholder trust, and a more accurate representation of the company’s financial health.

Key USPs of HashMicro AI Accounting Software:

- Automated Compliance: Ensures adherence to GAAP and IFRS principles with automated processes for revenue recognition, expense matching, and accruals.

- Customizable Reporting: Offers customizable financial reporting templates to fit different business needs while maintaining consistency and transparency.

- Real-Time Financial Insights: Provides up-to-date financial information, helping businesses make timely decisions and address potential issues proactively.

- Integrated Modules: This module seamlessly connects with other modules, such as inventory management, sales, and procurement, for a holistic financial overview.

- User-Friendly Interface: Simplifies complex accounting tasks, making it accessible for users at all levels, while reducing the risk of errors.

- Advanced Data Security: Protects sensitive financial information with robust encryption and access control features.

- Scalable Solutions: Easily adapts to the growing needs of your business, whether you’re a small enterprise or a large corporation.

- Bank Reconciliation – Matches internal records with bank statements to identify discrepancies and ensure accuracy. Integration with bank reconciliation software enables automatic data import, real-time matching, and faster error detection.

Whether following GAAP or IFRS, businesses need these principles to build trust, make informed decisions, and comply with global standards. Although many Accounting platforms used locally solutions are available to address challenges like outdated asset valuations and complex reporting, HashMicro remains a top choice, as it’s the best accounting software for retail industry and many more.

With its advanced features and automation, HashMicro’s software effectively simplifies financial processes, helping businesses easily navigate today’s dynamic environments.

Conclusion

Understanding and applying GAAP, IFRS, and PFRS is crucial for ensuring transparent and accurate financial reporting in the Philippines. These standards help businesses stay compliant and manage their financial processes more efficiently. However, the complexities of adhering to these standards can be challenging, especially for companies striving to remain competitive and transparent.

HashMicro’s Accounting Software offers a comprehensive solution to these challenges by automating compliance with GAAP and IFRS principles. This accounting system provides real-time insights, simplifies financial reporting, and enhances overall financial management tools with customizable reports, automated processes, and seamless integration with other systems.

Try our free demo to experience firsthand how it can streamline financial processes and improve reporting accuracy.

FAQ Around Accounting Principle

-

What is meant by accounting principles?

Accounting principles are standardized rules and guidelines that govern how financial transactions and statements are recorded, reported, and interpreted. They ensure consistency, transparency, and accuracy in financial reporting, making it easier for businesses to present their financial health clearly.

-

What are the 5 major elements of accounting?

The five major elements of accounting are assets, liabilities, equity, revenue, and expenses. Assets are what a business owns, liabilities are what it owes, equity represents ownership, revenue is income earned, and expenses are costs incurred.

-

What are the golden rules of accounting?

The golden rules of accounting outline how debits and credits should be applied across personal, real, and nominal accounts. They ensure every transaction is recorded accurately by defining who receives value, what moves in or out, and how expenses, losses, income, and gains are treated.

-

What are the 5 basic accounting principles?

The five basic accounting principles are revenue recognition, matching, cost, full disclosure, and conservatism, each ensuring that financial information is recorded accurately, consistently, and transparently.

-

What are the 4 fundamentals of accounting?

The four fundamentals of accounting are revenue recognition, matching, cost, and objectivity, which guide when to record revenue, how to align expenses, and how to value assets. Together, these principles ensure financial reports remain accurate, consistent, and based on verifiable data.