Imagine your business losing money silently, all due to overlooked asset valuation. Many businesses in the Philippines face significant losses because they fail to track and mag-manage ng kanilang mga assets. Properly understanding the true value of your assets is vital for shielding your business from hidden financial risks.

Neglecting accurate asset valuation is more than a minor oversight—it’s a critical flaw that can cripple your business’s ability to compete. You risk misdirected investments in crucial areas if you don’t assess your assets accurately. This can lead to mismanaged resources and significantly lower your profits.

Mastering asset valuation is beneficial and essential for your business’s sustained success and growth, such as using an asset management system. Let’s dive in to learn more about asset valuation in helping your business.

Key Takeaways

|

Table of Contents

What is Asset Valuation?

Asset valuation is a critical process that involves estimating the current value of a company’s assets, ranging from tangible items like machinery and real estate to intangible assets such as patents and trademarks.

This process is essential for creating accurate financial reports and providing stakeholders with a clear and precise understanding of the company’s financial health. Ensuring that asset valuation is done correctly is vital for maintaining transparency in financial statements, which helps build stakeholder trust.

By thoroughly understanding the value of your assets, a company can engage in more effective strategic financial planning. This knowledge enables businesses to optimize resource management, aligning asset utilization with company goals and operational needs.

Why is Asset Valuation Important?

Asset valuation is essential in guiding various business decisions and maintaining compliance with financial regulations. Accurately assessing the value of assets enables companies to set the right prices for their products and services, preventing underpricing and ensuring competitive market positioning.

Some of the importance of this are:

- Determining the Right Price: Accurate asset valuation helps businesses set appropriate prices, avoiding losses from underpricing and ensuring competitiveness in the market.

- Supporting Company Mergers and Acquisitions: In mergers and acquisitions, a clear understanding of asset values provides a solid basis for negotiations, helping to secure fair deals that benefit all involved parties.

- Loan Application and Collateral Assessment: For businesses seeking financing, asset valuation determines the credit amount and collateral terms essential for lenders to mitigate risks.

- Audit and Financial Reporting: Accurate asset valuation is indispensable for complying with financial regulations and preventing legal issues and penalties associated with incorrect financial reporting.

Precise asset valuation is critical in mergers and acquisitions for anchoring fair negotiations and defining loan terms for lenders. It also plays a key role throughout the asset life cycle, influencing strategic decisions from acquisition to disposal. Accurate valuation is vital for avoiding legal and financial issues.

Types of Business Assets

Valuing business assets requires a comprehensive approach, considering both tangible and intangible components.

| Types | Definition |

|---|---|

| Tangible Assets | Tangible assets include physical items like machinery, buildings, and vehicles. They are critical to any business’s operational capacity and require a regular valuation to ensure their book value aligns with their current market worth. |

| Intangible Assets | Although not physical, intangible assets play a pivotal role in a business’s valuation. These include trademarks, brand recognition, and proprietary technology, all of which can significantly influence a company’s market position and value. |

In practice, tangible assets are valued by assessing their condition, useful life, and depreciation. Intangible assets are evaluated on their revenue potential and competitive advantages.

Methods of Asset Valuation

Asset valuation is a critical component of financial management, employing various methods to determine the most accurate value of business assets. These methods cater to different asset types and scenarios, ensuring a comprehensive assessment.

- Cost Method: This method calculates the asset’s value based on the cost to purchase or create a similar asset. It is commonly used for physical assets.

- Market Value Method: It assesses an asset’s worth based on current market conditions, adjusting to market fluctuations.

- Income-Based Method: This method values assets by the income they are expected to generate. It is suitable for businesses and intangible assets.

- Comparable Transactions Method: This method involves comparing the asset to similar ones recently sold. It is useful for assets with observable market values.

- Standard Cost Method: It estimates the cost to replace an asset in its current state, frequently used in manufacturing and production.

These valuation methods play an essential role in business strategy, aiding decisions related to investment, mergers, acquisitions, and compliance reporting. By choosing the appropriate valuation method, businesses can ensure that their assets are accurately represented in their financial statements.

Common Errors in Asset Valuation

Asset valuation is a meticulous process, but errors can still occur, potentially leading to significant financial consequences. Awareness of common mistakes can help businesses avoid pitfalls and maintain accurate financial records.

Some of those are:

- Overestimating Intangible Assets: This can inflate a business’s value unrealistically, increasing investment risks.

- Ignoring Market Conditions: Overlooking current market dynamics can lead to incorrect asset valuations, particularly in fluctuating markets.

- Inadequate Documentation: Insufficient records and documentation can cause valuation errors, affecting financial decisions and regulatory compliance.

Awareness and correction of these common errors in asset valuation are crucial for ensuring financial accuracy and reliability. By paying close attention to these aspects, businesses can better safeguard their financial reporting, promoting a more stable and accurate assessment of their asset base.

