Maintaining a robust cash flow is vital for businesses to thrive especially in an economy as dynamic and diverse as the Philippines. A well-prepared cash flow statement not only tracks the inflow and outflow of funds but also provides a clear snapshot of your company’s financial health, aiding in strategic decision-making and long-term planning.

For business owners, financial managers, and entrepreneurs alike, mastering the preparation of this statement can mean the difference between sustained growth and financial strain.

But what does an effective cash flow statement look like, and how can you create one that aligns with the specific needs of your business? A reliable accounting system can play a crucial role in ensuring the accuracy and efficiency of your cash flow statement.

Sa artikulong ito, tatalakayin natin ang mga mahahalagang bahagi, mag-aalok ng isang halimbawa ng template, at magbabahagi ng mga ekspertong payo upang makatulong na gawing mas madali ang proseso at mapahusay ang pamamahala sa pananalapi ng iyong negosyo.

Table of Content

Content Lists

Key Takeaways

|

What is a Cash Flow Statement?

A cash flow statement is a financial document that tracks the movement of cash into and out of business over a specific period. This statement helps business owners, managers, and investors understand how well the company generates cash to meet its financial obligations, fund operations, and support growth.

In simple terms, it shows the liquidity of a business—how easily it can pay its bills and invest in opportunities. In the Philippines, where the economy is constantly evolving, having a clear picture of your cash flow is crucial for managing risks and planning for the future.

A cash flow statement is essential for assessing both short-term and long-term financial health, ensuring that your business stays on the path to success.

Cash Flow Statement Template Benefits

A Cashflow Statement is a vital financial tool that offers a comprehensive view of an organization’s inflows and outflows of cash. By utilizing a cashflow statement template example, businesses can streamline their financial reporting process and ensure consistency. Here are several key benefits of using this template:

- Simplifies financial analysis: Using a template for the cash flow statement makes it easier to categorize and track cash transactions over a specific period. It provides a standardized format allowing for more efficient analysis and comparison across different reporting periods. This enables businesses to identify trends and make informed financial decisions.

- Improves accuracy and reduces errors: A well-designed template minimizes human errors by providing predefined categories for cash inflows and outflows. This structure reduces the chances of misclassifying transactions, ensuring that the data is accurate and reliable, which is essential for making strategic business decisions.

- Enhances cash flow management: The template serves as a tool to monitor the company’s cash position regularly. By understanding cash inflows and outflows, businesses can better plan for future expenses, manage working capital, and avoid liquidity issues. With a clear overview of cash movement, organizations are empowered to maintain financial stability.

- Time-saving and efficient reporting: Using a cash flow statement template significantly reduces the time spent preparing reports. The template offers pre-built sections so businesses can quickly input data and generate financial reports without starting from scratch. This efficiency helps in meeting deadlines and allows more time for strategic decision-making.

- Supports regulatory compliance: Many businesses are required to maintain detailed cash flow statements for regulatory purposes. A well-structured template ensures compliance with accounting standards and industry regulations, making it easier to meet auditing requirements and reduce the risk of non-compliance penalties.

Key Components of a Cash Flow Statement

Understanding the key components of a cash flow statement is essential for analyzing how a company manages its cash. Below are the main sections that make up a comprehensive cash flow statement:

- Cash flow from operating activities: This section highlights the cash generated or used by the company’s core business operations. It starts with net income and includes adjustments for non-cash items such as depreciation and changes in working capital. It provides insight into whether the company can generate sufficient cash from its everyday business activities.

- Cash flow from investing activities: This part details cash transactions related to the purchase or sale of long-term assets, such as property equipment and investments. Cash outflows for acquiring assets and inflows from the sale of assets are recorded here. This section indicates how much the company invests in future growth or receives from divesting its assets.

- Cash flow from financing activities: This section reflects cash movements related to funding the business, including issuing stocks, borrowing and repaying debt, or distributing dividends. It helps illustrate how the company finances its operations and long-term growth through various funding strategies.

