Kumusta, Business People! Have you ever wondered why your business is struggling to grow? Maybe the lack of using cloud accounting is one reason.

Let’s consider this: Your company is expanding into new regions, but managing financial operations across multiple branches becomes a real challenge. Without a cloud accounting system in place, you start seeing inconsistent reports and duplicated efforts, which ultimately slows down your growth and expansion plans.

As a result, cloud accounting has become the go-to solution for 90% of business professionals, helping to minimize manual errors and boost company growth. Therefore, if you want to understand cloud accounting better, including its benefits and how it works, you’re in the right place. Pag-usapan natin ito nang magkasama.

Key Takeaways

|

Table of Contents

What is Cloud Accounting?

Cloud accounting is a software solution that allows businesses to manage their financial data online, providing real-time access to crucial financial information. With the inclusion of account reconciliation software, cloud-based accounting enables users to track transactions, generate reports, and monitor cash flow from any device with an internet connection.

In addition, cloud accounting software promotes collaboration by allowing multiple users to work on the same data simultaneously. It integrates with other key business systems like payroll, invoicing, and inventory management, creating a streamlined process that supports efficient decision-making.

How Does Cloud Accounting Work?

Cloud accounting lets businesses manage finances online with data stored on remote servers. You can log in from any device to access and update your financial management system info in real time, making accounting easier and boosting teamwork.

Here are the details about how cloud-based accounting works:

- Financial data is uploaded and securely stored in the cloud, making it easily accessible from anywhere.

- As transactions are recorded, the system instantly updates all relevant reports and financial records.

- Multiple users, such as accountants or managers, can log in simultaneously to view or update the same data.

- Accounting software automatically syncs with other business tools, such as payroll and inventory, to provide a comprehensive financial overview.

- All data is protected with encryption and regular backups to ensure security and prevent loss.

What’s the Difference Between Cloud Accounting and Traditional Accounting Software?

Bakit mas dapat piliin ang internet-based accounting kaysa sa tradisyonal na sistema ng accounting? Makakatulong ba talaga ang paglipat sa cloud system sa iyong negosyo? Let’s explore the differences between the two through the table below to understand the benefits of cloud accounting better.

Bakit mas dapat piliin ang internet-based accounting kaysa sa tradisyonal na sistema ng accounting? Makakatulong ba talaga ang paglipat sa cloud system sa iyong negosyo? Let’s explore the differences between the two through the table below to understand the benefits of cloud accounting better.

|

Feature |

Cloud Accounting |

Traditional Accounting Software |

| Access | Accessible anytime, anywhere via internet-connected devices | Limited to the installed device or network |

| Installation | No installation is needed, accessed via browser | Requires installation on local computers |

| Data Storage | Stored on remote servers (cloud) | Stored locally on company servers or computers |

| Cost | Subscription-based, usually with monthly or annual fees | One-time purchases may include additional upgrade costs |

| Updates | Automatic updates provided by the service provider | Manual updates are needed, often requiring IT involvement |

| Collaboration | Easy collaboration across multiple users and locations | Limited to users in the same network or office |

| Security | High-level security with regular backups and encryption | Security depends on company measures, backups required |

| Scalability | Easily scalable as your business grows | Limited scalability, may require new software for growth |

| Maintenance | No internal maintenance is needed, handled by the provider | Requires in-house IT support for maintenance and troubleshooting |

After understanding the difference between a cloud accounting system and the traditional one above, it will be very natural if the cost factor is also your concern. Therefore, you can try the best cloud-based accounting software pricing scheme in the Philippines through the following banner without any special conditions!

8 Benefits of Cloud Accounting Software

Some of the benefits of using cloud accounting Philippines are listed below:

- Cost-effective: More affordable with subscription fees compared to traditional software purchases.

- Real-time access: Access financial data anytime, anywhere with an internet connection.

- Automatic updates: Automatic updates without manual installation.

- Improved collaboration: Multiple users can work on the same data at the same time.

- Data security: High-level security with data encryption and regular backups.

- Scalability: Cloud based accounting software easily adapts as your business grows.

