Have you ever closed your fiscal year only to find your financial statements don’t add up? Those frustrating discrepancies often come from overlooked or messy adjusting entries. Consequently, they can also seriously throw off your entire accounting.

In fact, a study by the University of the Philippines found that 60% of companies faced financial statement errors due to improper adjusting entries. That’s a big deal, and a big reason to get this right.

The good news? You can try HashMicro’s Accounting Software to automate adjusting entries, ensure they’re recorded accurately, and keep your financial data and reporting easy and time-saving.

In this article, we’ll break down adjusting entries: what they are, why they matter, and how to get them right. Moreover, we’ll show you the best tools to keep your financial records safe and accurate.

Key Takeaways

|

Table of Contents

What is an Adjusting Journal Entry?

Adjusting journal entries are accounting journal entries used to convert a company’s records to an accrual basis, ensuring all financial information accurately reflects the period it pertains to. These entries are usually made right before issuing financial statements, capturing any adjustments needed to present a clear and comprehensive picture of a company’s financial health.

For those familiar with the accounting field, understanding adjusting journal entries is essential, as they allow businesses to track actual balances for each account accurately. Adjusting journal entries involve making specific changes to account balances, ensuring that revenues and expenses are correctly recorded in the periods they relate to, regardless of when cash transactions occur.

To fully grasp the importance of these entries, let’s explore how they are used in practice. Adjusting journal entries example scenarios include recording accrued revenues, deferred expenses, and depreciation—each essential for aligning records with true financial activities.

By mastering how to make adjusting and reversing entries, businesses can produce precise general journal entries, ultimately improving the accuracy and reliability of their financial statements.

Adjusting Journal Entries Function

Understanding the function of adjusting journal entries is crucial for ensuring accurate financial reporting. These entries help align the revenue and expense estimates with the actual nominal amounts for the corresponding period, creating a clear and reliable snapshot of a company’s financial health.

Adjusting entries in accounting plays a vital role in bridging the gap between recorded transactions and real-time business activities. For instance, adjusting journal entries might involve recognizing accrued expenses or deferred revenues, ensuring all financial records reflect the true state of operations.

Learning how to make adjusting entries enhances one’s understanding of financial processes and ensures compliance with accounting standards. With the help of tools like general journal adjusting entries, businesses can create accurate records that simplify reporting and provide solutions to common challenges, such as identifying discrepancies or missing adjustments.

Also read: Closing Entry in Accounting: Definitions, Types, and Examples

Why Adjusting Journal Entries are Important?

Adjusting journal entries (AJEs) are crucial because they ensure that a business’s financial records accurately reflect its financial position and performance for a given period. These entries help businesses comply with accounting principles, such as the matching principle, by recognizing income and expenses in the correct period, even if cash transactions have not yet occurred.

Here are a few reasons why AJEs are important:

- Accurate Financial Reporting: AJEs help ensure that the company’s financial statements, like the income statement and balance sheet, present a true and fair view of the business’s financial health by aligning revenue and expenses with the periods they relate to.

- Compliance with Accounting Standards: Many accounting frameworks, including the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), require adjusting journal entries to reflect a company’s financial activities accurately.

- Tax Reporting: Proper adjustments can help businesses meet tax requirements by ensuring that income and expenses are recognized in the correct periods, which can impact taxable income.

- Financial Decision-Making: By providing a more accurate picture of the company’s finances, adjusting journal entries give management, investors, and stakeholders the necessary data to make informed business decisions.

In summary, AJEs are essential for ensuring accuracy, compliance, and transparency in financial reporting, making them vital for businesses aiming for long-term financial success.

What is the Purpose of Adjusting Journal Entries?

Adjusting journal entries ensures that financial records reflect accurate, up-to-date information for transactions across accounting periods. These entries help reconcile items, like payments or expenses, that may not align precisely with the time of delivery or service completion, providing a clearer picture of your business’s finances.

Adjusting journal entries ensures that financial records reflect accurate, up-to-date information for transactions across accounting periods. These entries help reconcile items, like payments or expenses, that may not align precisely with the time of delivery or service completion, providing a clearer picture of your business’s finances.

Adjusting entries in accounting bridges the gap between cash and accrual accounting, converting cash-based transactions into an accrual-based format. This approach is essential for creating reliable financial statements, allowing businesses to track revenues and expenses accurately in the periods they actually occur.