- Net change in cash and ending balance: A company determines its net change in cash during the period by combining the cash flows from operating, investing, and financing activities. This change is added to the starting balance to arrive at the ending balance, giving a clear view of the company’s overall cash position.

These components together provide a comprehensive overview of how cash flows through a company, supporting better financial management and strategic decision-making.

Common Issues with Cash Flow Statement Formats

Creating an accurate and standardized cash flow statement can present several challenges. Here are some common issues companies may encounter with cash flow statement formats:

- Inconsistent classification of activities: One of the most common issues is the improper classification of cash flows. Cash flows from operating, investing, and financing activities must be clearly distinguished. However, sometimes companies incorrectly categorize transactions, which can distort the accuracy of the statement.

- Failure to adjust for non-cash items: Cash flow statements need to exclude non-cash transactions, such as depreciation or changes in the value of assets. Some companies fail to make these necessary adjustments, leading to misleading figures. This can result in an inaccurate representation of the company’s actual cash position, as these non-cash items affect net income but not the cash flow.

- Lack of transparency in financing activities: In some cases, companies may fail to provide enough detail in the financing activities section, such as distinguishing between long-term and short-term debt or properly identifying the sources of funds. Without clear transparency, stakeholders may find it difficult to understand the company’s capital structure and its approach to managing debt and equity.

- Overlooking changes in working capital: Changes in working capital, such as accounts receivable and payable, should be reflected in the operating activities section. Omitting these adjustments can mask liquidity issues and give a false impression of operational efficiency.

- Inaccurate representation of cash flow from investing activities: Failing to properly account for cash flows related to investments, such as asset purchases or sales, can lead to an incomplete or misleading view of the company’s investment strategy and cash position.

When is a Cash Flow Statement Used in A Company

A cash flow statement is used by a company to track and analyze the inflows and outflows of cash over a specific period. This document is crucial for assessing the company’s liquidity, operational efficiency, and financial health.

Unlike a sample profit and loss statement, which shows income and expenses to determine profitability, a cash flow statement provides a detailed view of actual cash movements.

Companies often use cash flow statements to make informed decisions regarding investments, budgeting, and financial planning. It also helps stakeholders understand how well the company manages its cash to sustain operations and fund growth.

How to Create a Cash Flow Statement

Creating a cash flow statement is essential for tracking a company’s financial health. Here is a step-by-step guide to help you create one effectively:

1. Determine the starting balance

The starting balance refers to the amount of cash available at the beginning of the reporting period. It is essential to accurately determine this figure as it forms the basis for calculating cash inflows and outflows throughout the period.

Typically, the starting balance is the ending balance from the previous period’s cash flow statement, which should be carried forward to ensure continuity and accuracy in financial reporting.

2. Calculate cash flow from operating activities

Cash flow from operating activities represents the cash generated or used by a company’s core business operations during a specific period. To calculate this, begin with the net income from the income statement and adjust for non-cash items, such as depreciation and changes in working capital.

These adjustments ensure that the cash flow reflects only the actual cash movements from day to day business activities, excluding any financing or investing activities.

This calculation provides insight into the company’s ability to generate cash from its primary business operations.

3. Calculate cash flow from investing activities

Cash flow from investing activities reflects the cash spent on or received from investments in long-term assets, such as property, equipment, or securities. To calculate this, include cash outflows for purchases of assets or investments, as well as cash inflows from the sale of such assets.

This section provides insight into how much cash the company is investing in its future growth or generating from the disposal of assets. It helps assess the company’s strategy regarding capital expenditures and investment decisions.

4. Calculate cash flow from financing activities

Cash flow from financing activities tracks the cash movements associated with raising or repaying capital. This section includes cash inflows from activities such as issuing stocks, obtaining loans, or other financial instruments that provide funding to the business.

It also accounts for cash outflows related to repaying loans, repurchasing company shares, and distributing dividends to shareholders. Accurately calculating this part of the cash flow statement is crucial for understanding how a company sustains its operations and growth through external funding.

