Imagine this: You’re pouring resources into capital expenditures like new equipment, technology, or even a new facility—yet somehow, tracking where every peso goes feels like a full-time job. Ay, nakakastress! With so many details, losing sight of spending and going over budget is easy.

When your capital expenditures aren’t properly monitored, they can quickly drain cash flow, impacting your company’s growth. And with high initial costs, any misstep in managing CapEx could mean setbacks in other areas of your business.

Huwag ka mag-alala! There are ways to solve this problem and make CapEx management much simpler. This article will walk you through effective strategies for keeping your capital expenditures on track and within budget.

Key Takeaways

|

Table of Contents

What is Capital Expenditure?

Capital expenditure, or CapEx, is money a business uses to buy or upgrade long-term assets that support its operations, such as land, machinery, or technology. For example, purchasing a new factory or upgrading an existing facility’s equipment are CapEx activities.

These investments are recorded on the balance sheet under assets rather than as direct expenses on the income statement because they bring future value to the business.

CapEx reflects a company’s investment in existing and new fixed assets to maintain or grow its business. Capitalizing an asset allows the company to allocate its cost over the asset’s useful life.

Industries with high capital expenditure needs include oil exploration, telecommunications, manufacturing, and utilities, as they are some of the most capital-intensive sectors.

As of 2024, Maynilad Water Services Inc. has the highest reported capital expenditure in the Philippines, planning to allocate P31 billion for various water and wastewater projects this year. This represents a 19.23% increase from their P26 billion allocation in the previous year and marks their highest annual capex to date

Types of Capital Expenditure

Capital expenditures typically come in two forms:

- Maintenance CapEx: Spending to sustain the company’s current operational levels.

- Growth CapEx: Spending aimed at driving future growth.

It’s worth noting that costs related to regular repairs or routine maintenance on assets don’t qualify as capital expenditures and are instead recorded as expenses on the income statement.

Other than that, these types of assets can also qualify as capital expenditure, such as:

- Buildings can serve multiple purposes, such as office spaces, manufacturing sites, or inventory storage.

- Land might be purchased for future development, although accounting treatment may vary if the land is held as a speculative long-term investment.

- Equipment and machinery are used to create goods or transform raw materials into finished products.

- Computers and servers support essential business functions like logistics, reporting, and communication; software may also qualify as CapEx under certain conditions.

- Office furniture makes workspace functional for employees, clients, and customers. Vehicles may transport goods and clients or be used by staff for business activities.

- Patents provide long-term value if the rights lead to successful product development.

Importance of Capital Expenditures

Decisions regarding capital expenditures are often critical for an organization due to the following reasons:

- Long-term impact: Capital expenditure decisions affect the company’s future operations. Current production capabilities often stem from past investments, and today’s CapEx choices will shape the company’s future direction. Strategic goals and budgets must be clearly defined before authorizing these investments.

- Irreversibility: Capital expenditures are typically hard to reverse without financial loss, as capital equipment is usually customized to a company’s needs, and there is limited demand in the resale market.

- High initial costs: Capital investments, particularly in industries like manufacturing, telecommunications, utilities, and oil, require significant upfront spending. Assets such as buildings, equipment, or land may offer long-term benefits but demand substantial initial funding.

- Depreciation: Capital expenditures initially increase a company’s asset accounts. However, as these assets are used, they depreciate, gradually reducing in value over their lifespan.

How to Calculate Capital Expenditure

To calculate capital expenditures, follow these steps:

- Find depreciation and amortization on the income statement.

- Locate the current period property, plant, and equipment (PP&E) on the balance sheet.

- Locate the previous period’s PP&E on the same balance sheet.

- Apply the formula below to determine CapEx:

CapEx = PP&E (current period) – PP&E (prior period) + Depreciation (current period)

This formula works because the current period’s PP&E equals the prior period’s PP&E plus any new capital expenditures minus depreciation.

Note: This formula provides a “net” capital expenditure figure, so any PP&E disposals during the period will reduce the calculated CapEx amount.

Calculating capital expenditure sounds like a tough job, right? Especially if your company has a lot of components. Therefore, you might need an automated tool that eases your burdens–one of which is an accounting system. Try the no-cost, no-credit card software demo to see how it calculates capital expenditures–and other financial calculations–easily!

Formula and Calculation of Capital Expenditure

To calculate capital expenditures (CapEx), use the following formula:

CapEx = ΔPP&E + Current Depreciation

where:

- CapEx = Capital expenditures

- ΔPP&E = Change in property, plant, and equipment (PP&E)

Capital expenditures are also crucial in calculating Free Cash Flow to Equity (FCFE), which represents the cash available to equity shareholders. The FCFE formula is:

FCFE = EP − (CE − D) × (1 − DR) − ΔC × (1 − DR)

where:

- FCFE = Free cash flow to equity

- EP = Earnings per share

- CE = CapEx

- D = Depreciation

- DR = Debt ratio

- ΔC = Change in net working capital

This formula can also be expressed as:

FCFE = NI − NCE − ΔC + ND − DR

where:

- NI = Net income

- NCE = Net CapEx

- ND = New debt

- DR = Debt repayment

Capital Expenditure vs Operating Expenses

Capital expenditures (CapEx) differ from operating expenses (OpEx), which cover short-term costs needed to keep the business running. Unlike CapEx, OpEx can be fully deducted from taxes in the year the expense happens.

