Are you still managing your financial reports manually with paper or spreadsheets? This method takes a lot of time and effort, diba? It can also lead to mistakes and missed details, which might cause financial loss.

Based on 6Wresearch, the Philippines Accounting Software Market is projected to grow at a CAGR of 6.4% during the forecast period of 2024-2030. Therefore, it is time to switch to modern accounting software that saves you a lot of hassle.

In this article, we’ll explore the advantages and benefits of accounting software for Philippine businesses, exploring how these tools can simplify financial processes, enhance efficiency, and drive business growth.

Table of Contents

10 Key Benefits of Accounting Software

Utilizing accounting software offers numerous benefits for Philippine businesses. By leveraging accounting automation, companies can streamline their financial management processes, reducing manual errors, saving valuable time, and driving growth.

Below are the 10 essential benefits of accounting software for businesses.

1. Improved accounting and bookkeeping accuracy

Accounting software minimizes the risk of human error in manual bookkeeping processes by automating data entry and calculations. Built-in validation checks also help identify discrepancies and inconsistencies.

This accuracy helps meet regulatory standards and boosts stakeholder and investor trust in the company’s financial reporting. It also cuts down the time spent fixing errors, freeing up employees to focus on tasks that add value, reduce accounting problems, and contribute to the business’s success.

2. Reduce costs and save money

By automating tasks like invoicing, payroll, and expense tracking, businesses can cut down on manual work and labor costs. This also gets rid of paper records, saving money on printing, storage, and document management.

Moreover, a computerized accounting system helps businesses maximize their profitability and gain a competitive edge in the Philippine market by optimizing resource utilization and minimizing overhead costs.

3. Saves time with automation

Accounting software automates tasks, allowing businesses to save time to be redirected toward more strategic activities. By automating data entry, reconciliation, and report generation processes, this software reduces the manual effort required for routine tasks.

This increased efficiency enables employees to focus on more important activities such as financial analysis, strategic planning, and business development, ultimately driving productivity and innovation within the company.

4. Simplified bank reconciliation

Accounting software makes bank reconciliation easy by automatically importing bank feeds and matching transactions. This eliminates the need for manual matching, saves time, and reduces errors.

Software features like bank rule creation, transaction categorization, and reconciliation reports give businesses a clear view of their finances, making bank reconciliation quicker and more accurate.

5. Enhanced accounting security and privacy

With the importance of data security and privacy, accounting software offers enhanced features like user authentication, data encryption, role-based access controls, and audit trails to protect sensitive financial information.

Accounting software uses strong security measures to prevent unauthorized access, fraud, and data breaches, keeping financial data safe. This builds trust among stakeholders and customers, enhancing the business’s reputation and credibility in the Philippine market.

6. Easy access to accounting data

Accounting software enables businesses to access financial data securely from anywhere with an internet connection, facilitating remote work and team collaboration.

Whether working from home, travelling, or attending meetings off-site, employees can access real-time financial information and perform accounting tasks using web-based or mobile applications.

This flexibility enhances productivity and responsiveness, allowing businesses to adapt to changing business conditions and market dynamics more effectively.

7. Tax compliance

Accounting software helps businesses comply with local tax regulations by automating tax calculations, generating accurate reports, and ensuring timely filings. With built-in tax codes and updates, it ensures businesses follow tax laws, reducing the risk of penalties.

Additionally, this software may provide features such as tax filing reminders, electronic submission capabilities, and integration with government tax portals, simplifying the tax compliance process for businesses in the Philippines.

8. Improved financial decision-making

Accounting software helps businesses make informed financial decisions by providing real-time data and analysis tools. It allows for customized reports, trend analysis, and scenario planning to assess the impact of various strategies on financial performance.

This enables businesses to identify opportunities for cost savings, revenue growth, and operational efficiency, guiding strategic decision-making and driving sustainable business growth in the Philippine market.

9. Enhanced customer relationships

Accounting software streamlines invoicing and payments, making customer transactions faster and more efficient. It sends professional invoices, tracks payments, and offers online payment options, enhancing the customer experience and strengthening client relationships.