For business owners, understanding how to make adjusting entry is crucial for maintaining transparent and precise accounting records. By properly utilizing special journal entries, businesses can align their accounts with true financial activities, ultimately supporting better decision-making and long-term financial stability.

Also read: Sales Journal: Definition, Types, Format and Examples

What Distinguishes Cash Accounting from Accrual Accounting?

Cash Accounting

- Timing: Records income and expenses only when cash is received or paid.

- Simplicity: Easy to understand and manage, suitable for small businesses.

- Financial Impact: Can lead to fluctuating income reports based on cash flow.

Accrual Accounting

- Timing: Records income and expenses when they are earned or incurred, regardless of cash movement.

- Accuracy: Provides a clearer picture of financial health by including accounts receivable and payable.

- Compliance: Required for larger businesses and public companies under GAAP.

Type of Transaction Adjusting Journal Entries

After knowing the definition, function, and purpose of adjusting journal entries, the next step is understanding the types of adjusting journal transactions. In this case, there are seven main types you need to know. What are those? Here’s the explanation:

After knowing the definition, function, and purpose of adjusting journal entries, the next step is understanding the types of adjusting journal transactions. In this case, there are seven main types you need to know. What are those? Here’s the explanation:

-

Equipment

Equipment in adjusting journal entries refers to assets owned by the company that are consumable or reusable and typically small in size. These items fulfill essential business needs and may require periodic adjustments to reflect usage or wear.

-

Revenue receivables

Revenue receivables represent sales made on credit, allowing buyers to obtain products or services by deferring payment. Adjusting entries ensure these revenues are accurately recorded in the period they are earned.

-

Accrued expenses (expense debt)

Accrued expenses, or expenses payable, are costs incurred but not yet paid by the end of the period. Adjusting entries for these ensure that all incurred expenses are recorded in the appropriate period, even if payment is pending.

-

Accrued revenues

Accrued revenues represent earnings from services rendered or goods provided but not yet invoiced or received in cash. This adjustment aligns revenues with the period in which they are earned, regardless of payment timing.

-

Deferred revenues (prepaid income)

Deferred revenues, also known as unearned income, are payments received in advance for goods or services to be delivered later. Adjustments recognize the portion of revenue earned while deferring the remainder until obligations are fulfilled.

-

Deferred expenses (expenses paid in advance)

Deferred or prepaid expenses are payments made for future periods, like rent or insurance, recorded initially as assets. Adjusting journal entries allocate these expenses across the periods they benefit.

-

Depreciation expenses

Depreciation accounts for the wear and tear or aging of fixed assets over time, reducing their book value. Adjusting entries for depreciation ensure that the cost of assets is spread across their useful life.

-

Provisions (loss of accounts receivable)

Provisions, such as losses on accounts receivable, represent potential losses when receivables may be uncollectible. This adjustment helps reflect a more realistic asset value by accounting for expected losses.

-

Shrinkage

Depreciation or shrinkage adjusts the original value of fixed assets to reflect their decreased value over time, enhancing the accuracy of the balance sheet. These types of adjusting journal entries ensure that financial statements accurately reflect a company’s assets, liabilities, revenues, and expenses, supporting accurate financial reporting and decision-making.

Steps to Make Adjusting Journal Entries

Creating adjusting journal entries is an essential step in ensuring accurate financial reporting for your business. These entries help reconcile discrepancies, account for accrued revenues or expenses, and align your financial records with the actual business activities.

Creating adjusting journal entries is an essential step in ensuring accurate financial reporting for your business. These entries help reconcile discrepancies, account for accrued revenues or expenses, and align your financial records with the actual business activities.

By following the proper steps, you can simplify the process and maintain precise financial statements.

1. Complete the trial balance: Before creating adjusting entries, it’s essential to prepare a trial balance to ensure that all financial transactions are accurately recorded in the general ledger. This report serves as a comprehensive tool to analyze, monitor, and verify financial transactions, and using a financial management system can simplify the entire process.

2. Prepare to adjust journal: The second step involves compiling the adjusting journal, where specific accounts such as income, expenses, and equipment need to be updated. These adjustments ensure that financial records reflect accurate values, providing a reliable basis for financial reporting.

