A debit note is a document used to record purchase or sales adjustments when discrepancies occur. Unlike invoices, a debit note captures issues such as incorrect quantities or product returns. Without proper documentation, payment schedules and account verification quickly become disorganized.

But keeping these notes organized can get overwhelming fast. That’s why having a smart solution matters. You can try HashMicro’s Accounting Software to simplify record management, helping businesses track purchases, sales, and adjustments accurately while reducing errors and maintaining tax compliance.

Want to understand debit notes better and see a sample in action? Keep reading as we explore their meaning, purpose, and how to manage them effectively. Book a free demo with HashMicro to experience how automation improves debit note handling from start to finish.

Table of Contents

Key Takeaways |

What is a Debit Note?

A debit note, or debit memo, is a formal document used in business transactions to adjust the amount owed by a buyer to a seller. This document plays a crucial role in accounting systems, ensuring that discrepancies or errors in invoices are promptly corrected.

A debit note is commonly issued when the buyer has already made a payment or when the seller wants to adjust an invoice due to overcharging, returned goods, or other errors. It acts as a notification of current debt obligations, helping businesses maintain accurate financial records and resolve transaction discrepancies effectively.

The Functions of a Debit Note

Tulad ng nabanggit kanina, ang isang debit note ay kadalasang ibinibigay ng isang mamimili sa isang nagbebenta kasunod ng isang transaksyon. This document plays a crucial role in the finance industry, serving several key functions:

-

Reducing the seller’s debt

A debit note can request a reduction in the amount owed when goods are returned, incorrect, or require correction. This document helps adjust payables and receivables accurately, preventing errors after collection and keeping financial records consistent for both parties.

-

Product price adjustment

A debit note may also request a product price adjustment when the agreed cost changes or revisions are needed. This ensures transparency between buyer and seller, helping both sides maintain fair pricing and clear documentation for any updated terms in the transaction.

-

Correction of product quantities

Debit notes help correct discrepancies in delivered quantities, especially when items are fewer, damaged, or incorrect. Buyers can request billing adjustments or refunds using a debit note, ensuring accuracy in every transaction and maintaining trust between both parties.

-

Freight in Debit or Credit

Debit notes can adjust freight charges when shipping costs are incorrect or need reallocation. If an overcharge occurs, the seller may issue a credit note in response. Proper handling of these documents ensures accurate freight accounting and smoother financial reconciliation.

If you’re looking for an efficient accounting system to manage debit notes in your business, consider using HashMicro accounting software. It streamlines the process and ensures accurate documentation and tracking of all your transactions. Discover how it can simplify your accounting tasks today!

Debit Note vs. Credit Note

It’s important to differentiate between a debt note and a debit note:

- Debit Note: This is a document issued by a buyer to a seller, indicating that the buyer has debited (reduced) the amount they owe. It usually happens when there’s a mistake in the invoice or if the goods received are defective or returned. Essentially, it’s a way for the buyer to say, “Kailangan nating bawasan ang ating singil.”

- Credit Note: This is a document issued by a seller to a buyer, showing that the seller has credited (reduced) the amount the buyer owes. Credit note is often used to correct an overcharge or return of goods. In simple terms, it’s a way for the seller to say, “Binabawasan namin ang iyong singil.”

Debit Note Features

Let’s explore the key features of a debit note to understand its purpose and how it facilitates seamless financial transactions:

- The issuance date

- The name and address of the seller

- The name and address of the buyer

- A detailed description of the goods or services

- Unit pricing for the goods or services

- The overall cost of the order

How Does a Debit Note Work?

To better understand how a debit note operates, let’s explore the key steps involved in its process.

- Issuance of the debit note: The seller issues a debit note to correct an earlier invoice or address changes, such as billing errors, additional charges, or returned goods. This document serves as a formal notification of the adjustment.

- Details and delivery: The debit note includes critical information such as the reason for issuance, adjusted amount, and references to the original invoice. It is then delivered to the buyer through email, courier, or accounting software for review.

