Cash flow is a critical indicator of a business’s financial health, often cited as a key factor in the survival and growth of any enterprise. According to a study, 82% of businesses that fail do so because of cash flow problems. Managing cash flow effectively is not just about balancing income and expenses; it’s about ensuring that there is enough liquidity to support operations, growth, and investment opportunities.

This article delves into what cash flow truly is, how to calculate it, the different types, and the importance of analyzing it. Whether you’re a business owner, CFO, or financial analyst, understanding cash flow—along with creating and interpreting a cash flow statement—will empower you to make better financial decisions and contribute to long-term business stability.

Let’s dive deeper into what cash flow entails and how it shapes the future of a business.

Table of Contents

Key Takeaways

|

What is Cash Flow

Cash flow refers to the net amount of cash and cash-equivalents moving in and out of a business over a specific period. In essence, it is the lifeline of any business, affecting its ability to pay bills, invest in growth, and meet unexpected expenses. Unlike profits, which can be tied up in accounts receivable or inventory, cash flow represents the immediate funds available for use.

Businesses monitor cash flow through cash flow statements—financial documents that provide a summary of cash inflows (such as revenue from sales or investment income) and outflows (like operating expenses and loan repayments). By tracking cash flow, companies gain insights into their liquidity and can make adjustments to avoid shortfalls.

Importance of Cash Flow

- Liquidity: Cash flow indicates the liquidity available to meet obligations, invest in assets, or manage emergencies.

- Financial planning: Tracking cash flow is essential for financial planning, as it helps forecast cash requirements and prepare for seasonal fluctuations.

- Investor confidence: Strong, consistent cash flow often reflects a well-managed business, attracting investors and stakeholders.

With an understanding of cash flow as a financial foundation, we can now explore how to calculate it accurately.

How to Count (Formula and Calculation of Cash Flow)

Calculating cash flow is crucial for determining a company’s financial health. The formula varies depending on the type of cash flow you are calculating, whether it’s operating cash flow, free cash flow, or net cash flow. Here, we’ll focus on the commonly used methods that provide insights into cash flow from core business activities.

Basic Cash Flow Formula

The general formula for calculating cash flow is:

Cash Flow= Cash Inflows – Cash Outflows

This formula gives a basic understanding of net cash flow but doesn’t provide detailed insights into specific areas like operations, investing, or financing. For deeper analysis, more specialized formulas are used.

Operating Cash Flow (OCF)

Operating cash flow represents the cash generated by the core business activities. It is calculated as:

Operating Cash Flow= Net Income + Non-Cash Expenses – Changes in Working Capital

This formula includes non-cash expenses such as depreciation and accounts for changes in working capital. Operating cash flow is a valuable measure of a company’s ability to generate cash from its regular business operations.

Free Cash Flow (FCF)

Free cash flow is the cash available after accounting for capital expenditures necessary to maintain or expand asset bases, making it a crucial metric for investors. The formula is:

Free Cash Flow = Operating Cash Flow – Capital Expenditures

This calculation shows how much cash a company has left to return to shareholders, pay down debt, or reinvest in growth.

Example Calculation

If a company reports a net income of $100,000, non-cash expenses of $20,000, and changes in working capital of $5,000, its operating cash flow would be calculated as follows:

Operating Cash Flow = 100,000 + 20,000 – 5,000 = 115,000

This means the business generated $115,000 in cash from its core activities. Understanding these formulas helps in preparing a clear cash flow statement format that provides essential insights for stakeholders.

Type of Cash Flow

Understanding the different types of cash flow is crucial, as each type provides unique insights into various aspects of a company’s financial position. Cash flows are typically categorized into three main types: operating cash flow, investing cash flow, and financing cash flow. Each plays a specific role in the comprehensive cash flow statement format, helping stakeholders see where the company’s money is coming from and where it’s going.

1. Operating Cash Flow (OCF)

Operating cash flow represents the cash generated by the company’s core business activities, such as sales of goods or services. It reflects the cash inflow from day-to-day operations and excludes secondary activities like investments or financing. A positive OCF indicates that the company’s core activities are profitable, which is a healthy sign for investors.