Additionally, this software may provide features such as customer portals, account statements, and automated communication tools, fostering transparency and communication between businesses and their customers in the Philippine market.

10. Real-time financial insights

Accounting software consolidates financial information from various sources into a centralized platform, giving businesses up-to-date visibility into their financial performance, cash flow, and key performance indicators.

This real-time view helps businesses monitor trends, identify opportunities, and mitigate risks quickly while ensuring compliance with accounting principles. It also offers interactive dashboards, customizable reports, and predictive analytics for deeper financial analysis, empowering informed decisions.

With several benefits mentioned above, accounting software is proven as a crucial tool to maximize financial operation in a business. If you’re curious about the best retail accounting software in Philippines, you can download the price scheme of HashMicro accounting software below.

Selecting the Right Accounting Software for Your Business

Choosing the best accounting system for your business is a crucial decision that can significantly impact your financial management processes and overall business success. To ensure you select the best solution for your needs, consider the following tips:

- Assess your business needs: Identify the features and functionalities you need in accounting software to streamline financial processes and meet your business requirements.

- Consider integration capabilities: Choose software that seamlessly integrates with existing systems to streamline data exchange and workflow automation, maximizing efficiency and productivity.

- Evaluate ease of use and training needs: Select intuitive and user-friendly accounting software with comprehensive training and support resources to ensure a smooth transition and adoption process.

- Check compliance and security features: Ensure that the accounting software complies with regulatory standards and offers security features, such as user authentication, data encryption, and compliance with data protection regulations.

- Trial and test the software: Before making a final decision, take advantage of free trials or demos offered by accounting software vendors to test the software’s functionality and suitability for your business.

By following these tips and strategies, you can choose the best accounting software that aligns with your business needs, enhances your financial management processes, and contributes to your business’s overall success and growth.

Elevate Your Financial Management with HashMicro Accounting Software

Implementing accounting software is crucial for businesses looking to simplify financial processes. With accounting software, businesses can automate routine tasks such as invoicing, expense tracking, and financial reporting while reducing the risk of human error and ensuring compliance with regulatory standards.

Selecting the right accounting software is equally important, as it directly impacts the effectiveness of financial management processes. The urgency of selecting the right software lies in its ability to meet the business’s unique needs and requirements.

