Understanding the cost of revenue is crucial for assessing your business’s financial health. This metric represents the total expenses incurred in producing and delivering a product or service to consumers. Information about the cost of revenue, found on the income statement, reflects the direct costs associated with your company’s goods and services.

Modern online accounting systems simplify calculating the cost of revenue, making it easier to manage business finances. Efficient accounting software helps avoid calculation errors, automate transactions, and provide real-time data insights.

To better understand the financial implications of a business, it’s essential to differentiate between the cost of revenue and the cost of goods sold. Tuklasin natin ang kanilang mga pagkakaiba, kung paano magkalkula, at mga epekto sa mga desisyon sa pananalapi. Get a free demo today!

Table of Contents

Key Takeaways

|

Cost of Revenue vs. Cost of Goods Sold

Cost of Revenue (COR) and Cost of Goods Sold (COGS) are terms often used interchangeably but have distinct meanings.

COGS refers specifically to the direct costs associated with producing goods. For manufacturers, COGS includes raw materials and direct labor but excludes marketing and distribution expenses.

In contrast, the cost of revenue is wider than COGS. It covers COGS plus extra costs like distribution and marketing. Service-based companies that don’t sell physical products use the cost of revenue to include all expenses related to their services.

Here’s a breakdown of COR components for various industries:

1. For product-based companies:

- Direct material costs cover all materials used in production, including raw materials, consumables, and semi-finished goods.

- Direct labor costs are wages paid to employees directly involved in the manufacturing process. Companies often use HRIS software to streamline employee administration, including payroll.

- Direct costs: In addition to labor and materials, direct costs include other expenses directly related to production, such as commissions for purchasing raw materials.

- Distribution costs: Costs for delivering the product to customers, such as shipping, storage, and insurance.

- Marketing costs are expenses directly associated with promoting the product during a specific period, such as advertising. Marketing automation systems can help optimize these efforts by targeting leads more efficiently.

- Other costs: Additional costs directly tied to producing and distributing the product.

2. For service-based companies:

- Direct labor costs: Human resources are the main asset, including salaries and recruitment expenses.

- Direct costs: Includes the cost of equipment used to deliver the service.

- Marketing costs: While similar to those in product-oriented companies, service companies may face different target audiences but similar expenses such as agency fees and advertising.

- Other costs: Additional expenses directly related to delivering the service.

How to Calculate the Cost of Revenue?

Let’s illustrate the cost of revenue formula with an example:

In 2021, Company A’s revenue was PHP 19,250,000, direct material costs were PHP 350,000, labor costs were PHP 665,000, research and development costs were PHP 420,000, shipping and other handling costs were PHP 157,500, and other costs were PHP 61,250.

To calculate the cost of revenue for Manufacturing Company A in 2021, follow a similar approach as before. We will include all direct costs associated with producing and delivering goods.

Components:

- Direct Material Costs: PHP 350,000

- Labor Costs: PHP 665,000

- Research and Development Costs: PHP 420,000

- Shipping and Handling Costs: PHP 157,500

- Other Costs: PHP 61,250

Cost of Revenue Formula: Direct Material Costs + Labor Costs + Research and Development Costs + Shipping and Handling Costs + Other Costs

Calculation: PHP 350,000 + PHP 665,000 + PHP 420,000 + PHP 157,500 + PHP 61,250

In 2021, Manufacturing Company A’s revenue cost amounted to PHP 1,653,750. Under accrual accounting, this total reflects all direct costs related to the production and delivery of products, as well as research and development expenses that were incurred during the period, regardless of when the corresponding cash payments were made.

