Managing business expenses is essential, yet many companies in the Philippines still rely on outdated methods like spreadsheets and paper receipts. These inefficiencies lead to errors, wasted time, and financial mismanagement.

The smarter solution? HashMicro’s Business Expense Software. It automates tracking, provides real-time financial insights, and uses AI-powered analytics to optimize spending and improve cash flow.

With so many options available, choosing the right software can be overwhelming. That’s why we’ve curated a list of the 15 best expense tracking software for 2026 to help you find the perfect fit. Let’s explore!

Key Takeaways

|

Table of Contents

Best Expense Tracking Software at a Glance

- HashMicro: Best for businesses seeking an all-in-one solution with customizable automation, real-time insights, and seamless integration across departments.

- Zoho: Best for teams needing a user-friendly platform with strong accounting integrations and multi-currency support.

- Rydoo: Best for centralized receipt management and mobile-friendly expense approvals.

- Emburse Certify: Best for organizations prioritizing intelligent automation, OCR-powered data extraction, and policy enforcement.

- FreshBooks: Best for freelancers and small businesses focused on invoicing, payment integration, and basic expense tracking.

- Expensify: Best for mobile receipt scanning, approval workflows, and advanced automation.

- QuickBooks Online: Best for SMEs looking for a robust accounting platform with financial reporting and banking integration.

What is an Expense Tracking Software?

Expense tracking software is a digital tool designed to help businesses manage, monitor, and record their expenses efficiently. It automates tracking of various business expenditures, such as travel, meals, office supplies, and utility bills.

This accounting software can also automatically categorize expenses and generate detailed financial reports. Its integration with accounting software further streamlines financial management, reducing manual data entry and enhancing the accuracy of financial statements.

Need to know!

AI-powered expense tracking software simplifies financial management by automating expense categorization and report generation. With Hashy AI from HashMicro, businesses can track expenses more accurately and efficiently.

Get a Free Demo Now!

The Importance of Expense Tracking Software

Expense tracking software is vital for financial management in companies of all sizes. Its importance lies in the following key benefits:

- Enhanced accuracy: The expense tracking software minimizes errors and ensures reliable data by automating expense tracking. This reduces manual data entry and mistakes caused by human error.

- Time and cost savings: Expense tracking software streamlines processes, reducing administrative tasks and freeing employees to focus on more productive work. It also reduces the costs associated with paper-based systems.

- Real-time visibility: Businesses gain real-time insights into spending, allowing proactive decision-making, better budgeting, and improved financial control.

- Data analysis and reporting: With built-in data analysis tools, businesses can generate custom expense reports and streamline the reconciliation and forecasting processes, effectively addressing companies’ common accounting problem.

What to Look for in Expense Tracking Software

When searching for the right expense tracking software, consider these key factors to ensure it aligns with your organization’s needs:

- Mobile access: In today’s mobile-centric world, it’s crucial to have software accessible on smartphones or tablets. Look for a solution that offers a mobile app or a responsive web interface to capture and submit expenses on the go.

- Receipt uploads: Choose expense tracker software that allows for the upload and storage of digital receipts. This feature enhances accuracy and simplifies record-keeping by reducing reliance on paper receipts.

- Auto-categorization: Opt for software that automatically categorizes expenses using AI or machine learning algorithms. Auto-categorization saves time, ensures consistency, and improves reporting accuracy.

- Automated reports: The software should allow easy report generation with customizable templates and real-time data synchronization. This feature reduces manual efforts and provides timely insights into expenses.

15 Best Expense Tracking Software

Here’s a list of the top expense tracker software to suit a wide range of businesses, from startups to large enterprises:

1. HashMicro

Why we choose: HashMicro business expense tracker software offers powerful automation and mobile access to streamline expense management. It simplifies data entry, receipt scanning, and categorization, helping reduce errors and save time. With a user-friendly interface, employees can manage expenses efficiently from anywhere.

Business people, HashMicro also integrates with other accounting software to ensure smooth and accurate data flow. Its best expense tracker software offers a free demo that is recommended by 1750+ businesses in Southeast Asia.

Key features:

- Cash flow reports: Monitor the company’s cash inflows and outflows to ensure sufficient liquidity, make appropriate financial plans, and identify and address potential financial issues.

- Multi-level analytical: You can see the trend or insight of all financial transactions in real-time, and they can be filtered based on various categories (project, branch, etc.).

- Profit & loss: A report comparing gains and losses’ value with the original budget and previous estimates.

- Financial ratio: Provides the top accounting solutions that automatically calculates various critical financial ratios such as liquidity ratios, profitability ratios, debt ratios, etc.

| Pros | Cons |

| Free to add users without additional cost | The system implementation time may vary according to your desire for customization. |

| User-friendly interface | |

| Strong integration with ERP systems | |

| Secure and reliable data handling | |

| Customizable workflows tailored to industries | |

| Strong customer support |

2. Zoho Expense

Key features:

- User-friendly interface

- Receipt uploads

- Expense approvals

- Multi-currency support

- Integration with accounting software

| Pros | Cons |

| User-friendly and clean interface | Limited offline access |

| Offers multi-currency support | It can be overwhelming for first-time users due to the numerous features |

| Integration with popular accounting software | Some advanced features are locked behind premium plans |

| Streamlines receipt uploads | Support response can be slow during peak times |

3. Rydoo

Why we choose: Rydoo offers digital receipt uploads, automatic categorization, and a unified space for expense tracking. Its user-friendly interface and seamless integration with other systems make it a strong fit for modern businesses.