Key components include:

- Revenue from sales

- Payments made to suppliers and employees

- Adjustments for non-cash expenses (like depreciation)

2. Investing Cash Flow

Investing cash flow includes cash transactions related to the purchase and sale of assets like equipment, property, or securities. This cash flow type often reflects the company’s investment in its long-term growth. While negative cash flow in this category can indicate investments in future growth, prolonged negative cash flow might also raise concerns if it doesn’t eventually contribute to revenue.

Key activities under investing cash flow:

- Purchase of machinery, property, or other capital assets

- Proceeds from the sale of assets or investments

- Purchases of securities or other investments

3. Financing Cash Flow

Financing cash flow pertains to cash generated or spent on funding the company’s operations. This includes transactions with investors and creditors, such as issuing stock, paying dividends, or repaying loans. Positive financing cash flow suggests new capital coming into the business, while negative financing cash flow often indicates that the company is paying off debt or issuing dividends to shareholders.

Key activities include:

- Issuance or repurchase of stock

- Dividend payments

- Loans and debt repayments

Each type of cash flow offers distinct insights into the company’s financial health. With these categories outlined, we can now explore how cash flow can be used strategically for business growth and stability.

Uses of Cash Flow

Cash flow serves multiple purposes, acting as a financial tool that aids in business decision-making, strategic planning, and sustaining financial health. It offers insights that go beyond profit and loss statements, enabling businesses to understand the availability of liquid funds for various needs.

1. Managing daily operations

One of the primary uses of cash flow is ensuring there’s enough liquidity to cover daily operating expenses, such as payroll, rent, and utilities. A steady, positive cash flow allows businesses to run smoothly without needing to rely on external financing for day-to-day operations. This is especially important for businesses that experience seasonal fluctuations or irregular income patterns.

2. Planning for growth

Cash flow can fuel growth initiatives like expanding facilities, launching new products, or entering new markets. When cash flow is consistently positive, businesses are more capable of making strategic investments without risking liquidity. Companies can use the statement of cash flow to analyze whether there’s room to invest in growth opportunities.

3. Debt repayment and financial stability

For businesses with existing loans or credit lines, cash flow provides the means to meet debt obligations on time. A healthy cash flow means companies can manage and repay debts, thus maintaining financial stability and avoiding interest penalties or credit issues. Regular cash flow monitoring ensures that companies stay within their debt limits.

4. Building investor confidence

Investors pay close attention to a company’s cash flow, as it reflects financial resilience and sustainability. Positive and consistent cash flow reassures investors and stakeholders, building confidence in the company’s financial health. This confidence often translates into increased investment, whether through direct equity purchases or loan offers at favorable terms.

5. Cushion for unexpected expenses

A robust cash flow allows a business to set aside funds for contingencies, such as sudden repairs, economic downturns, or urgent expenses. This “cash cushion” is essential for ensuring a business remains stable and prepared for unforeseen challenges without disrupting regular operations.

With these uses in mind, cash flow becomes a tool that supports long-term planning and resilience. Now, let’s look at how to analyze cash flow effectively.

How to Analyze Cash Flow

Analyzing cash flow involves reviewing the cash flow statement to assess a company’s financial health, liquidity, and sustainability. This analysis helps you understand not only where money is coming from but also how effectively it’s being utilized. Here are some key methods and metrics for cash flow analysis:

1. Review of cash flow from operating activities

The cash flow from operating activities provides a clear picture of whether the core business operations are generating sufficient cash to maintain the business. A positive figure here indicates that the company’s primary activities are profitable and self-sustaining, while a negative figure may suggest a need to reevaluate operational efficiency or increase revenues.

