The banking industry in Southeast Asia, including the Philippines, has seen ups and downs over the years. In the second quarter of 2024, the region’s economies showed resilience, driven by stronger domestic and global demand. However, geopolitical tensions and fluctuating commodity prices still pose challenges.

The banking sector in the Philippines faces notable challenges. As of December 2023, non-performing loans (NPLs) rose by 12.6% to ₱449.1 billion, reversing an 11.9% drop from December 2022.

With an NPL ratio of 3.2%, better risk management and loan recovery strategies are urgently needed. Relying on outdated methods isn’t effective in such a fluctuating situation. Banks must be aware of the challenges and devise ways to overcome them to stay competitive.

Grabe naman! In this article, we will take a deeper look at what other challenges the banking industry currently faces and the suggestions to make it easier for them. Let’s find out!

Key Takeaways

|

Table of Contents

Top 10 Pressing Challenges Faced by the Banking Industries

The banking industry is continuously developing, with both classic and technological challenges. From client expectations to regulatory complications, obstacles are building up like a tambak. Here’s a deeper look at the major concerns that banks face today.

1. Understanding Customer Expectations

Today’s digital-savvy consumers demand quick, personalized services both online and offline. They expect seamless, customized interactions and often want their financial institutions to anticipate their needs before they arise.

Projections show that there will be 216.8 million digital banking users in the US by 2025. Digital channels are becoming the main way people interact with their banks or credit unions. Yet, the high importance placed on security in mobile banking highlights that trust remains essential for customers.

To align with these expectations, financial institutions should:

- Strengthen digital security: Prioritize a smooth mobile experience reinforced by advanced security protocols to foster trust and safeguard customer information.

- Implement a hybrid model: Merge the efficiency and ease of mobile banking with personalized, direct advice offered in branches to appeal to both tech-forward customers and those preferring face-to-face engagement.

2. Regulatory Compliance

Regulatory compliance has emerged as one of the most significant challenges in the banking industry, driven by evolving regulatory demands and increased costs relative to earnings and credit losses following global financial disruptions.

From Basel III’s risk-weighted capital requirements to the Bangko Sentral ng Pilipinas’ (BSP) Domestic Systemically Important Banks (D-SIBs) framework, and from the BSP’s Expected Credit Loss (ECL) model to its guidelines on Allowance for Credit Losses.

An expanding array of regulations requires banks and financial institutions in the Philippines to ensure strict adherence. These requirements can strain resources considerably, primarily as compliance often hinges on effectively integrating and analyzing data from diverse sources.

To tackle these challenges:

- Invest in smart technology: Use tools that make gathering, analyzing, and reporting data easier. A solid tech setup can help you stay on top of requirements without scrambling for last-minute fixes.

- Stay updated on regulations: Regularly review BSP updates and global standards to anticipate changes before they become urgent. Proactive planning always beats rushing to catch up.

- Partner with experts: If managing everything in-house feels overwhelming, working with compliance consultants or legal advisors can give you peace of mind and a clear direction.

3. Security Breaches

With high-profile data breaches making headlines in recent years, security remains a top concern for banks, credit unions, and their customers. Financial institutions must adopt advanced, technology-driven measures to safeguard sensitive information.

Here are some effective strategies:

- Address Verification Service (AVS): AVS compares the billing address provided during a transaction with the one on record at the issuing bank. This helps flag suspicious activities and prevents fraud.

- End-to-End Encryption (E2EE): E2EE secures data during transfers by using cryptographic keys stored only at the sender and receiver’s endpoints. Banks can use this to keep mobile transactions and online payments safe.

- Biometric Authentication: This process uses unique biological traits—like fingerprints, facial recognition, or iris scans—to verify a user’s identity. Unlike PINs, biometrics are harder to duplicate and more secure.

- Location-Based Authentication: Sometimes called geolocation identification, this method confirms a user’s identity by checking their physical location. Banks can use it to send transaction notifications or verify if the customer is near where the transaction occurs.

