The BIR EIS is a major change in the dynamics of business accounting operations in the Philippines in 2025. Bakit nangyayari ito? The passage of Republic Act No. 10963, or TRAIN Law, significantly impacted the implementation of tax compliance for businesses in the Philippines.

The TRAIN Law shifted from paper-based to electronic tax collection, accelerating the adoption of the Bureau of Internal Revenue EIS for business modernization. This aligns with the mandatory e-invoicing system (EIS) for the 100 largest taxpayers, introduced for government invoices (B2G) in July 2022.

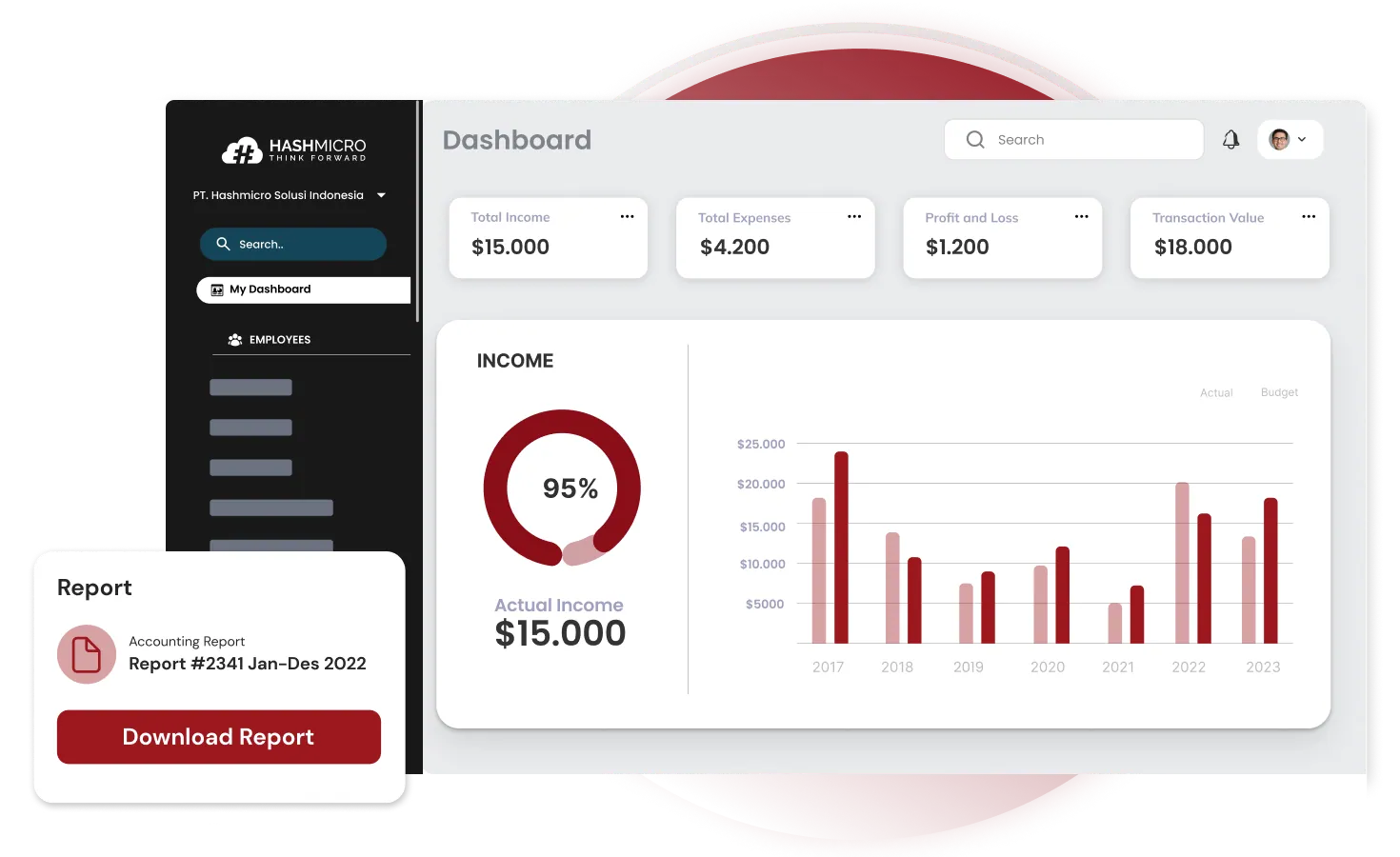

To help businesses stay ahead of evolving tax regulations, HashMicro’s E-Invoicing Software offers an automated, seamless solution that ensures compliance with the BIR EIS system. With real-time updates and secure integration, businesses can streamline tax filings and invoicing, ensuring both accuracy and efficiency.