- Buyer acknowledgment: The buyer reviews the debit note and confirms its accuracy. This step ensures both parties are aligned and agree on the adjustments made to the transaction.

- Update of financial records: Once acknowledged, the seller and buyer update their respective financial records. The seller adjusts accounts receivable while the buyer reflects the changes in accounts payable, ensuring accurate financial tracking.

When to Issue a Debit Note

A debit note should be issued when there is a need to request additional payment from a customer due to various reasons, such as undercharging, returned goods, or corrections to previously invoiced amounts.

It is typically used when the original invoice amount needs to be increased, ensuring that both parties have a clear understanding of the updated financial transaction. Issuing a debit note helps maintain transparency and accuracy in the business’s accounting records.

Components of a Debit Note

A debit note does not follow a fixed format and can vary based on the issuing company’s requirements. However, certain key elements should be included to ensure its effectiveness. These components are:

- Name of the Buyer

- Name of the Seller

- Debit Note Number

- Description of the Goods Debited

- Type of Goods Debited

- Price Per Unit of Goods

- Total Cost of Goods Debited

- Date of Creation of the Debit Note

- Name and Signature of the Buyer

How to Create a Debit Note

Creating a debit note requires attention to detail to ensure it serves its purpose effectively. Here are five essential steps to guide you in preparing a professional and accurate debit note.

- Include basic details: Begin by adding essential information such as the date of issuance, a unique debit note number, and a reference to the original invoice or transaction. This ensures proper tracking and identification of the debit note within your financial records.

- Add seller and buyer information: Clearly state the names, addresses, and contact details of both the seller and the buyer. This ensures that both parties are properly identified, reducing the chances of confusion or disputes.

- State the reason for the debit note: Provide a clear explanation of why the debit note is being issued. Common reasons include correcting billing errors, returning goods, or adding adjustments to a previous invoice. Clearly stating the purpose helps the buyer understand the context of the adjustment.

- Mention the amount due: Specify the adjusted amount that the buyer is required to pay. Include details like the original amount, any deductions or additions, and applicable taxes. This ensures transparency and helps avoid misunderstandings regarding the payment owed.

- Review and deliver: Carefully review the debit note for accuracy, ensuring all details are correct and complete. Once approved by the relevant authority, deliver the debit note to the buyer through a reliable method, such as email or integrated accounting software, for a professional and seamless transaction.

Examples of Debit Note

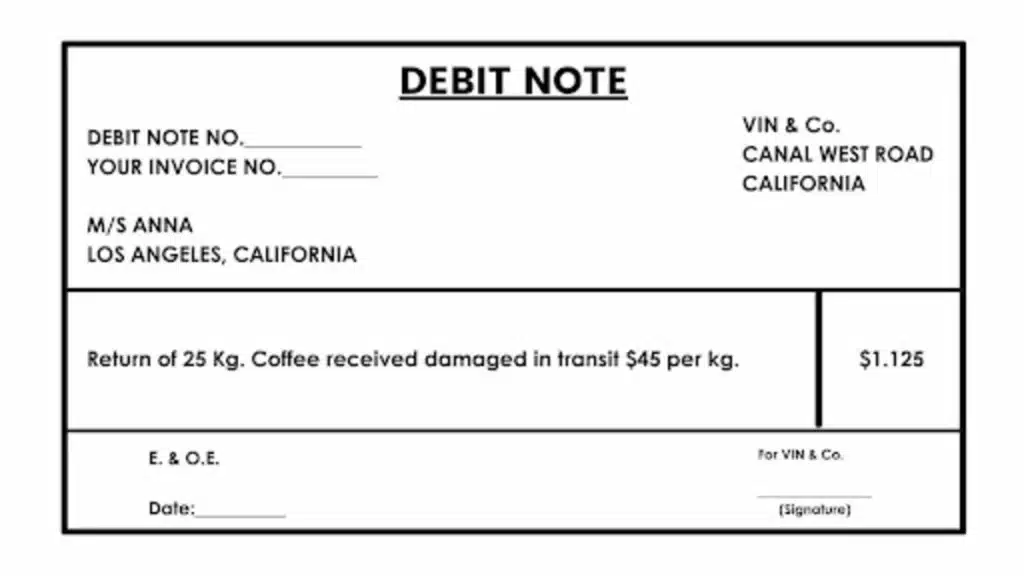

Creating a debit note is a straightforward process. If you’re doing it manually, you’ll need to complete several key details on the note, including the seller’s address, the creation date, a description of the items being returned or discounted, and other essential elements, which will be outlined later in this article. You may also add a signature if needed to authenticate the note for all parties involved in the transaction.