2. Free cash flow (FCF) analysis

Free cash flow (FCF) measures the cash available after accounting for capital expenditures (CAPEX). It provides insights into a company’s ability to fund operations, reinvest in growth, and distribute dividends. Positive free cash flow is a strong indicator of financial health, suggesting that the business can support growth without needing external financing. To calculate FCF:

Free Cash Flow = Operating Cash Flow – Capital Expenditures

3. Cash flow ratios

Several cash flow ratios provide insights into liquidity and financial efficiency. These ratios help evaluate the sufficiency of cash flow in covering liabilities and supporting investments. Here are two commonly used ratios:

- Operating cash flow ratio: This ratio indicates a company’s ability to cover its short-term liabilities solely with cash flow from operations.

Free Cash Flow =Operating Cash Flow – Capital Expenditures

- Cash Flow Margin Ratio: This ratio measures how much cash flow a business generates per dollar of sales. Higher cash flow margins indicate better efficiency in converting sales into cash flow.

4. Comparing Cash Flow over Time

A year-over-year or quarter-over-quarter comparison helps track cash flow trends, revealing seasonal patterns or growth phases. For example, if cash flow improves consistently over time, it indicates financial stability and efficient cash management. On the other hand, a declining trend may highlight operational challenges or excessive spending.

5. Cash Flow vs. Net Income

Comparing cash flow with net income allows you to assess the quality of earnings. A business might report high net income, but if cash flow is low, it could indicate issues like delayed payments or high levels of accounts receivable. Ideally, cash flow should align closely with net income, signaling that reported profits are backed by real cash.

With these methods, businesses can gain a detailed understanding of their cash flow and make informed decisions. Now, let’s put this analysis into practice with an example.