Ano ang ibig sabihin ng BIR EIS, at paano ito naiiba sa BIR CAS? This article will explain everything for you. Read on to learn about the BIR EIS system, compliant with Philippine government regulations and approved by thousands of Southeast Asian businesses.

Key Takeaways

|

Table of Contents

What is BIR EIS?

BIR EIS (Bureau of Internal Revenue Electronic Invoicing System) is a government-mandated system in the Philippines that automates creating and submitting e-invoices and receipts. It ensures businesses comply with tax regulations by digitizing financial transactions and reducing manual paperwork.

The system enhances tax reporting by improving accuracy, transparency, and efficiency in managing invoicing and tax documentation. Electronic invoicing system BIR supports the transmission of official receipts, sales invoices, credit and debit notes, and other similar accounting documents, ensuring seamless tax compliance for businesses.

This digital approach is particularly beneficial for companies handling high-volume transactions or those subject to strict tax requirements. By adopting BIR EIS, businesses can streamline financial processes, minimize errors, and maintain compliance with evolving tax regulations in the Philippines.

Hashy AI Fact

Need to know!

Hashy AI from HashMicro enhances your invoicing process, accelerates payment cycles, and optimizes cash flow, making it easy to save time and boost your productivity!

Get a Free Demo Now!

Benefits of Using BIR EIS Through Software

Integrating BIR EIS with accredited e-invoicing software offers multiple benefits for businesses in the Philippines. These systems can directly connect with government platforms, ensuring seamless compliance with electronic invoicing and tax reporting requirements.

The EIS BIR is responsible for implementing projects under the Tax Ordinance and aims to reduce VAT fraud and provide business advantages. One of its key objectives is to optimize the settlement process with tax authorities, ensuring businesses achieve greater efficiency and compliance.

Below are some of the benefits of using EIS BIR through software:

- Automated tax compliance: Accredited software integrates with BIR EIS, automatically generating and submitting e-invoices to government sites, reducing manual efforts.

- Enhanced accuracy: Eliminates human invoicing and tax documentation errors, ensuring precise financial reporting and regulatory compliance.

- Operational efficiency: Speeds up invoice processing, submission, and tracking, allowing businesses to focus on core operations rather than manual tax filing.

- Greater transparency: This improves record-keeping by ensuring that all transactions, including official receipts, sales invoices, and credit or debit notes, are traceable and securely stored.

- Cost-effectiveness: Reduces administrative costs by eliminating paper-based invoicing, cutting down on manual processing time, and simplifying tax compliance.

What are the BIR EIS Compliance Requirements?

Following the BIR EIS (Electronic Invoicing System) compliance requirements is important in helping businesses transition smoothly. The system requires businesses to meet specific technical and procedural standards, including:

- Electronic Invoices and Receipts: Businesses must create invoices and receipts in electronic format, specifically using JSON (JavaScript Object Notation). This lightweight format ensures a consistent way of transmitting and processing data.

- Submitting to the BIR: All electronic invoices and receipts must be sent to the BIR. This is done by submitting invoice data through the EIS using a web service or an API (Application Programming Interface), ensuring a secure and direct data transfer to the BIR.

- Data Security and Storage: Businesses must protect the integrity and safety of their electronic data. As the BIR guidelines outline, they must implement strong data protection measures and securely store their records for the required period.

Following these requirements shows a business’s commitment to using modern practices and technology. By meeting these standards, businesses can enjoy benefits like more accurate data, quicker processing, and better security for financial transactions.

The Differences Between BIR CAS vs BIR EIS

Before comparing BIR CAS (Computerized Accounting System) and EIS (Electronic Invoicing System), it’s essential to understand their distinct roles. While both systems enhance financial management, they serve different purposes. Here’s a simplified comparison to help you determine which best suits your business needs.

| Aspect | BIR CAS | BIR EIS |

| Main function | Manages complete accounting processes digitally | Automates issuance and reporting of an e-invoice for tax purposes |

| Scope | Covers all financial operations and accounting | Focuses specifically on tax-related electronic invoicing |

| Purpose | Streamlines overall accounting management | Ensures tax compliance with government regulations |

| Compliance | Follows general accounting standards | Mandated for businesses meeting specific tax criteria |

| Primary focus | Financial records, revenue, and expenses | Tax invoices and compliance reporting |

If you’re considering an accounting software, calculating the software pricing can help you make an informed decision. To discover how much you need to invest, explore the billing software pricing schemes below and choose the one that best fits your business needs.