An expense is considered CapEx when it’s for a new asset, an investment that will last more than a year, or if it improves an existing asset’s lifespan.

While repair costs can be fully deducted in the year they’re spent, CapEx usually adds long-term value to the asset rather than just keeping it in its current state.

If you still want to know more, read our article about cost vs expense for more comprehensive details.

Capital Expenditure and Depreciation

When an expenditure is capitalized, it’s recorded as an asset on the balance sheet. To gradually remove this asset from the balance sheet, it is expensed over time and reflected in the income statement.

Depending on management’s preference, accountants do this through depreciation, using straight-line or declining balance. Over an asset’s lifespan, the total depreciation will match the initial capital expenditure. If a company consistently has higher CapEx than depreciation, its assets increase.

Here’s a simple indicator of a company’s growth over time:

- CapEx > Depreciation: Assets are growing.

- CapEx < Depreciation: Assets are shrinking.

Challenges that Businesses May Face with Capital Expenditures

Despite the importance of capital expenditure decisions, they add significant complexity:

1. Measurement challenges

Accurately calculating the costs of capital expenditures involves more than just the purchase price. Companies must consider additional expenses like installation, transportation, customization, and any future costs of maintaining or upgrading the asset.

Additionally, estimating the asset’s useful life and potential depreciation can be complex, as these factors depend on both the asset’s quality and how intensively it will be used in operations.

2. Uncertainty

While organizations invest in capital assets aiming for predictable returns, outcomes are not guaranteed and may result in losses. Capital expenditure decisions often involve considerable uncertainty; even skilled forecasters may err.

During financial planning, companies need to consider risks to help mitigate possible losses, though they cannot completely eliminate them.

Best Practices of Capital Expenditure

Large capital projects with significant capital expenditures can quickly spiral out of control if not managed properly, leading to substantial losses for a company. However, these issues can be avoided with careful planning, the right tools, and effective project management. Here are key strategies to ensure efficient capital expenditure budgeting:

1. Plan before you begin

Capital expenditure budgets require thorough preparation to prevent overspending. Before launching a project, define its scope, set realistic deadlines, and ensure the entire plan is reviewed and approved.

At this stage, estimating the internal resources needed, including labor, materials, finances, and services is essential. The more detailed the plan, the more accurate your budget will be.

2. Consider the long-term

Decide early whether to fund your capital asset purchase through debt or set aside existing funds. Saving for the purchase means waiting to acquire the asset while borrowing increases debt and may limit future borrowing options.

Each approach has its benefits, and different projects may require different choices.

3. Invest in a quality accounting system

Choosing a reliable accounting system from the start can greatly simplify budget management. The software you select should fit the project’s scale, run efficiently, and minimize errors. Our recommendation of the best accounting software in the Philippines should help you to compare each system’s features for the best choice.

4. Collect accurate data

Precise data is essential for effectively managing capital projects. Gather reliable and relevant information to build a realistic budget and produce valuable reports.

5. Maintain optimal detail levels

Including excessive detail can delay the budgeting process, risking outdated data by the time the budget is complete. On the other hand, too little detail makes the budget vague and less useful. Striking the right balance is crucial for clarity and efficiency.

6. Establish clear policies

Managing capital expenditures in a large organization often involves many employees, departments, or regions. Setting clear policies helps keep the budget on track and ensures consistency across the organization.

Also read: A Guide to Electronic Invoice System BIR Philippines in 2024

Gain Full Insight of Capital Expenditure with Accounting System

Managing capital expenditures can be tough, but it’s key to a company’s growth. The right tools make it easier to track spending, control budgets, and make smarter investment decisions without extra stress.

