Imagine that you’ve worked hard, made the sale, delivered your product or service, and waited patiently for the payment, yet nothing arrived. Parang pamilyar? Bad debts are the silent setback that can drain your profits and disrupt your business, and it’s more common than you’d think.

Many companies struggle with unpaid invoices, but few know why this thing really matters to their business. Wouldn’t it be a relief to prevent these losses before they start? Keep reading to find simple, effective ways to handle bad debts, turning those potential losses into manageable challenges.

Key Takeaways

|

Table of Contents

What is Bad Debts?

Bad debts are a common issue that can quietly drain a business’s profits. They occur when a customer cannot make the payment they owe after receiving products or services on credit. Handling bad debts effectively is key to maintaining a strong financial position.

By understanding how much debt may go unpaid, you can take steps to reduce these losses and protect your revenue. Many businesses face bad debts simply because they have not developed a strategy for dealing with them.

Learning how to manage bad debts can make a real difference, helping you keep more of your hard-earned income where it belongs in your business.

Is bad debt considered an expense?

Yes, it counts as an expense. They’re recorded under operating expenses, specifically in a company’s selling and administrative costs, reducing net profit for that period. By tracking bad debts on the income statement, businesses can identify which customers might be at risk of not paying.

Why Do Bad Debts Matter?

Keeping track of unpaid debts is essential because they can quickly increase and impact a business’s cash flow and profits. When customers don’t pay what they owe, less money is available for other important needs.

Using an accounting system can really help with this. An automated system makes keeping accurate records and tracking payments easier, cutting down on manual work and reducing mistakes. This way, you can focus more on growing your business, knowing that the system handles your finances properly.

How Do You Manage Bad Debts?

There are two common ways businesses handle bad debts: the Write-off Method and the Allowance Method.

1. The Write-off Method

The business removes the unpaid debt from its accounts as soon as it becomes clear the customer will not pay. This method directly reduces accounts receivable and shows an immediate loss on financial statements.

While it helps to clean up records quickly, it does not help the business prepare for similar unpaid debts in the future, as it only addresses debts that are already uncollectible.

2. The Allowance Method

On the other hand, this is a more proactive approach. Instead of waiting for debts to go unpaid, the business estimates potential bad debts in advance based on past trends and customer payment history.

By setting aside a portion of expected bad debts, this method creates a buffer to handle future losses more gradually, helping the business maintain a clearer view of its overall financial health.

Steps in the allowance method:

- Estimate Bad Debts: Calculate an expected amount of unpaid debt based on past customer trends.

- Make Journal Entries: Record this amount as a bad debt expense and credit an “allowance for doubtful accounts.”

- Adjust as Needed: If a specific account goes unpaid, update the allowance and adjust the accounts receivable accordingly.

This gradual approach allows businesses to better plan for future losses and gives a more accurate picture of finances over time.

How to Calculate Bad Debts

Calculating bad debts can be made easier by using a simple percentage method. This method estimates how much of your total receivables might not get paid based on past trends. Here’s a step-by-step guide:

- Identify Total Receivables: Start by looking at the total amount of money owed to your business from customers, which is often listed as “accounts receivable.”

- Estimate Potential Bad Debts: Based on customer payment history, estimate the portion that may go unpaid. For example, if your business has $10,000 in receivables and you expect $500 of it won’t be collected, this is your estimated bad debt.

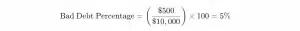

- Calculate the Percentage: Divide the estimated bad debt by total receivables, then multiply by 100 to get the percentage. In our example:

This percentage shows how much of your receivables you expect to lose due to unpaid debts. By regularly calculating and monitoring this percentage, businesses can better understand and prepare for potential losses, taking action—such as issuing a formal collection letter—before unpaid debts start to affect overall financial health.

