Bank Reconciliation Software is a tool designed to harmonise the balances in your company’s bank accounts with the balances recorded in the general ledger. By automating the reconciliation process, this software will quickly ensure that your financial records are accurate and up-to-date.

Without the right software, businesses may struggle to track balance discrepancies, deal with unknown or suspicious transactions, and identify financial issues on time. These challenges can lead to significant inefficiencies and potential financial risks that could have been easily avoided with proper tools.

According to a survey by Statista, the business software market in the Philippines is projected to grow by 9.50% from 2024 to 2028. This highlights that companies in the Philippines are increasingly seeking to enhance operational efficiency, particularly in managing the complex task of bank reconciliation.

However, have you ensured that you’re using the correct bank reconciliation software? If not, this article will discover comprehensive recommendations for the 8 best Bank Reconciliation Software for your Philippines companies.

Table of Contents

Key Takeaways

|

What is Bank Reconciliation Software?

Bank reconciliation software automates the process by checking for errors or omissions in transactions, making entries, and validating bank balances. It ensures accuracy by comparing a company’s internal records with its bank statements, verifying that all balances match correctly.

Building on this functionality, bank reconciliation software highlights unmatched transactions and simplifies the reconciliation process by automating much of the manual effort involved. Doing so helps companies maintain accurate financial records and reduces the risk of errors when reconciling accounts manually.

A powerful accounting software offers essential features that greatly simplify the reconciliation process:

- Effortless data integration: The software automates the import of banking data directly from the bank or through formats like XML or CSV files, saving time and reducing errors within an auditable framework that ensures compliance and transparency.

- Intelligent transaction matching: It intelligently matches transactions between your bank statement and accounting records using customizable rules, providing accurate transaction matching for a seamless and efficient reconciliation process.

- Precision in reporting: The software generates comprehensive reconciliation reports that accurately identify discrepancies and flag any unmatched transactions, maintaining precise and reliable financial records within an auditable framework.

Why Bank Reconciliation is Essential for Financial Accuracy

In today’s competitive business environment, financial accuracy isn’t just a goal—it’s a necessity. For this reason, more businesses are turning to bank reconciliation software to streamline this process, reduce errors, and strengthen financial control. But why exactly is bank reconciliation so important, and how can automated reconciliation software help maximize its benefits for your business?

1. Ensuring data accuracy and detecting discrepancies

One of the primary benefits of bank reconciliation is its role in maintaining accurate and consistent financial data. By meticulously comparing financial records with bank statements, companies can identify and resolve discrepancies.

2. Improving cash flow management with bank reconciliation software

Cash flow is the lifeline of any business. Bank reconciliation software gives businesses a clear, real-time view of available cash by ensuring that only actual, cleared funds are accounted for in financial statements. With automated reconciliation software, cash availability is accurately reflected, minimizing the risk of overdrafts or missed payments. Additionally, these tools enhance cash flow forecasting, offering more precise projections based on verified, reconciled data.

3. Simplifying financial reporting and compliance

Accurate financial reporting is essential for regulatory compliance and for maintaining trust with shareholders. By automating the reconciliation process with software tools for bank account reconciliation, businesses can ensure that all financial records are accurate and up-to-date.

In addition, the streamlined reconciliation process provided by software tools supports timely and organized record-keeping, which is crucial for audits. Reconciled accounts demonstrate to auditors that the company maintains precise financial records, minimizing the time and costs associated with audit processes.

4. Enhancing decision-making and strategic planning

Reliable data is essential for strategic business decisions. By using bank reconciliation software, business leaders gain access to dependable financial data that can inform decisions regarding expansion, budgeting, and investments.

The insights generated through automated reconciliation software allow businesses to make informed decisions, anticipate financial needs, and proactively address cash flow gaps. This leads to improved financial planning and supports the company’s long-term goals.

Benefits of using Bank Reconciliation Software for Business

Implementing bank reconciliation software can significantly enhance the accuracy and efficiency of your financial processes. By automating what is often a time-consuming task, this bookkeeping software allows businesses to focus more on strategic growth and less on manual reconciliation efforts.

In the following section, we will discuss the accounting software benefits that can help your business succeed:

1. Automatic transaction matching

Bank reconciliation software automatically matches transactions between the bank statement and the company’s accounting records, drastically reducing the time and effort required for manual reconciliation.

This automation minimizes the chances of human error, ensuring that transactions are accurately recorded. By matching transactions automatically, businesses can quickly identify discrepancies, such as missing or duplicated entries, and address them promptly.

2. Automated account balance tracking and reporting

The software continuously tracks and updates account balances, providing real-time insights into the company’s financial position. It generates automated reports that give a clear overview of all account activities, making it easier for businesses to monitor their financial health.

These reports are customizable and can be tailored to meet specific business needs, allowing for detailed cash flow analysis. With automated tracking and reporting, companies can stay informed about their financial status without requiring manual calculations or data entry.

3. Compare account balances with corresponding account ledgers

Bank reconciliation software enables businesses to compare their account balances with the corresponding account ledgers seamlessly. This comparison helps identify any inconsistencies between the records, such as unrecorded transactions or errors in data entry.

By ensuring that the balances in the bank statement align with the company’s ledgers, businesses can maintain accurate and reliable financial records. This process is crucial for maintaining transparency and ensuring that all financial activities are accounted for correctly.

