Many businesses worry about cash flow problems and customer dissatisfaction, which makes it essential to use every available tool for effective financial management. One important tool is the credit note, which can help prevent significant financial issues in business transactions.

A credit note, also known as a memorandum ng kredito, is a document issued by a seller to acknowledge a decrease in the amount a buyer owes. This can happen for various reasons, such as returned goods, pricing errors, or other adjustments.

In accounting, understanding credit notes is vital because they reflect a reduction in sales and accounts receivable, ensuring that financial reports are accurate. By grasping what is credit note, businesses can better manage their finances and avoid the negative consequences of poor record-keeping.

Susuriin ng artikulong ito ang mga paksang ito, na itinatampok ang kahalagahan ng mga tala ng kredito sa mga kontemporaryong kasanayan sa negosyo.

Table of Contents

Key Takeaways

|

Understanding Credit Notes

A credit note, often called a credit memorandum, credit notice, or credit invoice, does a seller issue a formal document to a buyer indicating that a specified amount has been credited to the buyer’s account. This document is essential in rectifying transaction mistakes, such as overbilling or returned merchandise. In essence, it serves as proof of a reduced payable amount.

The credit note meaning in accounting encompasses the adjustment to accounts receivable and sales revenue. This ensures that the financial records accurately reflect the actual transactions, thus preventing discrepancies that could lead to audits or monetary penalties.

Typically, a credit note includes key details such as the date of issuance, the buyer’s information, the reason for the credit, and the amount credited. This clarity helps maintain transparent records, benefiting both parties in the transaction.

Credit Note Benefits

1. Avoiding financial data mistakes

A credit memo significantly aids in maintaining accurate financial records by clearly documenting each transaction. By minimizing mistakes through thorough record-keeping practices, businesses can conduct audits more efficiently and avoid complications during financial inspections, ultimately leading to more reliable financial reporting.

2. Identifying errors in financial statements

In the complex landscape of financial operations, errors are not uncommon, particularly within the finance department. Recording transactions through credit notes gives businesses a comprehensive overview of their operations, enabling them to evaluate and correct discrepancies before they escalate into more serious issues that could impact the bottom line.

3. Orderliness in administration

Maintaining organized documentation is crucial for ensuring smooth operations across all departments. Credit notes facilitate administrative orderliness by providing written evidence for each transaction, essential for accountability.

By utilizing systems with the top accounting solutions, businesses can enhance their document management processes, reduce the chances of human error, and streamline administrative workflows.

4. Client assurance

Providing a credit note instills confidence in clients regarding their transactions. This assurance fosters trust and makes clients feel secure about their purchases, knowing that the business is prepared to address any issues that may arise.

As a result, this enhances customer satisfaction and loyalty, which are crucial for long-term success.

5. Demonstrating responsibility

Issuing a credit note signals to clients that a business is committed to taking responsibility for its transactions. This sense of accountability builds trust and encourages the development of long-term relationships with clients, creating a foundation for future business opportunities and fostering a positive reputation in the market.

Advantages of Credit Note

The advantages of issuing a credit note are multifaceted and contribute significantly to business operations’ overall efficiency and integrity.

1. Error prevention in reporting

Credit notes play a crucial role in preventing future reporting errors by maintaining detailed records of transactions. They act as a corrective measure, allowing businesses to learn from past mistakes and refine their reporting processes, enhancing accuracy.

2. Timely error tracking

Credit notes facilitate the early detection and documentation of errors, enabling businesses to implement necessary changes before issues escalate into significant problems. This proactive approach not only aids in refining processes but also helps prevent the recurrence of similar errors in the future.

3. Strengthening client relationships

Issuing credit notes can significantly strengthen client relationships. While there may be an initial financial impact due to reduced receivables, the long-term benefits of increased customer loyalty and satisfaction far outweigh these short-term concerns, leading to a more robust business-client bond.

4. Enhancing operational performance

Regular evaluations based on the data captured through credit notes allow businesses to improve their operational performance. By analyzing this information, companies can identify areas for enhancement, driving continuous improvement and operational excellence.

5. Conflict avoidance

The clear documentation provided by credit notes helps minimize misunderstandings between businesses and clients. This written agreement can significantly reduce potential conflicts, resulting in a smoother and more efficient transactional experience for all parties involved.

Differences Between Credit Notes and Debit Notes

Understanding the distinctions between credit and debit notes is crucial for effective financial management. A credit note indicates a decreased amount owed. In contrast, the buyer issues a debit note to request an adjustment, typically reflecting an increase in the amount payable due to underbilling or additional charges.