Key features:

- Receipt management

- Expense approvals

- Mileage tracking

- Policy enforcement

- Integration with accounting software

| Pros | Cons |

| Centralized receipt management | UI might feel cluttered for some users |

| Easy-to-use mobile application | Requires internet for most functionalities |

| Simplifies approval workflows | Pricing plans may not suit smaller businesses |

| Supports multiple languages | Limited customization of expense categories |

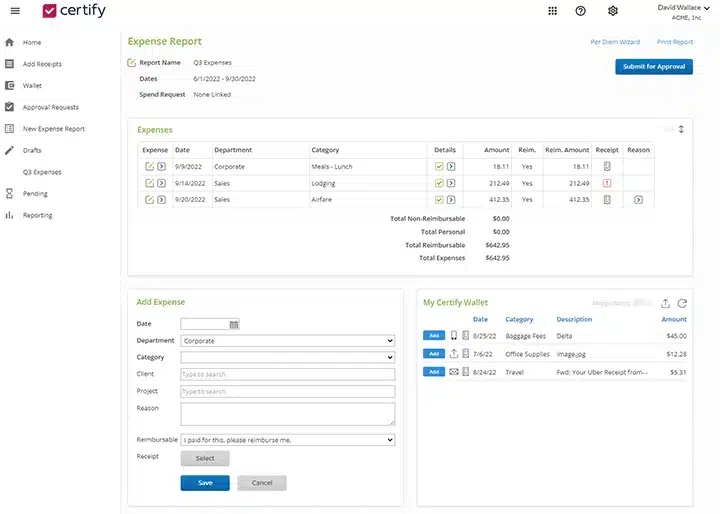

4. Emburse Certify

Key features:

- Automated data extraction (OCR)

- Multi-level approvals

- Receipt uploads

- Expense policy enforcement

- Report generation

| Pros | Cons |

| Automated data extraction from receipts | It can be complex to set up for new users |

| Intuitive interface for expense tracking | Higher-end plans can be expensive |

| Supports multi-level approvals | Limited offline capabilities |

| Real-time policy enforcement | Occasional delays in system updates |

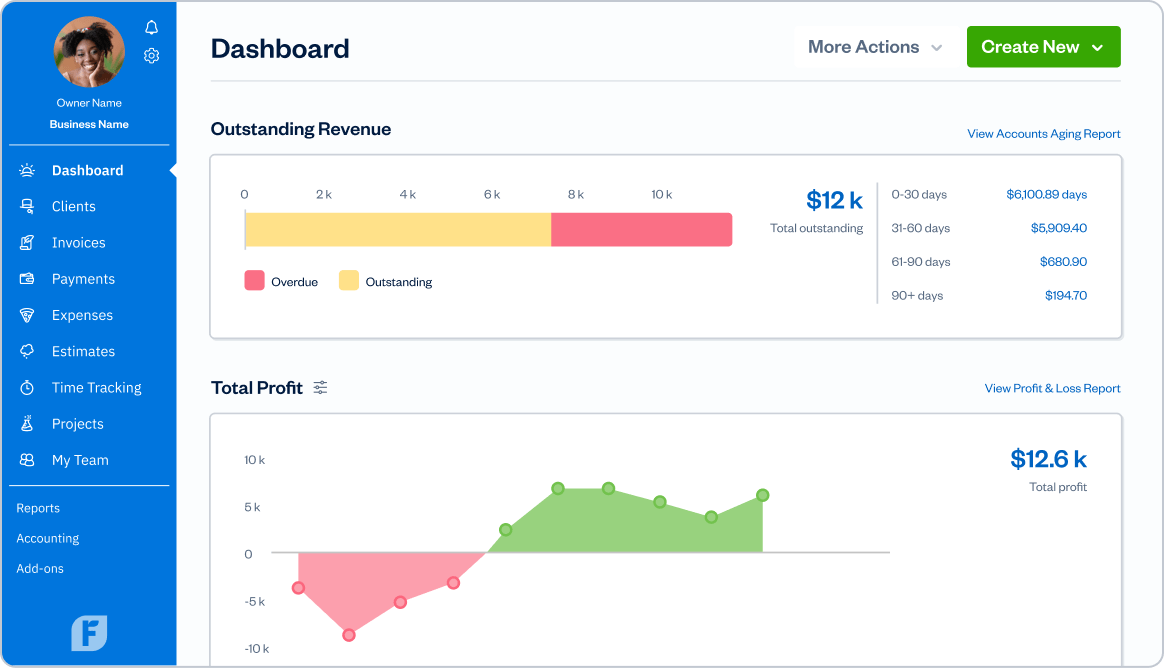

5. FreshBooks

Key features:

- Customizable invoices

- Time tracking

- Expense categorization

- Mobile access

- Online payment gateways

| Pros | Cons |

| Simple invoicing system | It does not support complex expense categorization |

| Easy integration with payment gateways | Lacks advanced reporting features in basic plans |

| Mobile app for expense tracking | It can get costly as the business scales |

| Cloud-based for accessibility | Limited customization in invoice templates |

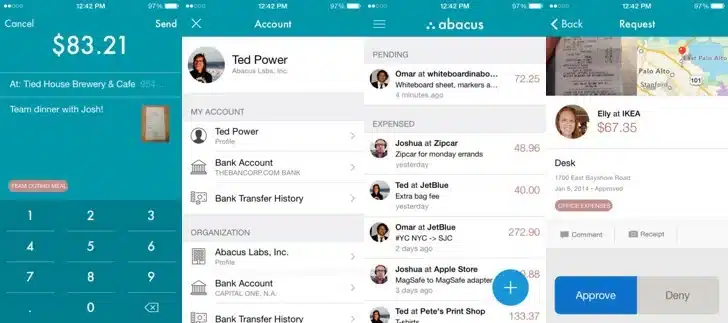

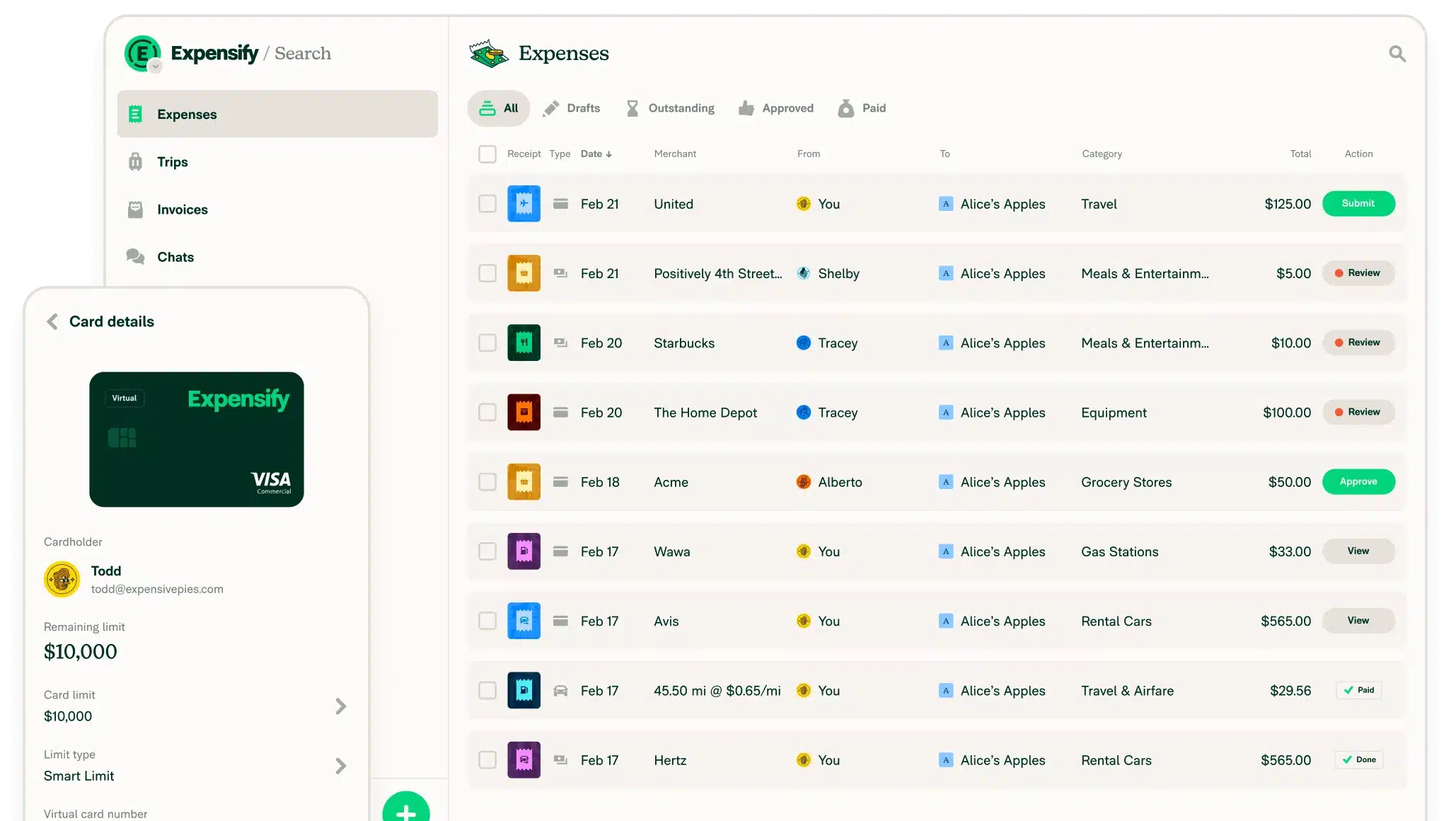

6. Expensify

Key features:

- Automatic data extraction (OCR)

- SmartScan receipts

- Expense categorization

- Approval workflows

- Integration with accounting systems

| Pros | Cons |

| Automated expense reporting with OCR | The high learning curve for advanced features |