4. Balance sheet reconciliation

The software facilitates balance sheet reconciliation by ensuring that all financial statements are accurate and complete. It systematically checks for discrepancies between the recorded and actual bank balances, helping to prevent errors in financial reporting.

This feature is essential for businesses that must prepare accurate financial statements for stakeholders, auditors, and regulatory bodies. By automating balance sheet reconciliation, companies can improve the accuracy of their financial reports and reduce the risk of non-compliance.

5. Strategic planning

Bank reconciliation software provides accurate and up-to-date financial data, enabling businesses to engage in more effective strategic planning. The software’s ability to provide real-time insights into cash flow and financial trends allows managers to make informed decisions about future investments and resource allocation.

This strategic advantage helps companies stay competitive and responsive to market changes. By leveraging precise financial information, businesses can plan for growth, manage risks, and achieve long-term objectives.

6. Reporting accuracy

Bank reconciliation software enhances the accuracy of financial reporting by automating the reconciliation process and minimizing the risk of human error. It generates precise and detailed reports that reflect the actual financial status of the business

Accurate reporting is crucial for maintaining stakeholder trust, meeting regulatory requirements, and making informed business decisions.

Bank industry ensures that any transaction is properly accounted for and recorded, so syncing up business’ transaction with the bank’s is always a good decision.

8 Best Bank Reconciliation Software for Philippines Companies

Choosing the right automated bank reconciliation software is crucial for businesses in the Philippines to ensure accurate financial management and streamline their accounting processes. With numerous options available, finding the best software that aligns with your company’s needs can be challenging.

To help you make an informed decision, we’ve compiled a list of the 8 best bank reconciliation software solutions for Philippine companies. These solutions offer reliable features, firm support, and excellent value.

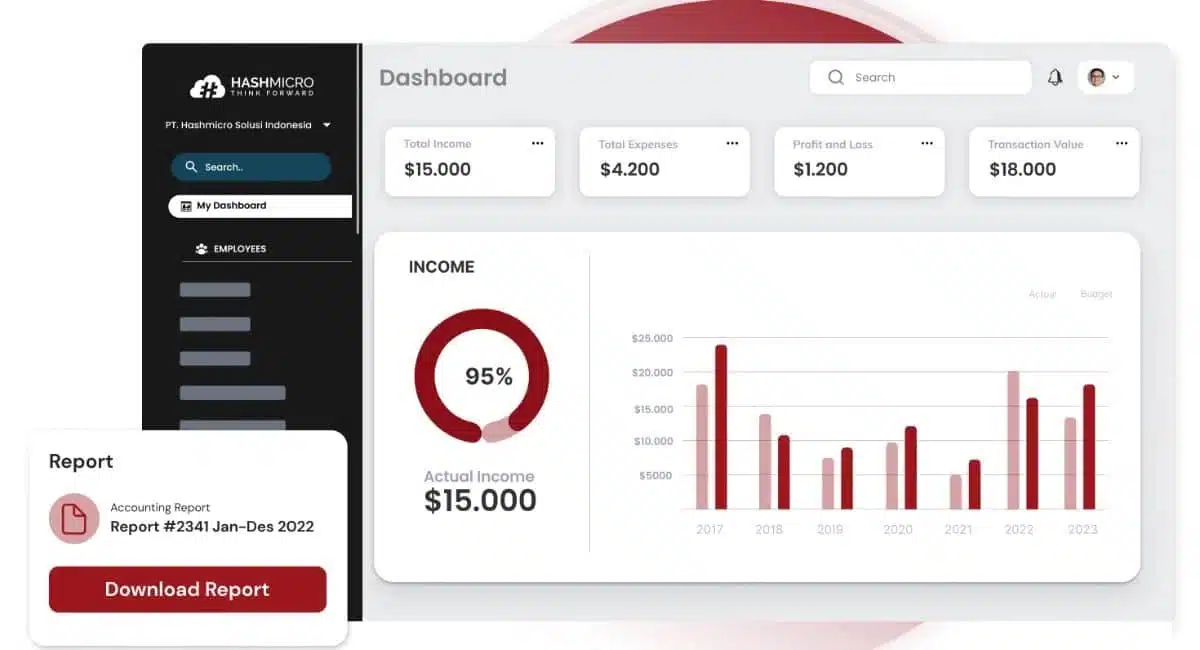

1. Automated Bank Reconciliation Software from HashMicro

HashMicro is a leading ERP software provider in Southeast Asia. It offers comprehensive Bank Reconciliation Software that seamlessly integrates with various accounting systems. The software automates reconciliation processes, reducing errors and improving financial accuracy for businesses of all sizes.

The top choice for Filipino companies seeking a comprehensive, localized, and scalable solution for bank reconciliation.

Why we recommend this solution: HashMicro excels in streamlining the bank reconciliation process, ensuring accurate financial records, and reducing manual errors. It offers automation tools for transaction matching, account balance tracking, and real-time financial reporting, making it ideal for businesses with diverse needs.

If you want to learn more about HashMicro’s advantages, you can use this leading vendor’s free demo and experience the benefits of an integrated and customizable ERP solution.