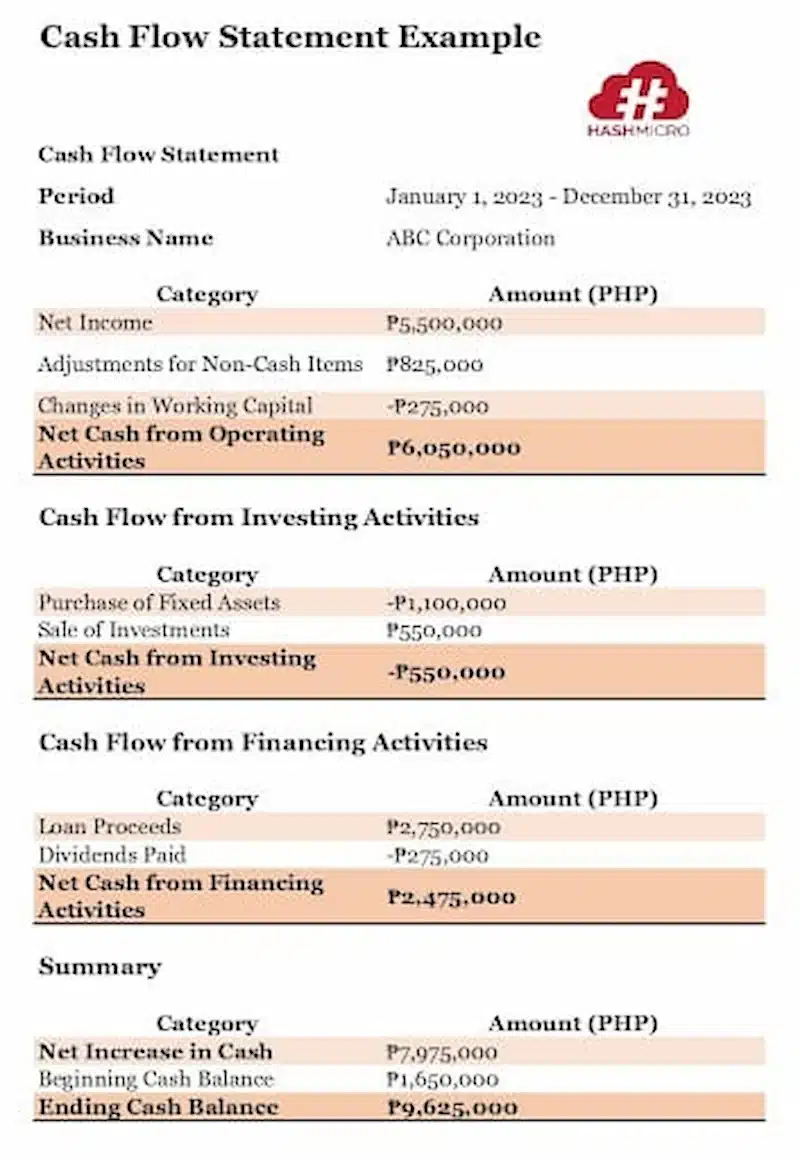

Cash Flow Statement Example

How This Cash Flow Statement Reflects ABC Corporation’s Financial Health

For example, ABC Corporation shows a net increase in cash of ₱7,975,000 for the year, ending with a total cash balance of ₱9,625,000. Here’s a breakdown of what this statement reveals:

- Operating activities: The company generated ₱6,050,000 from its primary operations, suggesting a healthy profit margin from core business activities.

- Investing activities: ABC Corporation made significant investments with a net cash outflow of ₱550,000, reflecting a commitment to growth and asset acquisition.

- Financing activities: The company raised funds through a loan (₱2,750,000) and issued dividends (₱275,000), showing a balance of growth funding and shareholder return.

This cash flow statement format in pesos is a practical tool for Philippine businesses, enabling them to manage cash effectively and plan for future growth.

Conclusion

Managing cash flow effectively is essential for sustaining business health and planning for growth. Cash flow statements offer a clear view of how cash is generated and used, allowing businesses to make informed financial decisions.

HashMicro’s Accounting Software simplifies cash flow management with automated statements and real-time insights, making it easier for Philippine businesses to maintain liquidity and achieve their financial goals. Request a free demo to see how HashMicro’s accounting software system can enhance your cash flow management and support long-term success.

FAQs Cash Flow

-

What is a cash flow statement?

A cash flow statement is a financial document that shows how cash moves in and out of a business over a specific period. It’s divided into operating, investing, and financing activities, helping businesses understand their liquidity and financial health.

-

How does cash flow differ from profit?

Profit is the income remaining after all expenses are paid, while cash flow represents actual cash on hand. A company can be profitable on paper but still have cash flow issues if funds are tied up in receivables or inventory.

-

What is the formula for operating cash flow?

Operating cash flow is calculated as Net Income + Non-Cash Expenses – Changes in Working Capital. This calculation reflects cash generated from core business operations.

-

How can accounting software help with cash flow management?

Accounting software like HashMicro’s streamlines cash flow tracking, generates real-time reports, and automates cash flow statements, making it easier to monitor and manage cash flow for informed decision-making.

-

Why is cash flow analysis important?

Cash flow analysis is crucial for understanding a business’s ability to cover expenses, repay debt, and invest in growth. It helps stakeholders evaluate the company’s financial stability and future potential.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [{

“@type”: “Question”,

“name”: “What is a cash flow statement?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “A cash flow statement is a financial document that shows how cash moves in and out of a business over a specific period. It’s divided into operating, investing, and financing activities, helping businesses understand their liquidity and financial health.”

}

},{

“@type”: “Question”,

“name”: “How does cash flow differ from profit?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Profit is the income remaining after all expenses are paid, while cash flow represents actual cash on hand. A company can be profitable on paper but still have cash flow issues if funds are tied up in receivables or inventory.”

}

},{

“@type”: “Question”,

“name”: “Why is cash flow analysis important?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Cash flow analysis is crucial for understanding a business’s ability to cover expenses, repay debt, and invest in growth. It helps stakeholders evaluate the company’s financial stability and future potential.”

}

},{

“@type”: “Question”,

“name”: “What is the formula for operating cash flow?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Operating cash flow is calculated as Net Income + Non-Cash Expenses – Changes in Working Capital. This calculation reflects cash generated from core business operations.”

}

},{

“@type”: “Question”,

“name”: “How can accounting software help with cash flow management?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Accounting software like HashMicro’s streamlines cash flow tracking, generates real-time reports, and automates cash flow statements, making it easier to monitor and manage cash flow for informed decision-making.”

}

}]

}