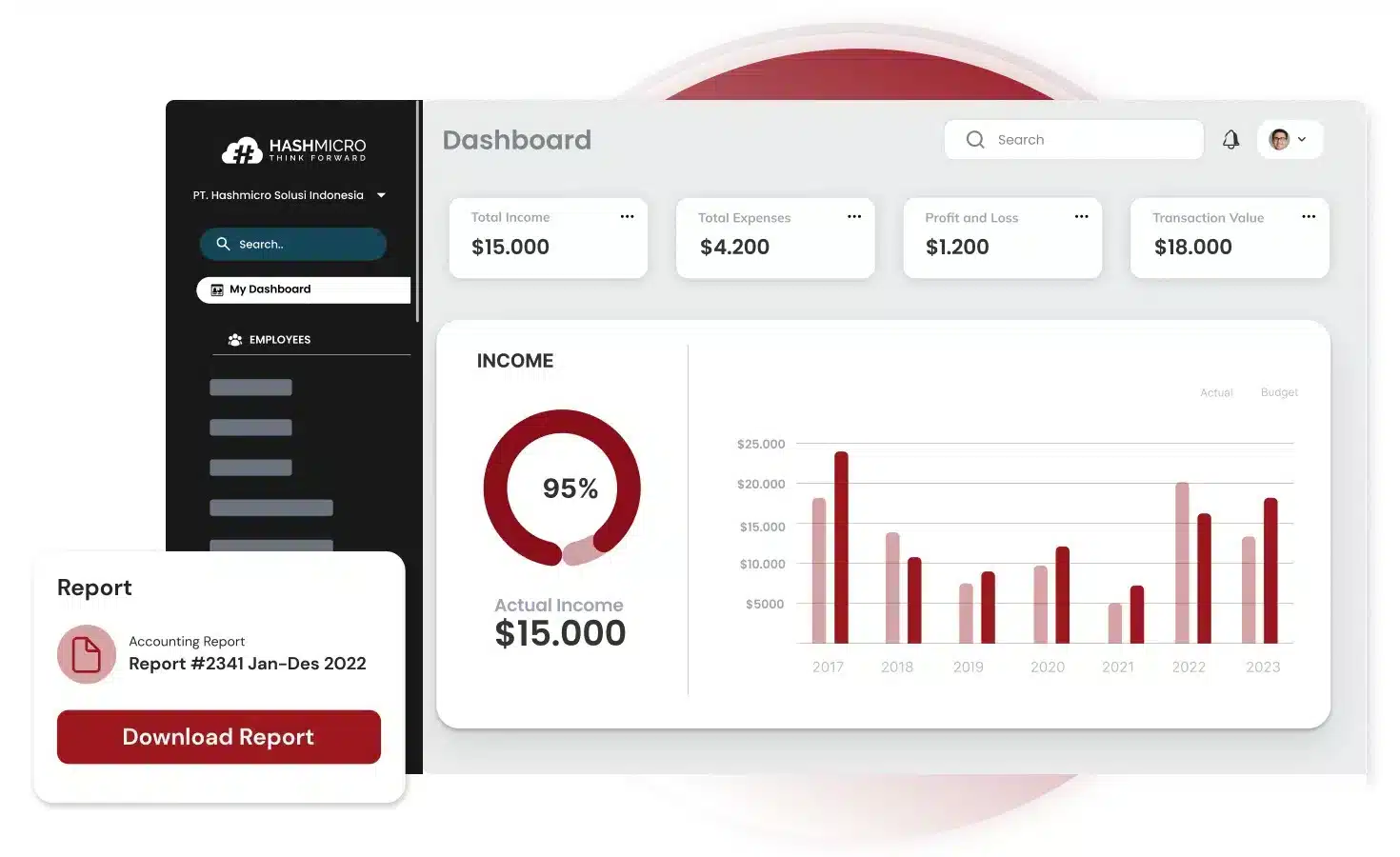

HashMicro Accounting System is the best financial solution for Filipino businesses. It’s BIR-CAS compliant, packed with customizable templates and reports, and offers advanced business intelligence (BI) analysis to help with not just capital expenditures but also other budgeting projects your company needs.

Here’s a look at some of HashMicro’s powerful features that make CapEx management a breeze:

- BIR CAS Integration: Automatically format reports to comply with BIR CAS standards, which makes companies easily comply with regulations without manual adjustments.

- Chart of Accounts Hierarchy: Organize accounts clearly, allowing accurate categorization and simplified tracking of income and expenses.

- Comprehensive Budgeting: To avoid budget overruns, this feature enables month-by-month tracking of capital expenditures, carryover management, and cost control.

- Direct & Indirect Cash Flow Reports: Direct and indirect cash flow reports offer insights into available cash, ensuring sufficient funding for operations and long-term initiatives.

- Bank Loan and Working Capital Loan Tracking: Companies can manage loans and limit debt by monitoring interest and repayments.

- Multi-Level Analytical (Project/Branch Comparison): Financial comparisons across projects or branches assist in improved capital expenditure and budgetary management.

Conclusion

Capital expenditures are essential investments for a company’s growth, supporting long-term assets like equipment, buildings, and technology. Managing CapEx requires thoughtful planning, accurate tracking, and control to ensure budget compliance.

HashMicro’s Accounting System provides the ideal solution for managing CapEx smoothly and effectively for Filipino businesses. It’s BIR-CAS compliant, offers customizable reports, and includes advanced business intelligence features for comprehensive budgeting.

With HashMicro, tracking and optimizing capital expenditures is straightforward, reducing stress and enhancing financial visibility. With tools like cash flow insights, loan tracking, and multi-level analytics, HashMicro makes CapEx management a breeze.

Gain control over your investments, make smarter financial decisions, and try the no-cost demo now!