| Mobile app for receipt scanning | Premium features can be pricey |

| Supports multi-currency transactions | Customer support can be slow at times |

| Real-time policy violation alerts | Limited offline functionality |

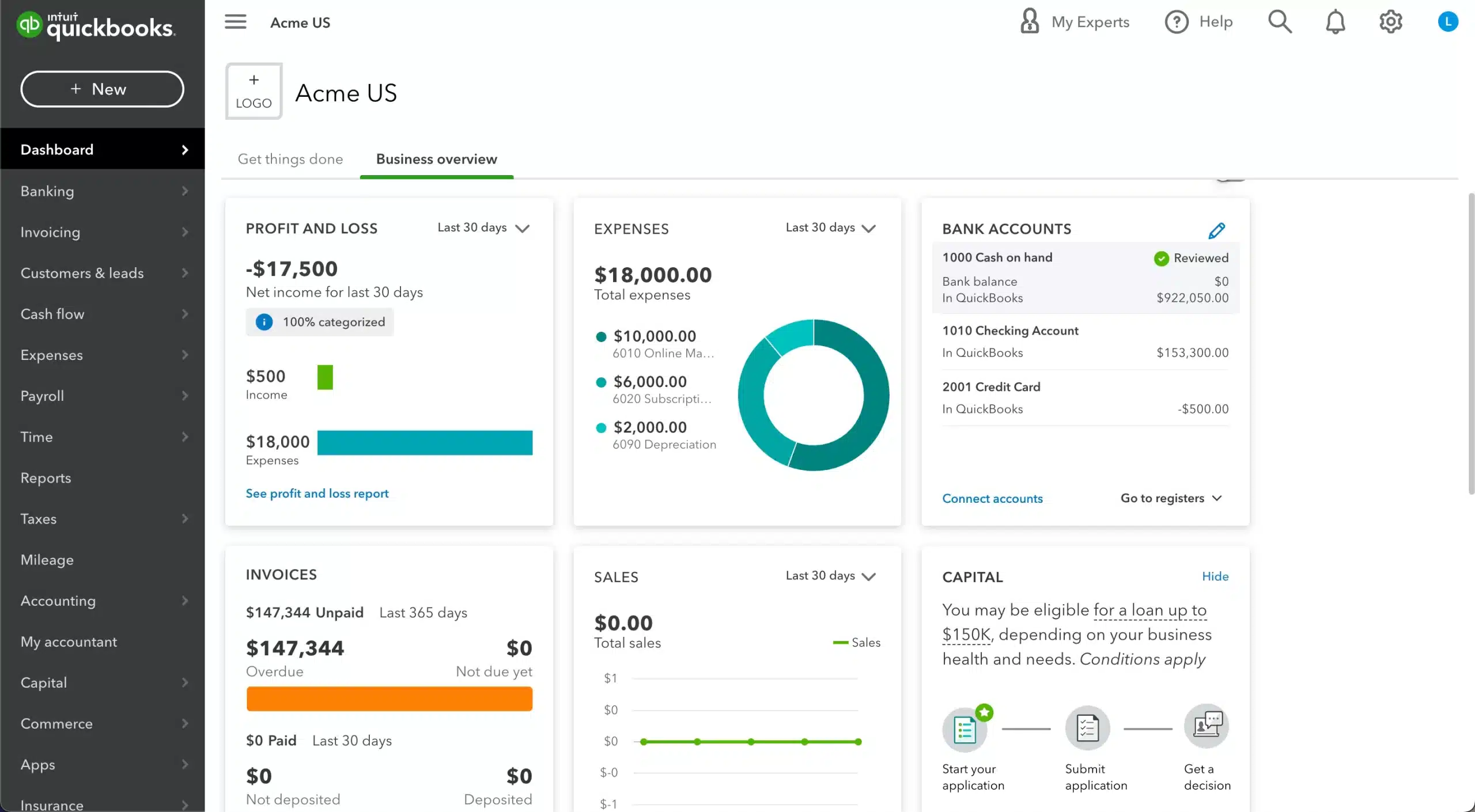

7. QuickBooks Online

Key features:

- Automated expense import

- Custom invoicing

- Receipt capture

- Bank reconciliation

- Reporting tools

| Pros | Cons |

| Widely recognized accounting platform | The interface may feel outdated for some users |

| Comprehensive reporting tools | Some features are only available in premium tiers |

| Integrates with various financial accounts | Setup and configuration can be time-consuming |

| Invoicing with multiple payment options | Limited customer support for lower-tier plans |