- Out-of-Band Authentication (OOBA): OOBA relies on two separate channels, such as sending a one-time code through SMS, email, or voice calls. The customer must enter this code to verify their identity, adding an extra layer of protection.

- Risk-Based Authentication (RBA): Also called adaptive authentication, RBA adjusts security based on the risk level of each transaction. Higher-risk activities may require stricter verification to ensure safety.

4. Improving the Mobile Experience

As mobile banking gains dominance, traditional in-branch services face growing challenges. Customers now prefer mobile solutions for everyday transactions, leaving banks with underwhelming digital offerings at risk of losing their competitive edge.

A seamless user experience (UX) is critical. Otherwise, customers won’t hesitate to switch.

To keep your customer going, focus on:

- Intuitive interfaces: Keep improving mobile banking apps for effortless navigation, especially for widely used tools like GCash or PayMaya. Ensure these third-party apps integrate flawlessly with your platform while delivering a user experience that matches or surpasses their convenience.

- Interactive video banking: Introduce video banking services to blend the personal touch of in-branch interactions with the ease of digital accessibility.

5. Rising Expectations of Digitized Experiences

Today’s customers demand more personalization and convenience, driven by tech-savvy Millennials and Gen Z, who dominate mobile banking and prefer digital interactions. Meanwhile, Baby Boomers and older Gen X still value human connection and in-branch services.

Millennials have significantly influenced the shift toward digital banking, with 67% preferring digital platforms over traditional branches. They also represent the largest group of mobile banking users, totalling 62.3 million in 2022.

This trend suggests that Gen Z will likely continue to prioritize omnichannel banking and advanced technological integration.

How do you cater to both needs at the same time?

- Tip 1: Introduce self-service stations in branches equipped with smart devices. These devices can help customers schedule appointments, access knowledge bases, or connect with financial advisors.

- Tip 2: Empower financial advisors to provide tailored assistance. They can also set up customers with AI tools for personalized recommendations, enhancing their banking experience.

6. Outdated Applications

A 2023 KPMG survey indicates that nearly all financial services firms actively pursue digital transformation strategies, with 97% either developing or implementing such initiatives.

However, businesses relying on outdated management systems or disconnected tools will struggle to compete in today’s digital-first environment. Simply put, digital transformation is no longer optional—it’s essential for staying relevant.

- Use Banking Software: Switch to cloud-based tools like bank reconciliation software to organize your systems better, cut down costs, and keep everything more efficient.

- Try Artificial Intelligence (AI): Use AI to make services more personal and handle repetitive tasks automatically so customers get faster and better experiences.

- Make the Most of Your Data: Use cloud technology to analyze data more effectively. This can help you understand customers better and make smarter business decisions.

- Stay Open to New Tech: Keep an eye on tools like blockchain for future opportunities. While they may not give instant results now, they can help you stay ahead in the long run.

7. Fintech Competition

Fintech is growing fast and giving banks and credit unions a tough challenge. With new ideas like cryptocurrency and peer-to-peer payment apps, fintech makes financial services quicker and more accessible, thus pushing traditional banks to step up so they’re not left out in the competition.

How to stay competitive:

- Collaborate with fintechs: Explore partnerships or support fintech initiatives to benefit from their cutting-edge technologies and innovations.

- Focus on specialized services: Stand out by offering personalized options, like in-depth financial planning, that fintech companies typically don’t provide.

8. Changing Business Models

Compliance costs are just one of many challenges pushing financial institutions to rethink how they work. Rising capital costs, consistently low interest rates, shrinking returns on equity, and reduced proprietary trading opportunities are all squeezing traditional banking profits.

Yet, shareholder expectations remain as high as ever. Here’s how banks are adapting to these pressures:

- Developing new competitive services: Creating innovative offerings to attract and retain customers.

- Reassessing business lines: Shifting focus to areas with stronger growth or profitability potential.

- Enhancing operational efficiency: Finding ways to reduce costs and improve overall productivity.

- Embracing flexibility: Structuring the organization to adapt to market changes and new demands quickly.