To explore the specific features of HashMicro’s Bank Reconciliation Software and how it can enhance your financial management, read on for a detailed overview below:

- Bank Integration – Auto Reconciliation: This feature ensures that your internal financial records are accurately aligned with the balances recorded by your bank. By automating the reconciliation process, you can confidently maintain up-to-date and precise financial statements.

- Bank Integration – Auto Payment: Implementing this feature guarantees that scheduled payments are executed on time, ensuring seamless and timely financial transactions. This helps prevent missed payments and enhances overall financial management.

- Multi-Level Analytical: Using this feature, you can gain real-time insights into financial trends across various categories such as projects or branches. It allows you to filter and compare financial statements, making it easier to analyze and manage your company’s finances.

- Profit & Loss vs Budget & Forecast: This feature provides reports that highlight deviations between forecasted profit and loss against the actual figures. It helps you understand where your financial performance aligns with or diverges from your budget, enabling better financial planning.

- Cash Flow Reports: This feature allows you to monitor the inflow and outflow of cash to ensure your company has adequate liquidity. It aids in making informed financial plans and identifying potential cash flow issues before they become critical.

- Forecast Budget: Implementing this feature allows you to predict future budgets based on historical data. It helps you plan finances, allocate resources efficiently, and make better strategic decisions. It ensures your business is prepared for future financial needs.

- Budget S Curve: This feature helps you visually track and understand the distribution of expenses in a project. It enables quicker and more accurate decision-making regarding budget management, ensuring your projects stay on track.

- Financial Statement with Budget Comparison: This feature compares actual financial performance with budgeted plans. It helps identify discrepancies and allows adjustments to stay on course with financial goals.

- Custom Printout for Invoices: Using this feature, you can easily print invoices that match your business identity in various formats or designs. It enhances the customer experience by providing professional and branded invoices that leave a positive impression.

In addition to having comprehensive features, HashMicro software is fully customizable to meet the specific needs of any business, offering unparalleled flexibility and efficiency. HashMicro’s reliability makes it a top choice for companies looking to optimize their operations.

| Pros | Cons |

|

|

After learning about the advantages of HashMicro’s features and other aspects that may be suitable for your business, consider the software’s pricing to find the right solution for managing your business finances in the Philippines. Click the banner below to get started.

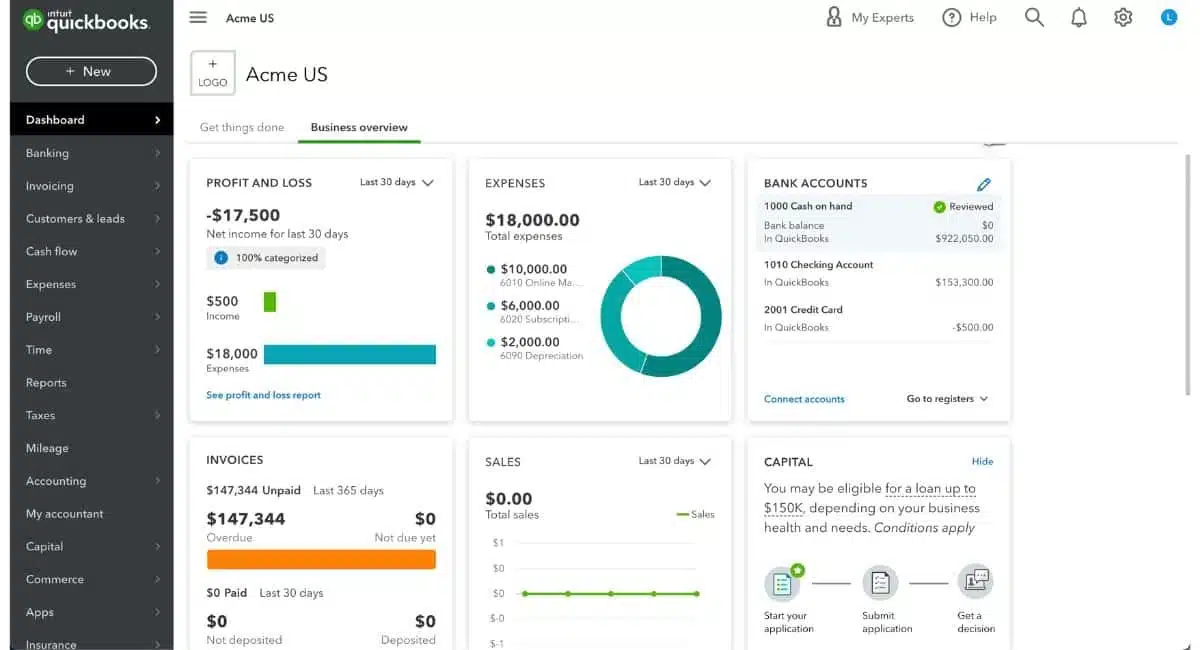

2. QuickBooks Bank Reconciliation Software

QuickBooks bank reconciliation software is a popular accounting software by Intuit that includes bank reconciliation features designed for small- to medium-sized businesses. It simplifies the process of matching transactions and helps ensure that financial records are accurate and current.

