Through amortization, businesses pay off loans or intangible assets gradually, reducing immediate financial impact. This steady payment schedule keeps cash flow manageable and aligns expenses with income.

Para sa mga negosyo, this is key to handling high costs and seeing the true value of assets. Accounting software can simplify this by automating calculations and reports. In fact, 6Wresearch reports a growing demand for it in the Philippines, with a 6.4% annual growth rate until 2030.

Tatalakayin ng article ito amortization meaning, types, schedule, formula, examples, how to calculate them, and how HashMicro’s accounting software allows businesses to easily manage them, gain accurate insights, and make smarter financial decisions.

Key Takeaways

|

Table of Contents

What is Amortization?

Amortization is a way to spread the cost of a loan or intangible asset over time. This gradual cost-sharing helps businesses and individuals manage finances better, ensuring that big expenses don’t overwhelm cash flow and align with income.

Loan Amortization

Loan amortization is the process of paying off debt through regular payments. Each payment covers part of the loan’s interest and principal. Early payments mostly go toward interest, but as time goes on, more of each payment reduces the loan balance. Ito ay nagbibigay ng malinaw na paraan para sa pagbabayad.

Intangible Asset Amortization

For intangible assets like patents, it spreads out the asset’s cost over its useful life. Each period has an equal expense, reflecting the asset’s decreasing value. This expense appears on financial statements, showing a realistic asset value over time.

If you are interested in managing your assets efficiently along with automating your calculations, discover what HashMicro asset management system can do!

Amortization Schedule

An amortization schedule is a detailed plan that shows each payment for loan management, breaking down how much goes to interest and how much to the principal. Early on, most of each payment covers interest, but later payments reduce the loan balance more quickly, helping you track progress.

It offers clarity on your loan repayment. It’s useful for budgeting because you can see exactly how long it’ll take to pay off the loan and how much interest you’ll pay over time. This schedule is helpful for mortgages, car loans, and other installment-based debts.

Many lenders provide a schedule, and you can also use online tools or calculators to create one. Adjustments, like extra payments, can shorten the loan term and reduce interest costs.

Here’s an example for a ₱10,000 loan with a 5% annual interest rate, repaid over 5 months. Each payment includes both interest and principal.

| Month | Payment | Interest | Principal | Remaining Balance |

| 1 | ₱2,041.40 | ₱41.67 | ₱1,999.73 | ₱8,000.27 |

| 2 | ₱2,041.40 | ₱33.33 | ₱2,008.07 | ₱5,992.20 |

| 3 | ₱2,041.40 | ₱24.97 | ₱2,016.43 | ₱3,975.77 |

| 4 | ₱2,041.40 | ₱16.57 | ₱2,024.83 | ₱1,950.94 |

| 5 | ₱2,041.40 | ₱8.13 | ₱2,033.27 | ₱0.00 |

Each month, the interest portion decreases as the balance goes down, while more of the payment covers the principal. By month 5, the loan is fully paid. This schedule helps you see how each payment impacts the remaining balance and overall cost.

Amortization vs. Depreciation

Amortization and depreciation both allocate asset costs over time but apply to different asset types. While amortization is for intangible assets, like patents, depreciation is used for physical assets, such as equipment, which wear down with use.

Another difference is in accounting. Amortization reduces the intangible asset’s account directly. However, depreciation credits an accumulated depreciation account, reducing the asset’s book value while keeping its original cost on record.

Finally, calculation methods vary. Amortization typically uses the straight-line method, spreading costs evenly. Depreciation may use methods like declining balance, which adjusts for physical assets’ unique patterns of value loss.

How to Calculate Amortization

Amortization formula differs for loans and intangible assets. For loans, it’s about regular payments reducing debt over time. For intangible assets, amortization spreads the asset’s cost across its useful life, showing its decreasing value in financial records.

Loan Amortization Formula

For monthly amortization and how to calculate the total monthly payment for a loan, including both principal and interest, use:

Where:

- Loan Amount = Principal

- i = Monthly interest rate

- n = Total number of payments

For calculating loan amortization monthly principal portion, use:

Where:

- TMP = Total monthly payment

- OLB = Outstanding loan balance

- Interest Rate = Annual interest rate (divided by 12 for monthly)

Intangible Asset Amortization Formula

Para intangible assets, amortization often uses the straight-line method, calculated by:

This divides the asset’s cost evenly over its useful life, assigning the same amount as an expense each period.

Businesses can automate this calculation process and save precious time without worrying about errors with the help of accounting software. Explore the Accounting platforms for Philippine businesses or click the banner below to see HashMicro’s system pricing scheme.

The Importance of Amortization for Businesses

Amortization is key for businesses in the Philippines to manage costs over time. It provides a structured way to handle large expenses, improving cash flow and financial planning, na tumutulong sa mga kumpanya na manatiling matatag sa kabila ng pagbabago sa merkado.