While both documents serve to adjust transaction amounts, their roles in an accounting system are different. Credit memo meaning encompasses a direct reduction in accounts receivable, while debit notes increase accounts payable. This fundamental difference impacts how each is recorded in financial statements.

Moreover, credit notes are primarily customer-facing documents, reinforcing positive relationships. In contrast, debit notes may indicate discrepancies that need resolution, potentially leading to misunderstandings. Understanding what is credit memorandum entails helps businesses navigate their accounting processes more effectively, ensuring clarity and accuracy in financial reporting.

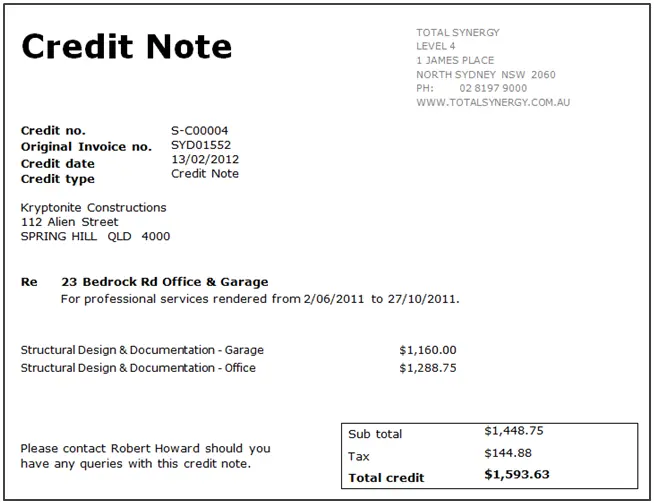

Sample of Credit Note

To illustrate how credit notes work, consider the following credit note example:

There isn’t a specific format for creating a credit note, but certain key details must be included, such as:

- Seller’s name

- Buyer’s name

- Credit note number

- Date of issuance

- Quantity of items

- Type or description of items

- Price per unit

- Total credit amount

- Seller’s signature or stamp

- Date the note was issued

Including these details ensures accurate transaction records and facilitates easy verification for all parties involved. The seller or an authorized representative is typically responsible for issuing the credit note.

Additionally, a credit note is an essential document for accounting purposes and inventory management, helping businesses maintain accurate financial records and manage returns or adjustments efficiently.