9. Internal Change

Digital transformation demands changes within organizations. As financial institutions embrace new technologies, industry roles must shift from purely transactional to a more consultative approach to better serve customer needs.

Steps to encourage internal change:

- Train employees for versatile roles: The “universal banker” model is becoming common, combining traditional teller duties with skills to provide more advanced financial advice.

- Prioritize digital skills: Hire staff with digital expertise and provide regular training to ensure employees are prepared to support both face-to-face and digital customer interactions.

10. Customer Expectations and Competition

Financial services customers demand personalized, seamless experiences across devices anytime, anywhere. While customer loyalty is harder to maintain, it hinges on understanding customer needs and offering client-focused solutions.

A 2023 Accenture study revealed that 49% of banking customers prioritize customer service for loyalty, yet 59% switched providers in the past year, especially younger consumers. With 52% of consumers now using digital-only banks, it signals a significant shift in consumer preferences.

Thus, the banking industry must adapt its approaches if it doesn’t want to lose more customers. After all, those who can fulfill the customers’ preferences and convenience will win in the long run, di ba?

How to stay ahead:

- Highlight human expertise: Offer personalized financial advice that digital-only banks can’t match.

- Stay adaptable: Respond quickly to changing customer preferences and the growing impact of tech-driven competitors like Apple.