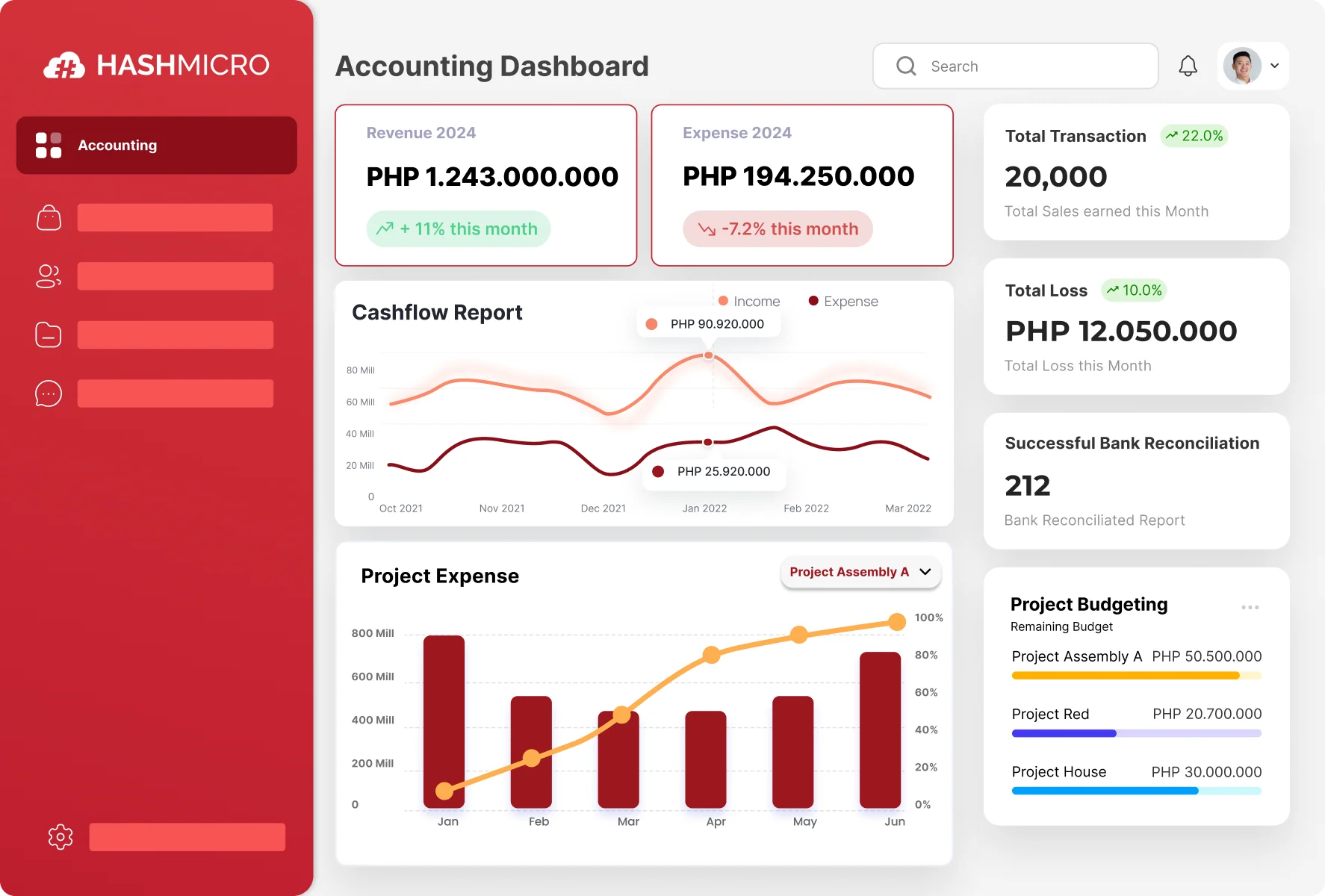

A comprehensive solution like HashMicro Accounting Software offers a standardized system designed to cover end-to-end financial processes. As a principal company known for its commitment to delivering high-quality solutions, HashMicro is trusted to empower over 1.750 clients from various industries.

Below are some of the comprehensive features that HashMicro offers:

- Budget forecast: Plan and forecast your budget effectively with HashMicro’s budgeting tool, allowing you to set financial goals, track expenses, and make informed decisions to achieve your business objectives.

- Budget S-curve: Visualize your budget allocation and expenditure over time with HashMicro’s S Curve feature, enabling you to monitor project progress and optimize resource allocation for maximum efficiency.

- Bank integrations and auto reconciliation: Seamlessly connect your bank account reconciliation software for automatic transaction import and reconciliation, reducing manual data entry and ensuring accuracy in financial records.

- Custom printout for invoices: Customize and personalize your invoices with HashMicro’s custom printout feature, allowing you to tailor invoices to your brand identity and include relevant details for professional communication with clients

- Financial ratio analysis: This tool gives insights into your financial health and performance, which calculates key financial ratios such as liquidity, profitability, and solvency to assess your business’s financial stability and growth potential.

Additionally, HashMicro AI accounting Software is designed to cover end-to-end financial processes, providing businesses with a standardized system covering all financial management aspects. It also integrates with other systems to ensure smooth data exchange and workflow automation across departments.

Therefore, selecting HashMicro software ensures effective financial management and provides businesses with the tools needed to thrive in today’s competitive market.

Conclusion

Implementing accounting software is vital for Philippine businesses looking to simplify their financial management processes, enhance accuracy, and drive sustainable growth. The benefits of implementing accounting software are undeniable, from improved accuracy and efficiency to real-time financial insights and compliance with regulatory standards.

For businesses that need a comprehensive solution that covers all aspects of financial management, HashMicro Accounting Software stands out as a reliable and efficient choice.

With advanced features such as bank integrations, budget forecasting, financial ratio analysis, and custom invoice printouts, HashMicro empowers businesses to optimize their financial operations and achieve their goals confidently.

Experience the transformative power of HashMicro Accounting Software and unlock the potential of streamlined financial management to propel your business towards success. Try the free demo now!