Automated bank reconciliation software by QuickBooks offers the following features:

- Income and expenses

- Invoice and payments

- Tax deductions

- Powerful reports

- Receipt capture

- Workflow automation

Why we chose this software: QuickBooks is a go-to choice for small businesses in the Philippines due to its ease of use and affordable pricing. It offers essential bank reconciliation features that cater to businesses with straightforward financial needs.

| Pros | Cons |

|

|

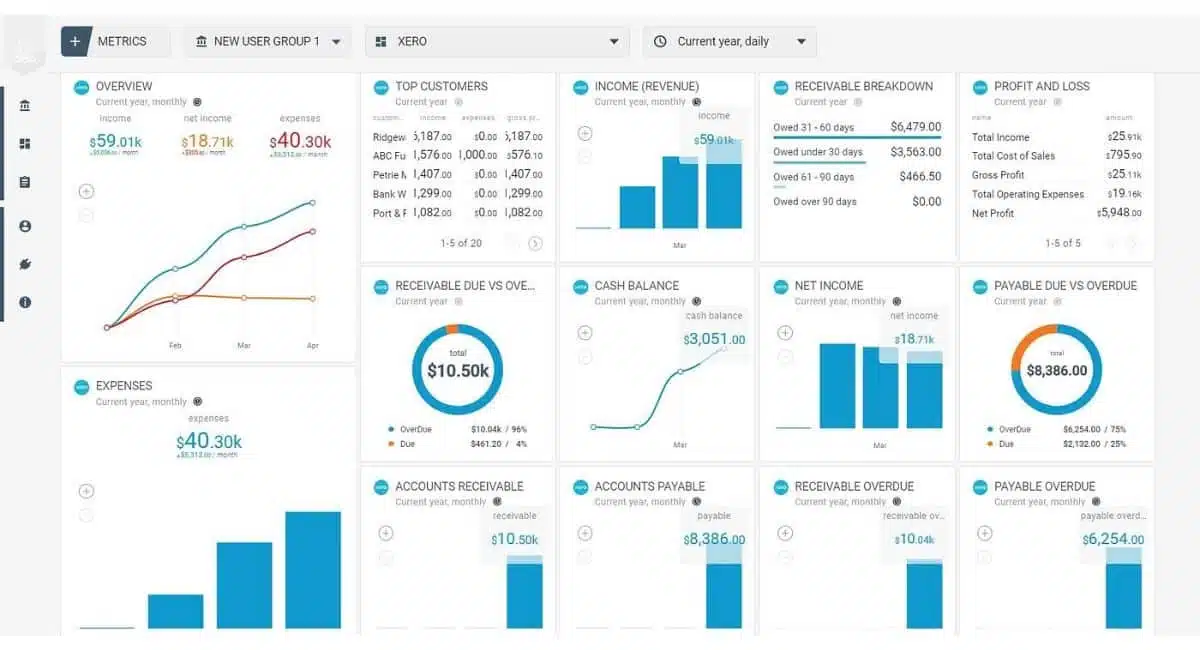

3. Accounting Software Xero

Xero is a cloud-based accounting software known for its user-friendly interface and robust bank reconciliation tools. It allows businesses to easily match bank transactions with their accounting records, ensuring accurate and efficient financial management.

Software tools for bank reconciliation by Xero provide the following features:

- Automated reconciliation process for faster and more accurate reconciliations

- Real-time financial statement analysis for better decision-making

- Integration with other third-party applications and online services

- Robust security for safeguarding data

- Automatic bank feeds

Why we chose this software: Xero is selected for its cloud-based accessibility and seamless integration capabilities, making it an excellent option for businesses in the Philippines that require flexibility and collaboration in their financial management.

