Alam mo ba kung paano ginagamit ang mga asset ng iyong negosyo?

Asset utilization is a crucial metric that measures how effectively a company uses its resources to generate revenue. Understanding this concept can transform your business performance, leading to more informed decision-making and strategic growth.

For example, a manufacturing company may find its machinery underutilized, highlighting an opportunity for improvement.

This article will delve into the definition, examples, benefits, and calculation methods of asset utilization.

Table of Contents

Key Takeaways

|

Defining Asset Utilization

Asset utilization refers to the efficiency with which a company employs its assets to generate revenue. It measures how well a firm converts its investments in assets—such as machinery, equipment, and facilities—into income.

Understanding asset utilization meaning also involves examining the relationship between a company’s total revenue and assets.

In practical terms, asset utilization can vary significantly across industries. For instance, manufacturing firms might have different asset utilization examples than service-oriented businesses, given their reliance on physical assets rather than human capital.

Effective asset utilization is crucial for maximizing profitability and ensuring sustainable growth.

Examples of Asset Utilization

Asset utilization is a crucial metric across various industries, reflecting how effectively resources are employed to generate revenue. Here are some asset utilization example in different sectors:

1. Manufacturing

A car manufacturer might measure asset utilization by comparing total revenue from car sales to the value of its factories and equipment.

2. Construction

Construction measures how effectively a company employs its resources, including machinery, labor, and materials, to generate project revenue.

3. Retail

A retail chain may use the asset utilization ratios to assess how well its stores perform by comparing sales revenue to the investment in retail locations and inventory.

4. Transportation

A logistics firm can analyze asset utilization by measuring revenue from deliveries against the costs of its vehicles and warehousing facilities, ensuring it is not underutilizing its fleet.

Benefits of Optimizing Asset Utilization

Ang pag-optimize sa paggamit ng asset ay mahalaga upang mapahusay ang kahusayan.

Companies can unlock numerous advantages by focusing on how effectively assets are used. The following benefits illustrate why this practice is crucial for sustainable success:

1. Cost efficiency

Optimizing asset utilization helps organizations minimize unnecessary expenditures by reducing the assets needed to meet operational demands.

2. Increased productivity

When assets are utilized effectively, employees can work more efficiently, resulting in higher output levels. This streamlined process enhances productivity and allows teams to focus on strategic initiatives rather than managing excess resources.

3. Enhanced revenue

By maximizing the use of existing assets, companies can increase their production capabilities without investing heavily in new equipment.

4. Improved decision-making

Collecting and analyzing data on asset utilization provides valuable insights that can guide strategic decisions.

5. Longer asset lifespan

Proper management and maintenance of assets contribute to their longevity, maximizing the return on investment.

Using tools like an asset management system ensures that the benefits can be optimized, so that the assets can be in tip-top shape for longer time, thus benefitting the companies in return.

How to Calculate Asset Utilization

You’ll need to start with some critical financial figures to assess how well an organization uses its assets to generate revenue. Here are some tips on how to calculate asset utilization.

1. Gather necessary financial data

- Total Revenue: Obtain the total revenue generated by the organization over a specific period. For example, if a company reports a total income of ₱500,000 for the fiscal year, that will be your starting figure.

- Total Assets: Determine the organization’s total assets, including all resources owned that can generate revenue. For instance, if the total assets are reported as ₱1,100,000, you will use this value in your calculations.

2. Calculate the asset utilization ratio

Use the following formula to calculate the ratio: Total RevenueTotal Assets / Asset Utilization Ratio

Example Calculation

Given:

- Total Revenue = ₱500,000

- Total Assets = ₱1,100,000

Plugging in these values:

Asset Utilization Ratio = ₱500,000 / ₱1,100,000

= 0.4545

This result indicates that for every peso invested in assets, the company generates approximately ₱0.45 in revenue.

3. Interpret the results

- Higher Ratios: A higher ratio suggests the effective use of assets to generate revenue, indicating operational efficiency.

- Lower Ratios: A lower ratio may indicate underutilization or inefficiencies within operations, signaling areas for potential improvement.

We provide an asset management software recommendation that can be a crucial consideration for your business. Ito ay epektibong makakatulong sa iyo na i-maximize ang potensyal ng lahat ng iyong asset.