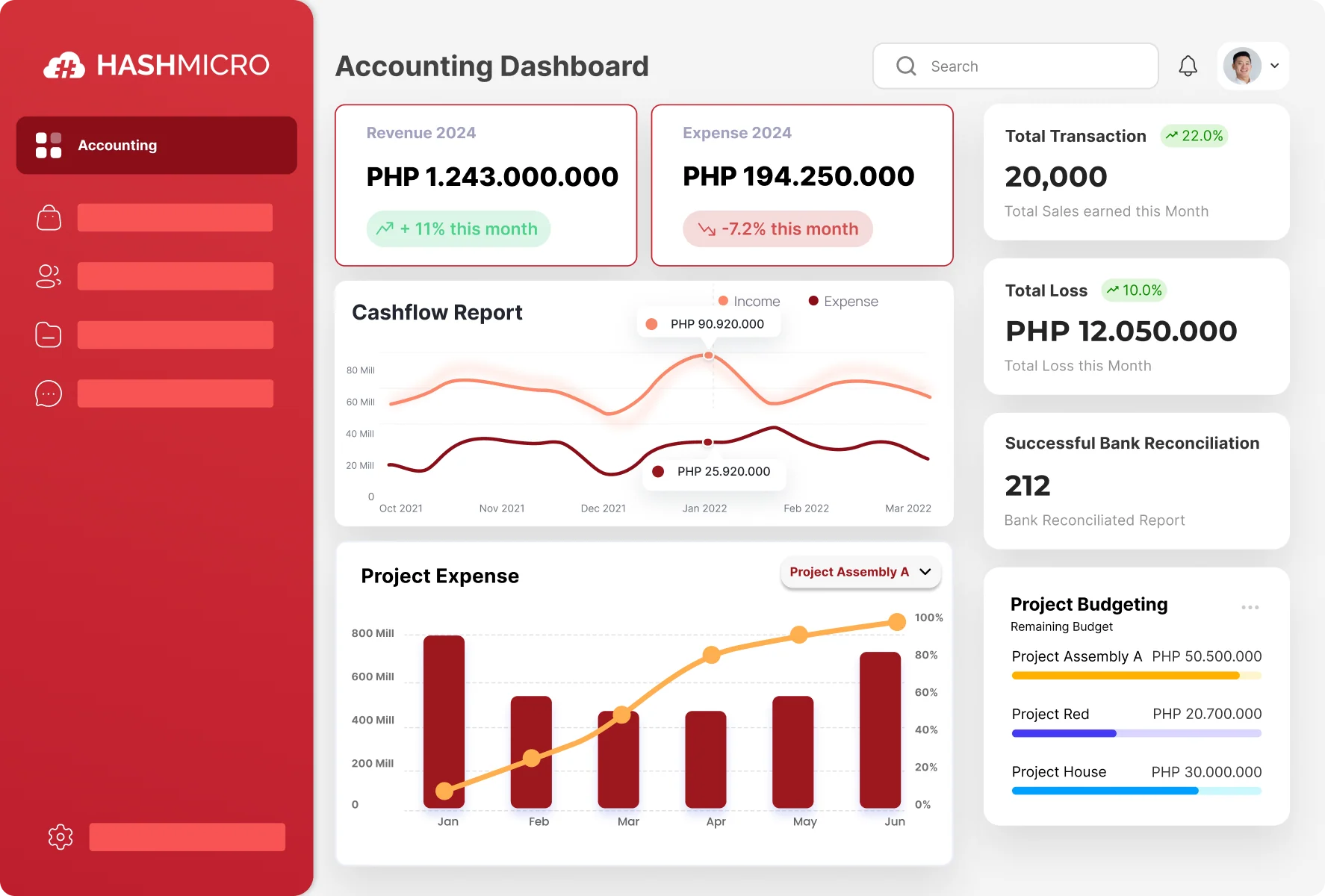

Enhancing Credit Note Management with HashMicro Accounting System

Features

- Bank Integration – Auto Reconciliation: Ensures that the internal bookkeeping balances match those recorded by the bank.

- Bank Integration – Auto Payment: Guarantees that scheduled payments are timely.

- Multi-Level Analytical: This provides real-time insights into financial transaction trends, with the ability to filter by various categories (project, branch, etc.).

- Profit & Loss vs Budget & Forecast: Delivers reports highlighting discrepancies between expected profit/loss based on the budget and actual profit/loss figures.

- Cash Flow Reports: Monitors the company’s cash inflows and outflows to ensure adequate liquidity, facilitate sound financial planning, and identify potential financial issues.

- Forecast Budget: Predicts future budgets using historical data to aid in financial planning, efficient resource allocation, and improved strategic decision-making.

- Budget S Curve: Visually tracks and analyzes expenditure distribution within projects, enabling faster and more accurate budget management decisions.

Optimize your company’s financial management with HashMicro’s accounting software! Here are the benefits of selecting our accounting software:

- Credit Note Management: The system automatically generates and tracks credit notes based on the data you input, ensuring accurate account adjustments.

- Complete Financial Statements with Period Comparison: Analyzes financial performance by providing detailed financial statements that include credit note adjustments for different periods.

- Equity Movement Report: Offers detailed reports on changes in equity, making it easier to track the impact of credit notes on your financial standing.

- Multi-Level Analytical: Allows for in-depth analysis of credit notes by project or branch, enabling precise adjustments to financial records.

- Cash Flow Reports: While not directly related, cash flow reports provide insights into how credit notes affect your cash flow management, impacting overall financial health.

By choosing HashMicro’s accounting software, you can enhance your financial management with precise credit note tracking and comprehensive analysis tools. Let our advanced features streamline your processes and support informed decision-making for sustained financial success.

Conclusion

In conclusion, using credit notes is a pivotal aspect of effective financial management in businesses. By understanding the credit note meaning and its benefits, organizations can enhance their accounting processes, improve customer satisfaction, and maintain regulatory compliance.

The distinctions between credit and debit notes further clarify their roles within an accounting framework, ensuring businesses can manage transactions effectively. By leveraging tools such as HashMicro’s accounting software, businesses can streamline their documentation processes and ensure accurate financial reporting.

Choose HashMicro as your preferred accounting software in the Philippines. It is specifically crafted to enhance your business accounting management. Subukan ito gamit ang isang libreng demo ngayon!

FAQ

-

-

What is a credit note?

A credit note is a document issued by a seller to a buyer, indicating a reduction in the amount owed, often due to returned goods or overbilling.

-

What is the difference between a debit note and a credit note?

A debit note is issued by a buyer to inform a seller about a discrepancy, such as goods received damaged or incorrect billing, requesting a credit adjustment, while a credit note is the seller’s response confirming that adjustment.

-