- Eco-friendly: Reduces paper use, making it more environmentally friendly.

- Better decision-making: Real-time data helps you make faster and more accurate decisions.

When Should a Company Use Internet-Based Accounting?

Online-based accounting has become highly beneficial for businesses in the Philippines in various scenarios. Cloud accounting offers flexibility if your company is expanding or managing finances across different locations. You can access financial data anywhere and anytime, even when operating remotely.

Online-based accounting has become highly beneficial for businesses in the Philippines in various scenarios. Cloud accounting offers flexibility if your company is expanding or managing finances across different locations. You can access financial data anywhere and anytime, even when operating remotely.

Cloud accounting is a smart choice if you want to reduce upfront costs. It runs on a subscription model, which makes it more budget-friendly than traditional software, which requires significant investment.

Furthermore, if data security is a priority, cloud accounting provides advanced protection with encryption and automatic backups. It gives you peace of mind that your data are secure. Cloud accounting is the perfect solution for companies focused on efficiency, growth, and cost-effectiveness.

Not to mention that obeying accounting principles, such as IFRS and GAAP is a must. A company has to ensure that every transaction and every record is in compliance with the standards.

The Future of Cloud Accounting

As technology evolves, undoubtedly, cloud accounting will play a bigger role in Filipino businesses. Moreover, automation accounting and Artificial Intelligence (AI) advancements will make online financial more efficient. It will handle more complex tasks, such as forecasting and financial analysis.

Similarly, as more companies adopt remote work, the need for cloud solutions with real-time access and collaboration grows. Additionally, enhanced data security increases confidence in protecting financial information. Consequently, cloud based accounting software is quickly becoming the top choice for businesses to stay competitive and future-ready.