Alternatively, using Microsoft Excel can help make the process cleaner and more organized. Excel offers an easy way to format and structure debit notes neatly. For even greater efficiency, you might consider using an automated financial management system. For those unfamiliar with what a debit note looks like, here’s an example to illustrate.

Debit Note Template

The Advantages of HashMicro Accounting System for Effective Debit Note Management

A debit note is an important financial document used to request a payment adjustment or correct an invoice. Efficient handling and accurate calculation of debit notes are crucial for maintaining financial accuracy and transparency.

If you’re looking for the best accounting software to manage debit notes effectively, HashMicro’s accounting software provides several benefits to streamline and enhance the process of managing debit notes:

- Financial ratios

Automated Calculations: The system automatically calculates financial ratios related to debit notes, such as adjustments to accounts receivable. This ensures that your financial ratios, including the Debt to Equity Ratio, accurately reflect the impact of debit notes on your financial health.

- Complete financial statements with period comparison

In-Depth Analysis: HashMicro generates detailed financial statements that compare data across different periods. This allows you to analyze how debit notes affect your financial performance over time, including the changes in debt and equity.

- Equity movement reports

Tracking Changes: The software provides detailed reports on equity changes, including the effects of debit notes. This helps in tracking equity fluctuations and ensures accurate calculations for financial ratios like Debt to Equity Ratio.

- Multilevel analysis

Segmented Insights: With multi-level analytical capabilities, you can examine debit notes and their impact by project or branch. This feature enables more precise calculations and better financial oversight across different segments of your business.

- Cash flow reports

Understanding Impact: While not directly related to debit notes, cash flow reports offer valuable insights into how debit notes influence your company’s cash flow. This understanding helps in assessing the overall impact on debt management and financial stability.

By integrating HashMicro’s accounting software into your financial management practices, you can ensure accurate handling of debit notes and gain deeper insights into your financial metrics. Let our advanced features streamline your accounting processes and support informed decision-making.

Conclusion

In summary, a debit note serves as crucial evidence of a legitimate financial transaction for both the seller and the buyer. Without this record, obtaining accurate pricing information and proper proof of payment can be challenging. Additionally, debit notes play several important roles in sales transactions.

For automating the creation of debit notes, consider using HashMicro’s accounting software. This technology offers a range of features designed to enhance your business decisions. With all transaction records integrated into the financial reporting system, the accounting process becomes more streamlined. Subukan ang aming libreng demo at tingnan kung paano ito makikinabang sa iyong negosyo!

FAQ Debit Note

-

What does debit note mean?

A debit note is a document issued by a seller to a buyer, requesting an increase in the amount due for a previous invoice. It is typically issued when goods are returned, there is an undercharge, or a correction to the original invoice is needed.

-

What is the difference between a debit note and a credit note?

A debit note is issued by the seller to request additional payment due to an undercharge or return of goods. In contrast, a credit note is issued to reduce the amount owed, typically when the buyer returns goods or there is an overcharge.

-

Is a debit note a refund?

No, a debit note is not a refund. A debit note is issued by a seller to request additional payment from a buyer due to an undercharge, returned goods, or invoice corrections. In contrast, a refund involves returning money to the buyer, typically when goods are returned or overpaid.

-

What is an example of a debit note transaction?

An example of a debit note transaction is when a company issues a debit note to a customer for additional payment. For instance, if a company sells goods for $1,000 but later realizes there was an undercharge of $200, it will issue a debit note requesting the customer to pay the remaining $200. This ensures that the original invoice amount is corrected and both parties are aligned on the payment due.