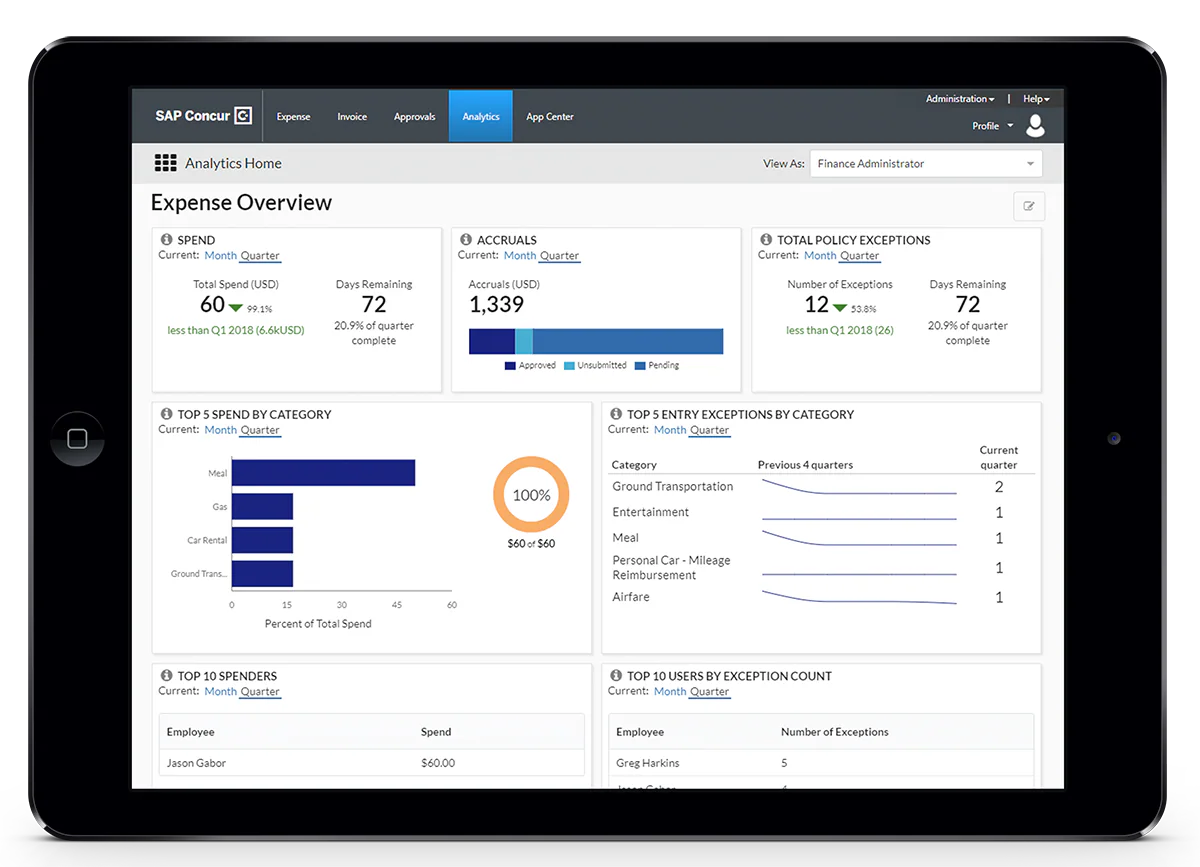

8. SAP Concur

Key features:

- Policy compliance

- Expense categorization

- Multi-platform access

- Expense report automation

- Integration with travel services

| Pros | Cons |

| Robust policy enforcement features | It can be expensive for smaller businesses |

| Comprehensive travel and expense management | Requires thorough training to use it effectively |

| Real-time tracking and reporting | Limited customization options in standard plans |

| Integrates with multiple financial systems | Complex user interface for beginners |

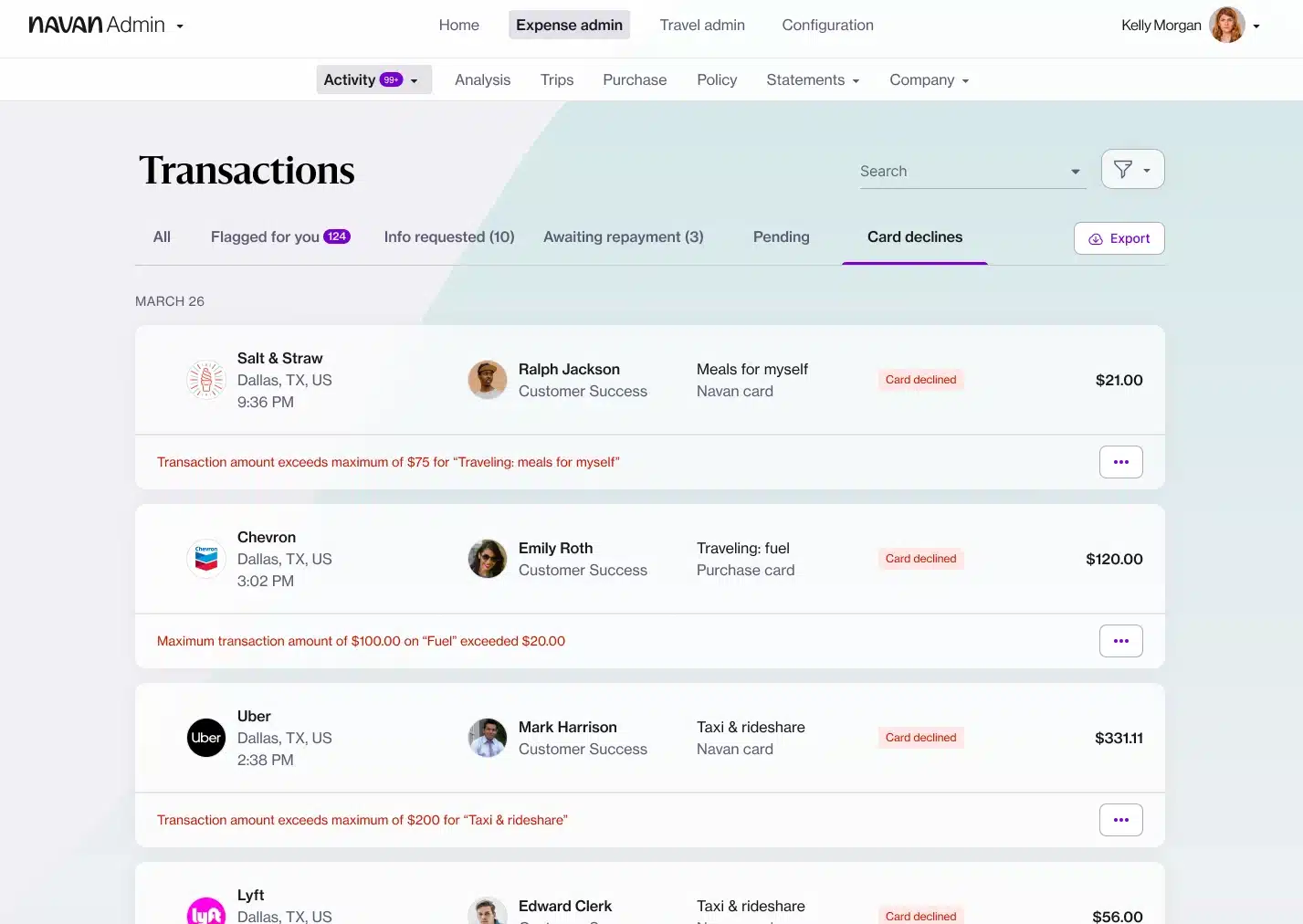

9. Navan Inc

Why we choose: Navan is ideal for businesses aiming to simplify travel management, reduce costs, and save time. As a combined expense and business tracker, Navan streamlines travel planning, consolidates receipts, and supports real-time monitoring across departments.