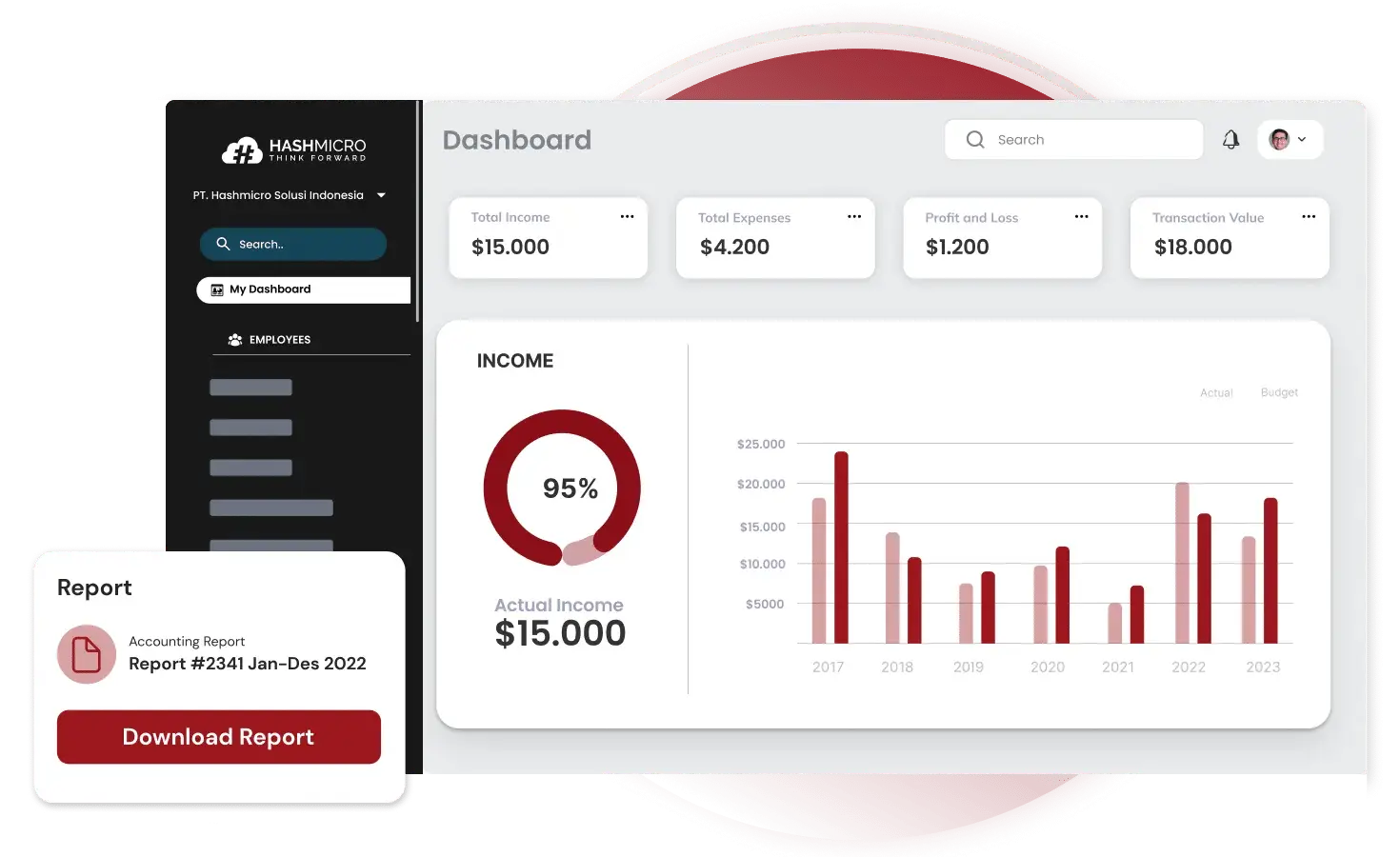

Choosing the Best Cloud Accounting by HashMicro as Your Top Solution

Nais mo bang makita kung ano ang magiging cloud accounting sa hinaharap? Isang systemang madaling sumabay sa laki at takbo ng iyong negosyo? Heto ang sagot.

HashMicro is the strongest cloud accounting provider in Southeast Asia. Its systems rapidly evolve with today’s business and technology, keeping your company competitive. Its comprehensive features make HashMicro a favourite choice of Filipino businesses.

More than 1750 Southeast Asian businesses entrust their cloud accounting operations to HashMicro. How could they not? This cloud based accounting vendor doesn’t hesitate to provide more benefits for its customers, such as free user additions, a free demo, and extensive customization options.

Some of HasMicro’s cloud based accounting key benefits are like:

- Forecast budget: Predict future budgets based on historical data to help plan finances, allocate resources efficiently, and make better strategic decisions.

- Bank integration-auto reconciliation: Ensure that the balance recorded in internal bookkeeping is in line with the balance recorded at the bank.

- Cash flow reports: Monitor the company’s cash inflows and outflows to ensure sufficient liquidity, make appropriate financial plans, and identify and address potential financial issues.

- Multi-level analytical: Know the trend or insight of all financial transactions in real-time and can be filtered based on various categories (project, branch, etc.)

- Custom printout for invoices: Make it easy to print invoices for various needs and format or display by business identity to increase positive impressions to customers.

Conclusion

Cloud-based accounting software helps businesses overcome financial management challenges by providing real-time access and enhancing data security. It reduces manual errors, streamlines processes, and supports better decision-making.

As more companies shift to cloud solutions, the future of cloud-based accounting software is clear. HashMicro, as one of the leading providers, offers robust internet-based accounting solutions tailored to the needs of Filipino businesses. Sign up for the free demo and start managing your finances smarter today.

FAQ About Cloud Accounting

-

Why is cloud accounting safe?

Cloud accounting software uses encryption to securely transfer and store data, protecting the confidentiality and integrity of sensitive financial information. This process encodes the data so that only authorized individuals can access and decode it.

-

Which one is a disadvantage of cloud accounting?

A key disadvantage of cloud accounting is its dependence on a stable internet connection. In regions with unreliable internet, users may face interruptions, making it difficult to access important financial data and carry out essential accounting tasks.

-

How to protect your cloud account?

It’s essential to create strong, unique passwords to ensure cloud security and protect the cybersecurity of your devices, accounts, and networks. Unique passwords help defend against cyberattacks like password spraying and credential stuffing. A password manager can help you generate and store secure passwords efficiently.