Maximize Your Asset Utilization with HashMicro!

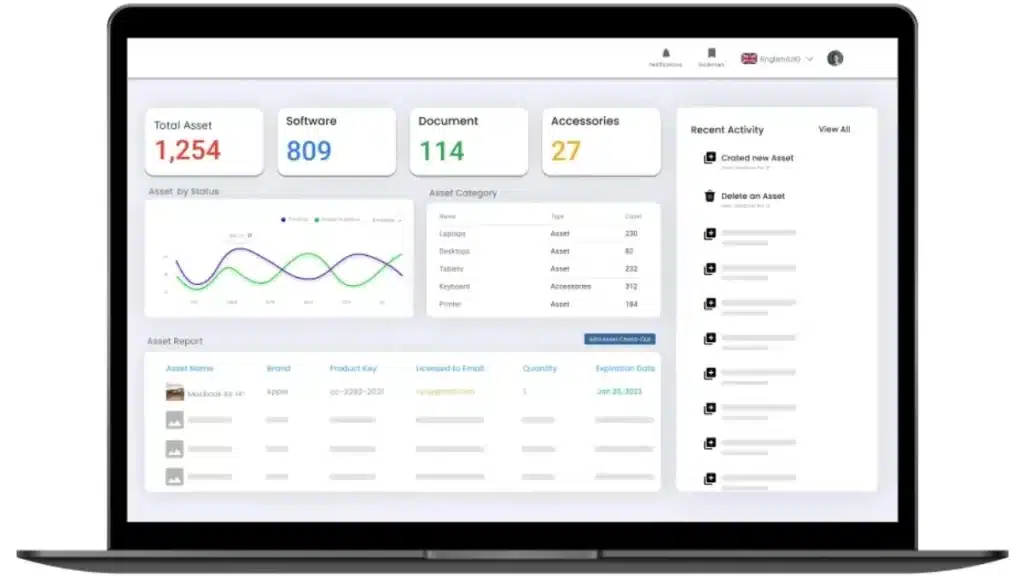

Asset Software is the key to unlocking your assets’ full potential. HashMicro’s asset performance management software is expertly crafted to streamline and harmonize your company’s resource management, making it easier than ever to maximize its value.

HashMicro module ensures that all assets are precisely recorded and readily available to the relevant departments. It emphasizes the productivity ratio to improve return on assets (ROA), featuring overall equipment effectiveness (OEE) as a critical component in identifying downtime that may adversely impact ROA.

Features

- Asset Comprehensive Cost Reporting: Generates comprehensive reports for future asset maintenance budgeting.

- Asset Maintenance Budget: Maintains budget compliance, optimizes resource allocation, prevents unforeseen costs, and extends the lifespan of assets.

- Preventive Maintenance Scheduling: This tool simplifies the creation of maintenance schedules to avert unexpected operational interruptions and ensure that assets remain functional and durable.

- Asset Stock Take with Barcode: This method utilizes barcodes to report asset conditions (such as operational status or missing items) directly into the system.

- Asset GPS Tracking: This service offers precise, real-time tracking of asset locations through GPS, enhancing the company’s asset visibility.

- Parent & Child Asset Management: Provides insights into individual assets and their broader context, facilitating efficient monitoring of maintenance, usage, and status.

- QR Code Scanning for Facilities Request: Allows employees to report problems, expediting the repair process quickly.

Conclusion

Optimizing asset utilization brings several benefits, including cost efficiency, increased productivity, and enhanced revenue without significant new investments.

To maximize your asset utilization, consider HashMicro’s asset management system. This manufacturing asset management software is designed to streamline resource management, ensuring that all assets are accurately recorded and easily accessible to relevant departments.

Interesado na subukan ang aming system? Sige, subukan ang libreng demo ngayon!

FAQ

-

What is asset utilization?

Asset utilization measures how efficiently a company uses its assets to generate revenue. It reflects the company’s ability to maximize its assets’ use.

-

What is asset utilization ratio?

The asset utilization ratio is a metric used to assess how effectively a company utilizes its assets. It is calculated by comparing total revenue to total assets, providing insight into how well a company generates revenue from its assets.

-

What are the standards for asset utilization?

Standards for asset utilization vary by industry. Each sector has specific benchmarks, and companies with ratios above industry averages are typically considered to have good asset management.