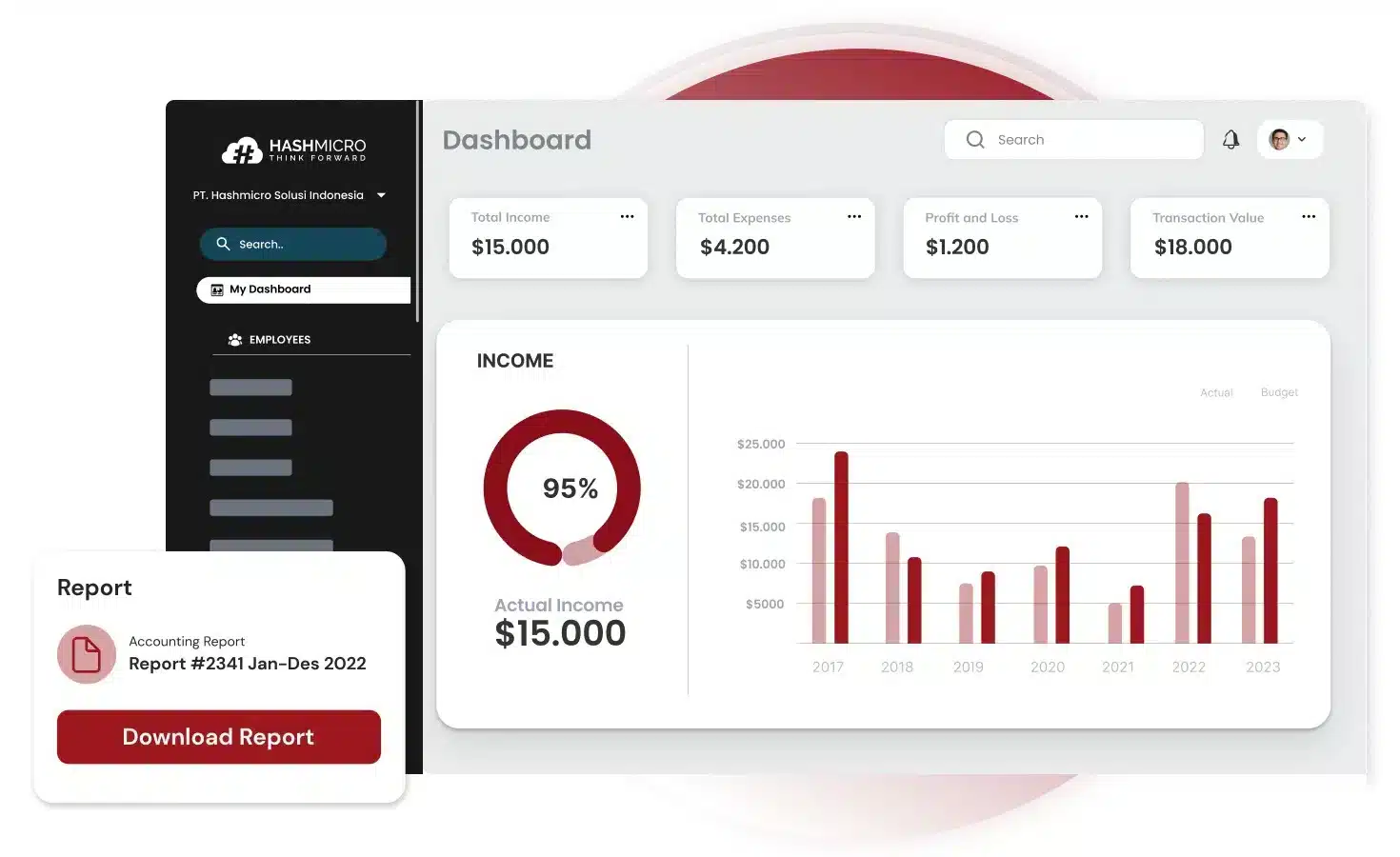

To accurately calculate the cost of revenue, an effective accounting system is essential. For a reliable solution, consider our Accounting platforms used locally recommendation: HashMicro Accounting Software. It offers seamless integration, automated reporting, and real-time insights, ensuring precise financial management and enhanced efficiency.

Leverage HashMicro Accounting Software for Accurate Cost of Revenue Calculation

HashMicro Accounting Software is designed to simplify the financial management of businesses, including calculating the cost of revenue. This online accounting system automates various financial processes, reducing the risk of manual errors and providing real-time data.

Key benefits of HashMicro Accounting Software include:

- Batch Tracking and Monitoring

Building on this, businesses can track the movement and location of batches during production and distribution. This feature supports precise inventory management and improves traceability. - End-to-End Traceability

Moreover, batch tracking software provides full traceability of products, enabling businesses to follow each batch’s history from production to delivery. This enhances oversight and accountability throughout the process. - Automated Reporting and Analytics

In addition, the software generates detailed reports and analytics, offering insights into batch tracking, inventory levels, and overall performance. This data is crucial for making well-informed business decisions. - Compliance Management

Furthermore, the system aids businesses in meeting industry regulations and standards by providing built-in compliance checks and maintaining necessary documentation. This helps reduce the risk of regulatory issues.

By using HashMicro’s accounting software, companies in the Philippines can efficiently manage their cash flow, financial statements, bank reconciliations, and invoicing, ensuring accurate and timely calculations of the cost of revenue.

Conclusion

Understanding the cost of revenue (COR) is essential for evaluating your business’s financial health. It includes all direct expenses related to producing and delivering products or services. Accurately calculating and analyzing COR can be challenging, but accounting software like HashMicro can simplify this process, improving efficiency and accuracy.

Makipag-ugnayan sa amin para sa isang libreng demo ng HashMicro Accounting Software at simulan ang pag-optimize ng iyong mga kalkulasyon sa halaga ng tubo ngayon!