| Pros | Cons |

|

|

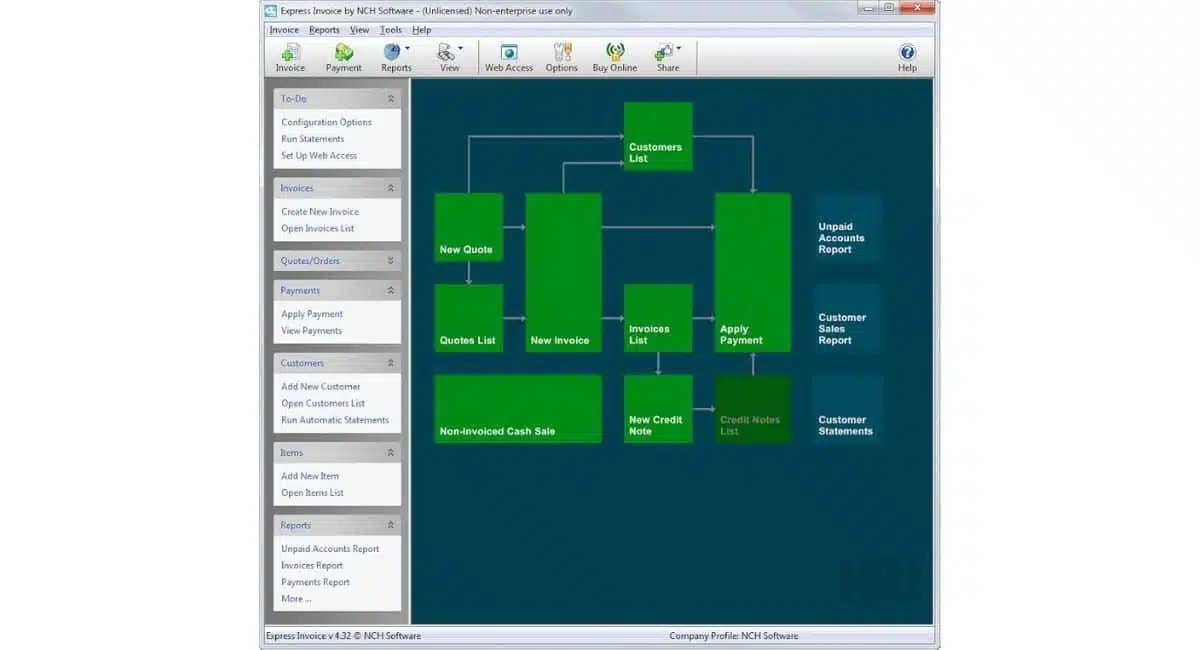

4. NCH Express Accounts

NCH Express Accounts is versatile accounting software ideal for small businesses. It offers basic bank reconciliation features to help users quickly reconcile their bank accounts and maintain accurate financial records with minimal effort.

NCH Express Accounts the comprehensive software tools for bank reconciliation with features such as:

- Manual import

- Immediate correction

- Balance recalculation

Why we choose this software: NCH Express Accounts is perfect for small businesses or startups in the Philippines that need a straightforward, no-frills bank reconciliation tool without the overhead of more complex software.

| Pros | Cons |

|

|

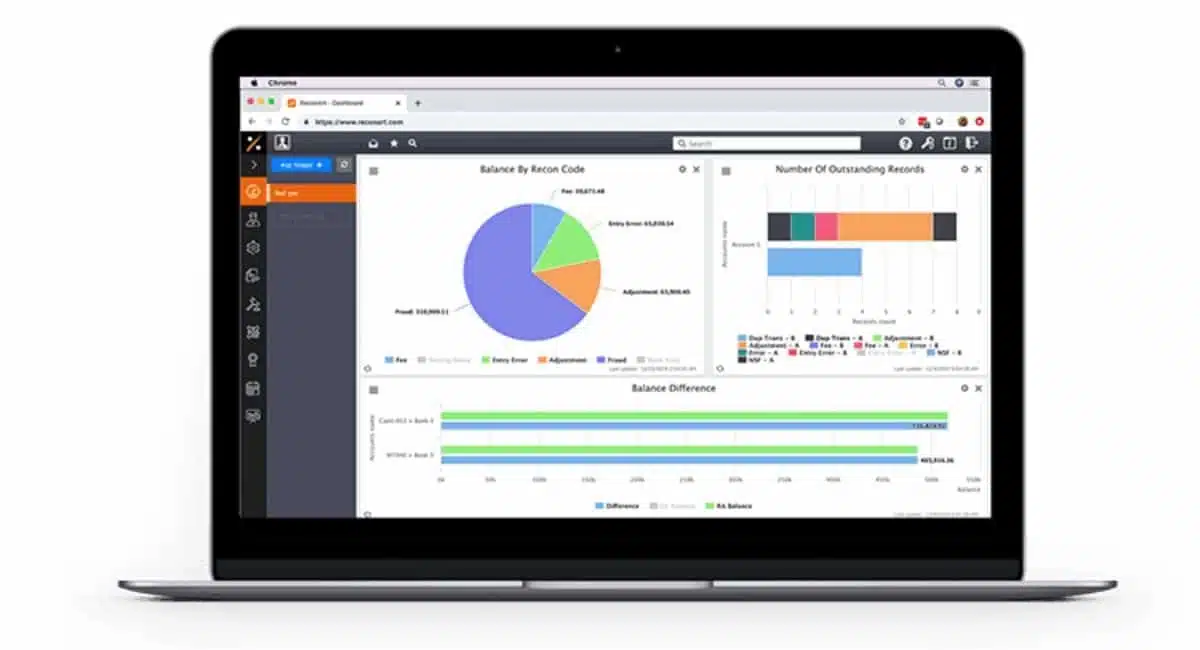

5. ReconArt Online Bank Reconciliation Software

ReconArt specializes in providing automated reconciliation software solutions for businesses of all sizes. Their highly customizable platform makes it ideal for complex reconciliation needs across various financial accounts.

Online bank reconciliation software by ReconArt has the features such as:

- Advanced automation of reconciliation processes.

- Configurable matching rules for complex transactions.

- Comprehensive audit trails and reporting.

- Integration with multiple financial systems.

Why we chose this solution: ReconArt is selected for its advanced automation and customization capabilities, which make it ideal for large companies in the Philippines with complex reconciliation needs and high transaction volumes.

