In business transactions, the existence of an invoice is important for legal evidence of the sale or purchase of goods/services that can be used for claims or dispute resolution. With valid evidence, invoices help companies keep track of income and expenses.

However, preparing your own invoices is not an easy thing, especially if done manually. Manually compiling invoices is prone to human errors that increase the risk of errors, such as miscalculations, misspelling names or amounts, which can lead to payment discrepancies. Therefore, this is where e-invoicing plays an important role.

An e-invoice is a digitized version of a traditional invoice that is issued, sent, and managed electronically. With e-invoicing, the process of creating and sending invoices becomes more efficient as everything is done digitally without the need for physical paper.

However, is the difference between e-invoicing and regular invoicing only limited to its digital form? Then, what are the benefits offered by implementing e invoices? Malalaman mo ito sa pamamagitan ng pagbabasa ng artikulong ito hanggang sa katapusan. Kaya, pag-usapan natin ito ngayon din!

Table of Contents

Key Takeaways

|

What is E-Invoices?

An e-invoice is an electronic invoice that is created, sent and managed digitally without the use of physical documents. It is a digitized version of traditional invoices that are usually issued in paper form and can be integrated with accounting systems to improve traceability.

The way e-invoicing works starts with the creation of a digital invoice through accounting software or an e-invoicing platform. Once created, the invoice is instantly sent to the buyer via email or an integrated system. This process is much faster than sending physical invoices through the post, thus speeding up receipt and payment.

E-invoices also provide better security compared to paper invoices. Since they are stored in a digital format and can be encrypted, the risk of losing or damaging physical documents is avoided. Additionally, the digital verification and authentication process helps ensure that only authorized parties can access the invoice.

The implementation of e-invoice in Philippines has been regulated since the Tax Reform for Acceleration and Inclusion (TRAIN) Act was introduced in 2018. TRAIN was introduced to require exports of goods and services, e-commerce, and large taxpayers to issue e-invoices, e-receipts, and reports. This was followed by the Philippines Department of Finance (DOF) launching a program that binds e-invoicing in 2022.

Several Types of E-Invoices Generally Used

E-Invoices themselves are generally divided into several standard types that have been regulated by various regulations in various regions. Here are several types of e invoices that you need to know:

1. XML-Based E-Invoices

This e-invoice uses the XML (Extensible Markup Language) format which allows the structured data in the invoice to be integrated directly into the accounting or ERP system. The XML format ensures that all information in the invoice, such as product details and pricing, can be processed automatically by the receiving system, minimizing manual errors.

2. EDI (Electronic Data Interchange) Based E-Invoice

This electronic invoice has a more complex and automated form. EDI is a system that allows direct exchange of business data between different companies’ computer systems. Invoices are sent in a structured format and imported directly into the recipient’s accounting system, without the need for manual input. EDI-based e-invoicing is often used by large companies that process a high volume of transactions.

3. Peppol E-Invoice

Peppol electronic invoice is the most frequently used standard in various countries, including in Europe and Asia Pacific. Peppol (Pan-European Public Procurement Online) enables the structured exchange of e-invoices between public and private organizations. This type of e-invoice is used to ensure that invoices meet certain standards and are acceptable across international borders, facilitating global trade.

How E-Invoice is Different from Traditional Invoice

Hanggang ngayon, malamang na iniisip mo kung bakit naiiba ang e-invoice sa regular na pag-invoice. In terms of management, manual invoices require physical archiving, which takes up space and is prone to the risk of damage or loss. E-invoices, on the other hand, are stored digitally, so it’s easy to access and search the data at any time.

Security is also an important differentiation. Manual invoices are vulnerable to theft, loss, or manipulation of physical documents. E-invoices are more secure because they use digital encryption and authentication systems, so only authorized parties can access and modify the invoice.

Finally, efficiency and accuracy are the key factors that differentiate these two types of invoices. Regular invoices require more time in the process of delivery, tracking, and manual record-keeping that is at risk of human error.

E-invoicing, with integration into accounting systems, enables automation in payment tracking, transaction recording, and even archiving. This speeds up cash flow, reduces input errors, and eases auditing and financial reporting.

Benefits of Implementing E-Invoicing for Businesses

The implementation of electronic invoices that adopt digital techniques certainly brings benefits that the implementation of ordinary invoices cannot provide. Businesses can streamline processes and enhance efficiency by integrating tools like a receipt template into electronic invoicing.

Here are some of the benefits of implementing electronic invoicing:

1. Time and cost savings

E-invoicing enables instant delivery of invoices via email or digital platforms without the need for physical printing or mailing. This saves on paper, ink, and postage costs, while speeding up the billing process so companies can receive payments faster.

One effective way to increase time and cost savings is to integrate with HM’s e-invoicing system. Click here to get a free demo!

2. Easy storage and access

An electronic invoice can be stored digitally in the cloud or server, making them easy to access and search at any time without the need to maintain a physical archive. It also reduces the risk of invoice loss or damage, which is common with paper documents.

3. Business process efficiency

E-invoicing integrates with accounting or ERP systems, enabling automation in recording, payment tracking, and financial reporting. This reduces manual workload and minimizes human error, thus improving overall operational efficiency.

4. Improved Security

Electronic invoices come with encryption and authentication features, ensuring that only authorized parties can access and modify the data. This reduces the risk of fraud, theft, or document manipulation, which paper invoices are more prone to.