| Pros | Cons |

| Seamless integration with my companys booking policies. |

|

| Simple and easy-to-use mobile interface | Handling flight cancellations is sometimes challenging |

| Easy to navigate | Limited reporting customization |

| Ideal for freelancers and small businesses | Requires internet connection for real-time syncing |

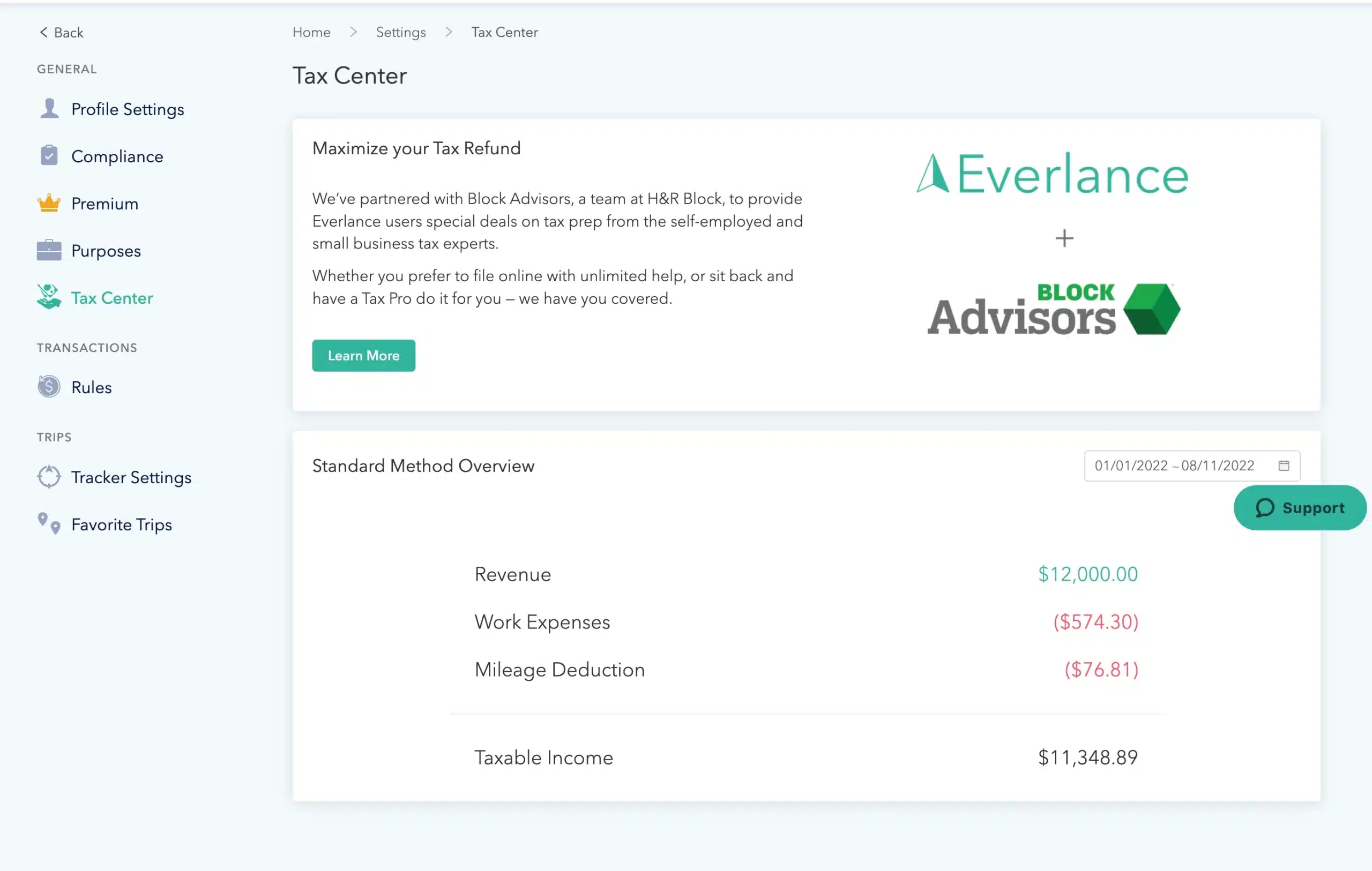

10. Everlance

Key features:

-

-

- Automatic mileage tracking

- Receipt uploads

- Expense categorization

- Report generation

- Web and mobile access

-

| Pros | Cons |

| Automatic mileage tracking | Limited features in the free version |

| Simple and easy-to-use mobile interface | Not designed for large enterprises |

| Customizable expense reports | Basic analytics compared to competitors |

| Ideal for freelancers and small businesses | Requires internet connection for real-time syncing |