| Pros | Cons |

|

|

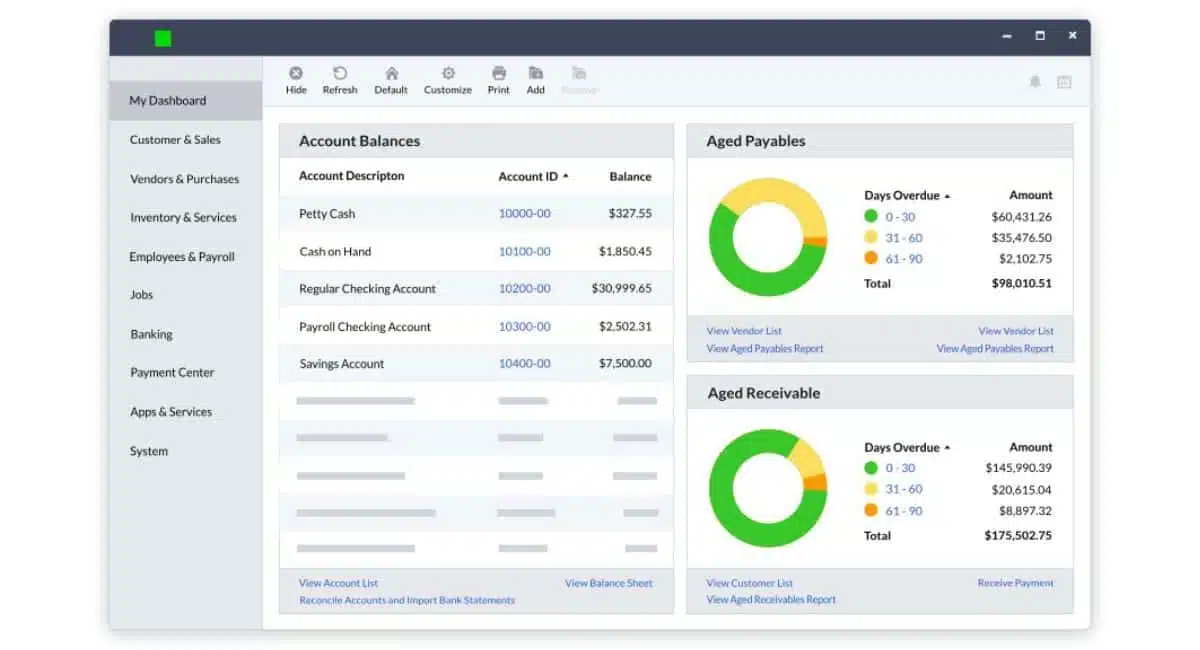

6. Sage 50 Automated Reconciliation Software

Sage 50 automated reconciliation software is comprehensive accounting software that includes powerful software tools for bank reconciliation features. It is designed for small—to medium-sized businesses, helping them streamline financial processes and maintain accurate records.

Below are the features provided by Sage accounting software:

- Automated account reconciliations

- Customizable workflows

- Robust reporting capabilities

- 24/7 customer support

- Security features

Why we choose this system: Sage 50 Accounting is chosen for its robust features tailored for medium-sized businesses in the Philippines that need a comprehensive financial management solution with solid reconciliation capabilities.

| Pros | Cons |

|

|

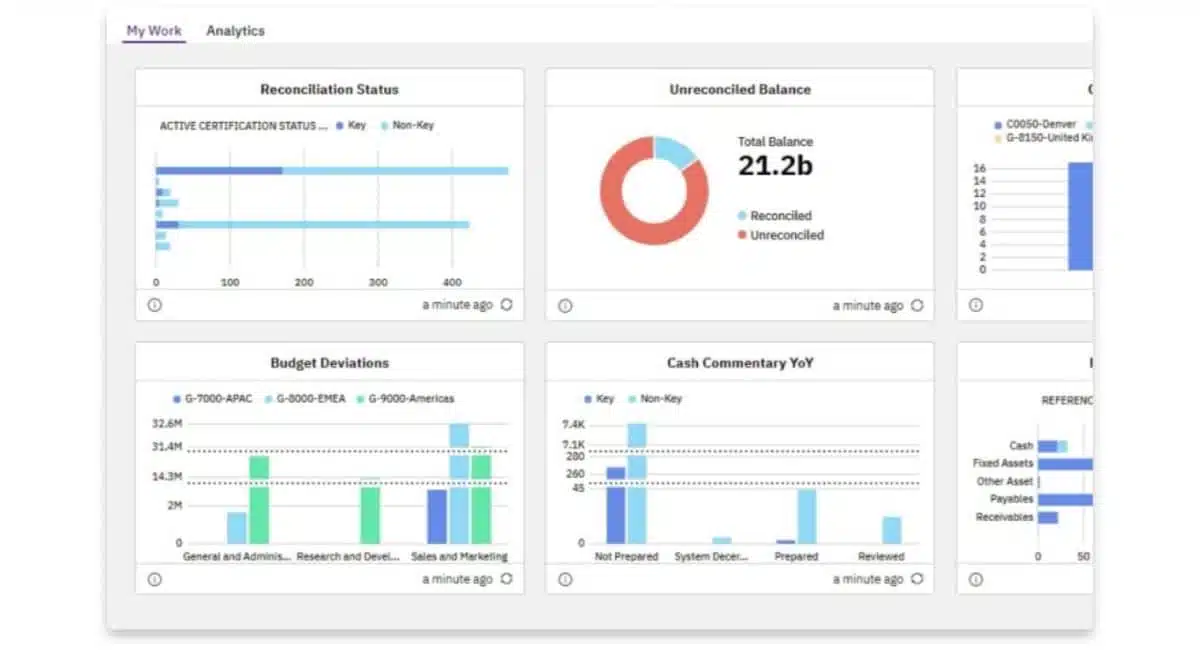

7. BlackLine

BlackLine offers advanced financial automation solutions, including automated bank reconciliation software tailored for large enterprises. The software enhances the accuracy of financial data by automating complex reconciliation tasks and improving compliance.