Why is the BIR Electronic Invoicing System Important?

The BIR invoice is essential for businesses in the Philippines to comply with tax regulations. Here are the main reasons why BIR EIS is necessary:

- Prevents fraud: Reduces opportunities for tax evasion and fraudulent invoicing practices.

- Enhances trade competitiveness: Helps businesses adapt to global standards, improving competitiveness in international markets.

- Encourages digital transformation: Drives businesses toward more efficient, tech-driven operations, promoting overall innovation.

- Simplifies cross-border transactions: Businesses can manage international transactions more easily by using standardized e-invoices, which can only be generated with BIR-accredited POS.

- Improves cash flow management: With faster invoice processing, businesses can manage cash flow more effectively.

- Reduces administrative burden: Minimizes the need for manual handling of invoices, allowing staff to focus on core business activities.

Also read: A Guide Inventory List BIR Submission in Philippines 2025

How does E-Invoicing Work in the Phillippines

The Electronic Invoicing System BIR (EIS) in the Philippines is a tax reporting tool that sends invoice data to the Bureau of Internal Revenue (BIR) after it’s issued to clients. Developed with KOICA’s support, the system follows a “Continuous Transaction Control” model, similar to South Korea’s approach.

The BIR EIS applies to all sales invoices, receipts, debit/credit notes, BIR eSales, and related accounting documents. To ensure timely and standardized data exchange, these documents must be submitted to the BIR within three days via an API in JSON format.

Each invoice requires key details like document number, issue date, Unique Identification Number, and seller and buyer information. A JSON Web Signature (JWS) is applied to verify authenticity before the BIR validates each submission, either accepting or rejecting it.

How to Achieve EIS Compliance?

To comply with the BIR EIS, businesses must follow a series of steps in an organized manner. Here’s an overview of the process:

Registration and System Setup

- Register on the BIR EIS portal.

- Set up the necessary software and systems to handle electronic invoicing and receipts.

- Make sure the company’s systems meet the BIR’s technical requirements.

Integration and Testing

- Integrate the EIS with your current accounting or ERP systems.

- Test everything thoroughly to ensure the systems work properly and meet BIR standards.

Training and Adaptation

- Train your staff on the new systems and procedures.

- Adjust internal processes to fit the new electronic invoicing and receipting methods.

Ongoing Compliance and Updates

- Stay updated on any changes in EIS requirements.

- Regularly review and update systems to stay compliant.

Each step is important for a smooth transition to the EIS. Businesses should approach this process carefully, anticipating any challenges and planning ahead. Getting expert help, especially for system integration and data security, is also a good idea to ensure all compliance requirements are fully met.

E-Invoicing Implementation Timeline

The journey toward mandatory e-invoicing is rolling out in phases to ensure smooth adoption. Since July 2022, e-invoicing has been required for government transactions (B2G), making it easier to process invoices between businesses and government entities.

In 2023, the focus shifted to large taxpayers and exporters, mandating e-invoicing for B2B transactions to improve efficiency and compliance in corporate dealings.

By the second half of 2024, all taxpayers will need to report their e-invoices through a governmental portal, marking the final step in fully digitizing the invoicing process and enhancing transparency for businesses across all sectors

Tips for Choosing BIR Electronic Invoice System for Bussiness

Choosing software that complies with BIR EIS standards is essential for businesses in the Philippines to meet regulatory requirements and optimize tax reporting. The right solution not only ensures compliance but also simplifies invoicing, improves accuracy, and reduces manual tasks, allowing businesses to focus on growth.

Here are some key factors to consider when selecting e-invoicing BIR-compliant software:

- BIR Compliance: Ensure the software adheres to the Philippines’ BIR electronic invoicing standards, including VAT invoice requirements.

- System Integration: Opt for software that integrates seamlessly with your existing systems.

- User-Friendly Design: Choose a platform with an intuitive interface to minimize training time.

- Scalability: Look for a solution that can grow with your business needs.

- Reliable Support: Ensure the vendor provides responsive customer support for troubleshooting.