Recording Bad Debts in Financial Reports

Businesses can choose between two main methods to record these in their journals:

1. Sales percentage method

The Sales Percentage Method calculates bad debts based on a set percentage of total credit sales. This method is simple and involves applying a predetermined rate to the total sales made on credit to estimate uncollectible amounts. Here’s how it works:

- Determine Credit Sales: Look at the total amount of sales made on credit, which represents the money owed by customers who haven’t yet paid.

- Apply the Bad Debt Percentage: Use an estimated percentage based on past experience. For instance, if a business has $100,000 in credit sales and expects that 1% of these sales may go unpaid, the bad debt expense would be calculated as:

- Record Bad Debt Expense: The business records this $1,000 as a bad debt expense, helping them prepare for potential losses.

This method provides a quick way to estimate bad debts based on overall sales, keeping financial records current without needing detailed customer analysis.

2. Accounts receivable aging method

The Accounts Receivable Aging Method takes a more detailed approach, grouping receivables based on how long they’ve been outstanding. Older debts, which have been unpaid for longer periods, are considered higher risk and more likely to go uncollected. Here’s a breakdown of this method:

- Organize by Aging Periods: Divide receivables into categories such as 30 days, 60 days, 90 days, etc., based on how overdue they are.

- Assign Risk Levels to Each Category: The longer the debt has been overdue, the higher the estimated risk of non-payment. For instance, debts overdue by 90 days may be assumed to have a higher chance of going unpaid than those only 30 days past due.

- Calculate Bad Debt by Category: Apply a higher bad debt percentage to older categories. For example, 1% for debts up to 30 days overdue, 5% for 60 days, and 10% for 90 days.

This method gives businesses a more accurate and detailed view of potential bad debts, allowing them to manage finances carefully and prepare for likely losses based on customer payment trends.

Simplify Bad Debts with HashMicro’s Accounting Software

HashMicro’s accounting software offers powerful features that streamline the process of tracking and managing bad debts. These features take the hassle out of managing finances and ensure that businesses can easily stay on top of their receivables.

By automating many of these tasks, HashMicro’s software allows business owners and financial teams to focus on growth rather than chasing unpaid debts. Here are five standout features of comprehensive Accounting platforms for Philippine businesses that specifically support bad debt management:

- Auto Reconciliation: Matches transactions from your bank automatically, ensuring accuracy and making it easier to spot unpaid invoices.

- Automated Customer Follow-Ups: Sends reminders for outstanding invoices to encourage timely payments from customers.

- Profit & Loss Tracking Against Budgets: Compares actual profits to your budgeted and forecasted targets, offering insight into how bad debts affect your bottom line.

- Real-Time Cash Flow Reporting: Provides a clear view of available cash to help you manage resources and account for unpaid debts.

- Budget vs. Actual Financial Statements: Shows how unpaid invoices impact financial goals, letting you make timely adjustments to stay on target.

These features in HashMicro’s accounting software simplify the often challenging process of managing bad debts. By automating follow-ups, monitoring cash flow, and maintaining up-to-date records, businesses can take proactive steps to reduce bad debts.

Conclusion

Bad debts are a reality for many businesses, but they don’t have to drain your profits. You can reduce the impact of bad debts on your financial health by tracking unpaid invoices. From understanding key methods to using smart tools, taking control of bad debts helps keep your cash flow stable and predictable.

HashMicro’s accounting software can further simplify bad debt management by automating essential tasks like customer follow-ups and cash flow tracking. With its powerful features, you can minimize the time spent managing receivables and focus on growth instead. Book a free demo today to see the benefits firsthand!

Frequently Asked Questions

-

What is an example of a bad debt?

An example of this is when a customer buys goods on credit but never pays. This uncollected payment is then written off as a financial loss for the business.

-

What is the accounting treatment for bad debt?

In accounting, they are recorded as an expense on the income statement. This reduces net income for the period to reflect the loss from uncollected payments.

-

How to record bad debts?

To record this, debit the bad debt expense and credit the allowance for doubtful accounts. This entry adjusts financials to reflect expected losses from unpaid debts.