Bookkeeping software provided by BlackLine offers the following features:

- Comprehensive financial close management, including bank reconciliation.

- Automated workflow and task management.

- Real-time monitoring and exception reporting.

- Integration with major ERP systems like SAP accounting system and Oracle.

Why we chose this software: BlackLine is selected for its enterprise-level features, which cater to large companies in the Philippines that require comprehensive financial management and reconciliation tools to ensure compliance and accuracy.

| Pros | Cons |

|

|

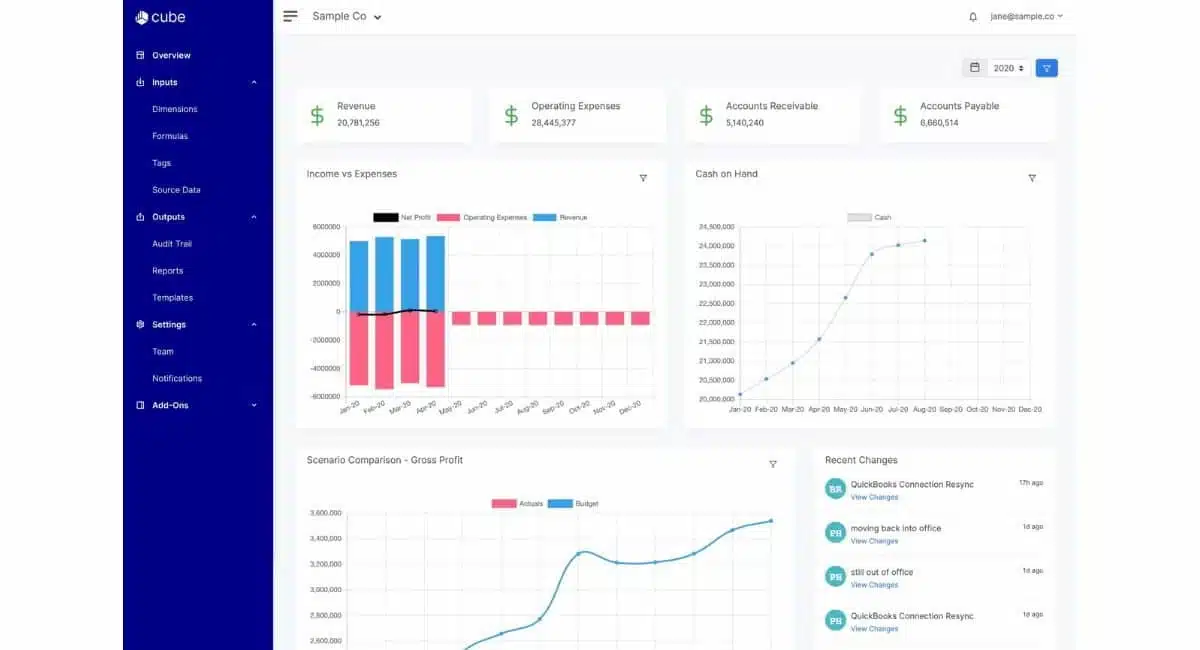

8. Cube Accounting Software

Cube is financial planning and analysis software that also includes bank reconciliation features. It is particularly useful for midsize businesses. It integrates seamlessly with existing economic systems, enabling efficient reconciliation and real-time financial insights.

The following are the features offered by Cube online bank reconciliation software:

- Data consolidation

- Spreadsheet-driven

- Audit trail

- Data management

- Report distribution

Why we chose this solution: Cube software tools for bank account reconciliation is selected for its strong financial planning and analysis capabilities, making it an excellent choice for midsize businesses in the Philippines looking to integrate bank reconciliation with broader financial management.

| Pros | Cons |

|

|

Example of Bank Reconciliation Statement

A bank reconciliation statement is a document that compares the balance in a company’s accounting records with the corresponding amount in its bank account. This statement helps identify any discrepancies caused by transactions that the bank or the company has not yet recorded.

Typically, the reconciliation process starts by noting the ending balance on the bank statement and adjusting it for outstanding checks, deposits in transit, and any bank errors. Next, the company’s book balance is adjusted for items such as bank fees, interest income, and any errors found in the company’s records.

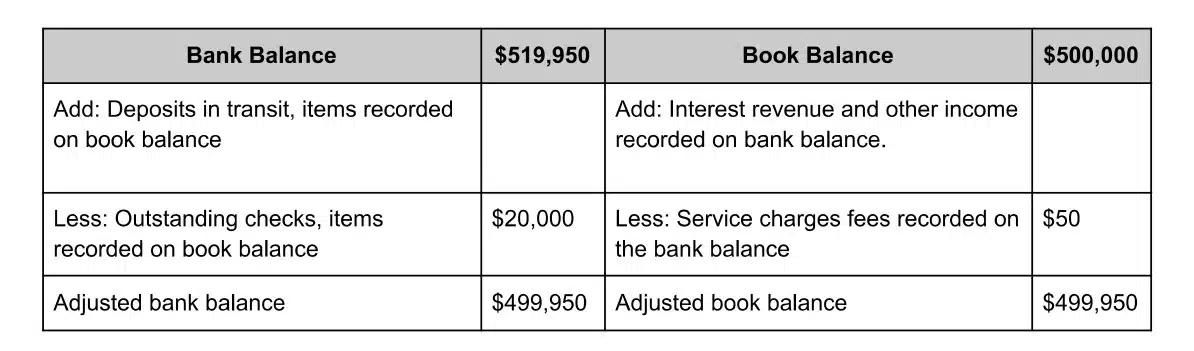

For example, consider the following table:

In this example, the bank balance starts at $519,950, while the book balance begins at $500,000. Adjustments are made by adding deposits in transit to the bank balance and interest revenue to the book balance.