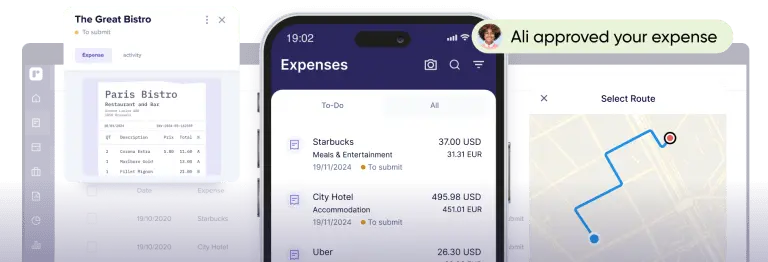

11. Rydoo

Why we choose: Rydoo is a business expense tracking software that helps streamline reporting, automate approvals, and ensure policy compliance across teams. Its customizable workflows and instant mobile access allow finance teams to manage spending efficiently while saving time on routine tasks.

| Pros | Cons |

| Ease of Use | Approval Issues |

| Easy Upload | Confusing Interface |

| Expense Tracking | Expense Management |

| Expense Management | Inefficient Submission Process |

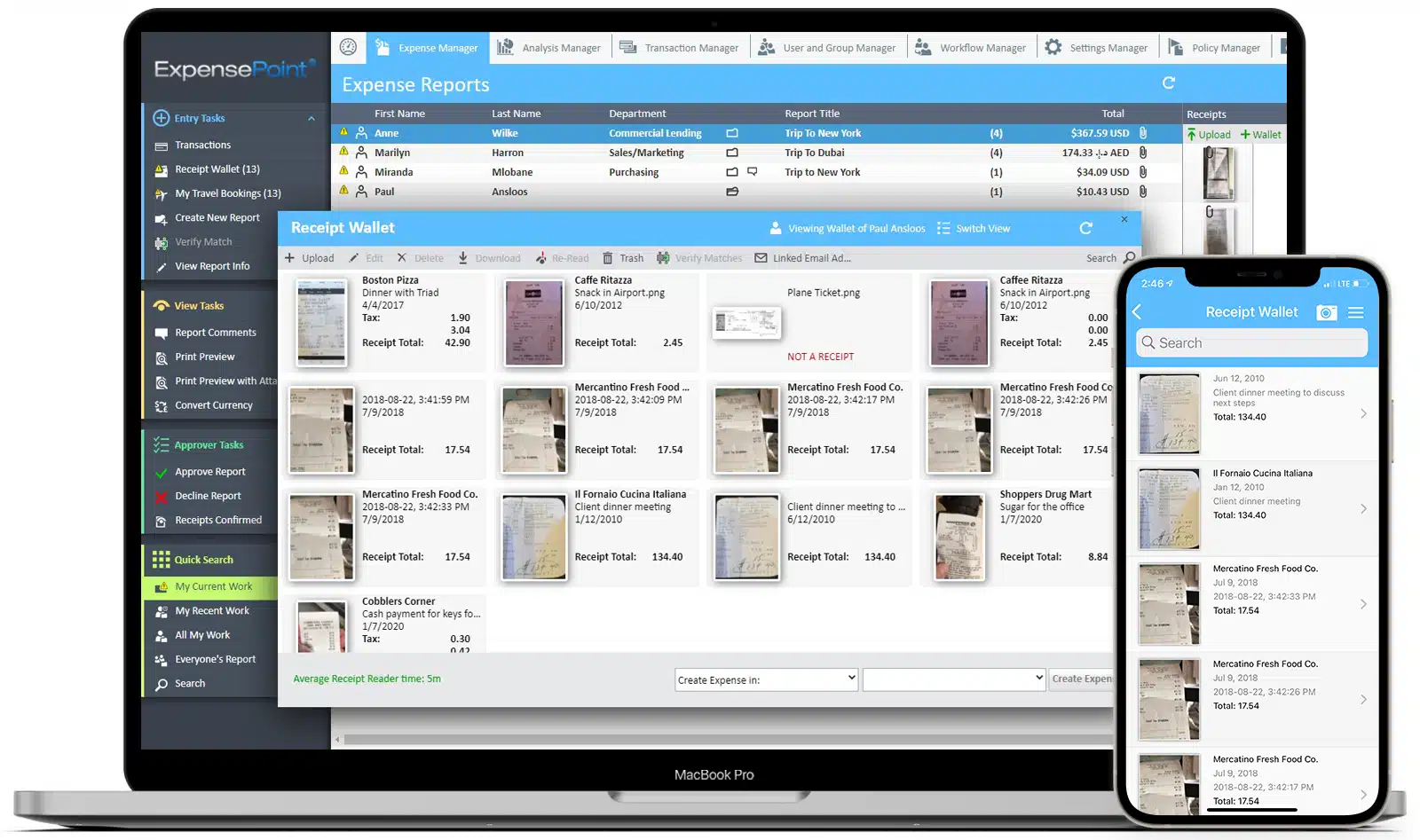

12. ExpensePoint

Why we choose: ExpensePoint stands out among business expense tracking apps by offering robust tools tailored for accountants and finance teams. It delivers precise policy management and advanced reporting features to support accuracy and compliance.