Empower Your Banking Industry Expertise with HashMicro Accounting Software

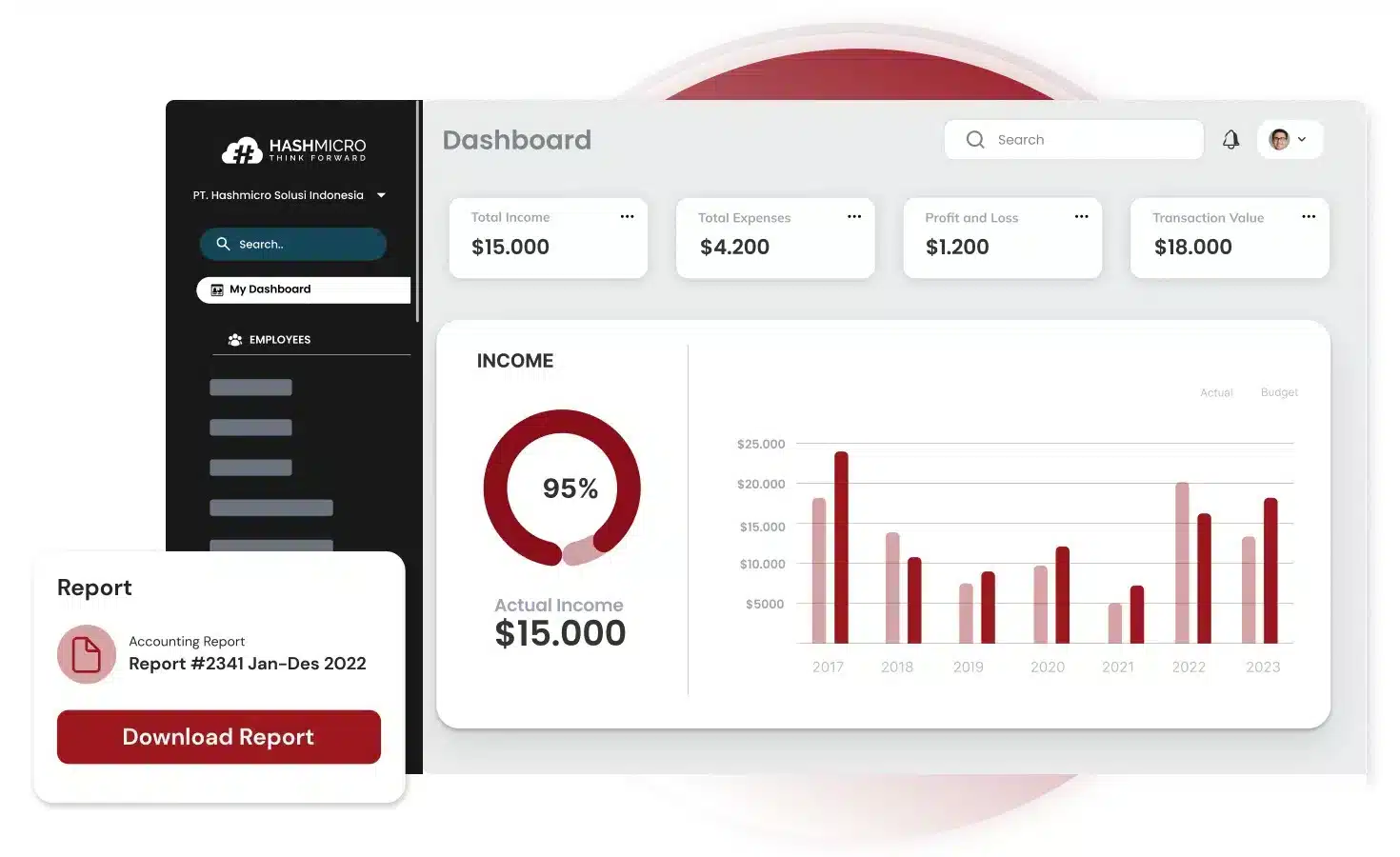

The banking industry is a serious business; your expertise is, and always will be, at the core of every critical decision. But HashMicro Accounting Software is here to make your job easier, faster, and more secure.

Trusted by 1750+ companies, including the renowned Bank of China, it’s designed with an intuitive and user-friendly interface. You can get started right away; no too-extensive training required. ISO certification and BIR-CAS accreditation further guarantee compliance with local and international standards.

You’ll be able to handle financial reports effectively with the aid of our technology. As a result, it encourages you to concentrate on what matters most: expanding your company and improving your client relationship. Better yet, it also provides a no-cost demo to help you get started.

HashMicro’s Accounting Software is packed with features that help tackle key banking challenges efficiently:

- Real-Time Financial Dashboard: Access live insights into cash flow, income, and expenses—all in one place.

- Cash Flow Forecasting Simplified: Plan ahead confidently by predicting your cash flow needs with precision.

- Quick and Secure Bank Reconciliation: Eliminate errors and save time with automated transaction matching.

- Accruals and Amortization Automation: Streamline complex calculations while ensuring compliance with accounting standards.

- Instant Financial Reports: Generate essential reports like balance sheets and income statements in seconds.

- Seamless System Integration: Connect easily with tools like Inventory, CRM, and Purchasing to unify workflows and improve service.

Conclusion

The banking industry faces various challenges, from fluctuating market demands to stringent regulatory environments. However, by adopting digital tools and refining strategies, banks can survive and thrive.

HashMicro Accounting Software simplifies tackling these banking challenges, bringing efficiency right to your fingertips. It’s easy to use, even if you’re not a tech guru, talaga! With features like real-time financial dashboards and automated bank reconciliations, it makes complex tasks a breeze.

Don’t just take our word for it; see how HashMicro can revolutionize your banking operations. Trusted globally, our software ensures compliance and security, setting you up for success. Kaya, try our free demo today and experience the upgrade your bank deserves.

FAQ About Banking Industry Challenges

-

What impact does technological disruption have on traditional banks?

Technological advancements, such as fintech innovations and digital payment systems, challenge traditional banks by introducing new competitors and changing customer expectations. Banks must adapt by integrating advanced technologies to remain competitive.

-

How do economic downturns affect the banking sector?

Economic downturns can lead to increased loan defaults, reduced profitability, and heightened credit risk for banks. They may also face challenges in maintaining liquidity and capital adequacy during such periods.

-

How does the aging infrastructure impact banks?

Many banks operate on outdated legacy systems that are incompatible with modern applications, leading to increased maintenance costs and difficulties in implementing new technologies.

-

What are the challenges of implementing open banking?

Open banking introduces challenges like ensuring data security, managing third-party risks, and complying with evolving regulations. Banks must balance innovation with robust security measures to protect customer information.