Next, outstanding checks are subtracted from the bank balance, and service charges are deducted from the book balance. After these adjustments, both balances match at $499,950, confirming the reconciliation is accurate.

This process ensures accurate financial records by matching the adjusted bank balance with the adjusted book balance, highlighting discrepancies. A well-prepared bank reconciliation statement is vital for promptly addressing any issues.

Key Considerations for Selecting the Ideal Bank Reconciliation Software

Selecting the right automated bank reconciliation software ensures accurate financial management and smooth business operations. With various options available, evaluating key factors that will best suit your company’s needs is essential.

Below are the most important considerations to keep in mind when choosing the ideal software for your business:

Features: Ensure the software offers essential features like automated transaction matching, real-time reporting, and error detection.

- Pricing: Choose software that fits your budget while providing your business with the necessary features and value.

- Ease of use: Opt for user-friendly software that simplifies the reconciliation process without requiring extensive training.

- Scalability: Select software that can grow with your business, accommodating increased transaction volumes and complexity.

- Integration capabilities: Ensure the software integrates smoothly with your existing accounting systems and other financial tools.

- Customization options: Look for software that can tailor features and workflows to meet your business needs.

- Customer support: Choose a provider that offers reliable and accessible customer support to assist you with any issues or questions.

Conclusion

Implementing bank reconciliation software is crucial for maintaining accurate financial management within your company. It helps streamline the reconciliation process, reducing the risk of errors and ensuring that your financial records are always up-to-date.

HashMicro’s comprehensive Accounting Software is one of the best solutions for addressing bank reconciliation challenges. Designed to simplify complex financial processes, it ensures that your company’s bank statements and accounting records are always in sync.

HashMicro offers significant advantages, including seamless integration with various software platforms, customizable features to meet specific business needs, and a simple and intuitive user interface. These strengths make it a versatile and reliable choice for businesses of any size.

Don’t miss the opportunity to experience the benefits of HashMicro firsthand—try their free demo today and discover how it can transform your financial management.

FAQ about Enterprise Accounting Software

-

-

-

-

What is the main purpose of an account reconciliation?

The primary purpose of account reconciliation is to ensure that the financial records of a company accurately reflect its financial transactions by comparing internal records with external statements, such as bank statements.

This process helps identify discrepancies, errors, or fraudulent activities, ensuring the integrity of financial reporting. Regular account reconciliation is essential for maintaining accurate financial records and preventing potential financial issues.

-

What is bank reconciliation in bookkeeping?

Bank reconciliation in bookkeeping is the process of comparing a company’s internal financial records with its bank statement to ensure that both records match. This process helps identify any discrepancies, such as outstanding checks or deposits in transit and ensures that the company’s financial records are accurate.

-

What are the three methods of a bank reconciliation?

The three methods of bank reconciliation include:

1. Adjusted balance method: Adjust both the bank and book balances for outstanding items to ensure they match.

2. Bank statement method: Reconcile the bank statement directly with the book balance by checking off matching transactions.

3. Book balance method: Adjust the book balance to match the bank statement by accounting for outstanding checks, deposits, and other items. -

What are the 7 steps of bank reconciliation?

The seven steps of bank reconciliation typically include the following:

1. Compare opening balances: Start by comparing the opening balance of the bank statement with the company’s financial records.

2. Verify deposits in transit: Identify and verify any deposits that are in transit but not yet reflected in the bank statement.

3. Check outstanding checks: List and verify all outstanding checks that have not yet cleared the bank.

4. Adjust for bank fees and interest: Account for any bank fees, charges, or interest that are recorded on the bank statement but still need to be added to the company’s records.

5. Reconcile errors: Identify and correct any errors in both the bank statement and the company’s financial records.

6. Compare ending balances: Ensure the adjusted bank balance matches the adjusted book balance at the end of the reconciliation process.

7. Document the reconciliation: Record the reconciliation details to maintain an accurate audit trail and for future reference. -

What is the difference between bank reconciliation and account reconciliation?

Bank reconciliation focuses explicitly on comparing a company’s internal records with its bank statement to ensure that all transactions are accurately recorded. Account reconciliation, on the other hand, involves verifying the accuracy of all financial accounts, including bank accounts, receivables, payables, and other ledgers.

While bank reconciliation is a subset of account reconciliation, the latter encompasses a broader range of financial accounts within a company’s overall financial management.

-

Which software is used for bank reconciliation?

Many companies use specialized bank reconciliation software to simplify and automate the reconciliation process. Popular options include HashMicro’s Accounting Software, which offers automated reconciliation features. These tools help businesses match transactions quickly, detect discrepancies, and generate reconciliation reports.

-

-

-