- Security Features: Prioritize software with robust data protection and encryption capabilities

- Transparent Pricing: Select a vendor offering clear pricing without hidden costs.

- Vendor Reputation: Research vendors with a proven track record of reliability and compliance.

- Customization: Look for software that can be tailored to meet your unique business needs.

- Advanced Reporting: Choose a system that offers detailed analytics and reporting tools.

By considering these factors, businesses can confidently select the best BIR-compliant software to streamline operations, maintain compliance, and drive growth.

Implement Your BIR EIS with Ease Using HashMicro’s Billing Software

Business people, alam mo ba na billing software ay lubos na inirerekomenda upang suportahan ang digitization ng BIR EIS? Therefore, let’s get acquainted with HashMicro, the best accounting software in the Philippines.

Business people, alam mo ba na billing software ay lubos na inirerekomenda upang suportahan ang digitization ng BIR EIS? Therefore, let’s get acquainted with HashMicro, the best accounting software in the Philippines.

HashMicro’s accounting software provides an ideal solution for billing invoices for BIR EIS compliance. With over 1,750 clients across Southeast Asia, it has extensive customization options, free demos, user-friendly UI, and no extra costs for adding users.

Some of HasMicro’s accounting software features are like:

- Tax & discount management: With HashMicro’s e-Invoicing Software, you can automatically calculate taxes and discounts for specific invoices.

- Online payment management: Allow customers to make payments through an online payment gateway. Send receipts through the same portal.

- Invoice generation: Create invoices with personalized templates for different clients. Print them in PDF or send them directly via email.

- Credit limit management: Our system makes it easier for you to set different credit limits for each client based on the price of your product/service.

- Invoice approval & validation: The system allows you to process approvals and validate each invoice with a special price or discount.

- Real-time invoice reporting: Our robust e-Invoicing System lets you figure out the age of your invoices & quickly find unpaid invoices to determine your total income.

Conclusion

In conclusion, BIR EIS is crucial for businesses in the Philippines to ensure efficient tax compliance through automated invoicing and reporting. Having the best invoicing software in the Philippines, such as HashMicro’s accounting software, makes this process smoother and more accurate.

To make sure your business stays compliant while optimizing financial operations, try HashMicro’s accounting software today. Sign up for a free demo to experience its user-friendly interface, extensive customization, and added value without extra user costs.

FAQ About BIR EIS

-

Does BIR accept an e-invoice?

BIR accept e-invoices. All electronic receipts submitted to the BIR must be in JavaScript Object Notation (JSON) format. Businesses can upload their e-invoices through the Electronic Sales Reporting System (eSRS) portal. This web-based platform allows for the secure transmission of e-invoice data directly to the BIR.

-

Who is required to use EIS?

The Philippines is advancing the implementation of its new e-invoicing system (EIS). As of July 1, 2022, electronic invoicing has been required for the 100 largest taxpayers in the nation.

-

What is the BIR regulation about invoicing requirements?

The invoice must include the necessary details of both the seller and the buyer. It should also provide transaction specifics, such as the quantity, unit cost, description or nature of the service, and the applicable VAT rate/amount or exemption, in accordance with Section 6(B) of RR 7-2024.

-

What is the penalty for no official receipt of BIR?

The BIR imposes a penalty ranging from PHP 1,000 to PHP 50,000 and imprisonment for two to four years, as specified under Section 264(a) of the Tax Code.

-

How does BIR detect tax evasion?

The BIR can review essential documents, like articles of incorporation and annual financial statements, which are key to investigating or auditing corporate tax fraud.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [{

“@type”: “Question”,

“name”: “Does BIR accept an e-invoice?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “BIR accept e-invoices. All electronic receipts submitted to the BIR must be in JavaScript Object Notation (JSON) format. Businesses can upload their e-invoices through the Electronic Sales Reporting System (eSRS) portal. This web-based platform allows for the secure transmission of e-invoice data directly to the BIR.”

}

},{

“@type”: “Question”,

“name”: “What is the penalty for no official receipt of BIR?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The BIR imposes a penalty ranging from PHP 1,000 to PHP 50,000, along with imprisonment for a period of two to four years, as specified under Section 264(a) of the Tax Code.”

}

},{

“@type”: “Question”,

“name”: “How does BIR detect tax evasion?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The BIR can review essential documents, like articles of incorporation and annual financial statements, which are key to investigating or auditing corporate tax fraud.”

}

}]

}