1. Predictable Budgeting

With amortization schedules, businesses can predict future payments, covering both principal and interest. This clear breakdown aids in budgeting and helps businesses allocate resources effectively, allowing them to focus on expansion and operational stability.

2. Financial Transparency

Amortized assets accurately reflects a company’s financial health by spreading out costs over an asset’s useful life. This transparency strengthens trust with investors, creditors, and stakeholders by clearly showing the company’s true operating costs.

3. Improved Debt Management

Amortization divides loan payments into manageable parts, reducing risk and making debt repayment sustainable. For businesses, this ensures steady cash flow for other priorities like investments, workforce, or equipment upgrades, while minimizing default risk.

4. Matching Expenses to Revenue

Amortization ensures expenses align with revenue generation. For example, amortizing software costs lets businesses spread the expense over years of use, providing a true picture of profitability in each period and aiding in accurate decision-making.

5. Tax Benefits

Businesses benefit from amortizing intangible assets, as the amortized cost may be deductible, lowering taxable income. This tax benefit helps companies optimize their financial performance while adhering to local tax laws.

Examples of Amortization

Amortization example appear in various business and personal finance scenarios in the Philippines. Here are some examples of how it works:

- Home loans: One of the most common examples is home loans, which are amortized with each payment covering both principal and interest. Over time, more of each payment reduces the principal, making it easier to budget for homeowners.

- Car loans: Car loans in the Philippines are also amortized. Similar to home loans, each monthly payment includes principal and interest, allowing borrowers to gradually own the vehicle while managing costs predictably.

- Intangible assets: Businesses often amortize intangible assets like patents, trademarks, or goodwill. This method spreads the asset’s cost over its useful life, reflecting its value decline accurately on financial reports.

- Leases: Lease payments in the Philippines are commonly amortized. Leases act as loans for using an asset, so their costs are spread over the lease period, making it easier for businesses to plan expenses.

- Prepaid expenses: Many businesses prepay for items like insurance or rent. These costs are amortized over the coverage period, helping companies manage costs smoothly without large, one-time expenses.

- Bonds: Whether issued by businesses or government entities, bonds are amortized over their term. This setup allows issuers to manage repayment steadily, appealing to investors looking for regular interest payments.