Implement HashMicro E-Invoice System for Efficient Electronic Invoice Management

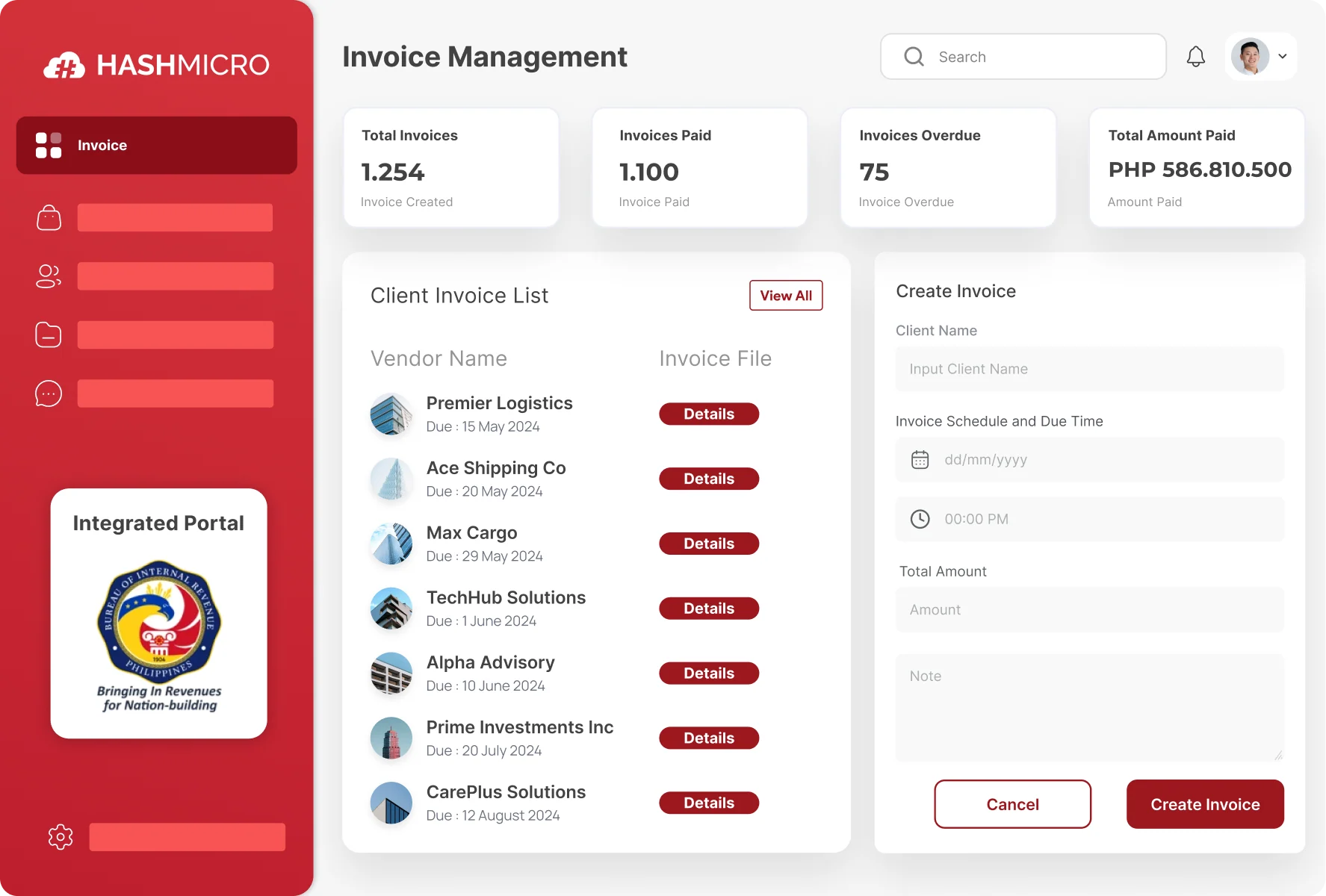

As part of HashMicro’s innovative ecosystem, Hashy AI enhances this efficiency by automating invoice tracking and follow-ups, reducing the risk of late payments. Its smart technology ensures accurate and timely invoice management, helping businesses maintain a smooth cash flow.

Another reason why the HashMicro system is an option worthy of your consideration is that it doesn’t put a limit on the number of users. This can indirectly increase the transparency of electronic invoice management because several people can supervise it at once. HashMicro systems are also accredited by BIS and CAS, which can ensure your productivity will be in compliance with the policies in the Philippines.

Here are the features offered by HashMicro’s e-invoicing system:

- Automated invoicing: helps to schedule invoice delivery to minimize delays in delivery automatically.

- Cash flow optimization: This feature monitors all invoice status in a single view and streamlines cash flow by ensuring timely payments.

- Invoice template customization: Allows users to customize templates according to the unique needs of the business.

- Real-time invoice reporting: provides real-time updates into a single platform to ensure users are always aware of progress at any time.

You can also read our previous article on invoicing software options by clicking here.

Conclusion

Electronic invoicing (e-invoice) is a modern solution to the billing process, which enables the creation, delivery and management of invoices digitally. Compared to traditional invoices that require physical printing and manual mailing, e-invoices utilize digital technology to speed up business processes and reduce operational costs.

Key benefits of e-invoicing include time and cost savings, improved security, easy access to invoice archives, and increased efficiency in business processes. Moreover, by reducing paper usage, e-invoicing also supports environmental sustainability.

To further improve the efficiency of electronic invoice management, integrating with HashMicro’s e invoice system can be a solution that you can do. This system does not limit the number of users and can be integrated with other systems to ensure all business activities can run optimally.

Schedule a free demo now!