It offers a clear view of the company’s financial strategies and obligations, highlighting its approach to leveraging debt and equity to support its business objectives.

5. Determine the ending balance

The ending balance represents the total cash available at the conclusion of the reporting period. To determine this figure, add the net cash flow from operating, investing, and financing activities to the starting balance.

This calculation provides a comprehensive picture of the company’s cash position at the end of the period and is essential for financial analysis and future planning.

The ending balance also serves as the starting balance for the next reporting period, ensuring continuity and consistency in financial reporting.

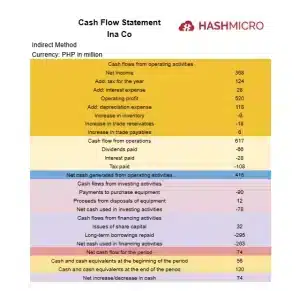

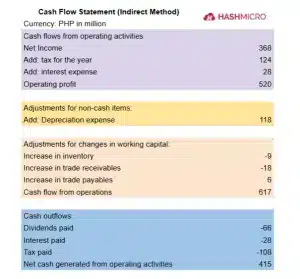

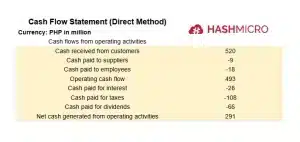

Example of a Cash Flow Statement

A cash flow statement is vital for assessing a company’s financial stability. To better understand its format and significance, consider the following example.

A. Indirect cash flow statement

B. Direct cash flow statement

Simplify Your Company’s Cash Flow Statement with HashMicro’s Software

Managing and analyzing cash flow statements can be a complex task for many businesses. HashMicro’s advanced software solutions simplify this process by providing a comprehensive platform that automates and streamlines financial reporting. With features such as:

- Cash flow reports: This feature is directly related to the creation of cash flow statements, making it an ideal example. It enables companies to generate comprehensive and accurate cash flow reports, monitor cash inflows and outflows, and gain a complete overview of their financial position.

- Bank integration – auto reconciliation: This feature ensures that recorded cash flow data is accurate and up-to-date. With auto reconciliation, companies can automatically match bank transactions with internal records, supporting the validity of cash flow statements. It demonstrates how efficient reconciliation processes keep cash flow records current.

- Profit & loss vs budget & forecast: This feature compares profit and loss statements with budgets and forecasts, which is useful for understanding how well financial planning aligns with actual cash flow. It supports cash flow statement examples by highlighting how budget accuracy impacts overall cash positioning.

- Forecast budget: This feature is relevant as it allows companies to project future cash needs, aiding in strategic cash flow planning. It serves as an example of how businesses can anticipate cash inflows and outflows to maintain financial stability.

- Financial statement with budget comparison: This feature provides direct comparisons between actual financial statements and proposed budgets, offering insights into how well the company maintains its cash flow in line with financial plans. It demonstrates key elements of a cash flow statement in the context of budget realization.

Conclusion

Creating and managing accurate cash flow statements is essential for businesses in the Philippines to understand their financial health and ensure long-term sustainability.

A well-organized cash flow statement helps business owners and stakeholders track cash movements, manage liquidity, and make data-driven financial decisions.

By leveraging a powerful solution like HashMicro software, businesses can significantly simplify and improve their cash flow management processes. With its robust features, including automated reporting, real-time analytics, and seamless integrations, HashMicro empowers businesses to optimize their financial operations and gain clearer financial insights.

You can take a free demo today to experience first-hand how HashMicro can simplify your financial management and improve your business strategy.

Frequently Asked Questions About Cash Flow Statement Example

-

What are the main components of a cash flow statement?

The main components are cash flows from operating activities, investing activities, and financing activities. Each section tracks different sources and uses of cash.

-

How does an example cash flow statement help in financial management?

Studying an example helps you understand the format and analysis of cash flow, making it easier to track your own business’s cash position and make informed decisions.

-

Where can I find a cash flow statement example template?

Templates are often available on financial advice sites, accounting software platforms, and business education portals for easy reference and customization.