Using Accounting Software to Manage Amortization

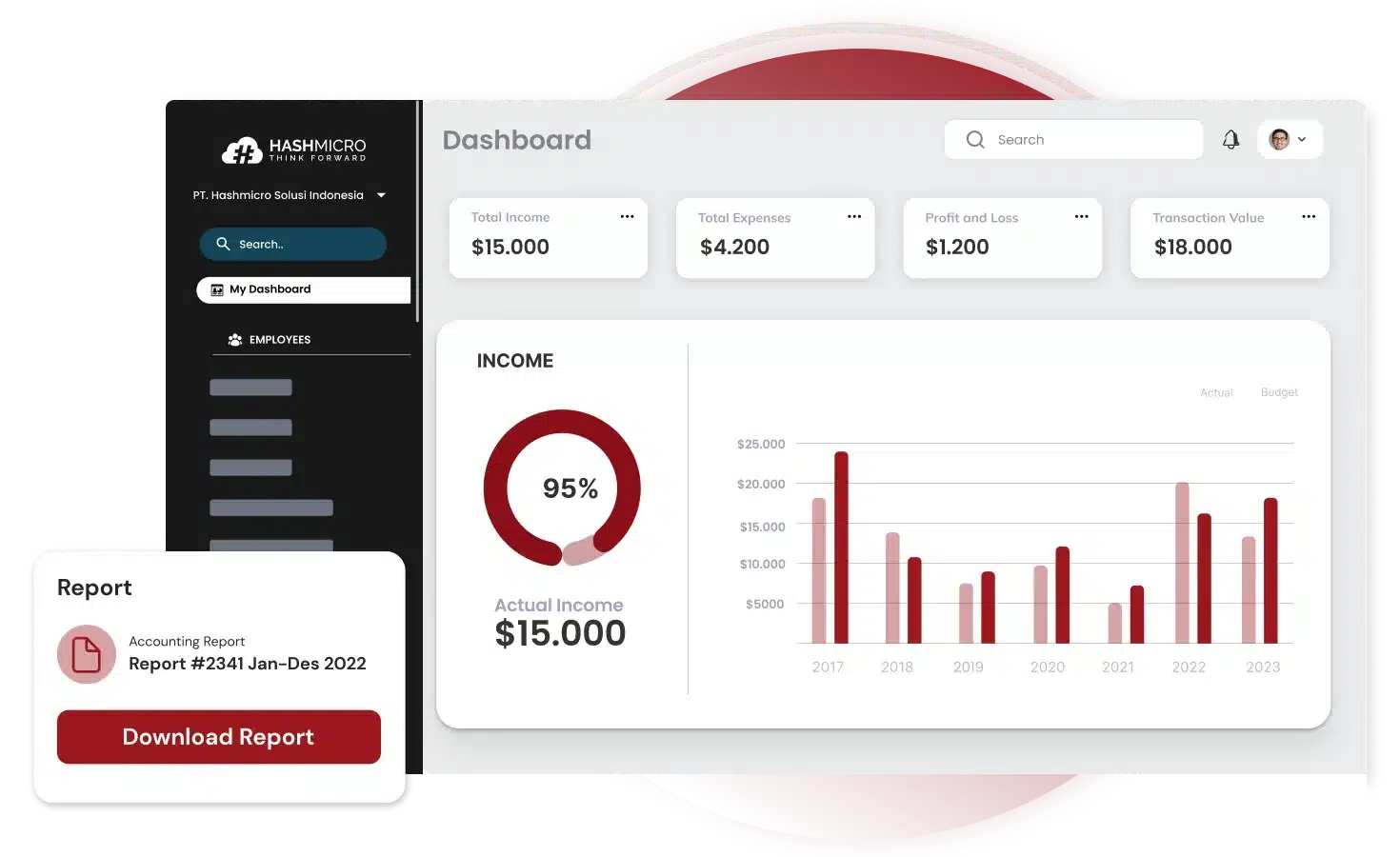

Amortization is vital for effective financial management, helping businesses manage large costs over time. HashMicro’s Accounting Software is crafted to simplify these processes, offering companies a comprehensive platform to automate amortization and maintain financial clarity.

With HashMicro, businesses can automate amortization schedules for both loans and intangible assets, saving time and reducing manual errors. The software ensures accurate tracking, improves financial reporting, and enhances compliance with local accounting standards.

HashMicro’s reporting feature provides instant access to up-to-date data, helping businesses make informed decisions quickly. It also includes tax deductions and compliance tools to maximize efficiency. Try HashMicro’s free demo to see the benefits firsthand.

Key features of HashMicro’s accounting software

- Automated schedules

HashMicro automates amortization schedules, accurately tracking principal and interest over time. This feature reduces manual work and ensures precise breakdowns for each payment. - Intangible asset tracking

The software tracks intangible assets, spreading costs over their useful life. This helps businesses show accurate asset values on financial reports, meeting compliance standards. - Real-time reporting

Real-time reporting provides updated amortization schedules and asset values instantly, allowing for faster, more informed decisions and better financial planning. - Tax management

HashMicro simplifies tax reporting by handling amortization-related deductions, reducing tax complexities for businesses in the Philippines and ensuring compliance with BIR-CAS.

With HashMicro, businesses streamline amortization management, gain accurate reports, and save time. Automated schedules and real-time insights help optimize cash flow, improve decision-making, and support growth effectively.

Conclusion

Amortization helps businesses manage high costs by spreading expenses over time. This structured approach maintains steady cash flow and gives a clearer view of true earnings, making it essential for both loan repayments and intangible asset management.

For businesses in the Philippines, using accounting software simplifies this process. HashMicro’s Accounting Software automates schedules, provides real-time reports, and ensures compliance, making it easier to manage amortization for loans and intangible assets effectively.

Upang tuklasin ang mga benefits, try HashMicro’s free demo. This hands-on experience shows how HashMicro supports better budgeting, smart decision-making, and efficient growth, all while keeping financial reporting accurate and clear.

Frequently Asked Questions about Amortization

-

Is amortization the monthly payment?

No, amortization is not the monthly payment itself. It’s the process of spreading the cost of a loan or asset over time. Each monthly payment covers a portion of both principal and interest, gradually reducing the loan balance.

-

What is an example of amortized?

When something is amortized, like a loan or patent, its cost is spread out over time. For example, a home loan is amortized with monthly payments, gradually reducing the loan balance until it’s fully paid.

-

What is the difference between installment and amortization?

An installment is the actual payment made, while amortization is the process that determines how much of each installment goes toward paying down the principal and interest. Amortization structures the loan so it’s fully repaid over its term.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [{

“@type”: “Question”,

“name”: “Is amortization the monthly payment?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “No, amortization is not the monthly payment itself. It’s the process of spreading the cost of a loan or asset over time. Each monthly payment covers a portion of both principal and interest, gradually reducing the loan balance.”

}

},{

“@type”: “Question”,

“name”: “What is an example of amortized?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “When something is amortized, like a loan or patent, its cost is spread out over time. For example, a home loan is amortized with monthly payments, gradually reducing the loan balance until it’s fully paid.”

}

},{

“@type”: “Question”,

“name”: “What is the difference between installment and amortization?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “An installment is the actual payment made, while amortization is the process that determines how much of each installment goes toward paying down the principal and interest. Amortization structures the loan so it’s fully repaid over its term.”

}

}]

}