Key Features:

- Expense Reports

- Mobile

- Administration

- Platform

| Pros | Cons |

| Highly granular control over expense policies. | User interface is a bit confusing for day-to-day user. |

| Reporting is outstanding. | Insufficient explanations |

| Versatile and effortless to use. | Itemization categorizes expenses only |

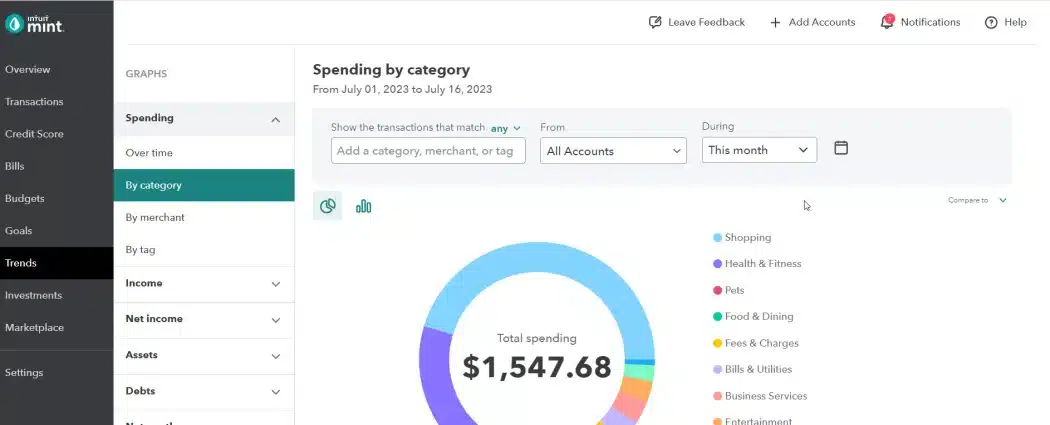

13. Mint

Key features:

- Automated transaction categorization

- Budgeting tools

- Goal setting

- Multi-account management

- Spending reports

| Pros | Cons |

| Free personal finance platform | No multi-user support for business teams |

| Automatic categorization of expenses | Lacks in-depth business analytics features |

| Visual representation of spending patterns | The ad-supported interface can be distracting |

| Budget tracking with goal-setting | Limited to personal finance rather than business use |

14. Abacus

Why we choose: Avolution’s ABACUS offers a comprehensive toolkit for enterprise architecture, IT management, and strategic planning. It supports data import, customizable models, and powerful analytics for planning and roadmapping. The platform also provides detailed visualizations and reporting features, making it suitable for complex business transformations.

| Pros | Cons |

| Flexibility | The studio tool is not easy to use |

| Flexible meta modelling | Manual visualizations is not a strength |

| Enterprise portal application | Limited export capability |

| Budget tracking with goal-setting |

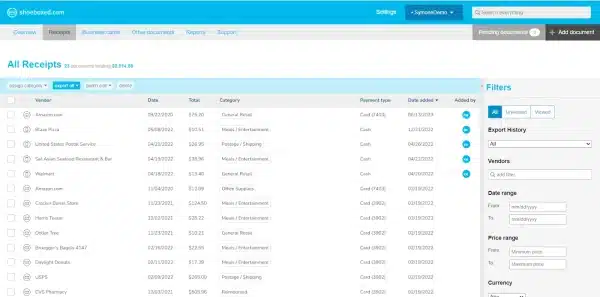

15. Shoeboxed

Why we choose: Shoeboxed is a digital receipt and expense tracking tool that helps users manage finances by uploading receipts, organizing expenses, and connecting with platforms like Evernote and QuickBooks. It digitizes financial documents, improving record-keeping and saving valuable time.

Key features:

- Receipt digitization

- Expense categorization

- Business card management

- Integration with productivity tools

- Online document storage

| Pros | Cons |

| Easy receipt digitization and storage | Limited expense categorization options |

| Integrates with tools like Evernote | Basic plan lacks some advanced features |

| Enhances productivity with organized receipts | Pricing may not suit smaller businesses |

| Simple user interface | Requires scanning for paper receipts manually |

How to Choose the Best Expense Tracking Software

When choosing the best expense tracker software in the Philippines, consider the following steps:

- Identify your business needs: Determine your business’s specific requirements, such as multi-currency support, receipt scanning, integration with accounting software, and budget management features.

- Ease of use: Select user-friendly software for all employees to ensure easy adoption and minimal training time. A simple interface can make tracking expenses less daunting.

- Integration capabilities: To streamline your expense management process, choose an accounting or ERP system that integrates seamlessly with business budgeting software.

- Compliance and local regulations: To simplify compliance, choose the best expense tracker software that adheres to Philippine financial rules and tax laws.

- Cost and scalability: Consider your budget and the software’s pricing plans. Look for options that can scale with your business as it grows.

Conclusion

Best business expense-tracking software is crucial for organizations to maintain financial control, improve accuracy, and enhance overall efficiency. The 15 options listed here provide a range of features to meet different business needs.

HashMicro stands out with its user-friendly interface, robust tracking capabilities, mobile access, and automated report generation, making it a top choice for Filipino businesses. Try a free demo today to see how HashMicro can optimize your expense management.

FAQs on Expense Tracking Software

-

Are expense tracking apps safe?

Since budgeting apps often contain sensitive financial information, hackers frequently target them. However, there are steps you can take to secure your data and use these apps without worry. Explore the best budgeting apps for 2026 to track your finances while keeping them safe and efficient.

-

What is the best software for keeping track of expenses

The best software for keeping track of expenses depends on your business needs. Some of the top options include: HashMicro, Zoho Expense, Rydoo

-

What is the best app to keep track of your daily expenses?

If you are looking for an app to track your daily expenses, the following are highly recommended: HashMicro, Zoho, Expensify

-

What business expenses should I track?

You should track all expenses directly related to your business operations. Common categories include office supplies, travel expenses, utilities, marketing, employee salaries, and equipment purchases. Using business expense tracking software or business expense tracking apps can simplify this process, ensuring accuracy and helping with financial planning and tax deductions.