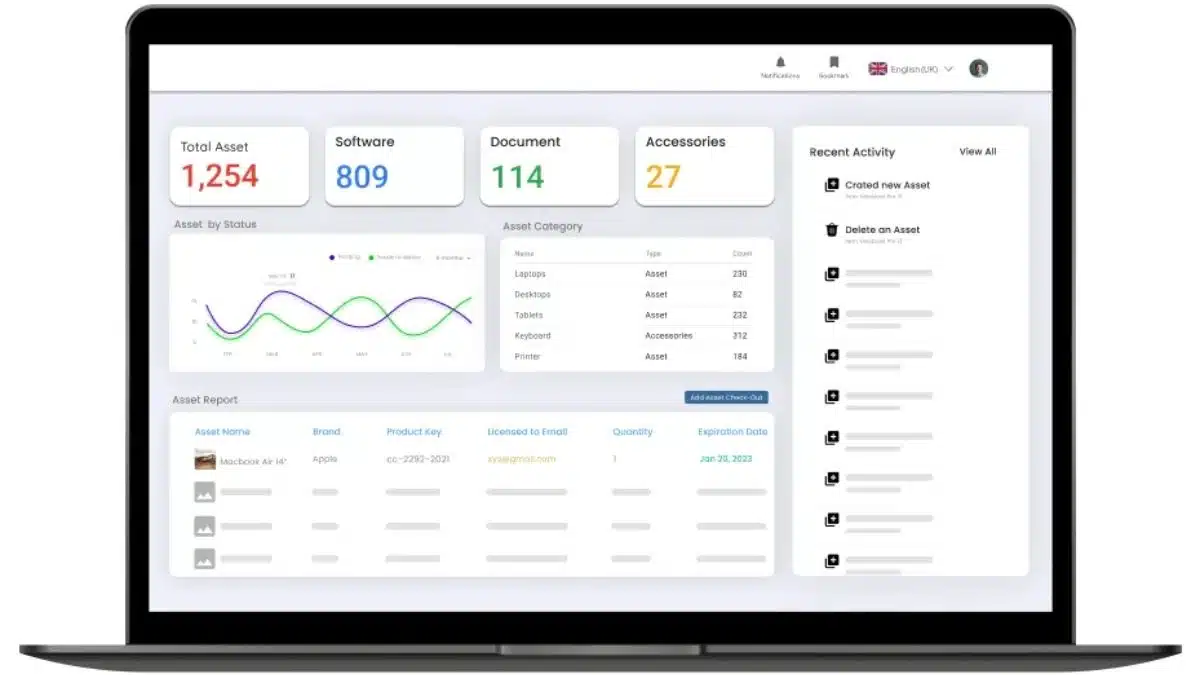

Streamline Asset Valuation Using HashMicro’s Asset Management Software

Streamlining asset valuation can transform a tedious, error-prone process into a seamless, efficient operation. HashMicro’s Asset Management Software offers robust features designed to enhance the accuracy and speed of asset valuation for businesses.

- Asset Comprehensive Cost Reporting: Delivers detailed reports on the costs associated with each asset, enhancing financial transparency.

- Asset GPS Tracking: Utilizes GPS technology to track asset locations in real time, ensuring accurate and current data.

- Parent & Child Asset Management: Manages complex asset hierarchies, allowing for detailed oversight of related assets and their dependencies.

- Fully Integrated with Accounting to Track Depreciation: Seamlessly integrates accounting modules to automatically calculate and record asset depreciation, aligning financial records with actual asset values.

Utilizing a cloud asset management software, like HashMicro and other asset management software, not only simplifies the asset valuation process but also provides comprehensive insights that aid in strategic financial planning. By leveraging these advanced features, businesses can ensure their asset valuations are precise.

Conclusion

Accurate asset valuation is crucial for safeguarding your business’s financial health and stability. It supports strategic decisions, from daily operations to long-term planning. As Philippine companies navigate complex economic landscapes, precise asset valuation becomes essential for ensuring financial compliance.

For businesses aiming to streamline this crucial process, HashMicro’s Asset Management Software offers a robust solution. With comprehensive cost reporting and real-time GPS tracking, this software improves financial transparency and supports strategic planning. Sign up for a free demo today and enhance your asset management strategy!

Frequently Asked Question

-

How do you calculate asset value?

Asset value is calculated by evaluating purchase cost, depreciation, market conditions, and potential income. The specific method depends on the asset type, such as using market value for real estate or income-based methods for intangible assets.

-

What are the two major methods of asset valuation?

The two major methods are the Cost Method and Market Value Method. The Cost Method assesses the value based on purchase or creation cost, while the Market Value Method evaluates assets based on current market conditions.

-

What is an example of asset value?

An example of asset value is a company’s office building estimated at its current market price. If the building was purchased for $1 million but is now valued at $1.5 million, that reflects its current asset value.