3. Creating a trial balance followed by adjustments: After making adjustments, the trial balance is updated to reflect the changes and ensure accurate financial statements. This step typically includes preparing key reports like the income statement, balance sheet, and cash flow statement for a comprehensive financial overview.

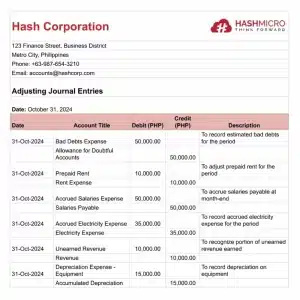

Example of Adjusting Journal Entry

Adjusting journal entries plays a crucial role in ensuring financial records accurately reflect a company’s actual performance during a specific period. These entries adjust revenues, expenses, and other accounts to align with the matching principle, providing a clearer view of financial activities.

To illustrate this concept further, let’s explore an example of an adjusting journal entry that highlights its purpose and importance.

Adjust Your Journal Entries Effortlessly with HashMicro’s Accounting Software

HashMicro Accounting Software is a leading solution for businesses in the Philippines seeking to optimize their financial management processes. With HashMicro, companies can maintain accurate financial records, reduce manual errors, and achieve better compliance with accounting standards.

HashMicro Accounting Software is a leading solution for businesses in the Philippines seeking to optimize their financial management processes. With HashMicro, companies can maintain accurate financial records, reduce manual errors, and achieve better compliance with accounting standards.

If you’re interested in HashMicro’s accounting software, you can try a free demo to discover how it can benefit your business. The demo provides an in-depth look at the software’s features and capabilities, showcasing how it can simplify adjusting entries and improve overall financial management.

Here are some of the key features provided by HashMicro’s accounting software:

- Bank Integrations – Auto Reconciliation: Automatically reconciling bank transactions minimizes manual effort and ensures cash and bank accounts are accurately adjusted. This feature helps reduce errors and streamline adjusting entries related to financial reconciliation.

- Multi-Level Analytical Reports: Analytical reports provide a detailed comparison of financial data across projects, branches, or periods, identifying inconsistencies. These insights help pinpoint areas requiring adjusting entries, ensuring accurate and reliable reporting.

- Profit & Loss vs Budget & Forecast: Comparing actual profit and loss figures against budgets and forecasts highlights variances that need adjustments. This ensures financial statements align with business goals and accurately reflect performance.

- Cash Flow Reports: Cash flow reports track all financial inflows and outflows, revealing unrecorded revenues or expenses. By identifying these gaps, businesses can create precise adjusting entries to maintain accurate cash flow records.

- Automated Currency Update: This feature ensures foreign exchange rates are updated in real-time, making adjustments for currency fluctuations seamless. It simplifies the process of handling international transactions, improving financial accuracy.

- Financial Statement with Budget Comparison: Comparing financial statements to budgets highlights discrepancies that require adjusting entries. This ensures that financial reports provide a clear picture of how actual performance measures up to expectations.

- Chart of Accounts Hierarchy: A structured chart of accounts makes it easier to locate specific accounts to adjust entries. This organization improves efficiency and ensures that all necessary adjustments are accounted for accurately.

- Treasury & Forecast Cash Management: This tool helps project future cash requirements, aligning adjusting entries with anticipated cash flows. It supports better financial planning and reduces the risk of discrepancies in cash management.

In addition to its powerful features, HashMicro offers seamless integration with various modules and third-party systems, providing flexibility to match your business needs. With customizable options, the software ensures a tailored approach to fit your specific requirements, making it an excellent choice for businesses seeking a robust and adaptable accounting solution.

Conclusion

Adjusting journal entries is essential for maintaining accurate financial records in your business. This critical aspect of accounting involves modifying account balances in the company ledger at the end of the accounting cycle to ensure accuracy.

The primary purpose of adjusting entries is to record any income or expenses that were not recognized during the reporting period. This process requires careful attention, as errors in the initial recording can lead to greater complications later in the financial cycle.

Reliable accounting software is highly recommended to simplify the management of your financial records and journals. With advanced features from HashMicro’s Accounting Software, user-friendly interfaces, and tools to minimize errors and prevent fraudulent actions, accounting software can significantly enhance your financial controls.

Strong financial management begins with the right tools—explore the best accounting software options in the Philippines, or try a free demo today!